Rating of the best NPFs

For some, in the rating of non-state pension funds, the volume of pension savings is important: this indicates the size of working capital and possible profit. Others rely on publications in the Bank of Russia Bulletin. Therefore, I will provide lists of the best NPFs according to various criteria.

By volume of savings

Rating according to the report of the Central Bank of the Russian Federation for 9 months of 2020, top 10:

- Sberbank - 608,202,297.64509 thousand rubles;

- “GAZFOND pension savings” - 551,559,605.81662 thousand rubles;

- Otkrytie - 509,907,811.62335 thousand rubles;

- “Future” - 256,074,688.38737 thousand rubles;

- "Safmar" - 254,942,846.5577 thousand rubles;

- “VTB Pension Fund” - 242,544,409.09023 thousand rubles;

- “Evolution” - 126,381,343.5706 thousand rubles;

- “Bolshoy” - 45,127,767.19274 thousand rubles;

- “Consent” - 30,044,787.69339 thousand rubles;

- “Socium” - 21,772,360.73238 thousand rubles.

By profitability

Rating of NPFs by profitability for the 3rd quarter of 2020 in percentage (remunerations for the management company and the depositary are deducted):

- “Professional” - 13.73;

- "Hephaestus" - 13.03;

- "Alliance" - 11.81;

- “Agreement” - 11.74;

- "APK-Fond" - 11.53;

- "First Industrial Alliance" - 11.12;

- Sberbank –10.93;

- there are two NPFs, “Tradition” and “Evolution”, with the same result - 10.91;

- "Volga-Capital" - 10.78;

- “Pension choice” - 10.73.

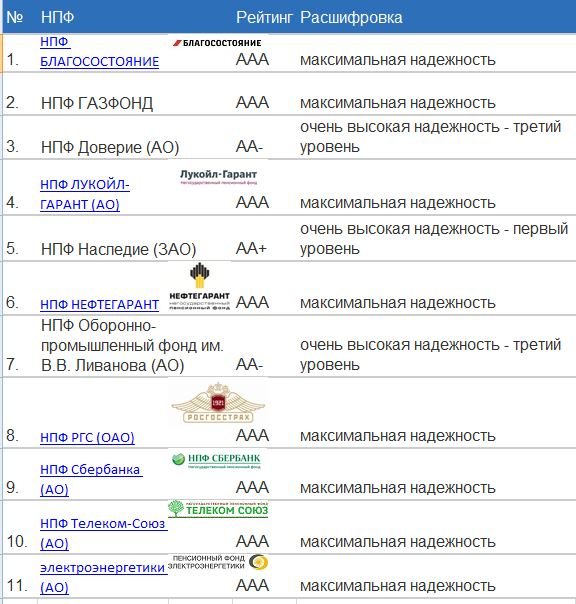

By reliability

Reliability ratings are assigned by agencies. Just keep in mind that such a rating is paid (I doubt the objectivity of the assessment).

According to Expert RA data (unfortunately, not even the top 5 at the beginning of 2020):

- Sberbank, Gazfond - ruAAA;

- “Big” - ruAA.

For other NPFs, data was not updated.

According to the Central Bank rating

Contrary to mixed information, the Central Bank of the Russian Federation does not compile ratings. Convince yourself of this by going to the website of the Central Bank of the Russian Federation www.cbr.ru. Here you can download summary data on performance results and compile a list of leaders yourself.

Comparative table of top NPFs

For complete information, I will also provide a comparative table of NPFs popular among the population (based on statistics from the Central Bank of the Russian Federation).

| Name | Volume of pension savings, thousand rubles. | Profitability minus payments to the management company and the depository, % | Volume of reserves, thousand rubles. |

| Sberbank | 608 202 297,64509 | 10,93 | 44 215 358,62975 |

| "Surgutneftegaz" | 10 302 267,16951 | 9,81 | 18 998 346,63823 |

| "Opening" | 509 907 811,62335 | 10,16 | 67 012 306,16124 |

| "VTB Pension Fund" | 242 544 409,09023 | 9,57 | 5 615 612,59693 |

| APK-Fond | — | 11,53 | 128 858,23129 |

| "Big" | 45 127 767,19274 | 9,88 | 6 654 426,69018 |

| "Safmar" | 254 942 846,5577 | 8,18 | 8 502 101,60406 |

| "Telecom-Soyuz" | 1 442 121,1112 | (-7,58) | 21 194 733,00505 |

| "Future" | 256 074 688,38737 | (-15,95) | 2 775 632,78037 |

| "Social Development" | 5 673 359,67294 | (-17,25) | 2 219 283,36904 |

NPF Electric Power Industry - profitability rating and customer reviews

Reading time: 4 minutes(s) NPF Electric Power Industry in 2017

Information about the fund:

Status in 2020: Reorganized (merger with another NPF) In 2020, NPF Electric Energy was merged together with NPF RGS to NPF LUKOIL-GARANT, which was soon renamed NPF Otkritie.

