Citizens of the Russian Federation after loss of ability to work have the right to financial support in old age.

But since the pension system has undergone many changes in recent years and is at the stage of major reforms, few people know what components the pension amount is made up of.

One of its important components is a fixed payment (FP) , the features of which and the procedure for calculating it will be discussed later in this article.

What is a fixed payment

The major reform of the pension system, which took place in 2015, changed the procedure and basis for calculating material payments for people retiring. Now, after finishing his working career, a citizen can only count on an insurance or funded pension together with an insurance one.

Insurance

This type of material support depends on the individual pension coefficient or accumulated insurance points, the number of which is directly affected by the amount of contributions paid by the employer for the employee to the Pension Fund.

Cumulative

It is formed if a future pensioner who meets the appropriate criteria has made a choice in favor of this type of pension provision. Also, funded pensions are formed by voluntary transfers of citizens to non-state pension funds on the basis of agreements concluded with the latter.

The insurance pension, the payment details of which largely depend on the length of service and the IPC, consists not only of the part that is calculated by the number of points, but also of a fixed payment. Almost all recipients of this type of pension have the right to count on it.

Reference! The amount under consideration does not depend on the insurance period and the volume of transferred insurance contributions to the Pension Fund.

In essence, the PV is a kind of mandatory material addition to the insurance pension, accrued after calculating insurance points. Material support for this payment is made at the expense of joint interest, that is, that part of the contributions that is sent not to the formation of the individual investment complex, but to the direct disposal of the Pension Fund.

Let us remind you that the amount of contributions directly depends on the level of the employee’s salary and is expressed as a percentage of it. Thus, the base rate is 22%. But only 16% is allocated to the formation of pension rights, while 6% is used for solidarity needs, through which additional payments are made to the pensions of existing pensioners.

The pension fund is automatically calculated when a citizen applies for a pension, so receiving it does not require collecting any additional documents or submitting applications.

Increase factor for late retirement

According to pension legislation, the insured person, in order to increase the amount of benefits, can independently determine the date of assignment of the pension. It has become beneficial to apply for her appointment at a later age , since increasing coefficients are now applied to the insurance pension and fixed payment.

The size of the increase due to bonus coefficients when applying for payment later than retirement age depends on the number of years for which the citizen postpones retirement.

The number of years giving the right to increasing coefficients is determined from the moment the right to payment arises until the day of its assignment, but not earlier than January 1, 2020.

Insured persons who are already receiving a pension also have the right to increase benefits through premium coefficients. In this case, they need to submit an application for refusal to receive an already accrued insurance pension. After the expiration of the planned period, which must be at least 12 months , the accrual will be restored at the request of the insured person, and increasing factors will be applied to the payment. The increase depends on the number of years for which the receipt of benefits is deferred, which is regulated by the annexes and the Law “On Insurance Pensions”.

10 120

Who is entitled to

The following categories of citizens have the right to receive this pension:

- Pensioners who have retired due to old age. A prerequisite in this case is to receive an insurance pension. This type of financial support can be received by persons who have reached the age when the right to an old-age pension arises, as well as those who have a sufficient number of years of insurance experience and individual industrial complex.

- Disabled people . If a citizen who has a persistent health disorder that does not allow him to carry out activities related to the performance of a labor function has at least a short insurance period, that is, a period of official work when the corresponding contributions to the Pension Fund were paid for him, then he can receive insurance coverage, of which PV is a part, regardless of age and IPC.

- Recipients of funds for the loss of a breadwinner . If the deceased breadwinner has insurance experience, his dependents receive an appropriate insurance pension.

Attention! Persons who have lost one or both breadwinners are entitled to receive payments.

What is the basic part of the pension (who is entitled to it, composition and structure)?

The basic pension benefit is a certain amount that citizens receive regardless of the condition of assignment (by age, death of the breadwinner or disabled people).

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

She is appointed according to Art. 16 of Law No. 400.

The exact amount is determined by the recipient's category, length of service and marital status.

The basic pension in 2020 is assigned to the following citizens:

- persons who want to retire due to age or length of service;

- upon the death of the breadwinner;

- disabled people;

- having dependents.

