The personal account “Renaissance Life” is available around the clock and works every day of the week. This is very convenient, since having access to the network, all insurance contracts, important documents and all the latest information related to the Renaissance Life Personal Account are available at any time, which in turn significantly saves time.

Using the Renaissance Life Personal Account, users have the following opportunities:

- Ability to search for information related to all previously concluded insurance contracts;

- It becomes available to view detailed information about specific risks, amounts, deadlines, etc.;

- View payment status information;

- Find out contact information about the Agent you are interested in;

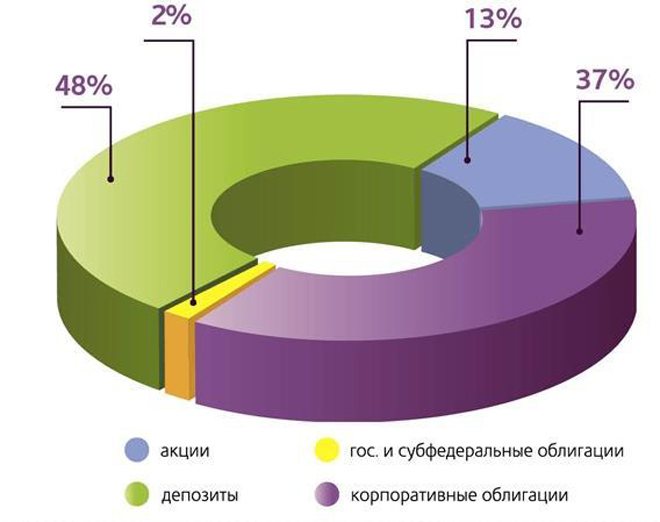

- Familiarize yourself with the structure of assets under the “Investor” program;

- The ability to view and analyze the dynamics of the return on assets under the “Investor” program for various periods of time.

Professional and prompt consultation provided by online support operators will allow the client to get an answer to any question regarding the insurance service.

Information about the fund

The fund offered many bonuses and was popular among Russians. Subsequently, a reorganization took place in this structure. As a result, the name changed to “Sun. Life. Pensions." This measure was taken to improve positions in the ranking.

The goal was to become one of the top five such organizations in Russia. To achieve this, certain changes were made to the strategy; it was planned to implement a number of innovative solutions that would attract the maximum number of customers.

Renaissance Insurance Help Desk

It is not at all necessary to contact the company’s offices for any reason. Many questions can be resolved by calling the Renaissance Insurance support service at 8 800 333 8 800. Over the phone, the organization’s specialists will help answer questions regarding:

- real estate insurance;

- obtaining an insurance policy against accidents;

- extension of the current contract between the client and the company;

- insurance of citizens traveling outside the Russian Federation;

- car insurance CASCO and OSAGO.

In addition, Renaissance hotline operators can express dissatisfaction with the work of individual offices and express wishes for improving the service.

Note! Renaissance Insurance contact center operators do not accept claims from clients of other companies. Moreover, employees do not have the right to disclose confidential information about the organization’s clients.

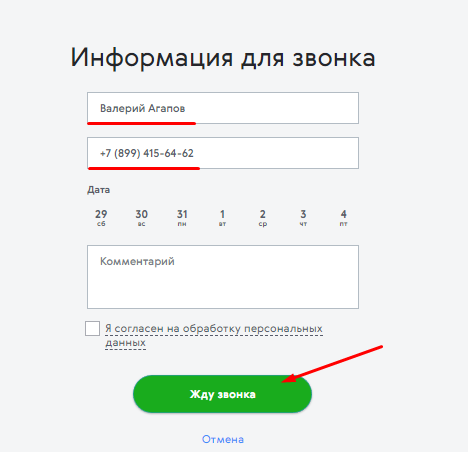

On the Renaissance company website you can order a call to a number convenient for the client. To do this, just go to the official portal and at the bottom of the page click on the inscription Call me back:

After this, the system will prompt the user to select a conversation topic and region. At the last stage, you need to fill in the fields Your name and Mobile phone, after which you should click on the Waiting for a call button:

Liquidation of non-state pension funds and its reasons

However, in August 2020, the license of this NPF was revoked by the Central Bank. The reason for this situation was the organization’s failure to fulfill its obligations. According to the regulator, clients were denied the transfer of funds to other structures of this kind at their request.

