Right to work

Taking into account the provisions of modern pension legislation, a citizen is not at all obliged to retire upon reaching retirement age. He can continue to work. This will help him accumulate more pension points, and therefore increase the amount of pension payments.

However, there are a number of nuances that must be taken into account when making a decision about delayed retirement. And the first of them is retirement age.

In 2020, the retirement age in the country is increasing. Without taking into account the transition period, it will be 65 years for men and 60 years for women. During the transition to the new rules, a systematic increase is provided - by 1 year annually to the previous age. Regarding the 2020 retirement age, the increase will occur as follows:

- 2019 – +1 year;

- 2020 – +2 years;

- 2021 – +3 years;

- 2022 – +4 years;

- 2023 – +5 years.

At the same time, the state proposes to abandon well-deserved rest and apply for pension benefits later than the statutory retirement age. In this case, the authorities increase the size of the fixed payment and index the accumulated pension points in a special manner.

For example, if you apply for a pension only a year later, the increase will be +7% to the value of the point and 5.6 to the size of the fixed payment. But if you retire, say, 7 years after retirement age, then the size of the increase will be more impressive: 74% to the value of the point and 58% to the size of the fixed payment.

Moscow resident Sofya V. turned to a lawyer for help in resolving an issue related to retirement. The fact is that she worked as an accountant all her life, she has a good salary. A woman’s right to a pension will arise in the second half of 2020, taking into account the transition period. But at a consultation with the Pension Fund of the Russian Federation, she was recommended to postpone her retirement until 2024, justifying this step with benefits in the form of an increased pension. The lawyer calculated that such a step would not be beneficial for Sophia if she wanted to continue working.

So is such a transition beneficial? Let's try to count. But for simplicity of calculations, 2020 “prices” and the average indexation of pensions to an inflation rate of 3.5% will be accepted.

How much can you earn from this?

The stock market on average grows by 4-6% above inflation. But only for a long term - 10-20 years.

Bonds give about 2%.

This is historical data. Tested over long periods of time. Since the beginning of the 20th century. In some countries, even since the mid-19th century.

Why don't we take inflation into account?

We plan for retirement based on today's value of money. No one knows what inflation will be like in 5, 10, 20 years. Profitability, cleared of inflation, shows the real financial result.

Look. In one year the return will be +10%. In another - +25% per annum. Which result is better?

And it is unknown. Perhaps in the first year inflation in the country was 5%. And in the second 35%.

Then 10% is better than 25%. We get a real return of +5% versus - ( minus) 15% .

Retirement 5 years later

Another abstract citizen decides to postpone his well-deserved rest and continues to work in his previous position while maintaining his salary level. During this period, the man will earn an additional 12.41 pension points, that is, by the time he retires he will already have 111.75 pension points.

Thus, his pension without taking into account bonus factors should be 15,083 rubles. 26 kopecks, of which:

- RUB 9,749.07 – by the amount of pension points;

- RUB 5,334.19 – according to the size of fixed payments.

But taking into account the bonus coefficient, these figures will be indexed, and the pension will be 21,390.65 rubles. In annual terms, this is already 256,687.80 rubles.

It would seem that the benefits of a deferred pension are obvious. But is there a catch?

Unreality these days

But then urbanization happened. The city began to win back residents from the village.

In the village, children are helpers, whom it is advisable to give birth to and raise.

In the city - a burden in which you need to invest endlessly.

It's everywhere. Both in Europe and in Russia.

Here are typical girls' stories:

“My great-grandmother gave birth to eight children. Grandmother - four. Mom - two. I’m childfree and don’t want children.”

Conditions for having children in the city are not suitable, and civilization provides too many opportunities, and some young people simply do not want to spend their resources on offspring.

All this is complicated by the crisis that our country experienced in the 90s. In those years, the birth rate fell to a severe minimum. Nobody wants to give birth to children in the city when there is nothing to feed them.

Accordingly, the number of working people who will support pensioners is decreasing. And it will decrease further. Because if your mother gave birth to two, and you gave birth to one (or no one at all), then on a mass scale this will greatly reduce the size of the future generation.

And there’s no point in blaming anyone: conditions simply haven’t been created for girls to want to give birth and for men to want to start families.

