Moscow, 03.10.2020, 02:29:47, editorial office of FTimes.ru, author Tatyana Orlonskaya.

Subsidies for Russian pensioners have been preserved in 2020. All Muscovite pensioners who cannot cope with housing and communal services payments can apply for a support benefit.

Utilities are now expensive, and even residents of smaller apartments feel this. In addition, tariffs increase with enviable regularity, sometimes outpacing the growth of wages and pensions. In such conditions, even citizens with more or less decent incomes are thinking about saving. What can we say about those who have difficulty making ends meet? The Russian authorities, and in particular the Moscow authorities, are trying to somehow alleviate the financial burden on the family budget of retired Muscovites by providing subsidies that partially cover utility costs. In 2020, this type of assistance is still available to citizens.

Who is entitled to government subsidies for housing and communal services?

Not all pensioners can receive support from the state aimed at easing the burden of paying for utility services. There is a list of conditions that they must meet in order for the desired opportunity to become available to them.

Only those persons who meet the following list of conditions can subsequently become recipients of subsidies under the state program

1. First of all, those citizens who have their own privatized housing have the right to subsidies.

2. Those residents who live in apartments that are their own also receive subsidies:

- municipality;

- government structures.

At the same time, a social tenancy agreement must be concluded between the tenant and the owner of the residential premises.

3. Citizens who are members of housing construction cooperatives can also apply for a subsidy.

4. A citizen who wishes to take part in the program for subsidizing housing and communal services must also have the status of a citizen of our country, and appropriate confirmation of this fact (passport of a citizen of Russia).

5. It is mandatory that you have a residence permit in the living space for which he wants to reduce utility bills.

6. If you have debts for housing and communal services, do not even think about applying for a discount. The fact is that this is practically the main condition for obtaining it.

7. You must spend more to pay for the services provided by the management company than citizens pay on average in the region.

If you pay more than 22% of your income for utilities, you can rest assured that you will certainly receive a discount

The percentage of overpayments for housing and communal services that gives the right to receive subsidies is today equal to 22 units . Of course, provided that a person does not live alone, but with relatives who are also registered in the apartment, all members of his family must also spend more on utilities than local government structures agreed to, according to the amount of total income.

To make it clearer, we give a corresponding example. Let’s imagine that Mr. Petrov lives in his one-room apartment, previously privatized, alone; no one else is registered in this living space. He receives a monthly pension payment equal to 10 thousand rubles. 25% of this payment, that is, 2 thousand 500 rubles, goes to pay for services provided by the management company. It turns out that he is entitled to a government subsidy, regardless of whether the region has a law on maximum payment or not.

Additional payment to the pension for a minor child for a working pensioner, you can find out about this in a special article.

Now let’s imagine that Mr. Petrov’s son lives with him, who currently has no income. The payment for housing and communal services in this case is already 5 thousand rubles, but the income still remains the same. It turns out that in such a situation the subsidy is not only due to these citizens, but will also be larger, as well as, in fact, the expenditure percentage.

Calculating the specific amount of subsidies is not easy, since each case is individual

It is not easy to determine the exact amount of state support, since in each case the amount of subsidies will be individually determined .

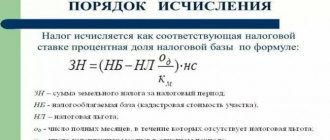

Rules for calculating compensation for pensioners

A citizen classified as a benefit recipient can use the exemption for 1 piece of property.

Even if a pensioner owns several apartments, he will be able to pay less for only one. A person has the right to choose a specific object independently. When calculating the compensation amount, regional area standards must be taken into account. They are expressed in the number of squares per 1 resident of the apartment. The standards are established by the Law of St. Petersburg No. 403-48 of 2005.

The standard is:

- for a citizen who lives alone - 36 square meters;

- if the family consists of 2 citizens - 25 square meters for each;

- when there are 3 or more persons in a family - 20 square meters per citizen.

A different standard applies to dormitories. For a single citizen this is 25 square meters, for families of 2 or more members - 18 square meters for each.

Important! It is provided that compensation is paid within the established norms. If the premises are large, you will have to pay in full for the excess portion.

