Formally, through a number of structures, Gavrilenko owns 65% in these funds. But he does not control them alone, but together with Gazfond, a corporate fund for gas industry workers with assets of about 390 billion rubles. Two key people in this pension empire are Yuri Shamalov and Anatoly Gavrilenko Jr. The first has been heading the NPF Gazfond for more than ten years, the second is the Management Company Leader, which manages almost 95% of the assets of this fund. And the ultimate beneficiaries of this pension empire, as Forbes found out, are Yuri Kovalchuk and his partners. They control a quarter of the pension market, the volume of which last year exceeded 3.1 trillion rubles.

How are the roles distributed? “Gavrilenko Sr. does little management,” says a source familiar with the decision-making system in the pension group. — Basically, all issues related to operational control lie with his son, “Leader”, in fact, the entire pension group is closed. At the same time, the system itself is regulated so strictly that they “run” to Shamalov to get approval for almost every figure.”

Investment of NPF assets is carried out with the help of management companies affiliated with each other. This is, firstly, “Leader” himself and the managers and TKB Investment Partners of Gavrilenko Sr. And secondly, a whole series of management companies gathered under one roof in a modest shopping mall on Warsaw Highway: “Partner”, “Perspective-finance”, “Severyanka” and “Progressive Investment Ideas”. The Moscow offices of Gazfond and Leader are also located in Airbus.

Based on extracts on the composition of the funds' assets, Forbes figured out where and how the funds collected in the Gazfond pension empire are invested.

NPF Gazfond: login to your personal account

To authorize, you must use your email address and a created password. If the user forgets the account password, you will need:

- On the login page, click on “Forgot your password?”

- Provide your SNILS number, mobile phone number and web address of your personal email address;

- Enter the symbols located on the anti-spam image and click “Submit”.

A link to reset a forgotten password will be sent to the e-mail associated with your account.

Personal account functionality

Thanks to the online service, a citizen can monitor the accrual of interest on the deposit and the current state of the pension account - all reports are presented in the form of tables, which makes it easier to perceive the information. Your personal account also allows you to:

- adjust the form with personal data;

- generate reports on savings account replenishments;

- remotely submit certain applications to the fund;

- Contact customer support to resolve problems and receive additional advice.

All functions of your personal account are grouped into special sections, so the user can easily find the tool they need. Minimalistic interface design includes .

How to withdraw pension savings from Gazfond.

To assign payment of pension savings, you must submit the appropriate application and the documents necessary for the assignment of payment to JSC NPF GAZFOND Pension Savings.

The application can be submitted: in person;

through a legal representative (guardian, trustee);

through a trusted person.

The application must be accompanied by originals or notarized copies (in accordance with Decree of the Government of the Russian Federation No. 1048 of December 21, 2009):

documents proving the identity, age and place of residence of the insured person (place of stay);

documents proving the identity and place of residence of the legal representative (place of stay) or authorized representative, as well as documents confirming their powers;

insurance certificate of compulsory pension insurance of the insured person;

a certificate from the territorial body of the Pension Fund of the Russian Federation confirming the receipt (right to receive) by the insured person of an old-age insurance pension, indicating the date of assignment (the emergence of the right) and the amount of the pension. This certificate must be obtained from the territorial office of the Pension Fund.

The application must also be accompanied by a printout of bank details indicating the personal account number of the insured person for the transfer of pension savings.

Types of payments from pension savings

On July 1, 2012, Federal Law No. 360-FZ of November 30, 2011 “On the procedure for financing payments from pension savings” came into force, which provides for the following types of payments from pension savings:

One-time payment;

Urgent pension payment;

Funded pension;

Payment to successors.

One-time payment

A lump sum payment is a one-time payment of all pension savings of the insured person recorded in the pension savings account.

The following are entitled to receive a lump sum payment:

1. Persons receiving an insurance pension for disability or loss of a breadwinner, or receiving a pension under the state pension provision, who, upon reaching the generally established retirement age (men - 60 years old, women - 55 years old) have not acquired the right to an old-age insurance pension due to lack of required insurance experience or number of pension points; ATTENTION! Insured persons who have exercised the right to receive pension savings in the form of a lump sum payment have the right to apply again for a lump sum payment no earlier than 5 years from the date of the previous application for payment of pension savings in the form of a lump sum payment. A one-time payment is not made to persons who previously received a funded pension.

