Insurance premiums are the main foundation of our future pension. The amount of future monthly payments depends on their size and duration of payment.

Compulsory pension insurance in Russia provides the opportunity not only to monitor your contributions, but also to manage them. To do this, you can choose one of the pension options offered by the state.

We will consider further which option is more profitable and whether it is worth transferring the funded part of the pension to a non-state pension fund. The information will help you choose a pension: funded or insurance.

Which pension option to choose?

Indeed, there is a right to choose an option in the compulsory pension insurance system. You can not only choose once, but also change your mind and return to the previous option. To do this, you must have a SNILS number.

Today, the insurance contributions transferred by your employer in the state compulsory insurance system can, at your choice, be sent in full to the Pension Fund of the Russian Federation, or part of the funds can be deferred to the Non-State Pension Fund for a funded pension.

Regardless of our choice, from the total tariff of 22 percent, the Pension Fund retains 6 percent to finance the fixed payment. This is called a solidarity tariff, when part of the insurance premiums goes to provide for current pensioners.

The remaining 16% is called the individual part. It is this money accumulated within the individual part that you can manage.

After all the reforms today, we have the following pension options to choose from. Let's compare each of them separately for understanding and informed choice and consider the pros and cons of each option.

Right to funded pension for new employees

Employees who began working in January 2014 and later can decide to choose a model for forming a future pension within five years from the date of the first accrual of insurance premiums in their respect. And if a young person began working before the age of 18, the corresponding decision can be made before December 31 of the year in which he turns 23.

At the time of submitting an application to the Pension Fund for choosing an insurer, a citizen must be 14 years old. Until the employee makes a choice, 6% will be used to finance the insurance pension (Clause 2, Article 33.3 of Law No. 167-FZ).

Option 1. Only insurance pension 16%

This option of OPS can be called the main one. It is offered by the Pension Fund “by default”. Most insured persons form pension savings using this option.

In slang they are called " silent people ". These are those citizens who have never chosen the option of compulsory pension insurance. Or they chose, but returned back to this option.

If you have not written any applications or agreements to transfer to a non-state pension fund, then all of your 16% contributions from the individual part go only to the insurance pension.

With this option for managing insurance funds, all transferred contributions are converted into individual coefficients. They are also called pension points.

Each insured person has his own individual number of accumulated points. They can be checked in the citizen’s individual personal account.

For example, for a monthly salary of 25,000 rubles, the number of pension points taken into account for 2020 will be 2.938. The calculation is as follows: (25000*12*16%/163360)*10. Where 163360 is the standard amount of insurance premiums for 2020, and 10 is a constant value.

All accumulated points remain in your individual pension account. They do not grow on their own and are not indexed. The number of coefficients will be exactly the same as you have accumulated throughout your life. Another thing is that they do not depreciate over time. The new formula for calculating the insurance portion multiplies the total number of accumulated coefficients by the cost of one pension point.

From 2020, the cost of one point increases annually by the consumer price index. Therefore, upon retirement, your accumulated points will be converted into rubles, taking into account all indexations.

For example, if a woman, upon reaching her retirement age in 2020, has accumulated 130 points, then the insurance portion will be equal to 10,593.70 rubles (130 * 81.49). Let's add to it a fixed payment from the joint and several part of 4982.90 and we get the total amount of payments 15576.60 rubles.

Thus, when choosing this pension insurance option: • All paid insurance premiums in the amount of 16% are sent to your insurance pension; • Contributions from rubles are converted into individual coefficients; • The number of pension points accumulated over a lifetime is individual for each person; • Points do not depreciate over time; • Every year the insurance pension is indexed with an increase in the value of the point.

Calculation of accrual for a pensioner - formulas

To preliminary calculate the expected pension payment for an individual citizen, it can be calculated using a certain formula approved at the federal level.

The complete manual consists of three components and can be represented by the following formula:

PP = FS + SD + LF

Where:

- PP – pension benefit in full;

- FS – fixed rate;

- SD – insurance share;

- LF – accumulative part.

FS are a fundamental part of the payment, which is provided at the state level.

NP is the individual savings of citizens.

