Assistance to citizens from the state is provided not only in case of complete or temporary loss of the main source of income, but also to persons who have lost their main breadwinner due to the sudden death of the latter. A survivor's pension (for military personnel and others) is assigned to his close relatives, as well as other people who are financially dependent on him (dependents). Read more about the specifics of assigning this pension in our article.

Military survivor pension: size and latest changes

Who can receive a survivor's pension?

The basis for assigning a pension is the Law “On Pensions” - N400-FZ. Latest revision – March 2020. You should also take into account N166-FZ, which specifically refers to former employees of the RF Ministry of Defense. This type of financial assistance is considered insurance.

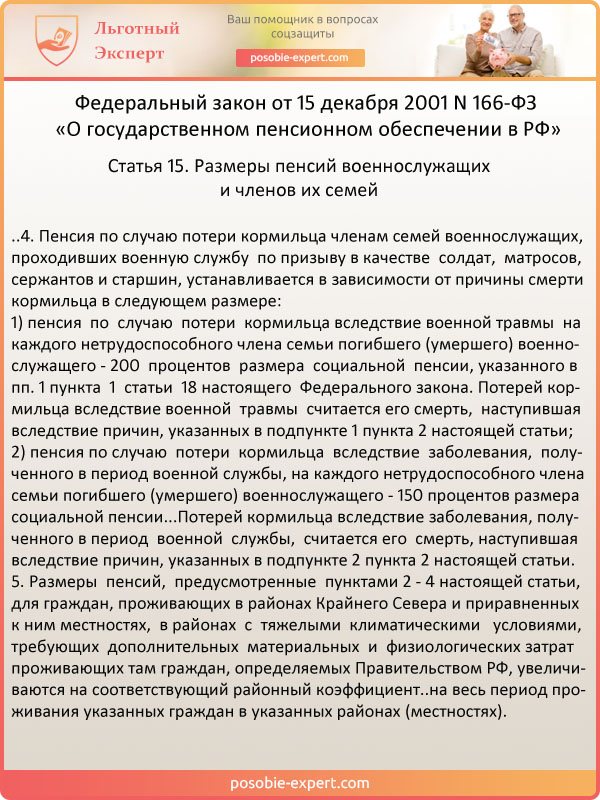

Clause 4 of Article 15. Amounts of pensions for military personnel (Federal Law No. 166)

List of persons who may qualify for monthly payments:

- children of the deceased under 18 years of age. If they study full-time at universities, lyceums and colleges, the period for obtaining it increases to 23 years. The accrual will continue, but in the case where the child received disability before adulthood;

- widows, if they are at least 55 years old and have not entered into a new marriage;

- parents (and grandparents), if they are at least 60 (55 for females) years old. The content will also be designed for people with disabilities;

- other persons who took up the responsibility of raising the deceased’s minor children.

Survivor's pension: who can count on it and under what conditions

Conditions for receiving an insurance pension:

- A person who relies on social benefits must confirm his disability.

- The deceased breadwinner did not commit crimes established in court.

- The soldier died either while performing his duty or within three months or less after the end of his service.

- The former law enforcement officer received serious injuries that caused his death; the pension is issued without time restrictions if there is a conclusion from a medical commission.

- The breadwinner has gone missing.

Important: both relatives of contract soldiers and relatives of conscripts have the right to count on state support. Payments will differ only in their size.

Rada appoints pensions for families of fallen military personnel

“In the event of the death of a person while in public service, a pension in connection with the loss of a breadwinner is assigned to one disabled family member in the amount of 70% of the salary of the deceased breadwinner, two or more family members - 90%,” says the explanatory note to the bill. .

Minister of Social Policy of Ukraine Lyudmila Denisova notes that to date, 8 thousand 558 people - 4313 families - have left the occupied Crimea in an unorganized manner, in addition to the families of military personnel. According to an UNIAN correspondent, Denisova said this during the Question Hour for the government in parliament. At the same time, the minister recalled that on March 16, a so-called “referendum” took place in Crimea, and since March 17, Crimea cannot receive funds either through the banking system, through the treasury service system, or through post offices.

Why do they stop paying survivor's pensions?

