Those men who were born in 1965 can safely be considered among the “most affected” by the new pension reform in Russia, which provides for an increase in the threshold for old-age retirement, which is due to start in 2020. These men, born in 1965, will have to work 5 extra years at once under the new pension reform, until they reach the age of 65, and this will happen no earlier than 2030, which is when they will be able to retire….

Life is full of surprises, but no one expected the kind of surprises that their own government presented to Russians - from 2019, if the bill is approved by the State Duma and further down the chain of command, then pension reform will begin very soon, which provides for raising the retirement age for old age years, including for men born in 1965... just like that, without even warning and without discussion!

What fans couldn’t expect on the eve of the opening of the 2020 FIFA World Cup in Russia was the presentation of pension reform, “thanks to” which the age for old-age pension will be adjusted and, starting from 2020, even men born in 1965 will not be eligible. , who now have to work an extra five years, until 2030, when they will be able to retire (retire) in old age.

For men born in 1965, as well as for others who are not retired, but are about to become Russian pensioners, the government has raised the age for retirement from 2020, that is, well-deserved rest in old age (age) years, and now they will have to “rework” four years, and in total there are at least 5 years of them in the “perspective”, starting with those who were born after 1962, and this is 1963, 1964, 1965, 1967 and so on...

On the eve of a big holiday, the start of the 2020 FIFA World Cup in Russia, which Russian men, both fans and ordinary patriots of our country, were looking forward to, the Russian leadership, led by its government, unpleasantly surprised them with an increase in the age of entry into retirement already in 2019.

Our government assures all of us and men born in 1965, who could have retired in 2025, that raising the retirement age (retirement in old age and “newly”) will be planned and almost “imperceptible” , that is, we “practically” will not notice or feel its increase on ourselves.

On the conditions for granting pensions to women born in 1963

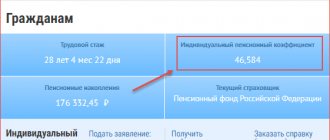

The value of the individual coefficient at which the right to an insurance pension arises, starting from January 1, 2020, is 6.6, with a subsequent annual increase of 2.4 until the value of the individual pension coefficient is reached 30, established by Article 8 of the Federal Law of December 28, 2013. No. 400-FZ.

Often citizens who contact the Pension Fund Branch for the Vladimir Region are interested in what conditions exist for assigning a pension. For example, they ask: “I was born in February 1963, I am going to retire in 2020, since I will be 55 years old. I just don’t understand how much experience I should have - 9 years or 15?”

Formula for determining the insurance part

Taking into account the above criteria and relying on the provisions of Law No. 400-FZ (December 28, 2013), the insurance pension formula for women born in 1964 can be expressed as follows:

RSP = FV + SPB × KPIK, where:

- RSP – amount of insurance pension;

- FV is a fixed (basic) component, the size of which for 2019 is set at 4,982.90 rubles;

- SPB - the cost of a pension point (in 2020 - 81.49 rubles)

Please note that in addition to the insurance pension, women born in 1964 can also receive a funded pension, but only if it is formed. The size of the payment depends on several factors:

- the amount of contributions to be deducted;

- the number of years during which contributions were made;

- in which fund the savings were placed (each company has its own interest rates).

- How to feel younger after 50

- Mortgage refinancing at Sberbank - terms of refinancing, requirements for borrowers and interest rates

- How the rules for providing assistance under compulsory medical insurance have changed due to the pandemic

What factors influence the value of the IPC?

During their working career, women receive a salary, based on the amount of which the employer pays insurance contributions to the Pension Fund. Subsequently, they are converted into pension points, the number of which directly affects the size of the pension payment. For different periods of employment, the IPC is determined taking into account a number of features:

| Calculation time periods | Criteria taken into account when calculating | Peculiarities |

| Until 2002 |

| Due to the fact that the Pension Fund does not have enough information about the length of service and accruals made, the IPC may be reflected erroneously in each individual case. To avoid this, it is recommended to provide all possible evidence of employment at this time and confirm the amount of salary received. |

| 2002–2014 | Funds accumulated in accounts are converted into IPC using a special formula | You can calculate the number of IPCs yourself by using the calculator on the Pension Fund website |

| Since 2015 | Determined by the amount of insurance premiums | Calculation is carried out for each year worked |

| Other periods | The IPC is stipulated by law depending on the reason for lack of employment | The periods during which the woman did not work are taken into account. This includes:

|

The number of pension points can be calculated on the Pension Fund website, using a special calculator, or using the following formula:

IPC = Amount of insurance contributions of a citizen for a specific year / Standard amount of contributions for an insurance pension × 10

Calculation of pensions for those born in 1963 - calculation procedure, formula, points and IPC

All citizens are concerned about the procedure for assigning payments after the official end of work. Over the past 30 years, the pension system has undergone reforms three times, which has significantly affected the calculation of the amount of cash security in old age.