For the calculation, you only need to determine the SD, which can be found using the following formula:

Where:

- SD – insurance share;

- PC – pension capital;

- T – time of deductions, calculated in months.

To carry out calculations using the above formula, you will need to determine the size of the PC, which is calculated by the following equation:

PC = UPC + RP

Where:

- UPC – conditional pension capital;

- RP – estimated pension.

To calculate the RP the following will be used:

Where:

- RP – estimated pension;

- SC – coefficient accrued for length of service. For men with twenty-five years of work experience and women with twenty years of work experience, the coefficient is 0.55. After this, for all years worked beyond this number, it increases by 0.01, but cannot exceed the figure of 0.75;

- ZR/ZP – the ratio of the candidate’s salary to the average salary in the state. The limit value can be no more than two;

- SWP is the size of the average salary in the country for the year two thousand and one, which was 1,671 rubles.

In order to determine the size of the insurance share, you will need to find out how much money has accumulated from contributions in the period after two thousand and two. You can find out this figure by contacting your local FIU.

After calculating all the components, you can get the expected amount of pension payments.

Calculation of pensions for those born before 1967 - example

Let's consider a practical example of calculating benefits for Artemov A.A., born in 1958, who wants to end his official work experience with retirement in 2020.

To obtain a pension, Artemov A.A. came to the local Pension Fund with a completed application and a package of documentation a month before retirement.

The benefit amount is determined using the following formula:

- The documents provided confirm the work experience of Artemov A.A. at 30 years old. For men, the coefficient for twenty-five years of experience is 0.55, since a citizen’s work experience exceeds this figure by five years, another 0.05 points are added. The final calculation gives a figure of 0.60 points;

- Artemov did not provide a certificate of income. Also, Pension Fund employees took into account average earnings. The average citizen's salary was 1,530 rubles. Divide by the average salary for 2002: 1530/1671 = 0.92;

- The figure is substituted into the formula to determine PC: 0.92 x 1671 x 0.60 – 450 (fixed rate for 2002) x 228 (approximate number of months of benefit payment) = 104,200;

- Next, the coefficient is multiplied by the total indexation coefficient: 104,200x 5.6148 = 585063.77 – the amount of pension capital of Artemov A.A. by 2020;

- In addition, a slight increase of 0.1 points is added for work activity in post-Soviet times, 585,063 rubles;

- To these calculations are added payments made by the employer to the Pension Fund since 2002, which amounted to 1,234,567.89 rubles;

- Let's sum it up: 1234567,89 + 2390338,27 + 2390400,12 = 6015306,26;

- This amount is divided by the approximate payment period (228 months):

6015306,26/228 = 26382,92.

- Next, the pension coefficient (which amounted to 120.1 for contributions) is multiplied by the cost of the point (81.49 for 2020), and we obtain the amount of insurance payment: 9786.9 rubles;

- We add a fixed rate to the insurance share, the minimum amount of which is 4983 rubles: 9786.9 + 4983 = 14770 rubles.

To calculate pension benefits, citizens can use the pension calculator, which is located on the official website of the Pension Fund. Also, to make calculations, you can contact the nearest Pension Fund.

Option 2. Funded pension 6% and insurance pension 10%

If the previous option of pension insurance is the default choice for everyone, then the option with a funded pension is chosen by a person only by submitting an appropriate application.

In case of such a choice, only 10% will be transferred to the insurance pension, and 6% will be transferred to your funded part.

Visually, the formula for such a choice will look like this:

In order to switch to this type of pension insurance, you must submit an application to the Pension Fund for transfer to the Non-State Pension Fund (NPF) or Management Company (MC) and conclude an agreement with them.

After concluding an agreement, 6% of your tariff from the next year after submitting an application will be transferred to a non-state pension fund or management company for investing these funds and generating income.

For example, from a salary of 30,000 rubles to a non-state pension fund, 21,600 rubles (6% of the annual salary) will be transferred to invest in the funded part of the pension.

Non-state funds and management companies manage the money you transfer, investing it to generate more income. Their benefit is to receive a percentage from money management.

The investment process can have not only income, but also certain risks of losing the invested money. It is important to take these circumstances into account when choosing the option of compulsory pension insurance.

