There are many elderly foreigners living in Russia. These are mainly citizens (former or current) of countries that were previously part of the CIS. A less numerous category are people who have worked for a long time in Russia, but who also live in other countries. Natural questions arise about whether foreigners have the right to apply for a Russian pension. Considering that the number of migrants, including the elderly, is only increasing today, it is worth understanding this in more detail.

Does a foreigner have the right to receive a pension in the Russian Federation?

According to Art. 62 The Constitution of the Russian Federation, foreigners and even people without citizenship enjoy the same rights in our country as Russians. Receiving social benefits, which include a pension, also applies to this statement. It does not matter what kind of payment we are talking about - for old age, length of service, loss of a breadwinner, disability - if there are grounds, it is assigned and paid regularly.

Important!

Residence and/or years of work in the Russian Federation must be confirmed by the necessary documents.

In order to have the right to receive a pension in Russia, it is not enough to simply work in the Russian Federation for some time. And even obtaining citizenship is not a guarantee of pension provision from our country. Read more about the main condition.

Documents required for obtaining pensions for foreigners in the Russian Federation

The list of documents that a foreigner will need to provide to the Pension Fund will depend on the country from which he arrived, as well as on the grounds for receipt. For example, if a Ukrainian applies for a pension, then his work experience in Ukraine will be taken into account, since this country is part of the CIS. Therefore, you will need to provide a work book with places of work in Ukraine.

The general list of documents required to receive a pension includes:

- Statement;

- Passport or other identification document;

- residence permit;

- Work book in the Russian Federation;

- Employment contract;

- SNILS;

- Personal account statement;

- Documents confirming the availability of benefits (if any);

- Documents confirming the change of surname and other data.

In some cases, other documents may be required.

The main condition for receiving a pension in the Russian Federation

There are two options for obtaining permanent residence status for foreigners in our country:

- TRP – temporary residence permit.

- Residence permit – residence permit.

An elderly citizen who has a temporary residence permit does not have the right to receive social benefits, that is, a pension either. Although at the same time it has the opportunity to receive medical care on the same conditions as Russians.

Foreigners who have issued a residence permit can apply for the accrual and payment of pensions in the same way as Russians (this right is guaranteed by the laws of Federal Law No. 166 “On State Pension Security in the Russian Federation” dated December 15, 2001 and Federal Law No. 167 “On Compulsory Pension Insurance in the Russian Federation”). RF" dated December 15, 2001).

Conditions for assigning state support

Law No. 115 sets out the basic conditions for receiving this pension. These are the two conditions that were previously mentioned: having a residence permit and mandatory participation in pension insurance.

Such a fact as a residence permit gives a foreign citizen the right to receive a Russian pension.

This is a prerequisite for applying for a pension, that is:

- A citizen who has lived for more than 15 years on the territory of Russia has the right to become a Russian pensioner in the case when:

- The total period includes the time spent obtaining a residence permit.

- The time of temporary registration is not included in the total period.

- The second mandatory condition is to be a participant in pension insurance. To become an age pensioner, you must be under a certain age to participate in work. In 2020, this type of social security in insurance form must meet the following minimum requirements:

- It is necessary to make contributions to the Pension Fund for 8 years.

- For pension insurance, you need to accumulate 11.4 points.

It is necessary to understand that in order to become a pensioner and receive a Russian pension, you must meet the legal criteria that are described for each type of social benefit.

See the latest news on retirement age in Russia from 2020. News on increasing the retirement age? Find it at the link.

How can a retired foreigner obtain a residence permit?

For a retired or pre-retirement foreigner, there are several options for obtaining the coveted residence permit (Article 8 of Law No. 115-FZ of July 25, 2002 “On the legal status of foreign citizens in the Russian Federation”:

- if a person was born in one of the countries or republics that were previously part of the RSFSR, after six months of living in Russia with a temporary residence permit, he automatically has the right to a residence permit;

- a pensioner who has the status of a native speaker of the Russian language (those who have lived in Russia for a certain time, or whose ascending relatives previously lived in the Russian Federation are entitled to it) can apply for a residence permit in a simplified and accelerated manner;

- if there are children with Russian citizenship, the pensioner receives a residence permit after six months of residence in Russia under a temporary residence permit.

In any case, an applicant for a residence permit must come to the department of the Ministry of Internal Affairs located at his place of residence in Russia and declare his intention in writing.

