Supplement to pension for civil aviation flight personnel

<On labor pensions and additional payment to the pension of civil aviation flight personnel <«>30 January 2012. Published in Pension <The PLC of Russia receives letters asking for clarification regarding the assignment of a labor pension in accordance with the <Federal Law “On Labor Pensions in Russian Federation" dated December 17, 2001.

No. 173-FZ and assignments (suspensions) of additional payments to pensions in accordance with the Federal Law “On additional social security for members of flight crews of civil aviation aircraft” dated November 27, 2001. No. 155-FZ. <The labor pension for civil aviation flight personnel is assigned in accordance with paragraph 13, paragraph 1 of Article 27 of Federal Law No. 173-FZ, which states that the old-age labor pension is assigned before reaching the age established by Article 7 of the Law (60 years for men and 55 years for women). For civil aviation flight personnel, age requirements do not apply. To qualify for a retirement pension, men must work for at least 25 years as a civil aviation flight crew, and women must work for at least 20 years as a civil aviation flight crew. When leaving flying work for health reasons, men must work for at least 20 years and women 15 years as civil aviation flight personnel. For civil aviation flight personnel, a special procedure has been established for calculating special length of service - based on total flight hours. For those who flew airplanes as ordinary crew members, the entire flight time is divided by 20 and 12 and the length of service is obtained in years. For those who have flown helicopters (regardless of their position) in the command and instructor staff and special-purpose aviation, it is necessary to divide by 12 and 12 again.

Time spent studying at higher educational institutions of aviation, if it was preceded by work in flight positions, is counted according to the actual duration.

To obtain the right to a retirement pension, you must have at least the following flight hours: on airplanes, transport work 6,000 hours for men, 4,800 hours for women;

Helicopter flights are 3,100 hours for men and 2,480 hours for women.

With 25 years of service for men, the formula for calculating the conditional pension by which the accumulated pension capital is calculated uses a coefficient of 0.55, and with 45 years of service this coefficient will be 0.75.

Formula for calculating the conditional pension:

1671р x (0.55÷0.75) x 1.2

1671 rubles - the average salary in the country for 2000-2001, which was underestimated by 2 times compared to statistics

0.55 – coefficient for 25 years of service, then 0.01 is added for each subsequent year, but not more than 20 years

1.2 is the ratio of a pensioner’s earnings to the average salary in the country for the same period.

For flight personnel, this coefficient is much higher, but the limit is 1.2 for everyone except northerners.

Using this formula, a conditional pension is calculated for each employee, according to which the accumulated pension capital is calculated as of 01/01/2002... Starting from 2002. length of service is required only to obtain the right to a pension, and the amount of the pension itself will be the sum of the value calculated using the above formula, to which will be added insurance contributions made by the employer, which will be divided into years of survival (in 2012 they are equal to 18) and by 12. If the employee is younger 1967 birth, he will have an increase in the funded part of the pension.

Due to the decommissioning of Soviet-made aircraft, navigators, flight mechanics, flight engineers and pilots were left without work. Many cannot retrain for new aircraft for various reasons, and have not earned the right to early retirement. Sometimes 50-100 hours are not enough to reach 25 years of flight time. There is a need to complete the total length of service on earth and wait until the age of 60 to receive a pension.

PLC of Russia believes that since the work of flight crew members of civil aviation aircraft is recognized as harmful, dangerous, stressful, difficult and of a special nature, it is possible to receive an early pension in accordance with paragraph 1 of paragraph 1 of Article 27 of the Law on Labor Pensions in the Russian Federation, which states: “The old-age labor pension is assigned before reaching the age established by Article 7 of this Federal Law to the following persons”:

- men upon reaching 50 years of age and women upon reaching the age of 45 years, if they have worked, respectively, for at least 10 years and 7 years 6 months in underground work, in work with hazardous working conditions and in hot shops and have an insurance period of at least 20 and 15, respectively years.

If these persons have worked in the listed jobs for at least half of the period established above and have the required length of insurance experience, they are assigned a labor pension with a reduction in the age established by Article 7 of this Federal Law, by one year for each full year of such work - for men and women.

The problem of assigning early pensions to flight crews according to the above point is that flight crews are not included in the 1st list of hazardous work for which such pensions are awarded (for example, flight attendants at 45 and 50 years old, women and men). But there is another document. In accordance with the Decree of the Ministry of Labor and Social Development of the Russian Federation dated July 12, 1999. No. 22, flight crew members of civil aviation aircraft (pilots, navigators, flight engineers, flight mechanics, flight radio operators, flight operators) are provided with a 36-hour work week when performing flight work for work under harmful, dangerous, stressful and difficult working conditions of a special nature.