The state guarantees the safety of funds when transferring funds to NPFs and management companies. This means that when you transfer, for example, 12,000 rubles to the Management Company to finance your funded pension, this money will remain with you even if you receive negative income from investment.

The maximum losses are inflation over the past year and the depreciation of your funds without receiving investment income.

Important: the right to choose a non-state pension fund is granted only once every five years. If you transfer early, your entire accumulated interest income is lost.

Which NPF to choose is up to everyone to decide for themselves. It is important to pay attention to its age and overall return over the entire investment period.

Calculating a funded pension is not complicated. The accumulated amounts are divided by the expected payment period, which is approved annually by Federal Law.

For example, in January 2020 a woman entered into an insurance pension. At this time, 158,767 rubles have been accumulated on the individual personal account. The expected period for 2020 was approved by Law No. 419-FZ with a duration of 246 months. The monthly amount of the savings portion will be equal to 645.39 rubles (158,767/246).

Let us summarize the results of choosing a funded pension option. • In the OPS system, 10% of insurance contributions from your salary will form your insurance pension and be transferred to pension points; • 6% of contributions will be transferred to your chosen NPF or management company for transfer to the savings part; • The profitability from managing your funds in each non-state fund and company is different and no one guarantees a stable and constant income. Ideally, it should be at least higher than the annual inflation in the country; • Your money is insured against investment losses; • The accrued money is not linked to the value of the pension point and will be calculated from the approved accrual payment period. • Your funded pension will not be indexed. • Savings are inherited by legal successors, but only until the date of assignment of payments.

The difference between the insurance and funded part of a pension

Let's understand the difference between insurance and funded pensions.

| Insurance | Insurance + Savings |

| 16% of income | 10% goes to insurance + 6% savings + maternity capital if desired |

| Annual indexation | Annual indexation is only 10% |

| Not invested | 6% + maternal capital are invested when transferred to Non-State Pension Funds and Management Companies. Can bring additional income. |

| In case of death they go to the state | In case of death, the savings portion will be inherited by relatives |

| In case of entry before 2014. In the pension co-financing program, the state doubles the amount of voluntary contributions (no more than 12 thousand per year). |

The difference between the two options is quite large. Once you receive a fixed amount, you can increase it:

- Continuing to work, further increasing your experience, income, gaining points;

- Due to state indexation.

By choosing a mixed option, you receive a fixed amount plus a funded part; you can take it in the entire amount or spread the payments over the number of years you specify, or your relatives will receive it. In this case, 10% is increased in the ways indicated above. At first glance, you should choose the second method as the most effective. But the accumulative part of investing may or may not bring income, or even go into the negative.

NPF or Pension Fund: choice with calculation of options in the OPS system

It can be difficult to get an answer to the question of which retirement option is best. Each of them has its own pros and cons. In order to decide whether to entrust your funds to an NPF or Pension Fund, you need to know which security option is more profitable for you.

It is very difficult to find a definite answer to this question both on the Internet and from other sources of information. Everywhere they write that everyone must decide for themselves which pension to choose.

Another thing is that not every person can independently calculate the most profitable option for themselves. The formulas for calculating points are quite complex.

The exact calculation of your future pension is influenced not only by the established tariffs and the amount of insurance contributions, but also by the possible profitability of your pension savings.

Let's try to calculate possible pension options using examples depending on the amount of wages in order to find out the possible size of a future pension.

