Is it possible to recalculate a pension after it has been assigned?

The old age insurance pension consists of two parts. The first is a fixed payment. Its size is reviewed annually on January 1. The second part is insurance. It is calculated individually for each pensioner. The size of old-age payments is influenced by the value of the individual pension coefficient (IPC) - the total number of pension points (PB) for the entire length of service.

When calculating pensions, employees of the Pension Fund (PFR) may make mistakes. Errors often occur due to human factors.

There may be malfunctions in the operation of the software installed on the computers of employees of territorial offices. All the data provided for the years of Soviet service or the transition period may not be taken into account.

If you suspect that the amount of old-age pension payments is not determined entirely correctly, you can request an adjustment. Both non-working pensioners and those who continue to work can request a calculation. If a pension accrual certificate has not been provided, you can file a complaint with the Pension Fund management.

Unfavorable period for calculating pensions

To calculate payments, 60 insurance months worked continuously are taken as a basis. They are multiplied by the experience coefficient. It varies depending on groups of professions and working conditions. The maximum coefficient is 1.2, and for those who worked in the North - 1.9.

To get a higher pension, you need to choose a favorable period. This is the 60 months for which the employee received the highest salary in relation to other years.

Fraud when calculating pensions may lie in the fact that PF employees choose an unfavorable period when wages were lower. They justify their decision by the fact that the length of service in other years has not been confirmed. You can clarify the situation with a specialist who will check the entries in the work book.

- How to make delicious homemade chicken salads

- Symptoms of high cholesterol

- Life expectancy of men in Russia

Where to check the accuracy of the accrual

You can find out whether your old-age pension has been calculated correctly in several ways:

- contact the relevant authorities personally or through an authorized representative;

- via the Internet;

- submit a written application (petition) by registered mail.

Where to go

Checking the accrual of old-age pensions is possible in the following organizations:

- Regional branch of the Pension Fund of Russia . You need to come to the customer service and write a corresponding statement. Among the documents you need to have with you, you must have a passport and SNILS.

- Multifunctional center (MFC) . Here you will be asked to fill out an application, to which you will need to attach your passport and SNILS.

- The bank where your pension is deposited. You need to go to the nearest branch at your place of registration. There you will be asked to write an application to gain access to this service in your personal account. You should have your passport and SNILS with you. Please note that this method is suitable if the bank has an agreement with the Pension Fund of Russia. Such institutions include Sberbank, VTB, Uralsib.

- Place of work. To obtain the correct information, you need to contact the accounting department.

- Non-state pension funds. Here, when you apply, you will be provided exclusively with information on the funded pension, which you form yourself or your employer does for you.

Application to verify the correctness of pension calculation

When you contact the Pension Fund or MFC, you will be given an application form. It must contain your personal information correctly. Next, ask to check the correctness of the pension calculations made. The specialist must make a note about acceptance of the application, after which it is sent for consideration.

5 days are allotted for this. You must be notified of the results of the inspection in the manner specified in the application. The amount is revised automatically if discrepancies are identified.

- How to get dental help during an epidemic

- How to stay healthy when leaving self-isolation

- Prune rolls - how to cook correctly and tasty at home using step-by-step recipes with photos

Reasons for engaging a lawyer in drafting applications to the Pension Fund of Russia

What prevents you from making a request for information from the pension fund yourself? There are no obstacles to this, with the exception of a number of errors that lead to loss of precious time. When making a request for length of service to a pension fund or other written requests, a person who does not have the necessary information sends it to an incorrectly defined address.

A problem may be the preparation of the content of the request to the pension fund about the calculation of pensions and other issues with violations that make it inconsistent with the current legislation. There are various nuances, ignorance of which leads to the fact that the application to the Pension Fund of the Russian Federation is left unanswered and returned without consideration to the subscriber who sent it. The legal validity of a request to a pension fund for wages or another thematic document allows us to resolve issues of appealing incorrect and illiterate decisions of Pension Fund employees with greater efficiency and efficiency.

In addition to drawing up archival and other requests, a specialized lawyer provides consultation and, if a conflict with the Pension Fund of the Russian Federation comes to court, prepares a statement of claim and protects the interests of the individual who has turned to his services. In addition to participation in court, it involves performing a large block of actions to collect certificates and other documents. A lawyer needs to submit petitions, prepare complaints, receive a writ of execution, etc.

How to find out the status of your retirement account online

It would be correct to constantly check whether your employer is making contributions to the Pension Fund for you. As reviews indicate, not all employers treat this issue in good faith. You can track information online:

- on the Pension Fund website in your personal account;

- through the State Services service.

After completing all the steps, you will be able to view the following information online:

- number of years of experience;

- the number of pension savings and who manages them;

- all employers and how much money they transferred during your employment;

- number of PB.