The amount of the fixed benefit varies for different recipients. For example, upon the death of the breadwinner, 50% of the basic amount is paid, and an additional payment is also due for each dependent.

What is the payout amount

The size of the fixed payment to the insurance pension may vary. It depends on which category the pension recipient belongs to. However, there is a basic PV amount of 5334.19 rubles. It is this that is relied upon when calculating bonuses for payments and annual indexations.

A fixed payment of 5334.19 rubles is received by all those citizens who receive old-age pensions.

For disabled people receiving payments, the amount of the PV is determined depending on the group as follows:

- Group III – ½ of the PV (2667.09 rubles);

- Group II – full amount of PV (5334.19 rubles);

- Group I – double PV (RUB 10,668.38).

Persons receiving funds associated with the loss of a breadwinner receive an increase in the amount of ½ of the FV (2667.09 rubles), however, those who have lost both breadwinners at once receive the full amount of the FV (5334.19).

Basic pension in the Far North in 2020

According to Article 17 of Law No. 440, persons working in the northern regions receive increased fixed pension benefits if their length of service is confirmed by documents:

- 25(20) years of total experience (depending on gender);

- 15 years of work experience in the North.

In this case, the basic part of the pension in 2020 will be 7474.35 rubles . The supplement for a dependent will be 50% of the minimum amount.

If you have more than 20 years of work experience in the north, the benefit will be increased by 30%; such an increase will be assigned if there is a dependent.

Is it subject to indexing?

The fixed payment is subject to annual indexation. The increase in EF occurs at the beginning of the year. In accordance with the law, the amount of indexation directly depends on inflation calculated by the Central Bank of the Russian Federation.

Thus, in 2020, there was a general increase in the price of goods and services by 5.4%, so the PV in 2020 was indexed similarly. In 2018, the possibility arose of increasing payments above inflation expectations - by 3.7%. In 2020, from January 1, the size of the FV increased immediately by 7.05% , which exceeds the Central Bank’s inflation forecast by 2 times. According to experts, such an increase became possible due to the increase in the retirement age.

Reference! In addition to the one-time mandatory indexation of the PV at the beginning of the year, the law provides for the possibility of an additional increase in its amount. The decision on this is made by the Government of the Russian Federation, but only if the Pension Fund has the capabilities and funds.

Recalculation of the pension amount after indexation of the fixed payment occurs automatically by the pension fund and does not require any action on the part of pensioners.

Documents required to receive a basic pension

To apply for a fixed pension benefit, you must come to the Pension Fund with the following documentation:

- identification;

- documents confirming work experience;

- a document on disability and a certificate issued by a special medical commission;

- document on marriage and birth of children;

- documents: about the composition of the family, about the place of residence, about the amount of salary, about the absence of another pension.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Citizens receiving assistance for the loss of a breadwinner submit certificates that confirm their difficult financial situation and family connection with the deceased.

Who can count on an increased payment

Certain categories of citizens can count on an increased amount of pension benefits. These include:

- Elderly people over 80 years of age . Pensioners who are over the age of eighty can count on a pension fund that is twice the base amount. In 2020, it is 10,668.38 rubles for them.

- Pensioners with dependents . Dependents should be understood as persons who are financially dependent on the pensioner and who do not have the opportunity to find employment. These include minors until they reach the age of 18.

The status of a dependent can be maintained after reaching the age of eighteen if the citizen is studying full-time at an educational institution. In accordance with the law, for each dependent, in addition to the already accrued payments, an additional allowance is given in the amount of 1/3 of the FV (1,778.06 rubles). The maximum number of dependents is no more than three.

- Previously worked in the Far North . “Northerners” can also count on an additional bonus. Thus, persons who have worked in the KS districts for at least 15 years receive an increase of 50% of the FV. Those who have worked for at least 20 years at the ISS have the right to count on additional payments in the amount of 30% of the FS.

- Citizens who have periods of labor activity in agriculture. If a pensioner has worked for at least 30 years in the agro-industrial complex, then he has the right to receive a bonus in the amount of 25% of the FV, but only on the condition that at the time of receiving the pension he lives in a rural area. If he moves to the city, the right to additional material support ceases.

Basic pension for disabled people in 2020

The size of the basic part of the pension in 2020 for persons with disabilities depends on the group of the recipient.

