The daily life of military spouses is not easy, given frequent moves, remote garrisons and minimal comfort conditions, not to mention the impossibility of career growth due to the lack of places of work.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Naturally, at the state level, they could not help but note the dedication of military wives, and therefore they were given the right to a number of benefits and compensation - in particular, receiving their husband’s pension after his death.

Pension amount

The size of your military pension depends on several factors. These include:

- the cause of the husband's death;

- rank and position of the military personnel;

- length of service until retirement.

In 2020, a certain procedure has been established for calculating military pensions for widows:

- If the death of a military pensioner occurred due to a disease acquired during his military service, then the widow will receive 40% of her husband’s payments.

- If the death is related to an injury received in military service, the wife will receive 50% of the husband's payments.

The calculation of the survivor's pension is made individually and depends on:

- military personnel pension coefficient;

- the sums of all pension coefficients;

- from the amount of the second pension;

- on the number of dependents of the military personnel.

These coefficients consist of many factors, such as length of service, position held, rank. If certain points were not taken into account when calculating this pension, you can apply for recalculation of payments only once a year, in August.

Is it possible for military widows to receive two payments?

According to the law, citizens cannot receive two government payments at once, so if they can apply for two benefits for different reasons, they will have to choose only one option. But there are exceptions that apply to the wives of deceased military personnel. For example, a widow, if she meets all the requirements, can apply for a standard old-age pension, and also count on payment for the loss of a breadwinner.

Reference! Preferential transfers stop if a woman gets married, since if she is represented by a disabled citizen, then the new spouse must take care of her.

Payment processing procedure

To begin receiving a widow's pension, it is necessary to determine what kind of payment she is entitled to. The government agency to which the application must be submitted depends on this.

To apply for a military pension, you need to contact the Pension Fund where your husband received his pension. To apply for a labor pension, you can visit any Pension Fund. To apply for survivor benefits, you need to contact the Ministry of Defense. To submit an application, you will need to have a certain package of documents with you, as well as their photocopies:

- husband's military documents confirming his rank and position;

- own passport;

- certificate of death of a serviceman;

- medical reports on the cause of death and documents confirming illness or injury during military service;

- papers confirming the official marriage between the applicant and the serviceman;

- documents on disability;

- the child's birth certificate;

- work book;

- any other documentary evidence of entitlement to receive this payment.

After the documents are accepted, the decision on assigning pension payments to the widow must be made within 10 days.

The procedure for assigning state support to dependents of fallen soldiers

In order to receive the required social support from the state budget, applicants must submit an application with a package of documents confirming this right to the Pension Fund of Russia (PFR):

- personally:

- at an appointment with a specialist at a local branch;

- in the multifunctional center;

- by mail;

- via internet connection:

- on the government services portal;

- on the official website of the Pension Fund;

- through a representative (an official power of attorney is required).

Important: there are no legislative restrictions on the time for declaring their rights for the families of fallen defenders of the Motherland.

Package of documents

To confirm the legality of the grounds for payments, you must provide the following documents:

- identification:

- passport;

- child's birth certificate;

- other;

- document certifying the absence of a military personnel:

- his death certificate;

- court decision on missing person;

- certificates confirming family ties:

- about marriage;

- about birth;

- about adoption;

- other according to circumstances;

- other documents:

- certificates of family composition;

- information about income or lack thereof;

- about obtaining full-time education and others.

Important: if the breadwinner was a contract serviceman, then the package of documents should be sent to the government agency where he served (Ministries of Defense, Internal Affairs and others).

How is maintenance paid to the dependents of deceased soldiers?

Pensioners are given the opportunity to independently choose the method of receiving funds. Namely:

- through the post office;

- to a bank card or account;

- through the services of an organization that delivers money (if there is an agreement with the payer).

Attention: if necessary, the recipient has the right to change the method of delivery of the pension. To do this, it is necessary to notify the payer in writing, indicating the new details for transfers.

On the timing of the assignment of survivor benefits

This type of state support is provided to former dependents from the date of death of the defender of the Motherland. It is established for the period of incapacity:

- until adulthood or reaching the age of 23 (if the fact of full-time education is confirmed);

- until the disability is cancelled;

- for citizens of retirement age - indefinitely.

