- home

- Reference

- Military pension

All military personnel of the Russian Federation are subject to the laws of the country, therefore they must pay alimony to support minor children after a divorce. Alimony is calculated from any type of military income, including pensions. Former spouses can conclude a peace agreement with each other with a fixed amount of alimony and have it certified by a notary.

If the debtor refuses financial responsibility, then the monthly collection of alimony can be ordered by a court decision and will be withheld automatically. This article examines in detail the question of how alimony is paid from the pension of a former military man and how to arrange it.

Payment of alimony by military personnel: legislative regulation

The legal basis for transferring alimony not only in favor of the child, but also other close relatives is established by the Russian Family Code. This document defines the forms of payments, the procedure for their withholding, and forced collection.

It is important to have an idea of what kind of military income is covered by alimony payments. Here it is necessary to be guided by government decree No. 841 of July 18, 1996.

Clause 3 states that the object of deductions is salary, allowance and other permanent payments due to military personnel.

A separate list of income from which debts (including alimony) cannot be withheld is given in Art. 101 Federal Law “On Enforcement Proceedings”.

When it comes to foreclosure on property to pay off debt, an amendment to Art. 446 Code of Civil Procedure of the Russian Federation.

The collection of alimony from a military personnel follows a standard procedure. If we are talking about wages or other payments, the writ of execution (court order) is transferred to the accounting department of the military unit to which the debtor is assigned. This also applies to situations where alimony is withheld from a serviceman under a contract.

As for pensions, Art. 98 of the Federal Law “On Enforcement Proceedings” states that the obligation to make contributions lies with the organization (institution) paying income to the debtor. Consequently, deductions will be made by the Pension Fund body served by the military.

For your information! You need to understand that we are talking about means that are the object of attention within the framework of enforcement proceedings. If alimony payments are not allowed from them by government decree, the debt is collected from other sources.

Is it possible to receive child support from a military personnel pension?

Ex-wives are interested in whether alimony is collected from military pensions? It must be assumed that there are several types of payments assigned to the military. The standard pension is subject to alimony collection. Its size doesn't matter.

In certain situations, a citizen may qualify for additional payments due to the loss of a breadwinner (provided that the military man was a dependent). Such money is not taken into account when deducting alimony (clause 10 of Article 101 of the Federal Law “On Enforcement Proceedings”).

Military personnel may be injured due to participation in hostilities. According to the law, they are entitled to assistance from the state. It is also not a basis for the bailiffs to withhold alimony. But this does not mean that the debt will not be claimed from other sources.

A military man in service can sell property he does not need (country real estate, vehicles, land). When a transaction is one-time in nature, it is not included in income. Accordingly, alimony cannot be recovered from these funds.

From what income is maintenance paid?

The law states that alimony is withheld from most periodic payments due to a military personnel. This includes salary (including contract remuneration), bonuses for ranks, and other types of compensation.

Pensions paid due to age and in connection with the performance of military duties by a citizen are also included in the range of income not exempt from alimony. Deductions from such payments are made on a general basis.

If a military pensioner went into the reserve and started a business, alimony is paid from the income received from the business. It is defined as the difference between revenue and costs of running your own business.

Working military pensioner

Alimony is withheld both from payments related to wages and from the pension received. However, not all funds provided by a military unit are subject to deduction. For example, what has been said concerns money allocated for a business trip.

For a military pensioner who works, alimony is withheld in two places. At the place of work (service), the accounting department is responsible for translations. In terms of pensions, actions regarding payments are carried out by the Pension Fund body.

When funds for child support are sent from both salary and pension, the final amount may worsen the financial situation of the payer. Therefore, he has the right to initiate a reduction in alimony.

Summary

The collecting party should not even doubt that the military pension will not pay alimony in full for a minor child. Retired military personnel are required to provide for their minor children in the same way as civilians. There are a number of exceptions to the rules that we have discussed in this article.

The legislation allows the collection of children's money from literally all income available to the debtor.

Ways to receive alimony from military pensioners

There are several options for legally securing alimony obligations. The specific way to solve the problem depends on the relationships between people and the remoteness of their residence.

