Fundamentals of the pension system

A pension is a cash payment that the state guarantees to different categories of citizens:

- upon reaching a certain age at which the law allows them to retire;

- to compensate for lost income after leaving government service, the position of astronauts and test pilots;

- upon loss of a breadwinner;

- upon receipt of disability;

- to compensate for loss of health during military service, radiation or man-made disasters;

- unable to work to obtain their livelihood.

The main source of pension payments are contributions to the Pension Fund of the Russian Federation, which are made for employees by employers from the wage fund. The system is now structured so that contributions from today's workers provide pensions for today's retirees.

In recent years, the government has sounded the alarm because the number of the latter is increasing and the number of the former is declining. It turns out that there may come a time when there is not enough money to support pensioners. There will simply be no one to list them. Hence the attempts to correct the situation by raising the retirement age.

Another step to increase the budget of the Pension Fund was the moratorium on the funded part of the pension. I'll explain in more detail.

Until 2002, employers transferred 22% of their employees’ income to the Pension Fund of the Russian Federation, which was used to pay today’s pensioners. After 2002, we received the right to divide contributions into 2 parts: 16 and 6%. The first part still went to the Pension Fund, and the second could be invested through a management company or a non-state pension fund (NPF) and receive additional income.

Thus, they wanted to create a mechanism for citizens themselves to save for their pensions. But this did not result in any money appearing in the Pension Fund. And since 2014, the state introduced a moratorium, according to which the funded part was again completely sent to the Pension Fund. This continues to this day.

Until the end of 2020, people under 52 could choose from two options:

- The entire amount of contributions is sent to the insurance part (22%).

- 16% of contributions goes to the insurance part, and 6% to the savings part.

The choice is also available to those just starting their careers. For older people, all contributions go to the insurance part. For the so-called “silent people”, i.e. citizens who have not yet decided on an option, contributions in full are also transferred only to the insurance part. But let me make a reservation once again: until 2020, all citizens are in the same position, regardless of age - they transfer contributions to the insurance part.

Which pension to choose: insurance or funded?

In accordance with the law of December 4, 2013 No. 351-FZ, which amended the legislation on compulsory pension insurance in terms of granting insured persons the right to choose a pension option, citizens not older than 1967, until the beginning of 2020, had to choose one of two options presented:

- continue to form a pension at a rate of 6% of insurance contributions for a funded pension;

- do not direct part of the contributions to the funded pension, but concentrate it entirely on the insurance pension.

Also, since in the period from 2014 to 2020 inclusive, pension savings will not be formed due to the moratorium adopted by the Government, all insurance contributions will go to the insurance pension and will be counted as individual pension coefficients , or points. All pension savings formed earlier are still invested by the previous compulsory pension insurers, and will be paid after the assignment of a labor pension.

If at the time of retirement the insured person participated in the formation of pension savings, then in accordance with clause 3 of Art. 5 of Law No. 400-FZ of December 28, 2013, the insurance pension is assigned and paid regardless of the assignment of a funded pension, for the registration of which you must additionally contact your policyholder.

Pros and cons of funded and insurance pensions

A significant difference between a funded pension and an insurance pension is not only the possibility of investment, but also the right to management : an insurance pension cannot be managed, but pension savings are managed and can generate profit through a management company chosen by the citizen himself, according to the accepted investment portfolio.

A funded pension has some properties of a bank deposit, so you can gain income from investing, or you can end up in a loss-making situation.

Therefore, there are both pros and cons of these two types of pensions.

| Type of pension | Funded pension | Insurance pension |

| pros |

|

|

| Minuses |

|

|

Which type of pension is better is chosen by each person individually, since working conditions and salary levels are different for everyone.

The employer is most often not interested in increasing contributions, so he registers the employee at the minimum rate, and the funded pension gives the right to influence the amount of the pension independently.

It is important to study in detail some of the nuances and all the proposals, which will allow you to optimally avoid all kinds of risks , as well as study and improve your knowledge in the field of pension provision, for your own economic well-being.

How is the pension calculated?

Our future pension may consist of one part - insurance or two parts: insurance and funded.

The size of the insurance pension is affected by:

- seniority;

- amount of earnings;

- willingness to apply for a pension later than the statutory period;

- years on maternity leave, conscript military service.