Attention: when applying for support later than a year from the date of entitlement to it, the accrued pension is paid for a period of no more than 12 months to the date of application.

Benefits for widows

In addition to pension payments, Russian legislation still provides some benefits to widows:

- The time when the wife accompanied her husband on military trips is included in the work experience for no more than 5 years.

- If the deceased husband was a participant in hostilities, then a 50% discount on utility bills is granted. For other widows, discounts for this category are determined individually by regional authorities.

- Priority right to admission to kindergartens and schools, as well as military schools.

- If the husband died in the first year after retirement, his family can compensate for the costs of moving, provided the weight of all property does not exceed 20 tons.

- Compensation for annual travel to and from the sanatorium.

- Free treatment, registration in departmental hospitals.

- Receive free prescription medications in these hospitals, as well as sanatorium treatment if it is prescribed in the medical report.

- Discounts on sanatoriums subordinate to the military unit where the spouse served.

This is important to know: Pension for length of service for state civil servants in 2020

In this way, the state provides financial support to women who remain financially unprotected after the death of their military husbands.

Pension for the wife of a military pensioner after his death

The daily life of military spouses is not easy, given frequent moves, remote garrisons and minimal comfort conditions, not to mention the impossibility of career growth due to the lack of places of work.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Naturally, at the state level, they could not help but note the dedication of military wives, and therefore they were given the right to a number of benefits and compensation - in particular, receiving their husband’s pension after his death.

What does the law say?

As a rule, military wives, being in garrisons remote from large populated areas, cannot find a job, while the husband’s career moves forward with another rank and a move to another military unit.

Of course, the spouses do not protest, because being a military wife is honorable, but, unfortunately, it is risky, due to the fact that by the age of 55 the woman will not have earned the length of service necessary to receive a pension, or will become a widow just before retirement, without livelihood.

That is why wives who selflessly provided support for their husbands during his service are given the right to receive several types of pensions at the woman’s choice, in particular:

- a survivor's pension if the ex-wife, due to her health condition, cannot provide for herself;

- the husband's military pension, provided that he was already entitled to the agreed payment;

- old age pension, subject to length of service.

The legislative framework

- death of a serviceman while on duty and in the performance of duties;

- untimely death after transfer to the reserve, but due to injury or illness that was received while still in service;

- death after receiving a military pension due to previously received injuries;

- recognition of a military man as missing or in captivity.

Also, a military spouse, at her own choice, can apply for a survivor’s pension in accordance with the norms enshrined in Article 10 of Federal Law No. 400, if at the time of her husband’s death she has a disability, that is, she is incapacitated or cares for the small children of the breadwinner, without opportunities to find a job and earn an independent income.

And of course, a woman has the right to count on an old-age pension on the basis of Article 8 of Federal Law No. 400, provided she reaches retirement age and has at least 15 years of experience, not to mention the IPC of 30 points.

Who is entitled to what?

Given the professional risk of military service, not all military personnel have time to enjoy the long-awaited retirement holiday, which is why their wives become widows at a young age and can count on a survivor's pension only under certain conditions established by law.

Survivor's benefit

Thus, on the basis of Article 10 of Federal Law No. 400, a wife can count on benefits for the loss of her husband or an insurance pension for the loss of:

- in the presence of incapacity for work, namely disability and being a dependent;

- when caring for children or little sisters and brothers under fourteen years of age, even if they are employed and not disabled;

- in case of loss of ability to work after a long time from the date of the husband’s death, subject to the loss of a source of livelihood.

At the same time, the right to a specified type of support is exercised at the expense of the state and is not lost by the woman even upon entering into a new marriage, given that the new husband is not obliged to support the children of the deceased serviceman, while the woman is paid benefits specifically for the agreed purposes.

Military pension

- being a dependent with a documented disability;

- loss of source of income;

- when caring for young relatives of the deceased under 14 years of age.

What time do mothers with many children retire? Find out here.