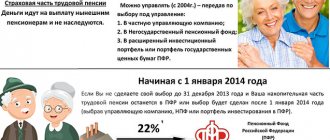

Important! Every Russian has the right to independently decide where to place the funded part of their pension. If for some reason you are not satisfied with the chosen NPF, a person can always terminate the agreement and transfer the money to another structure.

NPF Renaissance was also caught refusing payments. According to the Central Bank of the Russian Federation, the fund refused to issue about 3.4 billion rubles to clients.

By the way, the fund belonged to Anatoly Motylev, and he was the owner of several other structures working in the same area. There were seven of them in total.

By decision of the Central Bank, the license was revoked from each of them. NPF Renaissance tried to prove the illegality of the regulator’s decisions, however, these efforts were in vain. The fund insisted that the regulator did not give time to eliminate the identified deficiencies and submit the necessary documents.

Has the license been revoked?

As mentioned above, the NPF ceased its activities due to the withdrawal of its license. But how did it all happen? Let's tell you right now.

Despite the freezing of the funded part, many funds currently continue to be active in the field of pension provision.

However, in 2020, the Central Bank of the Russian Federation organized a “cleansing” of non-state pension funds. As a result, some of the funds ceased to exist. But most of all the changes affected Motylev’s funds, since the Central Bank withdrew licenses from all 7 funds of this owner. At the same time, Motylev did not stand aside and decided to go to court to challenge the decision.

The Central Bank indicates the following reasons for revoking the license: failure to fulfill obligations to clients, namely the unjustified refusal to transfer funds to other non-state pension funds.

During the trial, the NPF sought to have the court declare the actions of the Central Bank illegal. However, at the moment, the litigation has led to nothing, and the company has a temporary administration.

But what should fund clients do in such a situation? All citizens' deposits were transferred back to the Pension Fund. If desired, a citizen can transfer savings from the Pension Fund to a new operating NPF.

The only negative is that the Pension Fund did not return interest for the last year of operation of the NPF. The NPF no longer has a license to carry out pension activities. However, during the period of operation, the fund carefully protected the savings of clients. But what results did the fund show previously? You can find out after reading this material.

Actions of investors

So, NPF Renaissance’s license has been revoked, what should I do? At least 800 thousand people have faced this question. A temporary administration was created to solve the problem and satisfy customer demands.

The result of her work should be the transfer of all money to clients, and the funds will be transferred to the Pension Fund. If there is a shortage of funds, they will be fully compensated to pensioners.

This means that citizens will receive the funded part of the pension contributed to the Renaissance Non-State Pension Fund and will be able to transfer it to another non-state structure or leave it in the Pension Fund.

Good to know! Citizens will be returned only those funds that they invested in this fund. You cannot count on a return on the income accumulated as a result of investing.

Meanwhile, many citizens considered these funds as an opportunity to ensure a decent standard of living in old age.

