Unexpected changes in the indexation of pensions for working pensioners occurred due to the introduction of new calculation mechanisms for various categories of citizens several years ago. It was then that Law No. 385-FZ first introduced changes to our usual payment rules and partially suspended the increase in payments for some citizens.

Until that moment, pension increases were carried out annually by the Pension Fund for everyone, regardless of their category. In 2020, indexation is carried out based on the consumer price growth index established by the Government of the Russian Federation and only for a certain category.

Each year, such an increase varies between 5-7 percent, and indeed, until recently, every pensioner was entitled to it.

What types of pensions are not indexed?

The new rules do not affect all types of pensions. The restriction applies only to insurance and fixed payments to it. And besides, only for the category of workers, i.e. There will be no indexation for those who continue to work after retiring. Therefore, all working pensioners today cannot qualify for an annual increase in payments.

Since 2020, the Decree of the Government of the Russian Federation has annually approved the coefficient for increasing the size of the fixed payment.

For an insurance pension, which, as we now know, is taken into account in pension points, the concept of the cost of one pension coefficient is used. It is also approved annually by the Government of the Russian Federation. You should know that the fixed payment is indexed , and the insurance pension is adjusted by increasing the cost of one pension coefficient (point).

But this does not mean that the pensioner will now not be able to receive the due amounts and will lose the past indexation forever. After leaving his job, he is entitled to payments taking into account all missed annual payment increase factors.

Another thing is that such a restoration will not happen immediately , and not even from the next month after dismissal. Payments after dismissal, taking into account the new indexed amounts, are provided for by the Law only three months after dismissal from work .

Next, we’ll look at why recalculation takes so long after work stops. But first you need to know who is considered a working pensioner and how much pensions are indexed in 2020.

Pension point cost

The amount of payments is calculated using a point algorithm starting from 2020. To retire and receive an insurance pension, the applicant must score a certain number of points. The total pension coefficient is multiplied by the number of points - the more points, the greater the payment amount. The price of 1 point changes annually. In 2021 it will be 98.86 rubles.

Indexation of fixed payment and adjustment of insurance pension

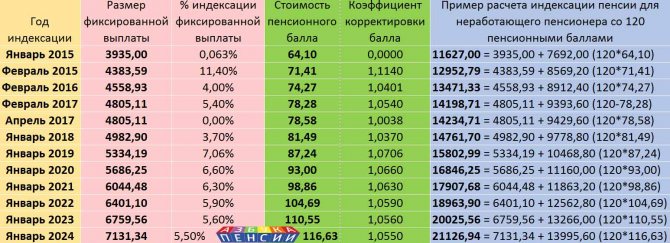

For convenience, we provide a complete table of pension indexation, taking into account the new approved indices for several years in advance.

| Year of indexation | Fixed payment amount | Indexation percentage | Pension point cost | Adjustment factor |

| January 2015 | 3935,00 | 0,063% | 64,10 | 0,0000 |

| February 2015 | 4383,59 | 11,40% | 71,41 | 1,1140 |

| February 2016 | 4558,93 | 4,00% | 74,27 | 1,0401 |

| February 2017 | 4805,11 | 5,40% | 78,28 | 1,0540 |

| April 2017 | 4805,11 | 0,00% | 78,58 | 1,0038 |

| January 2018 | 4982,90 | 3,70% | 81,49 | 1,0370 |

| January 2019 | 5334,19 | 7,06% | 87,24 | 1,0706 |

| January 2020 | 5686,25 | 6,60% | 93,00 | 1,0660 |

| January 2021 | 6044,48 | 6,30% | 98,86 | 1,0630 |

| January 2022 | 6401,10 | 5,90% | 104,69 | 1,0590 |

| January 2023 | 6759,56 | 5,60% | 110,55 | 1,0560 |

| January 2024 | 7131,34 | 5,50% | 116,63 | 1,0550 |

The size of the fixed payment will increase to 5,686.25 rubles from January 2020. Also, Federal Law No. 350-FZ approved the cost of one pension coefficient in the amount of 93 rubles for insurance pensions.