The insurance pension is calculated according to the formula.

The individual coefficient records the rights to receive an insurance pension. Its size depends on the citizen. But the state limited the maximum value of the IPC. In 2020 it is 9.13 points, in 2020 – 9.57 points and in 2021 – 10 points. The value of the IPC is influenced by the option of the selected pension provision.

The later you apply for a pension, the higher the fixed payment and IPC will be. For example, if you claim your right to pension payments after 4 years, the fixed part will increase by 27% and the IPC by 34%. If it is 10 years later, then the fixed part will increase by 2.11 times, and the IPC – by 2.32 times.

| Exceeding the statutory retirement age | Growth of fixed payment, % | IPK growth, % |

| 1 | 5,6 | 7 |

| 2 | 12 | 15 |

| 3 | 19 | 24 |

| 4 | 27 | 34 |

| 5 | 36 | 45 |

| 6 | 46 | 59 |

| 7 | 58 | 74 |

| 8 | 73 | 90 |

| 9 | 90 | 109 |

| 10 | 111 | 132 |

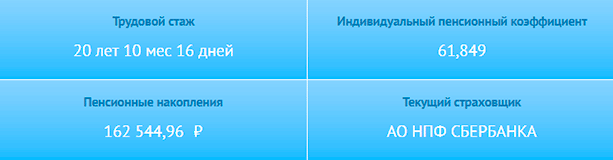

The accumulated coefficient can be viewed on the Pension Fund website. To do this, you need to create a personal account. You can use your login and password from the State Services website. This is what the information looks like.

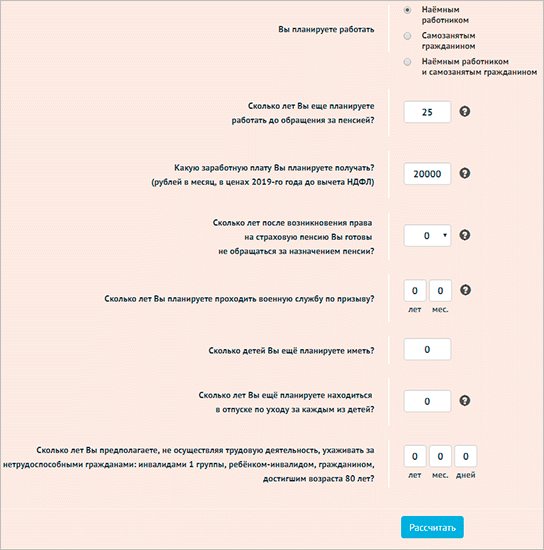

In your personal account, using the pension calculator, you can predict your future pension. For example, according to my data: current and forecast, it will be 15,752.66 rubles.

The calculation is conditional. When applying for pension payments, many more parameters will be taken into account, which lead to an increase in the fixed payment. For example:

- disability of the 1st group,

- work in the Far North,

- 30 years of work in agriculture, etc.

The insurance part is indexed by the state, namely the fixed payment and the cost of the pension coefficient. Cumulative depends on the profitability of the investment activities of the management company or non-state pension fund. And you shouldn’t change these organizations every year, that is, keep them in one first, then transfer them to another. If you do this before the 5-year period, the amount of accrued annual income from the investment will be lost.

Where does the pension come from: what is behind the pension formula in Russia

Everyone has the right to an old-age pension, but exactly how much money a person going on vacation will receive is determined by the state. The Pravmir portal figured out how the Russian pension formula works and whether it is possible to determine the size of your pension in advance.

What does a pension actually consist of?

The pension that a Russian citizen will receive after reaching retirement age consists of three parts:

- fixed payment;

- insurance pension;

- funded pension.

This is a basic scenario and may change depending on circumstances. For example, a future pensioner could refuse the savings part - then he will receive only insurance payments, and they may be higher than those of someone who nevertheless decided to save pension money into a savings account.

On the other hand, another social benefit may be added to the pension. This will happen if the total amount of material support (it includes all social payments and the cost of benefits) is below the subsistence level of a pensioner in the region. In this case, federal or regional authorities must add the missing amount to the pensioner. Each region annually sets the minimum living wage for a pensioner independently. Depending on prices and living standards in general, this indicator in Russia differs significantly. It is higher in Chukotka - 19 thousand rubles. The cheapest (according to officials) life for a pensioner is in the Tambov region - 7,489 rubles per month. The living wage for a pensioner in Moscow in 2020 was 11,816 rubles, and for Russia as a whole - 8,726 rubles. You can find out the cost of living for a pensioner by region here. People who go on vacation should not receive less than these amounts.