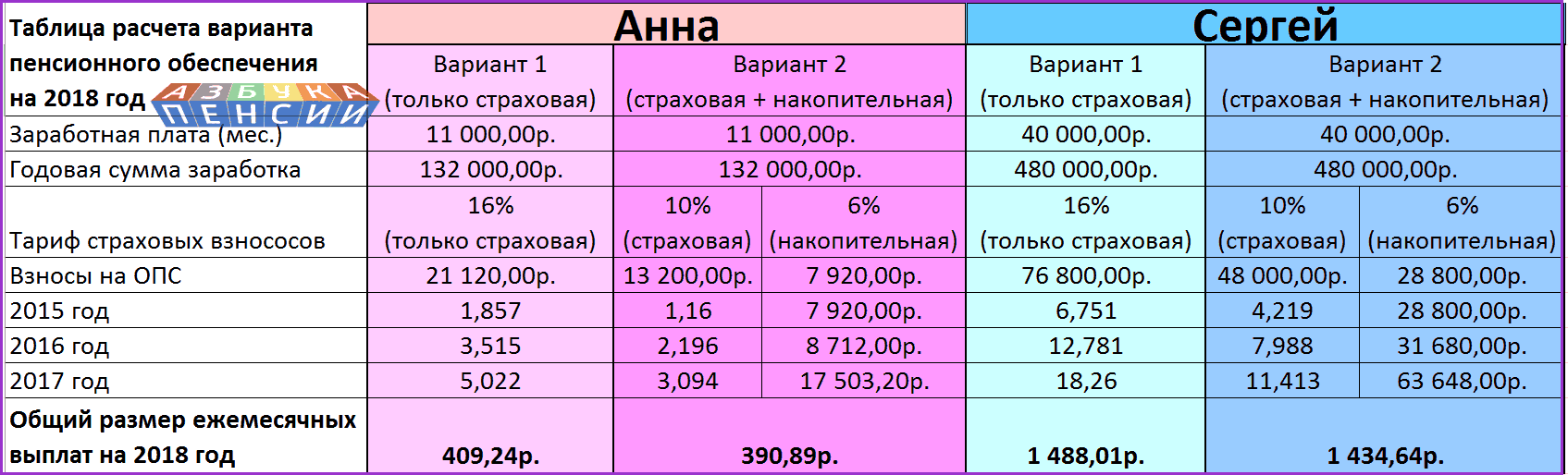

Let's imagine that Anna and Sergey could choose different options in the compulsory insurance system. They have different monthly salaries. For Anna it is 11,000 rubles, for Sergei it is 40,000 rubles.

Let’s check the possible payment amounts depending on the chosen tariff and see which pension option turned out to be more profitable. To do this, we will simulate options for investing in NPFs and Pension Funds over the past three years.

Let us immediately note that due to the imposed moratorium on financing the funded part, insurance premiums are currently not transferred for investment in non-state pension funds and management companies.

We will not describe in this article detailed calculations of the data obtained. You can track the calculation of your future pension in the content of the constructed data.

We also note the features that need to be paid attention to when calculating: • Calculation period - the last three years. It was in 2020 that individual pension coefficients were introduced. • The wages of our heroes did not increase during this time and remained the same. • To calculate the profitability of investing pension savings, no preference was given to a specific NPF or management company. The average percentage of return for the previous 3 years was taken - 10%. This is the optimal percentage that we recommend considering when choosing a non-state pension fund. • Monthly payments are calculated for 2020. The cost of one point is 81.49 rubles. The expected period of funded pension is 246.

To understand which pension option is better to choose, let’s present a final table with the results obtained.

Based on the final data, we can conclude that the first option with the formation of 16% on insurance is more profitable for each of our heroes. After the last three years, it was he who turned out to be better in terms of results.

But it is worth noting in support of the funded pension that the total amount for investment increases every year. That is, the more funds accumulate in your account, the greater the interest on them. Moreover, profitability occurs only a year after transferring funds to the savings part of the NPF.

Over a longer period, the formation of a cumulative payment can bring more income. Perhaps this is why the Pension Fund has limited the minimum period for transferring savings funds from one NPF to another to 5 years.

We will definitely repeat this calculation next year to compare the results of choosing a profitable option in the OPS system for NPFs and Pension Funds.

