What is alimony

Family law under alimony requires financial support from a family member if he does not fulfill this obligation provided by law on a voluntary basis. Maintenance can be recovered, including from a former family member, if we are talking about spouses who have terminated their marital relationship.

Such payments may be withheld from a pensioner to help the following persons:

- spouse or former spouse;

- a minor child;

- a child over 18 years old, but due to objective circumstances, does not have the opportunity to work and provide for himself;

- mother or father of adult adult children;

- grandparents, if they raised their grandchildren instead of their parents;

- other relatives, provided that they were dependent on the persons from whom alimony was being collected.

Reference! Funds are collected for the current maintenance of a person so that he can ensure his existence. For minor children, such payments are collected upon request unconditionally. For other relatives, it is necessary to prove that their current financial situation does not allow them to provide for themselves, as well as the impossibility of employment.

For the children of a person who does not live with them, funds can also be claimed if it is necessary to incur large one-time expenses. These may include undergoing treatment, purchasing the necessary equipment (for example, a musical instrument if the child plays music), purchasing a trip ticket for health purposes, etc.

Voluntary provision of maintenance is not considered by law as alimony .

The latter can be recovered from a person on the basis of a court order, decision and a writ of execution issued on its basis, as well as a notarized agreement on the payment of alimony.

Liability for non-payment

Pensioners are subject to general rules for holding them accountable if alimony payments are not made. We are talking about the following sanctions:

- administrative fine (Article 5.35.1 of the Code of Administrative Offenses of the Russian Federation);

- criminal prosecution (Article 157 of the Criminal Code of the Russian Federation);

- a penalty amounting to 0.5% of the debt amount for each day.

If the debtor became a pensioner during the payment of alimony and did not inform the bailiff about the change in his status, he will face liability under Art.

17.14 Code of Administrative Offenses of the Russian Federation. The bailiff will collect a fine from the violator, ranging from 1 to 2.5 thousand rubles. Various interim measures will also add to the troubles. The bailiff has the right to prohibit travel or suspend the debtor's driver's license.

Can alimony be collected from a pension - yes or no

The Family Code does not contain any list of payments or sources of income from which a citizen can withhold maintenance from family members. There is only one regulatory document that addresses this topic. By its resolution, the Government of the Russian Federation provided a list of the types of income from which alimony is collected.

The government decree clarifies the list of payments through which child support obligations are satisfied only in relation to minor children. True, the methodological recommendations of the Federal Bailiff Service suggest extending this legal act to the collection of any other types of alimony. The issue remains controversial and ambiguous.

At the same time, the legislation on enforcement proceedings establishes a list of those incomes from which, on the contrary, no penalties are allowed. And one of the types of such payments is provision of compulsory social insurance. Therefore, the question often arises whether such deductions from pensions are allowed.

Do they pay from old age pension?

This type of pension provision is directly cited as an exception to those insurance payments from which collections are prohibited. This means that alimony can be withheld from the old-age pension based on the order of the bailiff.

From disability pension

Despite the fact that this type of support is social in nature and is aimed at financial support for a disabled citizen, alimony is also withheld from the disability pension. This is also expressly stated in the text of the law on enforcement proceedings.

From military pensions

Pension benefits for former military personnel are nowhere explicitly mentioned as a type of income from which maintenance is withheld for a needy family member. However, the list approved by the Government of the Russian Federation mentions all types of pensions, which allows us to conclude that military pensions are also included in this list. This is logical; having military serviceman status cannot serve as an exemption from fulfilling the obligation to support your needy family members.

Should a pensioner pay child support?

The law in terms of whether alimony amounts are paid from a pension is categorical: yes, they are paid. Moreover, a pension can be assigned in connection with:

- loss of the opportunity to work fully, which is why a disability group has been assigned;

- reaching the age that allows you to go on vacation on a general basis (old age);

- completion of the required length of service, which gives the right to payment according to length of service (for employees of the Ministry of Emergency Situations, the Federal Penitentiary Service, the Ministry of Internal Affairs).