What is a fixed payment?

This is the simplest component of a pension. The state pays it monthly to every pensioner. In 2020, the fixed payment of old-age pensions amounted to 4,982.9 rubles. When the authorities talk about indexing pensions, they are talking about this money. Compared to 2020, Russian pensioners began to receive fixed payments by 3.7% more. This is 177 rubles 79 kopecks. In connection with the reform of the retirement age, the state plans to increase pensions by 1 thousand rubles per year from 2020.

However, only non-working pensioners receive an indexed fixed payment.

For those who continue to work, indexation has not been carried out since 2016. Then the fixed payment was 4383.59 rubles.

Of the 36.336 million old-age pensioners in Russia, 8.602 million people continue to work.

Why is the pension insurance?

The ideology of the pension system in Russia is similar to the principle of operation of insurance companies: a person pays contributions to a general fund, and if an insured event occurs, he receives compensation from this fund. Money for future retirees is contributed by his employers: the amount of contributions to the Pension Fund (PFR) is 22% of the wage fund, with at least 16% going to finance “insurance”. And the “insured event” becomes the onset of retirement age. In fact, the insurance part of the payment is transferred to the pensioner not from his own savings, but also from the money that working citizens pay today.

Only one question remains: exactly how much the pensioner will receive. To answer this, the state introduced individual pension coefficients - the so-called “pension points”. It is easier to explain what this is for a person who started working after the formation of the modern pension system in 2015.

For example, this is a man born in 1993. He is 25 years old, he receives a completely “white” salary - let it be the average for Russia: 42,364 rubles before taxes. Over the course of the year, his employer will transfer 81,338.88 rubles (16%) to the Pension Fund. To find out the number of pension points, you need to calculate the maximum amount of contributions to the pension fund established by the state. The maximum base for calculating insurance premiums in 2020 is 1,021,000 rubles, and 16% of it is 163,360 rubles. The number of points will be equal to the ratio of two numbers (actually transferred and maximum contributions), multiplied by 10 - that is, 4.98.

If this young man received not the average, but the median salary in Russia (this is a more accurate statistical indicator - half of the workers receive more, and half - less) - 27 thousand rubles (data as of the end of 2020) or 32.53 thousand. before taxes, the number of pension points he earned would be 3.82.

However, it is not necessary to make these complex calculations manually - on the Pension Fund of Russia website there is a special calculator with which you can calculate the estimated number of pension points for the year.

Pension points are accumulated every year, and an employee cannot receive less than 1 or more than 10 points in a year. More precisely, due to the transition period of the reform, the maximum number of points will increase from 8.7 in 2020 to 10 in 2021.

The sum of all pension points “earned” over a lifetime is multiplied by the “cost” of one point in the year of retirement - this is how the second, “insurance” part of the pension is obtained. The state determines the “price” of the point annually. In 2020 it is equal to 81.49 rubles.

If the economic conditions in which Russia lives and wages had not changed in 40 years, then the “average” young man could count on a monthly payment of 21.22 thousand rubles in 2058, and the “median” - on 17. 43 thousand rubles. Both amounts take into account the fixed payment (4,982.9 rubles).

Such calculations can also be carried out in the Pension Fund of Russia pension calculator.

What about those who started working earlier?

Due to numerous pension reforms in post-Soviet Russia, the formulas for calculating the “insurance” part of the pension will be different for them. According to the government’s plan, starting from 2020, all pension calculations must be reduced to pension points, but preliminary calculations depend on the start time and total length of work.

It is not very difficult to understand the period 2002-2014. At that time, the pension system was based on the concept of pension capital, which was accumulated in personal accounts from employers’ pension contributions. You can find out its size in your personal account on the Pension Fund website. To convert pension capital into pension points, it is enough to divide it by 228 (this is the number of months of the expected pension payment period for 2020) and 64.1 - the “price” of the pension point in 2020. The resulting number will be the sum of pension points received by the future pensioner by this time. They are added to the points received later.

