General provisions

A citizen has the right to leave military service and begin receiving a pension if:

- length of service has been achieved;

- received a disability group due to illness and (or) injury.

At the same time, the military retirement age as such is not taken into account; instead, it is the length of service that becomes the determining factor, including taking into account “grace” periods, during which the military is accrued length of service with an increased coefficient - from 1:3 to 1:1.5.

Let's consider all options for retirement separately. This will give an approximate idea of the age at which a service member can leave the service to enjoy a vacation.

Requirements for military service for the appointment of a long-service pension

When assigning a pension according to length of service, one of the requirements regarding military service , namely:

- having at least 20 years of military service at the time of dismissal;

- having a total work experience of at least 25 years, of which 12 years and 6 months of military or equivalent service.

In the second case, we are talking about the so-called mixed experience , when military personnel who have reached the age of 45 are dismissed from service on one of the following grounds:

- reaching the age limit for service;

- health condition that does not allow you to remain in the ranks of the military;

- reduction due to changes in staffing.

When determining the right to length of service based on mixed length of service, it is necessary to take into account exactly which periods are included in the total length of service. These, according to Law No. 173-FZ “On Labor Pensions in the Russian Federation” and Law No. 400-FZ “On Insurance Pensions” include:

- periods of work included in the total length of service for the period before 2002;

- insurance periods during which insurance premiums were paid after 2002.

What periods are included in the length of military service?

The procedure for calculating length of service for assigning payments to military personnel is determined by the Government of the Russian Federation. Military service includes the duration of military service in the relevant positions and departments, calculated calendar for all such periods by summing the number of years, months and days.

Special conditions for military service determine a special procedure for calculating length of military service - in preferential terms.

According to Art. 18 of Law No. 4468-1, the periods included in the service include the following:

- military service;

- service in the internal affairs bodies and the State Fire Service;

- in the authorities controlling the circulation of narcotic and psychotropic substances;

- in institutions of the penal system;

- in the National Guard of the Federal Service of the Russian Federation;

- in departments and organizations that remain in military service or are members of the Ministry of Internal Affairs of the Russian Federation;

- time spent in Soviet partisan detachments;

- service in emergency rescue teams, fire protection of the Ministry of Internal Affairs of the Russian Federation;

- period of forced captivity;

- time of unjustified serving of a sentence.

It is important that for persons from the commanding staff and officers of military departments, provided for by current legislation, study time can also be included in length of service in the following order - no more than five years of study with one academic year credited for six months of service.

Minimum length of service for pension provision

12 years 6 months this year, subject to the condition of having a total work experience of 25 years .

It should also be remembered that when assigning a disability pension to military personnel, there is no concept of minimum length of service, since the main condition here will be the period of acquisition of disability, and not the number of years of military service.

The determination of the disability group, its cause and time of onset is carried out by federal medical and social examination institutions.

Pension reform hits the army: Putin will repay debts to the military after devaluation

The pension reform, apparently, has reached the military. In theory, now the entire State Duma Defense Committee should stand up in unison and, taking a step, in a united formation, headed by Colonel General of the Reserve Vladimir Shamanov, leave the meeting room - their demands to the government to solve the problems of military personnel were once again ignored.

However, such a demarche did not take place, and the State Duma, at a plenary meeting on November 19, continuing the cannibalistic pension reform, adopted a law that again freezes at the current level the amount of monetary allowance to be taken into account when calculating military pensions. The document, part of the so-called package of budget-forming laws, was introduced by the government and was nevertheless approved by deputies in the third reading.

There will be no increase in military pensions expected from January 1, 2020 - instead there will be only a lip-rolling machine.

“In connection with the Federal Law “On the Federal Budget for 2020 and for the planning period of 2021 and 2022”... it is proposed to extend the suspension of the second part of Article 43 of the Law on Pension Security until January 1, 2021, maintaining the amount of monetary allowance taken into account for calculating the pension “73.68 percent,” says the adopted document. This means that the amount of cash allowance taken into account when calculating pensions will remain at the level of October 1, 2020, when a very belated and insignificant increase took place.

And after January 1 of the next year, there will be no changes in payments. So the military was compared to those who became victims of the pension reform.