The work of NPF Electric Energy began two decades ago - in 1994. Today, according to the rating of non-state pension funds, it is among the top five pension funds not only in terms of financial performance indicators, but also in the total number of clients, as well as the level of service. As of March 2013, 950,000 people—that’s exactly how many clients—entrusted this fund with insuring their pensions, and over 530,000 signed up for non-state pension agreements. The total volume of pension payments exceeds $9 billion.

Full name of the organization: Electric Energy JSC NPF

Data for 2013: The ratings of NPF Electric Power Industry are the highest possible. For example, the National Rating Agency assigned the fund an AAA rating. The Expert RA agency issued a similar verdict, awarding the NPF the A++ mark. But the Vremya pension fund does not take part in any ratings at all.

Reliability rating in 2017

Expert RA: rating withdrawn National Rating Agency (NRA): AAA

The rating agency RAEX (“Expert RA”) confirmed the reliability rating of the NPF of the electric power industry at the A++ level (exceptionally high (highest) level of reliability) and withdrew it due to its expiration and the fund’s refusal to update the rating.

The National Rating Agency confirmed the reliability rating of NPF Electric Power Industry JSC at the AAA level with a stable outlook. The rating was first assigned to the Fund on April 16, 2012 at the “AAA” level. The last rating action was dated June 1, 2015, when the rating was confirmed at the “AAA” level with a stable outlook.

Statistics of NPF Electric Power Industry

Statistics on NPO (non-state pension provision) as of July 1, 2013

- Participants: 533,832 people

- Pension reserves: 33,711 million rubles

- Amount of pensions paid: 1,540,510 thousand rubles

- Already receiving a pension: 109,036 people

Statistics on compulsory pension insurance (compulsory pension insurance) as of July 1, 2013

- Yield: 7.75%

- Volume of savings: 53,228,833 thousand rubles

- Insured: 954,766 people

The first payments of non-state pensions by the fund were made back in 1996. Currently, over 108,000 clients regularly receive pensions.

Profitability and reliability

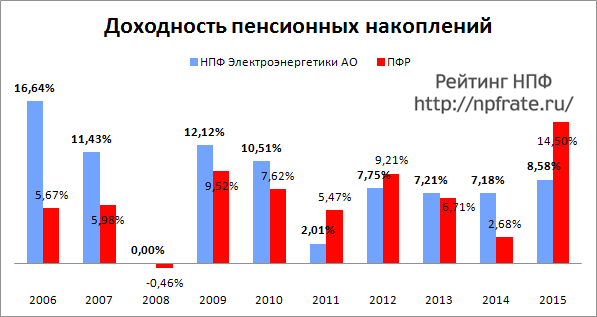

The basis of the investment policy of the Electric Power Fund is high-quality diversification of risks, which allows one to avoid significant losses of funds in the event of failures in a particular investment sector. The profitability of NPF Electric Power Industry for 2012 is 7.75%. If you look at long-term indicators, then in the period from 2005 to 2012, the fund produced results that exceeded by 15% the accumulation of the Pension Fund of the Russian Federation represented by the state. VEB company. In terms of the volume of pension savings, the Electric Power Fund is in fourth place in the top 10 non-state pension funds of the 2012 version.

Profitability indicators of NPF Electric Power Industry in 2005-2012

Data on the profitability of Electric Power Industry JSC NPF as of January 1, 2017, including information for the previous 10 years in comparison with the profitability of the Pension Fund of the Russian Federation:

Profitability of NPF Electric Power Industry for 2014-2015 and previous years

The fund has not currently provided a profitability rating for 2016-2017, but the profitability indicator as of September 30, 2016 is known: it is 9.08%.

For more than 18 years of operation, PF Electric Power Industry has not violated its obligations to its clients, providing a high-quality level of service and stable growth of invested funds.

