Story

VEB traces its history back to the Russian Commercial Bank created on August 18, 1922 at the beginning of the New Economic Policy (NEP). It was organized as a concession by the Swedish financier Olof Aschberg. On April 7, 1924, the institution was transformed into the Bank for Foreign Trade of the USSR. On July 17, 1987, by a resolution of the Central Committee of the CPSU and the Council of Ministers of the USSR, it was renamed the Bank for Foreign Economic Affairs of the USSR (Vnesheconombank of the USSR), and bore this name until 2007.

In Soviet times, the credit organization carried out settlements for export credit operations and managed a network of foreign banks. On January 2, 1992, Vnesheconombank actually declared a default on the external obligations of the USSR in the amount of about $8 billion. On January 13, 1992, the Presidium of the Supreme Council of the RSFSR decided to preserve VEB and assigned it a new function - servicing the external debt of the USSR. At the same time, the institution did not receive a license from the Central Bank and began to operate on the basis of separate regulations.

The bulk of the USSR's external debt was repaid in 2006. By that time, VEB had a new function: it became a management company for the trust management of pension savings (in accordance with the federal law of July 24, 2002 “On investing funds to finance funded pensions in the Russian Federation” and the resolution of the Government of the Russian Federation of January 22, 2003) . On May 17, 2007, Russian President Vladimir Putin signed the law “On the Development Bank,” within the framework of which Vnesheconombank of the USSR was transformed into the state corporation Vnesheconombank.

Until 2020, VEB manages the funded portion of pensions of citizens who have not transferred it to non-state pension funds or private management companies (the so-called silent ones).

In 2014, sectoral sanctions were imposed by the United States, Canada, the European Union, Switzerland and Japan against VEB and other large Russian state corporations in connection with the situation in Ukraine. They provide for a ban on medium- and long-term lending and transactions with new issues of securities.

The main differences between state and private organizations

| CHUK | GUK |

| Controlled by the state, which guarantees the safety of initial investments | |

| Engaged in investing, trying to get as much income as possible from it | |

| The risks are lower, since they work only in proven low-risk areas, most of them with large state-owned enterprises | Has a wider range of financial instruments and freedom of action |

| More reliable, but less additional income | The risks are greater, but with a successful choice, the profit is greater. |

Private management companies differ from public ones in the following parameters:

- The activities of such companies are controlled by the state.

- In both cases, individuals are guaranteed the safety of their starting savings.

- GUK and PMU are engaged in investment activities, the purpose of which is to increase the pension savings of Russian citizens.

- Cooperation with GUK is associated with lower risks, since they work only in proven investment areas.

- With a successful choice of the investment portfolio offered by the PMC, individuals will be able to receive maximum profit.

Vnesheconombank and future pension

So, if it has been decided that VEB Management Company will be your management company, then it is worth knowing some important points.

To begin with, it is worth understanding that the Pension Fund and non-state funds themselves are not directly involved in managing the transferred finances. For these purposes, there are specially created management companies - public and private.

Thus, a strong union between the pension fund and VEB Management Company has its advantages and possible disadvantages.

Placement of savings in VEB

GUK suggests submitting applications for its selection only through the territorial branches of the fund. You will additionally need to provide:

- SNILS (certificate with a unique individual number);

- passport of a citizen of the Russian Federation or other document confirming his identity.

Do you need expert advice on this issue? Describe your problem and our lawyers will contact you as soon as possible.

Investment portfolio

When transferring your savings portion to the bank's management company, you need to take care of choosing an investment portfolio:

- basic variety;

- extended version.

They differ from each other in the orientation of the securities and bonds of which they consist. In the first case, we deal only with state-owned companies and enterprises. In the second case, international financial market participants also appear.

VEB profitability issues

Having pension savings in VEB, you definitely need to know about profitability. It is calculated based on several indicators depending on calendar periods. It is noteworthy that Vnesheconombank’s information on pension savings, namely profitability, can be found in the public domain.

How to increase the profitability of pension savings in VEB Management Company

We usually forget about the profitability of pension savings, which every Russian with work experience has. Meanwhile, they can be “put into growth”, increasing your income by 2-6% per annum if your savings are managed by VEB. All you need to do is check how much you have already saved, write an application and go to the office of the Pension Fund or the MFC, if there is no digital signature.