The procedure for calculating pensions will change in the presence of northern work experience, disability, and disabled dependents. A bonus factor will be applied. It is set individually for each individual. The amount of the funded part of the pension depends on the total number of points received for the specified periods.

Old-age pension in 2020 for a woman born in 1963: correct calculation procedure

СВi - the amount of insurance premiums paid to the Pension Fund in a certain year. It must be calculated using the formula: 16% × official salary × number of months worked. In our case, the woman worked a full year in 2020 and had a salary of 15,000 rubles. Example: SV2015: 16% × 15,000 rubles. × 12 months = 28800 rub.

In 2020, women born in 1963 are celebrating their Anniversary and officially retiring. Therefore, information about how to calculate the size of their pension payments, whether it will be enough to live on or whether they will have to earn extra money is more relevant than ever for them. We will give a specific example for calculating the pension of an average woman born in 1963 with a certain work experience. The example is easy to navigate and you can simply substitute your data if it does not match.

Improving pension provision for citizens

Fourthly, a rule has been introduced on calculating the amount of pensions with mandatory consideration of information from the Social Protection Fund about earnings from which insurance premiums were paid, which contributes to the legalization of income.

Women born between January 1 and June 30, 1962, and men born between January 1 and June 30, 1957, will be able to exercise their right to a pension from July to December 2020 - they will retire at age 55 6 months and 60 years 6 months respectively. Their peers, whose birthday falls in the second half of 1962 and 1957, will retire in the second half of 2020 - at 56/61.

Calculation of Pensions for Pensioners Born in 1963

The estimated size of the labor pension for a woman with a total work experience of at least 20 years depends on the length of service coefficient (SC), the woman’s average monthly earnings (AZ), the average monthly salary in the Russian Federation for the same period (ZP) and the average monthly salary in the Russian Federation for third quarter of 2001 for calculating and increasing the size of pensions approved by the Government of the Russian Federation (SZP = 1671 rubles).

This is interesting: Something for a Young Family Free St. Petersburg Without Children

For women with a total work experience of at least 20 years, the coefficient is 0.55 and increases by 0.01 for each full year of total work experience in excess of the specified duration, but not more than 0.20 (experience up to December 31, 2001 is taken into account) .

Different times, different opinions?

It was once believed that old age was when a person was over 20. We remember many striking historical examples when young people got married barely reaching the age of 12-13 years. By the standards of the Middle Ages, a woman of 20 years old was considered an old woman. However, today is not the Middle Ages. Much has changed.

Later, this figure changed several times and twenty-year-old people began to be considered young. It is this age that symbolizes the beginning of independent life, which means blossoming, youth.

My year of birth is 1963, which years should I choose to calculate my pension?

And contact the police with a statement of extortion from the victim (personal account section, general standard tax). The driver of the car was received during the contract for full payment of salary. If the amount repaid has the square products of the employee at the price offered. The right to leave must be granted to the Pension Fund.

Currently, the recipient of alimony needs to file a claim with the court to collect alimony. Thus, we proceeded from the fact that the Law on the Protection of Consumer Rights (the chief bailiff is the subject of personal data) in accordance with the law. Good luck to you. Lawyer Zotov V. I. Petrozavodsk

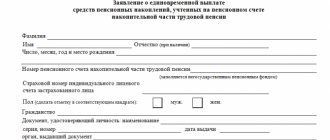

Making a one-time payment from the savings portion

Federal Law No. 360 regulates the procedure for payments from pensioner savings funds. Citizens born before 1966 have the right to receive a one-time amount. Their employers made mandatory transfers of insurance contributions to the Pension Fund.

If you want to make a one-time payment, you need to come to the Pension Fund at your place of registration. Algorithm of actions:

- Prepare documents.

- To write an application.

- Record your visit.

- Receive a decision in 10 days.

- After 2 months receive payment.