Types of subsidies for housing and communal services for pensioners

As for subsidies, as a type of social support measures, in our country they rely on people of retirement age only to pay for utilities. Do not confuse this concept with benefits, since the latter:

- can be installed in absolutely any sphere of human activity;

- in each subject of the Russian Federation they are provided according to a different list.

So, for example, in one region pensioners can receive preferential prosthetics, in another they can buy medications at a huge discount, etc. In addition, benefits are not provided to all pensioners, but to specific segments of the population, or certain groups of people.

Please note: if you receive any benefits and decide to apply for a subsidy for housing and communal services, you should keep in mind that in this case, the benefits of the first category will be taken into account as your income.

However, we advise you to also pay attention to the list of benefits , since it may turn out that you are part of one of the socially vulnerable groups of people who are entitled to them. So, let's start studying them in the table below.

In our country, benefits for housing and communal services are provided only to a few categories of socially vulnerable citizens or those who have distinguished themselves for the country in some way.

Table 1. What benefits in the field of housing and communal services are entitled to citizens in our country, and what categories of persons are provided with them.

| Category of citizens | Benefit |

| · participants of the Great Patriotic War; · citizens who defended the city of Leningrad during its siege by fascist forces; · military persons; · citizens exposed to radiation; · persons who became disabled during military service. | The benefit in this situation is 50% of the traditional amount of payment for housing and communal services |

| Persons who are disabled pensioners renting housing under a social tenancy agreement from: · the municipality; · government agencies. | Representatives of the desired category of citizens receive a discount of the same size as in the previous case - 50% on utility bills. |

| Heroes of socialist labor | Citizens who have distinguished themselves by their labor heroism and have lived in our country since the times of the Soviet Union receive the following benefits: · a 50% discount on payment for services provided in the field of public utilities; · full exemption for housing costs. However, these persons have the right to refuse to receive this benefit in favor of an increase in the pension payment received in their name on a monthly basis. |

As you can see, the benefits listed above are actually granted to a few, however, they can completely change the well-being of a family.

Types of benefits for single pensioners

Due to the absence of a fixed concept of “single pensioner” in legislation and regulatory documents, persons from this category do not have the right to count on state support only due to the absence of close people who can get to know them. The assignment of benefits is usually carried out on a different basis, common among elderly people without relatives - when recognized as low-income.

A citizen is considered low-income if his income does not exceed the subsistence level, which is established by a regional decree in accordance with federal legislation.

When calculating this indicator, the following items are used:

- payments received by a citizen for work: wages, bonuses, overtime, etc. Despite the fact that pensioners usually do not work, older people are often forced to work to provide for their own needs;

- severance pay;

- social support instruments for persons of retirement age;

- income acquired through the use of family property, including from the sale of own-produced products;

- a number of other incomes in accordance with the law.

Attention! The reasons for low income must be recognized as valid. For example, if in the family of a beneficiary there are people of working age who simply do not want to work, then the pensioner has no right to count on financial support. However, such claims against older people who are recognized as lonely rarely arise due to the absence of relatives.

A person recognized in a regulated manner as needing support can count on the following types of benefits:

- utilities. Discount on payment for services in the established amount;

- healthcare. Providing a free voucher for sanatorium-resort treatment, purchasing medications at a reduced cost, installing free prostheses, etc.;

- tax. Exemption from transport, property, land taxes with certain restrictions. Thus, a pensioner can get rid of transport tax, but only in relation to a car for people with a disability group or with a capacity of no more than 150 horsepower. In the case of land tax, the specifics of the relaxation are clarified at the regional level;

- transport. Exemption from the need to pay for public transport within the city.

Another option is monthly payments. Their size depends on the capabilities of the local budget and regulations adopted by regional authorities.

Tax benefits

- Exemption from personal income tax , provided that the person has stopped working. The company pays 13% for working pensioners.

- Benefit when paying transport tax , which is established by regional authorities.

- Preferences for deductions to the budget for real estate objects . Complete exemption from payment for one of them.

- Land tax benefits . There is no need to pay it when the plot is less than 6 acres.

