“Military pensions are always good”—this opinion has always existed in the country. Since the beginning of the nineties, the situation of the military personnel themselves and their families has changed several times: some benefits were removed, others were replaced with a cash increase in salary. Now Russia is actively moving along the path of pension reform. Has the life and pension of military personnel changed in connection with it? What benefits are available to military pensioners in Russia now that the general pension age is being raised, the requirements for work experience are being tightened, and benefit categories are being revised.

Where do military personnel have advantages?

Military personnel include persons serving under conscription or who have entered into a contract:

- Ensigns;

- Midshipmen;

- Sergeants;

- Petty Officers;

- Soldiers;

- Sailors;

- Officers;

- Cadets of military universities.

The following employees are granted military pensioner status:

- Ministry of Internal Affairs;

- Ministry of Emergency Situations and Fire Service;

- FSIN;

- MO;

- National Guard, etc.

How do military personnel differ from ordinary working citizens, and why are they entitled to benefits:

- In the event of a declaration of war or a state of emergency, all military personnel without exception will be mobilized: that is, they will have no choice whether to go or not to go;

- The rights and freedoms of military personnel are somewhat limited compared to civilians;

- The work of the military involves a risk to life, and tasks are required even under special conditions;

- The army has a special discipline that every person liable for military service must obey.

Therefore, military personnel, as well as members of their families (spouses and children) have a number of benefits. Some privileges are provided from the federal budget, but some regions of the Russian Federation have also adopted regional standards for social support for military families. This also applies to pensions. Former military personnel receive a long-service pension from the Ministry of Defense, and not from the country’s budget.

Types of benefits

In accordance with Federal Law No. 4468-1, all types of social privileges for military retirees are divided into three groups:

- by length of service;

- on disability;

- for the loss of a breadwinner.

A group of social benefits based on length of service is provided after military personnel have reached a certain period of service, as well as when they have accumulated a sufficient number of years of service. How many years of experience, as well as what age should be, depends on the type of benefit.

Privileges for persons with disabilities are provided to citizens who received a disability group during service or during the first three months after its termination (discharge to the reserve, except in cases of termination of service due to the commission of a crime by a military personnel).

A survivor's pension is available not to the serviceman himself, but to members of his family in the event that the serviceman died in the line of duty (including during combat operations). Official spouses and children of military pensioners can receive social assistance. Additionally, they claim benefits when paying for housing and communal services, tax breaks, social benefits (including payment for medical care, as well as free sanatorium and resort vouchers).

When do the military retire?

Military personnel have a concept of length of service. To receive all the privileges that the state promises for long successful service, you must serve in the armed forces for at least 20 years.

In addition to the fact that preferences are provided only to military pensioners with 20 years or more,

There are some other conditions:

- If a military man has become disabled, a pension is assigned in connection with this fact;

- The maximum age for service in the armed forces for women is 45 years , regardless of rank;

- For all military personnel, except for special categories, the age for acquiring the right to a pension is 50 years (before 2014 it was 45 years);

- Special category “from 55 years old ” - it includes captains and colonels;

- Special category “from 60 years old ” - for lieutenant generals, major generals, vice and rear admirals;

- Special category “ 65 years ” - it includes army generals, colonel generals, marshals, admirals;

- 25 of work experience behind them 1/2 of which were in military service, can count on the benefit.

Thus, to obtain the status of a veteran of military service, you must serve for at least 20 years and retire to the reserve upon reaching the age limit for service in the appropriate rank.

What can military retirees expect?

Military personnel are a category of citizens who have broad capabilities and receive support from the state at all stages of their service. Tax benefits for military pensioners are one form of such assistance.

There is a huge number of mandatory payments for which these entities can receive benefits, and in some cases even be exempt from tax obligations.

According to the law, military pensioners are persons who have reached retirement age, have 20 years of service, and have been discharged from service. This status applies not only to citizens who served in the Armed Forces, but also to those who had a position and rank in the Department of Internal Affairs, the Ministry of Emergency Situations. In exceptional cases, even relatives of military pensioners can claim benefits, however, provided that the serviceman has died.

Regardless of whether a person is a military pensioner or not, he can apply the benefit for only one object, but for each type of tax.

