Definition

What document are we talking about? It is important to understand that in Russia there are several concepts - TIN and TIN certificate.

An individual taxpayer number is a kind of citizen identifier in the Federal Tax Service system. This is a number consisting of some combination of numbers. It is assigned to every person at birth.

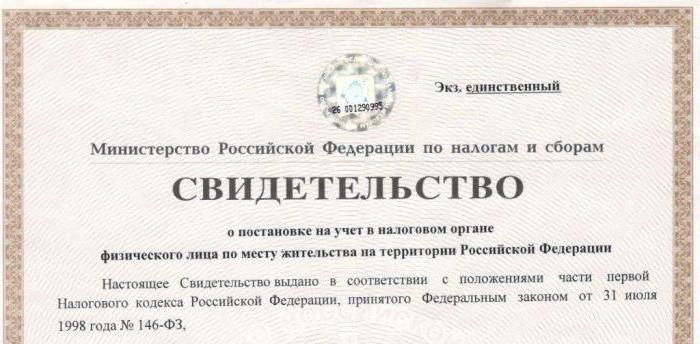

A TIN certificate is a document that contains the individual number of a person and information about the recipient. Usually it means A4 paper with relevant information and government signs. In Crimea and Sevastopol, together with the certificate, you can put a special stamp in your passport.

Reasons for replacement

Is it necessary to replace the TIN when changing place of residence or not? In Russia, many documents have to be exchanged from time to time. For example, after their expiration date or when moving to another city.

The reasons for exchanging the TIN are the following circumstances:

- change of personal data;

- detecting typos in a document;

- theft/damage/loss of old paper.

It follows that there is no need to change the standard certificate when moving. But there are exceptions.

Urgent replacement

Under some circumstances, a change of permanent residence entails the need to urgently replace a certificate with an individual taxpayer number. But not the TIN as a whole.

When is this possible? For example:

- if the recipient is a government employee and the document is needed for work;

- if you need to prepare tax deductions;

- when the old certificate is lost.

As you may have noticed, changing your TIN when changing your place of residence is not a mandatory procedure. Therefore, if there are no compelling reasons for this, there is no need to rush into implementing the idea.

The TIN number of an individual is not changed; another one is assigned and the TIN is replaced after a last name change

TIN is a Taxpayer Identification Number , a set of numbers, a digital code that organizes the accounting of taxpayers in the Russian Federation. Assigned to both legal entities and individuals. It has been assigned to organizations since 1993, to individual entrepreneurs - since 1997, to other individuals - since 1999 (since the beginning of the first part of the Tax Code of the Russian Federation).

We recommend reading: What documents are needed to return 13 percent from the purchase of an apartment

If the surname changes, the Certificate of Registration is replaced by the tax authority at the place of residence on the basis of a completed Application for a Certificate and upon presentation of a previously issued Certificate of Registration, an identity document and a document confirming registration at the place of residence.

TIN and certificate

However, sooner or later you will still have to change your TIN when changing your place of residence. A certificate of the established form is issued by regional tax services. It will indicate the city in which the document was issued. When moving to another region, you have to exchange paper. But not urgently. It's about testimony.

When changing place of residence, the TIN remains the same. As emphasized earlier, citizens are assigned an individual number once in their life. It remains unchanged throughout life. Therefore, the TIN cannot be exchanged under any circumstances. Data about the applicant will be transferred to the Federal Tax Service at the new place of registration. Accordingly, all tax notices will still reach the real recipient.

If you change your place of residence, the TIN remains the same

In case of moving, the citizen must be registered at the new place of residence. Registration is carried out by the tax inspectorate independently in accordance with Section II of the Procedure, approved by Order of the Ministry of Finance of Russia dated November 5, 2009 No. 114n. The period is five working days from the date of receipt of information about the fact of registration at a new place of residence from the authorities that carried out such registration. Within the same period, tax authorities are required to issue (send by registered mail) to an individual a notice of registration in the form approved by Order of the Federal Tax Service of Russia dated August 11, 2011 No. YAK-7-6/ [email protected] (Appendix 7).

We recommend reading: Is it possible to make an Inn at a location other than your place of residence?

When moving to another city, you do not need to change your TIN. The taxpayer identification number is used by the tax authority as his account number; it is assigned to an individual once and for life. In this case, after moving, you will have to submit a personal income tax return to the tax office at your new place of residence. Let's tell you in more detail.

Where to change

Where is the TIN changed when changing place of residence? In Russia this issue is dealt with:

- tax authorities;

- multifunctional centers.

You can also produce or change a certificate with an individual taxpayer number by using a service called “Government Services”. No other institutions in the Russian Federation are engaged in solving this problem.

Procedure

There is no change in TIN when changing place of residence. As already mentioned, a citizen can exchange a certificate issued to him earlier, but nothing more. What does that require?

The instructions below will help you exchange your TIN under any circumstances. Citizens will have to:

- Prepare some documents to add new information to the TIN certificate.

- Pay the state fee (not always).

- Send a written request along with documents to the Federal Tax Service or MFC for registration.

- After some time, receive a completed certificate with an individual taxpayer number.