A pension will not be assigned if the death of the breadwinner was caused by the actions of his relatives-applicants, and in some cases payments will be stopped, even if the registration took place according to the law:

- the recipient of the benefit became able to work - found a job, lost his disabled status;

- the widow got married;

- children have lost the right to a pension due to age;

- in the event of the death of a dependent (pension recipient);

- the breadwinner, who had gone missing, was suddenly found;

- Forged documents used by applicants during registration were discovered.

Information: in the latter case, it is possible to initiate a criminal case for fraud with the perpetrators held accountable.

When are pension supplements calculated?

There is such a thing as an addition to the basic amount of pension payments.

They are awarded to the following categories of citizens:

- residents of the Far North. In certain areas there are coefficients by which the principal amount is multiplied;

- disabled children receive a 32% premium.

In addition to the additional accrual of funds, children with disabilities, as well as their families, can receive such benefits from the state:

- provision of necessary medications as prescribed by a doctor;

- obtaining vouchers for health improvement;

- free travel to the place of treatment by suburban and railway transport.

Benefits are also provided to those children who are orphans.

They can count on education in higher educational institutions and medical care, as well as housing and legal assistance if their rights have been violated. All these services are free. It is important to note the following nuances of calculating payments:

- even if the child was not financially supported by the parent, he still has the right to a pension;

- adopted children have the same rights as their own children;

- if the child’s mother decides to remarry, payments will continue to accrue;

- if a child gets married, this is not a reason to cancel the pension payment;

- children cannot be employed while receiving payments. If they work part-time while studying at a university, then the right to receive funds from the state is lost.

The right to two pensions (in case of loss of a breadwinner)

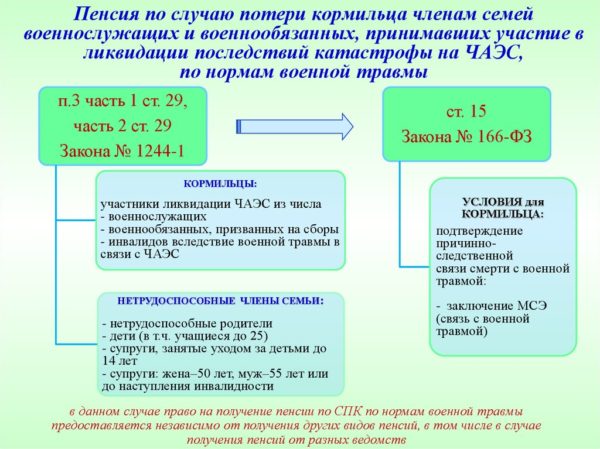

A number of persons have the right to receive not one, but two types of social benefits.

- Parents of conscripts who died in service or due to wounds received during service.

- Wives of deceased military personnel who did not remarry if their breadwinners died due to injuries.

This right arises after the death of the breadwinner and/or upon reaching retirement age. Disabled beneficiaries receive a second pension in addition to their main pension. The first pension benefit may be:

- old age/disability insurance;

- social benefits for old age/disability;

- long service payment.

Example: a mother’s son died while serving in the Russian Armed Forces. She will receive a survivor's pension immediately - if there are other reasons, and after she turns 56-60 years old, she will also be able to apply for an old-age pension .

Help: the list of papers for receiving a second pension should be found at the military registration and enlistment office and the Pension Fund of the Russian Federation.

What do veterans of combat in Afghanistan deserve?

All participants in combat operations (CA) in Afghanistan acquire the status of war veterans. It provides many benefits, including the ratio of one year spent in Afghanistan equal to three years of normal work experience. The pension of DB participants is slightly higher than that of other military personnel.

On average it is 8000-9000 rubles. Such a pension depends on the length of service, position held, and length of service. Such a category of citizens as participants in combat operations in Afghanistan, if they refuse social assistance, can receive an increase in their pension in the amount of 3,696 rubles. Disabled people from the Afghan war have special privileges. Depending on the group of disability they received as a result of injury, the multiplication of their pension also depends; for example, disabled people of the first group receive a pension of three times the amount, and of the first - one and a half times.

