Good afternoon everyone!

There is hardly any hope that the state will be able to provide us with a comfortable old age. It is difficult to declare social guarantees at the present time, when pension reform is undergoing endless changes (not for the better).

People have to decide their own well-being and worry about their pensions. A non-state pension fund would seem to be a good way out of the situation. However, what happens in practice?.. For example, “UMMC-Perspective” - is it worth trusting this pension fund?

Official website of NPF UMMC-Perspective

UNMK NPF Perspective was opened in early 2001; it was registered as a non-state pension fund, but the organization began to operate actively only five years after its founding. The company provides standard services for insurance of citizens and accumulation of a certain part of the pension, and also deals with corporate programs for company executives.

The fund is a fairly large organization; it has many founders from enterprises in the metallurgical and mining industries of the Urals, and naturally, its clients include many employees of these enterprises.

Complaints and reviews

Ambiguous opinions about NPF Perspektiva may alert potential clients. From my own experience, I know that competitors often write negative reviews in general phrases. People who have become clients of the fund leave adequate reviews.

Corporate pension provision of NPF UMMC Perspective

Prospect of NPF official website can offer corporate pension provision. NPF implements effective social policy, management and optimizes taxation. The organization is developing an individual program for each company to make employee provision as profitable as possible.

Payments begin to accrue immediately after concluding an agreement with the fund. You need to obtain the right to receive a state pension in advance.

Legal entities can work on the principle of cumulative solidarity. Contributions are paid to several citizens at once, and not to a specific person.

The organization pays contributions to all employees at once, and then informs them about it individually. As a result, funding is provided both by specific employees and the entire organization as a whole. The company's employees should also sign contracts with the fund to receive future accruals and pensions.

Comments

I read the article three times... I didn’t understand everything. I’m used to the fact that the state determines the size of the pension, and we are only indignant at the endless changes. And nothing is improving. And it’s somehow scary to solve the problem ourselves. I will think and consult.

I have long wanted to deal with NPF, but I still don’t have time. UMMC-Perspective impressed with its performance. Money is invested in metallurgical enterprises. It's a profitable business. One of these days I’ll go in and find out the details, fortunately there is a representative office in our city.

Three years have passed since I signed an agreement with UMMC-Perspective. So far I like everything. Every year I receive a refund. I paid for my daughter’s studies at the institute - also a deduction. The main thing is not to switch to another fund, otherwise you will have to pay the entire return... I advise everyone, old age is just around the corner.

Reviews from citizens about NPF UMMC – Perspective

Now it becomes clear that NPF UMMC Perspective is friendly and conscientious towards its clients. The organization is constantly developing new programs, trying to attract as many clients as possible and justify their trust.

Reviews from citizens report that the organization constantly provides information on the calculation of contributions and interest on them, which will certainly bring in the future an increase in the basic state pension. However, people often complain about the operation of the site; they report that various glitches often occur and it is almost impossible to enter the client’s personal account.

( 8 ratings, average: 3.75 out of 5)

Advantages and disadvantages

The state controls the activities of UMMC-Perspective. The likelihood of losing your money is minimized; money is invested only in reliable projects. I will list the pros and cons of such a structure.

| Advantages | Flaws |

| Increasing accumulated funds through profitable investments | There is no confidence that the financial year for UMMC-Perspective will be successful |

| Ownership of all pension capital. In the event of the death of a person who has entered into an agreement with UMMC-Perspective, the accumulated funds pass to the heir | Unexpected license revocation |

| If significant shortcomings are discovered in the work of UMMC-Perspective, a person has the opportunity to switch to another fund | Paying tax on the entire amount of savings upon reaching retirement age |

"Perspective" for a well-deserved rest

Why our people have a poorly developed culture of personal savings and how to protect themselves from financial shock after retirement - Denis Melenkov, director of the Joint Stock Company Non-State Pension Fund UMMC-Perspective, told Profile.

– Denis Vyacheslavovich, when and why did the need arise to create its own non-state pension fund at UMMC?

– The non-state pension fund “UMMC-Perspective” was created by fifteen enterprises of the Ural Mining and Metallurgical Company on December 25, 2001 in the form of a non-profit organization. The company's largest enterprises have joined forces to create a stable and reliable fund for additional non-state pension provision for employees. Such funds allow for effective financial and personnel management, as well as social policy. In 2021, it will be 20 years since JSC NPF “UMMC-Perspective” successfully adapted to a changing external environment. During this time, the Fund, together with the entire financial market, overcame several global crises and honed its risk management system. The fund regularly successfully passes stress tests of the Bank of Russia. This experience allows us to confidently continue to help enterprises create pensions for employees, as well as citizens themselves to save for themselves an additional non-state pension and a funded pension under compulsory pension insurance.

– What is the formula for accumulating pension funds?