To help motivate yourself to such a feat, let’s remember the “Savings Week”, which began on October 31. It's time for you to take care of your blood.

Well, we won’t stand aside either. In the following posts we will tell you how to correctly pay tax fines, which, by the way, the official help sections of the Federal Tax Service website are silent about; where young people should save for retirement and what savings portfolio we recommend.

Pension savings of “silent people”

By “silent”, Russian officials mean those who did not transfer their pension savings from Vnesheconombank (VEB) to the non-state pension fund (NPF). By the way, they did not lose, since the profitability of non-state pension funds turned out to be lower.

Let's compare the indicators of both for 2018

NPF rating by profitability in comparison with VEB Management Company

Source: investfunds

Remember the main numbers: the best result for 2018 is 6.83 %, and the average is below 5%. Now let’s look at the results of VEB Management Company, which manages our funds. It offers two portfolios and, as a result, two investment returns

- Extended investment, where the money ends up “by default”. Therefore, unless you asked the management company otherwise, then your funds are here. Interest rates are higher than those of non-state pension funds, but lower than in the next portfolio. Let's take note that in 2020 it brought 6.07 %, and three years before that: 8.38 %.

- Investment portfolio of government securities. To transfer money to it, you need to write an application. But in 2018 it gave: 8.65 %, and over 3 years 10.64 %.

It's time to draw conclusions

VEB Management Company provides more income than non-state pension funds. At the same time, the most profitable portfolio is government securities.

The difference with NPF is 2% or more. During crisis periods it grows to 4-6%.

Therefore, if you only have a few years left to save until retirement or there is a small amount in your account, there is no need to change anything. But for the owner of a decent amount and the younger generation, “all the cards are in their hands.”

How to change Web's investment portfolio?

First, find out how much is in your retirement account. We have already talked about this. If changing your portfolio is beneficial for you, then you have the following options to choose from:

“To transfer pension savings to the management company “VEB.RF” investment portfolio “government securities” you can submit an application for choosing an investment portfolio (MC) by selecting the investment portfolio “government securities” of the state manager, no later than December 31: - to the territorial body of the Pension Fund of the Russian Federation in person, in which case it is necessary to present an identification document (passport) and an insurance certificate of compulsory pension insurance; — the application can also be sent by mail, in which case your signature must be notarized; — through a multifunctional center (MFC) for the provision of state and municipal services (MFC);

— through the reference and information portal “Public Services” www.gosuslugi.ru, an application can be submitted by insured persons who have received an enhanced qualified electronic signature.” (information from the Pension Fund of Russia in response to an online appeal).

In your Personal Account on the Pension Fund website, you must first find “Management of pension savings funds.” Then, in the “Selecting an Insurer” section, set “VEB State Development Corporation” and the investment portfolio of “Government Securities”.

Can accumulated pension income be lost?

Here is the response from the Pension Fund of Russia

Transfer of pension savings from one investment portfolio to another portfolio or change of management company is carried out without loss of investment income, because The Pension Fund of the Russian Federation remains your insurer.

Personal experience of transferring savings

Pension Fund employee consults with senior comrades

From the suggested methods, I chose to visit the office of the Pension Fund itself. But here I must warn you, their work schedule is inconvenient for working people, from 9 to 17, the same MFC is more practical, since it works on weekends.

I can recommend making an appointment through your personal account on their website. In addition, you can send someone from your family in your place, giving them a power of attorney and your passport. There is no need to spend money on a notary; a simple written form of power of attorney is enough: a document with your signature, just like in a passport.

Another difficulty is that office employees rarely encounter applications to change portfolios; they do not know exactly how to process them. It all depends on the integrity of a particular official. In my case, it was necessary to call the city administration and get recommendations there. It took about 15 minutes just to do this.

Otherwise, the translation passed without any complaints. All that remains is to suggest that the actual change will take place next year, 2020.

For those interested in the topic of retirement savings, take a look at our previous materials on this topic. For example, How can a pre-retirement person prepare for retirement? Or the essence of pension reform 2018.

Source: https://www.money-in.org/2019/11/uvelichim-dohodnost-pensionnyh-nakoplenij.html

How to go

Pension savings will be transferred to the management company the next year after submitting the application.

