Pension funds are gaining wide popularity in the CIS countries, and the use of a personal account is especially useful. – a pension fund whose personal account is very easy to use.

The company specializes in the payment of old-age pensions; it is a non-governmental organization founded in 2004. The company occupies a leading position among industrial and financial groups in Russia.

Official website of NPF Safmar

The organization has a well-developed website, which is located at www.npfsafmar.ru. The successful provision of services in the areas of compulsory pension insurance and non-state pension provision, as well as the merger of several funds, led to the formation of an impressive client base - more than 2.3 million people.

The fund manages over 200 billion rubles of pension assets. The fund's participation in the system of guaranteeing the rights of insured persons makes it attractive among potential clients.

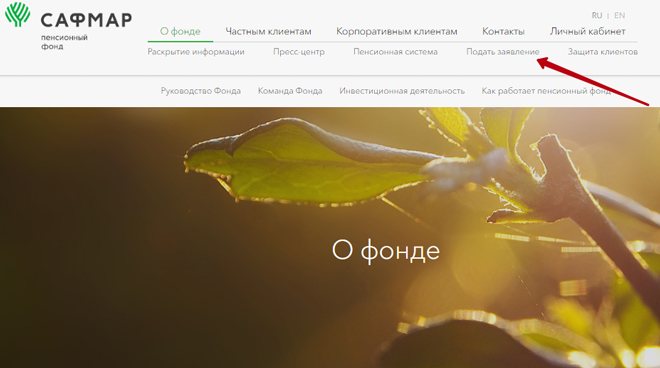

The main page of the official website has a navigation menu with all the necessary sections - from the general information block to the personal account service. The latter allows you to get timely access to your pension account, monitor its growth, and control the flow of funds.

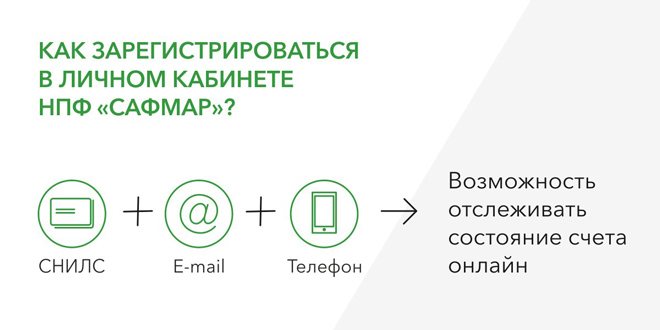

Only participants in the compulsory pension insurance program, SNILS, can register. You will also need to enter your email address and mobile phone number (if available).

After confirming your registration, you will have access to all important information regarding your future pension.

You can also find a convenient pension calculator on the website, which will allow you to calculate the amount of future non-state payments. The “Online Financier” program, presented on this same page, is a good financial product from NPF Safmar.

The advantages include the accrual of income from investment programs and the opportunity to receive a social tax deduction. In addition, the client can determine the size and frequency of deductions independently. Monthly contributions will allow you to accumulate significant financial wealth by the time you retire.

The fund also offers corporate programs, which will come in handy for many enterprises that want to centrally provide future pensions to their employees.

Foundation programs

Currently, the organization in question may offer its clients the use of certain savings programs for future retirement. This happens within the framework of pension insurance. The existence of an individual and collective program for financing the future accrual of pensions is envisaged.

Features of the programs include:

- increasing the level of investment-type income that the fund receives from the fact that the fund uses money as an investment;

- if the client dies, then the savings period expires, then the funds can be transferred to the heirs;

- a decision regarding whether placement should take place in a non-state or government fund.

The citizen makes this decision according to his own decision. It is important to take into account that the funds that accumulate in the organization’s accounts can be distributed throughout the citizen’s life or over a certain period of time. If a person does not meet the conditions established by co-financing programs, then the citizen receives the right to receive a one-time or permanent payment.

This fund offers its clients three different savings programs. In particular:

- Financier. The minimum contribution amount is 2000. Subsequently, the amount each month will be 20,000 rubles. There is no limit on the period during which funds are invested.

- Financier online. Initially, you need to deposit 30,000 rubles into your account. For further deposits – 5000 rubles. You need to make payments every month.