Double payments

Expert opinion

Davydov Dmitry Stanislavovich

Deputy Head of the Military Commissariat

As a rule, in accordance with the law, citizens who have the right to pension provision on several grounds can receive a pension on only one of them, at their own choice.

The stipulated norm states that a double pension for widows is established if a woman has the right to receive benefits on other grounds - for example, old age, which means reaching the age of 55 years or when a long-service pension is assigned on preferential terms.

A woman can also receive a disability pension, which actually confirms her status as a disabled person and the need for additional funds for treatment at the expense of her husband, and after his death - a loss pension.

However, given that a double pension is assigned only as an exception and for persons who really need additional financial assistance, the specified rule is valid only until the woman remarries, and therefore receives support from her husband, who in view of Article 89 of the RF IC, she is obliged to support her during the marriage relationship.

Preferential pension

By virtue of the law, widows of military personnel can receive a military pension indefinitely not only upon reaching 55 years of age, but also before the agreed period.

How to write an application?

Let's look at what data needs to be indicated in an application for a pension upon the death of a serviceman:

- Full name of the applicant;

- Legal address of registration;

- Actual location address;

- Series and number of the applicant’s passport;

- The reason for petition. It must be indicated that the applicant is related to the deceased, so he is applying for payment;

- Full name of the deceased serviceman;

- The name of the bank through which the applicant wishes to receive a pension;

- Full details for crediting the payment: microfinance organization, current account and card number of the applicant;

- Information about other family members who may qualify for a pension;

- List of documents attached to the application;

- Date of application;

- Applicant's signature.

Pension for widows of deceased military pensioners in 2020-2017

Benefits for the loss of the main breadwinner do not arise automatically with his death, but only after the provision of a package of documents provided for by federal legislation in compliance with the deadlines and other conditions of registration.

How to apply and receive?

First, you need to determine what type of pension the widow of a deceased military pensioner can apply for, taking into account her own length of service and the circumstances of her husband’s death - in particular, a survivor’s pension or a military pension, given that the agreed types of support are paid subject to conditions different from each other. friend.

A survivor's pension is paid to all widows who are unable to work or are raising small children or relatives of the deceased, and a military pension is paid only in the event of the death of a former soldier due to an injury or illness received during service.

Also, the widow must understand that she will be entitled to a double pension only if she has at least 15 years of experience, and not in any case, even if her husband died in the line of duty.

This is important to know: Pension certificate of a military pensioner

Where should I go to transfer my husband's pension?

The procedure for applying for accrual of pension benefits primarily depends on the type of pension.

In particular, if a woman applies only for a military pension, she needs to contact the military commissariat at her husband’s place of service or the military registration and enlistment office at her place of residence with an application for the issuance of documents confirming the fact of her husband’s service and death as a result of an injury received in the service.

Then the widow with the death certificate of her military husband applies for a pension to the Pension Fund at her place of residence in a general manner that applies to all categories.

Documentation

The list of documents giving the right to receive survivor benefits is approved by Order of the Ministry of Labor No. 958n, where clause 10 states that the widow must provide as supporting data:

- copy of ID;

- Marriage certificate;

- husband's death certificate;

- a certificate from the military registration and enlistment office about the length of military service;

- a certificate confirming the woman’s disability or incapacity for work;

- copies of birth certificates of children or small relatives of the husband, including documents confirming the death of their parents;

- certificate of family composition and place of residence;

- income certificate;

- work book;

- a certificate confirming receipt of another type of pension or non-receipt of pension provision at all.

Deadlines

In accordance with Article 22 of Federal Law No. 400, pensions of all types are assigned only after the right to a certain type of pension arises, that is, the widow of a serviceman can apply for a survivor’s pension only after his death.

How to calculate the disability pension? Information is in our article.

Read about the retirement of health workers based on length of service here.

Urgent pension payment - what is it? See here.

Accrual

Article 22 of Federal Law No. 400 states that in most cases, a pension is assigned only from the moment of applying for the agreed payment from the moment of registration of the application with the attached package of documents.

But in the case of a pension for the loss of a breadwinner, the agreed type of financial support is paid from the moment of death of the breadwinner on the basis of a death certificate, provided that the documents for calculating the pension are submitted within a year from the date of death.