This is important to know: Federal Law on state pension provision in the Russian Federation

The new law, which can only be described as predatory in relation to pensioners, suspends the rule of law according to which monetary allowance is taken into account when calculating pensions from January 1, 2012 in the amount of 54 percent and, starting from January 1, 2013, increases annually by 2 percent until it reaches 100 percent size. At the same time, for some reason, it is forgotten that President Vladimir Putin, back in May 2012, instructed the government to ensure an annual increase in pensions for military veterans by at least 2 percent above the inflation rate.

If we follow the logic of the presidential decree, then in 2020 military pensions should be indexed by 5 percent. However, Putin also promised civilians not to carry out pension reforms and not to raise the retirement age.

As “compensation” for freezing the amount of salary to be taken into account when calculating military pensions until January 1, 2021, the government sweetened the pill. As noted in the accompanying materials, the new draft budget still takes into account the increase in inflation and provides for an increase in the pay of military personnel and a number of other categories - by 3 percent from October 1, 2020.

Expert opinion

Antonov Viktor Sergeevich

Practicing lawyer with 8 years of experience. Specialization: military law. Recognized legal expert.

Accordingly, something will “break off” for military pensioners - again crumbs and only in a year. That is, the government is once again “throwing away” military pensioners with the now catchphrase “there is no money, but you’re hanging in there.”

During the second reading of the law “On the federal budget for 2020 and for the planning period of 2021 and 2022,” which took place on October 9, the head of the State Duma Defense Committee, Vladimir Shamanov, with the support of his associates, sharply condemned the proposals of the government, which constantly evades legislative implementation fixed pension guarantees for citizens discharged from military service. The conclusion, published on the State Duma website, indicated that from 2014 to 2020, the “increase in military pension” due to the increase in the reduction coefficient did not even cover the inflation rate, not to mention the implementation of the decree of the head of state.

According to parliamentarians' calculations, under-indexation has already amounted to 20 percent. At the same time, due to the reduction factor, budget savings from 2012 to 2020 amounted to about 2.8 trillion rubles.

It is likely that the current “freeze” of military pensions until 2021 will significantly replenish the treasury with money taken from retired defenders of the Fatherland. Again, during this time, more than one thousand of them will have time to pass away - pensioners in our country are rapidly leaving for another world.

It’s also “savings”. There is another reason for freezing pension increases.

For example, all economists believe that this measure, like the entire pension reform, is aimed at delaying time; the government is waiting for the ruble to devaluate and the national currency to depreciate even more. When the ruble finally collapses, the government will immediately pay off pension debts, including making payments to military pensioners who are heavily in debt.

There will be more devalued money supply and it will no longer be a pity to give it away, experts say.

It cannot be said that now, against the backdrop of the adoption of a law that is predatory for pensioners and the entire pension reform in general, the State Duma Defense Committee has “blown away” and stopped defending the rights of military pensioners. However, in the end, it was not possible to butt heads with the government on equal terms - Prime Minister Medvedev’s team once again ignored increasing the level of pay for military personnel and achieved the desired result.

In fact, they don’t give a damn not only about military pensioners, but also about the army as a whole.

Legal basis for military retirement

The standard retirement age in Russia is 60 years for men and 55 for women. But the length of service of military personnel is calculated using a different method. A military man retires after 20 years of service, regardless of rank and position.

If contract service begins at age 20, then at age 40 a military man can already retire.

The main laws governing the provision of military pensions are:

- Constitution of the Russian Federation. Establishes the right of any citizen of the Russian Federation, including military personnel, to receive payments.

- The federal law on pensions for military personnel and a number of law enforcement agencies, which describes in detail all aspects of receiving pensions for military personnel.

Pension provision for military personnel is regulated by the law of the Russian Federation of February 12, 1993 N 4468-1, according to which, at the expense of the federal budget, a serviceman can be assigned a pension for length of service, disability, and his family for the loss of a breadwinner.

Military personnel are entitled to three types of pension benefits after leaving service:

- According to length of service. Appointed with at least 20 years of military service, as well as on preferential terms.

- According to mixed experience. Relies on officers who have served in the army for at least 12.5 years. Additionally, periods of civilian employment are taken into account. Total experience of at least 25 years.

- Due to disability.

At what age and when do military personnel retire: retirement age

Military personnel can count on pension payments in 2 cases:

- upon reaching the maximum period of service;

- if it is impossible to continue service due to disability received in the performance of official duties.

Please note that the difference between the circumstances is the service life.

Individuals who want to receive payments under the first case must reach the age considered to be the limit for their rank and position and resign. In other words, for them the reason is old age.