- VIP financier. At the initial stage, a citizen contributes 60,000 rubles. Then every month the person pays five thousand rubles.

If a citizen dies, his heirs are paid 100% of the amount located in the account. It includes not only deposited funds, but also accumulated investment-type income. If the basis for making a payment arises, the person has the opportunity to establish the procedure for receiving payments from a non-state fund.

The organization proposes to establish payments throughout life or a certain period. In this case, the period should not be less than five years. You can also set the option to use the program when the account is reset.

To calculate the payments that will be provided to a citizen throughout his life, the average duration of the security received must be taken into account.

Reliability rating of NPF Safmar

The Central Bank of the Russian Federation summed up the activities of the Safmar fund as of the second quarter of 2020. Among 66 participants, the fund took worthy places, which demonstrates the reliability of the financial organization:

- first place among the top non-state pension funds (criterion - the size of the average compulsory pension account);

- fifth place in total savings;

- sixth place in terms of number of clients served.

Thus, the fund shows serious results, which indicate confidence in it. According to expert assessment, the organization’s financial reliability rating is the highest – A++.

This fact suggests that the fund will not close overnight, and you can trust it with your pension savings. For potential clients, such information is important because it allows them to decide whether it is worth concluding a pension agreement.

About the non-state pension fund

There are a large number of non-state pension funds operating on the territory of the Russian Federation.

But what is it and how much can you trust this organization? An organization that is not commercial, its action is aimed only at preserving and increasing the pension contributions of citizens during the period of their working activity - this is a non-state pension fund.

The existence and activities of the organization are regulated by current legislation. By concluding an agreement, everyone can be sure that at any time they will be able to check their account and monitor the effectiveness of their money management. Information in full is available on the official Internet resource of the NPF. Activities are under constant control of the relevant services:

- tax service;

- financial markets services;

- Russian Pension Fund;

- Accounts Chamber of the Russian Federation.

In addition to savings, non-governmental organizations offer their clients additional services:

- If an accident occurs and a client of the Fund dies, then relatives or trusted persons will be able to receive his savings. Anyone named in the will.

- Funds accumulating in the organization's account are not subject to withdrawal in the event of seizure of property.

- There is a possibility of increasing the savings portion. This is done personally by the client by transferring additional funds. You can deduct an additional amount from your salary. This is done through the accounting department of the enterprise where the client is registered.

The opinion of experts is that non-state funds are much more reliable than commercial banks. Unlike financial institutions, these organizations, in the event of bankruptcy, do not lose customer deposits and honestly transfer them to the appropriate accounts of citizens in the Pension Fund.

Fund returns by year

The profitability of any non-state pension fund largely depends on the current situation in the financial market. And we are talking about both debt and stock markets. The debt market is subject to a reduction in the key rate of the Central Bank, which entails a decrease in the profitability of each non-state fund.

Negative dynamics have been observed this year in the stock market as well. There are many reasons for this, but, first of all, the rapidity of events taking place in the banking sector. Due to the outflow of part of the capital, constant sanctions and the slowdown in the country’s economic development, positive dynamics are being replaced by negative ones.

But this is a common occurrence - by such indicators one can judge the real state of the economic sector. So far there is no growth trend, but the picture may change.

NPF “Safmar” cannot be called high profitability. Although clients claim that pension savings are still increasing. At the end of last year, the profitability of NPFs was able to overtake the 2.5 percent inflation rate and amounted to 3.8%.

If we do not take into account the payment of remuneration to all management companies with which the fund cooperates, then the result reached 4.6%. The placement of pension reserves gave a yield of 4.3%, taking into account the remuneration paid.

Reliability and stability of increasing future pensions is exactly what pensioners are interested in. The period of financial recession this year may well give way to growth next year.

Rules for submitting applications to NPF Safmar

All the features of submitting applications can be found on the official website of the fund in one of the menu sections - “Submit an application”.

Depending on what exactly the client needs (appointment of pension payments, notification of changes in personal data, etc.), a package of documents must first be prepared. What exactly should be included in it can be found in the corresponding lists (there are 14 of them).

Applications can be submitted in person or through a legal representative. There are several ways to submit:

- by mail (the authenticity of the documents must be confirmed by a notary);

- in the fund's offices;

- through partners, at Raiffeisenbank branches (pre-submission of an electronic application is required).