Dimensions and percentage

- 50% allowances for the deceased husband, provided that he was diagnosed with disability due to injury or the development of a disease in the performance of his duties;

- 40% husband's allowance, if the husband's disability was caused by an accident during service and is not related to the performance of direct duties.

At the same time, the husband’s monetary allowance, in accordance with Article 2 of Federal Law No. 306, will include the following accruals:

- salary according to rank;

- salary according to position;

- additional pay for length of service.

Also, in accordance with Article 15 of Federal Law No. 166, the widow of a conscripted soldier has the right to a pension in the following amount:

- 200% social pension in case of death from an injury received during service;

- 150% of the social pension in the event of the development of an illness, again received during military service.

Calculation example

Salaries for military personnel are established by Government Decree No. 992 in accordance with their position, rank and affiliation with certain troops.

Example:

The commander of a tank platoon squad has a salary of 15 thousand rubles and a rank salary of 6,500 rubles, while his service experience is more than 20 years, which provides for a 30% bonus to the existing salary.

In what cases is recalculation made?

- reaching the age of 80 years;

- receiving group 1 disability.

That is, the right to recalculate the survivor's pension arises in the event of circumstances that give the right to an increase in the previously established benefit amount.

Delivery options

In accordance with paragraph 106 of Order of the Ministry of Labor No. 885n, the responsibility for delivering the pension is assigned to the PF at the place of residence of the applicant.

The agreed payment is delivered based on the pensioner’s application, where he determines his choice of delivery method.

In particular, the loss pension can be delivered by mail or by crediting funds to the recipient's current account.

How much is the social old age pension? Find out here.

Other benefits and the procedure for receiving them (federal, regional benefits)

In addition to financial assistance, the state at the regional and federal levels provides benefits to widows of military pensioners in several areas:

- Healthcare. The widow retains the right to receive medical care in sanatorium-resort institutions no more than once a year.

- Free travel to the husband’s burial place once every 12 months.

- Compensation for the transportation of luggage (up to 20 tons) during the move of the deceased’s wife from the place of duty.

- Payment of housing and communal services and repairs of a private house. Depending on the length of service and merits of the deceased, the percentage of compensation for housing costs will vary. Most areas provide 50% utility reimbursement. Repair of a private house at the expense of the Ministry of Defense can be carried out no more than once every 10 years.

To obtain more detailed information regarding compensation for the cost of housing and communal services in your region, contact the housing office or the social department for the protection of the population.

The state also provides assistance to other family members of a deceased military man. If the mother, father or other relative took care of the children of the deceased (before they reached the age of 14), then they also have the right to receive survivor benefits.

Family members of the deceased who performed the funeral are entitled to financial compensation in the amount of 3 times the pension of the deceased.

All legitimate military children (including adopted children, stepdaughters and stepsons) under the age of 18 or 23, subject to full-time study at a university, have the right to receive a survivor's pension.

Brothers, sisters, grandchildren and other dependent minors are also entitled to receive a pension. An important condition will be documentary evidence of the death of their parents.

Important nuances

Given the economic downturn and rising inflation, many are wondering what kind of pension will be available to widows in the future?

Last news

A few years ago, the issue of increasing the pension benefits of military personnel was already raised and it was planned to increase pensions by 20%, however, in view of recent events, the agreed payments were postponed until the economic situation stabilized.

Will they increase it and how?

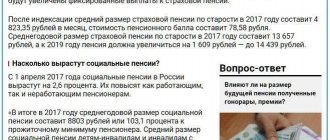

The Prime Minister of the Russian Federation brought up for discussion the issue of increasing the size of pensions of military pensioners in 2020 by 2%, in connection with which there is hope for an increase in the survivors' pension for widows of military personnel, given that the size of their pension directly depends on the pension provision of their husbands.