Such working conditions were approved in 1997 by the “Sanitary and Hygienic Characteristics” (harmfulness, danger, tension, severity of labor of Russian civil aviation crew members) by the First Deputy Minister of Health of the Russian Federation, Chief State Sanitary Doctor of the Russian Federation G. G. Onishchenko, Director of the Federal Aviation Service Russia by G.N. Zaitsev, which were agreed upon with the PLC of Russia.

Also, in 1997, G.G. Onishchenko and G.N. Zaitsev approved, agreed with the PLS of Russia and approved by the Chairman of the Scientific Council of the Association of Aviation and Space Medicine of Russia V.D. Vlasov, “Medical justification” (rights to increased and early retirement provision of flight personnel of the Civil Aviation of Russia in connection with the risk of loss of professional ability to work under the influence of dangerous, harmful and stressful working conditions).

Regarding early pension provision for flight personnel in accordance with clause 1, clause 1, article 27 of the “Law on Labor Pensions in the Russian Federation,” the Russian PLC appealed to the Ministry of Health and Social Development. Once we receive a response, we will publish it in the newspaper.

On emerging problems in the implementation of Federal Law No. 155-FZ (additional payment to pensions), I suggest that you familiarize yourself with the material posted in the magazine “Pension” No. 6 for 2011.

The maximum additional payment to the pension for February, March and April 2012 will be = 11615.45 rubles, the collection coefficient is 0.295704980. As previously predicted, the amount of additional payment to pensions decreased compared to payments in November, December 2011, and January 2012. This happened because in the third quarter of 2011, almost 300 million rubles more financial resources were received from airlines providing payments than in the fourth quarter due to the return of debts that were not paid on time. In the fourth quarter of 2011, only current payments were received, which will finance payments in February, March, and April. The PLC of Russia predicted all this back in October and warned veterans that a significant increase in the additional payment to pensions was due to additional contributions received by debtors and from February 1, additional payments to pensions would decrease. After the adoption of amendments to Federal Law No. 155-FZ, which related to the introduction of mandatory monthly and quarterly reporting on accrued and paid contributions, fines and penalties for late payment of contributions, and clarification of the basis for calculating contributions, the payment discipline of airlines has significantly improved. Funds from airlines began to flow significantly more compared to previous years.

From 02/01/2012 The entire labor pension will be indexed by 7% and from 04/01/2012. by 2.4%. Previously, the basic and insurance parts of the pension were indexed separately. To receive a new pension amount from 02/01/2012. it is necessary to multiply the entire pension (without Moscow and regional allowances) by 1.07.

EDV (monthly cash payments) from 04/01/2012. will be increased by 6%.

From 01/01/2012 the aggregate rate of insurance contributions to extra-budgetary funds has changed. In 2011 it was 34%. Of these, employers paid 26% to the Pension Fund of the Russian Federation (20% was spent on paying labor pensions and 6% was cut off for the funded part of the pension), 2.9% - to the Social Insurance Fund of the Russian Federation, 3.1% and 2% - to the Federal and territorial compulsory health insurance funds, respectively.

From 01/01/2012 the rate of insurance contributions to the Pension Fund has been reduced from 26 to 22%. The base of each employee subject to insurance premiums has also been indexed, that is, the maximum annual earnings from which insurance premiums are paid. It will increase from 463 to 512 thousand rubles (on a monthly basis from 38.6 to 42.7 thousand rubles). An additional tariff for insurance premiums has been established above the maximum value of the base for calculating insurance premiums in the amount of 10%, which will be sent not to the individual accounts of the employee, but to the solidary part of the pension for current payments to today's pensioners. The burden on the wage fund from high earnings has increased and this does not please, including aviation employers.

<The rate of insurance contributions to the Social Insurance Fund and the Compulsory Medical Insurance Fund has not changed. It remains at the 2011 level. On deductions of contributions by airlines in accordance with the Federal Law of November 27, 2001. No. 155-FZ no changes occurred.

<Member of the Presidium of the PLC of Russia V.P. Vechirko

Do military pensioners in Moscow have additional payment?

Military service is a prestigious and respected occupation at all times. The government of the Russian Federation strives to improve the living conditions of military personnel using federal budget funds. The program is valid for both retired and active military personnel.

