The pension reform of 2002 gave citizens the opportunity to enter into agreements with non-state pension funds. The profitability of the company plays a major role in determining the size of the future pension. Many Russians send money to the Savings Bank NPF. Everyone is interested in the question of how to check the status of a personal account. You can view the funded part of your pension at Sberbank without leaving your home.

How can I find out how much funds have been accumulated on the official website of NPF Sberbank?

There are several solutions for clients in such circumstances:

- Using special terminals.

- Through your Personal Account on the official website.

- Visit to Sberbank NPF branches.

Passport and SNILS are required documents for those who choose to personally visit one of the nearest offices. One visit is enough to obtain all the necessary information.

The client has the right to receive detailed statements. But the more information specialists collect, the more time it takes to resolve the issue.

Through Sberbank Online

Detailed instructions in this case will include the following steps:

- First, they write a statement that they need to obtain information regarding the amount of savings. When visiting the department, be sure to have your passport and SNILS with you.

- Next, visit your Personal Account on the Sberbank service. Pre-registration is required if required.

- Send a request to receive a statement of the status of the individual savings account.

- Click on the “receive statement” button.

- Confirm the operation. You will have to wait some time until the system processes the request.

- When the operation is completed, the information viewing button will become active. All known information about the client’s savings for the reporting period will open.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Free receipt of statements is available to all clients, but the action is performed maximum once a year. It is with this frequency that the organization itself collects information on savings accounts. If in a few months you need to re-register, the service will cost one hundred rubles. But after this, the client will have access to unlimited views of information.

Through your Personal Account

New users who are using this service for the first time will need to provide an email and password. The process itself takes a few minutes, no more. If your account or profile is already registered, you just need to log in.

To resolve the issue, select the “Other” tab on the toolbar. It goes to the section with Pension Savings. A new window will appear where the user will need to select the button to receive an extract. Please leave your personal information in your application for a certificate. Through your Personal Account you can easily track how requests are being processed.

Via ATM and sales offices

Visiting the nearest service office is the easiest option available to everyone. Passport and SNILS are required documents at this stage. A one-time visit allows you to immediately find out about all the savings associated with a citizen’s personal account. You will have to fill out an additional application if you need full details.

Reference! It takes about 3-4 weeks to produce an extract with all the required data. In the application, the visitor indicates the method in which this information is delivered to him.

In the case of ATMs, the actions will be the same as when working through an online service.

Through State Services

To check the funded part of the pension in this case you will need:

- Registration on the portal. Requires the indication of passport data, information from TIN and SNILS.

- A message with an activation code for the user is sent to a cell phone or email. This will complete the user identification.

- Filling out the form, gaining full access to your Personal Account.

- Activation of the section with Electronic services. In the menu that opens, all you have to do is select the section dedicated to the Pension Fund.

- The client is then provided with information about the status of the personal account.

How to find out by SNILS?

Information on funds in a citizen’s current account is classified as confidential information. But the account owner himself has the right to receive everything he needs. There are several options to resolve this issue:

- Personal application to the Pension Fund office.

- Online, without leaving your home.

Attention! For the last decision, they usually use the official website of the Pension Fund itself or State Services.

Find out by contract number

In this case, the rules apply the same as for the option described above. But it is difficult to find the information of interest using one contract number, except perhaps in the system of the Pension Fund itself, where the money is transferred for management.

Who is the program designed for?

It is customary that all working people make pension savings. After the collapse of the Union, the amounts that people save for old age are not enough for a decent life. This has also become a tradition, which is why many citizens prefer to contact non-state pension funds in the hope that in this way they will be able to ensure a comfortable old age.

The Sberbank pension program is designed for all Russians who want to decide for themselves what their pension will be.

Expert opinion

Alexander Ivanovich

Financial expert

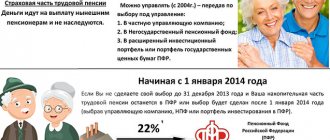

Important: the formation of the funded part of the pension has been “frozen” until 2021. All pension transfers from employers are aimed at insurance payments to current pensioners.

- Transfer of the funded part of the pension to Sberbank

- Certificate of income 2-NDFL for individuals in 2020

- Transfer of pension from mail to Sberbank bank card

How can I find out about the deceased’s savings?

