Home / Labor law / Payment and benefits / Pension / Additional payments to pension

Back

Published: March 26, 2016

Reading time: 7 min

0

15077

A veteran of labor is a person who has worked conscientiously for a long time in the national economy and has state insignia .

This title was established by the Law “On Veterans” No. 5F3. In the USSR, labor veterans were awarded the Veteran of Labor medal, but did not have any material benefits.

- Required surcharges

- What benefits are available to labor veterans?

- Monetization of benefits

- Registration procedure

- Payment of additional payments

According to Art. 7 of this law, labor veterans can be persons who have the “Veteran of Labor” medal or have been awarded orders, medals, and badges of honor for excellent work. All these persons must also have the required pensionable work experience.

In addition, this title can be awarded to people who began working during World War II and worked for 40 or 35 years.

Types of benefits for pensioners and labor veterans

Preferences and benefits for labor veterans of the Russian Federation can be divided into 2 main categories:

| Federal | Regional |

|

|

| Tax benefits | |

| Free medical services | |

To apply for veteran's preferences, a pensioner-beneficiary will need to prepare a package of necessary documents:

- application for benefits;

- labor veteran certificate;

- passport of a citizen of the Russian Federation;

- pensioner's ID.

What benefits can you expect?

What gives the title “Veteran of Labor” to a pensioner: according to Art. 22 Federal Law dated January 12, 1995 No. 5-FZ (as amended on March 7, 2018)? People with this status are entitled to various benefits. At the same time, they can be a cash supplement to the pension or discounts or free services. Such assistance is provided both at the federal and regional levels. Let's consider what a retired labor veteran is entitled to.

In particular, the following benefits are considered federal and should be valid in all regions of the country:

- transport in the city is free, except for taxis and minibuses;

- free services in clinics and other medical institutions;

- free dental prosthetics (except for metal ceramics and dentures made of precious metals);

- 50% discount on the cost of services in the housing and communal services sector;

- 50% discount for travel by rail and water transport;

- tax benefits;

- for a working veteran, additional leave at his own expense is provided for up to 30 days at any convenient time, in addition to annual paid leave.

Regional benefits depend on the financial capabilities of each region and are determined by local authorities. Since all regions have different opportunities, benefits differ in them.

So, according to Art. 62 of the Social Code of St. Petersburg, monthly social support for labor veterans - residents of St. Petersburg, is 707 rubles. As additional social support, they are provided with additional payments in the amount of:

- 50% of the cost of utilities;

- 50% of the cost of residential premises;

- 10% of the tariff for one-time travel by railway and suburban transport;

- opportunity to use the EDC. What is the EBC for retired labor veterans? This is a monthly monetary compensation to pay for housing and utilities. The size of the EDC is calculated individually and is carried out in the form of an appropriate preferential discount on receipts provided by citizens

Pensioners can use additional payments only after establishing their right to an insurance pension and its assignment.

Legal regulation

The conditions and procedure for providing benefits to pensioners with labor veteran status are regulated by the legislation of the Russian Federation. List of main regulations:

- Federal Law of the Russian Federation (hereinafter referred to as the Federal Law of the Russian Federation) dated January 12, 1995 No. 5-FZ;

- Law of Moscow dated November 3, 2004 No. 70;

- Government Decree (hereinafter referred to as PP) of Moscow dated 08/11/2009 No. 755-PP;

- GD of the Russian Federation dated December 14, 2005 No. 761;

- Federal Law of the Russian Federation “Housing Code of the Russian Federation” dated December 29, 2004 No. 188-FZ;

- Federal Law of the Russian Federation dated July 17, 1999 No. 178-FZ.

Subsidies and benefits for housing and housing and communal services

Benefits for federal labor veterans include a 50% discount on housing and communal services. The preference is provided under the following conditions:

- the property is fully or partially registered as the property of a pensioner-beneficiary;

- Housing is assigned to a labor veteran in accordance with a social tenancy agreement.

- Indexation of social pensions from April 1, 2020

- Remedies for mold and mildew on walls

- How to cook pilaf in a slow cooker

The procedure for providing benefits allows for 2 forms of its application - discount and compensation:

- the amount payable for housing and communal services reduced by half is displayed on the receipt;

- compensation funds are transferred to the recipient's bank account monthly.

The discount on housing and communal services is calculated for each item provided:

- use of residential premises;

- maintenance of common property;

- gas supply;

- heating;

- water supply;

- garbage collection;

- drainage;

- power supply

If there are installed meters - metering devices (hereinafter referred to as metering devices) for water, electricity or gas - the calculation is made based on their indicators. If there are no PUs, the discount is provided according to regional standards. A local preference includes the exemption of a pensioner with labor veteran status from paying contributions for capital repairs.

How to fill out an application?

If there is none, then this procedure must be performed. To do this, you should personally contact any bank branch , have an identification document (passport) with you and contact any operator. Next, follow his instructions.

The account opens instantly, after performing the necessary operations, you must also deposit any amount into the account to activate it (10, 50, 100 rubles).