A military pensioner has an impressive list of benefits and various privileges entitled to him. In order to receive a military pension, the pensioner must have the following length of service:

- 12.5 years if you have a total work experience of 25 years.

- at least twenty years (if working exclusively in the armed forces);

Since pensions for military personnel are formed in a different way from civilians, benefits are assigned on different grounds than for ordinary pensioners.

Benefits and privileges for military pensioners in 2020

However, such differences are minimal. Rather, some regions provide beneficiaries with additional guarantees from the corresponding budget.

For example, in the capital, military pensioners and their widows have received increases to their basic pay. They depend on the category of the recipient. The preferences laid down in this law apply to:

- midshipmen;

- officers.

- warrant officers;

Download for viewing and printing: Military personnel must be dismissed on the following grounds:

- for health;

- due to organizational and staffing events.

- due to reaching the age limit;

Attention: benefits are provided in full only to those military personnel in the reserve whose service exceeds 20 years.

Benefits for pensioners in Moscow in 2020: a complete list of benefits and privileges, compensation and allowances, federal and local, for working and non-working people, military and veterans, disabled people and single people

What benefits do Moscow pensioners have in 2020? Cash monthly payments established for certain groups of citizens - heroes of the Great Patriotic War, veterans of the defense of Moscow, and military operations.

Benefits for military pensioners in 2020 - list of required financial assistance and amount of subsidies

First, it is necessary to determine the circle of people who apply for allowances from military structures.

This category of citizens by law includes:

- military personnel of the Ministries of Defense, Internal Affairs and other military structures;

- National Guard members.

- fire service workers;

- employees of agencies to combat the spread of narcotics and psychotropic drugs;

- employees of the structures of the penal system;

To receive a military pension and assign benefits, one of the conditions must be met: According to the law, benefits are provided to military personnel of the Russian Federation, to those who served during the USSR and in the forces of the commonwealth: - The fungus will no longer bother you! Elena Malysheva tells in detail.

- Elena Malysheva - How to lose weight without doing anything! According to the order of the Ministry of Defense, the amount of payment depends directly on the number of years spent serving in the army and other departments covered by the law:

- up to 20 – 2 monthly salary;

- more than 20 – 7 monthly salaries.

Benefits for military pensioners - payment for housing and communal services, sanatorium-resort treatment and others

Benefits for military pensioners are provided in various forms: from cash payments to the provision of certain services on a priority basis.

All the benefits provided to this category of citizens are designed to increase the attractiveness of service in law enforcement agencies. These include former employees of other law enforcement agencies:

- citizens who worked in the Federal Drug Control Service;

- FSB employees, including border guards;

- employees of the penal system;

- employees of the railway troops;

- employees of the Russian Guard;

- fire service employees;

- employees of the Ministry of Internal Affairs;

All of the listed categories of citizens are reflected in Art.

Increase in pensions in Moscow in 2020 - additional payment to social benefits

Events in the field of pension accrual for 2020. According to the Law “On Insurance Pensions” dated December 28, 2013, the mandatory conditions for receiving social benefits in old age are:

- Reaching retirement age (60 years for women and 65 for men).

- Having the required experience.

- Possession of a sufficient number of pension points.

New rules for receiving pensions for civil servants

- the cost of living for a pensioner;

- city social standard (GSS).

Pension size in Moscow in 2020

Not all recipients of this social benefit will change. Those payments that receive:

Benefits for military pensioners in Moscow and the region in 2020

Military pensioners are recognized as military personnel discharged into the reserve of the Armed Forces of the Russian Federation, the former USSR, commonwealth countries, employees of law enforcement agencies - the Ministry of Internal Affairs, the State Fire Service of the Ministry of Emergency Situations, the FSPI, the Federal Drug Control Service, the penal system and others. Retirees are assigned a certain type of pension provision related to: The state allocates subventions to the regions to provide the military with:

- compensation for travel to the place of treatment or recreation;

- dental services;

- medications;

- EDV, one-time financial support.

- medical, social services;

- housing;

- sanatorium vouchers;

Subjects of the Russian Federation and municipalities are developing their own regulations regarding social support for pensioners receiving military pensions.

This applies to the following areas:

- financial assistance (regional payments, allowances, compensation, benefits);

- housing and communal services;

- healthcare.

- taxation;

- transport passage;

Pension in Moscow in 2020: what additional payments and bonuses to the minimum pension await Muscovites

The minimum pension in Moscow will be increased in 2020.