To compare payments taking into account work and without taking it into account, let’s look at an example. The first table contains an example where indexation by year is calculated for a non-working pensioner after dismissal. For the calculation, we took 120 pension points.

Pension indexation table

How does pension indexation work?

As can be seen from the example, the pension amount is indexed every year by an approved percentage, because this pensioner does not work. For a pensioner with this score, the increase in pension from January 2020 will be about 1,000 rubles. Further, the annual surcharge will also remain within one thousand rubles.

The second table provides an example of how amounts are calculated for a working pensioner. Here we see the cessation of indexation due to the introduction of Law No. 385-FZ of December 29, 2015. Thus, with continuous work, the pensioner receives his monthly payment at the same level.

According to calculations, it is clear that by 2024, for a pensioner who continues to work, the pension will be almost 2 times lower than possible.

The Constitution will not help: Working pensioners will not wait for indexation

On June 5, it became known that parliamentarians from the LDPR would submit to the State Duma a bill to return the indexation of pensions for working pensioners, which was frozen back in 2020. Deputies propose to return indexation from July 1, 2020, and set the cost of one pension coefficient at an amount equal to 93 rubles 00 kopecks.

A few days later, the authors of the bill explained why it was necessary to return indexation of pensions to working pensioners. As Yaroslav Nilov said, this should, firstly, eliminate social differences, secondly, increase the purchasing power of the population, and thirdly, “whiten” the labor market. Today, many continue to work without registration or part-time, which harms their interests and reduces the amount of contributions to the Pension Fund.

Mandatory indexation of pension payments is one of the main amendments to the Russian Constitution, which will be adopted by nationwide vote from June 25 to July 1 of this year. However, the indexation parameters are not specified in the basic law, so there are no guarantees that this clause will also affect working pensioners.

And, it is very likely that even after voting on amendments to the Constitution, the authorities will not return to the issue of indexing pensions for working pensioners, especially in the current difficult economic conditions. Experts interviewed called the proposed bill a populist step rather than a real prospect.

How to determine whether a pensioner is working

If the period of time under consideration is counted in the pensioner’s insurance period, then he is working. That is, officially employed persons, individual entrepreneurs, lawyers, clergy, etc.

In other words, these are insured persons for whom insurance premiums are paid and reporting is submitted in accordance with established forms. Insured persons: - those working under an employment contract, under an author's order agreement, as well as authors of works receiving payments and other remuneration under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements granting the right to use a work of science , literature, art; – those who independently provide themselves with work (individual entrepreneurs, lawyers, arbitration managers, notaries engaged in private practice, and other persons engaged in private practice and who are not individual entrepreneurs); – who are members of peasant (farm) households; – working outside the territory of the Russian Federation in case of payment of insurance premiums; – who are members of family (tribal) communities of small peoples of the North, Siberia and the Far East of the Russian Federation, engaged in traditional economic sectors; - clergy.

(Law dated December 15, 2001 N 167-FZ)

Who is considered a working pensioner?

The Pension Fund of the Russian Federation classifies as working pensioners all citizens who carry out work or other activities for which insurance premiums are paid to the citizen’s personal account.

Thus, this category includes:

- those who work under an employment contract (both fixed-term and indefinite);

- those who work under a civil contract (contract or contract for paid services);

- heads of organizations who are their sole founders, members of organizations, owners of their property;

- authors of literary, scientific and other works receiving payments under contracts for the implementation of copyrights;

- members of peasant (farm) households;

- members of tribal communities of indigenous peoples;

- clergy;

- those who work abroad, if insurance premiums are paid for them.

Question answer

How will the pension increase for those who receive it later? According to the Federal Tax Service (FTS), self-employed pensioners (carrying out entrepreneurial activities without registering as an individual entrepreneur) are not considered to be employed. They pay professional income tax (PIT): 4% when providing services to individuals, 6% when collaborating with individual entrepreneurs and legal entities. At the same time, the self-employed are not required to pay insurance contributions to the Pension Fund, as well as the medical (MHIF) and social (FSS) insurance funds. Therefore, these citizens are treated as unemployed, and their pension is subject to indexation.

