Approaching retirement age is usually associated with more than just anticipation of a new stage in life. For future retirees, the size of their future pension becomes an important issue. It is clear that this is not an idle interest, but a question of the degree of security of the pensioner, an assessment of the possibility of maintaining the usual standard of living or determining how much it will have to change. Calculating the exit time and finding out the approximate amount is also important for recipients of preferential pensions.

This category of pensioners has the right to early retirement; accordingly, having decided on its size, they may wonder whether to retire or continue working. The calculation will allow you to find out how you can change the size of your pension if you continue to work after reaching retirement age or achieving the required length of service.

Who can take early retirement

When considering the possibility of granting the right to early retirement benefits to employees of labor treatment dispensaries, it should be borne in mind that these dispensaries do not belong to institutions executing criminal penalties, since they provide labor treatment to persons who are not convicted. Therefore, the right to early assignment of an old-age labor pension in accordance with subparagraph. 17 they don't have.1.

All workers permanently and directly engaged in work with convicts (regardless of the name of the profession).

Calculation of the length of service coefficient for pensions

Today, the formula for calculating the amount of insurance benefits consists of:

- individual part - depends on the duration of work, the number of IPK, etc.;

- fixed payment - the amount of cash accrual established by law.

In accordance with Federal Law No. 400, the calculation of insurance benefits is based on the duration of work of citizens, the number of individual coefficients earned, as well as the price of one individual industrial complex at the time of pension assignment.

But what to do if the future pensioner worked in the USSR for half of his life? How are pension points calculated for service during the Soviet period? This issue is regulated by Federal Law 173-FZ (provisions that do not contradict the current legislation of the country).

Application of the “survival period” when calculating pensions

Alexander Ivanovich Question asked October 25, 2020 at 12:22 pm When calculating the pension in August 2020 under preferential list No. 2, the Pension Fund of the Russian Federation applied a “survival period” of 252 months.

Is this legal? The question relates to the city of Orenburg region.

Kuvandyk Gafarov Published October 30, 2020 at 4:29 pm Published October 30, 2020 at 4:29 pm Hello. The so-called survival period - T, officially called the expected period of payment of an old-age labor pension, is the most important parameter that directly determines the size of the pension for all categories of citizens without exception.

The size of the monthly pension (more precisely, the insurance part of the old-age labor pension) for those who were born before 1967 and do not have a funded part is determined by the formula: Pension = PC / T + B, where PC is the pension capital “earned” by the citizen for the entire period of his labor activity; T – the number of months of the expected period of payment of the old-age labor pension – the period of survival used to calculate the amount of the pension; B - fixed base amount of the insurance part of the old-age labor pension. It is clear that the longer the survival period is set, the smaller the monthly pension will be.

The method of adjusting the size of pensions in a similar way has been applied throughout the ten years since the beginning of the pension reform. The Government of the Russian Federation uses this quiet, inconspicuous and not advertised parameter as a convenient regulator of the size of assigned pensions. How realistic are these survival times for Russian pensioners and how true are they?

Let's look at the numbers. According to European experts who conducted a comparative analysis of the life expectancy of pensioners in different countries, the life expectancy of men after retirement in our country is about 6 years, and for women – 11 years. Since, according to Goskomstat, about 800 thousand men and 1,200 thousand women retire annually - about two million people in total - using these figures it is easy to calculate the average survival time for Russian pensioners (regardless of gender) using the so-called “weighted” formula » average:

Official website of the authorities of the Moscow Region - Selenginsky district

According to subparagraph 17, paragraph 1, article 27 of the Federal Law “On Labor Pensions in the Russian Federation of December 17, 2001 No. 173, the right to early labor pension is provided for workers, managers and employees of institutions executing criminal penalties in the form of imprisonment, the right to early labor pension is established old-age pension, which is assigned to men upon reaching 55, and women upon reaching 50, if they have been employed in work with convicts for at least 15 and 10 years, respectively, and have an insurance period of at least 25 and 20 years, respectively.

However, employees of these organizations and institutions do not enjoy the right to early assignment of a labor pension, since they are not employees of institutions that execute criminal penalties.

The right to early assignment of an old-age labor pension according to the List approved by Decree of the Government of the Russian Federation of February 3, 1994 N 85, is enjoyed by workers and employees of institutions executing punishments, employed in work with convicts constantly and directly during the full working day, i.e. at least 80% of working time. Some enterprises that are not institutions executing criminal punishments may use the labor of convicts.