To social security

Before receiving benefits for housing and communal services, a veteran should contact the local social security department, where he must submit an application.

This is important to know: New procedure for conferring the title of labor veteran, registration conditions

The social protection authority will consider the submitted application of a labor veteran if the following data is correctly and correctly indicated:

- Full name of the social protection authority (upper right corner of the document).

- FULL NAME. veteran.

- The labor veteran’s residential address, as well as additional contact information (for example, telephone number).

Title of the document.- Indicate the address to which the applicant is requesting the subsidy.

- A list of all people living at a given address (indicating the degree of their relationship, as well as the series and number of their passports).

- List of all documents provided (indicating the number of copies).

- Bank account number (indicating the name of the bank).

- Confirmation of familiarization with the rules for providing benefits.

- Confirmation that the requested benefit will be used to pay for housing and communal services.

- The date the application was filled out (lower left corner of the document) and the applicant’s signature (lower right corner of the document).

To the local housing and communal services

Before going to the housing and communal services department, make sure that you have all the necessary documents on hand (listed above). In housing and communal services you need to draw up an application that looks like this:

- Full name of the housing and communal services (upper right corner of the document).

- FULL NAME. applicant (veteran).

- Address of actual residence, indicating additional contact information of the applicant (telephone number or other type of communication).

- The name of the document (application, appeal, petition), in our case, is a statement.

Indicate the address to which the subsidies are expected to be distributed (indicating the type of housing: rented or purchased).- Indicate the area of living space.

- List all family members living (registered) at this address (indicate their numbers and series of passports, as well as the degree of relationship with the applicant).

- Bank account number (indicating the name of the financial institution).

- Insert the date of the application and personal signature with a transcript.

Tax benefits for labor veterans

Fiscal preferences due to pensioners with labor veteran status include:

- Complete exemption from property tax. Since 2020, the benefit is provided only for 1 object - a room, apartment or individual house - at the choice of the pensioner.

- Transport tax benefit. From 2020, the reduced fiscal rate or tax exemption applies to 1 car. The size and conditions for providing transport preferences depend on the region; they should be clarified at your place of residence, for example:

- in Moscow, Sakhalin region - not provided;

- in Bashkortostan and Irkutsk they operate at 100% rate.

- Preference for land tax. Russian legislation provides for a deduction of 10,000 rubles from the tax base for pensioners receiving benefits.

- Income tax benefits (hereinafter – personal income tax). The following types of income are not subject to 13% personal income tax:

- pension payments;

- material benefits;

- financial assistance, the amount of which does not exceed 4 thousand rubles per year, including the annual amount of the monthly allowance;

- funds allocated for sanatorium and/or medical treatment as prescribed by a doctor;

- Exemption from paying state fees when going to court.

- How to calculate pension indexation for non-working pensioners in 2019

- How to graphically unlock an Android key

- These cheap drugs will save your lungs from coronavirus

Transport preferences for labor veterans of Moscow and the region

Preferential travel in the capital and Moscow region is a preference valid for persons with labor veteran status for all passenger public transport. Exceptions: route and commercial taxis, long-distance trains, air travel - air tickets will have to be purchased at your own expense. Pensioners receiving benefits have the right to refuse the preference and replace the in-kind form with cash compensation. The dimensions of the EDV will be:

| Benefit | Equivalent (r.) |

| Use of all types of public transport | 378 |

| Travel on commuter trains | 188 |

| Proceeding to the place of sanatorium-resort treatment | 116,0 |

Medical benefits of federal and local significance

Persons with disabilities, citizens who were involved in eliminating the consequences of man-made disasters, including the Chernobyl accident, war and labor veterans are entitled to medical benefits. The procedure and conditions for providing regional preferences for health improvement:

- free services in government medical institutions;

- free dental prosthetics in budget clinics from standard (inexpensive) materials;

- sanatorium-resort treatment with free travel to the place of treatment by rail;

- free medications purchased in pharmacies with a doctor's prescription.

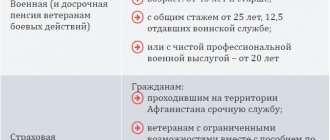

Conditions for obtaining the title

The following persons have the right to receive the title:

- with a century of service 40 years for men, 35 years for women;

- various state awards.

The “state award” category includes medals and orders - insignia that have state confirmation. The “Veteran of Labor” badge, for example. Previously, such an award was given to honored Soviet workers; it was a departmental distinction. Such awards also include:

- Gratitude;

- labor certificate;

- honorary title.

This is important to know: The title of labor veteran: where to apply for assignment and what documents are needed

If the data of one person is indicated on the patents of two or more inventions, then this person already claims the title of “Federal Labor Veteran”. But the worker who was issued the “Shock Worker of Communist Labor” badge cannot apply. And do not forget that in many regions the list is replenished with local insignia.

Also, those people who began working at a young age, before reaching adulthood, during the Great Patriotic War, can also receive the honorary title “Veteran of Labor of the Region”, regardless of whether they are a man or a woman.