Formula for calculating pension payments for those born before 1967

There are subtleties in calculating social security for this category of citizens. Due to the fact that the methods have changed several times, it is necessary to take into account many parameters. To calculate the old-age pension, use the following formulas:

| Decoding | Meaning in 2020 |

| PV = FF + MF | PV – pension payments |

| PF – fixed part (minimum) | 4982.9 rub. |

| SCh – insurance part | |

| MF = RK/TV | RK – estimated pension capital (taking into account the savings of the insured person) |

| TV – expected period of receiving pension payments | 240 months |

Experience coefficient for calculating old-age pension

For persons born before 1967, when determining the amount of pension income, a coefficient depending on length of service is taken into account. It is calculated individually, but the maximum value has a fixed value of 0.75. For each additional year worked beyond the term, the coefficient increases by 0.01 from the base indicator, which is equal to:

| Work experience (inclusive) | Seniority coefficient (basic) |

| Men | Women |

| Up to 24 years old | 0,55 |

| Up to 19 years old | 0,55 |

Calculation of retirement from 2020 for men and women - change schedule

What is an individual pension coefficient - formula and calculation periods, impact on the size of the pension

Types of pensions in the Russian Federation - labor and state support

Salary coefficient

When determining the estimated pension for those born before 1967, the ratio between the average person’s income in 2001 and the country’s salary at that time is taken into account. The limit value of the indicator is 1.2. The calculation is performed using the formula:

ZK = ZP/SZP, where:

- ZK – salary coefficient;

- ZP – monthly income of a citizen;

- SWP – national salary.

Valorization of pension points

If a pension calculation is made for those born before 1967 who had a working life before 1991, valorization is carried out. This is a one-time revaluation of the amount of pension benefits earned at the beginning of 2002. The reason for the recalculation is the lack of accrual of insurance points at this time. There are features of valorization:

- The basic increase for work activity in 2002 is 10%!

- For each year of operation before 1991, 1% is added!

- If there is no work experience before 2002, valorization is not carried out.

The procedure for determining the estimated capital

To find out the amount of pension payments for those born before 1967, it is necessary to make a number of calculations. They take into account the length of service, the amount of wages, the deduction of insurance contributions by the employer, and the IPC - individual pension coefficient. The estimated capital is determined by the following formula:

| Decoding | Meaning | |

| RK = P1+P2+P3 | RK – settlement capital | |

| P1 – calculation part | ||

| P2 – accounting for indexation from 2002 to 2017 | ||

| P3 – amount of contributions paid by the employer | ||

| P1= (RP-warhead) x TV | RP – estimated part at the beginning of 2002. | |

| Warhead – basic for the same time | 450 | |

| TV – expected period of receiving pension payments | 240 months (in 2019) | |

| RP = SK x ZK x SZP | SC – experience coefficient | |

| ZK – salary coefficient | ||

| SWP – average salary for 2002 | 1671 rub. | |

| P2 = P1 x CI x CV | CI – indexing coefficient for the reporting period (2002-2017) | 5,6148 |

| CV – percentage of valorization |

Since in 2020, when calculating pensions, the individual pension coefficient (IPC) began to be taken into account, for pensioners born before 1967, the insurance part of payments determined before that time is adjusted. The following formula for calculating pensions has been adopted:

| Decoding | Meaning | |

| SCHK = IPKhSPK | Insurance part with correction | |

| IPC for the billing period | ||

| SPK – cost of IPK 2019 | 81,49 | |

| IPC = IPC1+IPK2 | IPK1 – recalculated value until 2020 | |

| IPK2 – points accounting since 2015 | ||

| IPK1 = SC/SPK1 | SCh – insurance part | |

| SPK – cost of IPK 2014 | 64,1 | |

| IPK2 = SV/SM x 10 | SV – insurance payments | |

| SM maximum possible contributions | ||

| SV = salary x 12 16%! | ZP average monthly salary of a citizen in 2017 | |

| 16%! – employer contributions | ||

| SM = ZPM x 16%! | ZPM – maximum annual salary accepted for calculations in 2017 | 876 thousand rubles |

Who can choose the pension option?

In 2020, not all people can choose the proposed pension option, but only those who have just started working or have not reached the age of 23. For 5 years they can freely make their choice in favor of one of the options.

If during this period they do not apply for a transfer, for example, to a non-state pension fund to form a funded part, then by default they will only have the option of an insurance pension.

For all other persons born in 1967 and younger, the right to choose their pension provision was until 2020. The option chosen at that time remains to this day. The only difference for them: you can refuse the funded pension and return the first option, but not vice versa.

In case of refusal, the accumulated funds will not go anywhere. They will remain in your individual personal account and will continue to be invested. Upon retirement, they will be returned in the form of an urgent or funded payment.