Employees of such enterprises do not enjoy the right to early pension provision. When considering the possibility of granting the right to early retirement benefits to employees of labor treatment dispensaries, it should be borne in mind that these dispensaries do not belong to institutions executing criminal penalties, since they provide labor treatment to persons who are not convicted. Therefore, the right to early assignment of an old-age labor pension in accordance with subparagraph. 17 of the commented article they do not have.

Seniority coefficient

- What is the experience coefficient? How does it affect pension calculations?

- What is the experience coefficient?

- Question about the experience coefficient.

- What is the length of service coefficient for 29 years and 7 months of experience?

- What will the length of service coefficient be if the work experience is 30 years?

- What is my experience coefficient with a total experience of 22 years?

- Publications

- Started working from 03/1969 pension from 06/2011 What is my length of service coefficient?

If you find it difficult to formulate a question, call, a lawyer will help you: Free from mobile and landline Free multi-channel telephone If you find it difficult to formulate a question, call a free multi-channel telephone, a lawyer will help you 1. Question about the length of service coefficient.

Lawyer Boychenko A. Yu., 166 answers, 110 reviews, on the site from 06/16/2020 1.1. What exactly is the question? 2. What is the length of service coefficient for 29 years and 7 months of experience?

Lawyer Stepanov Yu.V., 43171 answers, 18328 reviews, on the site from 02/01/2014 2.1.

Hello! For the main category of citizens, the calculation of the estimated pension is made from the total length of service, calculated in calendar order, i.e., using the length of service coefficient established by the Law of 1990 and 1997. For men, full work experience is 25 years, for women - 20 years.

The pension for such length of service is 55% of the pensioner’s average monthly earnings. This indicator is called the experience coefficient (SC) and is expressed as a value of 0.55.

For each additional year worked beyond 25-20 years, the length of service coefficient (SC) increases by 0.1, but not more than by 0.20, i.e. up to 0.75. Consequently, the pension amount ranges from 0.55 to 0.75% of the average monthly earnings of the future pensioner. 3. What will be the length of service coefficient if the work experience is 30 years.

Lawyer Khokhryakova L.V., 73656 answers, 28987 reviews, on the site from 07/06/2015 3.1.

Hello! depending on duration

All about early retirement pensions

The conditions for assigning an early retirement pension to citizens employed in work with convicts as workers and employees of institutions executing criminal penalties in the form of imprisonment are as follows:

All workers permanently and directly engaged in work with convicts.

Punishment in the form of imprisonment is carried out in a colony-settlement, educational colony, medical correctional institution, correctional colony of general, strict or special regime or prison. Do they have the right to long visits with those sentenced to imprisonment? You can find out how to do this in the sections “How to save and increase money” and “Financial life planning”, and also learn from my books. If you have any questions, ask me, I will try to answer them. Medical workers constantly and directly involved in working with convicts: The representative of the defendant PKU IK-19 GUFSIN of Russia for the Sverdlovsk region did not agree with the plaintiff’s claims, since the plaintiff’s job responsibilities did not include direct work with convicts; during the controversial periods of work, job descriptions for drivers were not compiled. The representative of the defendant PKU IK-26 of the Federal Penitentiary Service of Russia for the Sverdlovsk Region also did not agree with the plaintiff’s claims, since there were no documents confirming the plaintiff’s constant and direct employment with convicts in the institution. In accordance with the List, which consists of 4 sections, the following have the right to early retirement, subject to constant and direct employment at work with convicts: This List is exhaustive and is not subject to broad interpretation, i.e., it is those managers and specialists who enjoy the right to early retirement , whose positions are expressly provided for in the List. For example, periods of work in the positions of “technological engineer” and “technical technician” cannot be included in the length of service giving the right to early retirement, since only “engineers and “technicians” are included in the specified List.

The penal system may include enterprises specially created to support the activities of the penal system, research, design, educational and other institutions. Employees of these organizations and institutions do not enjoy the right to early retirement, since they are not employees of institutions executing criminal penalties. The main condition for granting early retirement to these workers is their constant full-time employment working with convicts. In this case, the nature of the work they perform does not matter. Analysis of the above norms allows us to directly state that persons working in institutions for the execution of punishment in the form of imprisonment in the position of “accountant” have the right to early retirement in accordance with Article 28 of the Federal Law “On Labor Pensions in the Russian Federation”.

