The cost of living in the Altai Territory in 2018

At the beginning of March 2020, the most recent statistics on the cost of living in the region are still data for the third quarter of 2020. There is still no information for the last quarter; as for the third quarter, the data is as follows:

- 9,452 rubles is the cost of living per capita,

- 10,090 rubles - for able-bodied residents of the region,

- 7,693 rubles - for regional pensioners,

- 9,536 rubles - for children of the Altai Territory.

Although there is still no data for the fourth quarter, in any case, it is not they or even the information for the third quarter that have practical meaning in 2020, but PM statistics based on the results of the second quarter of 2017. It is precisely this that underlies social support measures for residents of the region; on its basis, it is determined whether a family is classified as low-income and whether it can qualify for additional budget assistance.

In the second quarter of 2020, the statistics were as follows:

- 9,359 rubles is the cost of living per capita,

- 10,002 rubles - for able-bodied residents of the region,

- 7,592 rubles - for regional pensioners,

- 9,434 rubles - for children of the Altai Territory.

The presented figures are important, including for the calculation of the first or second children who appear in the families of the region in 2020.

Living wage for a pensioner in the Altai Territory in 2018

As for pensioners, the PM is always set specifically for them, and the statistics of the previous year play only an indirect role in this. For 2020, the authorities of the Altai Territory have set the value of the pensioner's monthly pension in the region at the level of 8,543 rubles

. This is 180 rubles more than the 2020 value.

Let us recall that the pensioner’s monthly income plays a big role in determining the minimum pension in the region. The old-age pension in the Altai Territory in 2018 cannot be less than 8,543 rubles.

According to the existing rules, those pensioners who have a lower pension are paid by the state as much as necessary so that their benefits are equal to the pensioner’s monthly pension. Specifically in the Altai Territory, this rule applies to 102 thousand pensioners.

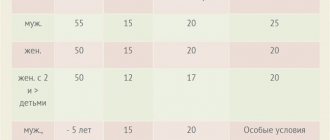

Insurance experience (formerly labor experience)

In 2020, every citizen in the Altai region must have at least 9 points earned, as well as at least 7 years of experience. The number of points increases annually, so the question of what pension will be awarded has its own individual answer for everyone. It is the points that make it possible to provide payments for those years when the citizen was not actually in a certain workplace, but, nevertheless, these periods are counted as socially significant. For example:

- if a Russian was in conscript military service - 1.8 points for each year;

- years when a citizen looked after elderly people over 80 years old - 1.8 points for each;

- the annual inspection period for a disabled child, as well as for a disabled person assigned to the first group – 1.8;

- when a woman looked after her first child - 1.8 points per year;

- respectively, for the same period, but with a second baby - 3.6;

- year when the third or fourth child was looked after – 5.4.

As you can see, the old-age insurance pension consists of length of service, points and other preliminary deductions made before retirement. The minimum pension will increase only due to resolutions adopted by the regional administration.

Minimum salary in the Altai Territory in 2020

As for the regional minimum wage, its federal value has been established in the region, however, taking into account the regional coefficient. Since there are two such coefficients in the region - 1.15 and 1.25, then in various regions of the region the minimum wage from January 1, 2020 is 10,912 rubles 35 kopecks or 11,861 rubles 25 kopecks.

Thus, the minimum wage in the Altai Territory already exceeds the subsistence level, which is one of the main tasks for the entire country for the current year.

Russian authorities regularly notify the population about changes in the subsistence level (LS). This figure is especially important for recipients of state support due to age or disability. The fact is that the minimum accruals for non-working citizens are strictly tied to the minimum wage.

Thus, pensions in the Altai Territory in 2020 will grow following prices and tariffs. After all, they are the ones who influence the calculation of the minimum amount for living.

Download for viewing and printing:

Factors influencing the pension content of residents of the Altai Territory

Due to the uneven economic development of the regions of the Federation, the authorities had to develop a methodology for equalizing the income of the officially disabled population.

At the legislative level, the following rule is established:

- a pensioner cannot receive less than the subsistence minimum;

- additional payment is provided at the request of the applicant;

- its calculation takes into account all regular accruals: the pension amount itself;

- monthly cash payments;

- additional material support;

- other social support measures.

