NPF ratings

The ratings of the Uralsib fund during its work as an independent organization were quite high. Thus, RA “Expert” assigned it an A+ rating for a high level of reliability.

The previous “developing” forecast was changed to “stable”. The NRA rating in 2013 was AA-, which corresponds to the third level or very high reliability. Subsequently, both agencies withdrew the ratings due to Uralsib joining another organization.

Profitability and reliability

The fund achieved its highest return over the past 8 years (from 2005 to 2012) in 2009 with 18% per annum. The minimum figures were obtained in 2008 (0%) and 2011 (0.60%). The total return for the specified period is 68.99%, the average annual return is 8.62%. For comparison, the Trust fund had an average return of 10.32% per annum.

Profitability of the pension fund URALSIB NPF in 2005-2012

Data on the profitability of UralSib CJSC NPF as of January 1, 2017, including information for the previous 10 years in comparison with the profitability of the Pension Fund of the Russian Federation:

Profitability of NPF Uralsib for 2014-2015 and previous years

The fund has not currently provided a profitability rating for 2016-2017, but the profitability indicator as of September 30, 2016 is known: it is 9.08%.

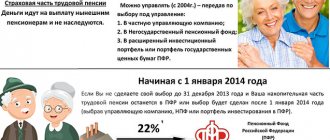

Investment portfolio structure for pension savings funds:

- 51.27% - bonds of organizations and enterprises of the Russian Federation

- 15.27% - state. securities of constituent entities of the Russian Federation

- 13.37% - bank deposits

- 8.96% - shares of organizations and enterprises of the Russian Federation

- 4.71% - real estate (mortgage-backed securities)

- 6.18% - other assets

- 0.24% - state. Russian securities

The management companies URALSIB, Kapital, Aton Management and Management Company Paribas Invest Partners are responsible for investments in the pension fund.

Profitability level

The total return of NPF Uralsib for 2005-2012 was 68.99%, the average annual rate was 8.62%. Like other organizations of this kind, the minimum indicators were obtained in the crisis years of 2008 and 2011. They amounted to 0% and 0.6% respectively. The maximum level of profitability was recorded in 2009 – 18% per annum.

As of 2020, the figure reached 14.5%. In 2020, the yield was last estimated before the merger and was 9.08%.

Several management companies are responsible for investing pensioners' savings. They invest in:

- Shares and bonds of enterprises and companies;

- Bank deposits;

- Government securities of Russian constituent entities;

- Mortgage papers and real estate.

The amount of pension reserves in the fund is growing at a good pace.

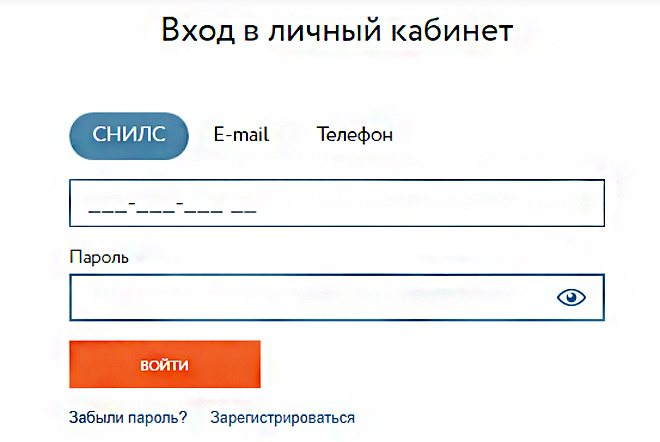

Registration and login to your personal account

New users can register an account and gain access to service management on the Future Foundation website.

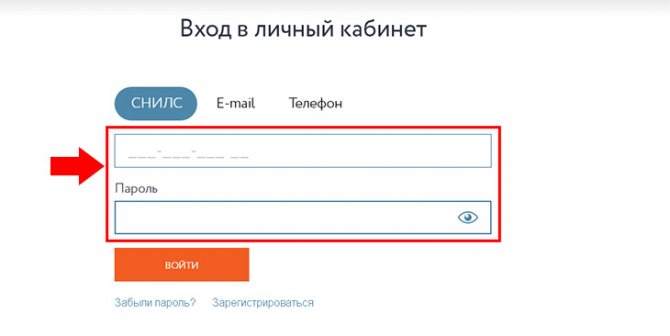

The link to enter your personal account of NPF Uralsib is highlighted in orange. The registration function is available on the same page. To register on the website of NPF "Future", to which Uralsib was merged, you need to click the "Registration" button under the login form and fill out the fields:

- SNILS;

- data from the passport (number, series);

- FULL NAME;

- phone number;

- e-mail.

Next, you just need to agree to the transfer of data for processing and complete registration.

futurenpf.ru/personal/ - personal account of NPF Uralsib

You can log into your Uralsib personal account using your password and login. It is either a phone number, or an e-mail, or SNILS. If the access code is lost, you can restore it by indicating the SNILS number in the “Forgot your password?” section. After this, you will need to enter the verification code and wait for the password reset email.