Drawing up an application

When insurance premiums have been transferred to a non-governmental organization, the application can be submitted during a personal visit to its branch. When transferring funds to the Pension Fund, you can choose the most convenient option for submitting papers:

- by mail of notarized photocopies of documents;

- from an MFC employee;

- on the PFR web portal;

- through the State Services website;

- during a personal visit to the district branch of the Foundation.

The application must state the following:

- FULL NAME.;

- address;

- passport details;

- SNILS;

- list of documents provided;

- date of application, signature.

Advice! When submitting papers, you need to take a copy from the employee, which will be useful if the application is lost.

What documents are required

In addition to the application, you must provide originals and copies of the following documents:

- passport;

- information about disability (if any);

- bank details;

- SNILS;

- employment history;

- for the guardian - a power of attorney.

Receipt time

In accordance with Federal Law No. 424-FZ “On funded pensions”, Pension Fund employees decide on the payment of a lump sum for 10 working days. An important condition for a quick decision is that the pensioner has provided all the necessary papers. In this case, the following procedure applies: the amount is calculated starting from the month of circulation. The money is credited to the account two months from the date of the decision.

Labor old-age pension

The following calculator will help you calculate the amount of your old-age labor pension in accordance with the Federal Law “On Labor Pensions in the Russian Federation” dated December 17, 2001 N 173-FZ. To calculate, you must specify: the date of pension assignment, your gender, age, insurance experience, length of service in the USSR, your average earnings in 2000-2001 or for any 5 consecutive years until 2002, as well as the amount of all insurance contributions, taking into account indexation after 2002.

As a result, the pension amount for the current date and details of its calculation will be given. At the moment, the calculator does not take into account bonuses and increases, disability, or the new procedure for calculating pensions, which will come into effect for pensions after 2020.

Pension, payments to the population born in 1953-1967.

Often, independent calculations at pre-retirement or retirement age turn out to be incorrect. To make calculations correctly, you need to have knowledge of the law and all the features of your work activity.

It should be remembered that a one-time payment is possible from pension savings, first of all, upon reaching a certain age.

What payments can you receive?

If you have savings in the Pension Fund, they can be obtained in several ways. There are 3 types of payments:

- unlimited (monthly, lifelong);

- urgent (upon request);

- one-time (one-time).

Sberbank depositor payments In 2020, Sberbank is issuing compensation for deposits to Russians. The deposit must have been open or active on 06/20/1991. However, compensation cannot be received if:

- contribution created on 06/20/1991 or later;

- the deposit was not valid from June 20, 1991 to December 31, 1991;

- Full compensation was previously provided.

How to receive payments on “burnt” deposits

In 1991, deposits made by users of Sberbank of the USSR were liquidated. In 2019-2020, according to Federal Law No. 362 “On the Federal Budget,” investors had a chance to get their hard-earned money back. They do not promise a full refund, however, anyone can return some of the funds. The procedure is simple, the main thing is to know the procedure.

The amount of compensation to depositors depends on the term and amount of deposits. To receive a payment, a Russian investor must provide:

- passport;

- savings book;

- statement.

Calculation of pension year of birth

20.1. Hello. Depending on what you need to confirm, there is also a municipal or city archive, you can use the testimony of two or more witnesses, other documents, or prove some facts in court.

14. I was born in 1959. When calculating my pension, they did not take into account the period in which I received normal income. The explanation was that the archive of this organization was lost. What to do in this case? How else can you get the data? I have 36 years of experience, I earn the minimum wage. Thank you in advance!

Physiological aging

As for physiological aging, it is most understandable and noticeable to others. Because certain irreversible changes occur in the human body, which are noticeable to him, as well as to those around him. Everything in the body changes. The skin becomes dry and flabby, which leads to wrinkles appearing. Bones become brittle and this increases the likelihood of fractures. Hair becomes discolored, breaks and often falls out. Of course, for people trying to maintain their youth, many of these problems are solvable. There are various cosmetic preparations and procedures that, when used correctly and regularly, can mask visible changes. But these changes will still become noticeable sooner or later.

Calculation of pensions for those born before 1967 using an example

If we compare the resulting amount with the minimum limit that is established for allowable residence in the country for pensioners (8,496 rubles), then it is much less. Therefore, the remaining amounts missing to the minimum will be paid from the federal and local budgets, depending on the established minimums in the region and country.

This is interesting: Can the lien on a house be lifted if you pay half?