You can submit an application in person to the Pension Fund, through the MFC or through government services after full registration on the website. Application forms are available on the Pension Fund website, at the MFC or in your personal account on the State Services website. When working with your personal account, an electronic signature will be required.

If you are transferring pension savings through government services, go to your personal account, follow the link “ and select “PFR” In the list of “Electronic services”, select the seventh item - “Reception and consideration of applications from insured persons in order to exercise their rights when forming and investing funds pension savings" You will be taken to the page "Management of pension savings" Then go to the tab "Selecting an investment portfolio (management company)" if your current insurer is the Pension Fund of the Russian Federation. Next, click “Get service.” Fill out the application on the website and sign the form

In this case, it doesn’t matter whether you check the “Early transition” box or not

If you are transferring from a non-state pension fund, the procedure is similar, but the form will be called “Transition from a non-state pension fund to the Pension Fund”. Indicate your NPF, in the “Where” column - Pension Fund, and below, in the “Name of the investment portfolio” column, enter the name of the management company and its portfolio, if it offers a choice. In this case, the early transition checkbox becomes an important element.

A transfer from a non-state pension fund is considered urgent when you have been there for five years and are transferring savings without loss of investment income. In 2019, a loss-free transition will be made by those who joined the NPF in 2011 or earlier. Also in 2020, you can apply for an urgent transfer if you ended up in a non-state pension fund in 2020.

Those who transferred to a non-state pension fund in 2012-2014 or 2016-2019 and submit an application to transfer a funded pension in 2020 make an early transition. If the agreement came into force in 2012-2014, five years have already passed and a new five-year period has begun, if in 2016-2019, the first five years have not yet passed. If you switch early, you lose investment income for the unfinished five-year period. To avoid untangling all of this yourself, call your fund and find out whether you will have an early transition and losses due to it.

Another option is to check the “Urgent transition” box. Then you will be transferred to the year when an urgent transfer is possible.

There is no need to conclude an agreement with the management company, since the insurer is the Pension Fund of Russia. SNILS is an analogue of an agreement between you, and you do not need to sign additional papers. You also do not need to contact the management company itself, because the account is maintained by the Pension Fund.

You can find out which NPF or which management company you are in by checking your account statement through the Gosuslugi website or on the Pension Fund website. There you will also find the number of the outgoing document on the transfer of savings.

To receive an extract through the state → “Get

The statement will tell you how long you have been with your current insurer.

Web uk extended profitability by year 2019

January 23, 2020 “The Silent Ones,” whose funds are managed by VEB, earned much less last year than in 2020. Inflation, which increased in the second half of 2019, also exerted significant pressure on the real return on investment of pension savings. However, the state manager was able to outperform the indicators of the conservative and balanced pension indices.

investment income, follows from the disclosure of the State Administration. Thus, according to Kommersant’s calculations, in 2020, the profitability from placing pension savings of citizens who have not decided on the choice of non-state pension funds or management companies through investments in an expanded portfolio (net asset value at the end of the year - 1.7 trillion rubles) amounted to slightly more 6% per annum.

We recommend that you read: Benefits in Moscow for Large Families in 2020

Choosing a convenient security option

Legislative changes at the beginning of 2020 provide that a pension can be provided in several ways:

- form only the insurance part of savings and abandon the funded part;

- provide for both accumulative and insurance savings.

Many people still cannot understand what each of these options represents. It's actually not that complicated.

The insurance part is a base with which a person’s future pension will be guaranteed in any case. However, its final size will depend on numerous factors, namely the situation in the state and its budget.

The funded part is organized only by professional market participants and is a mandatory part of the citizen’s future pension, if he chooses this option.

Advice! Caring for your comfortable old age should begin from the first days of employment in an official job.