Today, pensioners in Moscow receive payments slightly higher than in the country as a whole. The mayor of Moscow was ready to discuss the topic of raising pensions. “I think that next year the federal pension will nevertheless be increased, but without waiting for this, I believe that we still need to significantly increase the minimum pension in Moscow,” the Moscow Government Information Center quotes Sobyanin.

The pension increase will affect more than 1 million people.

Pension increases in Moscow

In accordance with Decree No. 1005-PP dated November 27, 2007, the following categories of pensioners can apply for additional payments: The average amount of additional payments is 4,500 - 12,000 rubles. More than 2 million Moscow pensioners receive the bonus.

To receive the additional payment, the pensioner must fulfill several conditions, namely: In addition, this period of time includes the period of residence in the territory annexed to Moscow.

Source: https://152-zakon.ru/est-li-u-voennyh-pensionerov-moskvy-doplata-12444/

Who is included in the recipient category?

Pension recipients can be:

- flight crew members;

- citizens employed in positions equivalent to members of the flight crew.

Flight crew:

- pilots: commander, mentor, inspector, pilot, first and second pilot, etc.;

- navigators: onboard navigator, inspector, mentor, chief navigator and flag navigator;

- onboard engineers;

- on-board mechanics (including aircraft technicians);

- aircraft radio operators;

- cabin crew: flight attendants and flight operators;

- other positions: director, chief, commander, rector, inspector, etc.

It is acceptable to indicate the position with the replacement of “flight-” with “air-“. This will not be an error when submitting documents confirming experience to government agencies.

Women must have served at least 20 years as a flight personnel to qualify for the payment.

Equivalent positions:

- parachutists;

- rescuers;

- paratroopers;

- workers of parachute landing groups (provided that work is carried out at a distance of at least 10 meters from the surface of the earth).

All of the above categories must be able to officially confirm their position upon retirement. The following documents are required for this:

- employment history;

- flight book;

- a certificate from the Federal Air Transport Agency or the Ministry of Transport of the Russian Federation (if incomplete and incorrect information is indicated).

The flight book is a document that confirms the right to fly. It also displays the availability of the necessary skills, specialization and clearance.

To confirm your experience, you must provide a flight book.

Additional payment of 4900 rubles for military pensioners - latest news

In 2020, changes were made to the laws of the Russian Federation regarding benefits and social payments. This also applies to people of retirement age. This is especially true for military pensioners - they can receive an additional payment of 4,900 rubles. Not everyone will receive such bonuses.

Additional payments to military pensioners in 2020: news

Inflation progresses every year. Along with the depreciation of the domestic currency, prices automatically begin to rise. This is especially noticeable in the cost of essential products. The state is aware of the situation and is trying to help people who cannot provide for themselves. Pensioners, in particular military personnel, fall under this category.

On average, all pensions increased by 1,000 rubles. Indexation from 01/01/2019 was 7%. All pensioners, with the exception of working people, will receive an increase.

The increase in payments will take place in two stages. The first stage will increase payments to the military (including salaries) by 4.3%. The second wave of additional payments will increase the overall result by another 2%. This means that the additional payment to military pensioners in 2020 will be no less than 6.3%.

The Ministry of Defense plans to postpone the increase to a later date, compared to 2020. For military personnel, additional payments will be made no earlier than October 1, 2019 (previously it was planned to start on February 1). The government explains this by lack of funds. It was said that in 2020 the increase in pensions will be no less than in 2019.

You need to remember that a military pensioner is awarded two types of pensions. The first (main) is for length of service in a military organization (or service equivalent to it), such as the Ministry of Internal Affairs or the National Guard.

The second is civilian, which all ordinary pensioners receive. This payment depends on the citizen’s length of insurance, and it will be increased separately in 2019.

This means that in addition to 4,900 rubles, a military man will be able to receive an additional increase in income.

Legislative regulation of the issue

The legislation established the basis for making additional payments to pensions. Since this additional payment will be considered as a state one, regional officials will not be able to influence it. Based on the preferential policy, personal income tax (which is 13%) will not be deducted from the monthly pension supplement for military pensioners.

The monthly additional payment to military pensioners is regulated by the following laws:

- Law on pensions.

- Federal Law “On Military Duty and Military Service”

- GI Bill.

- Presidential Decree on pension supplements.

- Decree “On Amendments to Certain Legal Entities”.