The right of foreigners to pension provision

Russian Law No. 166 and No. 167 describes that pensions for foreign citizens in Russia in the absence of insurance (work) experience are assigned under certain conditions:

- We have taken out compulsory pension insurance for ourselves.

- Have a residence permit.

Accordingly, a citizen of another state, when applying for a Russian pension, must have the following required documents:

- SNILS.

- A certificate confirming your residence permit.

The Russian government has prescribed new changes regarding the assignment of pensions to foreign citizens who operate on the basis of Federal Law No. 166.

Now the following persons have this opportunity:

- Citizens of other countries, in particular persons who do not have citizenship:

- Persons who temporarily or permanently reside in Russia.

- Individuals who transfer payment to the treasury of the Russian Pension Fund, this action is possible upon concluding an employment contract with the employer (the registration period must be at least 6 months).

- Persons who are considered refugees have received a corresponding certificate, which was issued on the basis of Federal Law No. 4528 - 1.

Which foreigners will receive a pension in the Russian Federation in the future?

Foreigners with a residence permit who:

- joined the Russian pension insurance system;

- were in an employment relationship with a Russian employer (and he transferred insurance premiums to the budget for them, i.e. the employment relationship was legalized by an employment contract).

There are exceptions, which we will talk about a little later. You can register in the pension insurance system in one of the following ways:

- if a foreigner is employed, then he joins the system through an employer, who transfers contributions for him and submits all the necessary information to the Pension Fund;

- disabled age pensioners, disabled people, simply unemployed or self-employed apply to the Pension Fund or MFC on their own.

In general, for persons with a residence permit, the conditions for obtaining a pension are similar to those provided for Russians:

- reaching the established age (remember: by 2024 for women it is 60 years old, for men – 5 years more, and now there is a transition period provided for by the new legislation on pension reform);

- the amount of insurance experience – from 15 years (by 2024);

- individual pension coefficient (IPC) – from 30 (by 2024).

This coefficient represents the number of points that a person has accumulated over the years of his work after registration in the compulsory pension insurance system. The system for counting them is quite complex. The amount depends on the total amount of insurance contributions transferred to the budget for the employee. A pensioner should not independently calculate the IPC; this is the work of Pension Fund employees (although the calculation scheme is published openly, and everyone can check how fairly pension payments are calculated to them).

An important point is that a foreigner can receive a disability pension in Russia only if he has passed a medical and social (medical) examination in the Russian Federation.

Moreover, if a person has worked in Russia for at least one day, he applies for a disability insurance pension. If not, then he can only count on social support. Let us remind you: the main difference between social and insurance pensions is that the first has a fixed amount, and the second is calculated based on the length of service and the amount of insurance contributions paid for the employee. As a rule, the insurance pension is slightly higher than the social pension.

Package of documents

To submit an application for consideration of receiving a pension, you must provide documents that confirm the presence of a residence permit and participation in pension insurance.

The supporting documents for the residence permit are:

- Passport of the country of citizenship. The translation must be certified by a notary.

- A residence permit document in which the migration service marks the registration.

- A certificate of registration on the territory of Russia is issued by the migration service.

- The receipt written by the applicant about the actual place of residence on the territory of the Russian Federation is written in free form.

Documents that confirm participation in pension insurance:

- SNILS (insurance certificate).

- Extract from the pension insurance system.

- Labor book of the Russian Federation, or other countries where the terms of labor activity are indicated.

- Agreements for the provision of services or other work.

How can a foreigner receive a pension in Russia?

First, a foreigner applying for a Russian pension should contact a branch of the pension fund or MFC. This is a completely free procedure. There they will work with him in several stages:

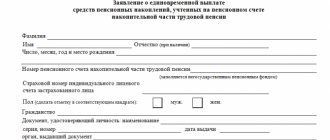

- writing an application for a pension (a prescribed form, uniform for both foreigners and Russians);

- drawing up an application on the method of delivery of pension payments - by mail, through a cash register or by transfer to a card;

- preparation of a package of necessary documents - passport, residence permit, insurance certificate (SNILS), possibly a work book, certificates from former places of work, conclusion from the Russian Bureau of Medical and Social Expertise, etc. (depending on the type of pension, the list of documents may be different).

A foreigner can submit an application to the competent authority either personally or through a representative. Acceptance of the application and other documents is documented by the appropriate document (it is handed over to the applicant to confirm that his application has been registered). An important point is that all documents drawn up in a foreign language must be translated into Russian. In this case, the translator's signature must be certified by a notary.

