Types of disability benefits

People who are unable to work due to disability are provided with the following types of financial support:

- The social pension is intended for those who have not accumulated insurance coverage. Can be received by minors, pensioners, citizens who have lost their breadwinner.

- A labor pension is assigned as compensation for the lost opportunity to receive income. To receive this type of payment, you must have a minimum length of service – at least 1 day.

- The state pension is accrued depending on the length of service to cosmonauts, military personnel, victims of man-made accidents, participants of the Second World War, as well as survivors of the blockade.

Who is entitled to disability benefits in 2020?

All disabled people who have officially confirmed their status can count on receiving disability payments.

The medical institution issues a conclusion about a persistent decline in health; you will regularly have to undergo a commission again so that the doctor can make sure that there is no improvement. Depending on the state of health in the Russian Federation, several disability groups are distinguished:

| Disability group | Characteristics and Features |

| First | A disabled person is completely dependent on third parties; he cannot navigate in space, control himself, or move. |

| Second | A disabled person can work with the help of auxiliary tools, orient himself in space, and is able to move. |

| Third | There is a serious illness that does not interfere with working with loyal demands. |

| Disabled children | There is no division into groups for people under 18 years of age. |

These categories of citizens can count on payment of benefits in the established amount. They are provided with additional benefits and are assigned monthly and one-time disability benefits.

Tinkoff Black Metal debit card from Tinkoff Bank - 5% on card balance

Apply now

What is an old age pension

The state assigns compensation, the amount of which allows you to lead a fairly tolerable existence. The goal is to reimburse part of the salary or other dividends.

Old age pension is divided into types:

- labor;

- social;

- state

Labor pension

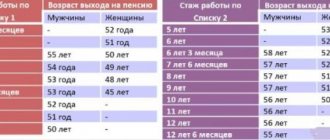

Today, men by law have the right not to work after reaching 60 years of age. A woman becomes a pensioner at 55 years old.

Important. The reform, which will end on September 1, 2019, will change the retirement schedule. The age increase is 5 years for men and women.

Some employees retire at an earlier age. Preferences apply to work:

- in special conditions;

- in a certain area.

Compensation is provided after appropriate work experience and at least five years of insurance experience. It consists of individual parts:

- basic;

- insurance;

- cumulative.

The basic share is a fixed amount, which depends on the presence of disability, dependents, and age 80 years. Pensions are calculated at an increased rate, taking into account several factors simultaneously. Since 2009, the “base” has become part of the insurance pension in the amount from 02/01/2011 - 2963.07 rubles.

The cumulative share is formed through insurance transfers and investment activities. Its size depends on the will of the citizen who wishes to use a government structure or a private fund.

Social

With this compensation, the state supports:

- pensioners who do not have five years of work experience;

- small ethnic groups of the North;

- disabled people.

On social media Even citizens who have not worked a single day can apply for assistance in old age. To receive support, you must wait until you reach an age that is 5 years higher than the official pension regulations.

Important. Not only Russians, but also foreigners, as well as stateless persons with permanent registration in the Russian Federation have the right to receive social compensation.

Before submitting an application to the Pension Fund for the assignment of this compensation, you should refuse all official part-time work.

State

Financial support to replenish lost income due to inability to work is provided from the state budget. The following citizens have access to the state pension:

- Russian army officers

- participants of the Great Patriotic War;

- civil servants;

- victims of man-made disasters;

- test pilots.

Citizens with a special status have the right to claim one type of state compensation:

- according to the age;

- disability groups;

- according to military or official experience;

- for the loss of a breadwinner.

Accrual rules

The amount of the pension depends on the points earned. They are formed based on annual contributions to compulsory pension insurance, taking into account the following conditions:

- length of service - the coefficient increases if the pensioner continues to work;

- salary level (“gray salary” is not reflected in future funds);

- duration of the worked period.