What needs to be done to maintain a funded pension

If legislators do not extend the time to make an appropriate decision, by December 31, 2020, citizens insured in the compulsory pension insurance system who have decided to allocate 6% of the insurance premium rate to finance a funded pension must submit an application to choose a management company or a non-state pension fund. Such an application is submitted to the Pension Fund. As before, when transferring pension savings to a non-state pension fund, a citizen must conclude an appropriate agreement on compulsory pension insurance with the selected non-state pension fund.

The new insurance premium rate will be applied starting from January 1 of the year following the year in which the application for choice was submitted to the Pension Fund (Clause 3, Article 33.3 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation”, hereinafter - Law No. 167-FZ).

However, for citizens who in previous years applied at least once to choose a management company or a non-state pension fund, and it was granted, 6% of the tariff will continue to be transferred to the funded part of the pension. In this case, there is no need to send an additional application to the Pension Fund. This category of citizens needs to apply only if a decision is made to refuse further formation of the funded part of the pension.

It should be noted that for citizens who during 2013 submitted applications to choose the State Institution “Vnesheconombank” with a tariff of 2%, from the beginning of 2014 the funded part was not formed by default and all insurance contributions were directed to the insurance part of the pension (to the insurance pension - from 2020). Thus, this category of citizens must, in general, decide to form a funded part in the amount of 6% by submitting an appropriate application to the pension fund, or to refuse it.

Even if a citizen refuses further formation of the funded part of the pension, all pension savings previously formed by him will continue to be invested and will be paid in full, taking into account investment income, when he receives the right to retire and applies for its appointment.

Before the insured person makes any decision (until December 31, 2020), the insurance premium rate will be used in full to finance the insurance pension (paragraph 2, clause 1, article 33.3 of Law No. 167-FZ). The tariff will be distributed in a similar way in cases where the choice is not made within the prescribed period.

Find out where the pension is formed

In the event that you do not know or have forgotten about the selected option in the pension system, you can obtain the necessary information online.

In order to find out, you need to go to the personal account of the insured person on the Pension Fund website. If you have an account on the government services portal, you don’t even have to register.

In the section “Management of pension savings” you can obtain the necessary information about your insurer.

Here you can find out not only where your pension is formed, but also get up-to-date information: • About the selected tariff; • The total amount of savings; • Investment results (only for Pension Fund); • Guaranteed amount of insurance premiums by the Deposit Insurance Agency; • Voluntary contributions to a funded pension.

Seniority

The second condition for receiving insurance benefits is the insurance period. These are the periods of time during which a person made contributions to the Pension Fund. There are two types of insurance experience:

- ordinary - this is a type of work experience when contributions to the Pension Fund are made by citizens working under ordinary working conditions;

- special - unlike ordinary, this experience characterizes the type of work in special (for example, harmful or dangerous) conditions.

Work experience until January 1, 2002.

Calculation of length of service until January 1, 2002 is carried out in calendar order according to the actual duration of each period. Confirmation of the fact of work, military service or the period of child care, and for calculating the insurance portion, will be documents of personal storage. What a person must submit to the fund:

- work book;

- employment contracts;

- salary certificates for five consecutive years of work until 01/01/2002;

- military ID;

- child's birth certificate;

- Marriage certificate.

Only if these documents are available in the fund can he count on the timely assignment of a pension in the established amount. To record time worked, since 2002, an individual personal account with a permanent insurance number must be opened in the Pension Fund for each insured citizen. In it, government employees are required to reflect:

- data on periods of labor activity;

- information on wages up to 01/01/2002;

- amounts accrued and paid by the employer or personally insured person of insurance premiums.

Recording of hours worked since 2002

Information on periods of work and wages before 2002 in the Pension Fund is provided by the employer in 2003-2004. If during these periods the person did not work or the employer provided incomplete or unreliable information, then the fund will not have the necessary information. If the insured person doubts that all the information has been provided, then you can always contact and provide the missing information about length of service and salary until 2002. The following periods are included in the length of service:

- army, service in the police department;

- service in bodies and institutions of the criminal correctional system;

- receiving social benefits for temporary disability (maternity leave);

- child care up to 1.5 years;

- registration for unemployment;

- reassignment of a civil servant for employment in another area;

- participation in community service;

- exile or stay in prison or colony;

- caring for a disabled person;

- when a citizen reaches 80 years of age.

