Disabled people in Russia are classified as a disabled category of citizens in need of financial support. They cannot ensure a normal quality of life due to physical disabilities that do not allow them to carry out work activities in full. A group of disabled people is identified who received injuries and injuries in connection with their professional qualifications. Sometimes deficiencies occur from childhood. These people are provided with guarantees and rights set out in Federal Law No. 181. To what extent they are fixed, what documents are needed to receive benefits, what length of service should be required to apply for an insurance pension for the disabled, is detailed in this material.

Features of the definition of disability in Russia in 2020

Citizens with disabilities are divided, according to legal requirements, according to medical criteria into three categories, depending on the level of dysfunction. The first category is assigned to those who cannot take care of themselves without outside help, the third - for minor deficiencies in which the citizen can carry out limited work activities.

The degree of disability is determined by a special medical commission based on a conclusion adopted collectively. Initially, a citizen turns to a local doctor to receive referrals to specialists. They order tests and conduct the necessary examinations. After receiving a comprehensive package of documents on the state of health, a commission is appointed. Based on the results of its implementation, a conclusion is made.

Depending on the state of health, that is, the assigned disability group, a list of benefits and benefits is determined at the expense of the state. In particular, a disability pension is awarded. To determine it, you must have a minimum work experience.

Registration process

The condition for receiving monetary compensation is passing the MSEC, which issues a certificate to the Pension Fund. It must be delivered to the local department of the Pension Fund within 10 days. Payments are accrued for the period specified in the document. People who have received disability status after retirement are entitled to lifetime accrual of cash disability payments.

Documents required for registration

To receive a labor pension, a disabled person or a person representing his interests must provide the following package of documents to the local department of the Pension Fund of Russia:

- passport;

- work book or contract;

- certificate of disability indicating the group.

In addition, the following documents may be required:

- a certificate indicating the presence of dependents and their number;

- certificate of average monthly income for 60 months, subject to working in one place;

- document confirming residence in Russia.

Russian legislation provides for the possibility of assigning a labor pension “retroactively”, that is, from the date of documentary confirmation of disability. Sometimes the patient loses up to 100% of his vitality and capabilities. He is not able to carry out the registration procedure. To recover from psychological shock and get back on his feet, the patient is given no more than 12 months

If a citizen applies no later than a year later, then the pension is calculated from the first day the group is assigned. The Pension Fund assigns a labor pension after completing the application in person. If the patient cannot do this on his own, then a loved one or a social worker can handle the registration.

Classification of pensions by disability category in the Russian Federation in 2020

Persons who have been assigned a disability group based on a decision of an authorized medical collegial body can count on one of the types of pensions. Each of them has certain criteria. These include:

| Disability insurance pension. If the amount of insurance contributions is small, then the appointment of an insurance pension is inappropriate and a minimum social pension is determined. | Available to persons with official labor protection. The pension amount is determined based on the pension savings reserve. | It is obligatory to pay insurance premiums to the appropriate budget at the expense of the employer during work. |

| Social disability pension | Available to all categories of Russians who have a medical certificate establishing an unsatisfactory state of health. | Appointed for disabled children, disabled people since childhood and people who do not have a single day of work experience, persons who became disabled after 18 years of age. |

| State pension | Available only to certain individuals whose status is subject to special laws, government regulations and federal laws. | This benefit from the government is given to war veterans, persons liquidating the consequences of the Chernobyl nuclear power plant accident and survivors of the siege of Leningrad. |

Disability retirement age in 2020 in the Russian Federation

In 2020, the law on pension reform comes into force in Russia. According to amendments to the law on the appointment of state support, the age of citizens of the Russian Federation for entering a well-deserved retirement by age has been increased. It will be 65 years for men and 60 years for women. The age for receiving financial assistance from the state due to the age limit will be increased gradually, with a frequency of 1 year.

Important: these changes and amendments to the laws in no way affected the requirements of the law on disability. Benefits from the state are determined in the case of persistent loss of health in an assigned group, resulting in disability.

Disability can be of the following types:

- The first group – entails permanent loss of ability to work, incompatible with the implementation of work activities. A citizen cannot take care of himself without outside help; he is assigned a legal representative, guardian or trustee who helps him with movement and solving legally important issues. There is no ability to communicate independently. Social functions are limited, adaptation to society is required. A disabled person has difficulty moving in space.

- The second implies severe health damage that prevents full work activity, with the exception of cases assessed as exceptional.

- The third one involves a partial loss of the ability to work; a citizen can continue to work if the activity is not limited by doctors.

Important: all types of pensions are subject to indexation every year, insurance is subject to upward changes twice a year. A pension for disabled people of 3 categories does not imply serious restrictions. Pensions for disabled people in 2020 were indexed on February 1 and April 1, depending on the type.

