, serious changes

were recently to the way pensions are formed.

The insurance and savings parts have become separate, independent types of benefits .

This raises many questions among citizens.

In which fund the savings for savings contributions are located and how to find out, we will consider below.

What is a funded pension?

The funded pension is regulated by a separate federal law, which, among other things, establishes its definition.

So, it looks like this:

- cash payment;

- provided to citizens once a calendar month;

- aiming to compensate them for financial losses due to termination of employment due to the age established by law;

- consisting of the pension savings of a working citizen;

- formed on a separate personal account of the insured person.

Reference! The size of the funded pension, by law, depends solely on the amount of funds that were transferred by the citizen himself or his employer within the framework of the funded part.

Accordingly, the money that has already been accumulated by a citizen and is managed by a state or non-state pension fund constitutes his pension savings. A citizen’s control over their placement and investment allows him to increase the total amount, and therefore increase the increase in his pension at the expense of his own savings in the future.

Until 2014, the composition of insurance payments to the Pension Fund of the Russian Federation (22%) in different years included a certain part (recently 6% for those who chose this method of formation), which was not directed to the insurance (in fact, payments to current pensioners), and to the storage part. These funds constituted the future funded pension.

Nowadays, savings are not replenished , but those already made still belong to citizens, are managed by one or another organization and, if successfully invested, generate investment income.

Purpose of the contribution

The Pension Plus deposit is intended specifically for citizens receiving pension payments. These can be both labor pensions and disability accruals.

The purpose of the deposit is for an individual to receive regular income in the form of interest.

Thus, citizens who have retired due to age or have become disabled have the opportunity not only to reliably store their money in the most reputable financial company in Russia, but also to significantly increase it. Interest is accrued to pensioners according to the terms of the deposit.

Where can I place my funded pension?

Citizens retain the right to manage existing funds; they have the right to independently decide where to place their accumulated money.

In a global sense, insured persons have 2 options:

- Transfer the right to manage funds to the State Pension Fund of the Russian Federation.

- Place savings in the hands of a non-state pension fund.

The choice of a specific fund also completely depends on the decision of the person himself, based on the parameters of interest to him (the level of profitability and reliability, the founder of the fund, the number of participants, etc.). At the same time, management funds can be changed; the legislator only set a limit on the number of such changes. You can contact the Pension Fund of Russia with an application to change the NPF no more than once a year.

Important! When changing NPFs more often than once every 5 years, the insured person risks losing not only the funds accumulated as a result of investment, but also part of the principal amount if the profitability of the fund’s activities was negative. If the management company changes no more than once every 5 years, the state guarantees the safety of the principal amount of savings, as well as all investment income, if any.

NPF "Agrofond"

If you are a client of Agrofund, you can personally visit its branch with your passport. You can find out the address of the nearest branch on the website www.promagrofond.ru.

The second option is to send a written application by mail to the head office. You can write it in free form, but do not forget to indicate your passport and SNILS details.

And also your address, date and number of the agreement with this NPF. The application must be dated and signed at the bottom.

There is another way to find out about the funded part of your pension. Scan the application online and send it to one of these emails or

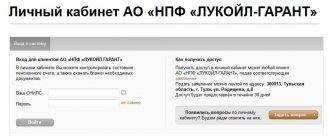

Also on the Agrofund website it is possible to create a personal account. To go through the registration procedure, you need to scan your passport (those pages containing the serial number, date of birth, full name, gender, photograph) and SNILS.

Before finalizing your personal account, you will have to fill out an electronic application to open it and check the “I agree with the processing of personal data” checkbox. The temporary password will be sent to the source you specified (email or phone) within ten days, and you must indicate your SNILS number as your login.

From a security point of view, after the first visit, the password must be rewritten to a more complex one. And after that you will be able to receive information about the funded part of your pension.

What to do if you don’t know where the funds are located

It is no secret to many that accumulative pension insurance agreements could be “offered” to citizens for signing in a bank, store, insurance company, etc. A citizen might not even know in which management fund his funds are located.

Since 2020, the procedure for selecting a non-state pension fund or transferring from one fund to another has been changed . From now on, the insured person can apply to the Pension Fund only in person (including electronically). Therefore, such semi-legal schemes have since been suppressed by the legislator.

Since a similar scheme could have been applied previously, it is important to carry out regular periodic monitoring of the placement of such funds, including the management organization and the result of its investment activities.

And for this it is necessary to obtain the relevant information using one of the tools offered by the state. It is worth mentioning right away that it is not difficult to obtain such information; it must be provided to the citizen upon his request.