When calculating the pension supplement, social support measures provided in kind are not taken into account.

Attention: the rule of bringing the content to the PM does not apply to employed persons.

The pension amount itself is made up of separate parts, which also affects its size. They are:

- Fixed

, which is a guarantee of the state.

It is the same for everyone and at the beginning of 2020 (before indexing in February) it is 5,334.19 rubles . - The insurance

component is calculated individually based on the following data: length of service; - points accumulated on an individual account.

Basic statistical data for the Altai Territory for 2020

Pensions are financed from the budget. Consequently, the government faces the challenge of finding a balance between raising funds and spending them. The analysis is carried out on the basis of the following data:

Reference: the pension provision of an officially working pensioner may be less than the given minimum. For example, a disabled person of the 3rd group.

Lives in the region 749 620

pensioners. Many receive minimal amounts. In addition, the number of recipients of budget subsidies is constantly increasing. Thus, from 2020 to 2020, pension benefits were assigned to another 40.6 thousand people. An increase in the number of pensioners leads to an increase in the burden on the budget.

Moreover, local authorities are developing and implementing regional measures to support non-working subsidy recipients.

At the end of 2020, the Government of the Russian Federation presented an increase in the minimum amounts of pension benefits. By 2020, the figure is planned to increase to 14.5 thousand rubles.

Do you need information on this issue? and our lawyers will contact you shortly.

Measures to support pensioners in Barnaul

Non-working pension recipients are classified as socially vulnerable segments of the population. Therefore, additional preferences are provided for them.

They are entitled to:

- reduction in tax rates;

- subsidies for utility bills;

- partial reimbursement of funds spent on medications;

- free medical care, including at home;

- travel on public transport without purchasing a ticket.

The list of benefits depends on the type of pension benefit, as well as the availability of a benefit certificate. For example, disabled people are provided with budget money:

- means of rehabilitation;

- conditions for conducting a rehabilitation and habilitation course;

- specialized workplaces;

- health vouchers.

For information: elderly citizens who have crossed the 80-year-old threshold can count on:

- to double the fixed payment (assigned automatically);

- to pay from the budget for the services of a person taking care of them at home ( RUB 1,200.0

); - for exemption from payments for major repairs.

Smolensk Integrated Center for Social Services for the Population

Organization

| Name of institution | Smolensk Integrated Center for Social Services for the Population |

| What area is it located in? | Leninist |

| Working hours | Monday-Friday: from 09:00 to 18:00, break: from 13:00 to 14:00 |

| In what region of the Russian Federation is it located? | Smolensk region |

| Phones | +7 (general questions) (hotline on wages) (on labor conditions and safety issues) |

| Site | https://www.socrazvitie67.ru |

| Institution address | Smolensk region, Smolensk, Gorodok Kominterna street, 12 |

Conditions for assigning pension benefits to residents of the Altai Territory

The criteria for assigning payments from the budget are reflected in the current legislation. They are strictly related to the types of pensions. Namely:

- assigned when meeting the criteria for length of service and points:

- after 60 years for women;

- after 65 years for men;

- at a different age in the presence of preferential grounds;

- work experience of at least 15 years (this indicator will be relevant by 2024, in 2020 the minimum experience is 10 years, within 5 years it will increase by 1 year annually);

- 30 individual pension coefficients (in 2020, the minimum amount of pension points is 16.2, the required number will increase annually and will reach 30 by 2024).

- women who have celebrated their 65th birthday;

- insurance in the presence of disability and at least one day of insurance experience;

- insurance is assigned upon the death of the breadwinner, who was dependent on the applicant for pension provision. The main condition is that the deceased breadwinner has an insurance period (at least one day);

- social is assigned to children under the age of 18, as well as over this age, studying full-time in educational organizations, until they complete such training, but no longer than until they reach the age of 23, who have lost one or both parents, and children of a deceased single person mother.

Hint: all pension issues are dealt with by specialized bodies - branches of the Pension Fund (PFR).

You should apply for an appointment when eligible (criteria described above). The applicant is required to write an application and bring a package of documents.