Personal account and contacts

Clients’ personal accounts are now located on the NPF “Future” resource at https://futurenpf.ru/personal/registration/?lkkus=Y. You can log in using the username and password you received earlier. There is also a registration option for new users.

Your personal account allows you to:

- Monitor transactions under your contracts with NPFs;

- Order account statements;

- Evaluate your own savings;

- Send applications for certificates;

- Download forms of necessary documents;

- Ask questions to fund specialists.

Helpful information! Using their personal account, NPF clients can familiarize themselves with the current provisions of pension legislation.

You can contact organizations by calling the hotline +7 (495) 745-47-00. The office is located in Moscow on Elektrozavodskaya street, 27, building 7. The fund's services are presented in Uralsib Bank branches throughout the country.

Personal account features

Using the personal account of NPF Uralsib, you can:

- Monitor the status of agreements with the Fund and transactions thereon.

- See savings in your retirement accounts online.

- Order a pension account statement.

- Request information.

- Use sample applications and download their forms.

- View relevant provisions of pension legislation.

- Conduct electronic correspondence with the Foundation.

You can calculate your future pension using a pension calculator directly on the NPF website, which is convenient for new clients.

About NPF

The founding date of the non-state pension fund URALSIB is December 26, 2000. Initially, the fund positioned itself as a corporate fund and was intended to provide pensions for employees of the bank of the same name and is part of the URALSIB financial corporation, which is the sole founder of this NPF. Activities on pension programs for the retail market were launched in 2007, and during this time the fund managed to achieve significant indicators.

In 2016, the Uralsib fund was merged with the Future fund. NPF Future is the new name of the pension fund Blagosostoyanie, which includes, among others, Stalfond, NPF Our Future (formerly Russian Standard). All Uralsib clients are switching to the services of NPF Future.

The rating agency RAEX (Expert RA) changed the forecast for the reliability rating of NPF URALSIB to “stable”, confirmed the rating at A+ (a very high level of reliability) and withdrew the rating due to the fund’s refusal to maintain the rating. Previously, the rating had a “developing” forecast.

Process and cost of registration

To obtain plastic you need:

- contact any bank branch;

- provide identification documents;

- present a pension certificate;

- write an application on the bank form to issue a card.

It takes several days for the card to be issued. Employees inform you about the possibility of picking it up by phone.

The cost of registration of plastic is 0 rubles.

The card is issued with a validity period of 3 years.

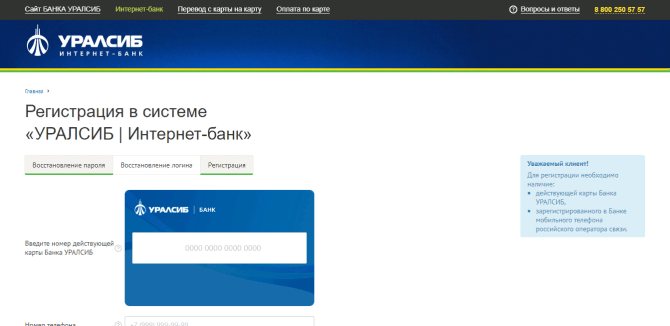

Conditions for Registration

- Cell phone number. Your telecom operator must be registered in Russia.

- Presence of a bank card, which must be valid.

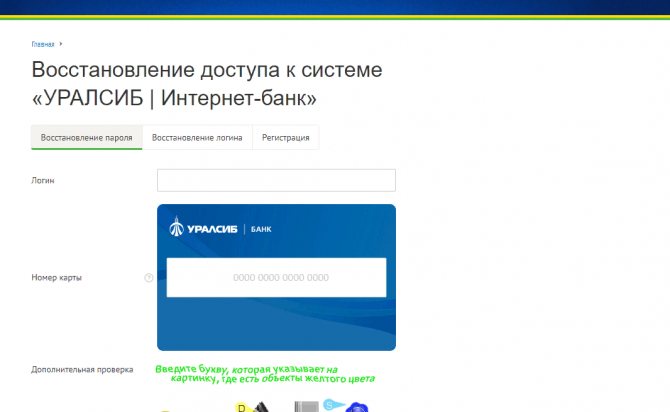

- The next step is the Internet Bank system. Here you can take a closer look at the benefits, mobile banking, company security, and also try out the test version. To register “Get access”. If authorization is not needed, then you need to enter your login and password. If necessary, click on “Get access”

Registration of a personal account

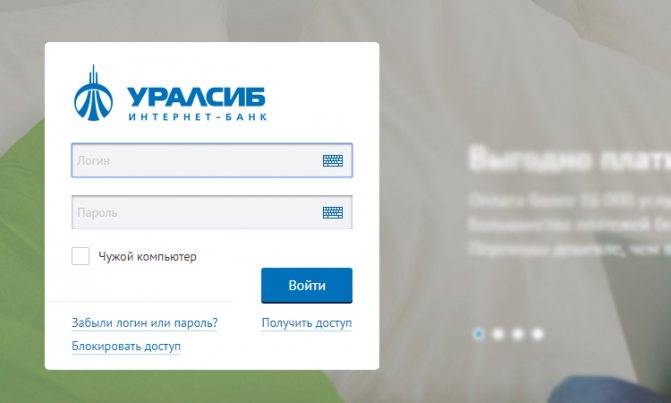

Login to Uralsib personal account

In order to get into your personal bank account, you need to perform a series of sequential actions.