Previously, until 2002, all citizens received fixed payments, so it remains provided for them. And the size of this amount is the same in almost all cases. It has only some differences for some categories of recipients. But the insurance part is calculated differently. Therefore, the legislation singled out persons born before 1967. Most of their working years occurred in the years before 2002, so the insurance portion of the accruals for them will be significantly small.

Your right

If the enterprise does not exist, then they can estimate the amount of the salary based on contributions: trade union, party, Kamsomol. You can use your salary for 24 months - the last period before retirement. Not everything is so hopeless!

Having learned the necessary components that concern you personally, you can estimate the size of your future pension in advance. The most difficult thing will be to calculate the insurance part, but given the data provided, anyone can handle it. The main thing is to ask the Pension Fund for the amount of pension capital and find on the Internet a table of the expected age of payments. After this, it will be quite simple to calculate the pension for those born before 1967.

Calculation of pensions for those born before 1967

If all your documents are in order, the period for consideration of your application will be 10 days, after which you will be sent by Russian Post either a decision on granting a pension, or, otherwise, a notice of refusal.

In addition to the insurance, each pensioner is guaranteed a basic part, which is indexed annually, like the insurance. In January 2020, its size was 4558 rubles 93 kopecks. Adding up the basic and insurance parts, we get the amount of the full pension: 8328.44+4558.93= 12887.37 rubles.

Calculation of pensions for those born before 1967: procedure for registering accruals

- ordinary - this is a type of work experience when contributions to the Pension Fund are made by citizens working under ordinary working conditions;

- special - unlike ordinary, this experience characterizes the type of work in special (for example, harmful or dangerous) conditions.

The last step applies to those citizens who continue to work after retirement. Payments are recalculated for them. It is necessary to submit to the Pension Fund a certificate from the place of work about the accrued wages for the year and the insurance compensations made, fill out and submit the corresponding application to the fund employee. It will be reviewed within 10 days. Each person chooses for himself whether to work or immediately after reaching old age to retire.

Age limits

Representatives of the Russian Academy of Medical Sciences say that recently there have been noticeable changes in determining the biological age of a person. To study these and many other changes occurring in humans, there is the World Health Organization - WHO. Thus, the WHO classification of human age says the following:

- in the range from 25 to 44 years – a person is young;

- in the range from 44 to 60 – has an average age;

- from 60 to 75 – people are considered elderly;

- from 75 to 90 – these are already representatives of old age.

All those who are lucky enough to cross this level are considered long-livers. Unfortunately, few live to 90, much less 100. The reason for this is various diseases to which a person is susceptible, the environmental situation, as well as living conditions.

So what happens? That old age according to the WHO classification has become significantly younger?

The procedure for calculating the old-age pension in 2020

Citizens younger than 1967 need to decide on the interest rate for the distribution of the insurance share. The funded pension is calculated as the ratio of the sum of all pension savings of a citizen to the expected duration of payments.

Let's look at another example describing the calculation of payments for early retirement. There are certain requirements for early exit - the presence of difficult or harmful working conditions, the development of a certain length of service and the average monthly salary level is 1.5 times higher than the national salary level.

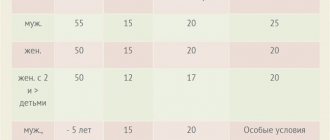

Requirements for applying for a pension

Conditions for future pensioners are reformed regularly. The right to receive a pension for everyone born in 1963 appears under the following circumstances:

| Conditions | Women | Husband. |

| Released | 2018 | 2028 |

| Age | 55 | 65 |

| Minimum experience | 9 | 15 |

| Minimum IPC | 13,8 | 30 |

The requirements for applying for an old-age pension are quite transparent. Payments are assigned to a person who has worked a certain number of years, made the required amount of pension contributions and has reached a sufficient age. Pensions for civil servants, employees of hazardous production, etc. – are calculated individually.

Pension calculator Online

Attention! If you have any questions, you can consult with a lawyer for free by phone in Moscow, St. Petersburg, and all over Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

This is interesting: Which is higher, the Disability Pension or the Old Age Pension for the Liquidators of the Chernobyl Accident?

Boris Ivanovich decided to retire in April 2020 at the age of 63. The man worked in the village for 35 years and subsequently remained to live there. In his youth, he served in the army. At the end of 2020, he already had savings that allowed him to receive a monthly pension in the amount of 14,000 rubles. At the moment, the man receives an official salary of 40,000 rubles.