State management company

as of 01/01/2020

Information about the state management company

- Full name: State Development Corporation "VEB.RF"

- Short name: VEB.RF, VEB

- State registration number: 1077711000102

- Registration date: 06/08/2007

- The body that carried out the registration: Department of the Federal Tax Service for Moscow

- Address (location): Akademika Sakharov Ave., 9, Moscow, 107078, Russia

- Taxpayer Identification Number (TIN): 7750004150

- Date and number of the license to carry out activities for managing investment funds, mutual funds and non-state pension funds: -

- Duration of activity (years): —

- Telephone and fax numbers: +7,

- E-mail address

- Website address on the Internet: https://www.veb.ru/

- Availability of branches indicating their actual addresses and telephone numbers: —

Composition and structure of shareholders (participants) of the management company

State Development Corporation "VEB.RF"

| No. | — |

| Full name of the shareholder (participant) (for an individual - full name) | — |

| Address (place of location of the legal entity) | — |

| Date and number of the certificate of state registration of a legal entity | — |

| Main state registration number of a legal entity | — |

| Taxpayer identification number | — |

| Data on the latest changes in the name, organizational and legal form of a legal entity | — |

| Shareholder's (participant's) share in the authorized capital. At nominal value | — |

| Shareholder's (participant's) share in the authorized capital. As a percentage of the authorized capital | — |

VEB.RF is a state corporation, a non-membership non-profit organization established by the Russian Federation on the basis of a property contribution and created to carry out social, managerial or other publicly beneficial functions. The property transferred to VEB.RF is the property of VEB.RF.

Investment declarations

Expanded investment portfolio

Decree of the Government of the Russian Federation dated September 1, 2003 No. “On approval of the investment declaration of the expanded investment portfolio of the state management company”

Investment portfolio of government securities

Decree of the Government of the Russian Federation dated October 24, 2009 No. “On improving the procedure for investing funds to finance the funded part of the labor pension in the Russian Federation”

Investment portfolio of the payment reserve and investment portfolio of pension savings of insured persons for whom a fixed-term pension payment has been established

VEB’s expanded investment portfolio - structure, profitability and risks

The functions of the fund for the trust management of pension savings funds and the functions of the state management company for the trust management of the payment reserve funds (GMC of the payment reserve funds) are carried out by the state corporation “Bank for Development and Foreign Economic Affairs” (Vnesheconombank). In accordance with the Decree of the Government of the Russian Federation dated June 14, 2013 No. 50 “On establishing the period for the state corporation “Bank for Development and Foreign Economic Affairs (Vnesheconombank)” to carry out the functions of the state management company and the state management company using the payment reserve until January 1, 2019.

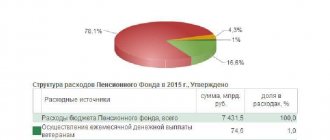

Pension savings held in trust by the State Management Company are divided into two portfolios: the default option (expanded investment portfolio) and the conservative option (investment portfolio of government securities) - for insured persons who want to limit themselves to investments in government securities. The investment portfolio of government securities of the State Management Company has a relatively small volume: in 2014, its value amounted to 10.53 billion rubles. (0.55% of the value of the total investment portfolio of the State Management Company).

Thus, the bulk of pension savings is concentrated in VEB’s expanded investment portfolio. The name of the investment portfolio “extended” is determined by the fact that it includes pension savings left by citizens for disposal by the state “by default.”

The investment declaration of this portfolio was supplemented with new instruments, into which the State Management Company was able to invest in November 2009. The share of these instruments in the portfolio structure has increased since 2009, for example, bonds of Russian issuers amounted to 1.6% (7.79 billion rubles) in 2009 and 31.8% (602.3 billion rubles) in 2014 .

The share of government securities of the Russian Federation decreased: in 2009 it amounted to 80.3% (RUB 385.7 billion) of the assets of VEB’s expanded investment portfolio, and already in 2014 – 45.4% (RUB 858.13 billion). ).

The value of VEB's expanded investment portfolio at the end of 2014 amounted to 1,892.28 billion rubles.

If we talk about specific types of assets that VEB can operate in its portfolio (determined by the investment declaration), then the list of these instruments and assets is as follows (the maximum limits of assets in the expanded portfolio are indicated in brackets).