Procedure for paying insurance premiums

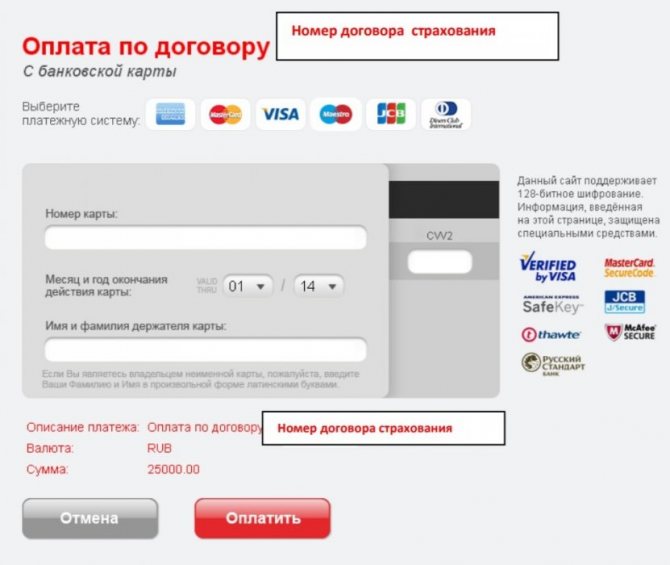

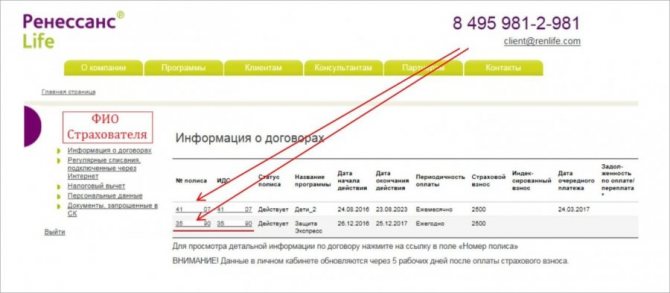

Through the section “Information about contracts” you can proceed to payment of insurance premiums. To do this you need to do the following:

- Open this block of your personal account.

- Find the contract and click the green “Pay” button on the right side of the table.

- A window will open for entering the contract number, client’s full name, Email, and contribution amount. Enter the information and click on “Confirm”.

- Check all the information and click "Pay".

- Now the system will offer to familiarize yourself with the public offer. You can read it or immediately check the box to agree to the terms. After that, click “Pay” again.

- A page with a form for entering payment details will load. Indicate the bank card number, expiration date, CVV2 code, as well as the holder’s first and last name in Latin letters. After copying the information from the card, click “Pay”.

- If there is the required amount on the card, confirm the procedure via SMS or through your bank's application.

After successful payment, a letter with an electronic check will be sent to the linked mailing address.

There is an alternative option for transferring contributions without authorization in your Renaissance Life personal account:

- Download the official website https://www.renlife.ru/.

- Go to the “Customers” section and click the “Online Payment” button. By the way, next to it there is a button to go to the personal account.

- Fill in all fields (contract number, contribution amount, payer information, details for sending a check).

- Check the “Connect Autopayment” checkbox if you plan to regularly write off a fixed amount. Click "Confirm".

- Confirm the transaction through your bank app or mobile number.

Fund performance before liquidation

It should be noted that before the problems with the license, the fund was doing very well. The national rating agency did not evaluate it, but the ratings from RA Expert were high. The last time the reliability level of a non-state pension fund was rated as “A+” with a positive outlook was in 2013.

During its activity, the fund has achieved high indicators:

- Accumulated funds in the amount of 34 billion rubles;

- The total amount of funds from the founders amounted to 433.8 million rubles;

- Right before the license was revoked, he received two prestigious financial awards at once;

- Own property amounted to 28 billion rubles;

- The yield was 7.68%;

- The accumulated return by 2013 is 37.34%, the average for the year is 8.25%;

- The fund took 15th place in the consolidated rating of all Russian structures of this kind, which also indicates successful work;

- Official website of NPF “Renaissance. Life and Pensions” was quite functional.

The fund invested in bank deposits, corporate and government bonds, and shares of leading companies operating in various fields.

Investments involved different degrees of risk, which indicates the implementation of a conservative investment policy.

The website featured a personal account that any client of the fund could use. Now this service is no longer available, but users who have a login and password can try to log in to it at https://lifecabinet.renlife.com/user/login.

Here, everyone could use a calculator to calculate the pension in this NPF and compare it with the indicators of other funds, including the Pension Fund.