2. Persons who, when the right to establish an old-age insurance pension arises (including early), the amount of the funded pension is 5% or less in relation to the amount of the old-age insurance pension, taking into account the fixed payment to the old-age insurance pension and the size of the funded pension. The amount of the funded pension is calculated on the date of its assignment.

Urgent pension payment

A fixed-term pension payment is a monthly payment of a pension for a period specified by the insured person, which cannot be less than 10 years, when the right to establish an old-age insurance pension arises (including early).

Persons who form a funded pension through:

1) participation in the State Pension Co-financing Program, namely:

— additional insurance premiums transferred by the insured person personally;

— additional employer contributions paid by him in favor of the insured person;

— state contributions to co-finance the formation of pension savings;

— income from investing all of the above funds;

2) directing funds (part of the funds) of maternity capital for the formation of a funded pension, including income from their investment.

A person who forms a funded pension in the above manner, if he has the right to assign an old-age insurance pension, can, at his choice, receive the above funds of pension savings:

- in the form of an urgent pension payment. The insured person determines the payment period independently, but not less than 10 years.

OR

— in the form of lifelong pension payments as part of a funded pension.

For insured persons who have exercised the right to receive an urgent pension payment, a special procedure is provided for the payment of pension savings to legal successors. In the event of the death of the insured person after the appointment of an urgent payment, the legal successors have the right to receive the balance of funds in the pension account, with the exception of maternity capital funds aimed at forming a funded pension, which is payable to the child’s father (adoptive parent) or minor children (if there is no father), if the children are minors or full-time university students under the age of 23 inclusive.

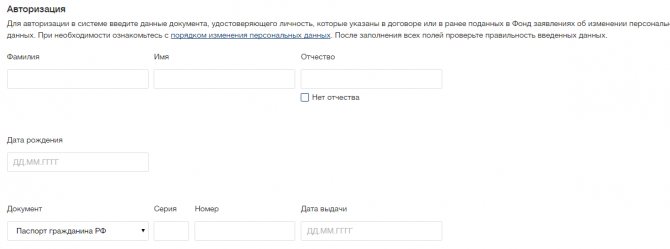

Registration in your personal account

To create a personal account in the system, the investor will need to open the Gazfond website (https://gazfond.ru), click on the link to the “Client Account” located in the upper right corner and select the “Registration” section. Next you will need:

- Read the privacy policy and consent to the processing of personal data.

- Provide your personal email address.

- Check your e-mail box for a letter from Gazfond, which should contain a link to the registration form.

- Enter on the page that appears such personal data as: • last name, first name and patronymic; • Date of Birth; • series, number and place of issue of the passport of a citizen of the Russian Federation.

- Click on the “Send request” button and wait for the questionnaire to be processed. When the information provided by an individual is verified by a Gazfond employee, a one-time access code to your personal account will be sent to the previously specified mobile number. By entering this access code, the user will be able to independently come up with a password for the account.

- Upload scanned copies of SNILS and passport to the server.

- Wait for the activation of your personal account.

It is important to note that it may take several days for a private pension fund employee to activate a user account.

Fund for the bank

In 2020, Gazfond separated the pension savings management business and transferred it to the Gavrilenko group. The requirements of the Bank of Russia for the investment policy of funds working only with corporate pensions are much softer than for non-state pension funds engaged in compulsory pension insurance. This is clearly demonstrated by the structure of Gazfond's assets. At the end of 2020, 137 billion rubles were invested in shares of three companies, GAZ-Tech and Gas-Service. Shares of these companies worth another 23.3 billion rubles belonged to Gazfond through the closed mutual fund Strategic Assets under the management of Agana Management Company.

What do the companies in which almost 50% of Gazfond’s assets are invested do? According to their annual reports, they are the owners of shares in Gazprombank, totaling 135.7 billion rubles at the end of 2020. This corresponds to approximately 43.5% of the authorized capital of the third largest Russian bank. Director for Corporate Ratings of RAEX Pavel Mitrofanov believes that the complex scheme of “packing” the bank’s shares into closed mutual funds and technical funds, “GAZ-Tek” and “Gaz-Service”) may consist in not reflecting Gazprombank in the reporting of Gazfond “ to his full height." “Otherwise, it will no longer be the reporting of a fund with 300 billion rubles of assets, but of a bank with 5 trillion rubles of assets,” says Mitrofanov.