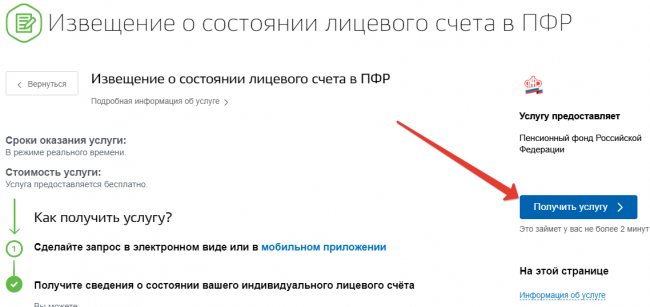

Obtaining information on the State Services portal

The second way is to go to the State Services website. If you have not yet opened an account on this portal (gosuslugi.ru), you will first have to register and create a personal account.

Expert opinion

Smirnov Vladislav Vyacheslavovich

Legal consultant with 10 years of experience. Specialization: family law. Law teacher.

There is also a simplified form. If you chose this option, you will need to indicate your last name, first name, patronymic, email and telephone number, and then click the “Register” button.

You will receive an SMS confirming your data (or an email). Next, you need to click the “Continue” button and enter the password twice.

After this, you will be given limited access to the portal's capabilities. Unfortunately, they are not enough to get a report on savings in a retirement account.

Therefore, next, what you will need to do is indicate the series, passport number, place and date of registration, as well as the number of the insurance certificate. The verification procedure will take a few minutes, and after that you will receive information about the results by phone or email.

Then you will be assigned an account on the State Services website. But that is not all.

Verification of your identity will be required to receive full registration. You will need to come to a branch of the Russian Post, Rostelecom, MFC or other government service center with a passport.

You can also confirm your identity with an electronic signature or a card. This will complete the registration.

If your personal account on the State Services portal is already open, you will need to find the “Pension Fund” tab and click on the “Pension Savings” section. By clicking “Get information” you will see all your data regarding the funded part of the pension.

However, clients of non-state pension funds do not have the opportunity to track the status of the funded part on the State Services website. What to do if you forgot the name of the organization where you invested your savings?

Step-by-step instructions: how to find out where the funded part of the pension is located

As of 2020, an insured citizen has several ways to obtain information about his pension savings , in particular, the location of the funds. They are available to every person and can be chosen by them on the basis of greatest convenience.

To the Pension Fund

For a long time now, the Russian Pension Fund has not sent citizens notifications about the status of their individual pension account. However, the law provides for the right of every citizen to apply for the provision of this information to the authority.

Attention! The provision of this service is free for citizens, and the number of requests is not limited.

What you need to check your savings funds at the Pension Fund:

- Form an application to provide information about the status of the individual personal account of the insured person. Its form is approved by the Pension Fund and must be used when submitting applications. But theoretically, the Pension Fund does not have the right to refuse to provide information even if the application is drawn up in free form but contains all the necessary information. The application form can be downloaded on the Internet or obtained from the territorial office of the Pension Fund.

- Submit an application to any division of the Pension Fund of Russia that works with clients. The request can be sent by mail or during a personal visit to the authority.

- Receive the requested information. The method of receipt is chosen by the applicant in the request: personal receipt of the response from the body to which the request was submitted, or registered mail.

The citizen receives a complete statement, which also contains the chosen method of placement of the funded part: in the PRF or NPF, as well as the name of the fund when choosing the method of placement in a private organization.

The necessary information is indicated in block 4 of the statement. It indicates who is the citizen’s insurer for pension savings, and from what date. The statement also contains information about the amount of savings and the result of their investment by the fund.

At work

It will not be possible to obtain information in this way for 2 reasons:

- from 2020, there will be no contributions to the funded part of the pension;

- the employer in any case transfers insurance contributions to the Pension Fund account and does not have information about the insurer of its employees.

In the bank

Any branch of Sberbank is ready to provide citizens with the same extract. Once a year, a citizen can receive it through Sberbank free of charge.

To do this you need:

- Prepare your passport and SNILS.

- Visit any Sberbank branch.

- Present the documents to the bank employee.

- Create a request using it.

- Get the necessary information.

Information is provided to the citizen immediately; an additional visit is not required to obtain it.

Advantages of the Pension Plus deposit

Sberbank has several deposit offers that are available to pensioners. However, among them, elderly people or people with disabilities most often choose “Pension Plus”. The benefits of this offer are:

- Opportunities to place an amount starting from 1 ruble on a savings account. Then you can replenish the deposit by making transfers from a pension or salary card. By the way, transfers between Sberbank’s own accounts are not subject to commission;

- Unlimited maximum deposit size;

- Possibility of replenishing the deposit throughout the entire period of its validity;

- Possibility of partial withdrawal of funds from the account along with interest up to the level of the minimum balance (1 rub.);

- Attractive interest rate (3.5% per year);

- Possibility to close an account at any time without loss of income.

Also, the advantages of the “Pension Plus” deposit are: a minimum package of required documents (Russian passport and pension certificate), convenience of registering a deposit (in a matter of minutes at a bank branch), security of storing funds, regular receipt of profit (every 3 months).