How to register?

You won't be able to log in using a fictitious password and login - first you need to register a unique account. The registration procedure for this service differs from the one to which most Internet users are accustomed. First of all, you need to become a client of the insurance company. On the official website https://www.renlife.ru/ you can familiarize yourself with all services and their detailed descriptions. To gain access to the personal account, you need to draw up an agreement during a personal visit to the customer service center or the main office of the organization. Regardless of the type of service (issuing one of the types of insurance policies, creating a deposit, participating in unique programs, and so on), you will be included in the general database. Thanks to this, access to the personal account of SK Renaissance Life LLC will be opened.

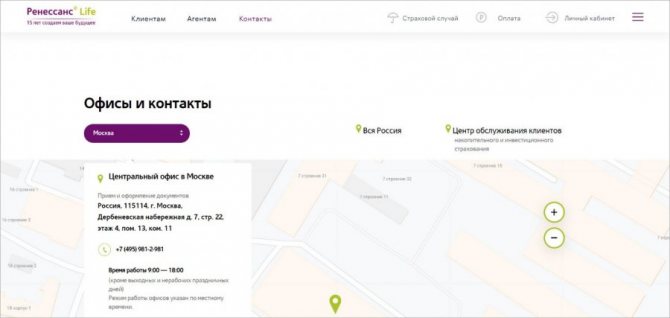

To make it easier to find the nearest branch of the company, use the interactive online map https://www.renlife.ru/contacts/. Enter your city, and the service will automatically show the nearest offices. The central office is located in Moscow.

If you would like personal account or any services of the company, please contact the employees for help through a special online form https://www.renlife.ru/for_clients/feedback/.

Customer Reviews

At one time, reviews of the work of the NPF “Renaissance. Life and Pensions” were quite positive. Many clients noted the good service and convenience of their personal account. The level of NGOs that generated high income also played an important role.

People were also attracted by the simple procedure for signing a contract. To enter into an agreement for service in the fund, a passport and a pension certificate were enough. In addition, the NPF has organized an extensive branch network throughout the country. Residents of any region could personally contact specialists in the nearest city.

But there were also negative reviews. They concerned, for example, the execution of contracts without people’s knowledge, as well as discrepancies between information on the website and actual indicators. First of all, this related to profitability.

Personal account features

The client who logs into his account for the first time must carefully read all sections. On the left side of the main page there are links to thematic tabs. In the “Information about contracts” section there is a table with a description of the documents. All contracts that you have concluded with the insurance company are collected here (number, IDS, status, program name, validity period, premium amount, and so on). If you click on the policy number or name, detailed information about insured events, the client’s name and other information will appear on the screen.

If any policy has not been paid, the “Pay” button will appear in the last column. With its help you can go to the form of payment for services.

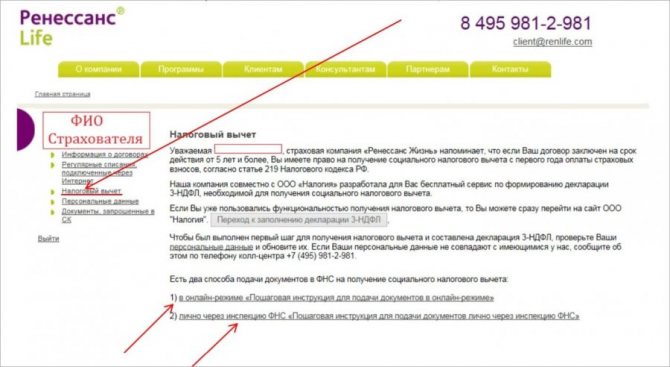

The next section is “Tax deduction”. Each client has the right to a refund of the initial contribution after 5 years of using the services of the insurance organization. Using two links, you can go to the taxpayer’s personal account (https://lkfl.nalog.ru/lk/) or to instructions for submitting documents to the Federal Tax Service to receive a tax deduction.

