All current obligations of NPF “Doverie” to clients are fulfilled by NPF “Safmar” without changes and in full. By merging funds, we are increasing the efficiency of pension fund management and the level of customer service.

The non-state pension fund "Doverie" began its activities in 1997. The organization has created special programs of non-state support for pensioners.

Which encourage employees, together with the company, to accumulate funds for people who have retired and to interest citizens in joining a non-state pension fund.

In 2003, the Udmurt Telecom Foundation Region-Svyaz joined NPF Doverie and a single company was created. In 2020, it was among the 500 largest Russian enterprises and among the ten largest non-state pension funds.

Brief description of NPF Trust

The fund has been operating since 1997.

Contents Hide

- Brief description of NPF Trust

- Functionality of the personal account of NPF Trust

- Registration in the account

- Authorization in your personal account

- Customer support through the account of NPF Trust

- How to disable your personal account?

- Security and privacy rules

At the end of 2020, NPF “Doverie” entered the RBC rating of “500 largest companies in Russia” according to the RBC Publishing House and took 235th place. During 2020, the fund's position rose by 129 points, which indicates the active development of the company.

The fund is also one of the ten largest non-state pension funds in the country. In this case, the rating was calculated based on the volume of pension savings and reserves in management.

In 2020, the fund’s pension assets doubled and reached 69.25 billion rubles. The assets include clients' pension savings.

The total number of insured persons in the fund reached 1.5 million people. The number of people insured under non-state pension provision is 5.5 thousand people.

In 2020, the return on investment of pension savings reached 7.39%. The rate of return distributed among the accounts of depositors and participants is 10.8%.

The reliability of the fund is confirmed by:

- participation in the system of guaranteeing the rights of insured persons;

- reliability rating "Expert RA" at level A+ ("Very high level of reliability").

Official website of the company

Like any self-respecting company, NPF has its own website. There is a pension calculator on the main page where you can calculate your pension plan according to the following criteria:

- floor;

- age;

- monthly fee.

You can check out:

- individual pension plans;

- funded pension;

- corporate pension programs.

And:

- submit an application directly on the website;

- use your personal account;

- get acquainted with the work of the pension system.

Is it possible to create a personal account?

You can create a personal account on the website in just a couple of clicks. To do this, click on “Personal Account” and then go to the “Registration” section. It is carried out only for persons with compulsory pension insurance.

To register please indicate:

- SNILS number;

- Mobile phone number;

- Email address.

The telephone number that is entered when registering in your personal account must be identical to that entered into the contract. Otherwise, you won’t be able to activate your personal account.

It is also necessary to have access to the email that is specified during registration. Notifications will be sent to it.

After registration, authorization is carried out using the issued login and password. You also need to enter the code from the picture each time.

Personal account functions

In the personal account, the user can independently check all the necessary information about the status of his accounts.

Namely:

- data on personal savings and account status;

- co-financing data;

- How can you increase your own savings?

You can also:

- find out profitability;

- change details and personal data;

- check the addresses of the fund’s offices in your hometown and find out about its founders;

- divide funds from savings at your own request.

Functionality of the personal account of NPF Trust

Your personal account allows you to:

- View the status of the individual personal account of the funded part of the labor pension for any selected period.

- View the user's personal data.

- Change Password.

- Changing your email address information.

- Receive information about the time the client last used the Personal Account Service.

Fund returns by year

NPF does not guarantee clients high interest rates of return, and subsequently does not live up to expectations. The adopted investment strategy gives positive dynamics and it does not arise by chance. This is why clients often respond positively to the transparency of pensions and insurance.

According to official information from the website, over the past 5 years, thanks to well-thought-out activities, “Trust” has managed to reach 73.15% in terms of accumulated customer income.

And if the average annual inflation rate stopped at 7.35%, and the income of citizens who entrusted the formation of pensions to the Pension Fund amounted to 7.7%, then NPF Doverie achieved a result of 11.6% per annum.

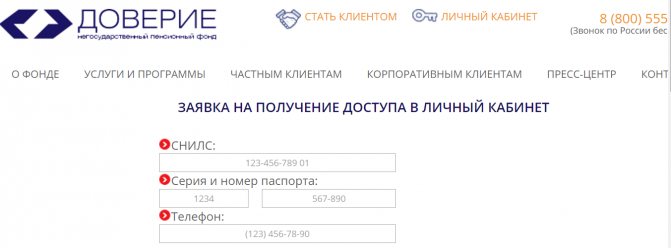

Registration in the account

Access to the “Personal Account” Service is provided after the funded part of the client’s labor pension is transferred under the management of the Fund and the pension savings funds have been credited to the personal account.

To register, on the official website of the fund you must fill out an application for access to your account indicating:

- SNILS numbers.

- Series and passport numbers.

- Phone. It is important to indicate the same phone number as in the agreement with the fund.