Notification of the acceptance of documents and the start of work with them is given to the applicant. Then comes the consideration of the case. It usually lasts up to 10 days, after which the pensioner receives information about the decision. In particularly difficult cases, you have to wait up to 3 months for a verdict.

If the decision is positive, the person will begin to receive a pension from the month following the month of application. In case of a negative verdict, the refusal must be documented. The notification is given to the failed recipient of the pension within 5 days after completion of the case consideration procedure.

How to receive a pension for a foreign citizen

To assign maintenance from the budgetary funds of the Russian Federation, it is necessary to justify the right to such a benefit. Therefore, the following steps need to be taken:

- Make sure that pension benefits are required by law (you can consult with a specialist at the Pension Fund of Russia branch).

- Collect a package of necessary documents.

- Submit an application, accompanied by supporting documents.

- Receive a receipt stating that the specialist has accepted the entire package:

- check whether it contains a list of documents provided, the date and personal signature of the employee.

- Wait for the issue to be resolved.

Important: legal consideration lasts ten working days:

- If a pension is assigned, it will begin to accrue from the date of: application;

- the emergence of the right to preference.

- specific reason;

Package of documents for citizens of other countries

The logic for selecting papers is quite simple for a specialist, however, it causes difficulties for pension applicants. To avoid mistakes, you should carefully read the conditions for granting subsidies to foreigners. It is written there:

- About the need for a residence permit. This circumstance is confirmed:

- a residence permit with a registration mark (issued by the Federal Migration Service - FMS);

- certificate of registration at the place of residence; certificate of registration at the place of residence.

- The following condition is formulated as a requirement to participate in the ATP. It is confirmed:

- insurance certificate (SNILS);

- an extract from a personal account in the SPS system;

- work book of the Russian Federation (of other countries, subject to the conditions described below), where there are records of the duration of participation in labor activity;

- agreements on the performance of work, provision of services, and so on.

Attention: papers confirming preferential conditions are required. They could be:

- certificates of dependents;

- documents on the conclusion and dissolution of marriage (if personal data has been changed);

- certificate of assignment of disability, etc.

Special preferences for residents of some countries

Residents of the CIS have some privileges compared to other foreigners. Namely:

- When assigning a Russian pension, the period of work in the citizen’s homeland is taken into account in the insurance period. Therefore, it is necessary to provide a work book issued in the former country of residence.

- If a person is assigned benefits under insurance guarantees in Russia, then in his homeland it ceases to be paid. This condition applies to nationals of the following countries:

- Kazakhstan;

- Ukraine;

- Armenia;

- Belarus;

- Tajikistan;

- Kyrgyzstan;

- Turkmenistan;

- Uzbekistan.

Citizens of Georgia, Lithuania, and Moldova also have preferential pension conditions. There are special international agreements on this matter.

Important: you do not need to independently inform the pension authorities of your country of citizenship. This is done in an organized manner, through the interaction of the relevant structures of these countries. Attention: Periods of work in the territory of the former Soviet republics after December 31, 1990 can be counted into the insurance period only if insurance contributions are paid during this period to the state budget.

Difficulties with registration issues

Often, foreign nationals are faced with certain nuances that raise questions. Some of them are described in legislation. Namely:

- If there is no official registration in Russia, then the application for a pension is submitted at the place of residence.

- If this cannot be confirmed, then the application is written in the city of actual residence.

- All actions related to the registration of state support for old age can be entrusted to the employer.

Any place of residence must be documented.

Currently, there are several ways to submit documents to the Pension Fund:

- in person at a local branch or multi-service center;

- by mail (papers must be certified);

- on the official Internet portal:

- public services;

- Pension Fund;

- through a representative (a power of attorney certified by a notary or the applicant’s employer is required).

Conditions for paying pensions to foreigners

Nationals of other powers can enjoy social benefits in Russia if they officially reside in the country. This means that the Pension Fund will transfer funds before the expiration date of the residence permit.

Important: if the residence permit is revoked, the payment of insurance benefits will cease. This provision by law lasts 6 months. If a new document on the right to reside in Russia is not issued, accruals are terminated. Therefore, recipients need to update the document in a timely manner. If there is a delay in its re-registration for the period of absence of a confirmed right to register in the Russian Federation, payments will not be made.

Recommendation: citizens who decide to move to the Russian Federation should take care of obtaining citizenship.

The Pension Fund makes transfers in accordance with the general procedure. It is defined in the initial application for appointment:

- postal transfer;

- transaction to a bank account or card;

- by using the services of an enterprise that has the appropriate license and agreement with the Pension Fund.