And also for many, the readiness to defend their own rights in court is important. Depending on this, the order of further actions is determined.

Let's look at two main ways to receive payments from military pensioners. Each of them has its own advantages and disadvantages.

Agreement with a notary on alimony

The possibility of signing it is provided for by Chapter 16 of the Family Code. Agreements on child support between parents are always sealed by a notary. Otherwise, the deal does not gain legal force.

When a concluded agreement is ignored, you can immediately turn to bailiffs for help. An interim court decision or writ of execution is not required.

The disadvantages of the agreement include the fact that adjustments to it will also have to be made by a notary. And this will result in additional costs for the child’s parents.

Note! It is allowed to fix in the agreement the condition that alimony is paid in one amount. It is also permissible to replace money with property, registering it in favor of your own child.

By the tribunal's decision

If it was not possible to agree on payments voluntarily, the only option would be to contact the magistrate in the defendant’s territory of residence or at the claimant’s registered address. Depending on the form in which alimony is planned to be received in the future, a claim or application for a court order is written.

A statement of claim should be filed when alimony is planned to be collected in a predetermined amount. However, the magistrate's court will still consider the case.

A court order is issued based on deductions as a percentage of income. At the same time, in the future it will replace the writ of execution.

For your information! The state duty for alimony is 300 rubles. However, you do not need to enter it when going to court. The Tax Code establishes benefits when going to court in this category of cases.

How to receive alimony payments if the military man is not registered?

The very fact of having a registration is not significant for the collection of payments for the maintenance of disabled family members from a contract employee of the RF Armed Forces. In the absence of registration, and in accordance with Art. 29 of the Code of Civil Procedure of the Russian Federation, a statement of claim for receiving funds from payments for length of service to a military personnel can be sent to the following place:

- actual residence of the plaintiff and the child;

- stay of a military personnel;

- location of property subject to recovery.

Attention

Upon receipt of a positive verdict on the payment of alimony from a military personnel pension, the plaintiff must submit a writ of execution to the FSSP office located at the address of registration or the last known fact of stay of the payer. If there is no information about the military’s place of residence, you should use an alternative option - ask the court to independently send the documents to the appropriate department of the bailiff service.

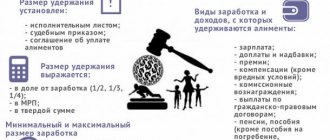

What amount do you receive?

The amount of deductions depends on many factors. These include the number of children in need of support, the composition and amount of the serviceman’s income.

If there is an agreement on the payment of alimony, the amount specified in it takes precedence over family law. The main thing is that the child’s situation does not worsen.

When assigning alimony, the court may also take into account the financial situation and state of health. The latter circumstance is especially relevant in relation to persons who were wounded or maimed during hostilities.

Percentage

With this option, alimony is collected in the case where there is specific information about the size of the serviceman’s pension. The deduction threshold is no different from other categories of payers.

A quarter of the income is withheld for one child. When two children need support, the maximum deduction threshold is at the level of 1/3.

For large families, the limit is set at half of the income. All figures must be reflected in the court order.

Note! Lawyers recommend collecting alimony as a percentage only if there is one child; if there are several, the best option would be a fixed amount.

In a fixed amount

At the moment, the legislator has not prescribed the minimum and maximum amount of alimony in the Family Code. Only a link has been made to the cost of living. For each region of the Russian Federation, it may differ depending on the demographic situation, climatic conditions, and price levels.

In a claim for alimony, the desired monthly amount is written together with its simultaneous relationship with the subsistence level. When it increases, payments are indexed.

The plaintiff is free to determine the amount required for the child. But the final word will still be up to the court.

Example of calculation of collected funds

Let's say a military man receives a pension of 50 thousand rubles. He has no other means of livelihood. If only one child is supported, 12 and a half thousand rubles will be spent on alimony.

This money will be transferred by the Pension Fund body on the basis of a court order. With more children, the amount will increase accordingly.

In the case where alimony is assigned in a fixed amount, no special problems arise. All deductions are documented.