So why are they denied the issuance of a “preferential certificate?” In pursuance of this norm, the Government of the Russian Federation adopted the Resolution “On the lists of jobs, professions, positions, specialties and institutions, taking into account which an old-age labor pension is assigned early in accordance with Article 28 of the Federal Law “On labor pensions in the Russian Federation”, (“Collection of Legislation of the Russian Federation”, 04.11.2002, N 44, Art. 4393, “Rossiyskaya Gazeta”, N 212, 06.11.2002). The right of teaching staff to early assignment of an old-age labor pension is currently provided for by Federal Law No. 173-FZ of December 17, 2001 “On Labor Pensions in the Russian Federation.” Decree of the Government of the Russian Federation dated October 29, 2002 No. 781 approved: The list of positions and institutions in which work is counted as length of service for an early pedagogical pension, and the Rules for calculating periods of work giving the right to an early pedagogical pension. It must be borne in mind that by order of the Minister of Education of the USSR and the Minister of Internal Affairs of the USSR dated February 20, 1976 No. 23/45, it was determined that for the education of convicts in the education system, evening (shift) secondary schools were created, the activities of which were regulated by the Regulations on evening ( shift) secondary school.

By virtue of Art. 19 of the Law “On Labor Pensions in the Russian Federation”, a labor pension (part of the labor pension) is assigned from the date of application for the specified pension (for the specified part of the labor pension), except for the cases provided for in paragraph 4 of this article, but in all cases not earlier than the day the right to the specified pension (the specified part of the pension) arises. Thus, the argument of the cassation appeal that the debtor of the head of the laboratory is not provided for by the above List is the basis for refusing to include the disputed period of work of the plaintiff from 04/18/1989 to 09/30/2000 in the special length of service for the early assignment of an old-age pension in connection with employment at work with convicts is not.

Case No. not determined

having considered in open court a civil case based on the claim of FULL NAME1 against the State institution - the Department of the Pension Fund of the Russian Federation on the inclusion of periods of work in special work experience and recognition of the right to early retirement pension,

Include periods of work FULL NAME1 with convicts in Institutions KM-401/1 and M-200/1 with DD. MM. YYYY according to DD. MM. YYYY and with DD. MM. YYYY according to DD. MM. YYYY in his special work experience.

Having heard the parties, witnesses, and examined the case materials, the court comes to the following conclusion:

. Corrective labor colonies No. 1, 2, and 3 were located in the villages of Keba, Bolshaya Shchelya, and Zubovo. The right to early retirement when working with convicts? In the village of Ust-Chulasa and in the village there were shift sites from the colony ITK-1, where convicts serving their sentences worked in the main production - logging and rafting, including on mechanisms and machines, as well as in work supporting the main production, in various economic work, construction, maintenance work on the departmental housing stock of the institution. Recognize the right of Full Name 1 to an early retirement pension with DD. MM. YYYY, as having sufficient work experience in special working conditions and insurance experience.

Seniority pension coefficients

- Started working from 03/1969 pension from 06/2011 What is my length of service coefficient?

- What is the experience coefficient?

How does it affect pension calculations?

If you find it difficult to formulate a question, call, a lawyer will help you: Free from mobile and landline Free multi-channel phone If you find it difficult to formulate a question, call a free multi-channel phone, a lawyer will help you 1. Started working from 03/1969 pension from 06/2011 What is my experience factor? Lawyer Chernetsky I.V., 60606 answers, 18714 reviews, on the site from 09/18/2013 1.1.

Ask the Pension Fund. 2. What is the experience coefficient? How does it affect pension calculations? Lawyer Bosonogov A.E., 10827 answers, 3568 reviews, on the site from 03/11/2013 2.1.

For the main category of citizens, the calculated pension is calculated using the length of service coefficient - based on the calendar total work experience. For men, full work experience is 25 years, for women - 20. With such a duration, the length of service coefficient (SC) will be 0.55.

For each additional year worked, the SK increases by 0.01, but not more than 0.20, that is, the maximum possible length of service coefficient can be 0.75. When calculating the pension amount, length of service and earnings are taken only for periods before 01/01/2002. Since 2002, to calculate pensions, insurance contributions received for the insured person to the Pension Fund of the Russian Federation are taken into account.