Let's look at the benefits

Of course, postponing retirement seems extremely beneficial on the surface. This is also a fairly high standard of living with a peer who retired on time - after all, the salary is 30% -100% more than the pension. This also means a higher monthly income after retirement. But the numbers tell a slightly different story.

If a citizen retires on time, then in 5 years he will receive (taking into account the average indexation of 3.5% annually) 900,894 rubles. For the same period, a citizen who has not retired will receive 0 rubles. in the form of a pension and 1,428,000 rubles. salaries. At the time of retirement, the difference in total income will be 527,106 rubles.

So far, all calculations show the reasonableness of deferring pensions. But for some reason no one takes into account the right of a pensioner to continue working after retirement. And here it turns out that a pensioner who continues to work will receive many times more funds.

A working pensioner, even taking into account the indexation freeze, will receive a total of 1,428,000 rubles over 5 years. salaries and another 840,000 rubles. pensions excluding annual adjustments. Total 2,268,000 rub. And what will a citizen who chose delayed retirement receive during the same period? Only 1,428,000 rubles. The difference is 840,000 rubles. This is much more than the initially stated “benefit”.

Investment options

Let's start with the most important thing - profitable instruments.

We need investments that allow:

- Protect money from inflation.

- Receive additional income.

For myself, I chose 2 main directions - stocks and bonds.

Anything else is slag, not very suitable.

We forget about high-risk and dubious investments: PAMM accounts, HYIPs, pyramids, cryptocurrencies.

We can't risk our future. And in the first place is accumulation, with protection from possible financial losses.

There is also gold and deposits. But... they don't really meet our requirements. Yes. They protect money from inflation. But nothing more. At best, they will give about 1-2% increase. Above inflation. The key word is “at best.”

How many years will it take to cover the difference?

Let's assume that for 5 years the indexation of pensions was 3.5% annually. At the age of 70, when both of them decide to end their working career, their pension will be accrued in accordance with all wages and indexation missed by the working pensioner.

Thus, a citizen who has worked an additional 5 years after retirement will receive 17,308 rubles, and a 70-year-old elderly person who has just retired will receive 24,546 rubles. The difference is 41%, which in annual terms is RUB 86,854.5.

It will take about 10 years to close the gap in income actually received, that is, a citizen who has postponed retirement will be in a more advantageous position at the age of 80. But here we should take into account the simplest factor: not every man in Russia lives to the age of 80. Average life expectancy at birth (according to Rosstat calculations made in 2018) is only 77.7 years in 2035. For women the figure is slightly higher – 85.01. And this is a high forecast; the low figures are much more modest - 70.74 and 80.06 years.

Due to frequent updates to legislation and the legal uniqueness of each situation, we recommend obtaining a free telephone consultation with a lawyer. You can ask your question by calling the hotline number 8 (800) 555-40-36 or write it in the form below.

Future pension calculations

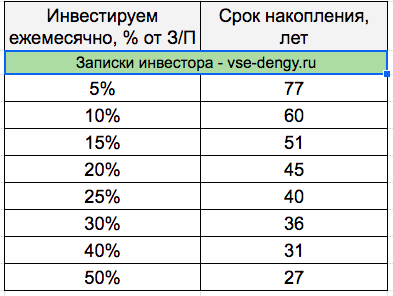

I put in the table below, approximate results for different initial data.

How many years will it take you to save for a pension equal to your current salary? By saving a certain percentage (from 5 to 50%) of your income. With a yield of 4% per year. Above inflation.

To be honest, the results are not very impressive. Especially the top half of the table. Saving money for half a century? Yes, people don’t live that long. Something needs to be done.

In fact, you can slightly reduce the accumulation period.

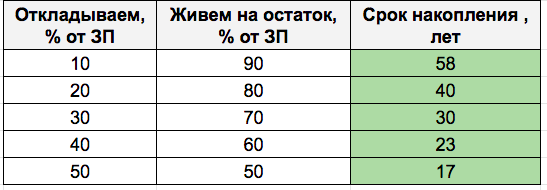

You save 20% of your income every month for the rest of your life. So you are used to living on the remaining 80%. And accordingly, the minimum required pension amount may no longer be 100%, but 80% of income. And you will need not 45 years, but “only” 40. (((

You allocate 30% of your salary to form a pension, you need to save up 70% of your income (it will take 30 years instead of 36). And so on.