If we are talking about assigning payments, then after accepting and reviewing the documents, a written response is sent to the client by email. If the paperwork is completed correctly, no later than a month after the decision is made, it will be possible to receive the first amount of funds.

How to find out your pension accrual

All necessary information about pension accruals and account status can be found by contacting the office directly, by calling the hotline or using the “Personal Account” service, which is located at client.npfsafmar.ru. The last method is very convenient, since it can be implemented without leaving home.

Access to your personal account is available to registered clients. Moreover, at the moment, the registration procedure is available only to participants in compulsory pension insurance. Clients in the field of non-state pension provision will be able to register a little later, as stated on the organization’s website.

Customer Reviews

The reviews that people who have encountered the company leave in comments on discussions on the Internet vary dramatically. Some people note the fund’s overly aggressive information policy, which causes rejection. Some, on the contrary, believe that the company’s popularity and the people’s trust placed in it are completely justified.

Galina, 46 years old. Zelenograd: “Convenient personal account, the site is well thought out, contains all the necessary information on available programs. The specialists in the office are able to advise even the most thoughtful client.”

Natalya, 28, Volgograd: “Intrusive advertising of the fund creates negative impressions about it. Employees offering to sign up for a pension insurance agreement are being overly persistent.”

How to receive the funded part of your pension

The packages of documents for assigning payments for the funded part are different if we are talking about submitting an application independently or through your legal representative. All necessary information on this issue is presented in Lists 1 and 2, respectively.

As soon as the necessary papers have been prepared, you can contact NPF Safmar - during a personal visit, by mail or through the fund’s partners.

If all documents are completed correctly, a notification that the application has been accepted for consideration should be sent to the post office within 5 business days.

For funded pensions, the decision must be made within 10 days, after which the NPF again sends a response by mail. One month is the deadline during which payments for the funded part of the pension must begin.

Important! The time for the fund to fulfill its obligations to the client is counted from the moment the corresponding decision is made.

Advantages and disadvantages

Of course, NPF Safmar has its pros and cons.

Advantages:

- in 2020, the fund managed to increase its returns with the expected closure of past losses;

- ease of use for clients (personal account, hotline, feedback);

- well-known banks act as agents (you can sign an agreement with NPF Safmar without sending documents by mail).

Disadvantages of NPF "Safmar":

- when concluding an individual insurance plan, an initial payment will be required;

- not the highest awarded rating (although the forecast is stable);

- I didn’t like working on the official website (there are no necessary document forms, no search, not all information is available);

- the policy of the Safmar group, as a result of which clients began to refuse service.

Safmar Foundation office addresses

The location address of JSC NPF Safmar is Moscow, Serp i Molot Zavoda proezd, building No. 10. The organization's head office is located on the 11th floor in the Integral business center, located at this address.

After the final reorganization of several non-state foundations, the Education and Science Foundation became a branch of Safmar. This happened in September 2020. Now the client can also contact the address: Leninsky Prospekt, building No. 42, building 2. There is also a territorial branch in Saratov.

Fund hotline number

For all questions, you can contact the hotline: 8-800-700-80-20 and +7 (495) 777 9989. A call center specialist will promptly advise on pension issues. Calls are accepted every day from 8.00 to 20.00.

In general, NPF Safmar is one of those organizations that you can trust with your pension savings. The fund's profitability changes depending on the situation on the financial market, but this does not change the overall positive trend in its development.

If you want to invest in something other than the top non-state pension funds in our country, you should pay attention to the fund considered.

( 68 ratings, average: 2.66 out of 5)

Security and privacy rules

uses the most modern security systems, for its part guaranteeing complete data confidentiality. However, the user must also make efforts to preserve personal information. To do this, it is recommended to use only trusted official browsers with a security system in place. After entering the issued password for the first time, you must immediately change it to a more suitable one. The password must be at least 8 characters long and include both numbers and letters of different case (upper and lower case). In addition, you need to disable the form autofill feature so that your login and password are not saved anywhere. And, of course, you need to protect your computer from all kinds of viruses. Compliance with all these requirements will help ensure complete safety. The company's support team can provide further assistance in this matter.