Who will be given an additional payment of 4900 in 2020

An additional payment of 4,900 rubles is due to military pensioners who have experience in the following organizations:

- Russian Guard;

- Drug Enforcement Administration;

- Sun;

- ATS;

- Criminal executive bodies;

- Fire service.

Note! To receive additional payment, the pensioner must earn sufficient length of service, which should serve as a reason for retiring. If a military man left service before he gained the required length of service (for example, due to health reasons), receiving a bonus is also possible, but the issue will be considered on an individual basis.

Additional payment for military disability pensioners

The military disability pension can be further increased:

- If a pensioner has 1st group of disability, or is already 80 years old, the supplement will be 100% of the social allowance. pensions.

- If the recipient does not work, has a disability group of 1 or 2 and has at least one dependent person, then the increase will range from 32% to 100%.

- War participants – 32%. If he is currently over 80 years old, the premium is doubled.

- Pensioners who have received a disability group due to a combat wound are awarded an allowance in the amount of 100% of the social allowance. pensions (on reaching 60 years for men and 55 for women).

Conditions of appointment

In general, payments are granted subject to the following conditions:

- work experience in positions from the list of civil aviation must be at least 25 years for men and 20 years for women;

- the citizen stopped working in his profession.

If health problems arise that do not allow you to continue working in your position, early retirement requires 20 years of service for men and 15 years for women.

Social benefits

The issue of flight attendants was discussed controversially. Previously, they were not entitled to early retirement. Due to this initiative, special rules apply for these positions.

For flight attendants:

- men: age 55 years, subject to a total experience of 25 years, 15 of which on an aircraft;

- women: age 45 years, subject to a total experience of 20 years, 10 of which on an aircraft.

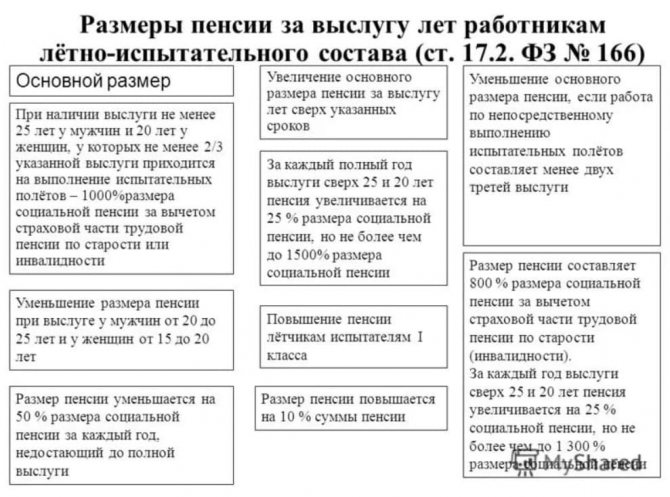

The length of service of flight test personnel is calculated based on the recalculation of hours spent in the airspace.

Flight hours:

- 20 hours on an aircraft and 12 hours specifically on a helicopter and specialized equipment is equivalent to 30 days;

- 12 months in emergency rescue units or for parachutists (when jumping from a height of at least 10 meters) is identical to 18 months.

The length of service also includes periods:

- training while working as a member of the flight crew;

- parental leave (up to 1.5 years);

- work abroad with payment of contributions from wages to the pension fund of the RSFSR (since 1992).

The calculation of length of service is based not on the duration of work according to the work record, but on the flight book.

Age and length of service for granting a long-service pension

Pension in Moscow in 2019-2020: what additional payments and allowances to the minimum pension await Muscovites

The minimum pension in Moscow will be increased from September 1, 2020. But not all veterans and elderly people will receive an increase. Read the latest news about indexing.

The Moscow authorities approved an increase in city pension supplements from September 1, 2020. Sergei Sobyanin wrote about this on his VKontakte page.

“Starting in September, we are raising the city standard for the minimum income of non-working pensioners to 19.5 thousand rubles . 1.6 million Moscow pensioners will receive additional payments to their pensions, 44 thousand of them for the first time. The recalculation will take place according to the usual schedule in the first ten days of September,” the mayor said.

Recalculation of additional payments will be carried out automatically.

– Deposits in Sberbank for pensioners: increased interest >>

– The highest interest rates on deposits for pensioners in reliable banks >>

The news hit like a bomb! Now let’s figure out what’s what: what exactly was increased, by how much, and who will receive the increase.