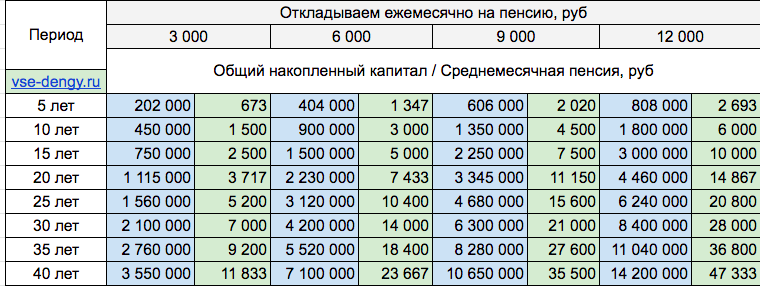

You can simply save money, counting on a certain increase in the form of your own monthly accumulated pension. Let this not be the expected average monthly salary. A little less.

Made the calculations. How much can you earn (accumulate, increase) over different periods of time with different amounts of funds allocated from income (blue columns). And what will be the average monthly “personal” pension (green columns).

Population bomb

Now, instead of 4 workers per pensioner, we are approaching 1 worker per person of retirement age.

The pension fund deficit is constantly growing. The money that today's grandparents put into the fund has long been paid to the then old people, or stolen.

What you pay into the pension fund goes to provide for today's elderly.

The future generation pays you. The number of which is much lower than in your youth.

After a few years, we will come to a 1 to 1 ratio, and the authorities are trying to somehow solve their current problems and protect themselves in the future.

Raising the retirement age is the simplest solution. The key is the employee-retirement ratio. The government is simply reducing the number of pensioners.

The alternative is to raise taxes substantially to finance the fund. That is, if an employee pays twice as much, then this payment can be

It will be necessary to support two, not one pensioner.

It's simple.

But this won't solve the problem. There are preconditions that in the medium term there will be no pension at all.

The procedure for calculating pension payments

To navigate the new pension formula, you need to understand the terms of the Federal Law “On Insurance Pensions”:

- individual pension coefficient (IPC) is a special value that depends on the amount of contributions to compulsory pension insurance (and therefore on salary) that employers transfer;

- fixed payment - the amount guaranteed by the state is similar to the fixed base amount provided in the law “On Labor Pensions in the Russian Federation”;

- bonus coefficients are multipliers that were created to motivate citizens to retire later than they became eligible for it.

The new formula for calculating old-age insurance benefits looks like this:

SP = SIPC x IPK x K + FV x K,

Where:

- SP - old-age insurance pension;

- SIPC - the cost of one coefficient (point);

- IPC - the sum of accumulated pension points;

- FV - fixed payment;

- K - premium coefficients (for IPC and PV they have different values).

The rules of the game are changing

Do you know why it was difficult for me to play board games with my little daughter? We played according to the rules she came up with, and if I started to win, she immediately came up with something else. So this is what I mean - the pension system has already changed several times in my not very long life, and no one knows how many more times it will change.

For example, until recently the state proposed investing money in the insurance part of a pension, doubling the investment. The funded part of the pension could be transferred to a non-state fund for more efficient management. Today, the formation of the funded part of the pension is frozen, the insurance part of the pension is transferred to abstract points.

One can only guess what else they will come up with if the economic situation in the country worsens. One thing can be said with confidence: this clearly will not improve the welfare of pensioners.

Comments (13)

Showing 13 of 13

- Natalya 11/29/2016 at 11:51 pm

Good afternoon A very relevant question for me at the moment, because... I’m thinking about continuing to work or applying for a pension. They say that if you delay retirement, you will have more in the future. Is it so?answer

- Yulia 11/30/2016 at 6:27 pm

According to the Law “On Insurance Pensions”

, if a person delays retirement, he will be accrued bonus coefficients for each year. Expert calculations show that it is beneficial if the expected period of receiving pension benefits is 20 years. In this regard, women in our country are advised to postpone processing payments, but men are not.