- Go to the official website of the bank https://www.uralsib.ru/.

- You will be taken to the main page.

- In the upper right corner you will see a personal account tab.

- Click on it.

- An empty field will appear where you need to enter your login or phone number. The password is entered below.

- If necessary, you can remember your login.

- Press the enter key.

Uralsib: personal account registration

In order to register with a bank, you need to perform a series of sequential steps.

- Go to the bank's official website.

- Click the Login button.

- On the tab where you need to enter your login and password, you need to click on the register button.

- The site will require a phone number.

- Enter your email address.

- The phone will receive an SMS with a code. Enter the code in the special empty field.

- You are registered, wait for a confirmation message to your email address.

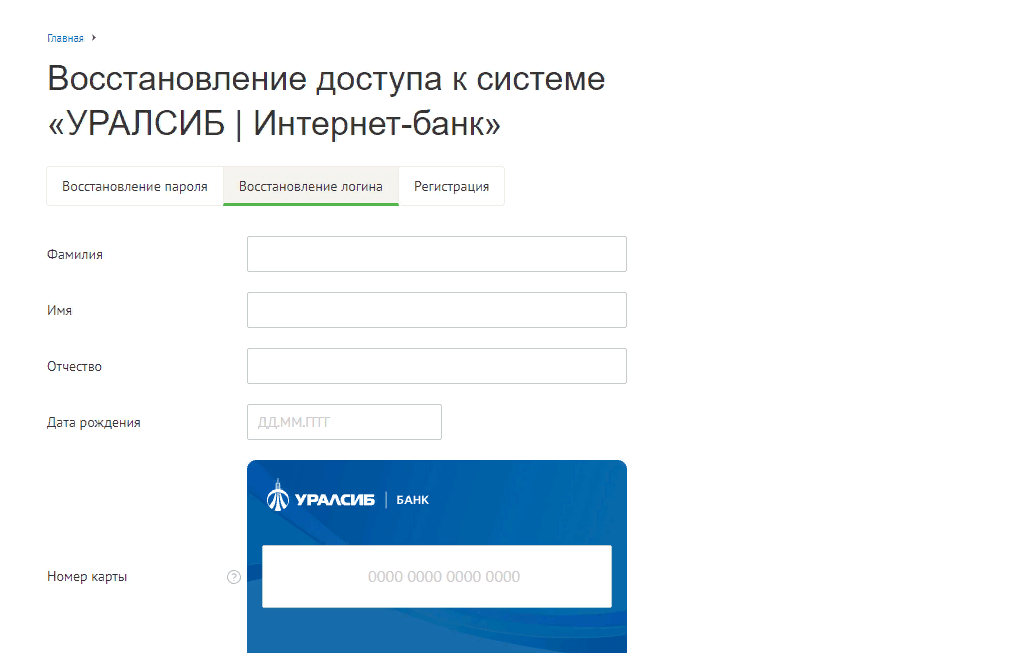

Authorization problems

Incorrect login or password.

- If you cannot log in because you have forgotten your password or login, you should contact the Bank office with documents.

- On the Uralsib website, next to registration there is a tab “Password recovery”, “Login recovery”.

Next - “Get access”.

- Restoring your login.

- Recovering the password.

- Call the support service at 8-800-250-57-57. Most likely, you will be asked for a code word and your passport number.

- a) You should call Uralsib Bank and block the card.

- b) Come to the Bank branch and fill out an application for re-issuance of the card. The cost of this service = from forty to two hundred and fifty rubles. The money will be debited from your account. If there is not enough money in your account to pay for the service, you must pay extra in cash. The waiting time is from fourteen days. Some cards are reissued within a few days. The previous card account number will not change, but the PIN code and number engraved on the card will change.

Management via Personal Account

Each participant has the right to access the Personal Account of NPF URALSIB. To do this, you need to request a login and password, which can be done at the stage of signing the contract or later, if the need arises.

In the Personal Account, the user can see:

- Date of account opening, its number;

- Last name, personal data;

- Estimated retirement date;

- Pensioner ID number (if available);

- The number of your agreement and the date of its conclusion;

- Addresses and details for transfers;

- Deduction option, profitability strategy;

- Amounts of receipts;

- Transfer sizes;

- Profitability from investing your funds;

- Transfers to other funds;

- Payment of pension.

The NPF personal account will help you find out the latest information on your pension account

So, in your Personal Account you can get general information and details on the transactions performed: day, amount, direction. In your Personal Account you can control your savings, monitor the increase in profitability and perform some simple operations.

Please note that after NPF URALSIB joined the FUTURE Fund, all passwords and access were retained. The address for accessing your Personal Account has changed, but the tools, interface and functionality remain the same. There is no need to change passwords or obtain new ones.