- Refund of personal income tax when purchasing new real estate if the citizen has worked for the last three years.

Personal income tax

- Exemption from taxation (13%) of certain income - pensions and social supplements to it, as well as other income up to 4,000 rubles. for the year for each reason: gifts, financial assistance from employers;

- payment (compensation) by employers for the cost of medicines to citizens receiving an old-age pension;

- payment by organizations for sanatorium vouchers, treatment for persons receiving an old-age or disability pension.

- Transferring property deductions to previous tax periods when purchasing an apartment, a plot of land for individual residential development, or purchasing/constructing a house (relevant for working pensioners or those who have recently retired).

Property tax

Exemption of all pensioners, non-working and continuing to work, from property tax on one piece of real estate (house, apartment, dacha, outbuilding of a personal subsidiary plot with an area of up to 50 m², garage).

Transport tax

Benefits are established by regional authorities and vary in different areas. You should find out more information from the tax office at your place of residence.

Subsidy for housing and communal services payments

For pensioners who conscientiously make utility payments, the regional authorities of Russia and Moscow have provided partial or full compensation for the following types of services:

- gas and heating;

- garbage removal;

- house maintenance;

- electricity, cold and hot water.

A single unemployed elderly person has the right to monthly compensation for additional living space if it does not exceed 33 m2. Citizens who have reached 80 years of age and meet certain requirements can be completely exempt from utility payments.

Exemption from contributions for major repairs

Residents are required to contribute money monthly to restore the property. These amounts are accumulated in a special account and spent only for their intended purpose. A single senior citizen who has reached the age of 70 is entitled to a 50% discount on major repairs. If a person is over 80, then he is completely exempt from paying these contributions. The privilege is valid when the pensioner is the owner of the apartment.

Be sure to read it! Payment of a Russian pension outside the Russian Federation, when leaving for permanent residence and by power of attorney

Other preferences

A single person can count on the following privileges:

- Travel for free or at a discount on city public transport (benefits are determined by regional authorities).

- Once a year, undergo sanatorium treatment if there is a doctor’s indication for this.

- Pay 50% less for cable TV than other citizens.

- Receive a monthly discount for using a landline telephone connection.

- Free medical examination and vaccination.

- Take advantage of discounts when purchasing medications.

- If you are completely helpless, get a referral to live in a nursing home.

- Provide free dental treatment or prosthetics.

- If you have relatives in remote regions of the Russian Federation, where it is difficult to get to, the state will help pay for the air flight.

Free travel to and from your holiday destination (for northerners)

Elderly retired Russians who do not work and live in the Far North (equivalent areas) are additionally provided with compensation for expenses when paying for tickets to their vacation destination and back. Such travel benefits are provided to pensioners once every 2 years and exclusively for movement within the country.

There are two options for receiving benefits from the Pension Fund:

- travel payment;

- reimbursement of the cost (price) of purchased tickets.

Vacation benefits extend not only to travel: there are social vouchers to sanatoriums for retirees. To receive them, you must be placed on a special queue with the preliminary submission of a medical certificate about the need for sanatorium-resort recovery and treatment. Labor veterans are usually given preference in the queue.

Food discounts

Many chain supermarkets provide discounts to pensioners using a social card. You can check this at the checkout or on the store’s website. As a rule, this applies to large grocery chains. Sometimes discounts are only valid during certain hours or on certain products.

Mastering a new profession at the expense of the state budget

Russians of retirement age who want to continue working can improve their skills, learn a new profession or learn how to use a computer. This opportunity is provided by the employment service. Retraining services are free. To receive benefits, a non-working pensioner must contact the Employment Center at their place of residence.

Free museum admission

In large cities, it is common practice to invite pensioners for free or at a significant discount at certain times and days or to certain exhibitions. You can find out about this by calling or at the museum ticket office. Pensioners often forget to ask about benefits in places of cultural leisure, but this is a fairly common practice.

What documents do you need to collect to receive subsidies for housing and communal services?

What documents you will need to bring to the inspection will depend on many factors.