This is the procedure for exchanging TINs that is in effect on the territory of the Russian Federation to this day. This is a very simple operation that requires little preparation. In particular, regarding the provision of documents for the production of a certificate.

List of documents for TIN

Do you need to change your Taxpayer Identification Number (TIN) when you change your place of residence? The procedure for dealing with this situation is already clear to us. The proposed instructions will help you obtain a new certificate with an individual taxpayer number not only when moving, but also in any other case.

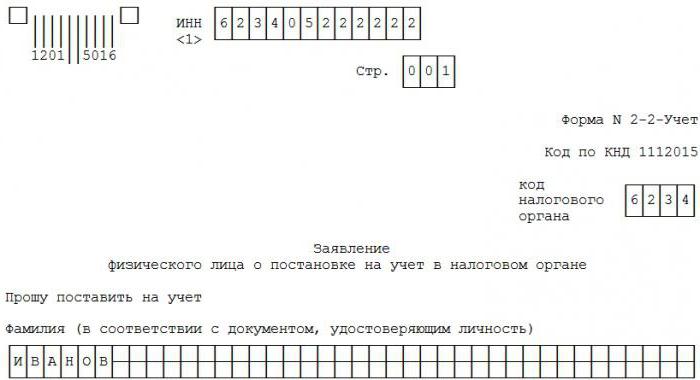

What documents are needed to receive the service? Among them are:

- old certificate;

- passport (or other identification document);

- receipt with paid duty (300 rubles for individuals);

- statement;

- certificates indicating the citizen’s registration (not needed if the applicant has brought a civil passport).

This list of documents is not exclusive. Other papers may be useful if the recipient is a minor child.

We prepare personnel documents when an employee’s personal data changes

Let's start with probably the most common situation, which, nevertheless, raises constant questions. We are talking about an employee (usually an employee) changing their last name. Obviously, in this case, it will be necessary to make changes to the personnel documentation, for example, to the employment contract, work book and personal employee card. However, making such changes requires a basis. Such a basis will be documents confirming the change of name, submitted by the employee himself. But you should ensure that the employee submits these documents in advance, and include in the employment contract a standard condition that the employee is obliged to inform the employer about a change of name, passport, place of residence and other personal data specified in the employment contract.

We recommend reading: Mortgages for young families in Bashkortostan in 2021

In this article, we decided to limit ourselves to only the minimum necessary explanations for a particular situation that may raise questions for an accountant performing the functions of a personnel officer. The main place in the article will be devoted to specific tools for solving the problem. After all, you see, finding an explanation of how to act in a given situation is usually not difficult. It is much more difficult to find specifics - what exactly needs to be done, what documents and how to complete them, etc.

TIN and minors

You can change your TIN when changing your place of residence in the shortest possible time if you follow the instructions provided. What documents do the Federal Tax Service require when exchanging a certificate of the established form for children?

Among them are:

- passport of the legal representative;

- application for TIN exchange, written on behalf of the parent;

- child's birth certificate;

- certificates indicating registration (parent and minor).

From the age of 14, children can obtain a TIN and exchange it themselves. If we are talking specifically about the reissue of paper, you will have to pay a state fee in the established amounts. Otherwise the operation will be denied.

Do I need to change my tax identification number when changing my passport?

Please note that at the moment, when changing your last name, it is not possible to replace the TIN through the government services portal; this procedure may appear in the future, but for now such a service is provided only by the Federal Tax Service website.

We recommend reading: Code kosgu and rk ventilation installation

After registering for them, you can issue many documents, including a new TIN; you can apply for a new TIN due to a change of surname. In addition, these services allow you to track the receipt of an application, its consideration and receive information about the results of consideration of the submitted application.

Waiting time

Sooner or later you will have to exchange your TIN certificate if you change your place of residence. This service takes about 5 working days. This is exactly how long you need to wait before picking up the completed TIN certificate from the Federal Tax Service or the MFC.

In some cases, the waiting period increases. Usually, when a certificate with a TIN is ready, the citizen is informed of the need to obtain it. For example, by phone or mail. The operation being studied is not too long.

How to change your last name if you are an individual entrepreneur

No later than 30 days after marriage, you must submit documents to change your passport. You need to submit the application to the territorial bodies of the Ministry of Internal Affairs - they are also called passport offices. You can also submit an application through the MFC or government services.

We recommend reading: Sample commercial offer for pallets

You will also need a marriage certificate. If you already have a new TIN certificate, send it too. After communicating with the manager, you will need to sign the updated client questionnaire in your personal account:

Let's sum it up

It is now clear whether a TIN change is necessary when changing place of residence. This operation is not mandatory, but it is advisable to carry it out. Otherwise, if you need to file tax deductions or obtain information about a person through the Federal Tax Service, problems may arise.

All of the listed nuances and features are relevant for each region of the Russian Federation. Therefore, all cities have the same rules and principles for issuing/exchanging TINs.

Tax authorities assure that the initial production of a certificate with an individual taxpayer number is the personal desire of the citizen. If he does not want to, he is allowed not to draw up the relevant paper. You can find out your TIN using a special service. It is located on “GosKnow your TIN”. With its help, it will be possible to obtain information about the taxpayer number, based on the citizen’s personal information.