Attention!

The only type of pension from which the law prohibits the recovery of child support is payment for the loss of a breadwinner. Alimony is also payable from the pension of a citizen who is serving a sentence by a court verdict (in prison).

How to calculate the amount of alimony from pension payments

The legislation provides for 2 options for collecting alimony: in a certain percentage in relation to all types of income of the obligated person and in the form of a fixed amount paid monthly.

In the first case, the Pension Fund of the Russian Federation or the government department through which pension provision is provided retains the part of the income established by agreement or judicial act.

So, for example, 25% of income (or ¼ of it) is usually collected for one minor child. In this case, 5,000 rubles will be withheld from a pension of 20,000 rubles for child support.

In the second case, the calculation is even simpler, since the executive document provides for a fixed amount, which is only subject to annual indexation taking into account the inflation rate. The pension fund can only transfer to the account specified in the bailiff's order the amount determined by the parties or the court.

Alimony payments withheld from the military

Alimony payments are withheld from persons performing military service in a manner similar to civilians. Therefore, the amount deducted in favor of minors does not change in any way.

So, according to Art. 81 of the RF IC, income reduced for the payment of alimony depending on the number of children is distributed in the following order:

- A quarter of earnings - 1 child.

- 33% - 2 children.

- 50% - more than 2 children.

In some situations, the court sets higher payments. They can amount to about seventy percent of the defendant's total permanent income.

Pensions for military personnel and civilians are no different. Therefore, the procedure by which alimony is established and paid is not fundamentally different. It is worth noting that the indicated procedure also applies to funds from the pension of a combat participant.

If alimony is paid voluntarily, then the citizen can contact the Pension Fund office and indicate the contact information of the guardian of minor children.

The Pension Fund independently withholds mandatory payments. The costs of transferring funds are paid by the alimony provider himself.

Child support is withheld from the following types of earnings:

- salary corresponding to rank;

- allowances (based on length of service, due to the location of the unit);

- compensation if they are provided instead of standard food;

- one-time deductions.

If a guardian raising children stops receiving alimony payments after the military man goes on vacation, then he will have to file a claim in court. According to the decision made, the bailiffs will begin the procedure for collecting funds in the normal manner provided for ordinary citizens.

If you have a court decision in your hands, as well as a writ of execution, the guardian will need to contact the service responsible for fulfilling the legal requirements of the plaintiff, having first written a corresponding statement. The bailiffs will formulate requests aimed at obtaining reliable information about the income of the alimony provider, from which funds for the maintenance of the minor will subsequently be withheld.

Is it possible to reduce the size

With regard to the maintenance of minor children, the law expressly provides that the amounts established as a general rule can be reduced, but only in the presence of exceptional circumstances.

Among them, the Supreme Court of the Russian Federation lists the following:

- the presence of other persons as dependents of the obligated citizen, in particular the need for him to support his other minor children;

- a citizen’s small income, in which, after paying alimony, he has no funds left for his own life (in this case, evidence must be presented to the court that in this way the person is not trying to hide official income);

- the advanced age of the payer or the deterioration of his health;

- in other cases of deterioration in the financial condition of the payer.

The procedure for exercising the right to reduce alimony obligations is as follows:

- The occurrence of circumstances giving, in the opinion of the obligated person, the right to a reduction in payments.

- Collection and preparation of documents to support these circumstances.

- Drawing up an application to the court with a request to reduce the amount of alimony and sending it to the court in accordance with the jurisdiction (usually the same court that made the decision on alimony).

- Issuance of the appropriate court decision and its entry into legal force.

It is worth noting that the possibility of changing the already established amount of maintenance is also established by the general norm, which means it applies not only to alimony for children, but also to any other family members. The law connects this possibility with a change in either the material well-being of the parties or their marital status.