For those who started working earlier, the system for calculating pension points will be even more complicated. It will be influenced by work experience before 2002, average monthly earnings in 2000-2001 or for any 60 consecutive months before 2002, work experience before 1991. These data make it possible to determine the estimated pension at the beginning of 2002 and, if necessary, the amount of valorization (the amount of a one-time increase in pensions for those who worked before 1991). The resulting number is multiplied by the recalculation index - it is fixed and amounts to 5.6148 - and divided by the “price” of the point in 2020 (64.1). Only after these calculations can one sum up the “unified” points before 2002, points from 2002-2014, and points according to the modern system.

But there are still savings!

In 2020, Russian citizens had the opportunity to choose whether they will form only an insurance pension (that is, accumulate pension points) or add a funded part to it. In the first case, all 22% of the wage fund, which the employer transfers to the Pension Fund, will be taken into account when forming the insurance pension, in the second, only 16% will go to the insurance pension, and 6% will be the employee’s savings. Once every five years, you can change the pension savings scheme or abandon them in favor of only an insurance pension (savings already made will remain under the management of the chosen insurer). In addition, for those who decide to save for retirement, the maximum number of pension points earned per year from 2021 cannot be more than 6.25.

But unlike an insurance pension, after retirement, the funded part can be received in its entirety at once, divided into several tranches, or received for the rest of your life in the form of monthly payments.

Their size depends on the size of savings: their total amount is divided by the duration of the expected payment period. It is also set by the government; in 2020 it was 20.5 years (246 months), but in the future the authorities intend to increase it due to growing life expectancy.

However, this system never fully worked. From 2014 to 2020, there is a moratorium in Russia on the formation of the funded part of pensions - all pension contributions go towards the formation of the insurance part.

What else affects the size of the pension?

The number of pension points may be affected by breaks in work for valid reasons. For example, points are awarded for military service, caring for a disabled person of group I or an elderly person over 80 years old, looking after a disabled child, parental leave (and the more children in the family, the more points for each subsequent child) . In most cases, a full year's break from work is necessary.

In addition, the government encourages older people to retire as late as possible.

Even before the decision to increase the retirement age, the authorities established increasing pension payment coefficients for each additional year of work. The fixed payment is multiplied by factors from 1.056 (for one year) to 2.11 (for ten or more years), and pension points - from 1.07 to 2.32, respectively.

In addition, separate rules apply to people who worked in special conditions (for example, in the Far North) or in special jobs (for example, military and civil servants).

What does experience have to do with it?

Although the pension points system has replaced the old concept of length of service, length of service still matters for those retiring.

Those who have completed the minimum insurance period are entitled to receive an insurance pension - in 2020 it was 6 years, but increases by a year every year. After completion of the reform - in 2025 - it will be 15 years.

Another condition for receiving an insurance pension is the minimum number of pension points: in 2020 it was 6.6, and by 2025 it will reach 30 (an increase of 2.4 points per year) - this is a mandatory condition for old-age retirement.

If these conditions are not met, the elderly person can only count on a social old-age pension. Before raising the retirement age, 65-year-old men and 60-year-old women were entitled to it, but the government has already proposed increasing this age to 70 and 68 years, respectively. The size of the old-age social pension in 2020 is 5,180 rubles.

What will happen to pensions next?

Changes in the Russian pension system occur constantly, so it is impossible to predict under what rules today’s workers will retire. The Russian authorities have not yet completed the transition to a points system, but Social Deputy Prime Minister Tatyana Golikova has already proposed abandoning it and returning to the system of individual pension capital - a variant of the model that existed in 2002-2014. In any case, the government will encourage citizens to save for their old age on their own.

pravmir.ru

TAGS:Indexation of pensions in 2020Indexation of pensions for non-working pensionersIndexation of pensions for working pensionersHow pension points are calculatedWho will receive an additional payment to the pensionMinimum pensionOleg GrigorenkoPensions in Russia latest newsPensioners of RussiaPension reform in RussiaPension pointsPension agePension Fund of RussiaSocial pension in RussiaInsurance old age pension

How to prepare documents to receive a pension

A citizen can submit documents for a pension at any time after he has the right to do so. It is better to start collecting them in advance. You should contact:

- PFR branch at the place of registration or actual residence,

- MFC,

- Postal office.