This video is unavailable

This video may not coincide with your views and beliefs, so we invite you to express your point of view in the comments. Regarding cooperation and all questions write to: Gmail VK: https://vk.com/slepaya_politica

. Earlier it was also reported that the head of the Ministry of Labor, Maxim Topilin, told how many of the country’s pensioners would be affected by the upcoming increase in pensions. According to the federal minister, at least 31 million citizens should feel the increase in monthly pension payments next year. Russian pensioners have suffered so much from the government over the past year that it seems they no longer expect anything good, either from ministers or personally from Prime Minister Dmitry Medvedev. All the more unexpected was the signing by the Prime Minister of a document that will, at least slightly, improve the lives of elderly Russians. And while the majority of pensioners in the country traditionally count pennies until their next pension, the government has actually prepared a document that can, to some extent, relieve them of at least some of their financial problems. However, it is too early to talk about exactly what the effect of this innovation will be - everything will be determined by the practice of its enforcement.

This is interesting: When can you listen to loud music in Belarus?

FAQ

Are widows of deceased disabled veterans entitled to benefits?

How long can I receive such payments?

Will they cancel if they gave me their second pension?

Pension provision for widows at the expense of the federal budget of the Russian Federation is well deserved, given that spouses have faithfully followed their husbands to different parts of the country for many years. But how a pension is calculated in more specific cases can only be found out by studying the legislation, taking into account that the circumstances of death, as well as the procedure for assigning pensions for different categories of wives, differ depending on their family circumstances.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

This is important to know: Benefits and pensions for military veterans in 2020

Pension for the widow of a serviceman

In most military families, it is the serviceman who is the main “breadwinner”, since spouses, following their husband (or wife), have difficulty finding a suitable job. This means that they do not have time to earn their living or their old age.

The state, understanding the specific situation of military spouses, provides for the possibility of a widow or widower receiving a military pension. In this material, we will figure out how a widow can receive the pension of her military spouse, as well as what kind of help from a lawyer in Moscow will be needed for this.

Basic provisions

In the event of the death of a military pensioner, the widow (widower) can count on receiving one of several types of pension benefits. A total of 3 options are possible if certain additional conditions are met:

- Retirement age has been reached - for men 65 years (excluding transitional provisions), for women 60 years (also excluding the transitional period of raising the retirement age);

- old age (over 65 years for women and over 70 years for men);

- there is no official labor income.

The types of pension provision available in this case are determined by the following list.

- Military pension - the amount depends on the specific amount that the deceased military man received.

- Old-age insurance pension - determined by the earnings of the widower (widow) during his working life. Cannot be less than the subsistence level in the region.

- Social pension is established upon reaching old age, regardless of other circumstances. Like the insurance pension, the social pension cannot be lower than the subsistence level of pensioners in the region of residence.

A widower (widow) has the right to choose the type of pension that will be most beneficial to her. For example, if a military man did not change his location for many years, and part of it was in a large (medium-sized) city where there was employment opportunity, then the widow could well have time to earn money for a decent old age.

If work was “tight”, or the pension turned out to be ridiculously low in comparison with the military one, then it makes sense to switch to it.

How to transfer to the pension of a deceased military man

It is noteworthy that the pension for the widow of a military pensioner is set in an amount tied to the actual salary received by military personnel who are currently receiving in a similar position and in a similar rank. That is, the calculation is not based on the actual pension of the spouse, but on the salaries that are paid today in the army or other law enforcement agencies.

Receipt of a spouse's military pension by a widow or widower is possible only if:

- reached retirement age (65/60 years of age for men/women without taking into account transitional provisions);

- have a disability officially confirmed by ITU;

- have a child under 14 years of age;

- have a child under 8 years old;

- the death of a military man occurred as a result of a combat wound in service.

Expert opinion

Davydov Dmitry Stanislavovich

Deputy Head of the Military Commissariat

To receive a military pension or survivor's pension, a widow (widower) must apply to the pension department of the department where the military man directly served. In this case, it is necessary to prepare the appropriate package of documents.

Results

The procedure for obtaining a pension for widows of military pensioners will include the following steps:

- To begin with, the widow will need to decide what type of pension will be issued.

- Next you need to start collecting the required documents. You can first visit the authorized authority and get a list of required papers there. It is always established officially and enshrined at the legislative level.

- When contacting an authorized authority, the interested party must draw up a personal statement. It is transferred to the specialist along with other documents. Next, based on the information received, the specialist assigns the required payments.