In total, Gazfond owns 49.6% of Gazprombank, more than 80% of the securities are in trust management with Leader. Yuri Shamalov and Gavrilenko Jr. are on the board of directors of the bank. Perhaps in 2014 they participated in a discussion of a loan that helped Yuri Shamalov’s younger brother Kirill become a billionaire. Then Kirill Shamalov, whom the media also calls the son-in-law of President Vladimir Putin, needed money to buy out 17% of SIBUR from billionaire Gennady Timchenko. The bank has approved the new borrower. Kirill Shamalov said that SIBUR was valued at more than $10 billion for the deal, so he could borrow at least 60 billion rubles from Gazprombank.

Also, the closed-end mutual funds in which Gazfond invests have large stakes in MOESK, Gazprom, RSC Energia, etc. The key asset of the latter is the hotel and exhibition complex of the same name on Krasnopresnenskaya embankment. Alor has been purchasing shares of WTC since 2006; in 2008, Gavrilenko Sr. estimated the stake at 18%.

In addition, about 48 billion rubles of Gazfond funds were invested in three closed real estate mutual funds: “Prospective Investments”, “New Horizons” and “Electron”. All three are managed by Progressive Investment Ideas Management Company. The management company refused to disclose the assets of these funds, citing the fact that they are intended only for qualified investors. But we can assume that it is in them. Thus, in the reporting of Gazfond for 2020, the development and hotel businesses Sochi-Breeze and Istra Management are listed among its subsidiaries. According to SPARK, their co-owner is Progressive Investment Ideas.

Mobile app

Gazfond has developed a special mobile application for freelance agents involved in advertising the company and increasing its client base. You can download the program from the App Store and Google Play. After installing the application, the agent will need to take a photo of his SNILS and civil passport and wait for access approval from the pension fund employees.

There is no proprietary application for investors. Clients of the fund can log into their personal account from a smartphone only using a mobile browser.

Gazprom's debts were paid off with pensioners' money

Gazprom, cut off from international capital markets by the gas dispute with Ukraine, has turned to Russians' pension savings ahead of major foreign debt payments. On Tuesday, the company entered the Russian debt market for the second time since the beginning of the year and borrowed 40 billion rubles. Investors were offered 3 bond issues - 15-year bonds worth 10 billion rubles and two tranches of 30-year bonds worth 15 billion rubles each.

Large Western investors virtually ignored the placement. The subsidiaries of European banks bought 3-4% of the securities (investing no more than 1 billion rubles), Eduard Dzhabarov, director of the Russian debt market department of Sberbank CIB, who organized the issue, told TASS.

Gazprom borrowed almost the entire amount—about 32 billion rubles—from the pension savings of Russians. 80% of the bonds, according to Dzhabarov, were bought by management companies of non-state pension funds.

Gazprom initially bet on this money. “We focused on those pension funds that ended up in private non-state pension funds after the April transfer,” Dzhabarov said.

“In fact, the market was closed throughout April and May; in June, banks were mainly placed. Therefore, the pension money that was invested in OFZs and deposits migrated to these issues of Gazprom,” he added.

The gas monopoly needed the funds on the eve of large payments on its foreign debt, Bloomberg recalls.

On Wednesday, July 25, the company needs to repay a loan of 900 million euros ($1.05 billion). The funds received from the placement (544 million euros at the exchange rate) can cover 60% of the required amount.

Initially, Gazprom intended to refinance this debt in the West: the placement of Eurobonds in British pounds was planned for June. But it had to be canceled due to the decision of the Stockholm Arbitration Court, which obliged Gazprom to pay $2.6 billion to Naftogaz of Ukraine.

After Gazprom’s assets were arrested in Switzerland and the Netherlands and similar permission was given by the High Court of London, there was a risk that the funds that Gazprom would raise would be immediately frozen, an Interfax source close to the company previously explained.

Gazprom currently has no options to borrow abroad, Igor Laukhin, managing director for brokerage operations at Septem Capital in Moscow, told Bloomberg: “The threat of sanctions and general geopolitics make it impossible to raise (money) on the foreign market.”

As a result, a record plan for external loans in the history of Gazprom was under attack, through which the holding intended to finance the construction of pipelines to China, Turkey and bypassing Ukraine.

The company planned to raise 417 billion rubles, or a third of the amount needed for capital construction (1.2 trillion rubles).