Multifunctional center - Smolensk

Where to go

| Name of institution | Multifunctional center - Smolensk |

| In what area | Industrial |

| In which region of the Russian Federation | Smolensk region |

| What is the address | Smolensk region, Smolensk, Industrialnaya street, 2/13 |

| [email protected] | |

| Phones | 8 +7 (48122) 0-56-55 |

| Website | https://mfts67.rf |

| Opening hours | Monday: from 09:00 to 19:00 Tuesday-Friday: from 09:00 to 20:00 Saturday: from 09:00 to 18:00 |

Where to contact

The Pension Fund branch follows the place of registration. But you need to complain about the sluggishness of specialists to the regional branch of the Pension Fund of Russia.

Hint: on Fridays and pre-holiday days, the reception time for citizens is reduced by one hour (until 16:00).

Branch of the Union of Pensioners of the Russian Federation of the Altai Territory

There is a public organization in the region - the Union of Pensioners. Its main tasks:

- bringing together people with rich professional and life experience and using their activity in solving the problems of the older generation;

- educational activities on social problems and pension legislation;

- participation in the implementation of national projects and social programs;

- interaction with authorities and management;

- development of charity in the interests of pensioners.

The Union closely interacts with authorities and receives funding from them. The following events are organized for wards:

- Spartakiads;

- evenings of rest;

- creative competitions;

- meetings with young people.

In order for non-working citizens to keep up with life, computer literacy courses are organized for them. For those interested, there are “circles” based on interests, including creative ones. Together with local administrations, the Union solves pressing problems, helps overcome crisis situations, and so on.

Hint: a lonely pensioner can always come to the Union workers with his problems. They will help you fill out the paperwork and tell you where to look for support.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website.

According to the latest data, over 755 thousand pensioners live in the Altai Territory (437 thousand in cities), which is 31.5% of the population. Since 2011, this figure has increased by 40.6 thousand people.

According to the Decree of the Administration of the Altai Territory dated November 14, 2016 No. 383, in the 3rd quarter of 2020 it amounted to 7243 rubles, with an average of 8931. In 2020, it is planned to increase this amount to 8363 rubles, that is, to the national level.

This indicator is based on the cost of the consumer basket, which is calculated for the basic food set established by law and a list of non-food goods and services. The basket does not include the price of medicines and consumer products.

According to retail chains, food costs in the region vary between 2700-2800 rubles. According to the Unified Interdepartmental Information and Statistical System in 2020, this figure across the country fluctuated between 3516-3824 rubles. Thus, we can conclude that the cost of the minimum set in the Altai Territory is lower.

The average pension payment today is 11,417 rubles, which is 3,700 more than the same figure in 2011. For comparison, the national figure is about 13,100 thousand. Find out in all regions.

For those whose actual payments, as well as the monetary equivalent of benefits in kind, are below the established subsistence level, a federal social supplement to their pension is provided from the budget to the required level.

755 thousand people received compensation payments this year, of which about 197 thousand were employed. The average amount of additional payment in the Altai Territory, according to the Head of Labor and Social Protection, is 1,800 rubles.

Statistical data on pension payments are presented in the table:

| 2011 | 2012 | 2013 | 2014 | 2015 | |

| Total number of pensioners, thousand people | 714.4 | 721.4 | 730.1 | 737.5 | 749.6 |

| Their share in the population structure | 29.68 | 30.07 | 30.54 | 30.92 | 31.54 |

| Average monthly pensions, rub. | 7717 | 8498 | 9258 | 10063 | 11073 |

| Minimum pensions in the region | 3931 | 4209 | 4476 | 4865 | 5354 |

| The cost of living, rub. | 4686 | 4980 | 5342 | 6179 | 7154 |

| Real amount of assigned monthly pensions, % compared to the previous year | 105 | 102.3 | 102.6 | 97.7 | 100.6 |

Main indicators of pension provision for the population of the Altai Territory (according to Rosstat)

As can be seen from the table, pension payments in the Altai Territory have increased by 43.5% over the past five years.

At the same time, there was an increase in both real payments and the minimum possible. The cost of living in the region is steadily increasing by the Parliamentary Assembly.

However, after the cost of food and utility payments, the average pension leaves about 1,500-2,000 rubles on hand, which classifies pension recipients as poor.