- Nail extension at home - lessons for beginners, video

- How to make a frozen seafood cocktail

- Tiffany salad - recipe with photos step by step. How to Make the Best Tiffany Chicken Salad

What periods are included in the length of service?

Based on the law, the minimum insurance period increases every month. In 2020 it was 6 years, in 2020 it will be 9 years, and in 2025 it will be 15 years. If, upon reaching old age, the minimum number of years of work has not been completed, then old-age insurance compensation will not be accrued. The insurance period is determined by entries in the work book showing the period of official employment of the employee.

If an employee’s work book is lost or some records are missing, the following documents will confirm the length of service:

- employment contracts;

- certificates issued to the employee at previous places of work;

- extracts from orders (for example, orders for hiring and dismissal);

- employee personal accounts;

- payroll statements.

Since 2020, innovations have come into effect for calculating pensions for those born before 1967 using new formulas. According to the law, people with 35 years of work experience are entitled to receive additional payment. And for those who have worked (officially) for more than forty years (40 years for women, 45 for men), when they retire, the state will pay an even larger bonus.

The third condition for receiving insurance benefits is individual coefficients. This is the number of points earned over 12 months or those periods that are included in the length of service. These coefficients are calculated depending on a person’s salary, subject to his official employment. The higher the salary, the higher the coefficients. The main condition is that before retirement the coefficients should not be less than 30.

Based on the Law “On Insurance Pensions”, increasing requirements for the minimum pension coefficient have been established. If, from January 1, 2015, old-age insurance compensation is assigned with a coefficient of at least 6.6, then with a subsequent increase in the coefficient annually by 2.4 by 2025, its maximum amount will be 30.

All periods will be included in the length of service if they included work activity lasting at least one working day, during which deductions to the Pension Fund took place. Scheme for increasing the coefficient in the table:

| Year of retirement | Minimum coefficient |

| 2015 | 6,6 |

| 2016 | 9 |

| 2017 | 11,4 |

| 2018 | 13,8 |

| 2019 | 16,2 |

| 2020 | 18,6 |

| 2021 | 21 |

| 2022 | 23,4 |

| 2023 | 25,8 |

| 2024 | 28,2 |

| from 2025 and later | 30 |

Let's sum it up

The formation of pension savings is an important process on which the well-being of the future pensioner depends. Therefore, in order to decide which pension option is best to choose, it is necessary to take into account the features of the insurance system.

- It is not necessary to choose a pension option . If you are satisfied with the option of an insurance pension, then you do not need to write any applications for the transition.

- In the OPS system, by default, each person generates only an insurance payment. Your future pension may also be funded.

- Each of the OPS options has pros and cons: The main advantage of forming only an insurance pension is the stability of saving funds and indexation. For a savings account, this is the opportunity to receive income above inflation and inherit funds to your spouses and children. The disadvantage of forming a funded pension is that the profitability of the funds is not guaranteed, but only the amount of paid contributions without the investment result is insured.

The choice of pension is yours: insurance or funded?

About the right to choose

The employer pays insurance premiums for compulsory pension insurance of employees at a rate of 22%, of which 16% is an individual rate; 6% is the joint part of the tariff.

The solidarity part of the tariff ensures the implementation of one of the most important principles of modern pension systems around the world - the principle of solidarity between generations. It is intended to generate nationwide funds necessary for a fixed payment. This is a guaranteed amount that the state sets for the insurance pension in a fixed amount.

Insurance premiums paid for the individual part of the tariff participate in the formation of the pension rights of a particular person. These amounts are accounted for in the individual personal account (IPA) of the insured person at a rate of 16% of the amounts paid by the employer. The ILS of each person is maintained by the Pension Fund. It is these 16% that form a person’s right to his future pension. Depending on the chosen option for forming pension rights: if a person decides to refuse to form pension savings, all 16% goes to the insurance pension. If a person decides to continue building pension savings, then 10% goes to the insurance pension, and the remaining 6% goes to the funded pension.