To understand the calculation principle, let's give an example:

In Kornilov A.B. By the time you turn 60, you have accumulated 40 points in your personal account. One point is worth 85 rubles. Multiplying two digits gives 3400 rubles. The fixed amount of 4990 is added to the insurance total. As a result, he is paid 8,390 rubles.

The legal basis for payments is subject to periodic changes. Inflation dictates upward adjustments and therefore the individual pension coefficient is constantly changing. In order to make calculations, it is necessary to rely on current legislative acts.

One-time disability benefit

A one-time cash payment to disabled people is financial support from the state, which can be expressed both in cash and in kind. A person has the right to choose the form of a one-time benefit.

What is included in EDV in kind:

- city telephone service;

- travel to the sanatorium once a year;

- social services;

- Dental prosthetics once every 5 years.

In material equivalent, EDV is paid in an amount depending on the disability group:

- for the first group – 3897 rubles;

- for the second group – 2783 rubles;

- disabled person of group 3 – 2228 rubles;

- minor citizens – 2783 rubles. (the amount does not depend on the group).

The recipient has the right to refuse assistance in kind in full, or from any specific type of service, replacing it with cash support.

Disability insurance payment

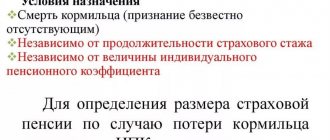

Paid if two conditions are met:

- There is any disability group.

- I have experience.

The disability insurance pension depends on several factors:

- groups;

- duration of employment;

- fees paid;

- presence in the family of persons under care;

- region of residence.

The amount of the insurance pension includes a fixed part, which is determined by the government and indexed every year. As of January 1, 2019, its value ranges from 3,467 to 24,003 rubles. The amount of disability benefits is calculated taking into account the group, family and social status, and length of service.

Debit card All inclusive from Fora-Bank - 3.5% on the card balance

Apply now

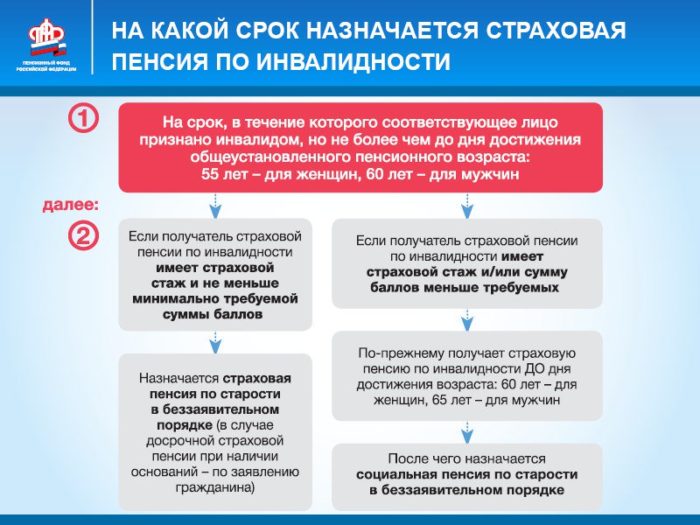

Is it possible to receive two pensions at once?

As soon as a person crosses the age limit beyond which he is officially considered a pensioner, the state, by law, can automatically transfer him from a disability group benefit to an old-age insurance pension. But this is only possible if a special status is obtained in the usual way - an illness develops, an injury occurs, etc.

State pension as a supplement is provided for such disabled people as:

- ex-participant of the Second World War or survivor of the siege;

- a serviceman who has acquired health restrictions while in service;

— injured as a result of a disaster (radiation or man-made);

— who received a disability during a space flight or preparation for it.

All of the listed beneficiaries, in addition to the disability pension, are fully guaranteed an old-age pension.

Disability benefit for group 1 in 2020

The amount of the fixed payment to the disability insurance pension of group I is 5,686 rubles 25 kopecks per month.