This:

- Government securities of the Russian Federation in the currency of the Russian Federation

- Bonds of Russian issuers, the fulfillment of obligations under which (payment of par value or payment of par value plus full coupon income) is secured by a state guarantee of the Russian Federation

- Government securities of the Russian Federation in foreign currency (no more than 80%)

- Government securities of the constituent entities of the Russian Federation (no more than 10%)

- Bonds of Russian issuers, with the exception of bonds, the fulfillment of obligations for the payment of the nominal value of which (for the payment of the nominal value and/or full coupon income) is secured by the state guarantee of the Russian Federation (no more than 40%)

- Mortgage-backed securities (not more than 20%)

- Securities of international financial organizations:

- Asian Development Bank (ADB);

- Council of Europe Development Bank (CEB);

- European Bank for Reconstruction and Development (EBRD);

- European Investment Bank (EIB);

- Inter-American Development Bank (IADB);

- International Finance Corporation (IFC);

- International Bank for Reconstruction and Development (IBRD);

- Nordic Investment Bank (NIB);

- Eurasian Development Bank (EDB);

- Black Sea Trade and Development Bank (Crimea)

Based on the analysis of the structure of the expanded portfolio, we can conclude that this portfolio is strictly conservative (more than 50% are government securities) and the majority of assets (95%) are denominated in rubles, which is the main risk in the context of growing inflationary processes.

For a complete picture of the study of the portfolio of the country's chief pension manager, naturally, there is not enough analysis of the success of his work, which requires calculating the profitability of the investment portfolio and its indicators over the past few years.

As can be seen from the diagram of the return on the investment portfolio, which was calculated in comparison with the consumer price index (inflation), only twice over a more than 10-year period did its income exceed the inflation rate - in 2005 and 2012. In other periods it remained either at the level inflation or below it.

| 2011 | 2012 | 2013 | 2014 | 01.04.20151 | Accumulation for the entire period | Avg. | ||

| 1 | UNIVER Management Management | -6,64 | 7,48 | 7,18 | -3,68 | 19,22 | 219,14 | 11,13 |

| 2 | OPENING OF A MC | 1,91 | 0,95 | 6,89 | 3,32 | 13,46 | 215,60 | 11,01 |

| 3 | Region Portfolio Investments Management Company | 3,81 | 9,36 | 6,27 | 0,62 | 19,29 | 190,88 | 10,19 |

| 4 | INFLATION in Russia | 6,10 | 6,60 | 6,50 | 11,40 | — | 171,92 | 9,52 |

| 5 | METROPOL UK | 2,13 | 5,26 | 4,57 | 6,15 | 12,07 | 149,14 | 8,65 |

| 6 | AGANA UK BALANCED | 0,81 | 6,29 | 6,43 | -2,74 | 18,62 | 147,18 | 8,57 |

| 7 | MDM UK | 2,39 | 8,04 | 6,49 | 4,14 | 16,93 | 143,84 | 8,44 |

| 8 | Sberbank Asset Management | -6,84 | 9,21 | 8,18 | -0,53 | 14,72 | 141,91 | 8,36 |

| 9 | Promsvyaz UK | 3,35 | 6,57 | 6,45 | 1,39 | 4,00 | 141,35 | 8,34 |

| 10 | SOLID Management Management | 7,69 | 10,79 | 9,94 | 3,92 | 14,12 | 139,15 | 8,25 |

| 11 | RN-TRUST UK | 4,65 | 8,64 | 6,97 | 4,00 | 9,81 | 135,14 | 8,08 |

| 12 | BKS UK BALANCED | 0,74 | 8,14 | 8,31 | 0,96 | 10,10 | 132,68 | 7,98 |

| 13 | VTB Management Asset Management | -1,41 | 10,51 | 6,31 | 0,17 | 18,43 | 131,86 | 7,95 |

| 14 | Kapital UK | 1,48 | 9,04 | 9,36 | 2,68 | 6,36 | 131,50 | 7,93 |

| 15 | Leader of the management company | 4,10 | 9,41 | 6,88 | 2,39 | 11,32 | 128,19 | 7,79 |

| 16 | PENSION RESERVE UK | 1,50 | 6,99 | 7,31 | 1,95 | 17,85 | 127,25 | 7,75 |

| 17 | UralSib UK | -0,58 | 8,23 | 6,19 | -0,45 | 9,85 | 125,59 | 7,68 |

| 18 | INVEST OFG UK | -2,65 | 6,74 | 7,17 | 1,96 | 13,18 | 118,74 | 7,37 |

| 19 | REGION ESM UK | 3,77 | 8,95 | 9,54 | 1,13 | 20,71 | 113,05 | 7,12 |

| 20 | RFC-CAPITAL UK | -4,72 | 8,99 | 8,11 | 1,85 | 6,00 | 107,86 | 6,88 |

| 21 | Aton Management Management Company | 4,25 | 6,56 | 9,72 | -0,68 | 10,11 | 106,12 | 6,80 |