Attention: the method of transferring money from the Pension Fund can be changed at any time. This is done on the basis of a written request from the recipient. It is worth considering that new details will be taken into account from the month following the date of the application.

Calculation of pensions for foreigners (procedure)

The procedure and tariffs for calculating pensions for foreigners are similar to the indicators used to calculate pensions for Russians. There are no additional coefficients (neither decreasing nor increasing) for citizens of foreign countries arriving in Russia. The only thing is that there are slight differences in the amount of insurance premiums transferred to the budget for foreigners.

And since the amount of these contributions directly affects the number of pension points, the size of the pension may differ slightly. Let's look at what insurance premium rates are provided for foreigners:

| Foreigner status | Pension contributions for payments up to 1,292,000 rubles (%) | Pension contributions for payments over 1,292,000 rubles (%) | Contributions for the period of incapacity for work and the case of maternity for payments up to 912,000 rubles (%) | Contributions for the period of incapacity for work and the case of maternity for payments of more than 912,000 rubles (%) | Medical contributions (%) | Contributions for injuries (%) |

| Foreigners with residence permits and temporary residence permits | 22 | 10 | 2,9 | 0 | 5,1 | 0,2-8,5 |

| Temporarily staying citizens of other countries | 22 | 10 | 1,8 | 0 | – | 0,2-8,5 |

| Foreign highly qualified specialists with residence permits and temporary residence permits | 22 | 10 | 2.9 | 0 | – | 0,2-8,5 |

| Highly qualified foreign specialists temporarily staying in the Russian Federation | – | – | – | 0 | – | 0,2-8,5 |

A logical question arises: why do they pay insurance premiums for foreigners without a residence permit, since they still do not have the right to a Russian pension? Firstly, a person can obtain a residence permit later. And then, when a pension is calculated in the future, its size will “suffer” - after all, contributions not paid at the time will not be taken into account when calculating the amount of payments. So these transfers are a guarantee of the rights of foreign workers.

“The task of first importance is to create conditions under which foreigners would be interested in official employment in the Russian Federation.”

Head of the Federal Migration Service Konstantin

Romodanovsky

In addition, possible situations where insurance premiums were paid for a person, but a residence permit, and, accordingly, he did not receive the right to a pension, are also regulated with the help of international agreements.

Russia will begin exporting pensions abroad

Russia will pay pensions to labor migrants from the EAEU countries - this is provided for by the agreement on pension provision in the union, which is being prepared for signing. Now migrants make contributions to the Pension Fund, but do not receive pensions

Photo: Michele Limina/Bloomberg

The agreement on pension provision between the countries of the Eurasian Economic Union (EAEU) assumes that the country in which the migrant worked and made contributions to the Pension Fund will pay him a pension upon his return to his homeland. The draft agreement was posted by the Eurasian Economic Commission back in March, and in mid-May the Russian Ministry of Labor sent a corresponding package of documents to the Government Expert Council for consideration, asking that they be agreed upon “as soon as possible,” follows from the letter from the Ministry of Labor, a copy of which is available to RBC.

The press service of the Ministry of Labor told RBC that the agreement will come into force on the date the depositary receives through diplomatic channels the last written notification that member states have completed the internal procedures necessary for its entry into force. “It is planned that the agreement will be signed in the fall and ratified by all EAEU member states by the end of the year,” the Ministry of Labor responded. The EAEU includes Russia, Belarus, Kazakhstan, Armenia and Kyrgyzstan.

How pensions are paid to migrants in the EAEU today

Currently, in the territory of the former Soviet Union, the Agreement on Guarantees of the Rights of Citizens of the CIS Member States in the Field of Pension Provision dated 1992 is in force. Its participants are current members of the EAEU. According to this agreement, pensions are assigned and paid by the state of permanent residence of the person, regardless of his citizenship. This “makes it almost impossible to implement the pension rights of workers in full, which they have formed over the years of work in the territories of several member states,” says the explanatory note to the draft agreement (available from RBC).

A year with a minus sign: why the population of Russia will decrease for the first time in 10 years Economy

At the same time, the EAEU now has different amounts of pension contributions from salaries. For example, in Russia - 22%, in Belarus - 29%, in Kazakhstan - 10%, in Armenia - 10%, in Kyrgyzstan there is no fixed rate.

