reference Information

Table 1. General information about the fund

| Name | Requisites |

| Full title | Joint Stock Company Non-state pension fund "Obrazovanie" |

| License issue date | 04.03.2004 |

| License | 412 |

| Member of the Deposit Insurance Association | From 2020 |

| Location | 620026, Ekaterinburg, st. Belinskogo, 56, of. 301-303 |

| Total number of insured persons and participants as of 12/31/2017 | 128.7 thousand people |

| Yield according to the Central Bank for 2020 | 3,27% |

| Official site | www.npfo.ru |

| Telephone | 8 +7 |

JSC NPF Obrazovanie is a company created in 2001 at the Russian Academy of Education in the Urals and the Russian State Pedagogical University in Yekaterinburg. At first it provided pension services to employees of the public sector, later it expanded and now provides a range of services on compulsory pension insurance, non-profit provision to private and corporate individuals. It is a major player in the regions of the Urals and Western Siberia. The fund's total savings approached 6 billion rubles.

Information about the fund

- Full name of the organization (name of NPF): Joint Stock Company "Non-State Pension Fund "Obrazovanie"

- Status in 2020: Active - Valid license

- License number: 412

NPF Education was created in 2001, initially it focused on the implementation of pension programs for employees of the public sector. As development progressed, the restrictions were lifted and now the fund operates under OPS and NGO programs for any interested citizens of the Russian Federation. On June 30, 2016, the fund entered the state insurance system DIA.

General Director - Tashchilin Vladimir Fedorovich.

Affiliated funds

No affiliated funds

Requisites

View details

Full name of the payment recipient Joint Stock Company "Non-State Pension Fund "Obrazovanie" Short name of the payment recipient JSC "NPF "Obrazovanie" INN of the payment recipient 6686996778 KPP of the payment recipient 668501001 Current account number of the payment recipient 40701810516540000081 Payee's bank Ural Bank PJSC Sberbank Bank of Russia Ekaterinburg Correspondent account payee's bank 30101810500000000674 payee's bank BIC 046577674

Who is the owner of the fund?

A few years after its opening, NPF “Obrazovanie” became part of the Financial Group “Future” and now uses its capabilities when investing trusted pension savings.

Briefly. FG "Future" was formed in 2020 as a single control center for 4 non-state pension funds controlled by the O1 Group of companies of entrepreneur Boris Mints. Engaged in asset development, investment of funds and interaction with management companies. It is one of the largest public organizations in Russia with total assets of about 330 billion rubles, serving 4.6 million people across the country.

The entire stake in NPF (100%) is owned by the Future group. The general director of the fund is Mikhail Fedotov.

The ultimate beneficiary of Obrazovanie is Russian businessman Boris Mints, who owns 76.4% of the company’s shares worth more than 114.6 million rubles.

Detailed information about NPF “Future” can be obtained in the article: “Review of the non-state pension fund JSC “NPF “FUTURE”.

Reviews from NPF clients

Good afternoon.

I became a victim of scammers during a fraudulent transfer of funds from the funded portion of a pension from the Pension Fund to the Non-State Pension Fund with a forged agreement and application. As a result, succession in all actions and means Read more. Is the review helpful? Yes 13 / No 2 Comments 0 Complain about review Link to review

It's 2020. Hey! Don't mislead people. NPF Trust has merged with SAFMAR. Update more often or leave!

Is the review helpful? Yes 8 / No 5 Comments 0 Complain about review Link to review

Left this fund for another. As a result, instead of losses of minus 4% (2017) and minus 12.6% (2018) https://www.kommersant.ru/doc/3931177, I received +26.77% over three years

Is the review helpful? Yes 6 / No 3 Comments 1 Complain about review Link to review

You, my dear, are either bad at mathematics or good at imagination, since you’ve already been in another fund for 3 years and for some reason you think that before that you were in the future))

I have been in the NPF GAZFOND fund for pension savings for the fourth year in 3 years +26.77% Before that I was in the NPF Future, savings there are now CATASTROPHICALLY melting: Minus 4% (2017), 12.6% (2018) https://www. kommersant Read more.