Quick application form

Fill out the application now and receive money in 30 minutes

Is it possible to find out online without leaving home using SNILS

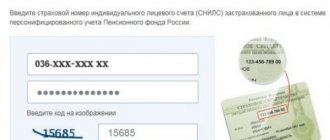

Using just one insurance certificate, you can obtain information about pension savings only in a citizen’s personal account in a non-state pension fund . But for this we need to know it, and this is what we need to find out.

Therefore, the only way left to obtain information without leaving home is to use your personal account on the Pension Fund website or on the government services portal. In both cases, you must have a verified account. Information can be sent to a citizen either in the form of an electronic document or by post.

Thus, you can obtain information about the insurer regarding the funded pension on the government services portal, in the citizen’s personal account on the Pension Fund website, during a personal visit to this body, sending a written request to it, as well as through any branch of Sberbank PJSC.

Find out through personal contact

You can request information about your affiliation with one of the Funds from the state Pension Fund, one of its partner banks, or at work from your accountant.

To the Pension Fund

The most logical solution is to go to the Pension Fund at your place of registration. You will seek a simple consultation, and the government agency does not have the right to refuse you this service. If you are not tied to a regular Fund, the specialist will immediately notice this in the database and will be able to tell you which organization is saving your savings for retirement instead.

You can’t just come to the Pension Fund; you will need the following documents:

- Your SNILS (you must have it, like all citizens of the country). It is recommended to bring the entire Pension Insurance Certificate card, and not just dictate the number to the specialist (the Pension Fund may not accept such information).

- Your passport with registration to confirm your identity and possible affiliation with this particular local Pension Fund.

You can verify your identity at a state fund only with a passport; no other document is suitable. Also, if you decide not to obtain information yourself, but to hand over your documents to a relative for this purpose, be prepared to receive a refusal to issue information.

Such data can only be requested from the Pension Fund in person and in extreme cases with a power of attorney, but this is not encouraged and can cause more headaches.

Information is not provided immediately - checking in the database takes up to 10 days (only workers are counted). If you decide to receive information by regular mail and write this in your application, the period may be extended due to the work of the Russian Post.

In the bank

The state Pension Fund has partners through which the Fund transfers funds to pensioners. The list usually contains 5-6 banks and it remains unchanged over the years.

The most important partner is, of course, Sberbank of Russia. Next come Gazprom Bank, VTB and UralSib. In addition, the Bank of Moscow also represents the interests of the Pension Fund in the capital.

When you contact one of these credit institutions, you will be able to receive a statement about the status of your personal pension account, and most importantly, where exactly it is located.

The application must be accompanied by the same documents:

- Your passport.

- SNILS.

A bank employee has the right to make a photocopy of these documents to be attached to the application. The timing for providing information varies and can range from 1-10 days. Sometimes it is possible to obtain information immediately if the technical equipment of the partner bank allows it.

At work

Information about what deductions from your salary go where is also stored by the accountant of the organization where you work. The option that the accounting department refuses to provide this information is not and cannot be. By law, you are responsible for your pension savings, and you have the right to be informed about it.

Expert opinion

Smirnov Vladislav Vyacheslavovich

Legal consultant with 10 years of experience. Specialization: family law. Law teacher.

The employer himself cannot redirect your contributions to another fund - you must sign an agreement with this new fund to do this. It’s another matter if at some point you were obliged to do this, and you forgot that this happened.

Important! If your employer forced you to transfer your savings to a non-state pension fund, he violated your right to freely dispose of your future pension. This action is punishable under the Criminal Code of the Russian Federation.

To obtain information, it is enough to inform the accounting department that you need this information - usually there is an employee there who is responsible for writing off funds from your salary for a pension in a non-state pension fund or Pension Fund. There is no need to provide documents, but just in case, take your SNILS and passport.

NPF "Sberbank"

When you personally contact Sberbank about pension savings (if you are its client), you will need to provide an agreement, passport and SNILS. If you open a personal account on the website www.npfsberbanka.ru, then obtaining information in the future will become more convenient.

To do this, you will need to enter all the requested data. The account will become accessible only after signing an agreement on pension insurance, consent to the processing of personal data and the availability of a pension account with NPF Sberbank.

You can apply to other non-governmental pension funds in the same way: the methods are approximately the same. You need to find out the address or website of the organization and its hotline.

And for any application or registration of a personal account, you will definitely need your passport data and SNILS number. A strict verification procedure when registering on sites is associated with increased security of your pension deposits.

From the article you received the answer to the question of how to find out where my funded part of the pension is.

Transferring the funded part of a pension to a non-state pension fund allows investors to invest their savings and receive additional income. But when changing a private pension company, difficulties sometimes arise: delayed payments, loss of interest.

Expert opinion

Smirnov Vladislav Vyacheslavovich

Legal consultant with 10 years of experience. Specialization: family law. Law teacher.

To avoid financial problems when receiving a funded pension from a non-state pension fund, investors are advised to regularly monitor the status of their individual personal account.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.