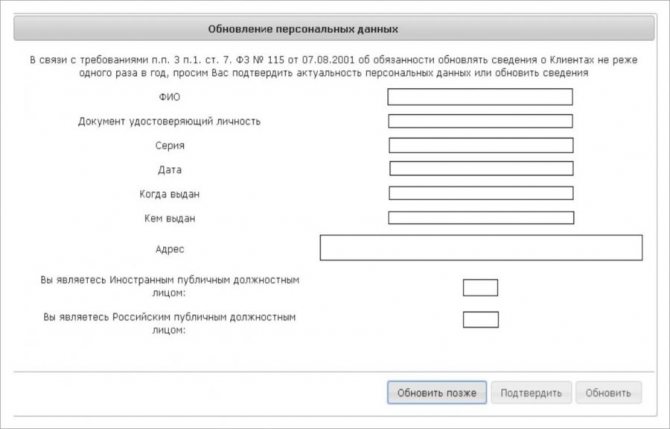

The “Personal Data” tab has already been mentioned in the context of changing the mobile number and password. Here you can find out all the information about VIP cards, link another email, edit client information, and so on. For example, to specify passport data, click on the “Change” button. Then enter the information in the table that opens and save the result with the “Confirm” button.

Through the “Documents Requested from the Investigative Committee” tab, you can upload scanned images of documents that the organization has requested to clarify information or arrange new services.

And also under the list of all sections there is a button to exit your personal account. And in the upper right part of the page the company’s contact information (number and mail) is indicated.

Main types of services of the Renaissance Insurance company

The Renaissance organization allows you to provide the following types of insurance:

- OSAGO;

- CASCO;

- for those traveling abroad;

- health insurance.

Each Renaissance policy option has its own characteristics.

Features of OSAGO insurance in Renaissance Insurance

The cost of an MTPL policy at Renaissance Insurance depends entirely on the following factors:

- type of car;

- region of use of the vehicle;

- driver experience;

- vehicle power;

- accident-free driving;

- data of persons admitted to management.

According to the law, a driver who completes a year without an accident is entitled to a 5% discount.

On January 9, 2020, new changes to MTPL tariffs came into force and additional discounts and increasing coefficients appeared for the policyholder.

OSAGO online from Renaissance Insurance is not much different from the policies of other specialized organizations. So the amount of payments in case of an accident is regulated by law and is:

- Up to 400 thousand rubles for compensation for damage when a vehicle causes damage to the property of third parties.

- Up to 500 thousand rubles for compensation for harm caused to the life or health of each victim.

The Renaissance OSAGO online policy allows the driver to use direct regulation and contact the insurance company for payment of monetary compensation. Such a compensation mechanism can only be used in the following cases:

- participation of only two cars in an accident;

- both drivers insured their vehicles with a Renaissance OSAGO policy;

- neither party suffered physical injury.

In their personal account on the Renaissance Insurance website, clients have the opportunity to use the following services related to the MTPL policy:

- extension of the agreement;

- receiving a copy of the agreement;

- changing personal data in the contract;

- termination of the current contract.

Especially for the convenience of clients, the company’s specialists have posted on the website a complete list of all regulatory documents according to which insurance compensation is paid. You can study this information in the following section: https://www.renins.com/insurance/auto/osago

Features of CASCO insurance in Renaissance Insurance

The CASCO Renaissance insurance policy allows the company's clients not to think about the cost of repairing their own vehicle. Concluding a CASCO agreement makes it possible to repair a damaged car in case of almost any damage.

The contract is drawn up in a modular manner, that is, the driver needs to select only those insured events that may actually occur. This approach allows you to save a lot of money by simply eliminating irrelevant offers from the insurance agreement.

The Renaissance CASCO insurance policy may include the following categories:

- Damage insurance. The option allows you to repair a damaged vehicle at one of the service stations that have entered into an agreement with Renaissance Insurance. The amount of compensation for damage cannot be greater than the amount of the insurance premium.