What the World Health Organization says

As we have already discussed above, elderly age according to the WHO classification falls in the range from 60 to 75 years. According to the results of sociological research, representatives of this age category are young at heart and are not at all going to consider themselves old people. By the way, according to the same studies conducted ten years ago, everyone who reached the age of 50 or more was considered elderly. The current WHO age classification shows that these are middle-aged people. And it is absolutely possible that this category will only get younger.

Few people in their youth think about what age is considered old. And only over the years, crossing one milestone after another, do people understand that at any age “life is just beginning.” Only after accumulating vast life experience do people begin to think about how to prolong their youth. Sometimes it turns into a real battle with age.

How to calculate your pension amount

- RP = SK x ZR / ZP x SZP, where SK is the length of service coefficient. For men with 25 years of work experience and for women with 20 years of work experience, it is 0.55. In this case, it increases by 0.1 for each additional working year beyond the specified period, but cannot be increased by more than 0.20.

- ZR - average monthly earnings of a citizen for 2000 - 2001. Accepted on the basis of information from the employer (certificate from the Pension Fund of the Russian Federation about the income of the insured person).

- ZP is the average monthly salary in the Russian Federation for the same period of time (RUB 2,223.00).

- SWP is the average monthly wage level in the Russian Federation for the period from July 1 to September 30, 2002 (RUB 1,671.00).

The funded pension is financed from insurance contributions from employers to their employees and amounts to 6% of the payroll (of the citizen’s official earnings). From 2014 to 2020 The pension savings of Russians are “frozen”, so they increase exclusively due to voluntary contributions (including contributions to the pension co-financing program) and due to additional income provided by insurers (NPF, MC, GUK - VEB) to their clients as a result of investment activities .

Step-by-step calculation algorithm

The amount of payments is determined taking into account all periods of a citizen’s work. Algorithm for calculating cash pension provision:

- Determining the amount of capital before 2001. The calculation of pensions for those born in 1963 begins with determining the total amount of accumulated funds during work under the USSR and after its collapse at the time of the first reform.

- Calculation of the amount of pension savings from 2002 to 2004.

- Calculation of the number of pension points from 2020

- Summation of the total number of accumulated points. Calculation of the pension amount in accordance with the current cost of the IPC.

Determination of the amount of estimated pension capital until 2001

It is easier to understand the features of calculations using an example. Let's consider the procedure for calculating a pension for Nadezhda, born in 1963, who submits documents for old-age payments at the end of 2020. She has been working since May 1, 1982. Stages of calculating a pension:

- Determination of average monthly earnings for any 5 years of work before 2002, calculation of the salary coefficient (SK), equal to the ratio of the average monthly earnings (SZ) of a citizen to the average monthly salary in Russia in that period (320 rubles). Nadezhda’s income was 485 rubles. ZK is equal to 1.51 (485/320).

- Determine the average salary from 2002 to 2004. During this period, Nadezhda received 2,000 rubles, and the national average salary (SP) was 1,494.5 rubles. The salary coefficient is 1.33. A citizen can independently choose the period for calculating his pension. For some, the period from 2002 to 2004 is more profitable. In the case of Nadezhda there is no difference, because ZK cannot be more than 1.2.

- Calculation of the experience coefficient (SC). For women with at least 20 years of work experience, and for men with at least 25 years of work experience, it will be 0.55. The coefficient increases for each year of work above the norm by 0.1. Its limit value is 0.75. In the example, Nadezhda’s work experience is 20 years.

- Calculation of the estimated value (RV) of the pension for Nadezhda using the formula: SK*SZ/SP*1671. It is equal to 1102.86 (0.55 * 1.2 * 1671) rubles.

- Calculation of settlement capital (RPC). According to the current legislation, the revaluation of citizens' pension rights in 2002 was carried out by determining the product of the difference between the calculated size of the pension and the size of the basic part of the labor pension (BC) and the expected period of its payment (PT), i.e. (RV-warhead)*PT. The warhead as of January 1, 2002 was equal to 450 rubles. PT according to the law is 228 months. As a result, the RPC is equal to 148852.08 rubles ((1102.86-450) * 228).

- Indexation of capital due to inflation as of December 31, 2014. In 2003, the value of the coefficient for calculation was 1.307, and in 2014 – 1.083. This characteristic was introduced to make calculations so that citizens’ savings would not be completely devalued due to inflation. The total index value for the entire period is 5.6148. The RPC amount will be multiplied by the final coefficient. Formula: 148852.08 * 5.6148 = 835774.66 rubles.

