Retirement is one of the reasons for dismissal. Upon reaching retirement age, the employee decides for himself whether to remain at his job or go on a well-deserved, earned rest. An employer does not have the right to force his employee to resign; the right to continue working activities is guaranteed to pensioners by law.

More often, those older people who are passionate about their profession or have a low pension remain at work. If an employee decides to resign upon reaching retirement age, should he receive severance pay or is this payment not eligible for this category?

It is important to know information on this issue in order to receive all the funds due upon retirement due to old age. After all, not all employers are distinguished by decency and honesty; some may want to save on such a one-time payment. It is worth asking in advance how the process of dismissing a pensioner goes, what age-related payments are due.

You can consult with an experienced lawyer in advance; he will tell you what benefits you can receive from your employer and how the pension is calculated correctly. A one-time benefit upon retirement is compensation that will be a good reward to the employee for his work . It is due to almost all categories of citizens in connection with their retirement.

What do pensioners receive upon dismissal?

ATTENTION! When leaving a job, a pensioner is entitled to several types of payments.

Care should be taken to ensure that the employer does not forget any of them. Retirement benefits are fixed by law. There are several of them, together they will amount to a decent amount.

- A one-time payment representing severance pay. Lump sum payments are calculated differently depending on salary and other factors. The calculation is carried out taking into account the requirements of the law. The payment amount must be given to the pensioner on the day of his dismissal.

- In the future, the pensioner receives only a pension , which is calculated taking into account the length of service and the amount of salary.

- Cumulative amounts allow you to receive a lump sum payment of funds upon retirement upon dismissal , or a monthly urgent payment . Funded pensions are also provided. If a pensioner dies, his legal successors can also receive a lump sum payment from the savings pension account.

The insurance period is considered to be the period during which contributions to the Pension Fund of the Russian Federation were made on behalf of the employee. Each employee has his own personal account to which deductions from salaries are transferred; these accounts store information about the citizen necessary for his identification in the Pension Fund.

A special system allows you to take into account the amounts of the funded part of the pension. Savings can be located either in a state pension fund or in a non-state fund.

Thanks to such accruals, the pensioner can receive several more payments. How much salary do enterprises and companies pay to their employees as severance pay? Typically the amount represents a month's salary. Since this category is already receiving a pension, the amount of severance pay is rarely calculated at two or three salaries.

Approaching retirement age, an employee can find out from lawyers what payments are due upon leaving and how they are calculated. The information will allow you to control the accrual and issuance of all amounts.

Registration of dismissal due to retirement

A citizen reaching retirement age cannot be a reason for dismissal. According to the law, this is the right to assign a state social benefit to a person. The Labor Code of the Russian Federation does not regulate the time period between an employee’s termination of an employment contract at his own request and his registration of pension benefits.

An employer does not have the right to refuse to terminate a pensioner’s employment contract or to set work periods. The step-by-step procedure for dismissal due to retirement looks like this:

- The employee writes a statement.

- The employer issues a corresponding order.

- Authorized persons of the enterprise organize the formation of payments upon retirement.

- The necessary entries are made in the work book of the dismissed employee.

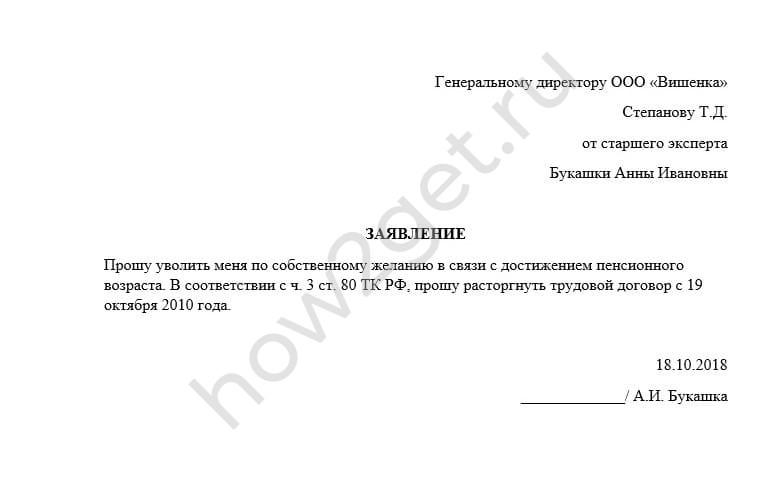

To terminate an employment contract, a pensioner must, on his own initiative, draw up a corresponding application in writing and in accordance with the procedure established by the Labor Code of the Russian Federation. The document must contain:

- position and surname, first name, patronymic (hereinafter – full name) of the employer;

- directly a request for dismissal indicating the desired date of termination of the employment relationship;

- position and full name of the pensioner;

- the date on which this document is submitted, the signature of the applicant.