The application must be submitted in person, through a representative or employer. It can be written in your own hand or in the form of an electronic document on the website and no earlier than 1 month before the retirement date.

Documents for applying for a pension:

- Statement.

- Passport or any document that confirms your identity.

- A document that confirms your work experience (for example, a work record book, contracts, military ID, etc.). Make sure it is formatted correctly. Must contain the necessary details: number and date of issue, full name, date of birth, place and years of work, position, signature and seal.

- Certificate of average monthly salary until 2002. There are 2 options: take any 60 months before 2002, or the calculation takes into account income for 2000–2001, information about which is available in the Pension Fund. You can obtain a certificate from the employer, his legal successor, from the archive or from other organizations that have the necessary information.

- Documents about the change of full name, birth of children, presence of dependents and others that would prove certain circumstances affecting the amount of the pension.

The future pensioner collects documents for registration of pension payments. Most of the information is already stored in the Pension Fund of Russia, some must be taken from the employer. Difficulties can arise only with frequent job changes, moves and other unforeseen life situations. This may require inquiries into archives, searches for successors of non-existent enterprises, and other rather time-consuming actions. The territorial branch of the Pension Fund of Russia will tell you what to do in this or that case.

The Pension Fund is obliged to consider the application and verify the documents within 10 days after receipt.

Is there a tax on pension supplements?

As stated in the legislation, both pensions and any social supplements to them are not subject to taxation if they are paid in accordance with the requirements of the relevant documents.

Thus, additional payments, the amount of which allows you to increase the amount of the initial pension to the subsistence level, are not subject to income tax, and pensioners do not have to worry about the state withholding some part of the funds. It should be noted that thanks to the innovations of 2020, additional payments are not taxed even if the standard pension amount reaches the subsistence level.

Both the pension and various additional payments are not subject to taxes.

In addition to additional payments that allow you to increase your pension to the subsistence level, there are also preferential payments from the state that can be received by:

- military veterans;

- residents of besieged Leningrad;

- labor veterans.

Additionally, it is worth noting the category of additional payments in the form of transferring a certain amount to dependents and pensioners after 80 years of age, as well as citizens who worked in the Far North or close to them.

Additional payments to pensions can be received by citizens who have worked for a certain amount of time in the CS area, pensioners over 80 years old, etc.

Thus, indexation or increase in payments related to cash support carried out by the state makes it possible to avoid taxation of pensions. However, this cannot be avoided if a citizen receives increases that do not relate to payments provided for by federal or regional legislation. Such payments should include:

- corporate additional payments to a company employee from the employer. The tax in this case will be 13%, regardless of who receives the payment - a retired pensioner or an active employee;

- additional payments to the labor pension of municipal employees, the decision on which is made by the local government. Such additional payments are not considered preferential, so you will have to pay the corresponding tax;

- severance pay paid by the employer to an employee who has decided to retire. As for the tax in this case, it should not exceed three times the average monthly salary of the employee.

If a citizen receives any increases not provided for by the state, they are taxed

Important! The latest norm came into force in 2012 and affected almost all categories of citizens.

Conditions for the right to well-deserved rest

To know when to retire, you need to focus on 3 conditions:

- Reaching 60 years for women and 65 years for men. There is now a transition period during which there is a gradual increase in age. For example, in 2020, women are 56 years old and men are 61 years old. By 2028, 60 and 65 years, respectively.

- Insurance experience. It must be at least 15 years old. There is also a transition period in effect. In 2020 – 10 years, then increased annually by 1 year. By 2024 – 15 years.

- At least 30 individual pension points by 2025. In 2019 – 16.2 points, followed by an increase of 2.4.

There are categories of citizens who have the right to early retirement. For example, women with 37 years of work experience and men with 42 years of work experience. People of certain professions, such as miners, tractor drivers, etc., have the right to retire early.

Who has the right to choose to retire?

There may be a situation where a pensioner meets several criteria according to which different types of pensions are assigned. And people mistakenly believe that they can receive two pensions. But this is completely misleading. For example, if a subject can receive a state social pension or an insurance payment, then he is obliged to make a choice in favor of one. True, the subject has a choice to make in favor of the one that is most beneficial for him.

