Since the beginning of the year, amendments have been introduced to the legislation of the Russian Federation. Thus, citizens of pre-retirement age can apply for unemployment benefits (USB). The retirement age is being raised. Employers are not particularly willing to hire people who are about to retire. Therefore, the state allows them to receive additional payments from the budget as social support. Since not everyone has complete information, let's look into everything in detail.

Who are pre-retirees?

Previously, pre-retirement people were people who had 2 years or less left before retirement. Now this concept has been revised. In your own words, in a new way, pre-retirement age is when you have 5 years or less left before your well-deserved rest. This is all reflected in the legislation (paragraph 6, paragraph 2, article 5 of the Law “On Employment...” dated April 19, 1992 No. 1032-1).

In 2020, retirement age is considered to be 60.5 years for men and 55.5 years for women.

In the future, the retirement age will increase every year until it reaches 60 years for women and 65 years for men. In 2020, pre-retirement age is 51 for women and 55 for men. If you have the right to early retirement, you can become a pre-retirement earlier.

Since 2020, the Pension Fund began issuing information about citizens belonging to the category of pre-retirement age. The Fund can send information in any form: by mail, the personal account of the insured person or in another way. You can order a certificate online directly on the Pension Fund website (section “Pensions”), you will need to register with the State Services. Find out about receiving unemployment benefits through the State Services Internet portal here.

Also, every employer is now required to submit reports to the Pension Fund about such employees.

Robots for automated trading

I want to share with you another opportunity to make money - trading using special programs for automatic analysis and conclusion of transactions. Nowadays you can find a huge variety of such robots and advisors. And in most cases they are created for the MetaTrader 4 and 5 terminal.

With their help, you can also earn 15-20% of net earnings from the amount of your deposit. But only in automatic mode. The robot will do everything on its own. You just need to optimize it and configure it correctly.

But this is one of the main difficulties and disadvantages of this method of earning money. And naturally - in choosing a high-quality robot. Now there are a huge number of robots on the network, but only a few of them are able to give us the desired result.

Moreover, it is difficult for beginners to install and configure the program, since they have to master the MT4 terminal itself, which is not easy.

I found a way out of this situation - robots for automatic earnings Abi and Autocrypto-Bot. They are presented in the web version of your browser, and setup will not take more than a minute. Everything is simple and accessible even to those who have heard about trading for the first time, but want to make big money from trading in financial markets.

You can learn how to set up a robot for profitable work from the corresponding section on my website.

How long can this category of citizens receive PBR?

Practice shows that employers do not want to hire older people , since they may soon retire and will have to look for a new employee (do they pay unemployment benefits to pensioners?). In 2020, the state had to take measures of additional social support for this category of people. By registering with the employment center, they can receive financial assistance in the form of unemployment benefits.

Payments to the unemployed may not be received for life, only for a short period until retirement.

But this is definitely good social support in between job searches. Moreover, the terms of payment of benefits to people before retirement are higher than for all other citizens: 12 months over a year and a half, and with long experience - 24 months over 3 years.

At the same time, ordinary citizens can receive benefits for a maximum of 6 months during the year , and some only for three months.

To receive benefits for 2 years, you must have at least 20 years of insurance experience for women and 25 years for men (is unemployment benefits included in the insurance period?).

Larisa Luzhina - 62 thousand rubles

The Soviet actress is also not in poverty, but she doesn’t really rely on government transfers. Luzhina acts on television, receiving about 15-30 thousand rubles. for participation in the show and 12-15 thousand rubles. - her salary in the theater.

In addition, the woman receives a payment as a person who survived the siege of Leningrad.

What is the minimum amount and how is the amount calculated?

Since 2020, citizens belonging to the category of persons of pre-retirement age receive benefits according to special rules, preferential ones.

The amount to be paid to a pre-retirement employee depends on the period of work in the last place. If the duration is more than 6 months, then the benefit is calculated as a percentage based on wages for the last 3 months. For citizens of pre-retirement age, 75% of the average wage for the first three months is taken into account. Then 60% over the next four months. Afterwards, only 45% of average earnings are paid.

- The maximum amount of payments to unemployed citizens of the pre-retirement period is 12,130 rubles.

- The minimum level of payment during the entire period will be 1,500 rubles, this is if you worked at your last place of work for less than 6 months.

These amounts of unemployment benefits are reviewed annually by the Government of the Russian Federation , but they are not always increased. The maximum and minimum amount of unemployment benefits is increased by regional coefficients if they are established in the area where the pre-retirement resident lives.

Let's look at the calculation of benefits using an example.

The man, born May 2, 1960, left his job in February 2020. Over the last 3 months, wages amounted to 18,000 rubles. Immediately after leaving work, he contacted the employment center. Work experience was 30 years.