Amount of fixed payment to the disability insurance pension of group I

| Category of pension recipients | The amount of a fixed payment to the disability insurance pension, taking into account increases to it |

| Disabled people of group I | Without dependents - 11,372 rubles 50 kopecks per month With 1 dependent – 13267 rubles 92 kopecks per month With 2 dependents – 15163 rubles 34 kopecks per month With 3 dependents – 17058 rubles 76 kopecks per month |

| Citizens living in the Far North and equivalent areas | The fixed payment to the disability insurance pension and increases to it are increased by the corresponding regional coefficient |

| Group I disabled people who have worked for at least 15 calendar years in the Far North and have an insurance record of at least 25 years for men or at least 20 years for disabled women | Without dependents - 17058 rubles 76 kopecks per month With 1 dependent - 19901 ruble 89 kopecks per month With 2 dependents - 22745 rubles 02 kopecks per month With 3 dependents - 25,588 rubles 15 kopecks per month (regardless of place of residence) |

| Group I disabled people who have worked for at least 20 calendar years in areas equated to the regions of the Far North, and have an insurance record of at least 25 years for men or at least 20 years for women | Without dependents - 14,784 rubles 26 kopecks per month With 1 dependent - 17,248 rubles 31 kopecks per month With 2 dependents - 19,712 rubles 35 kopecks per month With 3 dependents - 22,176 rubles 40 kopecks per month (regardless of place of residence) |

The fixed part, taking into account regional coefficients, is paid regardless of the place of residence of the person at the time of payment. Thus, in order to receive an increased insurance payment for work in the Northern regions and equivalent regions, it is not at all necessary to live there.

One-time cash payments amount to RUB 3,897 . The amount is paid only if the recipient has issued an EDV in cash and not in kind.

What benefits are available to disabled people of group 1:

- To pay utility bills (50%).

- Housing subsidy.

- For education.

- Free travel on city public transport, and a half discount on the cost of travel on other types of transport.

- A trip to a sanatorium, medications and medicines, prosthetics.

- Social services: nurse, discounts on funeral services, etc.

Persons who have lost the ability to work as a result of military operations, as well as prisoners of concentration camps, receive additional monthly material support (DEMO) in the amount of 1 thousand rubles.

DEMO for disabled people of the Second World War and residents of besieged Leningrad is 500 rubles.

With an income below the subsistence level, a group 1 disabled person has the right to a federal social subsidy (FSD). Its size varies depending on the region.

What is the difference between disability and old age pensions?

Pension payments are provided in cases where a citizen has reached the age determined by the legislative bodies of the Russian Federation, and therefore cannot perform work tasks to the same extent.

Disability payments are made in cases where a person who has suffered physical or psychological injuries loses his or her legal capacity.

Depending on the degree of complication, there are 3 groups of disabled people:

- The first category includes people who need constant supervision and are unable to care for themselves.

- The second group includes those who have serious health problems, but have the opportunity to take care of themselves, while their life activity is somewhat limited.

- Citizens from the third group are wealthy enough to solve most everyday and social problems; sometimes they are even hired for non-labor-intensive positions.

The main difference between these types of charges is as follows:

- Age limit. Pensions for people with disabilities are paid regardless of age.

- Work ability. In the case of pension payments, a citizen transfers part of his income throughout his life to the state pension fund and subsequently receives a pension on its basis. Disabled people are most often incapacitated, and money is allocated to them from the state budget.

Disability benefit for group 2 in 2020

The amount of the fixed payment to the disability insurance pension of group II is 5,686 rubles 25 kopecks per month.