To avoid potential conflict situations, the pensioner should make a copy of the paper. The application must be submitted to an authorized employee, asking the latter to indicate the number and date of the incoming document on the copy. A sample of it might look like this:

| To the General Director of Dynasty LLC, Konstantin Evgenievich Nikolaev, from senior technologist Ekaterina Artemovna Taneyeva |

| Statement I ask you to dismiss me from my position from “___”___________ ______ to (day month Year) voluntarily due to retirement. |

| __________________________ ___________ __________________________ (date of application) (signature) (signature transcript) |

After an employee submits a letter of resignation, the employer, after reviewing it, draws up a corresponding order. The document must contain the following information: the serial number of the employment contract and the date of its termination. After the order is issued, a corresponding entry is made in the work book. It includes the date of dismissal and its reason. The data entered into the work book must completely coincide with the information contained in the order.

Working out a 2 week period

A citizen's retirement is a special type of voluntary dismissal. According to the law, a pensioner has the right not to notify the employer 2 weeks in advance of his decision to leave service. In a statement of desire to terminate the employment contract, the subordinate must indicate the appropriate reason. It will give an elderly person the opportunity to take advantage of the benefit guaranteed by the Labor Code of the Russian Federation - to quit without working in connection with retirement.

- Chocolate Cake Recipes

- Cake icing: recipes with photos

- How to remove bags under eyes at home

What is a lump sum payment?

Such a payment is due when registering a disability group or in the event of the loss of a breadwinner . It can be obtained in the absence of insurance experience.

ATTENTION! A pensioner who has a funded pension cannot claim an additional lump sum payment.

This amount can be paid once every five years, therefore, after receiving the first amount, you need to count the required period and apply again for a lump sum payment.

How is the storage part formed?

In recent years, changes have been taking place in the system for determining insurance and length of service, and in the principles for calculating pensions.

Therefore, sometimes older people cannot independently figure out what insurance periods are established at a certain moment, what the amount of retirement benefits will be, and whether they are entitled to an urgent payment from a savings account. Another pressing question is what is the funded part, pension.

To form a funded pension, an individual account is created. Amounts from investment income and insurance premiums are transferred to it. These amounts can be transferred for years; the longer, the greater the amount of funds collected.

According to the law “On Labor Pensions in the Russian Federation”, they can also collect the funded part, or count on a pension only from the insurance part:

- Workers born before 1967 may not have time to form the funded portion. The state has developed an opportunity for them to transfer funds to the funded part with the help of maternity capital, with the help of co-financing a pension.

- Funds from the funded portion are paid within 20 years (no longer) after reaching retirement age. You may not immediately apply for an additional part of the pension; in this case, the period for paying money from the funded part will be shorter, and the monthly amount will be greater.

For government employees

When a civil service employee retires, he will receive a pension, as well as a supplement to it. The supplement represents a certain share of the insurance pension. Having worked in the civil service for at least 15 years, the employee will be rewarded with a bonus of 45% of the average monthly salary.

Another option is that civil servants may receive a pension supplement depending on their salary, which will be calculated over 10 years. What does a pensioner who has worked in such service receive from the state?

- All government guarantees are preserved.

- The right to medical care is given both for the pensioner himself (former civil servant) and for his family members.

- Compensation may be issued for unused vouchers.

- After the death of a civil servant, his family will receive funds for the burial of the deceased.

How can a pensioner receive payments from an employer?

If a person is not ready to continue working due to his age, management must let him go on vacation on the same day. Therefore, the reason must appear. Otherwise, two weeks will be considered absenteeism. And we will no longer be talking about additional payments, but about deductions from wages.

Of course, you will restore justice through the courts. But there is no point in ending your career with a trial.

Legal successors of the deceased

Many prudent people consider retirement savings and the portion of the inheritance they can leave to their successors in the event of their death. They identify such successors in advance and decide how pension savings funds will be distributed among them.

In this case, it is necessary to submit an application to the Pension Fund. The application indicates a list of persons who can receive pension payments in the event of the death of a pensioner, and indicates the distribution scheme between them.

A situation is possible when an elderly person did not have time to draw up such a statement, in which case the closest relatives become legal successors. Usually they act as legal heirs if the deceased did not leave a will:

- Children (including adopted children) can receive pension savings. Children are the first priority legal successors.

- If a pensioner does not have children, pension savings will go to the second-stage heirs. These are brothers, sisters, grandchildren.

- Without special orders from the owner of the savings, they are distributed in equal parts among relatives.

The pensioner could already receive payments, in which case the remainder from the funded portion is given to those who lived with him before his death and were his dependents.

How can legal successors receive the pension savings of a deceased relative? You need to write an application to the Pension Fund.

IMPORTANT! Such a statement cannot be delayed; it must be written no later than six months after the death of the pensioner.

The application can be left at the Pension Fund branch, or it can be sent by mail.

Basic provisions

- Typically, upon retirement, employees receive severance pay, part of the thirteenth salary (if the company has one), and compensation for unused paid leave.

- A remuneration of 1-2 salaries may be paid Typically, such a rule exists in government agencies.

- Military personnel and employees of the Ministry of Internal Affairs can receive as severance pay an amount equal to 7 salaries (if the service is more than 7 years).