– Individual adjustment by the Fund of the corporate pension system to the interests of a particular organization involves a combination of pension schemes approved in the Pension Rules of the Fund. The contributing organization can pay pension contributions either to one joint account of the organization or to the personal account of each participant in the pension program. If the funds are formed on the joint account of the organization, then when the employee retires, the organization gives an order to the Fund either to allocate funds to the employee’s personal account or to assign a certain monthly pension from the joint account. When an organization transfers pension contributions directly to an employee’s personal pension account, expenses for non-state pension provision can be attributed to the cost of up to 12% of the wage fund, thereby reducing the taxable base for income tax. In this case, the pension scheme must provide for the payment of pensions to participants for at least five years until the funds in the participant’s account are exhausted.

The most popular option for a corporate pension program is non-state pension provision for employees on a parity basis. In this case, the organization allocates funds for non-state pensions only to those employees who have a personal non-state pension agreement and pay pension contributions. When calculating the amount of funds allocated by an enterprise to an employee’s pension account, coefficients are usually used in proportion to the length of service in the organization and the amount of the employee’s personal pension contribution.

– How did the employees react? Has this attitude changed now?

– Of course, at first it was necessary to carry out active outreach work to both the Fund and enterprises: in those days, most citizens did not have a culture of personal savings, and there was distrust of any financial organizations. But workers' attitudes changed as they felt the effects of the savings. People saw how their senior colleagues received a significant supplement to their state pension; they were given back a social tax deduction for pension contributions of up to 120,000 rubles, along with expenses for treatment and training. At the same time, contributions to the non-state fund amounted to insignificant amounts - from 150 rubles per month. The change in attitude towards the additional pension resulted in an increase in the average monthly pension contribution of depositors.

By the way, in order for investors to understand their potential capabilities, the Fund introduced a non-state pension calculator on its website in 2012, and at the same time, to increase the transparency of savings, it was one of the first among non-state pension funds to provide access to the Personal Account, where information on the status of the pension account was updated monthly.

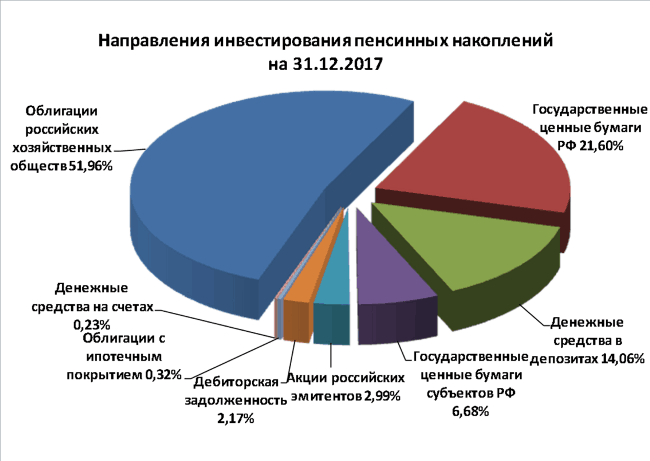

– In what areas does the Fund invest, and what are the financial results of such investments?

– JSC NPF “UMMC-Perspective” invests in various sectors of the Russian economy, our investment portfolio is well diversified. The assets consist of high-quality financial instruments with high Russian and international ratings. The majority of the investment portfolio consists of highly reliable bonds with a duration of about 3 years. This positioning makes it possible to receive additional profit from the positive revaluation of securities due to a reduction in the key rate of the Bank of Russia. The Fund's assets showed their stability during the turbulent period of March–April of this year.

The Fund's pension savings are invested in the financial market under trust management through management companies with the highest reliability ratings. The profitability of investing pension savings in 2020 was 9.98% per annum.

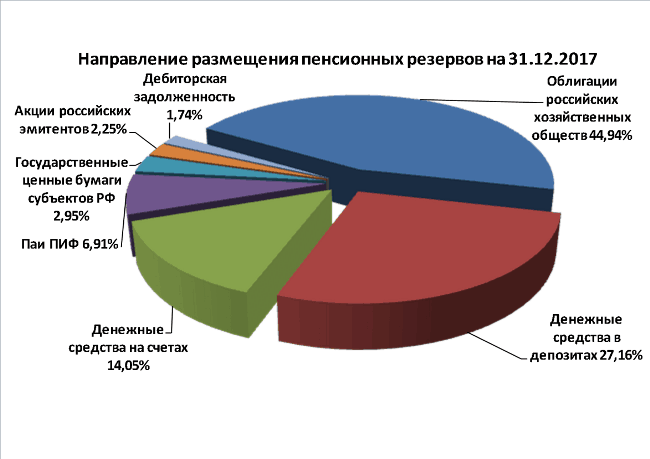

Also, pension reserves are placed by the Fund on the financial market independently and within the framework of trust management through a management company. The profitability of placing funds from pension reserves in 2020 amounted to 8.91% per annum.