For persons who consider themselves to be in the second case, the duration of military service has absolutely no meaning; the most important thing for them is proof of their inability to work. In this case, the acquisition of disability must fall under one of the following categories, that is, it was acquired:

- directly during military service;

- as a result of injury or illness received during service, but manifested later (within the next 3 months);

- out of service, but within 3 months after dismissal.

Anything can happen in the service; accidents that lead to the death of a military man also occur. Finding yourself in such circumstances, the family of the deceased has every right to receive a survivor's pension.

Age and length of service

The right of military personnel to retire based on length of service is regulated by Law of the Russian Federation No. 4468-1 of February 12, 1993. In accordance with this law, a serviceman may have:

- length of service in the Armed Forces of the Russian Federation;

- length of service in the RF Armed Forces and work experience in the civilian sphere (mixed experience).

The order of pension rights for military personnel depends on this:

- with pure length of service, the age of the serviceman does not matter;

- with mixed service, the retirement age of a military personnel cannot be less than 45 years on the day of dismissal.

Minimum and maximum age for a “military” pension

Federal Law No. 4468-I clearly defines the conditions for assigning all types of pension payments to retired security forces and the maximum age for the latter to remain in military service, depending on the rank of the contract soldier.

Minimum age

As explained above, there is no minimum age for appointment as a PI, and military personnel can qualify for PT by having a minimum required military service of 20 years or having earned a total service record of 25 years (at least half of which was spent in military service).

Accordingly, a 23-year-old lieutenant who enlisted in the army immediately after graduating from military school, having served in the RF Armed Forces for 20 years, can retire as early as 43 years old. At an even younger age, a contract sergeant who has served his military service in the army and immediately after completing it, as a 20-year-old guy, who signed his first professional contract with the Ministry of Defense, can apply for PV. But security forces who count on PV based on mixed length of service, as a rule, cannot receive it before the age of 45.

However, the law stipulates that the minimum retirement age based on length of service may still be less than 45 years for those who are assigned PV based on mixed length of service, and even less than 40 for applicants for “pure” PV, which is due to security forces exclusively for military service. length of service

Such a decrease in the retirement age of military personnel may occur due to the fact that length of service is not counted “day by day,” but according to a more complex scheme. During certain periods of service (and in each law enforcement agency they are regulated differently), 1 “working” day of a security officer can be counted as one and a half, 2 or even 3 days of service. As a rule, a serviceman’s length of service increases within three days when a serviceman is in a “hot spot” - accordingly, 12 months of stay, for example, on a business trip in Syria, immediately increases the serviceman’s length of service by 3 years.

Maximum age

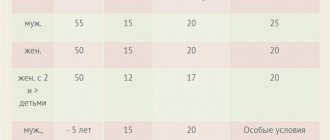

In 2014 in Art. 49 Federal Law No. 53-FZ dated March 28, 1998, changes were made, according to which the age limit for military service was increased as follows:

- for military personnel with a rank above lieutenant general - up to 65 years of age;

- for major generals and lieutenant generals - up to 60;

- for colonels - up to 55;

- for contract soldiers with a different military rank - up to 50;

- Women military personnel finish serving at 45.

By virtue of the above article, upon reaching the above age limit, the serviceman must be automatically dismissed from military service and retired. However, the same article of Federal Law No. 53-FZ states that in some cases (if the contract soldier’s health allows it and he has knowledge and skills that are especially important for the Ministry of Defense, which in most cases applies to senior officers and generals), a serviceman may be given the right to sign last contract with the Ministry of Defense before the offensive:

- 70 years old - for military personnel with the rank of lieutenant general;

- 65 - for contract soldiers with a different rank.

Retirement table by year of birth

For men

:

| DATE OF BIRTH | RETIREMENT AGE | HOW MANY YEARS ADDED | WHAT YEAR SHOULD I RETIRE IN A NEW WAY? |

| 1959 | 61 | 1 year (but you can retire 6 months earlier) | 2020 |

| 1960 | 62 | 2 years (but you can retire 6 months earlier) | 2022 |

| 1961 | 63 | 3 years | 2024 |

| 1962 | 64 | 4 years | 2025 |

| 1963 and younger | 65 | 5 years | 2028 |

For women

:

| DATE OF BIRTH | RETIREMENT AGE | HOW MANY YEARS ADDED | WHAT YEAR SHOULD I RETIRE IN A NEW WAY? |

| 1964 | 56 | 1 year (but you can retire 6 months earlier) | 2020 |

| 1965 | 57 | 2 years (but you can retire 6 months earlier) | 2022 |

| 1966 | 58 | 3 years | 2024 |

| 1967 | 59 | 4 years | 2025 |

| 1968 and younger | 60 | 5 years | 2028 |

Resignation due to disability

The receipt by a citizen in military service of an injury, injury or disease for which disability is assigned is the reason for the assignment of a military disability pension.