| 22 | TRINFICO UK CONSERVATIVE CAPITAL PRESERVATION | 4,63 | 6,58 | 7,31 | 0,70 | 6,57 | 104,41 | 6,72 |

| 23 | VEB Management Company Extended investment portfolio | 5,47 | 9,21 | 6,71 | 2,68 | 10,82 | 99,65 | 6,49 |

| 24 | TKB BNP Paribas Investment Partners Management Company | -0,85 | 10,70 | 8,55 | 0,69 | 14,42 | 96,84 | 6,35 |

| 25 | TRINFICO UK BALANCED | -7,99 | 3,05 | -0,09 | 0,68 | 8,86 | 94,77 | 6,25 |

| 26 | BKS UK DOCHODNY | -3,17 | 9,40 | 6,91 | -2,39 | 38,74 | 94,46 | 6,23 |

| 27 | BFA UK | 1,22 | 9,01 | 6,59 | 2,83 | 13,05 | 93,71 | 6,20 |

| 28 | MONOMAKH UK | -15,25 | 5,42 | 0,67 | -9,89 | 50,78 | 89,51 | 5,98 |

| 29 | TRINFICO UK LONG-TERM GROWTH | -17,31 | -0,66 | -6,03 | -1,54 | 13,72 | 86,40 | 5,82 |

| 30 | Ingosstrakh-Investments Management Company | 7,34 | 7,83 | 8,93 | 3,95 | 15,15 | 83,88 | 5,69 |

| 31 | BIN FINAM Group Management Company | -1,24 | 9,23 | 8,82 | 3,06 | 9,88 | 81,72 | 5,58 |

| 32 | VEB Management Company for GOVERNMENT SECURITIES | 5,90 | 8,47 | 6,90 | -2,05 | 18,06 | 37,55 | 5,46 |

| 33 | PALLADA UK | 3,43 | 7,52 | 9,16 | -0,60 | 14,73 | 77,22 | 5,34 |

| 34 | MC ANALYTICAL CENTER | -6,02 | 5,16 | 2,42 | 5,04 | 17,42 | 77,10 | 5,33 |

| 35 | PENSION SAVINGS MANAGEMENT | -4,02 | 9,15 | 7,40 | 2,03 | 14,32 | 75,59 | 5,25 |

| 36 | AGANA UK CONSERVATIVE | 2,87 | 1,55 | 7,17 | -1,41 | 21,61 | 72,38 | 5,07 |

| 37 | National Criminal Code | -6,18 | 7,96 | 5,91 | 2,36 | 4,83 | 61,12 | 4,43 |

| 38 | Alfa Capital Management Company | 0,80 | 6,40 | 8,36 | -3,41 | 25,27 | 59,81 | 4,35 |

| 39 | FINAM MANAGEMENT UK | -17,83 | 0,23 | 6,30 | 7,49 | 22,20 | 54,46 | 4,03 |

| 40 | AK BARS CAPITAL UK | -8,39 | 3,83 | -1,18 | 0,98 | 15,09 | 40,79 | 3,16 |

| 41 | METALLINVESTTRAST UK | -2,52 | 8,40 | 8,06 | 4,37 | 9,10 | 37,39 | 2,93 |

Based on the above facts, it is, of course, hardly possible to talk about the effectiveness of managing such a portfolio. And even in comparison with non-state pension funds, which perform not much better, VEB’s performance indicators for managing a portfolio formed with the money of pensioners of almost the entire country (see table above) are in the area of obvious outsiders in the domestic investment market.

Types of pensions

When choosing one or another pension provision option, investors have the right to use exclusively the insurance part of pension payments, or to retain the base part and additionally provide an investment base.

The insurance part is the main element with a guarantee of pension payment, the amount of which will completely depend on the economic situation in Russia at the moment and on the ratio of the number of working citizens and pensioners.

The savings part is mandatory pension savings funds under the control of investment specialists.

In the process of merging the funded and insurance parts, the highest quality option for guaranteed pension payments is obtained. This combination guarantees a pension consisting of budget and market parts, which additionally insures payments against risks.