– Has anything changed in the Fund’s work after the pension reform in 2018?

– The pension reform did not affect the activities of NPFs: both the non-state pension and the funded pension under compulsory pension insurance can be paid upon reaching the “old” retirement age – 60 years for men and 55 years for women.

I would like to note that the entire history of the Fund’s development took place during a period of numerous changes in the pension system. Since 2002, the formation of a funded pension for compulsory pension insurance began, and in 2004, non-state pension funds were admitted to this system as insurers, and employees of UMMC enterprises had a need to expand the list of Fund services. As a result, in 2004, the Fund received a license to operate as an insurer for compulsory pension insurance, and insured persons were able to transfer funded pensions to a corporate fund to organize reasonable investment and convenient interaction with the Fund when applying for payment. In 2020, the Fund underwent a detailed inspection by the Bank of Russia. Less than half of the NPFs passed this test, which led to a significant narrowing of the pension market while increasing reliability, since pension savings are guaranteed in the remaining NPFs at the moment! Since 2020, a “freeze” of contributions to the funded pension was introduced, which is extended until the current time. Given the lack of new receipts of compulsory insurance contributions, a significant number of NPFs were forced to consolidate in order to reduce operating costs, and at the moment there are only 29 NPFs operating in compulsory pension insurance.

– Are there any prospects for the formation of non-state pensions in Russia?

– In 2020, Russia ratified the convention of the International Labor Organization, according to which the coefficient of replacement of lost earnings with an old-age pension must be at least 40%. At the same time, the OECD recommends a replacement rate of 67.9% of lost earnings, of which 40.6% should be provided by the state pension system, and 27.3% by the voluntary formation of a pension by the future pensioner himself, his direct employer or within the entire industry. The average replacement rate in Russia in 2020 is 33%. At the same time, in accordance with the official PFR insurance pension calculator, a citizen, having worked for 40 years with earnings of 40,000 rubles, can count on a state pension of 19,506 rubles (at the current value of the pension point) and his replacement rate will be 48.7%. At the same time, a citizen with earnings of 108,000 rubles or more can only count on 42,644 rubles of insurance pension from the Pension Fund of the Russian Federation, which will amount to no more than 28.4% of his earnings. It is obvious that for such citizens, without additional savings, retirement will lead to a sharp decline in the standard of living. In order to avoid such a drop in income, non-state pension funds exist. As employees realize their own responsibility for their pension future, the importance of the corporate pension system in the social package of organizations will increase. Based on global experience in the development of the pension industry, we can say that strengthening the role of additional non-state pension provision is inevitable. The earlier you start saving, the smaller the pension contribution will be required to form the desired amount, and organizations that create a corporate pension system now will have a competitive advantage in the future.

Reference. Joint Stock Company Non-state pension fund "UMMC-Perspective" (JSC NPF "UMMC-Perspective"), license of the Bank of Russia to carry out activities in pension provision and pension insurance No. 378/2 dated November 23, 2004, issued without limitation of validity period.

The results of investing in the past do not determine income in the future; the state does not guarantee the profitability of placing pension reserves and investing pension savings. It is possible to increase or decrease income from placing pension reserves and investing pension savings. JSC NPF "UMMC-Perspective" was included in the register of non-state pension funds - participants in the system of guaranteeing the rights of insured persons in the compulsory pension insurance system on September 30, 2020 under number 31. Before concluding a pension agreement or transferring pension savings, you must carefully read the fund's charter and its pension benefits. and insurance rules and key financial service information document. You can obtain detailed information about the fund and familiarize yourself with the charter, pension and insurance rules, as well as other documents provided for by legislation and regulations of the Bank of Russia at the address Ekaterinburg, st. Boris Yeltsin building 3/2, office. 502, by phone or on the website www.npfond.ru Read in full (reading time 5 minutes)

History of the foundation

The establishment of the organization dates back to 2001, although it began active work in the field of pension savings only in 2006. This fund has not undergone major reorganization measures (except for bringing it into compliance with the requirements of the law) and has not changed its name.

The founders of the fund were Ural mining and metallurgical enterprises . Initially an exclusively regional fund, it expanded the geography of its presence in 2020 to the entire Urals, Siberia and even the Far East.

Disclosure of key indicators

Profitability indicators, the number of clients of the organization and the amount of funds in dynamics show a detailed picture of the state of the fund, as well as its reliability and prospects.

Profitability

UMMC-Perspective pursues a conservative policy regarding the accumulation of funds, which makes it possible to neutralize risks and increase income.