Moreover, we are talking not only about diseases and injuries that appeared during service, but also if:

- the circumstances arose within 3 months from the date of the military man’s dismissal from service;

- circumstances arose after 3 months, but provided that their occurrence is directly related to military service.

The duration of service itself no longer matters. Even after serving a few days after enlisting in a unit and receiving an injury, illness or injury, military personnel can retire. The age can be any, the main condition is the actual performance of military service.

Conditions for retirement of military personnel

In order for a contract serviceman to become a long-service military pensioner, one of the following conditions provided for in Article 13 of Law No. 44681 must be met:

- at least 20 years of service on the day of dismissal from the ranks of the RF Armed Forces;

- age 45 years and 25 years of total work experience, of which the length of service is at least half (12.5 years).

A service member can also retire if none of these requirements are met, but he is ill. In this case, the pension will be assigned based on disability.

If the required conditions are not met, then the serviceman can simply resign to the reserve or resign, and the pension will be assigned to him on a general basis upon reaching the established retirement age. In this case, military service will be taken into account in the citizen’s total insurance (work) record.

How to calculate length of service for retirement

The length of service of military personnel for the right to receive a military pension in accordance with Article 18 of Law No. 4468-1 must include such periods as:

- serving in the Armed Forces of the Russian Federation, including conscription.

- serving in the Ministry of Internal Affairs, the state fire service, the Ministry of Emergency Situations;

- service in institutions of the criminal correctional system;

- service in drug control authorities;

- period of study at military universities;

- the period of study in civilian universities is counted as a year for 0.5 (in general, no more than 5 years are counted);

- period of captivity;

- period of participation in hostilities;

- time of unjustified detention with deprivation of the status of a military man, subject to subsequent judicial rehabilitation.

In some cases and in some territories, length of service is considered with an increasing factor. For example, one calendar year for one and a half or even two years of service.

Military personnel have the right to a preferential pension upon reaching the age of service, but there are also categories of employees equivalent to them who also have the right to a preferential pension for long service. These are, in particular:

- employees of search and rescue and parachute aviation services;

- employees of the air force, civil defense forces, air assault units;

- citizens who served under contract abroad;

- persons whose performance of official duties involves an increased danger to life.

Military pensioners can receive a second pension for length of service

Military pensioners are offered a pension upon reaching length of service or becoming disabled during service in the FSB, the Ministry of Internal Affairs, the Ministry of Defense or other law enforcement agencies. There is a second line, according to which a military pensioner can count on payment. It is awarded if the following conditions are met:

It is important to reach the age limit, which is 60 years for women and 65 years for men. The calculation of working years is carried out in accordance with the transitional annexes of Law No. 400-FZ.

For some categories of pensioners, payments are accrued despite the failure to reach the age limit, if the condition for early appointment has been met. For example, work in harsh conditions or weather/temperature environments is taken into account.

It is mandatory to achieve the required insurance period if the pension is accrued not only through the law enforcement department. In 2020, up to 11 years of “civilian” service will be taken into account as a maximum. This figure will gradually increase until it reaches 15 years in 2024.

If the pensioner has a minimum pension coefficient. For the current year, a coefficient of 18.6 has been adopted, while it will gradually increase until it reaches 30% in 2025.

This is important to know: Medical support for military pensioners

If a person has reached the minimum pension for long service or has become disabled while working in a law enforcement agency. When determining the insurance and general length of service for a military character, periods of service when he was engaged in other activities, service or work that are already included in the amount of the pension assigned for length of service are not taken into account.

Military pensioners have the right to an insurance pension, which is calculated without calculating fixed payments.

Two pensions instead of one: what time do military personnel retire?

A military pensioner may refuse to receive a military pension, opting for a regular one, assigned according to age and length of service. The state has provided for the possibility of obtaining a military pension, old-age payments, and seniority payments, combining them.