Only after submitting a corresponding application to the fund can you receive money that belonged to a previously deceased person. You need to apply depending on where the funds were previously stored.

According to the law, such payments are received by the official successors who opened proceedings on this issue. As part of the standard probate process, the transfer of savings can also occur.

Payments are made at least 6 months after the person dies. But most often in practice the process ends before 7 months. After all, the Foundation needs some time to study the information provided. If the decision on the application is positive, the citizen receives a notification of the results.

To obtain information regarding savings in this case, there are also several options:

- When contacting a number of banking organizations.

- Through the State Services portal or in the services of partner organizations.

- During a personal visit to one of the offices.

- Remote receipt based on the SNILS number of the deceased.

Calculator limitations

The calculator gives only approximate values. It is impossible to give exact values for various reasons:

- The exact profitability of the investment portfolio is unknown

- The exact amount of inflation is unknown

In addition, it is important to understand that all calculation results are given in today's figures (not adjusted for inflation). This means that annually it is necessary to index the amount of portfolio additions to the amount of inflation. The situation is similar with withdrawals during retirement.

The calculations in the calculator assume that all portfolio additions are made at the beginning of each year at once. If you plan to replenish your portfolio in the middle of the year, at the end of the year, or, for example, monthly, then the amount of monthly replenishment should be slightly higher than indicated (the difference depends on the rate of return of the portfolio).

Transfer of pension savings

The following steps are followed when transferring money to a new non-state pension fund:

- The choice of the organization itself. It is best to obtain as much information as possible regarding current programs and their conditions.

- Fill out the transfer form. There are urgent and early types of procedures. They differ in the moments of transferring money from one organization to another.

- Contact the existing fund with an application to transfer savings to another market participant.

- Wait until the application is reviewed.

Attention! The procedure remains the same regardless of whether the citizen transfers from Sberbank NPF or vice versa.

Payment of money by the Sberbank pension fund

Citizens receive savings after they reach retirement age. You can do this early to receive a lump sum payment. Or we can accept the option of making monthly or quarterly transfers. The pensioner himself chooses the payment procedure that turns out to be the most convenient for him:

- On a social card.

- Through a current account, the service bank does not play a role.

- In cash, when contacting one of the Sberbank offices.

To resolve the issue, fill out a special application. The banking institution itself provides a template or form.

On the development of individual pension plans

A non-state pension becomes an excellent source of additional income if you approach the process correctly. Sberbank NPF has several plans in this direction, available to citizens:

- Complex. To combine non-state and funded pensions.

- "Guaranteed". The client himself chooses the amount of money paid. The contract specifies the exact amounts for transfers and a schedule with dates.

- "Universal". The choice of parameters is free. The size of a citizen’s pension depends on final savings.

As citizens note, one of the main advantages of such a program is the opportunity to apply for a social tax deduction. Which contributes to additional savings. Such investments are protected from claims from third parties, since they do not relate to jointly acquired property.

Conditions in NPF

Before creating savings for a future pension, the client must understand the operating conditions of the system and the algorithm for completing documentation for saving funds.

Expert opinion

Anastasia Yakovleva

Bank loan officer

Apply now

Right now you can apply for a loan, credit or card to several banks for free. Find out the conditions in advance and calculate the overpayment using a calculator. Want to try?

Sberbank offers the following conditions:

- The minimum down payment is 1000 rubles.

- Possibility to top up your account at any time.

- The minimum for additional deductions is 500 rubles.

- Accrual of funds upon a citizen reaching the age of retirement and termination of employment.

- The minimum threshold for the duration of payments is 5 years.

The client has the right to register savings with NPF Sberbank via the Internet or visit a branch of a credit institution. Take your passport and SNILS with you.

What to do if errors appear when calculating savings?

Modern banks have automated many processes related to customer service. But even the most innovative programs are not immune to errors. And banking developments sometimes fail. It often happens that other people's money, or simply excess amounts, end up in savings accounts.

Attention! Such transfers will be debited from client accounts in the future.

Sberbank employees should report any such errors. They fill out a special application and come to one of the offices with SNILS and a passport. The same procedure is relevant for those who are faced with insufficient funds. The money transfer should be completed a maximum of 5-10 days after the request.