Has the license been revoked?

There is information circulating online that NPF Elektroenergetika had its license revoked in 2016, but this is not true, the license has NOT been revoked and the company is not bankrupt. In 2017, the fund continues its work, on the basis of a perpetual license received by the fund in 2005.

Information about the license on the website of the Central Bank of the Russian Federation

You can find out the latest information about non-state pension funds with valid licenses on the official website of the Central Bank of the Russian Federation at this link.

Official website and contacts

You can find out all the information about work and more precise conditions of various pension programs on the official website https://www.npfe.ru/. There is also a loan calculator for NPF Electric Energy for calculating pension savings.

Personal account: find out your savings

The entrance to the personal account of the Electric Power Industry Pension Fund is located at the web address https://lk.npfe.ru

Address

The company's head office is located at: 129110, Moscow, st. Gilyarovskogo, 39, building 3

Hotline number

The 24-hour support service for the non-state pension fund of the Electric Power Industry is available by calling toll-free 8 800 200-44-00

NPF Electric Power Industry on the Yandex map:

In 2013, the fund already had 90 representative offices in various federal districts of the Russian Federation. NPF UMMC Perspective has branches in only 30 cities of the Russian Federation.

Feedback from clients and employees

Leave your feedback about the non-state pension fund of Electric Power Industry if you are already a client or ask your questions about pension programs. If you were an employee of NPF Elektroenergetika, you can leave a review about the employer. Also, if you know of a case of fraud on the part of employees of this fund, be sure to write about it!

Partner banks

NPF Elektroenergetika has a list of partner banks, by contacting which you can get advice and enter into an agreement with the fund on the transfer of the funded part of your pension. List of partner banks, based on data from the office. site, the following:

- Opening

- NOMOS-BANK

- NOMOS-REGIOBANK

- Novosibirsk Municipal Bank

- NOMOS-BANK-Siberia

- Asia-Pacific Bank

- KB Let's go

- Bank Trust

Office addresses

Below is a list of cities where NPF Electric Energy has offices and representative offices.

Moscow Address: 129110, Moscow, st. Gilyarovskogo, 39, building 3 Telephone Opening hours: Mon.-Thurs.: 09.30-17.00 Fri.: 9.30-16.00 Closed: Saturday, Sunday.

According to information for 2017, in the following cities, offices previously located at the indicated addresses are currently CLOSED :

- Saransk - st. Krupskaya, 29, of. 202

- Tula - st. Radishcheva, 6

- Izhevsk - st. Lenina, 30, off. 305

- Krasnodar - Central microdistrict, Krasnaya street, 180

- Omsk - Frunze St., 1, building 4, office. 703 V.

- Nizhny Novgorod - st. Varvarskaya, 40, of. 302

To obtain consultations and enter into agreements with NPF Electric Power Industry, you can contact partner banks, the list of which is indicated in the article. If information about office work is inaccurate, you can correct it by writing in the comments.

Did this article help you? We would be grateful for your rating:

0 0

Tips on how to choose a fund

Unfortunately, the agreement with the NPF itself has very unfavorable conditions:

- in any case, the services of the non-state pension fund, management company and depository are paid, and losses are passed on to the client;

- It is difficult to switch to another non-governmental organization without losing savings.

Choosing a storage facility for your future pension based on a rating is not the best decision. I recommend:

- Based on the summary reports of the Central Bank of the Russian Federation, create a table of the dynamics of profitability over the past 5 years for the best funds from the rating.

- Go to the official website of each NPF. Try to find public reporting there.

- Write to support, call the hotline. If they do not answer questions for a long time, or give deliberately false information (for example, when asked about profitability), it is better to refuse this option.

- Find out in what mode it is possible to track savings, whether there is a personal account, whether reports are sent by email, and whether the necessary certificates are provided.

- Search for scandalous information about the fund on the Internet (who is the final owner, with whom the business was redistributed, whether investors were defrauded).

- Check whether the ratings on the NPF website correspond to the real data of the rating agency.

The main thing is to first collect information (not just look at the ratings) - only then make a decision.