Multifunctional center - Smolensk

Where to apply

| Name | Multifunctional center - Smolensk |

| Area | Leninist |

| Operating mode | Monday: from 08:00 to 18:00 Tuesday-Friday: from 08:00 to 20:00 Saturday: from 09:00 to 18:00 |

| Phones | 8 +7 (48122) 0-54-44 |

| What is the address | Smolensk region, Smolensk, Yunnatov lane, 10 |

| Region | Smolensk region |

| [email protected] | |

| Site | https://mfts67.rf |

Fringe benefits

Pensioners, as a vulnerable category of citizens, have the right to a number of benefits. At the national level, reductions in taxes on real estate and tax deductions are provided. Pensions and social assistance are not subject to taxes or fees.

In accordance with the pension legislation of the Russian Federation, in 2020 (as well as in previous years), every person living on the territory of the Russian Federation, upon reaching a certain age, is assigned an old-age pension. This type of support is established for the purpose of financial support for citizens who, due to their age, are limited in their former ability to work or, having reached age parameters, cannot work for other reasons.

To receive at least a minimum pension benefit, in addition to reaching retirement age, the recipient must meet other minimum requirements

established by law:

- The main condition for assigning a pension payment is the presence of a certain amount of work experience.

- At the same time, pension provision is provided both for citizens who have earned the required length of service and for those who do not have it.

Working pensioners

According to the decision of the government and the Prime Minister of Russia, there will be no indexation for those citizens who continued to work after crossing the age limit specified for retirement. This will save impressive amounts in both the federal and regional budgets.

The pension, the registration of which was postponed, will also increase. This happens due to special bonus coefficients. The fixed part will increase by 36%, and the insurance part will increase by 45% when processed in five years. All exact figures and the number of bonus coefficients can be found at your place of residence, in the Altai PF.

The age limits for retirement have not yet been changed. Of course, bonus rates are an additional incentive to continue working. The vast working experience accumulated by people over the entire period of long working activity cannot be overestimated. In fact, it is still impossible for these professionals to find a worthy replacement. So the government is trying to keep people in jobs.

Types of old-age pensions and conditions for their assignment

Depending on the pension recipient’s compliance with the conditions specified by law, he may be assigned one of the following types of old-age pension:

Insurance pension provision

The old-age insurance pension is assigned in our country more often than other pension payments. The vast majority of pensioners (about 83%) are its recipients. This type of payment is regulated by Federal Law dated December 28, 2013 N 400-FZ “On Insurance Pensions”

, according to which the right to appoint it is acquired by its recipient if there is:

- Age 60.5 years

for men and

55.5 years

for women. - lasting at least 10 years

. - (IPC) not less than 16.2

.

The above parameters for the amount of insurance experience and IPC are set for 2020 and, according to the law, increase annually. The experience requirement increases by 1 year until it eventually reaches 15 years

, and IPC by 2.4 to the size

30

.

For persons who worked in difficult climatic conditions, as well as in jobs with harmful, particularly difficult or hazardous conditions for health, access to old-age insurance pension benefits is possible earlier than the generally established retirement age, that is. The conditions for assigning an early pension, as well as the list of professions and persons entitled to it, are established by the same law “On Insurance Pensions”

.

Is a pension entitled if there is no work experience?

There are cases when a person, for some reason, did not have the opportunity to work at all or only had temporary official earnings. In a word, by the time he reached retirement age, he was unable to earn enough length of service that would give him the right to an insurance pension. And for this category of citizens, pension support is provided by the state.

If the citizen’s insurance experience and IPC do not reach the minimum amount

, required to establish an old-age insurance pension, or

are absent altogether

, such category of recipients is assigned a pension.

However, to receive this financial support there are conditions that are provided for by the Federal Law “ On State Pension Provision in the Russian Federation”

» dated December 15, 2001 N 166-FZ, in accordance with which social old-age pension benefits are assigned to

disabled

persons:

- from among the small peoples of the North

who have reached

55 years of age

(men) and

50 years of age

(women), as well as on the day of granting a pension

permanently residing

in the territory considered inhabited by these peoples. - Citizens of the Russian Federation permanently residing

in our country, as well as citizens of other states, or those without citizenship at all, provided that they have

been permanently residing

in our country

for at least 15 years,

when both reach the age of

65 years

(men) or

60 years

( women).

What is the minimum old-age pension in Russia by region?