As can be seen from Sobyanin’s words, this is not about increasing pensions, but about increasing the city standard for the minimum income of a non-working pensioner.

Let us recall that until September 2020, this city social standard in Moscow was 17,500 rubles per month . This is the minimum level of pension received by a non-working pensioner registered in Moscow for at least 10 years . That is, now, since September, it has grown by exactly 2,000 rubles to 19.5 thousand.

But if a pensioner has been registered in the capital for less than 10 years, then this city standard does not apply to him, and the minimum level of his pension in 2020 is 12,115 rubles per month.

That is, those who have been registered in Moscow for less than 10 years are not affected by Sobyanin’s increase in payments. Their minimum wage remains at 12,115 rubles. It will be increased slightly only from January 2020.

Do not miss!

From 2020, old-age insurance pensions for non-working pensioners in Russia will increase by 6.6%. Details here >>

How pension indexation works in Moscow

In general, the annual process of increasing pensions in Moscow occurs in the same way as throughout Russia - in three stages.

1. As you know, the indexation of the old-age insurance pension for non-working pensioners in 2020 took place not on February 1, as many are accustomed to, but on January 1, as was the case last year.

Vladimir Putin outlined the main parameters of the increase in his televised address. The President said that “in 2020, the indexation of old-age pensions will be about 7 percent.”

On average, the pension will increase by 1,000 rubles per month.

The details of indexation were clarified by the Pension Fund. As follows from the press service of the Fund, from January 1, 2020, the old-age insurance pension for non-working pensioners was indexed by 7.05 percent.

This resulted in an average monthly increase in the insurance pension by 1,000 rubles. Working pensioners did not receive this increase. But many pensioners were unhappy with the January indexation.

After massive appeals to Putin, it was decided to recalculate.

2. From April 1, 2020, in Moscow, as throughout Russia, social pensions and state pensions will increase. Putin said nothing about them in his televised address. The Pension Fund itself outlined the prospects for the growth of social pensions in 2020.

So, at first it was planned to increase social pensions from April 1, 2020 according to the growth index of the pensioner’s cost of living for the previous year, namely by 2.4%. But then plans changed. As of today, social pensions are planned to increase by 2.0% from April 1, 2020.

More information about social pensions can be found here >>

3. In August 2020, insurance pensions for Muscovite pensioners who worked in 2020 also increased. The maximum increase was the same as before - the monetary equivalent of three pension points.

Now let us recall the two types of minimum pension in Moscow.

Minimum pension in Moscow in 2020

As you know, older people in Russia cannot receive a pension below the average annual subsistence level for a pensioner in their territory of residence. If the accrued pension is less than this level, then the Regional Social Supplement (RSD) to the pension is additionally paid from the budget.

In 2020, the cost of living for a pensioner in the city of Moscow was set at 11,561 rubles. Thus, the minimum pension in 2020 in Moscow, taking into account the Regional Social Supplement, was 11,561 rubles.

In 2020, the cost of living for a pensioner in Moscow was set at 11,816 rubles.

For 2020, the cost of living for a Moscow pensioner is set at 12,115 rubles. Accordingly, this figure can be considered the minimum pension in MSC this year.

But this “minimum wage” is established for those pensioners - Muscovites who have been registered at their place of stay / place of residence in Moscow for a total of less than 10 years.

For Moscow old-timers, a different minimum pension applies. It is adjusted to the City Social Standard of Minimum Income.

Additional payment to pensions in Moscow in 2020 up to the size of the city social standard

An additional payment to the pension up to the value of the City Social Standard (GSS) is established for non-working pensioners and certain categories of working pensioners and disabled people registered at their place of residence in Moscow and having a duration of such registration of at least 10 years in total (including the time of residence in the territory annexed to Moscow) .

In 2020, there was no increase in the State Social Insurance Fund and the minimum pension in 2017 in Moscow for recipients of the City Social Standard was 14,500 rubles.

But in 2020, the size of the GSS was increased. Thus, the minimum pension for non-working pensioners with more than 10 years of residence in Moscow was 17,500 rubles this year.

Plans for the growth of the City Social Standard for 2020 have not yet been announced.

– At what percentage can you now make a deposit at Sovcombank >>

– Sberbank pension cards: types, interest, cost >>

Increasing the amount of payments to beneficiaries in Moscow

In 2020, monthly payments to citizens of preferential categories also increased. Below are the sizes of some of them.