Rules and terms for indexing insurance pensions after dismissal

After dismissal from work, the Pension Fund will recalculate payments taking into account the missing indices during his work. The restoration of the payment of the full (indexed) pension, taking into account the missed indexations, will not occur immediately, but only three months after the dismissal of the pensioner.

Legislators have set aside a fairly long period of time for confirming and processing data on the fact of work using simplified SZV-M forms from policyholders, with the subsequent issuance of appropriate decisions on payment by the Pension Fund. And here we cannot do without an example.

Let's consider the dismissal and indexation of a working pensioner on April 3, 2020: 1. The policyholder submits information monthly using the SZV-M form (Resolution of the Board of the Pension Fund of February 1, 2016 No. 83p). No later than the 15th day of the month following the reporting period - month, submits information about each insured person working for him, with whom contracts (labor, civil law, copyright, etc.) were concluded during the reporting period, continue to be valid or terminated.

In our situation, a pensioner is considered working in April, despite the fact that he was fired at the beginning of the month. And for him, the employer is still required to provide information about the work until May 15. And he will be considered non-working from May .

2. According to Part 6 of Article 26.1 of Law No. 400-FZ, the decision on the payment of indexed amounts is made in the month following the month in which the Pension Fund of Russia received data on work.

In the month of July (following June, in which information about the fact of work for May is received), the Pension Fund is obliged to calculate and make a decision on the payment of amounts, taking into account the due increase.

3. The calculated amounts of the insurance pension will be paid from the month following the month in which the decision was made (Part 7 of Article 26.1 of Law No. 400-FZ).

Thus, only from August 2020 , a person who quit in April will be able to receive a full pension payment, taking into account the restored indices . If, after the restoration of indexed payments, the retired pensioner gets a job again, then its amount will not be reduced (Part 8 of Article 26.1 No. 400-FZ).

What is the reason for the proposal to index pensions for working pensioners?

The FNPR message is posted on the union’s website, it contains a link to a letter to Mishustin. The document was signed by the chairman of the federation Mikhail Shmakov .

According to the document, the FNPR proposes to index pensions for working pensioners in connection with the adoption of amendments to the Constitution of the Russian Federation in July 2020. The new version of Article 75 of the Basic Law states that in Russia pensions are indexed at least once a year in the prescribed manner. At the same time, the FNPR notes that the Constitution does not differentiate citizens by the fact of employment, therefore all assigned pensions, including working pensioners, are subject to indexation.

Indexation of pensions for working pensioners has been frozen since 2016. Currently, pensioners who work or carry out any activity during which they are subject to compulsory pension insurance are paid the amount of the insurance pension and the fixed payment (FB) to it without indexing the size of the FB and adjusting the size of the insurance pension (for non-working pensioners it is carried out annually from January 1). Only after the termination of labor activity, a citizen begins to be paid a pension in full, taking into account all indexations that were carried out during the period of his work.

Article on the topic

The calculation did not come true. Why do errors appear when calculating pensions?

Additional payment to a pensioner for the past time after leaving work

Indexation of pensions for working pensioners in 2020 will still not be carried out. But recently amendments for workers came into force. Article 26.1 of Federal Law No. 400-FZ was supplemented with new provisions for those who quit. You can find out the details in this article.

The time frame for restoring a new size remains the same, 3 months after dismissal. But already taking into account the surcharge. Thus, they will also pay additional payment from the date of dismissal for these 3 months. Let us remind you that previously such an increase was not paid for the past time. We recommend that you familiarize yourself with these rules in more detail using the examples in the video.

Indexation of pensions for working pensioners in 2021

What awaits working retirees in 2021? Will the increase in state old-age benefits, which have not been indexed for several years, affect them? For now, the situation will remain unchanged: the annual recalculation of the amount of payments associated with inflation does not apply to working Russians.

Officials at different levels have repeatedly spoken out about the possible resumption of recalculation of old-age social benefits for working pensioners. To restore it, 368 billion rubles are needed - this amount was announced to journalists by the head of the Russian Pension Fund, Anton Drozdov. There are no such funds in the federal budget yet. As soon as they appear, the moratorium will be lifted. For now, everything remains unchanged, and there will be no increase in 2021.