Besides this, a lot depends on income. If a person works and has a high salary, it is easier for him to refuse a pension of 15,000 rubles, starting to receive it 5 years later. And then he will receive about 25 thousand rubles. Unfortunately, the majority of the Russian population has a small pension and low salary, so there are only a few who want to postpone retirement.

answer

- Andrey 10/08/2019 at 18:30

Yulia: “... it’s easier for him to refuse a pension of 15,000 rubles, starting to receive it 5 years later. And then he will receive about 25 thousand rubles.”

Not very good with arithmetic. 15000 x 1.36 (overall coefficient for 5 years) = 20400. In 5 years he would have received 15000 x 60 = 900000. An increase of 20400 - 15000 = 5400. 900000: 5 (400 x 60) = 2.7, only in the third year it will come out a plus. Those. you have to live at least 8 years after 65 to enjoy it. Moreover, he must continue to work for 5 years and receive a salary no lower than what he was.

answer

- Arthur 10/23/2019 at 7:34 pm

Andrey, not quite like that. The fixed part increases by 1.36, and the insurance part (usually larger than the fixed one) increases by 1.45. In addition, with a high salary, the insurance part grows due to the IPC - this also provides a significant addition. In general, this is individual, we need to consider it specifically.

answer

I deferred my retirement until 2020 in 2010. And I still don’t receive a pension. Will this be taken into account?

answer

By court decision, early retirement was granted; 30 years of service is required, and I have 31 years. Pension Funds refuse to apply bonus coefficients, allegedly because they do not have sufficient experience.

answer

Please tell me how the regional coefficient is applied to a fixed payment, increased by the coefficient for deferment (clauses 4, 5, article 16 of the Federal Law-400)? Which article of the law should one rely on?

answer

On March 17, 2010 I turned 55 years old. But she applied for a pension to the Pension Fund in January 2014. Can I count on a bonus rate being applied?

answer

According to the preferential category, my retirement date was 2020. Exit to a preferential pension for agricultural workers, where the total length of service is 30 years and for tractor drivers 20 years. I am 32 years and 10 months old.

answer

Hello! I am 55 years old, at the end of May I was invited to the Pension Fund to clarify my work in the individual private enterprise, which will not be included in the length of service - it is 2.5 years. During these years, my child was sick, and a disability was issued for 5 years (periods - 2.5 years on maternity leave and 2.5 years on individual private employment), which I informed the PF employees about. I was shocked to learn that I had the right to early retirement at age 50! Does this right to apply the bonus coefficient apply to me for these 5 years that I didn’t know about? Can they be counted as deferred pension? PF calculated the total length of service – 35 years, 6 months. 15 days Thank you.

answer

Tatyana 06/03/2019 at 16:16

Yes, sure. Premium coefficients are also assigned in the case of an old-age insurance pension on preferential terms.

answer

“Yes, of course” says nothing! If you know, please provide articles of laws and so on.

answer

Hello! He applied for a pension at the age of 50, having worked for 26 years and 3 months, of which he worked for 20.5 years in the RKS (Kamchatka), sailing crew. When calculating, we calculated a coefficient of 1.6. This is right? Could I have applied for a pension earlier, with 25 years of service? Should a bonus factor be taken into account?

answer

Share your opinionCancel reply

What to do?

If you are ready to take responsibility for your old age and a decent pension into your own hands, then you need to start acting right now. The degree of aggressiveness of your actions will depend on how old you are at the moment.

If you are young and just starting your career, you can save quite a bit, without denying yourself anything. If retirement is already looming on the horizon, you will have to tighten your belt as much as possible and perhaps take a lot more risk.

Traditional investment options:

- Bank deposit

- Mutual investment fund (I wrote about my experience here)

- Securities

- Real estate

- Gold

- Business

A bank deposit is traditionally the most conservative and low-income instrument; on the contrary, a business can bring a thousand-fold profit, but there is always a risk that something will go wrong. Perhaps the best option is gradual investment in all areas. It may not bring fabulous profits, but at least you can pay yourself a decent pension.

Oddly enough, it was the fear of old age and poverty that made many people very wealthy. Don’t think that I advise you to get hung up on these thoughts, but from time to time it’s worth looking around and thinking about the future.