What documents are needed

Pensions for widows of deceased military personnel are granted on an application basis. That is, it is not accrued “automatically” immediately after the death of a military retiree. The widower (widow) submits an application to the pension department of the department, and the following package of documents is also provided:

- identity card - residence permit or civil passport;

- Death certificate of a military pensioner;

- documentary evidence of family relationships - Marriage Certificate;

- documents of the deceased husband confirming his service in the department.

In addition, specialists may request other documents. For example, this could be a medical report on the cause of death, a conclusion on the absence of involvement of the widower (widow) in the death of a military pensioner, Birth Certificates of children, etc.

If you don’t have the moral strength to collect documentation and draw up contents, you can turn to a lawyer for help. Based on the contract, the specialist will act as a trustee and resolve the issue in favor of the client.

It is mandatory to provide a complete list of requested documents. Indeed, in addition to the pension itself, certain benefits are provided for the widow (widower).

- Discounts on housing and communal services payments if a deceased military pensioner took part in combat operations.

- An advantage when entering kindergartens, schools, and military schools for the children of a military pensioner.

- Free luggage transportation weighing up to 20 tons and free travel when moving if the military man died within 1 year from the date of retirement.

- Service in departmental hospitals and clinics with the right to undergo free sanatorium-resort treatment if there are medical indications.

- Discounts on treatment in departmental sanatoriums.

- Right to a second pension.

Funeral benefit

The state not only takes care of pensions for widows of deceased military pensioners. A lot of public funds are spent on the burial of a deceased citizen. If relatives bury with their own money, then they are entitled to compensation for the amount spent. In different regions it ranges from 6 to 11 thousand rubles. The funeral can be carried out entirely at the expense of the state by specialized funeral service bureaus. It is important to apply for social benefits for burial no later than six months from the date of burial. Otherwise, no partial refund will be given.

The Russian Pension Fund is a serious structure that requires literal execution of the norms and rules prescribed by law. It’s good if the documents for receiving pension benefits are in perfect order. However, this does not always happen. Therefore, it is necessary to first consult with experienced lawyers who will help you understand the intricacies of pension legislation.

Survivor's pension

If a deceased military man has not reached retirement age, a pension is awarded in the following cases:

- If death (destruction) occurred during service or within three months after dismissal.

- If the cause of death was a wound, injury, or disease received during service. The deadline in this case does not matter.

When a service member dies after retirement, family members are entitled to a survivor's pension if the death occurred while he was receiving his military pension or within five years after it ceased to be paid.

- If she has reached the age of 55 or is disabled.

- If she takes care of the children, brothers, sisters, and grandchildren of the deceased who are under 14 years of age and does not work. Age does not matter in this case.

- If the cause of death of the breadwinner was a disability acquired during service, then a military pension is assigned to the widow of a military man when she reaches the age of 50 years. If she is busy caring for a deceased child under the age of 8, then the pension is assigned regardless of the woman’s age and whether she works or not.

The procedure for calculating length of service

The work experience of military wives, if they were not employed, will be calculated from the years they spent with their husband at his place of service. It will consist of two parts: labor and insurance.

According to the law “On the Status of Military Personnel,” total length of service of military wives includes the entire Soviet period of life with their husband, regardless of where the service took place, that is, until 1992. After 1992, the length of service includes the time when the family lived at the husband’s place of service, in which there was no opportunity for the woman to get a job. This must be confirmed by a document from the employment service.

The insurance part includes the time when the military spouse could not work due to the health of the child, if this is due to special living conditions at the husband’s place of service. To do this, you will need a certificate from a medical institution, which confirms that during this period the child requires care provided by the mother.

The Law “On Insurance Pension” guarantees military wives inclusion in the insurance period of 5 years from the period when they lived in a place where it was impossible to find a place of work. Even if it took a longer period of time - 15 or even 20 years, the experience is limited to five years.

You can add the time spent caring for a child up to one and a half years to the insurance period. If there are several children, then the total period of incapacity for work in connection with child care, included in the insurance part, cannot be more than six years.