Amount of fixed payment to the disability insurance pension of group II

| Category of pension recipients | The amount of a fixed payment to the disability insurance pension, taking into account increases to it |

| Disabled people of group II | Without dependents – 5686 rubles 25 kopecks per month With 1 dependent – 7581 rubles 67 kopecks per month With 2 dependents - 9477 rubles 09 kopecks per month With 3 dependents - 11372 rubles 51 kopecks per month |

| Citizens living in the Far North and equivalent areas | The fixed payment to the disability insurance pension and increases to it are increased by the corresponding regional coefficient |

| Disabled people of group II who have worked for at least 15 calendar years in the Far North and have an insurance record of at least 25 years for men or at least 20 years for women | Without dependents - 8529 rubles 38 kopecks per month With 1 dependent – 11372 rubles 51 kopecks per month With 2 dependents - 14215 rubles 64 kopecks per month With 3 dependents - 17058 rubles 77 kopecks per month (regardless of place of residence) |

| Disabled people of group II who have worked for at least 20 years in areas equated to the regions of the Far North, with insurance experience of at least 25 years for men or at least 20 years for women | Without dependents - 7392 rubles 13 kopecks per month With 1 dependent - 9856 rubles 18 kopecks per month With 2 dependents - 12320 rubles 22 kopecks per month With 3 dependents - 14,784 rubles 27 kopecks per month (regardless of place of residence) |

The EDV size is RUB 2,783.

The DEMO size is the same as for disabled people of group 1 - 1000 and 500 rubles, depending on the status of the recipient. Federal subsidies are paid provided that the citizen’s income is below the subsistence level.

Privileges:

- Free travel on public transport.

- 50% discount on travel on other types of transport.

- Visit the sanatorium once a year.

- Benefits for medicines.

- Free prosthetics.

- For education.

- Free medical devices and drugs that provide a decent standard of living: hearing aids, orthopedic shoes, etc.

- 50% discount on housing and communal services.

Also, disabled people of group 2 have the right to improve their living conditions - they can take advantage of a housing subsidy to purchase real estate.

MIR debit card from UniCredit Bank - up to 30% miles on purchases

Apply now

Disability benefit for group 3

The fixed payment to the disability insurance pension of group III is 2843 rubles 13 kopecks.

Table title

| Category of pension recipients | The amount of a fixed payment to the disability insurance pension, taking into account increases to it |

| Disabled people of group III | Without dependents - 2843 rubles 13 kopecks per month With 1 dependent - 4738 rubles 55 kopecks per month With 2 dependents - 6633 rubles 97 kopecks per month With 3 dependents - 8529 rubles 39 kopecks per month |

| Citizens living in the Far North and equivalent areas | The fixed payment to the disability insurance pension and increases to it are increased by the corresponding regional coefficient |

| Group III disabled people who have worked for at least 15 calendar years in the Far North and have an insurance record of at least 25 years for men or at least 20 years for women | Without dependents - 4264 rubles 70 kopecks per month With 1 dependent - 7107 rubles 83 kopecks per month With 2 dependents - 9950 rubles 96 kopecks per month With 3 dependents - 12794 rubles 09 kopecks per month (regardless of place of residence) |

| Group III disabled people who have worked for at least 20 years in areas equated to the regions of the Far North, and have an insurance record of at least 25 years for men or at least 20 years for women | Without dependents - 3696 rubles 07 kopecks per month With 1 dependent - 6160 rubles 12 kopecks per month With 2 dependents - 8624 rubles 16 kopecks per month With 3 dependents - 11088 rubles 21 kopecks per month (regardless of place of residence) |

Also, persons in this group are entitled to:

- EDV – 2228 rub.

- DEMO – from 500 to 1000 rubles.

- Federal subsidy (if a disabled person receives a minimum income below the minimum wage).

Privileges:

- Discount on housing and communal services payments (50%).

- Right to housing subsidy.

- Free travel on public transport.

- Visit to the sanatorium with a 50% discount.

- 50% discount on medications (for certain medications).

- Benefits for training.

For working disabled people, increased leave of up to 60 days and a shortened working week of 40 hours are provided. Dismissal of a disabled worker at the initiative of the employer is legal if the employee has been undergoing treatment or recovery for more than 4 months. At the same time, the employee retains the right to paid sick leave and severance pay.