How pensions will be paid after ratification of the agreement

Read on RBC Pro

How to become a Speaker: advice from re:Store founder Evgeniy Butman How to manage talent in the era of “large-scale rebellion” - part I Bill Gates - about the madness of conspiracy theorists and the new Steve Jobs Strategy of Ivanushka the Fool: how a top manager can get out of a dead end in 9 steps

The basic principle is that the pension will follow the pensioner. The experience acquired in the territory of different Member States will be summed up. The pension, ultimately assigned in one of the member states, will be “exported” if the pensioner moves to another EAEU country.

If a migrant, for example, from Kazakhstan, upon reaching retirement age, has received the right to an old-age insurance pension in Russia, then even upon returning to Kazakhstan, Russia will continue to pay him a pension. If a Russian citizen received the right to an old-age pension and then moved, for example, to Armenia, Russia will also pay him a pension.

But the agreement will not apply retroactively to periods of employment prior to its entry into force. This means that the first assignment of an old-age pension to a citizen who has moved from one EAEU country to another will be possible no earlier than 2020. At the same time, the length of Russian service for which the pension will be exported will be no more than one year in 2020, two years in 2021, etc.

The Ministry of Labor agreed with the idea of giving pensioners an advantage over migrants Society

This does not apply to relations between Russia and Belarus in the pension sector, where an agreement on the export of pensions has already been in force since 2006.

How much will the Pension Fund pay?

According to the letter from the Ministry of Labor, in 2020–2021 (the calculation was carried out for the current three-year budget period), additional expenses of the Russian Pension Fund for pension payments under the new agreement will amount to a total of 166 million rubles. This figure consists of: pensions to citizens of Belarus, Armenia, Kazakhstan and Kyrgyzstan (including those who continue to reside in Russia after receiving a pension) for a total amount of about 75 million rubles; pensions for elderly Russians who, after receiving a pension, will move to live in other EAEU countries, for a total amount of about 91 million rubles.

The amounts are small, since they are formed on the basis of contributions that migrants will make after ratification of the agreement between the EAEU countries. However, payments will gradually increase, as contributions to the Pension Fund received after signing the agreement will accumulate.

Photo: Vladislav Shatilo / RBC

Where are pension contributions for migrants going now?

According to Russian legislation, the employer makes contributions to the Pension Fund for foreign workers, but today they cannot claim pension payments. At the same time, companies are exempt from pension contributions for highly qualified foreign employees temporarily staying in Russia.

“Migrants and their employers make a huge number of contributions to various budgets: for example, in 2020, revenues to the Moscow budget from personal income tax paid by foreign workers were more than twice as high as revenues from the oil and gas sector,” says Batyrzhon Shermatov, director of the Migrant Assistance Center. — Employers are required to make contributions to the Pension Fund for employees in case they obtain citizenship. But this rarely happens, and I do not know of a single case where a migrant could claim his deductions.”

According to a HSE study, in 2020 the average salary of migrant workers in Russia was 30.1 thousand rubles. Even if we assume that the salaries of migrants in 2020 grew two times less than the national average (that is, by 5.4%), then in 2020 their average salary was 31.7 thousand rubles.

At the end of 2020, according to the Ministry of Internal Affairs, 1.76 million foreign citizens worked in Russia (with a valid work permit or patent). At the same time, the statistics do not include citizens from Armenia, Kazakhstan and Kyrgyzstan (the EAEU countries) who have the right to work in Russia without permits. According to Demoscope, in the total number of foreign citizens with a work permit, the share of highly qualified specialists increased to 50% by the end of 2020 (they can be excluded from the calculation of the number of those for whom pension insurance contributions are paid).

Thus, during the year, transfers for migrants to the Pension Fund of the Russian Federation could approximately amount to at least 74 billion rubles. (based on the average monthly salary of 31.7 thousand rubles and the contribution rate to the Pension Fund of 22%).

RBC sent a request to the Pension Fund of Russia in order to find out exactly how the Pension Fund manages income from the salaries of migrant workers, but the Pension Fund refrained from commenting. Batyrzhon Shermatov believes that this money goes to pay current pensions.

What questions remain?

The procedure for applying for a pension will still be determined by a separate document - the Procedure for applying the agreement. According to the mechanism of “exporting pensions,” payments will be transferred first to the Pension Fund of the country where the pensioner lives, and only then to the account of a specific person.

“It is impossible to determine how much money a migrant will ultimately receive at home,” says Alexander Safonov, vice-rector of the Academy of Labor and Social Relations. - This will be decided by the party where it is registered. Moreover, we do not know how this will work out taking into account exchange rates and how pension funds will distribute this amount.”