When is it profitable for a pensioner to resign?

Let's now look at examples of when it is profitable for a pensioner to quit in order to be subject to the new Law from 2020 with an additional payment for the past time. First, let’s remember why new amounts are still paid 3 months after dismissal.

In accordance with Part 6 of Article 26.1 of Law No. 400-FZ, the decision to pay a full pension is made by the Pension Fund in the month following the month in which information about the fact of work was received (or not received).

If a pensioner, for example, resigns in September 2020, then he will be considered unemployed for a full month only from October (1st month after termination of work). Accordingly, in November (the 2nd month after termination of work), the Pension Fund of the Russian Federation will not receive information about his work for October (information on the SZV-M form is submitted only for working pensioners).

In December (3rd month after termination of employment), the pension fund decides that from January 2020 it will be paid an indexed fixed payment and an insurance pension, taking into account the current value of the pension point.

In the example considered, the pensioner will receive new amounts from January. He will also receive an additional payment from November (the month from which he is considered unemployed).

In practice, this means that the most profitable month for dismissal of a working pensioner is September . After all, an increase in points is now provided for from January 2020. But even if you were late with your dismissal and left work only in October, your pension will also be indexed, but a month later.

Indexation for working people

What awaits working retirees in 2021? Will the increase in state old-age benefits, which have not been indexed for several years, affect them? For now, the situation will remain unchanged: the annual recalculation of the amount of payments associated with inflation does not apply to working Russians.

Officials at different levels have repeatedly spoken out about the possible resumption of recalculation of old-age social benefits for working pensioners. To restore it, 368 billion rubles are needed - this amount was announced to journalists by the head of the Russian Pension Fund, Anton Drozdov. There are no such funds in the federal budget yet. As soon as they appear, the moratorium will be lifted. For now, everything remains unchanged, and there will be no increase in 2021.

Working pensioners are subject to the annual August recalculation. The amount of the bonus is affected by the pension coefficient earned in the previous year. According to current standards, up to 3 IPCs are taken into account. In absolute numbers, this is 98.86 x 3 = 296.58 rubles.

Why is the pension not indexed after dismissal?

If, after the expiration of the period specified for making a decision on indexation, the amount has not increased, then one of the main possible reasons may be the employer’s untimely submission of monthly reports on the fact of work. Of course, the pensioner is not to blame in this case, and the law is completely on his side.

If the employer fails to provide information on the fact of work on time, or provides false information that affects the increase in pension , the amount is revised by the Pension Fund for the past (Part 9 of Article 26.1 No. 400-FZ). This means that in the event of an error in reporting, in which the increased amounts were not paid, an additional payment is due for the elapsed time from the date of entitlement.

A situation may arise when incorrectly submitted work information affects the increase in pension . The employer did not submit (or did not submit on time) information about the fact of his work for the working pensioner, and the Pension Fund of the Russian Federation, based on these data, indexed the employee’s pension, considering him unemployed. In this case, the Law is on the side of the pensioner, and if an error is detected, the amount will be brought into compliance with the next month after the error is discovered, and all responsibility in this situation lies only with the employer.

In this case, the policyholder will be responsible for overpaid pension amounts, incl. taking into account penalties in the amount of 500 rubles in relation to each insured person.

Will working pensioners have their pensions increased?

Photo: Svetlana MAKOVEEVA

And now more details. In mid-January, the president announced changes to the Constitution. The amendments that came from the Kremlin spoke about the principle of “decent pension provision and regular indexation of pensions.” The working group for introducing amendments immediately concluded: the increase will now affect all pensioners, both working and non-working. This was stated by Senator Andrei Klishas and Academician Talia Khabrieva. But then it turned out: respected people were in a hurry. And in vain they gave hope to millions of working elderly...