Amount of benefit for disabled children

Payments to disabled people under 18 years of age:

- Social benefits – 12432.44 rubles.

- EDV – 2783 rub.

The following amounts of payments are provided for caring for a child with a disability:

- 10,000 rub. parents or persons registered as guardians;

- 1200 rub. - to other persons.

Also, disabled children have the same benefits as other disabled citizens. Additional benefits in the form of increased leave, early retirement and additional days off are available to their parents or guardians.

These benefits are assigned only to children under the age of majority. If the ability to work has not been restored after 18 years, then the person receives the status of “childhood disabled” with a certain category and is assigned social disability benefits.

Is there an additional payment if you retire due to age?

It is possible to choose only one of the social and material surcharges provided by the state in favor of a larger one. But if you have work experience, old-age supplements are automatically assigned to the Pension Fund of the Russian Federation, without any applications.

It is allowed to receive a labor pension and a minimum social payment for disability in the amount provided for each disability group.

The accrual for this category of citizens does not depend on length of service.

Read about the transition from a disability pension to an old-age pension here.

Coronavirus benefit for disabled people

Disabled people who were previously assigned a disability group will have their group automatically extended for 6 months if the deadline for its re-certification falls on a date before October 1, 2020. The same applies to disabled children.

For persons establishing disability for the first time before October 1, 2020, a medical and social examination will be carried out without the personal presence of the applicant. This proposal was made by the Russian Ministry of Labor.

All changes will be automatically entered into the Federal Register of Disabled Persons. The Pension Fund will automatically assign or extend disability pensions.

How to apply for benefits - required documents

You can find the procedure for applying for benefits at the medical institution where the disability group is assigned. As soon as you have received the appropriate conclusion, you should contact the Pension Fund of your region. Here you need to provide:

- Identification;

- Conclusion of the commission;

- Work book.

When applying for other benefits, for example, a subsidy for utilities, an additional set of papers may be required, for example, a certificate of family composition.

Disability benefits are usually assigned together with a pension; just contact the Pension Fund, where they will calculate the specific amount of the benefit, tell you what papers you need to provide, and how payments are received. You will also need to open a bank account or take your card details where the money will be transferred. In addition to payments, there are also additional benefits and various services for the disabled - you shouldn’t refuse a little help.

Calculation rules

The payment of a disability insurance pension depends on the length of service and the capital accumulated over the years of work of the recipient. The calculation is made using the formula:

TPPI= PC/(T x K) + B, where

PC is pension capital; its size can be found out individually at the Pension Fund. Calculated based on the amount of capital on the date from which payment is planned to begin. Capital is accrued from taxes paid on wages.

T - the time expected to pay old-age insurance benefits, since 2013 is 228 months = 19 years.

K is the proportional ratio of the insurance period to 180 months. He can't be anymore. Accordingly, the coefficient will be either equal to or less than it.

B - the basic amount of disability benefits corresponding to gr. (for example, the minimum base rate for a single disabled person without a dependent is 2,402.56 rubles).

For example, Lyubov Grigorievna signed up for a disability insurance pension of 3 degrees, having accumulated capital in the amount of 400,000 rubles. Her work experience is 180 months (coefficient 1). She is single, has no dependents, therefore the basic amount of insurance payment is 2402.56 rubles.

The monthly payment under these conditions will be equal to: 400,000/(228*1) + 2402.56. As a result, Lyubov Grigorievna will receive 4156.38 rubles monthly and EDV of the third disability group.

You can also use an online calculator to calculate. You can find it on the official website of the Pension Fund. The calculator will help you figure out what kind of pension disabled people receive, what it consists of, and calculate the amount.

Procedure for payment of benefits

Social pension is paid monthly. The pensioner can choose the authority that will pay the pension and the method of receiving it. In addition to the pensioner, the person for whom the power of attorney is issued has the right to receive a pension. The validity period of the power of attorney is one year.