Within 30 minutes, an SMS will be sent to the specified mobile number - a message that may contain:

- Password to access the service. This is possible if the data verification was successful.

- Refusal of registration with explanation of the reason. This may be due to the fact that at the time of registration the funded part of the user’s labor pension was not transferred under the management of the fund. Or one of the verification parameters does not match the NPF database.

- A message indicating that the user is already registered in the system. In this case, you should use a password recovery service.

It is also possible to obtain an access password by sending a letter via Russian Post. But it will take much longer.

Foundation programs

Since NPF “Doverie” is now part of NPF “Safmar”, further discussion in the article will be about.

You can apply for transfer of pension contributions:

- on the State Services website;

- Safmar personal account;

- office of the Russian Pension Fund;

- with the help of a representative who has a power of attorney.

In case of early transfers, the accumulative part is burned out. This information should be clarified in advance.

Corporate programs

Corporate programs are designed for contributions by the employer in a specified amount. Contributions vary, depending on the employee's salary level and other criteria that may be set by the employer.

Payment of pensions is carried out after the employee reaches retirement age established by the legislation of the Russian Federation.

Individual pension plans

To create contributions for a non-state pension, it is enough to conclude an agreement with NPF Safmar.

The client independently determines the size of the contribution, its frequency and payment period. If desired, the client can appoint legal successors.

Attention! The increase in funds in NPF accounts is due to the company’s investment package. Interest on income helps increase clients' pensions.

You can choose a pension plan:

- lifetime pension;

- pensions with a period of succession;

- urgent payments within a specified period (no more than 1 year);

- pension contributions until all funds are written off.

Funded pension

Paid throughout life after reaching retirement age. Regulated by law.

Income from funded pension:

- stored in ruble currency;

- increase due to the investment package of non-state pension funds;

- savings may be transferred to legal successors indicated on the pages of the agreement.

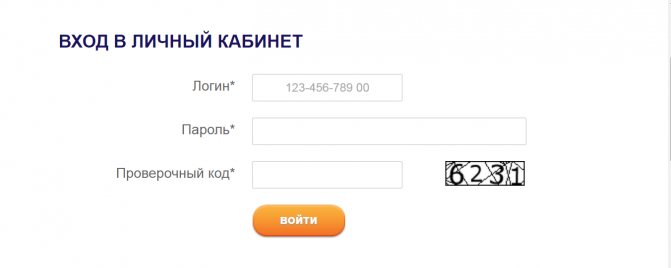

Authorization in your personal account

To log in, you need to go to the “Personal Account” section on the official website. The active button is located in the menu at the top. Then you are prompted to enter your login (SNILS number), password and verification code. The latter consists of 4 crossed out numbers and is indicated here.

On first access, for security reasons, you must change your password. The new password must contain at least 8 characters, including upper and lower case letters, numbers and special characters.

To be able to recover your password, you must provide a valid e-mail.

Is there fraud in the Trust fund?

Employees of non-state pension funds, and Doverie is no exception, are often tasked with attracting a large number of clients. There are many ways to do this, some of them resemble fraudulent schemes. This is where most of the negative reviews about the company come from.

Sometimes company representatives, under the pretext of quickly employing citizens, seek to sign an agreement, after which the latter receives a notification about joining the ranks of the organization’s clients.

Another scheme involves intimidation, when a legally unskilled person is informed of the need to enter into an agreement with a non-state pension fund.

At the same time, employees of non-governmental organizations refer to the fact that in the near future only non-governmental organizations will be involved in the formation of pensions. Another option to attract a client is the promise of high profitability and guarantees from the state.

Considering the above, it cannot be said that Trust is a fraudulent organization. Official figures and statistics show the opposite picture. Nevertheless, the issue of terminating the contract with the company does not lose its relevance.

How to disable your personal account?

The User’s access to the “Personal Account” service is terminated upon submission of an application to NPF “Doverie” with a request to terminate access to the service or block it.

The Fund will stop providing access no later than 1 business day after the client’s request.

The Foundation may initiate temporary or permanent termination of access to the service in the following cases:

- If there are suspicions of unauthorized access to the service on behalf of the user.

- Upon termination of the OPS agreement.

- For technical reasons.

History of creation and reorganization of NPF Trust

The non-state pension fund "Doverie" was registered back in October 1997. It was formed from the merger of several companies in Nizhny Novgorod. The company has a perpetual license to operate in the field of insurance and pensions. Co-finances pensions, manages the funded part, and creates additional savings.

The foundation served more than 800 thousand people. The total budget of the Trust Foundation has long exceeded 11 billion rubles.

Fund reorganization:

- 2003 NPF acquired Udmurt Telecom and Region-Svyaz. This helped the company get into the top 10 large non-state pension funds.

- In 2020, there was a need for change. The fund's financial performance began to fall. The Bank of Russia no longer saw any prospects for the development of the enterprise. It was proposed to carry out additional capitalization or change the entire structure of the fund.