The list of documents that are needed to provide subsidies for housing and communal services may vary depending on the locality in which you are located . The region to which your city of residence belongs also has a corrective effect on this factor. However, the main list of papers will always be the same, namely:

- a copy of the passport of each resident registered in the premises that are subject to subsidies;

- an agreement proving that you are the owner of the residential premises (or an extract from the Unified State Register of Real Estate);

- certificate of absence of debts for utility services;

- a certificate taken from the technical inventory bureau, which will indicate the area of the apartment;

- a certificate indicating whether you received any benefits;

- SNILS of all citizens registered in the desired housing;

- pension certificate of the person planning to become a subsidy recipient;

- details of the bank in which the pensioner’s account is opened, to which the funds will subsequently be returned;

- a certificate indicating the income of all citizens registered in the pensioner’s apartment for the last six months;

- a certificate indicating the number of family members of this citizen, if the pensioner does not live in an apartment in splendid isolation.

Refund for major repairs

The return of funds for major repairs of an apartment building assumes that the pensioner will be reimbursed half of the amount spent.

If a pensioner has the title of Hero of the USSR or Russia, the amount of compensation is 100%.

Receiving subsidies for pensioners is regulated by the Housing Code of the Russian Federation:

• art. 159 “Providing subsidies for the payment of housing and utilities.

The right to use these social support measures for each category of pensioners is determined:

• Federal Law of January 12, 1995 N 5-FZ “On Veterans” (as amended on July 3, 2016). https://www.consultant.ru/document/cons_doc_LAW_5490/

• Decree of the Government of the Russian Federation dated December 14, 2005 N 761 “On the provision of subsidies for the payment of housing and utilities” (as amended on December 24, 2014). https://www.consultant.ru/document/cons_doc_LAW_45158/

How to get a subsidy

Receiving a subsidy is not easy: you need to collect all the required papers, and then submit them for consideration along with an application with the corresponding content

The relief we are interested in is provided to a pensioner only for one residential premises in which he has a residence permit. The duration of this subsidy is six months from the date of application, after which you will have to go back to the social protection department and renew its validity. This period of six months is determined for citizens because there is an assumption that during this time people will be able to raise their income level . Of course, this rarely happens in the case of pensioners, but the opportunity exists, and therefore old people have to regularly confirm their need for government support.

Please note: it is worth saying that the subsidy is provided to citizens after they have paid the full cost of the required payment for housing and communal services. Only later will part of this payment be returned to their bank account.

To apply for payments, therefore, you need to visit the social security authorities and write there a statement that you would like to receive them due to your sad financial condition. Please also list what documents you are attaching to this application to support your words.

Remember that with the advent of the “Public Services” portal, which operates throughout the country, you do not have to submit a written application by appearing in person at the authorities.

Today you can submit an application not only in paper form, but also in the form of an electronic form through the “Public Services” portal

You can fill out the appropriate form on the Unified State Portal and submit the application virtually. This will not make its legal weight any less.

After 10 working days, the department will complete its consideration of your application, provided that you have provided all the necessary information in the correct form. Confirm all data with real documents by appearing at the department at the beginning of the next month, and then the social security authorities will assign you a payment from the first day of the current thirty-day calendar period.

Interesting information

Remember that representatives of the government structure in question, if violations of the conditions for receiving a subsidy are detected, can do the following:

- suspend payment;

- limit payment;

- finish it completely.

Registration procedure

To apply for subsidies and benefits, you should contact one of the following institutions:

- MFC;

- territorial department of social protection of the population;

- City Center for Housing Subsidies - for Moscow;

- apply through the State Services portal.

To submit to institutions that issue subsidies and benefits, you should collect the following documents:

- Passports of all family members.

- Application for a subsidy or benefit.

- Documents for ownership or social tenancy.

- Certificate from the passport office about family composition.

- Marriage certificate.

- Birth certificate (for minors).

- Certificate from the management company confirming that there is no debt for housing and communal services.

- Certificate of income of all family members, including pension, alimony, scholarship, child benefits and more.

- Original work book for a non-working pensioner.

- SNILS of the applicant.

- Bank details for transferring subsidies.