There is an exception to the rule. According to the law, there are citizens who are simultaneously assigned two types of pensions. These citizens include Chernobyl survivors.

People affected by the Chernobyl nuclear power plant have the opportunity to simultaneously receive the following payments:

- Disability pension. It can be either insurance or state, paid from the federal budget;

- Old age pension. It can also be either insurance or government.

But in most cases, if a person receives a disability pension, then upon reaching retirement age he is assigned an old-age pension. He is obliged to make a choice in favor of a specific type of payment.

The same situation applies to all preferential pensions that are awarded for length of service. Until a citizen reaches retirement age, he receives a pension from the state. As soon as he reaches retirement age, he must make a choice in favor of one payment: either for length of service or in connection with old age.

Payment procedure

The pension is paid to the pensioner monthly. He can independently choose the delivery method:

- Traditional via Russian Post. The recipient comes to the post office on the appointed day, or the money is delivered to his home.

- Through the bank. The pensioner receives his pension at the branch or on his bank card.

- Through an organization that is authorized by the Pension Fund to issue pensions to pensioners. Lists of such organizations are available in the territorial branch of the fund.

Since 2020, new pensioners can receive money to a bank card only from the Russian payment system MIR. If the card was issued before 2020, then regardless of the current payment system, after expiration it will be transferred to MIR.

The pensioner chooses the most convenient way for him to receive money by:

- submitting an application in writing to the territorial Pension Fund,

- submitting an electronic application in the fund’s personal account.

Non-state pension tax – what is it?

Unfortunately, the Tax Code of the Russian Federation does not fully explain the peculiarities of taxation in the case of a funded pension program, and the regulatory document basically only confirms that this type of pension does not relate to income only if its payments are made by the state.

Thus, pensioners should take into account and remember that payments of funded pensions, the amount of which was accumulated during 2004-2014, are not subject to income tax and are paid in full. The same applies to situations where savings are transferred to non-state entities. In any case, they are part of the salary and therefore belong to the employee.

Income from funded pension is not withheld

Important! As for the existence of the funded pension program, it has been temporarily frozen since 2014. Currently, citizens are not generating savings. This situation will continue until 2021, after which it is likely that the program will be resumed or modified.

In this case, it is necessary to consider several cases. So, for example, it can be noted that:

- contributions paid by an individual for himself or a third party are not taxed. In the case of the second option, third parties include parents, children, and close relatives. No tax will be charged on all transferred contributions, since they will be made from funds from which a certain percentage has already been withheld;

- payments made under corporate programs are subject to income tax. Here we are talking about transferring a contribution for an employee to employers. It is he who pays the percentage determined by law, and the employee receives the amount minus the withheld funds.

If a citizen himself made contributions for himself or a third party (parents, children, etc.), then such money is not taxed as income

Additionally, in case of participation in the funded pension program, it can be noted that the citizen can take advantage of tax deductions. However, this right is given only to those who independently transfer funds to the funded part. If, for example, an employer does this, then an individual will not be able to take advantage of the program’s offer.

In addition, a working pensioner will need to take into account that the maximum amount of expenses in case of applying for a social refund should not exceed 120,000 rubles. Otherwise, you will also not be able to take advantage of the program offer. Finally, the third condition is that a citizen can take advantage of the benefit only within three years from the moment he becomes entitled to it.

What happens when the contract is terminated?

If for some reason a citizen wants to terminate the contract with a non-state pension fund, he should take into account that the amount of the deduction used will be withheld from the redemption amount for the contract if the individual exercised his right to it. If the right to deduction was not used, the redemption amount remains the same.

If a citizen decides to terminate the contract with a non-state pension fund, then the amount of the deduction used is withheld from the redemption amount

Among other things, one of the conditions for terminating the contract includes taxation of profits received as a result of investing existing savings. The tax will be 13%. If necessary, such costs can be avoided if you initially receive savings in the form of pension payments and only then terminate the contract.

Popular questions

This year I will need to retire. Which years are best to take for calculations?

Good afternoon. Information for any sixty months of continuous work before January 1, 2002 is taken into account.

If you calculate a pension with salary certificates for seven years, from 80 to 87, and any continuous sixty months are needed for the calculation, then which months are counted, where the salary was large , or where it was not so much? When I first started working, my salary was low, and then over the last five years it was much higher.