Facts in numbers

- about 13% per annum

Official inflation at the end of 2020 - more 15% per annum

Average expected return on the accumulative part

- 4%

Indexation of pensions and insurance at the end of 2020 (will occur in February 2016)

For example, over the nine months of 2020, Vnesheconombank provided a return on pension funds of 12.2% per annum for the expanded portfolio and 15.8% for the portfolio of government securities. Thus, VEB brought pensioners an income higher than what non-state pension funds could offer on average. At the same time, the state management company represented by Vnesheconombank generally adheres to a conservative policy when managing pensioners’ funds, avoiding unjustified risks. The portfolios of securities in which VEB places savings show returns above inflation in a growing market, and during crises they consistently turn out to be among the most stable on the market

Which is better: public or private

Private management companies also work with the Pension Fund; their activities are subject to legislation and controlled by the Pension Fund and the Ministry of Finance. They annually send financial statements to the Central Bank of the Russian Federation and are subject to a full audit.

However, private organizations, unlike state management companies, have more opportunities for investment. Thus, they have the right to work with securities of a lower reliability rating, mortgage certificates, etc.

However, investments through private management companies are riskier. The Central Bank of the Russian Federation regularly “cleanses” the sector of unscrupulous players. Since 2003, 20 management companies have been closed; in 2020, the management companies Pallada and UNIVER Management lost their licenses.

The decision to change the manager of funds to a more profitable one must be balanced. However, in any case, the Pension Fund insures the annual income from investment if the client transfers his savings to a private management company. But when transferring to a non-state fund, losses can amount to up to 20% of the profit earned.

Differences between private and public management companies

The activities of all management companies are controlled by the Pension Fund and the Ministry of Finance, but private ones have great opportunities for investment. Thus, they have the right to invest in shares of non-state Russian companies, foreign firms, etc. The benefits may be greater, but the risk is also higher.

According to statistics for the 1st quarter of 2020, VEB is not the most profitable management company out of 38 existing in Russia today, including the 33 with which the Pension Fund has entered into agreements. She's somewhere in the middle of the list. However, you cannot make a decision to replace your management company (or insurer) with a more successful one rashly.

Thus, Otkritie Management Company was recognized in 2020 as the most profitable market participant for the entire period of activity. At the same time, another “subsidiary” of the holding of the same name, Otkrytie Bank, fell under reorganization in the summer of 2020. In 2003, there were 56 management companies, in 2020 there were 38 of them. More than 10 management companies lost their license or went bankrupt.

Find out whether working pensioners have the right to additional leave at their own expense. Read the article about the conditions for assigning a disability insurance pension.

At what age are pensions granted to civil servants for length of service? Read here.

When making a decision, you need to consider several nuances:

- The right to receive income is retained only after a 5-year “fixation”.

- If the funds were initially sent to a non-state pension fund, if the management company or fund is changed early in the event of an investment loss, the amount of savings may be reduced.

Video report on the topic

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

For future retirees

Where can I form a funded pension?

Unlike the insurance payment, which is taken into account in pension points (IPK) and only on the personal account of the Pension Fund of the Russian Federation, the funded pension is formed in monetary terms in the account of the insurer, which the citizen has the right to choose himself:

- state (PFR);

- non-state (NPF).

Both state and non-state foundations cannot manage funds. For this purpose, there are management companies (MCs). The NPF independently, without taking into account the opinions of the insured persons, selects the management company with which it enters into an agreement. The Russian Pension Fund reserves the right for citizens to choose their own management company. It could be:

- GUK (state management company);

- CHUK (private management companies).

Both State Management Companies and private management companies are legal entities that have the appropriate license to manage funds in the financial market. There are many of them, but not all of them can carry out this activity.

According to the legislation of the Russian Federation, an insured person can transfer his savings to the management only of those management companies that are annually selected based on the results of competitions held by the Federal Service for Financial Markets, and with which the Pension Fund of the Russian Federation has concluded a trust management agreement.

Web uk extended profitability by year 2019

Let me remind you that there were no state guarantees for the return of pension savings until 2013, when the law was adopted. I did not want to give money to the market leaders (NPF Blagosostoyanie and NPF Lukoil-Garant), because I always believed that a person “from the street” should not participate in a project “for his own people.” The fund I had chosen just then began an active campaign to attract clients “from the market.”

