Pension in Sweden occupies one of the leading positions in the world. This is a fairly rich country, whose authorities were able to provide its citizens with a decent life. The size of the pension in Sweden depends on many factors.

Panoramic view of the center of Stockholm

You can find out more about applying for a visa to visit Sweden on our website.

Return to contents

General pension

The general pension is a state pension (allmän pension) that is provided to everyone who has lived and worked in Sweden. It is paid through the Swedish Pensions Agency, which has an official website: www.pensionsmyndigheten.se. Every year, money earned during work, study or maternity leave is credited to the pension account of each citizen. The general pension consists of three parts: income-based pension (inkomstpension), premium pension (premiepension) and guarantee pension (garantipension). Earnings-based and bonus pensions can be taken from age 61. Guaranteed pension – from 65 years of age. In 2013, the average general state pension was CZK 8,900 (after tax). For 6% of Swedes receiving an old-age pension, the total pension did not exceed 3,600 crowns, for 34% it was in the range of 3,600–8,300 crowns. 7% of pensioners lived outside the country.

Help for the unemployed

Unemployment benefits in Sweden are paid to everyone who already worked in the country, but for one reason or another lost their job. Such payments are called arbetslöshetsförsäkringen

The average benefit amount is calculated by A-kassa employees. This is an insurance organization, of which every officially employed citizen is obliged to become a member.

During the period of his employment, a person makes contributions to the cash desk. If he is fired, benefits are paid from his savings.

When a person begins his working career, he needs to clarify which A-kassa covers the scope of activity of a particular company.

You can learn more about life in Sweden in the video below.

This information can be clarified from trade unions or from specialists in the HR department of the employing company.

One of the most important conditions for receiving financial assistance from the state is a clear length of service. A person must work at least 80 hours within six months. If a Swedish citizen worked part-time, then the total number of hours during six months is 480.

If during the billing period a person did not work for a valid reason, it is extended. Inpatient treatment and care of a small child is recognized as a valid reason.

Sometimes the billing period includes work in other countries of the European Union, as well as in Switzerland. This point needs to be clarified in advance with A-kassa specialists.

Return to contents

How is the benefit calculated?

Unemployment benefits are calculated as follows:

- It is based on average income for the last 12 months before dismissal.

- For the first 200 days, the applicant receives up to 79% of the average salary.

- All the following days the person receives 69% of the average salary.

For the first 3.5 months of receiving cash assistance, the applicant can count on 911 CZK/24 hours. The “ceiling” for the following days is 759 CZK.

Cash assistance is subject to income tax.

You can learn more about unemployment and benefits in Sweden from the video below.

Return to contents

How long does government assistance last?

The maximum that an unemployed person can count on is 300 days. For parents with small children, temporary cash assistance is paid for 450 days.

All this time, the unemployed must actively look for a new job.

If during a job search a person took part in one of the Aktivitetsstöd projects, this period is included in the future insurance period.

Return to contents

Memo to non-members of the cash desk

If a temporarily unemployed person who is 20 years old has not joined A-kassa, he will be paid Grundbelopp. Its size is 364 CZK/24 hours.

The calculation of such benefits is based not on the average salary, but on the number of hours worked. If there are few of them, then Grundbelopp will be small.

There are also private insurance policies available throughout the country in case of job loss. The managers of many companies encourage even their most valuable employees to purchase such insurance.

Return to contents

2. Premium pension

2.5% of wages and other taxable payments goes annually into a pension account for a future premium pension (premiepension). The money for this pension is invested in various funds consisting of securities or shares, of which there are numerous owners of different people. You decide for yourself which equity funds to invest your money in. When you put money into a fund, you are buying a small share of that fund. As the value of securities increases, you and other fund owners will receive more money. When the value of a fund's securities or shares declines, owners receive less cash. Thus, the size of the bonus pension depends on how much and in what funds the future pensioner has placed money, as well as on the development of the value of shares and securities held in them.

Labor pension for long service

The long-service pension (tjänstepension) is a salary deduction paid by the employer. Most people who are employed are entitled to such a pension. Students, unemployed people or those working in enterprises that do not have a collective labor agreement, as well as private entrepreneurs do not receive long-service pensions. There are several organizations that pay pensions for long service. They enter into contracts with various employers. The size and payments of such pensions vary depending on the decisions of trade unions and employers.

Nursing homes in Sweden

Many people deliberately choose boarding schools. Here they receive full medical and social care and communicate with peers. Nursing homes also provide a cultural program for residents. Accommodation in such boarding houses costs no more than a month's pension, so the services of the institutions are available to all elderly citizens.