Head of the Federation Council Committee of the Russian Federation on Constitutional Legislation and State Building Andrey Klishas. Photo Mikhail Tereshchenko/TASS

Let us recall that in 2020, as part of the next pension reform, the government decided to divide all pensioners into two large groups: those who are no longer working and those who continue to work. For the second, the indexation was “frozen” until they finally retired. The rationale was as follows: they say that those who receive additional income do not need the full amount of benefits from the state so much. But there wasn’t enough money in the budget.

Currently, working pensioners receive only a small increase in August. This is not indexation, but recalculation based on the number of pension points they earned over the previous year. But the increase is insignificant. For example, in 2020 the maximum was 262 rubles, and this year it will be 279 rubles. For comparison, the average indexation for non-working pensioners in January was 1,000 rubles.

Moreover, if a working pensioner resigns, then from the next calendar month he will begin to receive an increased pension. All missed indexings will be taken into account. For example, if a pensioner continued to work in the last five years, the pension may increase by 3 - 4 thousand rubles per month.

Teaching people of pre-retirement age the art of floristry at the College of Architecture and Design.

Photo: Mikhail FROLOV

Experts interviewed by KP are not sure whether the new government will amend the law and equalize the rights of all pensioners. On the one hand, this is a very big expense. According to approximate calculations - 370 billion rubles per year. On the other hand, there are prerequisites for this decision. There is money in the budget, and the number of pensioners will gradually decrease in the coming years due to a gradual increase in the retirement age.

In the meantime, while the amendments have not been adopted, some enterprising pensioners are sharing tips on the Internet for increasing their pensions. It is known that the pension increases immediately after dismissal. Therefore, you can quit, get indexation, and after a couple of months get a job again or become self-employed (the latter do not pay insurance contributions to the Pension Fund, so they are legally considered unemployed). According to the law, it is impossible to take away already accrued indexation. The main risk is finding a job again after being fired. You can use this method only if you have a good relationship with your superiors or you are a sought-after specialist who will quickly find a use for yourself.

Increase in pensions for working pensioners in August 2020

For working pensioners, the next recalculation will be carried out from August 2020. The increase in the insurance pension will be calculated based on unaccounted points for 2020, which are formed on an individual personal account from funds paid by the policyholder for its employees. you do not need to submit an application to the Pension Fund to carry it out

If several months have already passed, but the amounts have not increased since August, then you can call the hotline at the Pension Fund of the Russian Federation at your place of residence and find out about your right to this type of recalculation. It is possible that your employer did not pay insurance premiums. But if the right to such an increase is confirmed, then the increased indexed insurance pension will be paid taking into account the additional payment for the months that have passed since August. You can learn more about this type of recalculation from August.

What exactly does the FNPR offer?

The union notes that the adoption of amendments to the Constitution involves the preparation of new laws and amendments to some existing regulations. Therefore, the specification of the right of working pensioners to pension indexation should also be enshrined in federal law.

The FNPR has already voiced its proposals to restore the indexation of insurance pensions. But the Ministry of Labor did not give a clear answer to the question, the federation’s letter says. In this regard, the federation asks the government to once again consider its proposals on the implementation of the constitutional rights of working pensioners.

Earlier, the former head of the Russian Pension Fund, Anton Drozdov , said that approximately 368 billion rubles would be needed to resume indexation of pensions for working pensioners in 2020.

Results

The new algorithm for indexing pensions after dismissal is quite confusing. Summarizing all the rules, we can say that in 2020:

- Working pensioners will continue to not receive indexed pension amounts;

- New amounts will be paid only three months after dismissal;

- Now the pensioner will receive an additional payment for the “lost” months of reporting processing, which were not previously paid;

- The total amount of payment upon dismissal will be indexed by as many indexes as were missed during work.

How much money will it take to resume indexation?

In October 2020, the former head of the Pension Fund of Russia (PFR) Anton Drozdov (became Deputy Minister of Finance in the new government of Mikhail Mishustin ) said that the resumption of indexation of insurance pensions for working pensioners would require an additional 368 billion rubles. He noted that this is a significant expense for the Pension Fund, so restoring indexation in 2020 is hardly possible.

According to the Pension Fund, at the beginning of 2020, the total number of pensioners was 43.87 million people, of which 9.67 million were working.