3. In 2006, upon retirement, the Pension Fund incorrectly calculated the length of service coefficient: 0.997, but it should have been 1.07. From 2006 to 2020, the pension was calculated taking into account a coefficient of 0.997. Can I receive the lost pension for this period?

Lawyer Petrov A. A., 3459 answers, 1268 reviews, on the site from 03/18/2020 3.1. Hello! Yes, you can go to court. Lawyer Kadyrov R.O., 39575 answers, 14694 reviews, on the site since November 24, 2005 3.2.

You can if you prove in court the guilt of your PFR department. According to part

Decree of the Government of the Russian Federation of October 29, 2002

By Decree of the Government of the Russian Federation of May 26, 2009 Who has the right to long visits with convicts? N 449 this resolution has been amended

Rules for calculating periods of work giving the right to early assignment of an old-age labor pension to persons who carried out medical and other activities to protect public health in health care institutions, in accordance with subparagraph 20 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation.”

In accordance with Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”, the Government of the Russian Federation decides: b) persons who were employed in work with convicted persons as workers and employees of institutions of the Ministry of Justice of the Russian Federation, executing criminal penalties in the form of imprisonment, - a list of jobs, professions and positions of employees of institutions executing criminal punishments in the form of imprisonment, working with convicts, approved by Decree of the Government of the Russian Federation of February 3, 1994 No. 85 (Collected Acts of the President and Government of the Russian Federation, 1994, No. 7 , Art. 509; Collection of Legislation of the Russian Federation, 1996, No. 36, Art. 4240); list of positions and institutions in which work is counted towards length of service, giving the right to early assignment of an old-age labor pension to persons who carried out medical and other activities protection of public health in healthcare institutions, in accordance with subparagraph 20 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”;

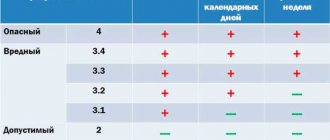

Preferential pension due to harmfulness

- when working according to List 1 - for every 1 full year of work for women and men;

- when working according to List 2 hazardous professions - for each:

- 2.5 years of hazardous work for men;

- 2 years of special experience - for women.

List 1 of professions that give the right to early retirement includes positions related to underground work, hot shops, and hazardous working conditions . To determine the right to a preferential pension, a list of works and positions approved by legislative acts is used:

- having at least half of the established special experience (see table above);

- availability in full of the required amount of general insurance experience and IPC .

List No. 1 for periods of working activity from January 1, 1992 includes 24 types of industries , each of which identifies professions in which work allows early retirement. Let us give as an example some of them in the table below: If the harmful experience indicated in the table was not completed in full, then you can count on a reduction in the generally established retirement age in proportion to the accumulated special experience.

How to calculate the experience coefficient

My wife retired in 2013.

on preferential terms (T *240 months). Experience until 2002 -14 years 26 days.

By the time of retirement, the insurance period is 22 years.

The length of service coefficient (SC) is calculated as for incomplete experience and is equal to 0.387. She turned 55 in April. Is it possible for her to retire on a general basis? Will the size of the pension change in this case? She has 5 years of study at the institute; she had no experience before studying. Will these years count? In this case, the size of the preferential pension is determined by the same formula as the old-age pension on a general basis.

True, there is one more nuance - when calculating the size of the pension, the IC, if it is beneficial, can be determined at the choice of the pensioner not only based on the total length of service, but also on the existing preferential work experience, which gives the right to early retirement.

- The result obtained during the calculation is displayed.

- the current work experience is included in the calculation formula;

- an application for carrying out the specified calculation is submitted electronically;

- a calculation algorithm is drawn up indicating the calculation coefficient to be taken into account;

- the current value of the existing work experience is included in the calculations;

- documents are being prepared about the pensioner’s disability group;

- the final calculated result is displayed.

- length of service is multiplied by a calculated coefficient selected taking into account the disability group of the pension recipient;

Formulas and calculation rules for different periods turned out to be different.

Therefore, assessment and calculation have to be carried out separately for each period: the period before 2002, the period from 2002 to 2014 and the periods after 01/01/2015. In order to calculate the amount of pension due to a citizen, it is necessary to know (calculate, calculate) the amount of his individual pension coefficient - IPC (in points).

Next, on its basis, the size of the pension is determined in rubles - if the IPC is known, then it is multiplied by the cost of one pension point in the year the pension was assigned and its ruble size is determined.