Retirement age

In 1913, Parliament set the retirement age at 67 years. On July 1, 1976, it was reduced to 65 years. A person decides for himself when he wants to retire. The later you retire, the larger your monthly pension payments will be. Earnings-based and bonus pensions can be taken from age 61. The guaranteed pension is paid upon reaching 65 years of age. People usually retire at age 65, but they have the right to continue working until age 67. If you want to work longer than this period, you can negotiate this with your employer. You yourself can decide the amount of pension payments. You can receive from 25 to 100 percent of the accrued pension monthly. You can, for example, receive half of your pension benefits and continue to work part-time.

Private pension funds

Sweden also provides for such a measure to increase social protection as pension insurance funds.

A fund in Sweden, designed to ensure a dignified old age, is a very popular type of financial activity for citizens - 38% of Swedes transfer part of their income to increase their own pension savings.

There are two ways to participate in a private pension fund. First, become his client, which implies an individual pension plan, according to which a set amount is paid monthly. Another option is to simply open a special bank account, to which you can transfer any amount at any time, depending on your desire. The invested funds will be returned to the client either in the form of payments from the pension fund or in the form of bank interest.

The country also has a high level of medical and social services for pensioners. This social protection measure is guaranteed by the Health Law of 1982, which provides equal quality of medical services for all segments and groups of the population.

It is noteworthy that students who receive the profession of both doctors and paramedical workers undergo practical training in Sweden in a boarding home for the elderly. Among these trainees there are also immigrants from Russia and other countries of the post-Soviet space; students consider their participation in social assistance for the elderly to be a good experience in introducing them to the humanistic values of Swedish society.

Benefit for the elderly

Persons aged 65 who are not receiving a pension are entitled to old age benefits (äldreförsörjningsstöd). This benefit can also be paid to those who have a very small pension. In 2013, the average benefit for the elderly was 3,625 kroons (tax-free).

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ Comments from the author of the repost -

The average pension in Sweden is approximately 6-7 times higher than the average in Russia. Where did we sin so much, huh? :))

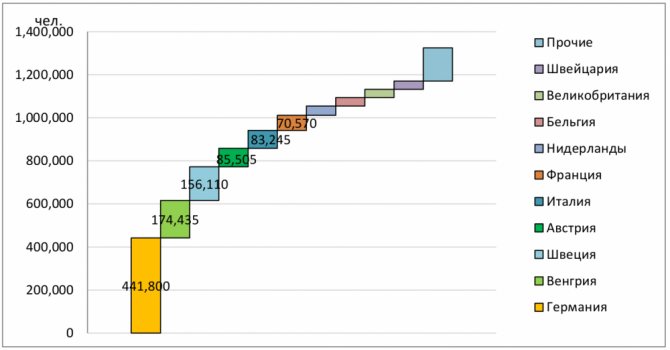

Help for refugees

Today the number of refugees in Sweden is 150 thousand people. Statistics show that the country is in 4th place in the ranking of the most popular countries among those seeking asylum.

The provisions on who can receive asylum in Sweden are set out in the UN Refugee Convention and Swedish law

If you do not take into account the strange sympathy of the country's authorities for hordes of people from the Middle East, the number of people wishing to receive protection in Sweden is quite strictly limited.

Assignment of the appropriate status to persons who are refugees is carried out on the basis of a quota. Today it is 1.7-1.8 thousand foreigners/12 months.

Sweden's migration rules cannot be called lenient, and often a person trying to obtain refugee status is faced with refusal.

The grounds for granting status must be very compelling.

Return to contents

Providing financial assistance

A single person, as well as a refugee couple who came to Sweden with a child, is provided with a daily allowance. To receive these funds, you must contact the Migration Office. You must have a corresponding application with you.

The benefit is designed for:

- nutrition;

- clothes and shoes;

- medical care;

- hygiene items;

- other consumer goods.

Number of refugees by country of residence

The cost of food is deducted from the benefits of persons living in places where free food is provided.

In order for the financial assistance to be calculated correctly, the refugee undertakes to inform the Migration Agency employees about changes in their financial situation. This applies to people who have found work.

The amount of financial assistance is reduced if a person does not help establish his identity and does not take part in organized activities.

There is no separate child benefit today.

Return to contents

Special program

Since 2010, the Etableringsreformen program has been operating in Sweden. The goal of the program is to help refugees find employment.

The main tasks of Etableringsreformen include creating conditions for:

- obtaining a residence permit;

- quick learning Swedish;

- labor activity.

The program is designed only for those who have received refugee status and their family members. Age range: 18-65 years.

If the refugee meets all the criteria, the benefit amount is 6.7 thousand CZK/30 days.

Return to contents