In order to be able to one day receive two pensions instead of one, that is, old-age payments and a military pension, a number of conditions must be met:

- A labor pension for the military will be issued to those categories of citizens who, upon completion of their military service, continued to work in a civilian manner, under a contract, and so on.

- The retirement age if a person continues to work will be sixty years for men and fifty-five for women.

- After completion of military service, a labor pension can be assigned additionally to those who have worked for at least five years in civilian life.

Working after completing his own military service, a person has the right to leave his current job at any time. However, if he worked for less than five years, then he will have to be content exclusively with a military pension, even when the real age already corresponds to the retirement age. When calculating pension payments, the years that were taken into account when calculating a military pension will not be counted.

Retirement of military personnel on a general basis

If a serviceman retires from the ranks of the RF Armed Forces without achieving the required minimum length of service of 20 years or a combined length of service of 25 years, he completely loses the right to a military pension. Therefore, to acquire the right to pension payments, he will have to reach the required retirement age. From January 1, 2020, its gradual increase began over 5 years for both men and women in order to achieve:

- for men - 65 years;

- for women - 60 years.

Currently, the retirement age has been increased by 1 year, but taking into account the benefits of the transition period, pensioners in 2020 will be able to become:

- women upon reaching the age of 55.5 years;

- men upon reaching the age of 60.5 years.

At the same time, receiving an insurance pension does not limit the former military man’s right to continue working. Also, the pensioner will be able to reinstate himself in service and earn a military pension. While the pension for military personnel with 25 or 20 years of service is not paid if he is reinstated in service.

Raising the retirement age for military personnel in practice

Expert opinion

Antonov Viktor Sergeevich

Practicing lawyer with 8 years of experience. Specialization: military law. Recognized legal expert.

When the retirement age for civilian pensioners was raised, the situation with the military could not remain aside. The position of the state is to strive for justice.

This is important to know: Benefits for FSIN pensioners based on length of service

People's rights must be equalized, and this also applies to this case. Thus, if the draft law did not take into account such nuances, a huge stratification would form between people.

Some men could retire and relax by the age of 40, or engage in quiet, unburdensome work. Others would have to work until they were 65.

It is impossible to completely equate civilians and military. After all, people who guard the Motherland often sacrifice a lot for the sake of service.

They are forced to travel, they have to deal with irregular schedules and stressful situations. Some of them go through combat.

Moreover, their military pensions are small. In 2020 in Russia, privates, sergeants and corporals, who represent the bulk of employees, can count on approximately 10 thousand rubles.

Officers don't get much more. And since 2020, a moratorium on the reduction coefficient and its changes has also been used.

The ratio was relevant until the beginning of 2020, amounting to about 4 percent.

Many military personnel would be interested to know what the latest news promises, will there be an indexation of pensions for military pensioners in 2019? In this regard, there is still positive news. Social payments will be increased in the coming year, and in 2 stages.

Even more than that: money to increase military pensions has already been allocated from the budget. These funds should be used only in retirement, in order to raise the standard of living of retirees to the most acceptable level, taking into account current social conditions.

How is pension for military personnel calculated for length of service?

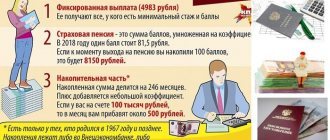

When calculating pensions for military personnel, the following are taken into account:

- salary for military position;

- salary according to military rank;

- long service bonus;

- other allowances, for example for working with classified materials, etc.

Pensions are calculated using the regional coefficient to the salary for persons who have served in the Far North and equivalent areas for at least 15 and 20 calendar years, respectively. In this case, a reduction factor of 0.7223 is applied, which is valid until October 1, 2020.

How will military pensions increase in 2021?

Since military pensions depend on the monetary support of military personnel, they will definitely increase from October 1, 2020 - but only by 3%. This is exactly the inflation that Rosstat calculated last year. Promotion awaits not only military personnel, but also employees of other law enforcement agencies, as well as civil servants.

As for the reduction coefficient, there are no plans to raise it - at least until 2021 it will be 73.68%.

Accordingly, military pensions will increase by only 3% from October 1, 2020. For comparison, last year they grew by 6.3% - of this figure, 4.3% was an increase in monetary allowance, and 2% was an increase in the reduction factor. Some politicians even complained that in 2020, military pensions would increase by the lowest percentage in recent years.

For 2021, one thing is known so far - military salaries will increase by 4% (according to the plan, this should be inflation in 2020). But this is not an official document, but only a statement by Russian Deputy Defense Minister Tatyana Shevtsova. However, this is the official position of the state - the salaries of civil servants are growing no more than inflation.