Monthly city cash payments to preferential categories

| Monthly city cash payment to rehabilitated citizens and persons recognized as victims of political repression | 2000 |

| Monthly city cash payment to home front workers | 1500 |

| Monthly city cash payment to labor veterans and military veterans | 1000 |

Payments to families of disabled people and families raising disabled children

| Monthly compensation payment to a person caring for a disabled child or a person disabled since childhood up to the age of 23 | 12 000 |

| Monthly compensation payment for a child under 18 years of age to non-working parents who are disabled people of group I or II | 12000 |

| Annual compensation payment for the purchase of a set of children's clothing for attending classes during the period of study | 10 000 |

Plans to increase payments to beneficiaries for 2020 have also not yet been officially announced.

Source: https://top-rf.ru/investitsii/242-minimalnaya-pensiya-v-etom-godu-v-moskve.html

Payment amount

It is impossible to unequivocally answer the question “what is the pension of the flight crew.” The amount of payments depends on:

- average salary per month (calculation period to choose from - 5 years of continuous work activity or for the last year);

- average salary per month in Russia for the same time period;

- specialized coefficient (calculated based on the share of earnings and length of service);

- average monthly amount of contributions to the Pension Fund (the last 4 months are taken into account).

The calculation is made as follows:

Payment = average salary per month in Russia * (average salary of an employee / average salary in Russia) * specialized coefficient * (amount of contributions to the Pension Fund / amount of security funds).

The amount of funds for security is understood as the required amount of finance to implement the possibility of calculating an additional payment. This indicator, together with the value of insurance premiums, is used by the Pension Fund of the Russian Federation to adjust the overall indicator.

Men must work for at least 25 years to receive benefits.

Limit values:

- the maximum amount of payments for flight personnel is no more than 3.5 times the minimum old-age pension;

- the minimum size cannot be lower than the subsistence level.

Also, when calculating pensions for civil aviation personnel, an increasing coefficient is used when continuing to work after reaching the threshold age.

Amounts of supplementary payments based on length of service

Related topics:

- Labor Code of the Russian Federation, Article 31 Article 31 of the Labor Code of the Russian Federation, entry into the labor Judicial Collegium for Civil Cases of the Moscow City Court...

- When is a Russian passport invalid? The passport turns into... Let's leave out the obvious things, such as torn, burnt or gnawed by animals - what...

- 779 of the Civil Code of the Russian Federation Article 779 of the Civil Code of the Russian Federation. Contract for paid services Current version of Art. 779 of the Civil Code of the Russian Federation with...

Moscow pension supplement in 2020: size and conditions of receipt

The Moscow pension supplement in 2020 significantly increases the provision of capital residents compared to payments for citizens from the regions. The Luzhkov surcharge provided was not increased, but only those who have lived in the city for a long time can still count on an increase.

Why is the Moscow pension supplement provided?

Federal Law No. 400 of 2013 “On Insurance Pensions” establishes that older citizens cannot receive payments below the level that is used as the minimum subsistence level for a pensioner. The national average for 2020 is 8,846 rubles.

This value differs in the regions, while local authorities have the right to increase the minimum wage of elderly people based on their own capabilities. Any increase that is not fixed at the federal level will be financed from the subject’s budget.

Moscow Government Decree No. 1268-PP dated November 17, 2009 defines who is entitled to an increase in 2020.

Additional payments to pensioners in Moscow were adopted under Luzhkov, in order to provide increased protection for local elderly residents. Thanks to the surcharge, citizens' benefits are growing much faster than as a result of federal indexation, which is carried out annually throughout the country.

The social increase was increased to win over Muscovites before the Sobyanin election. This is confirmed by the fact that the surcharge was last increased in 2020, reaching the level of 17,500 rubles . Despite promises, the Moscow allowance was not indexed in 2020.

The amount of pension supplement in Moscow

PMP in Moscow in 2020 amounted to 12,115 rubles (in the Moscow Region - 9,908 rubles). Compared to 2020, this figure increased by 299 rubles. However, the minimum pension paid to Muscovites does not correspond to this value.

The subsistence level is used for those who have lived in the capital for less than 10 years and do not belong to a preferential category. The regional pension supplement in Moscow in 2020 is not always assigned on top of the payment already received. It should only increase the provision of senior citizens to the PMP established in the capital.

There is no clear value of how much additional insurance benefits are paid. The amount of the premium is not fixed, but in general it is relatively small. Therefore, Moscow pensioners with income above the subsistence level are not entitled to a capital increase.