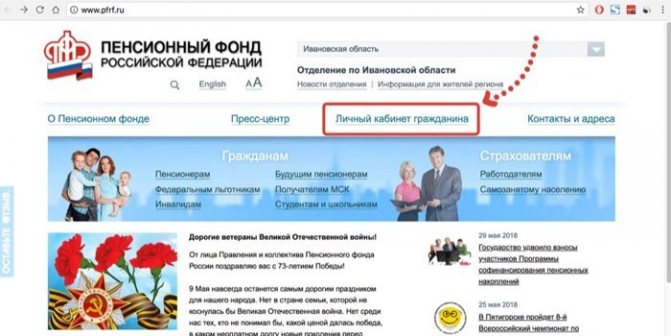

On the Pension Fund website

In order to find out your pension on the Pension Fund website and check the data online, you need to have a computer, tablet or mobile phone at hand. You can check whether your pension has been calculated correctly in the following way:

- Go to the foundation’s website at www.pfrf.ru.

- Log in to your personal account. For authentication, the correct mobile phone number, email address or 11-digit SNILS number, and password specified during registration are used. If you are not logged in, you must follow the link at the bottom of the form.

- After logging in, select .

- Order information by filling out a request to receive a notification.

- Study the information.

Check pension contributions on the State Services portal

You can view contributions to the Pension Fund via the Internet on the State Services portal:

- Go to the website www.gosuslugi.ru.

- Click the “Personal Account” button.

- Go through authorization by entering the correct mobile phone, email or SNILS number and password. If you are not yet a user of the portal, follow the provided link. Fill out the standard form.

- Follow the link “Obtaining information about the status of an individual personal account.”

- Click on the “Get service” button.

- Information about your pension will appear on the screen, which you can view online, save or print.

How to submit a request to the pension fund?

Appeals to the Pension Fund are made for all pension matters. The need for the initial assignment of a pension, an application for an early pension, a requirement for recalculation - all this necessitates the need to submit a request to the pension fund. Compliance with this procedure is also mandatory for subsequent appeals to the judicial authorities.

As a general rule, the application under consideration is submitted at the citizen’s place of residence. Therefore, when deciding how to start applying for an old-age pension, you should initially decide on a specific territorial pension authority. This is of fundamental importance, since an incorrectly selected recipient of the application will almost certainly cause a refusal to grant a pension.

It is noteworthy that it is for the initial assignment of any type of pension that the law establishes a mandatory application form. In all other situations, there are no requirements for the form and text of appeals.

You can apply for a pension in one of the following ways:

- Through the State Services system

- Personal appeal

- By Russian Post

- Express delivery

A citizen, at his own discretion, has the right to choose any of the listed options for delivering a completed application to the Pension Fund. The method of submission has no significance for the pension authority making a final decision on the application.

However, in some cases, for example, on the issue of how a long-service pension is calculated for teachers, a more convenient way of filing will obviously be in person or through the mail. This is due to the need to attach, as a rule, a large number of documents confirming the preferential nature of the work and its period. In addition, when applying for an early pension, it is mandatory to confirm the appropriate qualifications of the employee. Providing a work record book about work, for example, as an employee of a medical organization, will not be a sufficient basis for granting a pension. Even at the stage of submitting an application to the Pension Fund of the Russian Federation, sufficient evidence should be sent to the body that the citizen actually had the necessary qualifications for the position held. A similar requirement applies to the employer.

It is worth remembering that the pension fund carries out careful work to answer the question in what cases an early pension is granted for each application. For these purposes, the government agency may question the reality of the work. Taking into account these circumstances, in addition to the application, it is important to attach documents from the employing company, which will also help for a positive outcome when assigning a pension. Documents of this kind must confirm that the enterprise had the necessary equipment, in cases provided for by law, a special permit for such work, and so on.

Also watch our video from the YouTube channel with advice from a lawyer, write comments on the video and you will receive a professional answer, which is an advantageous offer with a reduction in time for receiving feedback:

How to calculate your pension yourself

You can personally try to determine the amount of due old age pension payments if you think that your pension has been calculated incorrectly. For this you will need a calculator.

It is important to understand that the calculation will only be approximate.

Only a Pension Fund specialist can tell you the exact amount of the old-age pension after studying the payment file.

Payments are calculated by age, taking into account the following data:

- Salary data. You can get them from your employer. If the company is liquidated, you should order a certificate from the archives. To do this, you need to personally contact the appropriate organization. It is impossible to obtain such information on the Internet.

- Duration of official work activity. You can check the information using your work record book.

- The presence of non-insurance periods - times when you did not work for objective reasons. For example, they were on maternity leave or served in the army.

- Retirement age.

Old age pension formula

When calculating the old age pension, the formula is used:

SPS = FV x PC1 + IPCtot. x SPB x PK2 + NChP, where:

- SPS – the amount of accrued old-age insurance pension.