Ranking of NPFs by profitability of pension savings

Here is the ranking by profitability according to the Central Bank at the end of 2019:

- “NPF GAZFOND pension savings” – rate 9.12% per year,

- “Soglasie-OPS” – 6.83%,

- "NPF "First Industrial Alliance" - 6.82%,

- “Diamond Autumn” – 6.81%,

- NPF VTB Pension Fund – 6.81%,

- "UMMC-Perspective" - 6.62%,

- NPF NEFTEGARANT – 6.44%,

- "NPF Sberbank" - 6.36%,

- NPF Surgutneftegaz - 6.27%,

- "NPF "Defense-Industrial Fund named after. V.V. Livanov" - 5.83%.

How to become a client of a non-state pension fund

Sometimes it is possible to join a non-state pension fund without the client’s consent. Scandals erupted across the country when people were transferred from the Pension Fund or Non-State Pension Fund to another fund without their knowledge.

If you approach the choice consciously (after studying the ratings and available information), to sign the contract you will need a minimum list of documents:

- passport;

- SNILS.

At the fund's representative office or on the official website, you need to fill out an application and then sign an agreement.

My advice: if early retirement is likely, if possible, indicate in the contract with the NPF the start date of payments (not the retirement age, but the date of retirement).

Is it possible to change NPF

Yes. To do this, an agreement is signed with a new non-state pension fund (usually the best in the rating). The contract with the old one is broken. Then an application is submitted to the Pension Fund at the place of residence.

How to transfer money from NPF

It is not possible to transfer savings to a personal bank account. The savings will either be paid out as a pension or transferred to another fund.

The heirs must submit an application to the NPF, then the funds will be sent to the specified bank.

How did 2020 turn out for pension funds?

So, to begin with, I would like to clarify one important point - all ratings in our country are compiled on the basis of the data that funds publish in the public domain. However, such data becomes available only at the end of the year, so at the moment there is information about funds only for 2020.

If you believe the official information provided on the website of the Central Bank of Russia, then last year was very favorable for NPFs. There was an increase in the total volume of deposits by 3.1%; the volume of savings throughout the country amounted to more than 3.3 trillion rubles.

The trend towards “cleansing” the market has continued - weak companies have left it, leaving only strong ones that show good results in their activities and merge with other organizations to increase assets.

If a year ago there were about 77 non-state pension funds operating, then by the beginning of 2020 their number was only 37, with the top ten leaders remaining almost unchanged.

Later in this article:

How NPFs are structured and work

NPF enters into contracts to attract money from investors. Management companies are hired to manage capital. Their actions:

- buy stocks, bonds, derivatives;

- engage in currency speculation;

- placed on deposit;

- lend at interest.

Securities are kept in a depository that provides accounting. Let me remind you: today securities are an electronic document. Therefore, a specialized depository resembles more a server center (where data is stored on powerful computers) than a bank vault.

On the part of the state, the activities of the fund are controlled by the Central Bank of the Russian Federation. In addition, the best funds are members of the non-governmental Association of Non-State Pension Funds (participants are required to comply with a number of financial requirements).

Client funds are insured by the Deposit Insurance Agency (a state corporation) if the fund has passed the inspection. Within the NPF, the work is controlled by its own audit commission.

The rating agency works under an agreement with the fund (paid services), analyzes public information and assigns a rating.

How is a funded pension formed?

The funded pension is formed from insurance contributions. The management company works with money: if a profit is made as a result of financial transactions, it is reduced by the amount of payment for the services of the NPF, management company and depository, then distributed to the accounts of depositors in proportion to the amount (i.e. profit is the contribution multiplied by the profitability).

These returns are expected from the top rated funds, but this is not always the case. If the management company works in the negative, all costs are also distributed across the register of depositors. Therefore, instead of the expected increase in savings, the client sees a decrease in savings.

Money must work, therefore, when moving to another NPF, of course, the best in the next rating, the investor loses investment income if it is not fixed (once every 5 years).

NPF or Pension Fund - which is better to choose?

Complex issue. The comparison begins with a sample of 2–3 NPFs (based on minimum ratings). Then the results of previous years, ideally 5, are considered, and only then a forecast is made.

My search for the best NPF after a thorough analysis of all available ratings was not crowned with success (harmful in nature, probably). Therefore, my savings remained in the Pension Fund; I prefer to invest my free funds on my own.

How much money is lost if you leave your funded pension in the Pension Fund?

It all depends on the non-state pension fund where the funded part of the pension is formed. Personally, I prefer to “keep your eggs in different baskets”:

- The funded pension in the Pension Fund will be indexed, even with a lower rate than the inflation rate.

- I have no guarantee that a pension from a non-state pension fund will not become part of the payment for someone’s wedding, banquet, or business.