“Even after signing the agreement, questions may arise, because the mechanism for distributing savings is not yet fully understood,” agrees the head of the Trade Union of Migrant Workers, Renat Karimov. “Of course, it would be preferable for migrants who worked in Russia if payments were made in the amount provided for by Russian legislation.”

Where are migrants going?

According to a report by the Eurasian Economic Commission published in October 2020, Russia has the largest number of migrant workers among all EAEU countries, but only 0.01% come from other EAEU countries. The majority of visitors to Russia come from other CIS countries, for example from Uzbekistan and Tajikistan. The salary level in Russia is higher than anywhere else in the EAEU. According to the report “Socio-demographic indicators”, which the EEC published in March of this year, the average salary is:

- in Russia - $695;

- in Kazakhstan - $471;

- in Belarus - $470;

- in Armenia - $358;

- in Kyrgyzstan - $236.

This is fraught with a situation where Russians who have earned work experience in other EAEU countries will receive a pension significantly lower than what they could earn in Russia. Alexander Safonov believes that in this case - if the pensioner lives in Russia - the state will index payments to the level of the subsistence level, as is the case now with those pensioners who have a low pension.

Russia has signed bilateral agreements with some countries on the transfer of pensions. For example, citizens of Russia and Bulgaria, when moving to Bulgaria and having work experience in Russia, can receive a Russian pension - the Pension Fund transfers it to the account of the National Insurance Institute in Bulgaria, and the Bulgarian authorities make payments. Bulgaria makes payments in exactly the same way when citizens move to Russia.

Alexander Safonov notes that the signing of the EAEU pension agreement is part of the integration processes that are taking place around the world and are dictated by the 102nd Convention of the International Labor Organization, which Russia ratified last year; its main significance is that a person’s pension should be at least 40% from his previous earnings. “This is a mechanism for protecting not only citizens of the country, but also migrants, including in the social security system,” explains Safonov. “This is the first approach, an attempt to resolve complex issues. But then a lot of cases will arise, and depending on their prevalence, decisions will need to be made.”

On international agreements regarding pensions

International agreements are agreements concluded at different times between Russia (RSFSR) and certain countries. They mainly contain rules that make pension rights “earned” in one country legal in another state. The Russian Federation has concluded 2 dozen such agreements with 24 countries.

Example. According to an agreement with the Republic of Estonia, a citizen who worked for some time in the Russian Federation (if insurance premiums were paid for him, that is, he was officially employed) can apply for a Russian pension. It will be calculated on a general basis - taking into account the length of service and the amount of contributions received to the budget. And in this case, it does not matter whether the pensioner has a residence permit in Russia. He can live in Estonia or any other country, but still have the right to receive a Russian pension.

The table below shows with which foreign countries the Russian Federation has entered into international agreements regarding the moment of registration of pension payments:

| Agreement category | Countries | Years of signing, years |

| Agreements in force since the times of the USSR | Czechoslovakia, Romania, Hungary, Mongolia | 1959 – 1981 |

| Russian agreements based on the territorial principle | Armenia, Kazakhstan, Tajikistan, Kyrgyzstan, Uzbekistan, Ukraine, Republic of Belarus, Ukraine, Moldova, Georgia, Lithuania | 1992-1999 |

| Russian agreements based on the proportional principle | Ukraine, Spain, Belarus, Latvia, Bulgaria, Estonia, Israel, Serbia, Czech Republic | 1993-2017 |

| Other agreements (they deal with the establishment, starting from 2002, of pensions for citizens of these countries according to the laws of these countries and bringing pensions to the average level for the North Caucasus region, that is, up to 10,410.7 rubles). | Abkhazia, South Ossetia | 2014, 2016 |

What is the minimum pension in Moscow for those with a residence permit

The minimum insurance period (length of payment of insurance premiums) to acquire the right to a pension will increase from 5 to 15 years. If the residence permit has expired, the insurance payment is suspended for six months starting from the 1st day of the month following the month in which the specified document expired (clause

The size of the pension in Moscow is one of the highest in the country. From January 1, 2020, its minimum amount is 17,500 rubles, as a regional allowance is paid

.

But not all pensioners are entitled to it

. Who is entitled to it and how to get a Moscow pension?