It is in relation to the 16% of the individual part of the tariff that the insured persons will have to make a decision. You can implement the option of choosing a pension provision option (insurance contribution tariff) as follows: either leave 6%, as it is today, or refuse further formation of a funded pension, thereby directing all the insurance contributions that the employer pays for you to form an insurance pension.

As financial advisors note, choosing a pension option is a multifactorial process that depends on many initial conditions:

— having a personal pension plan or at least pension goals;

— level of income and its expected sustainability;

— availability of sources of passive income;

— the desire to continue working after reaching retirement age and many others.

Therefore, the choice of pension option cannot be universal.

Workers who are not interested in their retirement future and who give up the right to make a choice constitute the so-called “silent” category. Starting next year, their savings will no longer be formed, and insurance premiums at a rate of 16% will be used to form an insurance pension.

Those who do not rely on the state and want to choose their own retirement future need to understand the full range of opportunities that pension legislation provides.

Making a one-time payment from a funded pension

To receive the accumulated money, you must submit an application to the NPF or Pension Fund. Through the Pension Fund of the Russian Federation, a one-time benefit to pensioners born in 1957 is issued upon an application submitted:

- to the territorial branch of the Pension Fund or MFC at the place of residence - upon a personal visit to the pensioner;

- via the Internet on the website of the Pension Fund of Russia or in the system on the State Services portal - electronically, by registering there and opening a personal user account;

- by registered mail.

How to make an application

If the funds are in accounts with the Pension Fund, the application is submitted there in the form approved by Order of the Ministry of Labor No. 11n dated 07/03/2012. To receive savings from a non-state pension fund, the application is drawn up in the form of Appendix 1 of Order of the Ministry of Labor No. 12n dated 07/03/2012. The document must contain:

- name of the authority;

- individual data about the insured applicant;

- SNILS of a pensioner;

- savings account number (filled out by a fund specialist);

- information about already assigned pension benefits;

- method of receiving payments;

- date of registration;

- pensioner's signature.

What documents are required

Decree of the Government of the Russian Federation No. 1047 of December 21, 2009 approved the documentation required to be submitted for processing funded payments (originals or notarized):

- the statement itself;

- passport;

- confirmation of the right to receive a pension, insurance or social;

- certificate of assignment of disability (incapacity for work), loss of a breadwinner;

- documents for the representative (passport, power of attorney), if the application is not submitted by the pensioner himself.

It is legally permitted to submit copies of documents certified by a notary instead of originals. Important: when sending an application by mail, only copies are sent, original documents are not included. When accepting documents, the fund specialist issues the applicant a corresponding receipt, notifying that the pensioner’s application has been registered and accepted for consideration.

How to take into account valorization when calculating pensions

Valorization must be taken into account as an additional value. It is used to increase the level of the pension point. The amount was fixed at 10% for all persons who had work experience before 2001. In this case, the duration of work is not important.

for each year until 1990 . When applying the calculated indicator, it will be possible to increase the benefit amount. The percentage is added to the amount obtained in the above calculations.

Examples of pension calculations

The algorithm shown above will be used. Citizen Ryleeva worked for 30 years until 2002. She has developed a minimum amount of experience (20 years) and beyond that another 10 years.

In this case, the experience coefficient is 0.55 +10*0.01 = 0.65. Ryleeva’s earnings amounted to 120 rubles, while the average salary in the country is 200 rubles. The coefficient is calculated: 120/200 = 0.6.

The resulting value is multiplied by 1671 = 651.69 and subtracted 450 = 201.69 rubles. According to valorization, the indicator increases by 10% and 1% for each period over 20. The total value is multiplied by 30% = 262.20 rubles. Then multiply by 5.6148 and get 1472.20 rubles.

At the end you need to add the base figure 5034 = 6506.2 rubles. Due to the fact that the amount does not reach the subsistence level, Ryleeva is entitled to additional payments. Their value depends on the region of her residence.

Thus, for citizens born before 1967, pension payments are calculated in a special manner. When calculating, you need to take into account the length of service and salary coefficients, as well as the average earnings in the country.