The man is in the pre-retirement period, and in November, upon reaching 60.5 years old, he will be able to retire. Before this, it will be possible to apply for unemployment payments in accordance with the legislation of the Russian Federation.

The period during which a man will receive benefits is:

12 months + (30-25) * 2 weeks = 12 months 10 weeks, that is, 14 months 10 days.

- 30 – the value of the maximum length of service;

- 25 – the minimum length of service for a man;

- 2 weeks – increase in length of service for overtime in excess of the minimum length of service.

How much benefit is paid:

For the first 3 months (March, April, May) after dismissal, he could receive payments: 18,000 * 75% = 13,500 rubles.

But according to the law, there is a maximum limit on payment - 12,130 rubles. A man will not be entitled to receive more than this amount. Therefore, for 3 months he will receive 12,130 rubles.

The next 4 months (June, July, August): 18,000 * 60% = 10,800 rubles.

Then for 7 months 10 days: 18,000 * 45% = 8,100 rubles.

In November, a man can apply for a pension, and then these payments will stop.

Pre-retirees who were dismissed during the liquidation of a company or due to staff reduction have the right to apply for an early pension through the employment center. Two conditions: the employment center could not find a suitable job, no more than 2 years until retirement (Article 32 of the Law “On Employment...” dated April 19, 1992 No. 1032-1).

Find out more information about how unemployment benefits are calculated in a separate article.

Calculation rules

To determine the optimal payment amount, average earnings are taken into account. If a person did not have a place of employment, then he can rely solely on the minimum value. But it cannot be less than the subsistence level, so the state increases the payment based on regional indicators.

In the first three months after dismissal, citizens receive 75% of their previous earnings. After 3 months, 60% of this value is issued . Afterwards, the money is not paid, but the citizen can still use the services of the center to find a place of employment.

How to apply - procedure

The procedure for receiving payments by an unemployed pre-retirement person is similar to the procedure for any unemployed person. The essence is the same, only the benefits differ. Let's look at the procedure:

- We contact the employment center to register as a job seeker (how to register with the labor exchange?). If you apply within 12 months after dismissal, the benefit will be increased, up to 12,130 rubles, if later - only 1,500 rubles.

- You need to have a package of documents with you:

- passport;

- employment history;

- certificate of income for the last 3 months from the last place of work;

- document on education, training, advanced training;

- rehabilitation card in case of disability and your inability to work.

- The employment center begins to select possible vacancies. If you have not found a job within 11 days, you will be considered unemployed. And it is from this moment that the calculation of unemployment benefits begins.

- Additionally you may need:

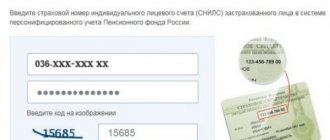

- SNILS;

- TIN;

- bank account details for transferring funds.

- Next, we visit the employment center 1-2 times a month to re-register and receive new vacancies.

- You may also be sent to retraining courses, and a stipend is paid throughout your studies.

During 2020, a temporary procedure for registering for unemployment and receiving benefits is in effect. You can register remotely, without leaving your home: through the “Work in Russia” and State Services portals. For those who quit and registered after March 1, 2020, increased benefits have been introduced: from April to June they will be able to receive 12,130 rubles, regardless of lost earnings. For minor children they will pay another 3,000 rubles.

Read more details about where and how you can apply for unemployment benefits, what documents are needed and what the procedure for assigning payments is in a separate article.

What to do if a person does not like the places offered

The employment center offers citizens several options for employment. To do this, people first undergo interviews and also evaluate the conditions of the proposed job. Sometimes people who have been fired from a highly paid and prestigious position do not want to work under other conditions, so they are not satisfied with the vacancies offered.

But low earnings are not a valid reason for refusing employment. You can refuse a vacancy only if you need to move, violate labor standards or rules , and also if the offered salary is lower than the average income at your last place of work.

Attention! If a citizen refuses several vacancies, the payment of benefits automatically stops.

Payment terms and rules

As soon as you come to the employment center, declare yourself, register, you are immediately assigned benefits from this period.

In the event of dismissal as a result of downsizing or liquidation of the enterprise, funds from the Central Employment Center will begin to arrive after the period for maintaining the average level of wages for the employee has expired, which is three months from the date of dismissal (Article 178 of the Labor Code of the Russian Federation) and six - in case of dismissal at the Extreme North (Article 318 of the Labor Code of the Russian Federation).

You will receive payments every month, but only if you strictly comply with the requirements of the employment center where you are registered. It is necessary to visit the employment service regularly.

The innovations mentioned above regarding the increased amount of benefits for pre-retirees will be relevant for the group of people who were recognized as unemployed in 2020 or will be recognized in subsequent years. If a citizen received unemployed status before January 1, 2020, then benefits are calculated according to the rules that were in force before. This is indicated in paragraph 1 of Art. 10 Federal Law dated October 3, 2018 No. 350-FZ.