The period that is the most profitable is taken into account. We recommend that you seek advice from the employee to whom the papers were provided to clarify all the details and nuances.

The months when the salary was the highest are taken into account

What periods of labor activity are taken for calculation? Any five years before 2001? Or any years throughout your entire experience?

In order to make the calculation, any 5 years of experience before 2002 or your income for 2001 are taken.

Seven years ago I was granted an old-age pension. Two years ago in November, it turned out that the period for 1999-2000 was not included in my experience. At this time, all necessary operations were carried out with the Russian Pension Fund. All documents were sent by the company where I worked. The Russian Pension Fund called me and asked me to provide an application to include the length of service of the above period and to recalculate the pension payment. Should I recalculate for the period that began seven years ago and what legislation should I appeal to before visiting the Pension Fund?

They must do all this, since it is clear that the employees of the Pension Fund are to blame. Based on Part 2 of Article 26 of the Law “On Insurance Pensions”, those payments that were not received by a citizen in the due period due to the fault of the body that is responsible for providing payments must be paid to him for the entire past period without time limits.

If PF employees made a mistake in payments and this has been proven, the citizen will receive the entire missing amount

In order to calculate average earnings for pension payments, is it possible to take the period 2000-2004? Is it possible to demand a recalculation so that the pension is calculated in accordance with Law No. 173-FZ? I am a pensioner born in 1960.

In order to determine the amount of payments, wages are taken into account for 2000-2001. or for five continuous years before January 1, 2002.

Where can I get information about average earnings to calculate pensions in 2000-2001? for a citizen who is retiring?

If a citizen has the highest coefficient, then you do not need to take anything - the Pension Fund employees will advise you. If not, then you need to write an application to the place where you work; if they refuse, then to the city archive or regional archive.

When exactly did they begin to count service in the armed forces of the Russian Federation into their length of service?

The law that was in force previously was written about accounting for military service. It is worth knowing that this experience is not always taken into account. It is better to clarify this issue with the state administration.

When calculating a pension, as a rule, the time spent in service is taken into account

I'm retiring this year. How will payments be calculated and which years will be taken into account for the calculation?

The calculation will take place for length of service until 2020. Then everything will be converted into points for experience after 2020. All points will be multiplied by the value of 1 point. Salary is taken into account for 2000-2001 or for continuous five years until 2002.

Periods of receiving salaries that are taken to calculate pensions

Due to recent changes in laws, many citizens are extremely puzzled, and this applies not only to those people who are currently receiving pension payments, but also to those who retired in 2017-2018. The new points system is not yet clear to everyone, and it is not yet clear what will happen to the calculation procedure.

It is worth knowing that there are a huge number of various pitfalls on this issue, and all sorts of innovations and branches in the legislation of our country can only further puzzle citizens. We will try to clarify which years are taken for pension payments to be calculated based on these laws, and what awaits citizens in the future.

Important ! Which periods should you choose? The law that was in force earlier had a certain rule where pensions were calculated on the basis of the average income of citizens for working activities before December 31, 2001.

You can take salary data to calculate your pension for any 5 consecutive years that were worked before 2001

It is also possible to take information on wages from 1997 to 2001. It turns out that a citizen can take periods of work that will fully comply with all the new norms and procedures of pension laws.

It turns out that in order to calculate pension payments from citizens, it is possible to take information on wages for the periods 2000-2001. Citizens can also take periods for any 60 months (five years) before 2001.

By the way! Many people wonder whether banks have the right to charge a commission on pension payments. No, banks are not allowed to do this.

When pension payments are being processed, a request is made to the archives regarding the length of service and the salary received at the enterprise where the citizen worked from 1982 to 1991.

When applying for a pension, Pension Fund employees make a request to the organization where the citizen worked

Now, when calculating pensions, the pension points that citizens receive for each year of work are taken into account. Importantly, childcare also earns points.

For the first child, a citizen receives 1.8 points. For the second child - twice as much, for the 3rd and 4th children - 5.4 points. As a result, if a citizen has four children, then for caring for them for 1.5 years she can receive a total of 24.3 b. When serving in the army, points are also given - 1.8 per year of service.

During the period when a woman cares for a child, she also receives pension points