Everyone makes their own decisions regarding finances.

NPF reliability rating from RA:

- OJSC NPF Gazfond Pension Savings

- JSC NPF Sberbank

- "GAZFOND"

- JSC "NEFTEGARANT"

- OJSC "NPF RGS"

- JSC "SAFMAR"

- NPF Neftegarant

- JSC "NPF "Diamond Autumn"

- JSC National Non-State Pension Fund

- JSC NPF Surgutneftegas

All of them have an A++ rating, which indicates the extreme reliability of these organizations. This assessment positively indicates their ability to fully and timely fulfill their current and future obligations under contracts without taking into account external risk factors. A stable outlook means that the agency expects the rating to remain at the same level throughout the year.

You might also be interested in these articles:

TOP 10 according to the NRA, which is slightly different from the previous agency

How else can you evaluate companies that provide pension services?

If you have already studied information on the profitability of the investment policy of a non-state pension fund, learned its reliability from several agencies, but still cannot choose one of the funds, then you can turn to another indicator - the number of its participants. It is logical to assume that a large number of citizens who have given preference to one or another fund indicates that it offers truly favorable conditions.

In addition, the more people are insured by the company, the more money he receives, invests and increases accordingly. This is also an important plus when choosing between several institutions.

Rating by number of insured persons

- NPF Sberbank (JSC),

- GAZFOND pension savings (JSC),

- FUTURE (JSC),

- LUKOIL-GARANT (JSC),

- RGS (JSC),

- SAFMAR (JSC),

- VTB Pension Fund (JSC),

- Trust (JSC),

- JSC NPF Soglasie-OPS,

- JSC NPF Electric Energy.

Many people ask: why are not all accredited companies represented on these lists?

Let us explain: rating agencies assign ratings to funds on a contractual basis, i.e., for money. Therefore, these lists do not include all funds, but only those that paid for this service.

Thus, we have reviewed with you the most important ratings of non-state pension funds for 2020.

Question-answer section:

2020-06-23 17:13

Sergey

I would like to clarify for myself: the NPF “Blagosostoyanie” and “Future” funds are different legal organizations or not? Why do some ratings indicate one fund, and others another?

View answer

Hide answer

Consultant

Sergey, these are really two different organizations. There is NPF Future, which was previously called OJSC NPF BLAGOSOSTOYANIE OPS, and there is JSC NPF BLAGOSOSTOYANIE. The names are different

2020-03-16 13:04

Lyudmila

Hello! How can you transfer from a state pension fund to a non-state one if there is no fund office in the city?

View answer

Hide answer

Consultant for the site KreditorPro.Ru

Lyudmila, you need to go to the official website of the fund you need and find the hotline number there. Call it and discuss the issue with a NPF consultant; very often it is possible to leave an online application for the transition directly on the website

2019-10-16 20:31

Alexander

Hello! I would like to urgently transfer my funds from NPF Bolshoy to NPF Gazfond. How to do it? The offices of NPF "Gazfond" are located only in the capitals and I live in the provinces.

View answer

Hide answer

Consultant for the site KreditorPro.Ru

Alexander, you can call the Bolshoi Foundation hotline. There they will tell you, it is quite possible that the transition can be made using an application sent by regular letter to the head office

2019-10-23 09:01

Julia

I looked at the information about the status of the individual personal account of the insured person and found the following: the income for 2020 is more than for 2020, but the points are less, what is this connected with?

View answer

Hide answer

Consultant for the site KreditorPro.Ru

Yulia, you need to ask this question to a representative of the pension fund to which you are a member. Perhaps you changed jobs, went on maternity leave, etc., all this affects your scores

2019-07-13 16:42

Lera

I, too, was lured by Sber when applying for a card, this was back in 13, and as a result, in all that time I haven’t heard anything at all from their NPF! Should they send some kind of notification about my account?? In fact, there is generally silence. Now I’m thinking about leaving them somewhere, 5 years have passed since the transfer anyway, I certainly won’t lose anything!

View answer

Hide answer

Consultant for the site KreditorPro.Ru

Lera, according to the resolution of the Central Bank of the Russian Federation dated 2020, non-state funds are no longer required to send information about the pension savings of their clients. All information is contained in your Personal Account on the website of the fund where you are a member

View all questions and answers ⇒

04/06/2019 Information about the authors | Category: Current | Pension funds