Participants in the wars in Chechnya and Afghanistan also fall under the category of military personnel

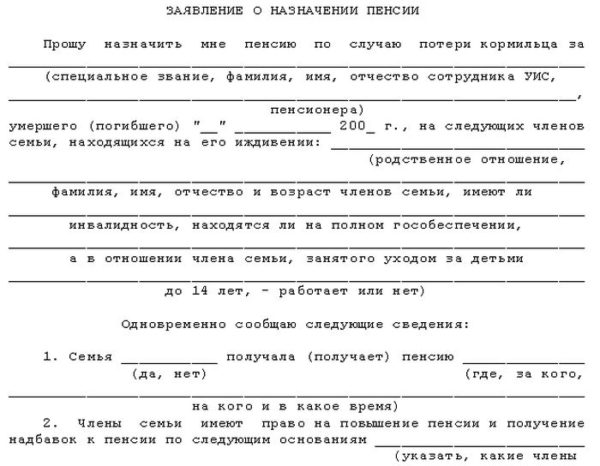

Registration of a survivor's pension

To receive a pension, you will either have to contact the Pension Fund department or submit papers to the nearest MFC. Online registration through the Pension Fund portal is also allowed.

Pension application form

To begin the procedure for obtaining a pension, the applicant will have to prepare a minimum set of documents:

- identity cards of applicants for social payments - passports, military IDs, birth certificates;

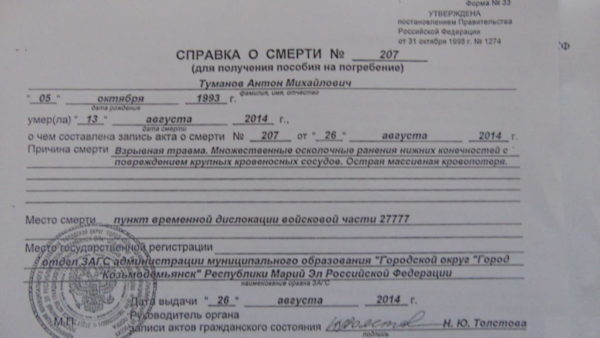

- a paper that records the death of the breadwinner. If a person is missing, a supporting document will be required - with a judge's visa;

- proof of relationship, such as adoption papers;

- additional certificates that pension department consultants may require: from school/university, about income, disability, and others.

The package of documents may vary in composition depending on the situation. When receiving benefits for a military man who served under a contract, you will have to contact the Ministry of Defense of the Russian Federation. The same applies to other law enforcement agencies: the Ministry of Internal Affairs, the Federal Penitentiary Service, the FSB. There it will be possible to collect evidence of the breadwinner’s service, data on his salary, and other documents necessary for the situation. You should arrive at the Pension Fund of the Russian Federation with a complete package of papers. Government officials will accept the application in the form, review the package of papers and make a decision. In case of refusal, the reason must be indicated. In controversial cases, it is recommended to go to court.

Death certificate

Important: according to the law, officials are given 10 days to consider the case and make a decision.

Social benefits will be transferred to the dependent’s personal bank account, received by mail or delivered directly to their home. The accrual must be made from the first day of the month in which the applicant submitted an application to the officials, that is, initiated the registration.

Possible problems during registration

Most often, problems arise with documents. The applicant is often unable to collect the entire required package. Cases of sudden death of a breadwinner who did not have time to adopt a child are not considered rare. In such cases, paternity must be established through the court. There is no other way to apply for a pension. In order to be able to recognize the deceased as the father at the meeting, photos or videos must be provided confirming the life together with the deceased. It is even more appropriate to invite witnesses who admit that the deceased called the child son/daughter. After a positive verdict from the judge, the applicant will be able to continue applying for a pension as usual.

If the breadwinner disappeared while serving, then it is necessary to initiate the procedure for declaring him missing. This can be done six months after the person went missing. To do this, you need to contact the Ministry of Internal Affairs and file a missing person report. If after 6 months the breadwinner does not show up, then he should be declared missing in court, and then a pension should be issued.

How to get

In order for the family of the deceased to be assigned a pension, it is necessary to contact the relevant authority with a certain list of documents.

Let's look at what you need to do to receive benefits:

- If a conscript dies, you should contact the Pension Fund at your place of residence or the Multifunctional Center (MFC);

- If a contract soldier died, it is worth bringing documents to the authorities to which the person was assigned. This could be the Ministry of Internal Affairs or the Ministry of Defense of Russia.