What pensions are social?

Social pension provision is regulated by Federal Law No. 166-FZ of December 15, 2001.

In accordance with its provisions (Article 11), social pensions are of the following types :

- SP for old age. Who receives: elderly citizens who have not earned the right to receive an insurance labor pension.

Note: if a citizen begins to engage in paid work, then social benefits for the period of employment are terminated;

- SP on disability . Who receives: disabled people of groups 1, 2 and 3,

- disabled people since childhood,

- disabled children;

- children under 18 years old,

Suspense

All grounds for suspension and complete termination of unemployment benefits are listed in Art. 35 of the Law “On Employment...” of April 19, 1992 No. 1032-1. Suspension is possible in case of not very serious violations, for a period of up to 1 month. However, the benefit period is not interrupted, meaning you will actually receive less money than you otherwise would have.

Let's look at some possible reasons for suspending unemployment benefits:

- refusal of two job offers from the Central Employment Center;

- visiting a health center while intoxicated;

- expulsion from training in the direction of the central educational center for guilty actions or unauthorized termination of training;

- violation of the deadlines for re-registration in the central registration center without a valid reason.

Read more about the reasons and rules for suspending or terminating unemployment benefits here.

Thus, from 2020, citizens have the opportunity to receive additional financial support from the state. Since it is not easy for pre-retirement people to find a job, the terms for paying unemployment benefits have been extended for them. Without working for a year or more, you can receive money from the employment center. The maximum payment amount is limited to 11,280 rubles, unless you live in an area with a higher coefficient for social payments.

Social pension is...

In order to exist, a person must eat, dress, and satisfy his other needs. While the child is small, his parents provide him with everything he needs. Over time, he begins to earn money himself, providing for himself and his children.

It so happened historically that every person on our planet lives in some state and is its citizen. When receiving income, he pays taxes to the state (what is that?).

For various reasons, a person may lose his livelihood . For example, having reached retirement age, becoming infirm as a result of illness, having lost the breadwinner on whom he was dependent (how is that?)

The state does not leave its citizens alone in trouble. It provides disabled people with a special regular cash benefit called a pension. The type of pension depends on the reason for its payment.

What does "social" mean?

Social pension (SP) is a regular monthly payment to a citizen from the state, independent of his work activity.

Such payments are called state pensions because they are financed from the federal (state) budget.

Let's sum it up

We have already found out to whom and under what conditions a social pension is assigned and paid, as well as what exactly it is intended for. All sizes of social pensions are established by the state apparatus, depending on which category the recipient belongs to, as well as on the type and type of the pension itself.

Social assistance is assigned in a fixed form, and its size directly depends on the subsistence level established in the state for a given period of time. There is an official practice of increasing and modernizing social standards, which prescribes annual indexation of pensions before the first of April, therefore, from year to year, the amount of social payments can grow noticeably and increase, but not decrease.

A pension cannot in any way be lower than the subsistence level, which is why the Pension Fund of the Russian Federation has provided for a social supplement to this type of payment, which equalizes the rights of citizens. To receive such an additional payment, you need to contact the pension fund with an application and provide all the necessary papers. Such a social supplement can be federal as well as regional, which means that the source of benefits is either the treasury of the country as a whole or the municipal regional budget.

Where to go

To apply for a social pension, you should contact the MFC or the Pension Fund of the Russian Federation.

The list of documents provided depends on the category of person. The required document for all cases is the applicant's passport. You will need to write an application.

Disabled persons provide a certificate of completion of a medical and social examination. In the event of the loss of a breadwinner, a death certificate or birth certificate of the child is presented. Upon reaching 18 years of age, to extend the period, you will need to provide a certificate from the place of study. It usually takes about 10 days to review documents.

Legislative regulation

The issue regarding payments to such citizens is regulated by the following legal acts:

- Constitution of the Russian Federation. It is she who guarantees all citizens the payment of security in old age. Art. 7 regulates the issue of a decent life for a pensioner, but Art. 39 stipulates the receipt of social security;

- Federal Law “On State Provision. It is this legal act that is considered the main basis for settlement operations;

- Federal Law No. 167 regulates the rules of insurance for all individuals;

- Federal Law No. 111 regulates the possibility of investing funds in the funded part of a pension;

- Federal Law No. 173 regulates the issue of receipt conditions, as well as the formula for calculating security.

Who receives a social pension in Russia

Who is entitled to a social pension is also stated in Federal Law No. 166-FZ:

- citizens of the Russian Federation;

- foreign citizens living in the Russian Federation for at least 15 years;

- stateless persons living in the Russian Federation for at least 15 years.

A citizen applying for a joint venture must be disabled .