The right to early retirement when working with convicts

Let's give all kinds of examples in the table and indicate how many years citizens will be able to take out early retirement pensions in 2020, under what conditions.

Work on vessels of the marine fleet of the fishing industry for the extraction, processing of fish and seafood, acceptance of finished products in the fishery, as well as on certain types of vessels of the sea, river fleet and fishing industry fleet.

Citizens who want to apply for an early pension will have to contact the Pension Fund in advance, when the retirement age has not yet reached the established limits. Citizens working with convicts as workers, as well as employees of institutions executing criminal penalties in the form of imprisonment.

Military pensioners can apply for a pension before reaching the required age.

Early retirement, pension disputes: advice from a lawyer

Please note: if the special service period is more than half of the required period, the retirement age will be calculated proportionally. So, in order for a man to retire at 50, he must have 10 years of experience in a special activity; if he has worked only 5 years, retirement age will not come earlier than 55 years.

Important: you can protect your right to preferential pension benefits in court.

- mining;

- ore processing;

- metallurgy production;

- chemical,

- coke and mixed production;

- nuclear industry and energy.

However, this list is not exhaustive. There are other categories that find themselves in a difficult social situation. Work in flight test personnel with direct employment in flight tests (research) of experimental and serial aviation, aerospace, aeronautical and parachute equipment. At least 25 years in rural areas and urban settlements. At least 30 years in cities, rural areas and urban-type settlements or only in cities

How to calculate the experience coefficient?

» » 4.64/5 (11) Calculation of the work experience coefficient is carried out in stages. Please note! To determine the exact indicator, you will need to go through five steps:

- work period countdown. It is important to pay attention to the exact start and completion dates of the work. The length of service is summarized from performance indicators at all enterprises, which are reflected in the work book;

- bringing the resulting indicator to a single digital value. To do this, you will need to determine the number of full years, and if there are unaccounted months left, you need to convert them into years, dividing the existing indicator by twelve;

- converting days to years, which is based on the calculation: year = 360 days (one month is always equal to 30 days);

- the resulting number of years is multiplied by a fixed value. This indicator is determined in the standards adopted by region.

- calculation of total length of service. This stage is carried out by determining the length of service using the work book, extracts from orders, and other documents reflecting the official period of employment;

The result is the employee’s individual coefficient, which will later be multiplied by the person’s average earnings to determine the monthly pension payment.

From what year is early retirement possible: list of who is eligible, conditions, length of service, documents

The required insurance period will gradually increase: from 6 years in 2020. up to 15 years by 2024 And the individual pension coefficient will grow by 2.4 points annually until it reaches 30.

- women who have raised more than 5 children, parents and guardians of disabled people from childhood.

- the right to early retirement belongs to disabled people: due to military injury, with pituitary dwarfism, and having the first group of vision.

- citizens permanently residing or working in the Far North and equivalent regions, persons employed in underground and mining industries, doctors in rural areas, etc.

Articles 30,31 and 32 of Federal Law No. 400 provide guaranteed assignment of a labor pension to citizens whose work experience includes the following periods.

- standard retirement age (65 years for men, 63 years for women);

- age limit of disabled people (70 – men, 68 – women),

- age level of certain categories (medical workers, teachers, theater workers, workers of the Far North, etc.).

Then the payment of the early pension stops and is resumed only after the dismissal or closure of the individual entrepreneur or legal entity. Therefore, it is worth deciding in advance on the choice (pension or salary) that gives the greatest income. A citizen must independently notify Pension Fund branches about all changes (including the age required for receiving an old-age insurance pension).

Read other articles on the site:

- Issues of qualification of crimes in criminal law and judicial practice

- Warned about liability for knowingly false denunciation under Article 306 of the Criminal Code of the Russian Federation

- Circumstances mitigating a person’s guilt in committing a tax offense

- What is guilt as a sign of a crime in criminal law

- How to get a long date with a convicted common-law wife

Dear colleagues, I wish each of us to hold high the title of lawyer, unswervingly adhering to the principles of impartiality and objectivity!

Popular tags

Committing a crime Composition of a crime Article of the Criminal Code car administrative initiation civil money activity document complaint law statement health property execution supervision punishment sample application release grounds liability refusal to submit police receiving order resolution right preliminary termination involvement causing harm production prosecutor's office prosecutor process decision witness investigation deadlines judicial condition petition storage