Since the category of citizens in question is exempt from paying tax on one of the grounds, the property that is the object of the relationship will also be subject to the following requirements:

- the area of the premises for running personal subsidiary or dacha farming, gardening, gardening activities should not exceed 50 m²; this rule does not apply to housing;

- the cost of such property does not exceed 300 million rubles;

- The premises may not be used for business purposes.

These conditions apply only to real estate. However, there are other types of taxes that are also available to military pensioners under relaxed conditions. Most often, they are given discounts, that is, rates are reduced and the amount of tax is reduced.

We talked in detail about property tax benefits for military personnel in this article.

Benefits fixed at the federal level

All military retirees can count on:

- Improving living conditions , if this did not happen earlier (if you were not given an apartment upon dismissal);

- Partial (50%) or full compensation for utility bills , including contributions for major repairs. You can reduce bills for water supply, gas supply, electricity, housing maintenance and garbage removal. You can confirm your right to this benefit once every six months, or pay your bills in full, and then receive a cash refund of half of what you paid;

- Compensation for the cost of travel to and from vacation (no more than once a year and only within the territory of the Russian Federation);

- Tax benefits;

- Advantages for a military pensioner and his children when entering educational institutions;

- Some protection from layoffs if a military retiree after service gets a job at some civilian enterprise;

In addition, if a military pensioner himself or members of his family decide to relax in sanatorium-resort establishments that belong to the Ministry of Defense, the cost of their vouchers will decrease due to the military benefit ( 25% will be paid by the pensioner himself and 50% by his family members).

Regional preferences for military pensioners in Moscow

There is no separate legal document containing general information about these benefits. All necessary data is distributed according to separate legal acts. Moscow military pensioners are entitled to the following benefits (in addition to the federal list):

- Discounts when paying for telecommunications services and housing and communal services. They are established by Decree of the Moscow Government No. 850-PP “On the Procedure and Conditions for Providing Social Support Measures for Citizens” dated December 7, 2004.

- Benefits for payment of transport tax. This benefit is determined by Moscow Law No. 33 “On Transport Tax” dated 07/09/2008. Preference is provided for 1 vehicle with an engine capacity of no more than 200 horsepower.

- Free travel on public transport. Basic information about this benefit is given in Moscow Law No. 70 “On measures for social support of certain categories of residents of the city of Moscow” dated November 3, 2004.

Payment for housing and communal services

Moscow Government Decree No. 850-PP establishes the following preferences for housing and utility payments for retired military personnel:

- 50% discount on rent;

- a benefit of the same size for utilities (supply of gas, cold and hot water, electricity, heating and garbage collection) and contributions for major repairs.

Utility benefits for pensioners in Moscow are issued at the Center for Housing Subsidies, where an application must be submitted. A package of documents is attached to it:

- passport of a citizen of the Russian Federation;

- pensioner's ID;

- a certificate from the management company that payment for housing and communal services occurs without the required benefits.

Free pass

Benefits for pensioners in Moscow include free use of public transport. The 100% discount applies to the use of buses, trolleybuses, trams, metro and commuter trains (the last preference was introduced on August 1, 2018). To receive free travel, you must apply for a Muscovite social card. To do this, you need to contact the Multifunctional Center (MFC), providing:

- passport of a Russian citizen;

- pensioner's certificate;

- photo on electronic media (in some MFCs the recipient of a social card can be photographed on the spot).

Separately about tax benefits for military pensioners

Military pensioners in the Russian Federation:

- Exempt from property tax on one piece of real estate;

- They receive a discount on land tax (reduction of tax burden on the entire plot or deduction of a certain area from the general estate of a military pensioner);

- Receive benefits when paying personal income tax for gifts and winnings;

- In some regions, 1 car owned is exempt from transport tax;

- They have preferences when going to court (there is no obligation to pay state fees when resolving issues worth up to 1 million rubles).

To receive any of the tax benefits, you must apply for it to the tax authority.

Land tax

The same land tax benefits apply to all owners and owners of plots. According to the Tax Code of the Russian Federation, benefits are provided on the following grounds:

- The benefit consists of complete exemption from land tax for a plot of up to 600 sq.m. (everything above this area will be taken into account for tax purposes);

- benefits can only be obtained for one plot of land;

- the benefit is given not only if there is a plot of land in the property, but also with the right of lifelong inheritable ownership, indefinite use.