- In March 2020, NPF Doverie merged with NPF Safmar, which belongs to Mikhail Gutseriev. Now the latter fund is responsible to all clients of the Trust fund.

Attention! Citizens who previously entered into an agreement with the Trust Foundation will not need to redo it. All previously stated conditions are preserved, but are served by the new fund.

During 2020, Safmar increased its profitability, this was facilitated by the Central Bank’s softened rhetoric regarding the key rate. The absence of new sanctions also has a positive effect on the percentage.

Is there a Trust Bank in Russia?

Hello Alexey!

It is quite difficult to carry out a detailed check on the information you provide. It is advisable to also have the address of the credit institution’s official website, which all specialized commercial structures in the Russian Federation must have. At the same time, if you rely solely on the name of the Trust Bank you indicated, you can highlight the following nuances.

Firstly, in the state register of the Central Bank of the Russian Federation there is no operating credit organization with the appropriate name. Previously, there was a Trust Bank with registration number 1030, but it was liquidated back in 1993. That is, there is currently no operating credit organization in Russia that has the right to conduct core activities.

Moreover, we note two nuances. First, the word bank in the name can only be used by a company that is included in the register of the Central Bank of the Russian Federation and has the appropriate license. Secondly, scammers quite often use the names of banks that have closed (the license has been revoked, declared bankrupt or completely liquidated). This makes it possible to mislead citizens due to the availability of information and reviews on the Internet about the real credit institution whose name they use.

Secondly, as mentioned above, banks must have at least one official website. Taking into account the practice of search engines, a clear indication of the name is enough, and such a resource will be in first place in the search results. We were unable to find a site that would position itself as official from Trust Bank. This, to the same extent as the situation with the previous paragraph, is of a clearly fraudulent nature of the actions of the persons who contacted you.

Thirdly, banks do not require any advance payment when applying for a loan. Not for translation, not for insurance, not for courier, etc. Moreover, this applies not only to commercial structures with a classic service system, but also to those that provide services remotely. Any commission is included or deducted from the loan amount, or is provided free of charge, but the borrower does not have to transfer his money anywhere.

Based on all the above nuances, the likelihood that you were contacted by scammers and not a real bank is maximum. Therefore, we categorically do not recommend transferring money in their favor. Getting them back will be incredibly difficult. If you need to apply for a loan, we advise you to contact only legal banks. You can view their offers and submit an online application in this catalog of our independent portal. Before adding a financing program, a commercial structure must undergo a detailed check to ensure the legality of doing business.

Answered by: Victoria Loginova, legal consultant at OccupyOnline.ru.

How to terminate a contract

The reasons for leaving to another NPF may be different, but regardless of why the client decided to leave the fund, managers do not have the right to create obstacles for him. For their part, investors must understand that when moving from one NPF to another before the expiration of the five-year period, they will lose part of the investment income.

Therefore, before terminating the contract, you need to carefully weigh all the consequences of such a step. If the decision is nevertheless made, then it is necessary to submit an application to the servicing NPF to change the fund and at the same time notify the territorial branch of the Pension Fund about this. You must find out in advance about all the nuances of this procedure from your pension fund.

Trust Fund hotline number

The hotline is open every day from 8 a.m. to 8 p.m. (Moscow time). Phone number 8-800-555-61-62, calls within Russia are free.

Due to the merger with the Safmar group, NPF Trust JSC was able to achieve very good results in a number of indicators, which indicates the reliability of the fund and great prospects for its further development. The question of whether to trust the formation of a future pension to this organization is something everyone decides independently.

( 21 ratings, average: 2.62 out of 5)

How to join

Algorithm for joining the NPF:

- Go to the official website.

- Click the “Become a client” button below.

- A form will open that you need to fill out and submit.

Enter all data carefully and check it with the documents. At the end, you will need to attach a photocopy of your passport.

You can also conclude an agreement in person at the fund’s office. The only required documents are a passport of a citizen of the Russian Federation.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

All questions must be asked before entering into a contract. It remains in two copies: one in the hands of the fund, the other in the client’s possession.

If it is not possible to contact the office directly, you can call or email the NPF, negotiate with employees and invite them for consultation, conclusion of an agreement and receipt of a certificate.

The agreement comes into force after the first pension contribution is made to the client’s account.

Note! Don't fall for scammers' tricks. The Orenburg NPF “Doverie” does not go door to door and does not try to attract clients from other funds.

He also does not call his clients, does not clarify their personal data, does not check their current validity, does not activate any applications, and does not re-sign contracts. Be vigilant before transferring SNILS and passport data into someone else's hands. NPF agents do not have access to a single client database.

Double-check the information and facts that agents use. Often they may not be true.

Be careful and carefully read the various contracts you are about to sign. Often, along with loan agreements, cards issue another document for signing the transfer of pension savings to another fund. Careful familiarization with the details will protect you and your loved ones from unplanned disposal of the funded part of your pension.