It is necessary to collect the following package of documents:

- Application for receipt of payment (read about the rules for its preparation in the next section);

- A copy of the applicant's passport;

- Death certificate of the deceased;

- Documents that confirm the existence of a family relationship between the applicant and the deceased.

The package of documents can be sent by mail or brought in person to the relevant authority. When making a decision, the applicant may be asked for additional documents (for example, a certificate of family composition from the house register, a certificate of income, a document confirming the presence of a disability group, etc.).

Important! The time limit for processing a request for a pension is no more than 10 days from the date of submission of all necessary documents. If a positive decision has been made, funds will begin to arrive on the first day of the next month.

Amount of pension and bonus

The amount of funds received by a dependent depends on the characteristics of the breadwinner’s service (including the amount of his salary), the causes of death and the region of residence of the applicant relatives. Taking into account the fact that the amount of social pension is 5180.24, the approximate amounts of payments to dependents can be given in the table.

Table. Survivor's pensions

| Type of breadwinner's service/cause of death | Pension amount, % of salary | Examples of calculations |

| Contractor/due to wounds or injuries | 50 | If a serviceman’s salary was 44 thousand rubles, then his relatives will be able to count on at least 22 thousand rubles |

| Contractor/from diseases acquired during service | 40 | If a contract soldier's salary is 60 thousand rubles, dependents will be paid 24 thousand rubles each |

| Conscript/injury or mutilation in service | 200 | 10360.48 rubles |

| Conscript/due to illness | 150 | 7770.36 rubles |

The place of residence of the military personnel’s families should also be taken into account. Those living in the Far North or equivalent will receive bonuses in accordance with certain coefficients. The following will also receive increased payments:

- disabled people I gr. - 100%;

- dependents who are 80 years old – 100%;

- disabled children (including from childhood I-II groups), orphans - 32%.

Example: contract serviceman Semenov A.S. received a salary of 64 thousand rubles. His wife did not work and cared for their common disabled daughter, class I. The family lives in the city of Norilsk - the regional coefficient is 1.8. Semyonov died in the line of duty. Rules for calculating pensions for both family members: for a daughter - 64,000/2 = 32,000 rubles - the main pension. Plus disability allowance: 32000*2= 64 thousand rubles. Taking into account the “northern” coefficient 64000*1.8 = 115200 rubles. The mother will receive the following amount: 32,000 * 1.8 = 57,600 rubles.

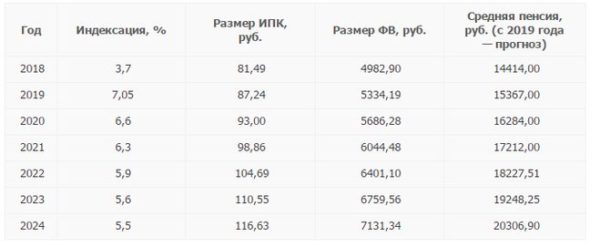

Please note that in 2020 it is planned to increase social payments and benefits from April 1, 2020. This is necessary to compensate for rising inflation. The size of pensions will increase by a little over 2%. Also, employees of a number of law enforcement agencies may have their salaries increased, which will also affect recipients of survivor’s pensions. A bill to change the salaries of employees of the Russian Guard, the Federal Penitentiary Service and other institutions is being considered in the State Duma.

Pension indexation plan until 2024

Increasing pensions for military pensioners

Indexation of pensions for military pensioners in 2020 will be carried out by increasing the amount of monetary allowance by 4.3%. In this regard, from October 1, 2020, pensions for military personnel and security forces (employees of the Ministry of Internal Affairs, the Federal Penitentiary Service, the Russian National Guard, the Ministry of Emergency Situations, etc.) will be increased by 4.3%.

The government planned to increase pensions for military pensioners from October 1, 2020 only by indexing the pay of military personnel by 4.3%. The draft federal budget, which provided for such an increase in payments, was submitted by the Government of the Russian Federation to the State Duma on September 29, 2020. On October 24, 2020, it was even approved by deputies in the first reading.