Federal Tax Service specialists are required to calculate the tax themselves and provide benefits. To do this, current data on citizens’ plots and information on cadastral value are requested. If the benefit is not provided, or an error is made when calculating the tax, the military pensioner needs to apply for recalculation.

It is important that local authorities can introduce additional land tax benefits, including for military pensioners. In practice, this right is practically not applied, since the replenishment of the budget of municipalities depends on the amount of tax. You can find out if there are additional benefits in your municipality at the local administration, at the Federal Tax Service.

Improving living conditions

Military retirees can count on:

- Preferences when purchasing a home, including mortgages;

- Opportunity to obtain housing for social rent;

- Compensation for monthly rent of living space;

- Free land for building a house (not all categories of military and not in all regions);

- Financial support for this construction in the form of a one-time payment.

All this is possible for those military retirees who:

- Are registered due to poor living conditions;

- They have at least 20 years or at least 10 years if they were dismissed due to layoffs or due to the inability to continue serving (for example, injury or disability).

Housing benefits for military personnel

Housing preferences are provided to military personnel in the following form:

- registration of a military mortgage for the purchase of real estate on preferential terms;

- obtaining free land plots for residential construction;

- registration of municipal subsidies for the purchase of housing;

- one-time financial assistance for the construction of your own home;

- obtaining living space on the basis of a social tenancy agreement;

- full compensation of costs for rented housing;

- provision of a service apartment in which a serviceman and his family members can live after termination of service.

To gain access to housing benefits, in accordance with the provisions of Federal Law No. 76 of May 27, 1998, a military personnel must register with the municipality as a person in need of improved housing conditions.

The second condition is that the military man must have at least 20 years of service (accumulation of 10 years of experience is allowed, but only subject to termination of service for health reasons or due to staff reduction).

Cash supplements for military pensioners

The pension of many military personnel is indeed higher than that of civilians.

In financial matters, military pensioners can count on:

- Additional payments for rank, various bonuses, pension indexation;

- One-time benefit upon retirement;

- Regular financial assistance to the pensioner himself;

- Financial support for family members in case of loss of a breadwinner. It consists of transferring the benefits of a military pensioner to his spouse, preserving benefits for his children when entering educational institutions, assigning a pension for the loss of a breadwinner for the period up to 18 years or until graduation from a university, etc.

The amount of payments and bonuses is affected by:

- Presence of disability, including that resulting from injury in service;

- The fact of exposure to radiation during service;

- State awards that the pensioner was awarded during his years of service;

- The honorary title of Veteran of Military Service.

Benefits for veterans of the Russian Armed Forces

Those who have devoted most of their lives to military service and have a veteran's certificate are given the right to receive preferences after reaching the age of 60 years. The procedure for their calculation and the amount of payments are determined on the basis of federal and regional laws. The following benefits are provided for military pensioners:

| Varieties | Size | Conditions of appointment | |

| For taxes | Property | Exemption from payment for one type of property | |

| Transport | Depends on vehicle power, set by region Provided for 1 vehicle | ||

| Land | 10,000 rub. | Tax-free deduction from cadastral value | |

| Personal income tax | Tax compensation is carried out only for working pensioners | ||

| State duty | Not paid | Statements of claim to the courts, amounts up to 1 million rubles. | |

| Housing | Payment for housing and communal services | 50% | Refund of this part of the paid amount for 1 apartment |

| Providing housing and subsidies for its purchase | If the need is recognized | ||

| Social | Funeral services | Provided free of charge in full | |

| Connecting a landline phone | No queue | ||

| Reimbursement for telephone services | The size is set by regional law |

The law provides for medical benefits for military service veterans after 60 years of age. The citizen is provided with:

- free treatment in public medical institutions;

- purchase of prostheses and orthopedic products at the expense of the state (installation is paid for independently, unless regional benefits are provided);

- dispensing medications according to a doctor's prescription with discounts or free of charge;

- medical appointment without a queue.