This is interesting: Penalty for driving around an obstacle in the same direction

Errors on the topic “Pension for a foreigner in Russia with temporary residence permit in 2020”

Error:

Citizen Maslova G.I. 54 years old moved to Russia from Kyrgyzstan in 2020. Over 4 years of work in our country (official employment), she earned 8.8 pension points. At the same time, her total insurance experience is 29 years. Citizen Maslova is confident that she will not be able to retire in Russia anytime soon. Since her salary is small, it will take a long time to accumulate the required number of points.

This is mistake. After all, the time spent working before 2020 (the year pension points were introduced) is also translated into points, which are added to those earned after the reform. Considering that the citizen arrived from another state, when applying to the Pension Fund of the Russian Federation, she will have to present a certificate of contributions paid to the budget of Kyrgyzstan to confirm her right to an insurance pension.

Error:

A foreigner who moved to Russia first received a temporary residence permit, then a residence permit. He had the right to receive a pension, which he took advantage of. After the required amount of time, the residence permit expired (previously, the validity of the residence permit was 5 years - approx.). The person, being confident that the previously assigned pension would not go anywhere, did not take action to extend the residence permit.

It shouldn't have been done that way. As a result, the foreign pensioner’s pension payment was suspended for 6 months (from the date of expiration of the residence permit). In order to regain his rights, he will now have to re-issue his residence permit.

The procedure for calculating pension payments to foreigners in Russia

The procedure for calculating the pension will primarily depend on its type. The total amount of the pension will consist of a fixed part, as well as an insurance and savings part. If there are additional grounds, state support is also assigned.

The insurance pension will be calculated based on the following indicators: the number of pension points and insurance experience. In order to retire, you must score at least 13.8 in 2020. The required work experience in 2020 is 9 years. In accordance with the length of service, age at the time of application, as well as the amount of pension contributions, the individual pension coefficient (IPC) will be calculated. Based on the IPC, the insurance pension will be calculated.

Questions on the topic “Pension for a foreigner in Russia with temporary residence permit in 2020”

Question:

What kind of pension can a disabled foreign pensioner expect?

Answer:

If this person has a residence permit, then due to the lack of insurance coverage, he is only entitled to a social old-age pension. It is paid to women upon reaching 65 years of age, to men from 70 years of age (Article 11 of Federal Law No. 166 “On State Pension Provision in the Russian Federation” dated December 15, 2001).

Question:

Elderly parents (75 and 78 years old) moved from Ukraine to Russia to be closer to their grown children. They plan to obtain Russian citizenship. Do these people have the right to a Russian pension if they have worked in Ukraine all their lives?

Answer:

Let us remind you that foreigners permanently residing in Russia have the same rights to a pension as Russian pensioners. The fact of permanent residence in the Russian Federation is confirmed by a residence permit. So, upon receiving a residence permit, older people can apply for a pension in the Russian Federation. Ukraine is one of the countries included in the international agreement on the rights of citizens of the CIS countries. According to this agreement, as soon as the payment of a pension to an elderly couple in Russia begins, the accrual of a similar payment at the previous place of residence will immediately stop.

Pension for citizens of CIS countries in Russia

If foreign citizens living in Russia arrived from a country that is part of the CIS, then more flexible conditions for calculating pensions will apply to them in the Russian Federation. For example, work experience in your country will be taken into account. But you should know that the pension can only be paid in one country.

If, for example, a Ukrainian of retirement age is already moving to Russia, then in order for him to transfer his pension to the Russian Federation, he must provide evidence that pension payment has been stopped in his homeland. For Ukrainians applying for a pension in Russia for the first time, they will need to attach documents confirming their work experience and salary for any 5 years before 2002. If it is impossible to provide the necessary information, the applicant can independently provide information about the termination of payment. If it is not possible to confirm your work experience, then the foreigner will receive a social pension.

Pensions for Belarusians working in the Russian Federation are regulated by international agreements. An agreement on cooperation in the field of social security has been concluded between the Russian Federation and Belarus. In accordance with this agreement, a citizen of Belarus who moved to Russia can receive a pension from his country until he receives a residence permit.

Registration of a Russian pension abroad: possible options

In order to use the government service of registering a Russian pension abroad, citizens of the Russian Federation must personally or through their authorized representative contact the Pension Fund.

The decision of the territorial body of the Pension Fund must be made within 10 working days from the date of receipt of the application (the date begins to count from the moment the full package of documents is submitted), and the applicant must be notified of the results of the consideration within 5 working days from the date of the decision.