Now let's look at three ways to get paid:

- Through Russian Post. There are two options - receive your pension at the branch or at home. In this case, the money must be paid within the delivery period (its period differs in each branch). If the pension is not withdrawn within six months, its payment stops. To resume payment, the pensioner needs to contact the Pension Fund;

- Through the bank. Money is given out at the cash desk or transferred to a card, which can be withdrawn without commissions at the bank’s own ATM. Thus, the pension is available on the day it is transferred. Banks do not charge interest for servicing pensioner accounts;

- Through an organization engaged in the delivery of pensions. You can pick up the money at the office of such an organization or receive it in your hands while at home. A complete list of organizations is approved at the regional level. Their list is published by the territorial branch of the Pension Fund.

To approve or change the payment procedure, you can contact the Pension Fund in two ways - by physically visiting the territorial representative office or by sending an electronic appeal (via the “Personal Account of a Citizen on es.pfrf.ru”).

How to switch from a disability pension to an old age pension?

Every citizen can choose between two types of payments upon reaching retirement age. In this case, the Pension Fund automatically transfers it from the disabled to pension payments. If the pensioner contacts the governing bodies in a timely manner, he will be given the most profitable option to choose from.

And in order to choose one of two types of pension, a citizen must contact the local branch of the Pension Fund, providing a package of documents:

- A scanned copy of your passport, identification, personal data and place of registration.

- Labor book.

- Certificate of earnings for 6 months from the last place of work.

If the pensioner has never worked, the government agency will determine the optimal type of financial support.

Additional assistance for people with disabilities

In addition to payments and monetary compensation, the state offers disabled people benefits in the following areas and areas of life:

- Working conditions. Without the consent of disabled people, they cannot be forced to work overtime, on weekends or at night. The nature of the work itself should not be harmful to health;

- Public transport. Travel is free for disabled children, as well as disabled people of groups I and II who have visual impairments or cannot move;

- Driving. Disabled people of all groups can install a “Disabled” sign on their car - this allows them to park for free;

- Discount on medicines. This benefit is provided in the amount of 50 or 100% depending on the group and whether the disabled person is employed;

- Public places. Disabled people of groups I and II are accepted without waiting in line wherever people are treated or served (in clinics, in stores, etc.);

- Accommodations. The standard area for a disabled person is 36 m², twice as much as for a healthy person. An apartment or land plot is equipped with special equipment and devices (for example, ramps) at the expense of the state;

- Social housing. A disabled person may qualify for housing under a social tenancy agreement. At a minimum, he will be registered, and a disabled orphan will be given housing out of turn.

The list presented is far from complete. All benefits can be found in the text of the Federal Law on the social protection of disabled people in the Russian Federation.

Can I apply for benefits for caring for a disabled child if I myself am disabled?

The rules for assigning benefits for caring for disabled children are contained in Decree No. 175 of the President of the Russian Federation “On monthly payments to persons caring for disabled children.” The recipient of payments must satisfy a number of requirements:

- be able to work;

- not officially work;

- not be registered with the Employment Center;

- not receive a pension.

If you have a disability, it will not be possible to arrange care for a disabled child. It is best to give permission for these actions to a person (relative or friend) who meets the above requirements.

Is it possible to apply for benefits if disability was established in another country?

The Russian Federation does not have agreements with other countries on the recognition of citizens as disabled - the procedure and procedure for medical examination in other states may differ from Russian rules. For this reason, to obtain a benefit, establishing disability abroad is not enough - you need to undergo a medical and social examination in the Russian Federation.

The only exceptions are citizens whose disability was established on the territory of the USSR before December 8, 1991 - re-examination is not required for them. At the same time, foreign citizens who arrive in Russia do not lose the right to payments at their place of previous residence until the disability pension is assigned in the Russian Federation.