The minimum amount of assistance for disabled people is 9965.8 rubles, and if there are dependents, its amount is 11626.77-14948.71 (depending on the number of dependents).

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

For disabled people of the first group with northern work experience, the amount will be 14848.71 . Persons who are unable to support themselves and take care of themselves are entitled to 21,622.98 rubles .

Who receives an insurance pension without a fixed payment?

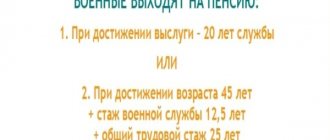

Employees of the Armed Forces and Navy, state (municipal) employees, as well as employees of structures equivalent to the army, for the most part are not recipients of insurance pensions, since, upon becoming pensioners, they are fully supported by the state, receiving the corresponding state pension for length of service or disability.

However, those who, after leaving government agencies, have earned the required insurance experience are entitled to receive a “civilian” insurance pension. For them, it is calculated based on accumulated pension points, but they are not entitled to a fixed payment.

FV is an important component of pension provision for citizens, especially in cases where the pensioner has a short insurance period and an individual industrial complex. The appointment of a fixed payment serves as a guarantee of ensuring the minimum material needs of a retired citizen.

What to expect in 2020

Annual changes in pension policy force current and future retirees to be in constant tension. What will the fixed pension be in 2020? The LDPR has submitted to the State Duma a bill to lift the moratorium on indexation of pension payments to working pensioners. But the bill was rejected. In 2020, citizens who are retired but continue to work will not face any changes in the amount of payments.

On November 30, Dmitry Medvedev announced that indexation of pension benefits in 2020 would be carried out ahead of schedule. Citizens can expect an increase in January, and not as earlier in February.

Dmitry Medvedev

In addition, indexation should exceed inflation, which will be no more than 3%. According to Medvedev, the country has entered a normal rhythm, and now it is possible to increase pensions both by the rate of inflation growth and above it. The cost of a pension point will be 81 rubles 57 kopecks, and the insurance payment will be paid in the amount of 4987 rubles.

Working pensioners will only be affected by changes regarding the increase in pension after dismissal. Previously, after a working pensioner quit his job, 3 months had to pass before his pension could be indexed. From January 1, 2018, indexation will be carried out in the first month after termination of the employment contract.

Fixed salary

The fact that today fixed wages have become more popular than before is explained by both scientific and technological progress and changes in the principles of organizing production in general. Product output is regulated by the profitability forecast, and therefore the need for workers to produce more than can be sold disappears by itself. The technologization of the work process averages out individual productivity indicators - now machines do a lot, and demand goes for professions with deeper specialization. In addition, highly competitive conditions force entrepreneurs to increasingly pursue the high quality of their products, rather than their quantity. This reduces the cost of monitoring the work process, and gives employees the opportunity to feel a sense of belonging to the common interests of the company, ensuring team cohesion.

A stable salary, free from production indicators, weather forecasts or supplier reliability, focuses the employee's interest on the company's success more than on his own, which motivates him to long-term cooperation. But as in the case of piecework wages, fixed wages have their drawbacks.

With a fixed salary, a person actually receives money for his presence at work. The side effect of this trend is obvious: the employee is deprived of incentive to do his job better. The race for his own results is no longer necessary for him: his next salary will be the same as the previous one. This imposes on the employer the need for control, but of a different kind. If with piecework you need to care about the quality of the product, then here we are talking about doing the work in principle.

Control must be carried out at all stages, including quantitative indicators. This situation forces us to mobilize additional resources, in particular personnel. The department must be assigned a responsible person who regulates the integrity of the performance of duties by each employee separately. By using a fixed payment method, the employer bears the risk of fluctuations in staff productivity. Today an employee works well, tomorrow - not so much; one is trying, the other is sitting waiting for the end of the working day. At the same time, both receive the same salary. The situation is aggravated by Article 22 of the Labor Code of the Russian Federation, which prescribes equal salaries for employees of the same rank. Taken together, these factors hinder the connection between the work process and the final result, demotivating staff who do not want to overwork beyond the norm without changes in wages or pull the ballast of incapacitated colleagues.