The procedure for the Pension Fund to issue pensions to Russian citizens who permanently reside abroad depends on:

- depending on which country the Russian citizen moved to for permanent residence. If there are bilateral international agreements with the Russian Federation, the pension will be issued in accordance with the agreements;

- depending on when the move was made: that is, a citizen of the Russian Federation received a pension before leaving abroad or reached retirement age after the move.

There are several options for registering a pension, which you should familiarize yourself with in more detail.

New assignment of pension to a citizen living abroad

To assign a pension to a citizen of the Russian Federation who has gone abroad for permanent residence, he should submit to the Pension Fund an application for a pension (in two copies).

In addition, other documents must be attached to the application (the case will be considered only if they are available):

- application for pension delivery, completed in duplicate;

GDE Error: Error loading file - Turn off error checking if necessary (403:Forbidden) - a copy of the passport of a citizen of the Russian Federation;

- a copy of SNILS (if available);

- confirmation of work experience - original or a clear, notarized copy of the work book, certificates of periods of work (originals);

- original salary certificate for any five years of service with the number and date of issue, seal and signature of the manager, indicating the basis for issuance, clearly stated full name of the certificate recipient. For certificates for the period from 1991 to 2001, data on contributions that were transferred to the Pension Fund is required;

- a copy of your military ID (if you don’t have one, a certificate from the military registration and enlistment office confirming your military service);

- certificate confirming permanent residence in a foreign country indicating the date of move from the Russian Federation. Such a certificate can be obtained from the diplomatic institutions of the Russian Federation in the country of residence.

In some cases, additional paperwork may be required:

- upon entry into/divorce of marriage and change of surname - a copy of the relevant document;

- if a woman has parental leave for up to one and a half (three) years, a copy of the child’s birth certificate;

- when changing the name of the enterprise or organization in which the applicant worked - a certificate of its renaming.

All copies must be certified by the Russian consulate.

What to do if your pension is suspended or terminated

The situation when pension payments may be suspended or terminated occurs quite often. The following may lead to a suspension of payments for 6 months:

- non-receipt of pension for 6 months;

- reaching the age of majority by a person receiving a survivor's pension, without confirmation of his full-time studies;

- receipt of documents by the Pension Fund on the departure of a pensioner outside Russia for permanent residence in the absence of his application for departure.

Termination of pension payment occurs when:

- establishing the death of a pensioner or recognizing him as deceased or missing in the prescribed manner;

- the expiration of 6 months from the date of suspension of the pension and failure to submit an application for its renewal;

- loss of the right to a pension: acquisition of working capacity, entry to work, expiration of the period of recognition as disabled.

Thus, there are two options for returning payments - renewal and restoration of the pension.

To resume pension payments, you must submit an application.

The following documents must be attached to it (depending on the reasons for termination of payments):

- confirmation of the applicant's full-time studies at an educational institution;

- confirmation that the applicant does not have the right to receive a pension in the state of residence (if there is an agreement with the Russian Federation);

- certificate of permanent residence;

- a certificate of performance/non-performance of paid work outside the Russian Federation (when paying a survivor's pension to a person caring for children under 14 years of age);

- document confirming that the applicant is in good health - a notarial deed, a document from the competent authority of the state of residence, a personal appearance certificate;

- a document from the diplomatic mission of the Russian Federation abroad or the territorial branch of the Pension Fund of the Russian Federation, which would confirm the termination of activities or work, during which pensions were not paid to those working abroad.

If the reason for stopping the payment was the receipt of documents on the citizen’s departure for permanent residence abroad, no additional documents are required - just an application is enough.

Pensioners whose pension payment was suspended due to a court declaring them dead or leaving for a new place of residence abroad must contact the Pension Fund and submit an application for the restoration of pension payment.

The application must be accompanied by:

- a document canceling a court decision declaring a citizen dead or missing;

- confirmation of full-time education of a disabled citizen at an educational institution (except for additional educational programs);

- confirmation of termination of work or a certificate stating that the applicant is not working;

- certificate of permanent residence abroad;

- a certificate of the applicant’s performance/non-performance of paid work in the host country (required for payment of a survivor’s pension to persons caring for children, brothers, sisters or grandchildren of the deceased breadwinner under 14 years of age);

- document confirming that the applicant is in good health - a notarial deed, a document from the competent authority of the state of residence, an act of personal appearance.

For pension restoration, the presence or absence of Russian citizenship does not matter. 12 months after the restoration of pension payments and thereafter, the applicant must annually submit to the Pension Fund a certificate of being alive.