- Those who have not earned insurance coverage or are retiring due to disability can receive a lump sum benefit.

- It will also be received by the pensioner who was able to form a funded part in the amount of less than 5% of the insurance part . A lump sum benefit is a one-time payment; the pensioner receives the funds collected in the funded pension account.

What payments are due?

A retiring retiree is entitled to the same benefits as any other employee in a similar situation. In addition to salary, a citizen who decides to retire has the right to expect to receive compensation for unused vacation. If the company's management dismisses an employee due to staff reduction, he is entitled to severance pay, the amount of which must correspond to his average monthly salary.

In accordance with the current legislation of the Russian Federation, a citizen who decides to retire has the right to claim:

- salary for the current pay period;

- payment for unused vacation;

- compensation 13 bonuses - paid by those institutions whose employment contracts provide for material incentives for employees at the end of the year;

- severance pay.

Salary for the current pay period

The final payment upon termination of the employment relationship with a pensioner must be made within a strictly established time frame in accordance with the legislation of the Russian Federation. As a rule, it is carried out on the last day of work. If the worker was not present at his place on the date of dismissal, but his position was retained, payments upon retirement by age must be made no later than the day following the request for final payment indicated by this citizen.

Scheme of monthly income payments upon dismissal:

| Balance of unpaid wages | Days worked per month. Salary x Total number of days per month. | Prices x Products manufactured in the last month. | Bonus approved for payment by the manager |

Russian employers use unified form No. 61 to document the calculation of salary and other compensation upon dismissal. After deducting all due payments, the calculation of wages upon retirement will be calculated according to the following formula: Z (OST) = OKL / RD x OD - D, where:

- OKL – monthly salary of the worker;

- RD – the number of working days in the month for which the salary balance is calculated;

- D – debts of the employee to the employer;

- Z (OST) – salary (balance);

- OD – the number of unpaid days worked (including the day of dismissal).

Cash compensation for unused vacation

If a retiring pensioner has unused vacation days left, they are calculated using the following formula: BUT = GG x 28 + 28/12 x M – O, where:

- BUT – compensation for unused vacation;

- GG – the number of complete years worked in the organization;

- M – the number of months in partial years of work in the company;

- O – the number of compensated vacation days at the time of dismissal.

If a pensioner has worked at the enterprise for a full 11 months from the date of registration of the employment contract, it is considered that he has worked for a full year. If the length of service does not exceed an eleven-month period, a simplified formula is used to calculate the number of vacation days: BUT = 28/12 x M - O. If the resigning pensioner worked in the organization from 5.5 to a full 11 months, and the termination of the employment contract is due to:

- liquidation of the company;

- reduction of staff;

- temporary suspension of work or reorganization;

- conscription of an employee for military service;

- professional incompetence;

the BUT indicator will be calculated using the formula: BUT = 28 – O.

Compensation for unused vacation will be calculated using the following formula: VNO = NO x SZ, where:

- VNO - payment of compensation for unused vacation;

- SZ – average daily salary;

- BUT – unused vacation.

Average daily earnings are calculated using the formula SZ = V/OD, where V are all payments that are taken into account in the billing period (1 year or less, starting from the date of conclusion of the employment contract until the day of leave or dismissal), and OD is the number of hours worked. days. To obtain the OD indicator, the following formula is used: OD = M x 29.3 + ODNM / KDNM x 29.3, where:

- M – number of full months worked;

- ODNM – the number of days of labor activity in partial months of the billing period;

- KDNM – the number of calendar days in partial months. work.

13th prize

Payment of 13 salaries after dismissal is a separate procedure. Only the employee whose work contract contains a bonus clause has the right to apply for this type of compensation. The presence of a contractual condition is relevant if:

- the results of labor activity were satisfactory, and during the billing period the company made a profit;

- According to the contract, a pensioner who resigns at his own request does not lose the right to receive a bonus.

In exceptional cases, claims for financial incentives in the form of 13 salaries are not satisfied, for example, when workers are laid off due to unprofitable production. The right to bonuses, as a rule, is stipulated by a number of documents - any of them gives the worker the opportunity to claim this type of compensation:

- collective contract;

- wage regulations;

- bonus act;

- personal employment contract.

The bonus is paid immediately before retirement along with other compensation. If the employer provides quarterly and/or annual financial incentives, the legislation of the Russian Federation obliges the employer to pay even those employees who quit earlier, since they were related to the organization’s profit for the specified time period.

- Men's tennis haircut (PHOTO)

- Pork kebab: delicious recipes

- How to effectively treat a sore throat at home

The bonus amount is calculated according to the following rules (for the specified period):

- the total percentage of incentives is calculated;

- the employee’s total income is calculated;

- if the billing period (quarter or year) was not fully worked out, only the number of full months is taken into account;

- the percentage of payments should be multiplied by the worker’s current income - this is how the amount of incentives is obtained;

- from the bonus received, 13% personal income tax (hereinafter referred to as personal income tax) is deducted and paid to the federal budget.