Changing the amount of alimony

This step is permissible in a situation where payments are of a fixed amount. Moreover, the law allows them to be reviewed through the court, both up and down. Accordingly, the author of the claim is both the payer and the recipient of funds.

The reason for increasing alimony may be a deterioration in the financial situation of the person who is supporting the child. A change in the amount is also allowed when a serviceman conceals his actual financial condition.

In turn, a reduction in payments is possible due to a deterioration in the debtor’s health or a change in his family status. When making a decision, the court is obliged to evaluate all the circumstances in their entirety.

In what cases do payments stop?

There are several situations when a person’s obligation to pay alimony ceases. They are spelled out in Art. 120 IC RF.

Here are the most common reasons for termination of legal relations :

- death of the child or child support payer;

- adoption of a son (daughter) by a third party;

- the child reaches adulthood.

Child support transfers also end when children receive full legal capacity before they officially reach adulthood. This happens after marriage or after receiving emancipation status through the courts.

To free himself from alimony obligations, the payer can file a corresponding claim in court. The resulting decision is passed on to the bailiffs. Based on it, they close the enforcement proceedings.

If the money was paid under an agreement certified by a notary, the obligations terminate upon the expiration of its validity. The above also applies to cases of death of one of the parties to the agreement.

Problems and nuances

The process of collecting alimony obligations from a serviceman’s pension has many features, without taking into account which increases the risk of complications that prevent the receipt of payments. Therefore, you need to determine the following important subtleties:

- Before going to court, you should try to reach an agreement with the military on payments for the maintenance of the needy. In this way, you can significantly save financial and time costs associated with going to court.

- When drawing up a claim to recover funds from a military pension, you should collect as many documents as possible to substantiate the positions in the application. You need to remember the requirements reflected in Articles 131-132 of the Code of Civil Procedure of the Russian Federation.

- If a working military man refuses to pay alimony, it may be worth contacting his place of employment. In this case, it is likely that the desired disciplinary effect will be achieved.

- After transferring a court decision to collect alimony obligations from a military pension to the bailiffs, then the recipient needs to constantly maintain contact with employees and monitor the process of withholding payments. As practice shows, FSSP specialists often delay the procedure for collecting funds from the payer, violating the regulated deadlines. The reason for this: incompetence, workload, imperfection of the system, etc. Therefore, it is important for the claimant to independently notify the executors about the change of place of residence of the serviceman, his additional income or new property.

- In practice, it is not uncommon that when resolving issues regarding the assignment of alimony from a military personnel’s pension in court, it may take up to several months to obtain a satisfactory verdict on the claim. In this connection, when formulating requirements, it is necessary to initially assess their validity. Otherwise, the time spent on the proceedings may increase even more.

IMPORTANT

The effectiveness of the process of withholding alimony from a military personnel pension largely depends on how prepared the claimant is for this procedure. Therefore, before filing a claim or trying to reach an agreement with the debtor, you should study the regulations established by law, familiarize yourself with findings from practice and consider related features.

Comments Showing 0 of 0

Possible liability for failure to pay child support

In accordance with current legislation, a military personnel has the same obligations to make payments in favor of a child as other citizens. Accordingly, the penalties for ignoring payments are the same.

Provided that alimony is not paid intentionally for two or more months from the date of commencement of enforcement proceedings, the risk of administrative punishment increases.

The sanctions for the debtor are prescribed in Part 1 of Art. 5.35.1 Code of Administrative Offences. If there are no results from the measures taken, criminal liability arises in accordance with Article 157 of the Criminal Code of the Russian Federation.

At the same time, financial leverage is provided for influencing the defaulter. They consist in the collection of a penalty defined in Article 115 of the RF IC. Since August 2020, its amount is 0.1% for each day of delay in payment.

Finally, when the debtor belongs to the category of car enthusiasts, the bailiffs have the right to restrict him from driving the car. This requires that the accumulated amount of alimony debt exceed 10 thousand rubles.

For your information! Bailiffs have the right to initiate administrative proceedings or criminal proceedings against a citizen regarding alimony payments. Therefore, the recipient of funds must contact them.