Family members of a military veteran are also eligible to receive benefits. The amount of payments is determined by rank, length of service and other indicators. The following rights are provided:

- the wife of a military man who was with him in a hot spot is given up to three years of service;

- after the death of the husband, survivor benefits are due;

- if necessary, travel to the burial site is provided free of charge;

- in the event of death due to injury during service, the family has the right to receive insurance (equal shares for all members).

- One-time benefit for pensioners - conditions for appointment, registration procedure and necessary documents

- Zucchini casserole

- How to cut a cat's hair

How to apply for benefits

In all cases, a military pensioner will be required to have with him:

- Military pensioner certificate, military ID;

- Passport;

- Order on enrollment in military service (copy);

- Order of dismissal (copy);

- Evidence of receipt of awards, regalia and titles;

- Actually, the application for benefits itself.

Eligibility for each benefit will need to be confirmed regularly. Thus, tax benefits will have to be confirmed every time circumstances change. For example, exempting yourself from paying state fees every time you go to court. Or always apply for compensation for housing and communal services and tax benefits when changing property ownership.

Preferences for military veterans after 60 years in Moscow

For military personnel living in the capital, there are privileges upon reaching the age of 60 years. Tax benefits are provided for military service veterans on property - a complete exemption from payment for one property. There are no transport tax benefits for this category of persons in Moscow. Veterans of the capital have the right to the following preferences:

- free travel on public transport;

- annual receipt of a voucher for sanatorium treatment;

- free dental prosthetics;

- 50% discount on electricity, gas, living space maintenance.

Monthly cash payment

Military personnel who have retired due to old age may qualify for a single cash payment (USB). The basis for the accrual is Federal Law No. 122-FZ of August 22, 2004. Participants in combat operations on the territory of the Russian Federation and abroad also have benefits. The amount of EDV in 2020 is 2869.72 rubles. To apply for a benefit, you must contact the territorial branch of the Pension Fund of the Russian Federation. The following documents are required:

- passport of a citizen of the Russian Federation;

- veteran's certificate;

- document on the right to benefits;

- certificate of disability.

Preferences for wives of military personnel

If a spouse is transferred to serve in a unit in another city, his family, of course, follows him at the expense of the Ministry of Defense. At the new location, they are provided with guaranteed housing for the entire period of service.

The inconveniences associated with the duty to serve are compensated by several points:

- Calculation of the pension of a military man's wife. If she was unable to get a job at her husband’s place of service (for example, her specialty was not useful in a military camp), her work experience will be counted: until 1992 - for the entire period of her husband’s service, until 2014 - only for the years when the wife could not find work at the husband’s place of duty, and from 2020 – up to 5 years of work experience will be added;

- Benefits for paying for housing and communal services are transferred to the spouse if the military husband dies or is killed;

- Tax and medical benefits in most cases go to the spouse who has lost a military husband or the husband of a military retiree.

The main condition is that the marriage is not dissolved by mutual desire of the parties. A woman can count on benefits if she is the spouse or widow of a military man.

What benefits are provided for military pensioners in St. Petersburg in 2019-2020.

Our state continues to improve the system of social and living guarantees for those who performed military and law enforcement service. Thus, from October 1, 2020, the following were indexed: salary and military pensions

When retiring from military service, a serviceman, in addition to monthly benefits, receives a number of advantages over other categories of pensioners.

Each of the benefits depends on the serviceman’s length of service and is regulated by the federal legislation of the subject of the federation.

Rules for providing benefits and types of pensions for military personnel.

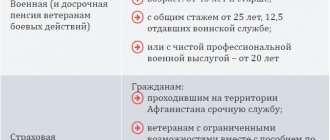

Article 5 of the Law of the Russian Federation dated 02/12/1993 N 4468-1 (as amended on 04/30/2019) “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances substances, institutions and bodies of the penal system, troops of the National Guard of the Russian Federation, and their families" considers the following payment options:

✅According to length of service.

Appointed subject to the citizen achieving a certain period of service and having an established length of service.

Military personnel with 20 years of service or more. (clause a. Article 13 of the Law of the Russian Federation N 4468-1). These persons are provided with all the benefits for military pensioners.