The concept of “minimum pension”

in itself is very subjective, since in different regions of our country both wages and prices differ significantly from each other, and in some areas, such as the Far North and other areas, regional coefficients are applied to wages. The amount of pension payments depends on many circumstances and may vary in different regions of residence.

If the recipient meets the minimum conditions provided for by law, the old-age pension in 2019 was established in the following amounts:

- Social pension benefit - from April 1, 2020, 5163.2 rubles

(until April 1, 2019 - 4959.85 rubles); - Insurance pension - 6107.46 rubles

(based on data for 2020, see calculation below).

Social pension payments are set to their recipients in a fixed form

, while old age insurance benefit: IPC multiplied by its cost plus a fixed payment.

Depending on the region of residence of the pensioner, the minimum amount of the pension payment received may differ due to the different cost of living in the constituent entities of the Russian Federation. This is due to the appointment of one of the measures of social support for pensioners - a supplement to pensions.

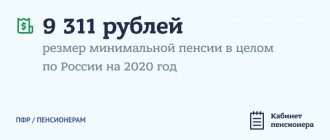

Minimum size in 2020

Annual pension payments. The law provides for an increase in pension benefits at the level of actual inflation of the previous year. Now the Government has provided for the indexation of pensions in 2020 more than inflation in 2020 - by 7.05%

(according to calculations, inflation in 2020 was 4.3%):

- at the same time, the cost of the pension coefficient will increase to 87.24 rubles

; - and the fixed payment is 5334.19 rubles

.

Thus, taking into account that from January 1, 2020, the conditions for assigning an insurance pension change (you will already need to have 16.2 pension points), the minimum old-age insurance pension will be:

16.2 x 87.24 + 5334.19 = 6747.48 rubles.

As for social pensions, the Government of the Russian Federation (in particular, the forecast of the Ministry of Economic Development) reports that it will be indexed by only 2.0%, then in 2020 the social old-age pension benefit will be 5163.2 rubles

.

What to do if the pension is less than the subsistence minimum?

Minimum pension amount for a non-working person

a pensioner, by law, should not be below the subsistence level determined by the state for such citizens, while the total income takes into account not only the pension itself, but also additional monthly payments, allowances and compensations.

If the pension recipient’s monthly income is below the pensioner’s subsistence level (PLS), then his pension is set.

Depending on the level to which the pensioner’s maintenance does not reach (in Russia or in the region of residence), a social supplement is assigned to him:

- federal

, paid from funds provided in the Pension Fund budget; - regional

(from the budget of a constituent entity of the Russian Federation).

Accordingly, for its appointment it is necessary to contact the territorial branch of the pension fund or the territorial body of social protection of the population.

Living wage for pensioners in 2020

In 2020, the size of the PMP, which determines the right to receive a federal social supplement, decreased (relative to 2020). The Federal Law on the Budget of the Russian Federation included the minimum subsistence level for a pensioner (in the country as a whole) to determine the social supplement to the pension at the federal level in the amount of 8,540 rubles. This event was aimed at reducing budget costs for the payment of social supplements to pensions.

However, in 2020, the budget included an increased cost of living for a pensioner - 8,726 rubles.

Here it should be taken into account that the social supplement is set to the level of the regional PMP, and in many regions it differs in one way or another from the federal value (maybe either up or down). For example, in Moscow in 2020, a PM was established for receiving social benefits for pensions of 11,561 rubles, and in the Khabarovsk Territory - 10,895 rubles.

Latest pension increase

The unified technology for calculating pensions prohibits local authorities from engaging in arbitrariness by underestimating the amount of monetary benefits, making them lower than the size of the state pension benefit. Thanks to unified rules for calculating pensions, in many regions the allowance of pensioners has increased by 2,000 rubles. When a pensioner’s income is less than the minimum cost of the food basket, then a social supplement is added to his pension.

Next year, pensioners will have to re-register this increase. This is required by a new methodology for recalculating pensions and will not affect all subjects of the Russian Federation, but only those where the size of the minimum pension has increased too noticeably. To date, the subsistence minimum has not been legalized in all constituent entities of the Russian Federation. The table shows the approved and unapproved living wage. It was developed and formed on the basis of legislative acts of the constituent entities of the Russian Federation.