Private management companies, like VEB.RF, only manage the pension savings of citizens, for which the Pension Fund is the insurer. At the same time, to transfer funds, citizens independently choose a management company or a portfolio of VEB government securities, while the funds of the “silent people” are in the expanded portfolio of VEB.RF. At the end of the first quarter, 20 private management companies managed 35.9 billion rubles.

Values

Values are the frame of reference for any organization. VEB's strategy is consistent with new values. We held a broad discussion and together developed the values that will lead VEB.RF into the future.

Development We see significant tasks ahead of us in transforming VEB.RF. At the same time, we not only have to “catch up” with the best practices of financial institutions, but we also see an opportunity to create advanced solutions for clients.

Leadership Achieving the goals of the Strategy is impossible without dozens and hundreds of VEB employees taking responsibility for the result, solving problems despite difficulties and obstacles, and showing initiative.

The partnership between VEB.RF and clients should be truly partnership-like. Partnership means a deep understanding of the client’s business and needs and the ability to jointly create a complete solution for the success of the project.

Team Success requires teamwork. The team as a value means for us mutual assistance and mutual assistance, lack of formalism, the ability to listen, and a constructive approach.

Honesty VEB.RF works with financial resources entrusted to us by the state and investors. To maintain trust, we comply with professional ethics, we are transparent in our work and do not leave room for corruption.

The patriotism of VEB.RF is not just an investor; we must not only ensure the return and profitability of invested funds, but also ensure the maximum positive effect from our investments for the Russian economy. We are proud that our work makes the country better!

How to place the funded part of your pension at Vnesheconombank

Since when choosing the State Institution “Vnesheconombank” the insurer is the Pension Fund of Russia, you only need to submit the corresponding application to the territorial branch of the Pension Fund of the Russian Federation. This can be done either in person or by post (in this case, copies of documents must be notarized). In addition to the application to the pension fund, you must submit:

- insurance certificate (SNILS);

- identification document (usually a passport of a citizen of the Russian Federation).

It is also allowed to submit documents through an official representative (authorized person). In this case, you will additionally need a document certifying the identity of the authorized person and a corresponding document that confirms the right of the representative to act on behalf of the insured person (for example, a power of attorney).

Both those who are just planning to create a future funded pension and those who have already accumulated a certain amount in other companies can entrust their savings to Vnesheconombank. In the second case, the legislation of the Russian Federation allows at least a year to transfer savings under the management of the State Management Company.

This can also be done by insured persons who have chosen a non-state pension fund as their insurer. However, in this case, the insurer will be changed, that is, the citizen will transfer his funds from the NPF to the Pension Fund. And this can lead to loss of investment income. Therefore, it is necessary to switch from a non-state fund to a state fund no earlier than after five years.

When choosing the state management company Vnesheconombank, a citizen must also choose one of two investment portfolios offered by the company.

Selecting an investment portfolio and placing funds

The investment portfolio represents assets that were formed at the expense of funds transferred to the Pension Fund of the management company under one agreement. These funds are separated from other assets, and the portfolio is formed in accordance with the investment declaration.

State Management Company “Vnesheconombank” offers two investment portfolios for insured persons to invest their savings:

- Basic portfolio of government securities (GS);

- Expanded investment portfolio.

The government securities portfolio consists of government securities of the Russian Federation and bonds of domestic companies, as well as funds in rubles and foreign currency guaranteed by the Russian Federation. The expanded investment portfolio also includes mortgage-backed securities and bonds of international financial organizations. Remedies of the “silent”

were automatically transferred to the expanded GUK portfolio.

The management company separates investment portfolios, which are formed from pension savings, from other property (including its own), and opens separate accounts for each (with the Bank of Russia, credit institutions, etc.).

The average return on investing pension savings is 4.74%

The average yield by the end of 2020 was 4.74%, which corresponds to the results of the previous reporting date (4.75%), and more than half as low as 9.67% a year earlier. Changes in macroeconomic indicators, primarily the dynamics of inflation and the policy of the Bank of Russia regarding the dynamics of the key rate, had a fundamental impact on the result.

The National Rating Agency has prepared another periodic rating of the quality of pension savings management of the Pension Fund of Russia - this time based on data for 2020. The study involved 21 companies representing 24 strategies for managing pension savings.

We recommend that you read: New occupational safety and health regulations in 2020