✅Military personnel with a total experience of 25 years or more, of which at least 12.5 are in military service. (clause b. art. 13 of the Law of the Russian Federation N 4468-1). It is mandatory to reach the age limit or have a health condition that does not allow further participation in the Armed Forces. This category also includes military personnel aged at least 45 years, whose dismissal is associated with organizational staffing measures (staff reduction, transfer of units).

✅Due to disability. (Articles 19-21 of the Law of the Russian Federation N 4468-1) This provision is issued if a serviceman (regardless of combat operations) became a person with disabilities directly during service or no later than 3 months after its completion. This also includes situations where, due to a health disorder acquired while serving in the Armed Forces, disability occurred later.

✅For the loss of a breadwinner. (Article 28 of the Law of the Russian Federation N 4468-1) This pension is issued to family members of a military personnel. The reasons for assigning this support are similar to the previous point, only instead of disability, the death of a military man occurs (during combat operations, etc.). Children and widows of retired military personnel are entitled to preferences in payment for housing and communal services, taxes, housing, medical care, and sanatorium and resort benefits.

Military pensioners of all categories are entitled to receive the following types of benefits:

✅For payment of utilities. Military pensioners pay utility bills the same as everyone else. For certain categories of military personnel (disabled people, fathers of many children) there are discounts (about 30-50%) and compensation for actual expenses incurred.

✅Upon admission to state universities. Children of military pensioners are admitted without a waiting list to kindergartens, schools and general military schools.

For retired military personnel themselves, this is receiving their first higher education. The law allows enrollment in a university for free education without passing the Unified State Exam. After receiving a diploma, the state provides support in employment.

Completion of incomplete higher education. In this case, free enrollment is provided for the first or subsequent courses. The pensioner is required to have a document confirming previous studies at a university with certification results.

Obtaining a second higher education. Provided free of charge if you have a university diploma.

✅Providing housing. (Article 15 of Federal Law No. 76 of May 27, 1998 “On the status of military personnel”). This benefit is implemented in several ways:

-in the form of an interest-free subsidy (military mortgage).

- in the form of a specific residential premises owned by a federal or regional government authority.

-in the form of a one-time cash payment for the construction of an individual residential building.

-in the form of a land plot for construction.

-in the form of the right to extraordinary entry into the housing cooperative.

✅When paying taxes. Military pensioners are exempt from paying tax on one piece of personal real estate (Clause 7, Article 407 of the Tax Code of the Russian Federation) and personal income tax on pensions, as well as on amounts of material assistance received at the place of work, and from the cost of vouchers to special medical institutions (Article 217 of the Tax Code of the Russian Federation).

Military personnel dismissed from service due to retirement and continuing to work retain the right to receive a tax deduction from personal income tax when purchasing/selling real estate within the following limits: 2 million rubles when purchasing real estate or carrying out construction work at their own expense , 3 million rubles when buying real estate on credit (applies to the amount of interest actually paid), 1 million rubles when selling your own real estate (Article 220 of the Tax Code of the Russian Federation).

✅Preferential medical care.

-free medical care in military medical institutions.

-production of dentures;

- free supply of medicines.

-75% discount when purchasing vouchers to military sanatoriums.

Also, depending on length of service and other features of the service, retired military personnel are assigned:

✅One-time cash payment✅– to those who have served less than 20 years. The incentive does not have a fixed amount or frequency, and is awarded on the basis of the Decree of the Government of the Russian Federation on the occasion of holidays and other dates, for example, Victory Day.

✅Special allowance✅ – those who have served in the Armed Forces for more than 20 years.

✅Increasing 150% pension coefficient✅ – for those who have served in the Far North for at least 15 years (or 20 in regions equivalent to it).

✅Monthly cash payment (EDV)✅ – to combat veterans, military disabled people (regardless of the group), persons holding the title of Hero of Russia or the Soviet Union.

Will the military pension be increased from January 1, 2020?

The question at the end of 2020 is controversial. According to the Government's draft for 2020, an increase in pension provision for military personnel and changes in the procedure for calculating pensions were provided for in 2020. The increase in payments was due to the indexation of monetary allowances by 4.3% and an additional 2%.

From January 1, 2020, it is planned to further increase payments to military pensioners, according to current legislation, by 5.8%, that is, 2% above the inflation rate.