Is the review helpful? Yes 7 / No 4 Comments 1 Complain about review Link to review

not a review but some kind of linden. first, information about the future and profitability for the last 2 years, and then suddenly it turns out that the author has been in the gas fund for as long as 3

NPF "SAFMAR", where I ended up against my own will, at the end of 2018, stole more than 31 thousand rubles from my OPS account, to which I made my own contributions under the co-financing program. This is what they call Read more.

Is the review helpful? Yes 38 / No 2 Comments 2 Complain about review Link to review

This is disgusting. SAFMAR. Today I accidentally found out that I was there. These people stole my personal information and made an application on my behalf. I’m going to sue them, and I’m preparing a claim with a lawyer for damages.

The Foundation employs a VOR. Using passport photographs, he issues online loans and then they arrive with fines to unsuspecting owners! The Foundation's employees know everything perfectly well and do nothing. Don't trust them with your money.

NPF Safmar received an investment return for 2020 minus 11.02%. They got out of it very simply: they spread their losses across client accounts. Thus, more than 31 thousand rubles were withdrawn from my OPS account. People are shocked, and the fund is in chocolate.

Is the review helpful? Yes 44 / No 1 Comments 0 Complain about review Link to review

A company of scammers! In 2020, he transferred to a non-state fund at BIN. Then they transferred me to SAFMAR. Since the amount was not large, I was not interested in the fate of my savings for a long time. Today I remembered about the fund. I went Read more.

Is the review helpful? Yes 60 / No 4 Comments 1 Complain about review Link to review

In 2018, Safmar showed a negative investment result; people’s savings were lost. I'm thinking of leaving them. The only question is to whom.

Show must go. I transferred my pension here 3 years ago, I still don’t understand anything, but in my personal account I saw numbers that show some interest, although the last time I checked was about a year and a half ago Read more.

Is the review helpful? Yes 20 / No 18 Comments 0 Complain about review Link to review

They promise normal profitability, so I decided to try it. In general, it would certainly be nice if we had a pension like in Europe; I also want to travel in retirement and not sit on the children’s necks. Who knows, maybe we'll get there soon

Is the review helpful? Yes 5 / No 19 Comments 0 Complain about review Link to review

Services provided

The following offers apply to private clients of the fund:

- compulsory pension insurance (OPI);

- non-state pension provision (NPO);

- co-financing of pensions.

NGOs offer a number of programs: “Great Opportunities”, “Informed Decision”, “Parental Support”.

Corporate clients can take advantage of the following programs:

- classic corporate program - creation of pension accounts for employees at the expense of the employer;

- parity corporate program – creation of pension accounts at the expense of both the employer and the employee;

- Solidary corporate program - without opening individual accounts.

Interesting fact! The activities of NPFs are regulated by the state (Central Bank of the Russian Federation), a specialized depository, and the Board of Trustees. Every quarter, Obrazovanie publishes information on investment results for the reporting period.

Information disclosure

During the period 2014-2016. the size of pension reserves for mandatory pension insurance and non-profit pensions in the fund decreased. This was due to the difficult macroeconomic situation and changes in the Russian economy. In 2020, the fund's total financial savings increased again.

Table 2. The amount of pension savings of the NPF “Education” in 2011-2017. Source: npf.investfunds.ru

| Year | Amount of funds under OPS, rub. | Amount of funds for NGOs, rub. |

| 2017 | 5.48 billion | 341.7 million |

| 2016 | 4.17 billion | 315.6 million |

| 2015 | 4.25 billion | 356.4 million |

| 2014 | 5.2 billion | 320.9 million |

| 2013 | 5 billion | 288.7 million |

| 2012 | 3.32 billion | 222.9 million |

| 2011 | 1.89 billion | 164.7 million |

Chart 1. Dynamics of changes in the total amount of pension savings of the NPF “Obrazovanie” in 2011-2017.