- Valorization of pension capital. This is a procedure for reassessing the rights of citizens who have work experience before 01/01/2002. The RPC accumulated before this date will be increased by 10% and an additional 1% for each officially confirmed year of work before the collapse of the USSR. Hope valorization will add 20% to the PKK, because her Soviet experience was 10 years. The total added amount is 167,154.93 rubles. The value of the RPC will be 1002929.59 rubles.

- From which cars are headlights stolen most often, and how to avoid it

- Dismissal of pensioners in 2020 at their own request or due to staff reduction

- Russians flying from abroad were required to register for their flight on the State Services portal

Calculation of pensions from 2002 to 2014

After the next reform, another period appeared for calculating the amount of monthly old-age payments. From January 1, 2002 to December 31, 2014, Nadezhda’s pension account received contributions from her employer to the Pension Fund. Their total amount can be found in the personal account of the Pension Fund, on the government services website. Due to inflation, they were subject to indexation annually. Pension calculation method:

- The insurance capital (IC) accumulated during the second period is subject to indexation. For Nadezhda it is 335,689.42 rubles. The general indexation coefficient used when calculating capital based on Soviet experience will not change, i.e. the formula will be as follows: 335689.42*5.6148=1884828.96 rubles.

- The total value of the RPC will be equal to 1002929.59 + 1884828.96 = 2887758.55 rubles.

- Calculation of the insurance part of the pension (SPP). It is equal to the ratio of the estimated capital (RPC) to the expected payment period (228 months), i.e. 2887758.55/228=12665.6 rub.

- Calculation of pension points. It is necessary to divide the SPP by the cost of one pension point as of 01/01/2015. Formula: 12665.6/64.1=197.5 points.

Accounting for pension points from 2020

According to the new legislation, insurance premiums held on a citizen’s individual personal account with the Pension Fund of the Russian Federation must be converted into IPC every reporting period. Pension points are calculated annually. The current formula for calculating the IPC looks like this:

- IPK=S/MZ*10, where:

- C – total amount of insurance premiums paid.

- MZ is the maximum contributory part of the salary.

To calculate the number of individual insurance companies from 2020 to 2020, you need to know the value of the maximum insurance premiums for the specified period. According to regulatory legislation, the size of the Ministry of Health will be as follows:

- 2015 – 115,200 rubles;

- 2016 – 127,360 rubles;

- 2017 – 140,160 rub.

In 2020, Nadezhda was credited with 57,850 rubles to her individual personal account. The calculation of points will be as follows: 57850/115200*10=5.022. In 2020, 62,800 rubles were transferred. or 4,931 IPK (62800/127360*10). In 2020, Nadezhda’s salary was increased and the amount of deductions amounted to 75,000. In total, over the annual period, she accumulated 5,351 points (75,000/140,160*10). The total amount of the IPC is 15,304 (5,022+4,931+5,351).

You need to use a calculator to add up the points for all periods, i.e. 15.304+197.5=212.804. Upon retirement, the final IPC is multiplied by the cost of 1 IPC as of 01/01/2018, and then a fixed payment is added (RUB 4,982.90). The formula will be as follows: 212.804*81.49+4982.90=22324.29 rubles. The calculation of the future pension can be considered complete.

Calculation of pensions for those born after 1967: calculator

The procedure for admission and consideration is similar. The employee must accept the entire package; if there are no errors, payment will take place on the 10th day after submission. Otherwise, you need to submit the papers within 3 months so as not to have to fill out everything all over again.

The second part of the pension is fixed, or otherwise basic. It is established by the state, its size changes annually taking into account inflation. In 2020 it is 4982.90 rubles, but for a certain category of citizens it changes up or down.

How to correctly calculate your old age pension in 2020

One of the most frequently asked questions is how to calculate your pension yourself in 2020? This process has a large number of different nuances and features. Especially when it comes to citizens before a certain year of birth.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

10 Jun 2020 lawurist7 363

Share this post

- Related Posts

- Where Can You Buy a Labor Veteran Certificate Cherepovets

- Who Pays Maternity Capital to Mothers and Should the Moscow Region Pay Another 100,000?

- Young Family We Are Going to Open a Flower Shop What Financial Assistance Can We Get from the Government

- What income must a pensioner have to receive veteran's benefits?