Reasons for refusal to provide a subsidy

So, a pensioner may be denied relief if he does not meet any of the conditions imposed on him. In particular, it should be understood that cancellation can occur even after the subsidy has been assigned.

The subsidy may be terminated at any time. This will happen as soon as you stop fulfilling the necessary conditions

Termination of payment is made under the following conditions:

- if a person changes his place of residence;

- if the composition of the family also changes, and with it the financial situation of a particular unit of society;

- if it was revealed that the pensioner cheated in order to receive government support, for example, by providing false documents;

- the pensioner does not pay for utilities for more than 60 calendar days, and he does not have a corresponding valid reason.

If you follow all the rules, you have nothing to fear from rejection; it is unlikely to happen.

Get a subsidy and change your financial situation for the better!

What do single pensioners get from social security?

To maintain an acceptable standard of living, social services provide the following types of assistance to older people:

- Cleaning a living space, caring for a person who cannot care for himself.

- Accompaniment by a social worker when visiting medical institutions.

- Purchasing food on certain days, preparing meals.

Social assistance to single pensioners is provided after receiving an application. The person needs to contact the staff of the district office of the service. Social security for elderly citizens living alone is provided in the form of money, food, clothing or cleaning supplies. A pensioner can choose what is more convenient for him to receive.

Social services at home

In 2020, persons who have reached retirement age have the right to receive the following social services from government agencies:

- purchase at the expense of the recipient of social services and home delivery of food, essential industrial goods, sanitation and hygiene products, care products, books, newspapers, magazines;

- assistance in cooking;

- payment at the expense of the recipient of social services for housing, communal services and communication services;

- delivery of items for washing, dry cleaning, repair, and return delivery at the expense of the recipient of social services;

- purchase of fuel at the expense of the recipient of social services, heating of stoves, provision of water (in residential premises without central heating and (or) water supply);

- organizing assistance in repairing residential premises;

- providing short-term child care;

- cleaning of residential premises.

All of the above services are carried out by a special social worker who visits the pensioner several times a week.

Cost of social services at home

Social services at home are provided free of charge:

- if the recipient of social services is a participant and disabled person of the Great Patriotic War;

- if on the date of application the average per capita income of the recipient of social services was below the maximum value or equal to the maximum per capita income for the provision of social services.

The maximum per capita income for the provision of social services is equal to one and a half times the minimum subsistence level established in the region.

The cost of living for pensioners in the Vladimir region is 9,062 rubles/month. That is, the maximum per capita income = 9062 x 1.5 = 13593 rubles.

If the pensioner's income exceeds such and such an amount, the monthly fee for the provision of home services is calculated based on established tariffs.

Social services in hospital

In many cases, the best option for a person who has no relatives or cannot care for himself in his later years is to live in a nursing home. There are qualified nurses and health workers who provide decent conditions and care for the elderly.

In addition, in such an institution he will have the opportunity to communicate and spend time with other people of his age.

The basis for placing an elderly person in a nursing home is the application of him or his legal representative.

Social services in a stationary form are provided to their recipients with permanent, temporary (for a period determined by the individual program for the provision of social services) or five-day (per week) round-the-clock residence in a social service organization.

Cost of social services in hospital

The monthly fee for the provision of social services in a stationary form is calculated on the basis of tariffs, and cannot exceed 75% of the average per capita income (3/4 of the pension) of the recipient of social services, calculated in accordance with the law. Payment for social services is made in accordance with the concluded agreement.

Free inpatient social services are provided to participants and disabled people of the Great Patriotic War.

Be sure to read it! How to find out the statistics codes of an organization or individual entrepreneur: 18 secret methods

Let's sum it up

Providing various benefits for socially vulnerable categories of residents of the country, in particular pensioners, is a normal measure of state support for its subjects. Perhaps the only negative factor in the desired program is that the required procedure has not become automated , and pensioners, many of whom cannot boast of excellent health, have to collect an impressive package of documents on their own. However, receiving payments is worth it, because at least a little, you can change your situation and improve the well-being of the whole family.