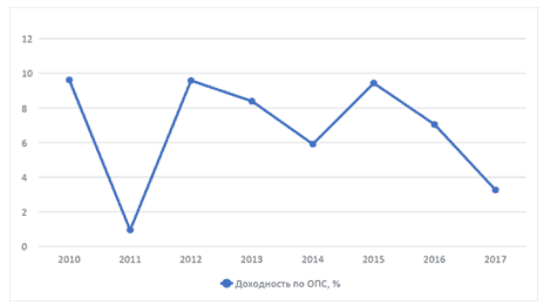

In 2009, the fund showed a record profitability of 26.85%. In 2010-2016 its level, with the exception of two years, remained stably at an average level. In 2020, profitability fell, including due to the recovery of the banking system in Russia.

Table 3. Change in profitability from investing savings of NPF “Obrazovanie” in 2010-2017. Source: npfrate.ru, npf.investfunds.ru

| Year | Profitability according to OPS |

| 2017 | 3,27% |

| 2016 | 7,04% |

| 2015 | 9,43% |

| 2014 | 5,91% |

| 2013 | 8,39% |

| 2012 | 9,58% |

| 2011 | 0,95% |

| 2010 | 9,62% |

Graph 2. Dynamics of changes in profitability from investing savings of NPF “Obrazovanie” in 2010-2017.

Statistics of NPF Education: rating of reliability and profitability

According to the Central Bank of the Russian Federation from the reporting “Main performance indicators of non-state pension funds” as of the date: 01/01/2020

Fund assets (thousand rubles): 4523635.89

Statistics on NPO (non-state pension provision) as of 01/01/2020

- Total volume of pension reserves (thousand rubles): 259247.38

- Total number of participants (people): 18628

- Participants receiving a pension (persons): 1303

- Total amount of pensions paid under NPO (thousand rubles): 32289.04

Statistics on compulsory pension insurance (compulsory pension insurance) as of 01/01/2020

- Pension savings (thousand rubles, market value): 4134256.13

- Number of insured persons (people): 96944

- Participants receiving a pension under compulsory pension insurance (persons): 1032

- Amount of pension payments under compulsory pension insurance (thousand rubles): 34020.23

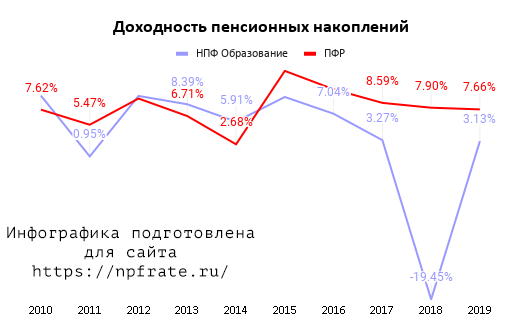

Profitability of pension savings

Current profitability

Minus remuneration for management companies, specialized depository and fund.

- Profitability of placing funds from pension reserves (NPO): 2.58%

- Return on investment of pension savings (OPS): 3.13%

Profitability chart

Data on the profitability of NPF Education in 2020 (as of 01/01/2020), including information for the previous 10 years in comparison with the profitability of the Pension Fund (VEB):

Yield comparison table

| Year | NPF Education | Pension Fund |

| 2010 | 9.62% | 7.62% |

| 2011 | 0.95% | 5.47% |

| 2012 | 9.58% | 9.21% |

| 2013 | 8.39% | 6.71% |

| 2014 | 5.9% | 2.68% |

| 2015 | 9.43% | 13.15% |

| 2016 | 7.04% | 10.53% |

| 2017 | 3.27% | 8.59% |

| 2018 | -19.45% | 7.90% |

| 2019 | 3.13% | 7.66% |

Number of clients

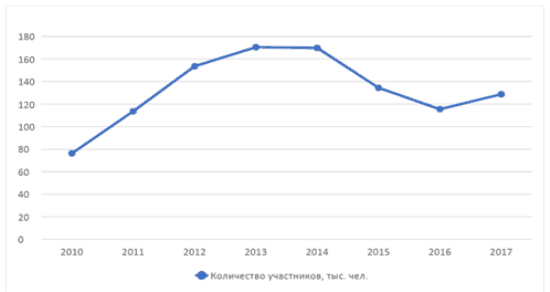

During the period 2014-2016. the number of Obrazovanie clients has noticeably decreased, caused, among other things, by the fund’s unstable profitability. Starting in 2020, the customer base began to increase again.