Pension supplement

In some cases, retired veterans of labor are entitled to supplements to their benefits. There are 2 of them in total:

- EDV - compensation for the social package in case of partial or complete waiver of preferences due to the beneficiary in kind:

| Service | Equivalent (r.) |

| Medicines | 833,79 |

| Annual voucher for spa treatment | 128,99 |

| Travel to the place of treatment | 119,75 |

- Local supplement to pension, if its amount is below the regional subsistence minimum (hereinafter referred to as PM).

Privileges for working retired veterans of labor

Due to the difficult economic situation in the Russian Federation, the amount of funding for social programs has been reduced. In 2020, pensioners with benefits who continue to carry out working professional activities and have received labor veteran status retained the following preferences:

- 50% discount on housing and communal services;

- free treatment in government medical institutions;

- provision of extraordinary leaves - both annual compulsory and at your own expense - at any period convenient for the benefit recipient with preservation of the job;

- improvement of living conditions as a priority;

- free dental prosthetics, repair of orthopedic structures;

- reimbursement of costs for appropriate medications in state city pharmacies.

Supplement amount

Depending on the region of residence, payments to veterans may be assigned instead of a package of social services, which, as a rule, includes (there is no single list):

- reimbursement of costs for housing and communal services bills;

- free travel on intercity municipal transport;

- compensation for costs of paying for landline telephone services;

- treatment in sanatorium-resort institutions;

- production/repair of dentures.

The amount of subsidy varies greatly from region to region and can reach 500-1000 rubles.

Transport benefits

The right to free travel on municipal transport or replacing potential costs with cash payments is a choice that a pensioner makes based on his own benefit. However, it is necessary to understand that compensation does not include costs for the services of private cab drivers and taxis.

The compensation also concerns the return of expenses incurred by the pensioner for the use of railway transport, and in some cases, air travel. The maximum amount of compensation is 50%.

The authorities of some regions provide holders of the title of veteran with relief on transport tax in the form of a complete abolition of the tax on vehicles with a capacity of less than 100 units. If the aggregate exceeds the established limits, then tax is paid on the difference.

Housing and communal services benefits

Veteran status gives the right to receive benefits in the housing and communal services sector according to the following rules:

- Reimbursable services include:

- gas;

- drainage;

- water consumption;

- heating;

- electricity supply;

- absence of debts from previous accruals;

- invoices issued for payment are paid by the applicant in full, and after that compensation payments are provided to his bank account.

Health Benefits

Medical benefits imply the following scope of preferences:

- laboratory/instrumental examination of the patient;

- provision of medicines at a reduced cost or free of charge;

- free dental prosthetics or compensation for the costs of the procedure (except for dentures made of precious metals);

The benefit is issued in the social services department. protection when providing a package of documents, which, without fail, contains a certificate from the attending physician confirming the intentions declared by the pensioner.

Housing benefits

Veterans in need of improved living conditions can count on:

- provision of an apartment from the municipality;

- compensation for part of the acquisition costs.

Features of the preference:

- the veteran is enrolled in the queue on a general basis;

- Documentary proof of need is required;

- The applicant must annually prove their low-income/needy status.

Social support measures for labor veterans in Moscow

Capital benefits intended for pensioners with labor veteran status include:

- free travel on city public transport and commuter trains;

- 50% discount on housing and communal services;

- annual free sanatorium and resort vouchers for medical reasons;

- reimbursement of travel costs to the place of treatment;

- free provision of medications in accordance with Order of the Ministry of Health and Social Development of the Russian Federation dated September 18, 2006 No. 655;

- 50% discount on city telephone services;

- free production, installation, repair of dentures;

- an increase in pension taking into account annual indexation, provided that the insurance part of the benefit of an elderly beneficiary is lower than the regional minimum wage;

- EDV for the monetization of benefits due to a labor veteran in case of refusal to receive them in kind.

Veteran of labor - documents for registration and stages of the procedure

The length of service required to obtain the status includes: – the period of military service; – time of child care (from 6 months to 1.5 years), while the entire period in total cannot exceed three years; – time of caring for people of disability group I, a disabled child or people aged 80 years and older.

The first step is to contact your local social security office. There they issue a special form where you need to fill out a written application to receive monthly payments in cash equivalent that the labor veteran will receive.

The length of service is calculated immediately, and then benefits are issued to cover housing and utility bills. For utilities, compensation in the amount of 50% is distributed equally to all members of the veteran’s family, provided that they live together.

In the process of applying to the social protection authorities to process the required payments, you should first of all submit the necessary documents:

- passport data (original and copy);

- veteran and pension supporting documents;

- an extract from the house management book;

- insurance number from the personal individual account;

- documentation confirming personal ownership of the account to which cash payments are to be transferred;

- form nine, as well as all provided documentation in copies.

This is important to know: Tomenko’s decree on conferring the title of labor veteran

After acceptance, documents are reviewed no more than 5 days. After this, the personal file, which has already been created, is sent to the Ministry of Labor, Demography and Social Protection of a certain region. In turn, the Ministry reviews submitted cases within 30 calendar days.