Monthly cash payment (MAP) for disabled people of groups 1, 2 and 3 in 2020 in the Russian Federation

The procedure for providing financial support is regulated by Federal Law No. 122 dated Federal Law of June 21, 2010 No. 122-FZ. The benefit was first defined in 2004 and became known as cash compensation. The transfer of funds is carried out by order of the Pension Fund of the Russian Federation through branches of the Russian Post, social service bodies or divisions of the Pension Fund of Russia.

There is no need for a disabled person to undergo an examination. To receive funds, it is enough to apply to the Pension Fund, the branch at your place of residence. Money is credited to your personal account.

In 2020, the indexation of payments for disabled pensioners was carried out on February 1, 2020. The increase was 4.3%. From this date, the amounts of the monthly allowance for various categories of citizens in need of financial support due to health conditions are provided for the following amounts of payments:

- Group 3 – RUB 2,177.44;

- Group 2 – 2,720.07 rubles;

- 1st group – RUB 3,808.77

The amount of payments is established by federal and regional regulations. Most of the funding may be allocated to local authorities from the regional budget. Every year, a larger volume of funds is transferred to the disposal of branches of the Russian pension system.

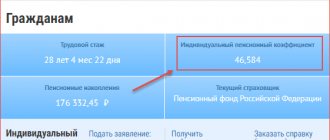

Calculation of pensions of various categories for disabled people in 2020 in the Russian Federation

Each type of pension benefit to which persons with a confirmed disability group may qualify has its own system for calculating payments. It consists of the following points:

| Disability insurance pension. When assigning payments, regional coefficients and the number of dependents - minor children in support - are taken into account. | Determined by summing the basic pension amount in proportion to the degree of disability. For example, work experience in the Far North region is taken into account. If it is more than 20 years old, then the pension is provided at an increased rate. | It is compared with the amount of accumulated funds in the pension fund. The resulting amount is divided by the duration of probable survival, which is 240 months. |

| Social pension for disabled people. A coefficient of 100 to 300% is provided. This affects the basis for receiving a pension. | It is established in a fixed amount by the state and approved on the basis of regulations. | Subject to annual indexation by order of the Russian Government. |

Social pensions for 2020 in Russia are set in the following amounts:

- Group 3 – RUB 4,403.24;

- Group 2 – 10,360.52 rubles;

- 1st group – 12,432.44 rubles. A pension is paid in the specified amount for disabled people of group 2 if a complex health condition has been established since childhood.

Important: insurance pensions are calculated based on a formula taking into account the basic payment. For 2020, its size is 5,334.19 rubles. Annual indexation is associated with inflation and a corresponding increase in prices for consumer goods. On April 1, an increase in the social pension is provided and on February 1 – in the daily allowance and insurance pensions.

Completion of internship

In the later version of Law No. 255-FZ, these citizens also include heads of organizations who are the only participants (founders), members of organizations, and owners of their property.

They are also subject to compulsory social insurance in case of temporary disability and maternity, i.e. they are considered as employees - insured persons. In the situation under consideration, the insurance period is eight years, i.e., it is determined by the duration of continuous service, including training at a vocational school, so that the employee is entitled to a benefit in the amount of 100% of his average earnings.

The procedure for registering the right to pension provision for disabled people in 2020 in the Russian Federation

The procedure for obtaining the right to state pension provision for disabled people consists of going through the following steps:

- Contact your local doctor to obtain certificate No. 088/u-06 to undergo an examination.

- Passing all narrow specialists within the framework of medical and social examination, passing all tests and studies.

- Appeal to the ITU territorial commission, where evidence is provided of the presence of a certain disease, which entails the appointment of a disability group and payment of financial support from the state.

- Submitting a conclusion to the Pension Fund of the Russian Federation on the payment of a social pension.

- Passing the re-examination procedure to confirm the disability group. For disabled people of group 1, it is carried out twice a year, for people with disabilities of group 2 - every year. For some injuries, they are not prescribed if restoration of body functions is impossible due to physical disabilities.

After passing the commission, in addition to the ITU conclusion, the citizen is given a rehabilitation program. For group 1, it is also possible to appoint a guardian and trustee - mother, father or legal representatives based on the decision of the guardianship council. Restorative measures are prescribed on an individual basis with the goal of restoring normal health. For example, this could be treatment in a sanatorium, undergoing certain physiological and therapeutic procedures.

Sick leave and work experience

The social security of an able-bodied citizen of the Russian Federation lies, in particular, in the right to receive paid days when absent from work due to illness. People working under employment contracts can count on such a social guarantee.

All those years when a person was officially employed and performed his job functions are considered to be working years. Such years are usually calculated from entries in the work book. The main indicator of this concept is that it is taken into account in full, without any exceptions, the periods are considered from the moment of admission to the moment of dismissal.