- PV - the amount of the fixed payment at the time of calculation of the pension (in 2020 - 5,334.19 rubles).

- PC1 and PC2 are increasing coefficients. Rely on later retirement. You can view them in Law No. 400-FZ “On Insurance Pensions” (December 28, 2013). When a pension is assigned at the generally established age, they are equal to 1.

- IPKobshch . – the number of pension points for the entire period of work.

- SPB - the cost of one SP at the time of recalculation of the old-age pension (in 2020 - 87.24 rubles).

- NPE is the funded part of the pension, if you formed it.

In order to calculate the pension according to the IPC, you need to know that in different periods different formulas were used to determine the number of PB. This is due to the ongoing pension reforms. Conventionally, working time is divided into 3 periods:

- until 2002;

- from 2002 to 2020;

- after 2020.

Based on this, IPKobshch. can be defined as:

IPKobshch. = IPK2001 + IPK2002–2014 + IPK2015 + IPKnon-insurance, where:

- IPK2001 - the number of PB earned during Soviet times and up to January 31, 2001 inclusive;

- IPK2002–2015 – number of points from January 1, 2002 to December 31, 2014 inclusive;

- IPK2015 – the number of PB accrued starting from 2020.

- IPC non-insurance – the number of pension points for non-insurance periods.

Calculation of points for calculating pensions

You can view your pension points online. To get started, you should go to the Pension Fund website. There you can use a special calculator. To independently determine the amount of your old-age pension, adhere to the following formulas:

- Until 2002. The amount of pension capital is divided by the cost of 1PB as of January 2020 (64.10 rubles).

- From 2002 to 2020. The insurance part of the pension is divided by the cost of 1PB as of January 2020 (64.10 rubles).

- From 2020. All insurance contributions from your paycheck are automatically converted into points. To do this, the received amount is divided by the standard amount of contributions to the insurance pension. It is 16% of the maximum contributory earnings, which is determined by the Government of the Russian Federation annually). The total value is multiplied by 10.

Please note that the maximum IPC is limited by law. Regardless of your accrued salary, you are entitled to no more than:

- 7.39 PB for 2020;

- 7.83 for 2020;

- 8.26 for 2020;

- 8.70 for 2020;

- 9.13 for 2020

For each full year related to non-insurance periods, 1.8 PB must be accrued for the following circumstances:

- compulsory military service;

- caring for a disabled person of group I, a pensioner over 80 years old or a disabled child;

- detention if the citizen is subsequently rehabilitated;

- being with a military spouse in an area where it is impossible to get a job in your specialty (maximum 5 years);

- residence outside the borders of Russia, if the spouse is a representative of embassies, diplomatic missions (no more than 5 years).

- Chicken with walnuts - step-by-step recipes for preparing a Georgian dish at home with photos

- How to insulate a balcony

- Searching for ads by phone number - step-by-step instructions for checking the seller

The number of PB accrued for each year of caring for a child until the child turns 1.5 years old depends on the child’s birth order:

- for the first – 1,8;

- for the second – 3,6;

- for the third and fourth – 5,2.

Step-by-step calculation algorithm

The procedure for calculating an old-age pension consists of several stages:

Stage 1. Find out how much PB was accrued before 2002:

- The experience coefficient (SC) is determined. By default it is 0.55. If a man has more than 25 years of experience, and a woman has 20 years, for each year in excess an additional 0.01 must be accrued. The maximum value cannot exceed 0.75.

- The average monthly earnings coefficient (AMC) is calculated. You need to take the average salary for any 60 consecutive months (or for 2001–2002) and divide it by the average monthly salary in Russia for the same period. The limit value cannot exceed 1.2. For persons with “northern experience” it varies between 1.4–1.9.

- The estimated pension (RP) is determined.

If SC is greater than 0.55 . RP = SK × KSZ × 1671 – 450. Regardless of the result, the minimum value is 210 rubles.

If SC is 0.55 . For men, the formula is used: RP = (SC x KSZ x 1671 - 450) x (length of service in years before 2002 / 25). For women - RP = (SC x KSZ x 1671 - 450) x (length of service in years before 2002 / 20). Remember, the minimum value (SC x KSZ x 1671 – 450) is 210.

- Valorization (one-time increase) is applied to the RP amount. If you were not officially employed before 1991, the RP increases by 10%. If you have experience, an additional 1% is added to 10% for each full year.

- To calculate the pension capital, the result obtained is multiplied by 5.6148 - the product of the indexation coefficients for each year from 2002 to 2014.

- Determine how much PB was earned before 2002.

Stage 2. Find out the number of PB accrued from 01/01/2002 to 12/31/2014. (inclusive):

- Receive information about the status of your personal account. This can be done by sending a written request to the Pension Fund, via the Internet on the State Services website, or during a personal visit to the Pension Fund.