Table 4. Total number of clients in NPF “Obrazovanie” in 2010-2017. Source: npf.investfunds.ru

| Year | Number of insured persons, people. | Number of participants, people |

| 2017 | 108.6 thousand | 20.1 thousand |

| 2016 | 90.1 thousand | 25.4 thousand |

| 2015 | 108 thousand | 26.4 thousand |

| 2014 | 143.4 thousand | 26.4 thousand |

| 2013 | 144.5 thousand | 25.9 thousand |

| 2012 | 128.5 thousand | 25 thousand |

| 2011 | 89.7 thousand | 23.9 thousand |

| 2010 | 58.7 thousand | 17.8 thousand |

Graph 3. Dynamics of changes in the number of clients of NPF “Obrazovanie” in 2010-2017.

Awards and ratings

Currently, NPF “Obrazovanie” does not participate in rating assessments from Russian agencies.

In particular, the company has never taken part in the NRA (National Rating Agency) rating. The rating from the RAEX agency (“Ra Expert”) was withdrawn at the end of 2013 due to the fund’s refusal to update the information. However, before this, the fund’s activities were rated A+, which means very high reliability.

Figure 2. Evidence of the reliability of NPF “Education”. Source: myslide.ru

“Education” adheres to a conservative investment policy, due to which it guarantees average returns (above the inflation rate) and safety of funds.

Important! Another evidence of the fund’s reliability is its participation in the system of the state deposit insurance corporation DIA.

Official website of NPF "Obrazovanie"

It was created quite recently, it has been founded since 2001. The fund is registered in the city of Yekaterinburg. He has a website that also provides all the information regarding his work, rating levels, profitability and much more. In the short time the company has been operating, it has already managed to help millions of pensioners successfully invest money with the help of their fund and earn good amounts of money.

It should also be noted that when choosing a fund, it is worth checking the information provided regarding its ratings and figures, as it is possible that the data may be out of date and no longer valid. Now let's clearly examine the level of profitability and reliability rating of this fund.

Profitability

One of the most important factors that play a key role in the performance of any fund. With its help, it is possible to predict what the outcome of the invested funds will be, since this rating is intended precisely for this. This will seem strange to inexperienced people, and they will treat the presented figures as just numbers, but in fact this is very important data that in the future will help you not to lose your invested savings.

Therefore, the lower the rating, the higher the risk of losing funds. This fund has a slightly above average rating, with the exact figure being 5.3. a good indicator, but you need to be careful when investing.

Reliability rating

Also no less important. It also plays an important role in the operation of the fund system and carries its own meaning. If the number of investors is high, it means that people trust the fund and are not afraid to invest money in it.

This means that it is a very reliable fund in which you can invest without worrying about payments. Thus, they increase its reliability, and the rating also increases. The Education Fund has an A+ rating, which means very high reliability.

Personal Area

The personal account service on the website of NPF “Obrazovanie” is another way to control all changes in your pension account, available to every client. Here a person can:

- at any time of the day, check the account status, all accruals and the total amount of savings;

- make a list of all operations performed, generate an extract;

- quickly contact support;

- If personal data changes, inform about it and make the appropriate changes (for this you will need to send documents by mail, e-mail, fax and bring them to the fund’s office).

Figure 3. Login to the personal account of NPF “Education”

The personal account service is free for each client; you can connect it in two ways:

- personally visit the NPF office with your passport and SNILS. You will need to fill out an application on the spot; in return, fund employees will provide you with your personal login and password;

- leave a request on the website, fill out and send the client’s personal data. In this case, the login and password will be sent by registered mail.