Moreover, this rule applies to both sides. For example, if a disabled ex-wife remarried, the court may completely exempt the citizen from paying alimony. Likewise, if a person has a new dependent wife, the amount of alimony to the previous spouse may be reduced.

How much alimony does a pensioner pay?

The amount of alimony from a pensioner depends on the number of children whom he is obliged to support financially. If the amount is collected in shares, then it is:

- a quarter of the pension - for one child;

- third - for two;

- half - for three or more.

When there is arrears in alimony payments, the percentage of deduction from the debtor's pension can be up to 70 inclusive.

Reducing the amount of alimony collected is possible by the payer himself only by filing a corresponding application with the court.

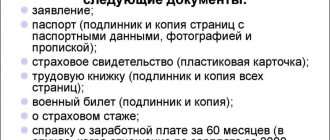

What is the collection procedure?

To receive alimony, a person must have a writ of execution in his hands. According to the law, these are, in particular:

- agreement on payment of alimony;

- court order;

- a writ of execution issued on the basis of a court decision that has entered into legal force.

To obtain one of the last two documents, a citizen must go to court. After receiving the writ of execution, the claimant also has 2 options at his discretion:

- Contacting the bailiff service with an application to initiate enforcement proceedings (with an attachment of the enforcement document). In this case, the bailiff issues a decision to foreclose on the pension provision of the alimony payer and sends it to the Pension Fund of the Russian Federation or another agency (the pension service of the armed forces in the case of payment of a military pension, the pension authorities of the Investigative Committee or the Prosecutor's Office, etc.).

- Independent submission by the claimant of a writ of execution to the Pension Fund of the Russian Federation to withhold awarded payments. This method allows you to directly contact the agency paying the pension to the debtor, but forces the claimant to independently monitor the execution of the sent document.

The withheld amounts of alimony are sent to the account of the claimant specified in the application or resolution of the bailiff.

Statement of claim for alimony

The legal basis for applying to court to establish alimony will be a statement of claim. The content of the statement of claim must include the following points:

- name and address of the court;

- personal data and contact information of the plaintiff and defendant;

- an indication of the presence or absence of family relationships;

- information about the children of the plaintiff and defendant;

- requirement to establish alimony payments.

A sample statement of claim can be downloaded on our website, and to draw it up, we recommend consulting with our specialists. Only in this case can mistakes and violations of the law be avoided, which will lead to a significant delay in the collection of alimony. Fill out the feedback form or call one of the numbers listed on the website. We will offer the most optimal options for establishing alimony payments.

From what type of payments can child support be withheld?

In relation to alimony for a minor child, the shortest list of incomes from which collection cannot be made has been established. For example, even amounts in compensation for harm to health are not protected from withholding alimony for a minor child.

The following income is protected from such deductions:

- survivor's pension;

- payment in connection with the death of the breadwinner;

- benefits in connection with injuries and mutilations in the performance of official duties;

- compensation for victims of radiation or man-made disasters;

- payments for caring for disabled persons;

- alimony received by a person who is also obliged to support a member of his family;

- financial assistance on the occasion of the birth of a child or the death of a relative;

- benefits and maternity capital;

- humanitarian aid;

- funeral allowance and some others.

The full list is established by Art. 101 of the Law “On Enforcement Proceedings”.

Thus, with all types of pensions, except for provision in connection with the loss of a breadwinner, alimony for disabled family members can be collected. To do this, you must have a writ of execution in your hands in the form of a court order, an agreement of the parties or a writ of execution.

When is a minor not subject to retention?

In addition to the list of income subject to reduction by the amount of alimony, legal acts establish a list of payments from the pension system for which deduction is not established.

The first type is a survivor's pension. The indicated payment is a federal support measure (additional payments are made from the budgets of the constituent entities of the Russian Federation). Such funds are intended to provide for disabled citizens who have lost their only breadwinner.

The second type is one-time payments, and the third is additional payments to individuals for performing duties in harmful conditions.