- Insurance against total loss of a car. An option that makes it possible to receive monetary compensation only if the vehicle is completely destroyed. A complete loss is considered to be the condition of the car in which the cost of repairs exceeds 75% of the insurance premium. If the car is completely destroyed, the owner has the right to receive a one-time compensation in the amount of the insurance amount.

- Protection against car theft and theft. An option that allows you to receive some kind of monetary compensation if your car is stolen. It is important to remember that payment is made only after an investigation into the circumstances of the theft of the vehicle.

- Insurance of additional equipment. If additional equipment installed on the vehicle fails, the owner has the right to receive an insurance payment.

- Full value insurance or GAP insurance. An option that allows you to get the full value of the car if it is lost or stolen. This insurance option is available only for vehicles from the current or last year’s model range.

- Accident insurance. A service that makes it possible to receive insurance payments if the driver or passengers are injured resulting in disability or death. The amount of payments depends on how much the driver or passenger was insured for.

- Civil liability insurance. The client has the right to increase the limit of civil liability provided for by compulsory motor liability insurance to 2.5 million rubles.

As additional services, clients of the Renaissance Insurance organization have the right to use:

- repairs without providing certificates;

- emergency commissioner services;

- technical assistance in case of unforeseen circumstances on the road;

- rental of a vehicle;

- taxi from the insurance company.

Calculator CASCO and OSAGO Renaissance insurance

Using the universal calculator on the Internet portal of the Renaissance Insurance company, you can make a preliminary calculation of the cost of car insurance policies:

- OSAGO;

- CASCO;

- CASCO together with OSAGO.

You can calculate the cost of MTPL insurance online and compare the amount with other companies.

Insurance for traveling abroad at Renaissance Insurance

Insurance for citizens traveling to other countries allows them to receive qualified medical care anywhere in the world. This type of insurance is in incredible demand not only among fans of extreme sports, but also among fans of a relaxed beach holiday.

The amount of insurance benefits provided by travel insurance varies by country. For tourism within the Russian Federation, the Renaissance Insurance company provides policies with coverage amounts from 300 thousand to 1 million rubles. Foreign trips are characterized by a coverage amount of 30 to 100 thousand US dollars. All travel insurance policies include the following services:

- emergency medical and dental care;

- provision of necessary medications for treatment;

- use of modern medical equipment;

- medical transportation of the patient to the place of immediate treatment;

- further treatment of citizens who did not have time to recover before the start of the trip;

- transportation of remains.

As additional services, the Renaissance organization provides the opportunity to receive:

- assistance in evacuating children;

- timely assistance in case of exacerbation of chronic diseases;

- assistance when returning home.

Depending on the planned type of vacation, tourist insurance is divided into:

- Leisure. Insurance is ideal for clients who plan to spend time actively, swimming, volleyball, surfing and other traumatic sports.

- Insurance of real estate during departure. This type of agreement makes it possible to protect yourself from damage to home property due to flooding or fire. In addition, the option makes it possible to quickly resolve a conflict in the event of damage to neighboring property due to the fault of the client.

- Accident insurance. Payment of a certain amount if during the vacation the client suffers bodily injury resulting in disability or death.

- Civil liability insurance. Reimbursement of costs associated with damage to health or property of third parties due to the fault of the client.

Traveler calculator (VZR - traveling abroad) Renaissance insurance

You can pre-calculate the cost of travel insurance on the official website of the Renaissance Insurance company.

Medical insurance at Renaissance insurance

Health insurance is a separate category of Renaissance policies. As part of health insurance, clients can choose one of the following options:

- voluntary insurance of citizens or VHI;

- accident insurance;

- medical insurance for children.

Voluntary insurance

The Renaissance compulsory insurance program allows employers to significantly save on the treatment of employees. Standard voluntary insurance programs are divided into:

- outpatient services;

- dental services;

- emergency medical services;

- hospital treatment.