Additional benefits for military family members

Some citizens receiving survivor pensions are also entitled to receive:

- medicines or special products to improve the quality of life;

- vouchers to sanatoriums for treatment;

- travel compensation for arriving at places for health improvement.

Applicants for benefits are children who have serious problems with the body (disability). If a deceased serviceman served for at least 20 years, then his family members have the right to receive compensation when paying:

- housing and communal services;

- telephone, radio and TV antenna;

- fuel if the house where the family lives does not have central heating.

Information: the family of a deceased serviceman cannot be evicted from a service apartment until similar housing is provided to them.

Members of such families may also have additional benefits at the regional level. For information, please contact your local social security office.

Tax benefits for parents of deceased military personnel

This includes:

- free provision of medications according to a doctor’s prescription;

- free dentures;

- provision of medical products (prosthetic limbs, etc.);

- preferential sanatorium-resort treatment.

Benefits are available not only to active military personnel, but also to persons discharged into the reserve with more than 20 years of service. After completing tasks that negatively affect their health, the serviceman is granted rehabilitation leave of up to 30 days, paid from the federal budget.

Benefits for education Citizens whose continuous service is 3 years or more have the right to receive secondary vocational or higher education at the expense of budget funds.

Contract workers who receive a civilian specialty in parallel with their service are additionally provided with study leave.

benefits for families of fallen military personnel

The surcharge is due in the following cases:

- for advanced training;

- for harsh conditions of service;

- for performing tasks that pose a risk to life and health;

- for access to state secrets.

A bonus is also awarded for length of service. Depending on the duration of military service, it can range from 10% to 40% of the basic salary. Provision of housing At the new duty station, military personnel and their families are provided with free official housing for a period not exceeding 3 months.

Large families raising 3 or more children are provided with a service apartment on a priority basis.

This type of housing is not provided with ownership rights, and military personnel are required to leave it after the end of the contract or upon transfer to service in another region.

Article 24. social protection of family members of military personnel who have lost their breadwinner

Order of the Ministry of Defense of the Russian Federation dated June 20, 2009 N 565 “On measures to implement the Decree of the Government of the Russian Federation dated August 2, 2005 in the Armed Forces of the Russian Federation.

N 475″ 9 For family members of military personnel who have lost their breadwinner, parents who have reached retirement age, and disabled parents of senior and senior officers who died (died) during their military service, as well as senior and senior officers who died (died) after dismissal from military service upon reaching the age limit for military service, health reasons or in connection with organizational and staffing measures, which had a total duration of military service of 20 years or more, the right to social guarantees for the provision of medical care, sanatorium treatment is retained, travel to and from the place of this treatment.

List of benefits for contract military personnel and their families in 2018

Attention What is required for military personnel

- Medical benefits

- Tax benefits

- What is due to the family of a conscript soldier?

- Benefits for mothers

- Changes in 2020

Conscripts are required to spend 1 year in service. However, they and their families are entitled to a number of benefits. They are valid throughout the entire period of military service. After a soldier is demobilized from the army, the right to benefits for a conscript soldier is canceled.

What is entitlement to military personnel First of all, conscripted soldiers have the right to work. At the same time, it is implemented as follows: for each day of “work” in the army, two working days go into seniority. That is, after serving for a year, a man receives two years of work experience.

In the future, this has a positive effect on employment and the calculation of various benefits (for example, when calculating sick leave). Art.

In the case of transportation of personal property in a separate carriage, baggage and small shipments, they are reimbursed for actual expenses, but not higher than the cost of transportation in a container weighing 20 tons.

In the event of the death of a citizen-soldier, members of his family (but not more than three people) and his parents have the right to travel free of charge by rail, air, water and road (except for taxis) to the burial place of the deceased (deceased) serviceman -citizen and vice versa. One of the family members of a deceased (deceased) citizen-soldier and his parents have the right once a year to travel free of charge across the territory of the Russian Federation by rail, air, water and road (except for taxis) transport to the place of burial of the citizen-soldier and back .

Survivor's pension for military personnel: problematic situations

Question No. 1. I am a military pensioner, and so is my husband, who died six months ago. I will soon turn 55. I wanted to replace my pension with the pension of my late husband. The military registration and enlistment office told me that this can only be done through the court. Is it so?