How the pension increases due to the Moscow surcharge

Regional social supplement increases the level of provision for senior citizens to 17,500 rubles. Insurance benefits for Muscovites cannot be lower than this level. Therefore, when making calculations, you need to start from this figure, subtracting the current pension amount without an allowance from 17,500 rubles.

The calculations take into account not only the standard pension amount. They also look at other increases - for dependents, for people over 80 years old, etc. If a citizen’s total income exceeds the PMP in Moscow, no additional payment will be assigned.

Who is entitled to the Moscow pension supplement in 2020

Regional social supplement is assigned only to persons who can confirm the fact of being in the capital on a permanent basis. As a general rule, Moscow pensioners who have lived in the city for at least 10 years receive the Luzhkov bonus. The citizen must already have retired and remain unemployed.

It is not necessary to be in the capital for the entire established period. The period during which the citizen had a residence permit in the capital is counted. You can leave Moscow and check out, and then return again.

A pleasant bonus for local pensioners was the fact that after the expansion of the city at the expense of the localities of the Moscow Region, all elderly people living within its boundaries also received the right to a bonus. Residents of the included territories do not need to wait until 10 years have passed since their place of residence became part of the capital; they have the right to receive an additional payment now.

Exceptions to the rule are:

- Heroes of Russia and the USSR;

- disabled people of 1st and 2nd groups;

- pensioners receiving survivor benefits, or disabled people of the 3rd group combining work with full-time education (not older than 23 years);

- WWII participants and a number of other categories.

The listed persons have the right to receive the Luzhkov surcharge, even without the required period of residence in the capital.

Is there an additional payment for non-working pensioners in the Moscow Region?

The allowances apply only to residents of the capital. Persons living in the territory of the Moscow Region are not entitled to receive such an increase.

In the Moscow Region, the cost of living for elderly people is also higher than the national average (8,846 rubles). The past indexation increased the regional indicator by 400 rubles.

In 2020, an increase is given to those residents of the Moscow region whose pension does not exceed the regional PMP of 9,908 rubles, but nothing in excess of the specified value is provided.

How to apply for a Luzhkov bonus

Moscow Government Decree No. 1268-PP of November 17, 2009 establishes how to receive a Moscow supplement to a pension if the supplement was not assigned earlier. To apply for registration, you need to contact the territorial departments of social protection.

The applicant submits:

- an application filled out in the prescribed form;

- passport (with a note indicating Moscow registration);

- SNILS;

- certificates confirming the required period of residence in the capital.

is given up to 30 days to consider the submitted appeal . Once the request is approved, the additional payment will be accrued along with the main part of the pension.

Are working pensioners entitled to a Moscow pension supplement in 2020?

Luzhkov's increases are not paid to working older people, but they have the right to receive compensation payments. Benefits are available to everyone whose salary does not exceed 20,000 rubles on average over the past 6 months.

You can submit documents to assign such an increase to the social security departments. In addition to the papers listed above, you will need to provide a certificate of salary received (form 2-NDFL) for the last six months, with the help of which the applicant’s current income is determined.

Who receives the capital surcharge?

Representatives of certain areas and types of activity have the right to become recipients of additional payments for working pensioners.

The bonus is not given to all workers, but only to:

- employees of state and municipal institutions providing various services to the population and financed from the budget of any level;

- disabled workers of the 3rd group, as well as deaf and blind people employed in organizations from the All-Russian Society of the Blind, Deaf or Disabled Persons;

- liquidators of the Chernobyl accident;

- persons whose merits in the field of physical education and sports were recognized by the state;

- test pilots;

- representatives of other categories.

If a citizen does not belong to the listed groups, he cannot count on additional payment.

Which public sector employees can receive additional payment?

A complete list of professions is given in Decree of the Moscow Government of November 17, 2009 N 1268-PP.

Among them are workers:

- medical field;

- education and sports;

- registry office;

- libraries;

- housing and communal services (cleaners and janitors).

In addition to the above certificates, in order to obtain an increase, the applicant will need to submit a document confirming his belonging to the beneficiaries. For example, a certificate of disability from a place of work, study, etc.

Thus, an increase in pension is available to persons who have lived in the capital for a long time. The allowance is provided as long as the citizen lives in the city. The additional payment should bring the amount of security to the local PMP of 17,500 rubles. More than 160,000 Muscovites became recipients of such assistance.

Source: https://ProPensiu.ru/razmer-pensii/moskovskaya-nadbavka-k-pensii-razmer