The VHI program from Renaissance Insurance cooperates with a huge list of domestic and foreign medical institutions. According to the organization’s statistics, as of 2020, more than 4 thousand legal entities with a total number of employees of about half a million people participate in the compulsory medical insurance program.

Renaissance Insurance Company provides flexible conditions for the provision of voluntary health insurance policies for various employers. Large companies can count on the following privileges:

- The insurance premium is six percent of the annual wage fund. In this case, the amount of insurance contributions is included in the organization’s expenses section.

- Insurance premiums are not subject to the unified social tax.

- Medical expenses do not appear in an employee's annual income.

Accident insurance

The Renaissance insurance policy against an accident can have a coverage amount from 100 to 650 thousand Russian rubles. A similar type of insurance protection can be issued for adults, children or groups of children going on a joint trip around the country or abroad.

Renaissance Insurance JSC has several types of accident policies:

- Standard package. The agreement includes protection against temporary or permanent disability and death.

- Extended program. In addition to the standard policy, the extended plan offers protection in the event of disability or death due to illness.

- Special program. The insurance organization allows you to issue specialized policies for sports teams or medical workers.

- A policy with different protection periods. If protection is not needed around the clock, then this insurance option is perfect.

Medical policy for children

Children are the most important thing in life, so Renaissance Insurance has prepared a line of policies that provide protection for children. All types of children's insurance agreements contain the following services by default:

- consultations with a pediatrician and highly specialized doctors;

- laboratory research and testing;

- calling emergency medical assistance;

- emergency hospitalization of a child;

- routine medical examination.

As additional options, clients who have taken out a children's insurance policy are entitled to the following services:

- personal doctor available by mobile phone during business hours;

- analysis of medical services provided to the client by a specialist from the insurance company;

- service support.

The entire list of children's insurance policies is divided by the age of the child. Thus, on the company’s website you can find programs:

- up to a year;

- from one to three years;

- from three to seven years;

- from seven to seventeen years.

Each type of insurance agreement has its own characteristics. To obtain comprehensive information on each of the programs offered by the organization, it makes sense to visit this section of the official website:

https://www.renins.com/insurance/health/child

Reinsurance

Renaissance Insurance Insurance Company actively cooperates with the world's leading companies in order to maximize sustainability and improve the reliability rating. The list of reinsurance companies includes such well-known brands as:

- Munich Re;

- Swiss Re;

- Hannover Re;

- Gen Re;

- SCOR;

- Partner RE;

- Lloyd's.

Proper diversification of risks allows the Renaissance Insurance organization to be in the top ratings of the most reliable companies not only in Russia, but throughout the world.

Reincarnation

It's difficult to decide. After all, Renaissance is a non-state pension fund, which has undergone quite a lot of changes throughout its existence. The thing is that he went through a merger with several pension funds several times.

The last name of the organization is “Renaissance - Sun. Life. Pension". It is under this name that the non-state fund mentioned can be found. Therefore, it is surprising that about “Renaissance” and “Sun. Life. Pension” leaving the same reviews is not necessary. This is the same organization.

Frequent changes of names, as well as combination with other non-state funds, makes many people think about the integrity and sustainability of the company. But what should you pay attention to in order to determine as accurately as possible whether it is worth investing in the fund or not?

Additional system functionality

How to register a personal account on the official website of Alfastrakhovanie Life

For users who participate in the Investor program, additional opportunities will be provided in their personal account. So, after logging in, they will display a table on the main page with the following information:

- Available insurance programs;

- The amount of all contributions made;

- Information on the distribution of available capital according to certain strategies;

- The amount of the cumulative contribution share;

- Risk component (the amount of money spent to cover risks);

- Sum insured (the amount of payments that the user will receive upon expiration of the program).

In addition, a graph will be placed under the table, which displays all changes in assets based on the rates of return of certain strategies. In addition, the user will have the opportunity to change the parameters of investment strategies.