Answer: yes, you will have to file a claim because you did not have time to resolve the issue within 6 months from the date of death. If your husband had died later than six months ago, the problem would have been resolved in the branch of the Pension Fund of the Russian Federation upon application. Now an additional court decision will be required to resume the review of the pension issue. In most cases, the outcome of the case is positive. After receiving a survivor's pension, you should refuse your own social benefits. The same situation will arise if the wife was a dependent (Article 10 of Federal Law N400) and has a disability or is recognized as an old-age pensioner.

Question No. 2. My husband, who served as an officer, was not officially married. He died recently while on duty. Before that, he supported me completely for more than 5 years. His relatives demand that I hand over all documents. Do I have any rights? Will they issue a pension?

Answer: you will have to prove the fact of dependency. According to Part 2 of Art. 1148 of the Civil Code of the Russian Federation, the breadwinner may not be a blood relative of the breadwinner. If you can convince the court, then, according to paragraph 1 of Article 1149 of the Civil Code of the Russian Federation, you have the right to an inheritance, but not to a pension. If you have a common child, then it is possible to receive social benefits in his name. Proof of dependency can be:

- medical certificates of disability;

- testimony of neighbors and relatives about the fact of cohabitation;

- information about financial dependence (recommended).

They cannot issue a pension because the marriage has not been officially registered. This is how Article 10 of the Law “On Insurance Pensions” works: if a marriage relationship is not registered in the registry office, then it is not possible to recognize it as official.

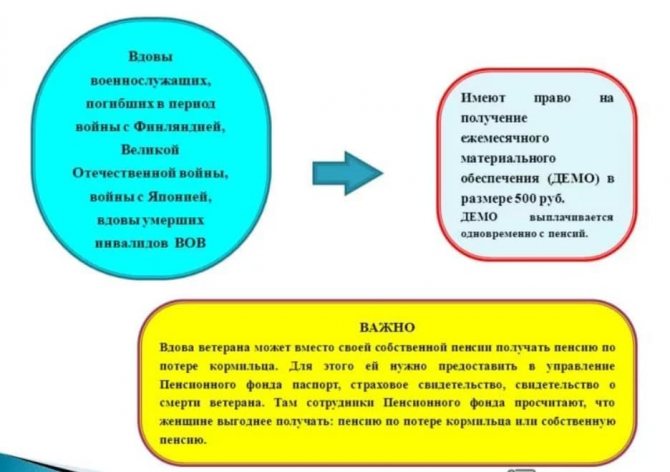

Military pension for widow

Pensions for widows of military personnel

The widow of a deceased member of the armed forces can receive a pension if she did not enter into an official marriage after his death. In this case, she will receive financial assistance from the state every month if her husband died while serving or from an illness acquired at that time.

According to the same criterion, the widow of a military pensioner can accept a pension, since due to her husband’s service she might not have time to work out the required number of years to receive her own pension.

To receive financial assistance, the widow of a military pensioner must meet the following requirements:

- if the family breadwinner died after the pension began to be paid to him or after the payment period had expired, but no later than 5 years from this period;

- the woman has no other income other than the pension of her late husband;

- the spouse of a deceased military pensioner is recognized by law as disabled and cannot perform any work due to disability;

- the widow is over 55 years old;

- The widow is supported by minor children or disabled relatives.

When does payment stop?

A pension of this type is not assigned for life, but as long as there is a basis for payment. Sometimes the family situation of relatives of a deceased breadwinner changes and the basis for paying a pension disappears. This can happen, for example, in the following cases:

- the widow of a conscript who died from a military injury remarried;

- a citizen receiving a pension due to disability was recognized as able to work;

- the child has reached the age of majority or the student is 23 years old.

These are just some examples of the loss of grounds for receiving a pension. In reality they can be very different. In the month when these circumstances occurred, the pension payment will be made for the last time.

So, a pension payment in connection with the death of a breadwinner-soldier is due to children, spouses, parents, and sometimes other close relatives. The specific accrual amount will depend on the cause of death and type of service. It is important not to miss the deadline for applying for a pension - this is the year after the death of the breadwinner. Otherwise, it will be assigned only from the moment of application. Payment will be made as long as there is a basis for this.