Rice. 2. Directions of investment according to OPS. Source: official website

Rice. 3. Directions of investment in NGOs. Source: official website

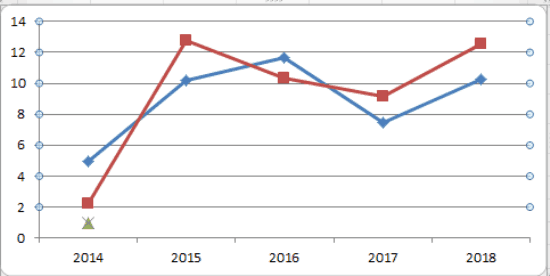

Table 2. Return on savings and reserves in 2014–2018 Source: npf.investfunds.ru, cbr.ru

| Year | Profitability, % | |

| OPS | NPC | |

| 2014 | 2,19 | 4,92 |

| 2015 | 12,75 | 10,2 |

| 2016 | 10,36 | 11,68 |

| 2017 | 9,19 | 7,47 |

| 2018, March | 12,52 | 10,23 |

Chart 1. Profitability dynamics in 2014-2018 Source:: npf.investfunds.ru, cbr.ru

Reference! At the end of 2020, the Central Bank assigned the UMMC-Perspektiva Pension Fund 7th place in the overall list in terms of profitability.

The leaders in the ranking in terms of profitability in the first quarter of 2020 were the NPF Gazfond Pension Savings, the Vladimir Fund and the National Non-State Pension Fund.

Number of clients

The fund works with individuals in two directions, concluding contracts for compulsory and voluntary pension provision.

Table 3. Number of insured persons of the fund in 2014–2018. Source: npf.investfunds.ru, cbr.ru

| Year | Number of clients by OPS, people. |

| 2010 | 58 914 |

| 2011 | 60 983 |

| 2012 | 65 561 |

| 2013 | 65 471 |

| 2014 | 65 179 |

| 2015 | 58 965 |

| 2016 | 70 635 |

| 2017 | 74 517 |

| 2018, March | 82 066 |

Chart 2. Growth dynamics of the fund's insured persons, 2010–2018. Source: npf.investfunds.ru, cbr.ru

Reference! The NPF also serves 89,631 participants, of which 3,137 people, as of the end of 2017, received an additional pension.

Volume of pension savings

Table 4. The amount of pension savings of the fund in 2005–2017. Source: npf.investfunds.ru, cbr.ru

| Year | Amount of savings, million rubles. |

| 2010 | 1 532 |

| 2011 | 2 727 |

| 2012 | 3 726 |

| 2013 | 4 686 |

| 2014 | 4 751 |

| 2015 | 5 389 |

| 2016 | 7 175 |

| 2017 | 7 956 |

| 2018, March | 8 414 |

Graph 3. Dynamics of increase in savings in 2010–2017 Source: npf.investfunds.ru, cbr.ru

Reference! The volume of pension reserves at the end of the first quarter of 2020 reached RUB 2,018 million.

Reliability and profitability rating

The reliability indicator in the truest sense of the word is not officially assessed, and no ratings are compiled. However, it is important to keep in mind that the Central Bank has the authority to revoke the license of those funds that conduct risky transactions or engage in other questionable activities. Therefore, a valid license of a non-state pension fund is, in a certain sense, a guarantee of its reliability on the part of the state.

Unofficial reliability ratings among business organizations and non-state pension funds, in particular, are compiled by independent expert organizations. The most authoritative in our country are the National Rating Agency and the Expert RA Agency (RAEX). UMMC-Perspective did not take part in the first rating, but was last included in the second one in 2017.

As of this year, the organization was assigned an A+ rating, which not only indicates a high level of reliability, but a high degree of likelihood of maintaining it in the near future. It will not be possible to find more recent indicators of reliability assessment, since the fund participates in such ratings on a voluntary basis.

It is much easier to evaluate profitability, since it follows directly from the fund’s financial statements. And this documentation, based on the requirements of the law, is public in nature and must be posted in open sources, in particular, on the company’s official website. Also, reporting is sent quarterly to the regulator in this area - the Bank of Russia, which generates a consolidated list of data for all funds.

The latest (current) figures, including profitability, are presented as of the end of 2020 for the first three quarters. Although these figures are intermediate, they are quite indicative, reflecting the general trend and results of the year as a whole.

Profitability is assessed by two indicators separately and is:

- Placement of pension reserves – 10.45%.

- Investing pension savings – 10.69%.

Attention! The numbers are given in their pure form, i.e. minus those amounts of remuneration that were withheld in favor of management companies, the specialized depository and the fund itself.

In terms of profitability, the management fund occupies one of the leading positions in the market. According to the summary table compiled by the Central Bank based on the results of the funds’ activities for the 3 quarters of 2019, UMMC-Perspective is in 13th place among 48 organizations, which is a very good indicator.