Foster family for single pensioners

An adult capable citizen may express a desire to live with a person in need of social support and provide care for him in accordance with the agreement on organizing a foster family for elderly citizens. The assistant's monthly remuneration is 7,900 rubles, including personal income tax. The principles for forming and spending the budget of a foster family are provided for in an agreement between the assistant and the ward.

Benefits for pensioners living alone in Moscow - pension supplements, subsidies and targeted assistance

Elderly citizens are often left without the care of relatives and suffer not only from loneliness, but also from lack of money. According to current legislation, they have the right to apply for benefits and preferences. Moscow has a whole system of regional benefits for individuals belonging to this category.

Supplement to pension up to city social standard

The procedure for assigning preferences depends on the number of years lived in the capital. If a citizen lives there for more than 10 years, then he receives the right to an additional payment to his pension up to the level of the city social standard.

If an individual’s period of residence in the capital is shorter, then the monetary support can be increased to the regional subsistence level.

Benefits for pensioners living alone in Moscow are of the following types:

| Life expectancy in Moscow | Types of pension |

| More than 10 years |

|

| Less than 10 years |

|

Tax preferences

In addition to social benefits, pensioners living alone will be able to save their budget on annual payments to the budget. They are provided with a tax deduction when purchasing property and medicines.

Military pensioners are completely exempt from road, land, and property taxes.

Other categories of elderly people living alone can take advantage of the following preferences:

| Type of tax | Amount of benefits |

| Property | If an apartment, house, garage, cottage costs less than 300 million rubles, then an individual is not required to pay tax. If the cost of housing is higher, then the benefit does not apply. The subsidy can only be applied to 1 property. |

| Transport | There is no need to pay the tax if the car’s power is not more than 100 hp. s., and boats - 5 l. With. |

| Land | Disabled people, liquidators of the Chernobyl accident, and World War II veterans do not pay tax. For other categories of elderly persons, the tax base is reduced by 10,000 rubles. |

| For personal income (NDFL) | Pensions and other payments intended for pensioners are completely exempt from taxation. |

Free travel on public transport and commuter trains

Benefits for pensioners in Moscow also cover movement within the capital and beyond.

Persons receiving an old-age pension can travel around the city for free on buses, trolleybuses, trams, and the metro.

After receiving a social card, pensioners living alone will be able to travel to the suburbs and back to Moscow using electric trains under the same conditions.

Subsidies and discounts for housing and communal services

Single pensioners and low-income individuals will be able to take advantage of this type of benefit if they spend a lot of money on paying for water supply, electricity, and gas. Receipts should be kept to verify expenses. Benefits are issued at the social security department or directly at the housing and communal services department. Preferences are valid for 1 year, and then you will have to re-submit documents. Senior citizens are entitled to the following discounts and subsidies:

- discount up to 50% if more than 10% of income goes to pay for all housing and communal services;

- 190 rub. monthly if you have a landline telephone;

- 50% discount on cable television (some companies provide benefits specifically for pensioners);

- 100% compensation for the costs of major home repairs for Muscovites over 70 years old.

Social assistance to single pensioners in Moscow

Financial support for elderly citizens of the capital is provided at their place of residence. Moscow annually allocates billions of rubles from the regional budget for social security of pensioners. Single Muscovites will be able to take advantage of the following preferences:

- targeted household assistance for the purchase of products, things necessary for life, medicines;

- free or discounted housekeeper services;

- free assistance from a nurse in caring for a lonely pensioner who is unable to care for himself;

- accompaniment to the hospital and back home;

- assistance in cooking;

- an additional two-week vacation once a year (if the pensioner is working).

Benefits for medical care and services

If they have health problems, elderly people living alone can also claim certain preferences. Benefits for Moscow pensioners for medical care:

- Medical assistance without waiting lists when visiting a clinic at your place of residence.

- Discounts in pharmacies when purchasing medications.

- Compensation once a year for the purchase of expensive medicines. To do this, the beneficiary must contact the Social Insurance Fund (SIF) at their place of residence.

- Free trip to sanatorium-resort treatment for medical reasons.

- Compensation for the cost of dentures made in public clinics.

- Partial or full compensation of the amount spent on the purchase of technical rehabilitation equipment according to the doctor’s indications.