- The numbers indicated in the statement must be multiplied by the appropriate indexation coefficient. There is one for each year:

- 2014 – 1,083;

- 2013 – 1,101;

- 2012 – 1,1065;

- 2011 – 1,088;

- 2010 – 1,1427;

- 2009 – 1,269;

- 2008 – 1,204;

- 2007 – 1,16;

- 2006 – 1,127;

- 2005 – 1,114;

- 2004 – 1,177;

- 2003 – 1,307.

- Add up the indexed numbers. Divide the final figure by the survival age determined as of January 1, 2015. It is equal to 228 months.

- The number of PB accumulated from 2002 to 2015 is determined.

Stage 3. Calculate PB accumulated since January 1, 2015.

Stage 4. PB for non-insurance periods is summed up.

Stage 5. IPCtotal is determined.

Stage 6. The amount received is multiplied by the cost of 1 PB (87.24 rubles).

Stage 7. The PV is added to the result. It will be different for each group of applicants. For example, if you are over 80 years old, the base value doubles. If there are dependents, an additional 1/3FV must be charged for each.

If your old-age pension is small and does not reach the subsistence level established in your region of residence, you should be assigned a social supplement:

- From the federal budget , if the PMP in the region is lower than the federal value (8,846 rubles). Payments are made through the Pension Fund.

- From the regional budget, if the PMP is higher than the federal value. Paid through social security authorities.

Self-check procedure

Procedure for independently checking the correctness of pension calculation:

- The experience coefficient is determined. A woman must work at least 20 years, a man 25 years, then this figure is 55%. For every 12 months, 1 percent is added.

- Income for any 5 years is taken from personalized accounting statements.

- Its ratio to the average monthly salary in the country for the same period is calculated. This indicator should not exceed 1.2 for all regions. In the Far North, it ranges from 1.4 to 1.7.

- The insurance part of the remuneration is determined by multiplying the length of service coefficient, which is provided separately for men and women, by the average monthly income in the state and the ratio coefficient.

- Pension capital is calculated as the difference between the previous indicator and the base part multiplied by the number of months after which the payment is due.

From January 1, 2020, the size of the insurance pension increased by 3.7%. Indexation cannot be lower than the inflation rate recorded in the previous year.

To check your calculations, contact your regional Pension Fund office

To the received insurance portion of the remuneration is added the basic amount established by the government and the amount of contributions that was in the personal account at the time of legal retirement. The federal supplement is not provided for those who are still working in retirement.

To recalculate remuneration, having personalized accounting data, you can use a special calculator. The one posted on the PF website is more reliable.

Checking the accrual of preferential pensions

You can calculate early retirement pension for workers in hazardous industries or with northern work experience using the above scheme. In this case, it is necessary to take into account this application of the regional coefficient. It is used if you live in areas with difficult climatic conditions. The value varies from 1.15 to 2.

When you change your place of residence, the value of the regional coefficient is revised.

In addition, for citizens who have a certain length of work experience in the Far North (FN) and equal territories (EKS), the PV in the formula for calculating the old-age pension has an increased significance. It does not decrease even when moving to another area:

- RUR 8,001.29 – citizens under 80 years of age, if they have worked for the RKS for 15 years or more, and their total insurance experience is at least 25 years for men and 20 for women.

- RUB 16,002.58 – citizens over 80 years of age, if they have worked for the RKS for 15 years or more, and their total insurance experience is at least 25 years for men and 20 for women.

- RUB 6,934.45 – citizens under 80 years of age, if they have worked in the PKS for 20 years or more, and their total insurance experience is at least 25 years for men and 20 for women.

- 13868.90 rub. – citizens over 80 years of age, if they have worked in the PKS for 20 years or more, and their total insurance experience is at least 25 years for men and 20 for women.

If there are dependents, an additional payment to the old-age pension must be accrued in the amount of:

- for the first – 1/3 of the established fixed payment amount (FPV);

- for the second – 2/3 UVV;

- for the third - 1 UVV.

What social benefits are provided for pensions?

Article on the topic

European-style pension: how the elderly live in Spain, Germany and Poland If the total amount of cash payments to a non-working pensioner is lower than the pensioner’s subsistence level established in the region of his residence, then he is provided with a federal or regional social supplement to his pension.

The federal social supplement to pension is set in such an amount as to:

additional payment + pension = minimum living wage for a pensioner in a given region.

If the pensioner works, no additional payment is made.

A regional surcharge is established if the cost of living of a pensioner in the region is higher than the cost of living of a pensioner in the Russian Federation.

The cost of living for a specific region can be found on the website >>

The federal social supplement to the pension is paid by the territorial body of the Pension Fund of the Russian Federation (PFR), and the regional one - by the authorized executive body of the constituent entity of the Russian Federation.

See also: Minimum pension in Russia from January 1, 2020 →