As for the reduction coefficient, there is no clarity about it yet - if the State Duma does not delay its increase for another 1-2 years, then according to the plan it will increase by 2%. Accordingly, in this case, military pensions will immediately increase by 6%. However, given the tension with the budget due to the crisis, there is no point in hoping for this.

By the way, from 2020, disabled family members of deceased military personnel will receive an increased pension. True, not everyone - first of all, beneficiaries (veterans of the Second World War and military operations, Heroes of the USSR and the Russian Federation, disabled children due to war trauma, Olympic champions, etc.). They will be paid the same additional payments that their deceased breadwinner would have received during his lifetime.

Which new categories of citizens will become pensioners early?

In addition to people whose pension conditions have not changed in any way, there are categories of citizens for whom the reform provided the opportunity to receive a pension earlier than the new period. In particular, the new version of Law No. 400-FZ made it possible to assign an old-age insurance pension to mothers with many children with insurance experience of 15 years, who gave birth and raised four children before the age of 8, from the age of 56 (clause 1.1, part 1, article 32 ), three children - from the age of 57 (clause 1.2, part 1, article 32).

At this time, they can become pensioners if they earn the required IPC amount. It should be noted that when determining the right to an old-age insurance pension, a woman’s children are included, in accordance with Part 3 of Art. 32 of Law 400-FZ, those in respect of whom the court has deprived her of parental rights or canceled the adoption will not be taken into account.

The procedure for assigning pensions to military personnel

It is necessary for eligible citizens to apply for a military pension in accordance with the departmental affiliation of the institution in which they serve. Work on organizing pension provision for military personnel is carried out by authorized departments of the following departments:

- Ministry of Defense of the Russian Federation;

- Ministry of Internal Affairs of the Russian Federation;

- Federal Penitentiary Service;

- Federal Security Service of the Russian Federation;

- General Prosecutor's Office of the Russian Federation;

- Investigative Committee of the Russian Federation.

The deadline for assigning military payments is set within 10 days from the date of receipt of all missing documents. The date of assignment of this type of pension is the day following dismissal from service.

To establish a pension payment, it is necessary to submit a number of documents , namely:

- document proving identity and registration at the place of residence;

- certificate of periods of service included in length of service;

- military ID;

- employment history;

- document confirming the presence of dependents;

- awards.

The obligation to submit the listed, and if necessary, clarification of some circumstances and additional documents may be assigned to the applicant himself. If these documents are included in a special list according to which such information is requested as part of the provision of public services, then the information is received through interdepartmental interaction channels without the participation of the applicant.

Amount of long service payments and purpose of bonuses

Payment of pensions to military personnel is carried out monthly for the current thirty-day calendar period from federal budget funds.

The basis for calculating the assigned benefit for military service is the amount of monetary allowance, the value of which depends on:

- official salary (military or civilian);

- salary according to military or special (excluding promotion) rank;

- bonuses for length of service;

- indexation amount determined by the Government of the Russian Federation.

The size of the pension payment is determined as follows :

- 50% of the amount of salary - if you have at least 20 years of service;

- 50% of the corresponding salary - if you have a total work experience of at least 25 years, of which 12.5 years are military service;

But the amount of allowances due differs significantly in both cases:

- for each year of service exceeding 20 years - 3% of the amount of salary, but not higher than 85%;

- for each year of service exceeding 25 years - 1% of the established salary.

It is worth noting that in case of resumption of service, the payment of pension benefits is suspended, and in case of subsequent dismissal, the calculation is carried out taking into account data on the length of service and total length of service at the time of the last dismissal.

In addition, certain categories of military personnel are provided with additional allowances from the calculated pension amount depending on:

- presence of disability group I or 80 years of age;

- number of disabled dependent family members;

- participation in the Great Patriotic War.

What is the size of military pensions

The calculation is made using a special formula. Its components:

- Job salary.

- Bonus for rank.

- Additional pay for length of service.

All parameters are summed up and multiplied by 50%. If a person transferred to the reserve has served for more than 20 years, the amount of interest increases: for each additional year 3% is added. During indexation periods, the pension by law must increase by 2%.

In 2020, the reduction coefficient was set at 54%. In the end, the entire amount received is multiplied by it. Service in the northern regions adds a regional coefficient to the total amount.

The fact of disability during participation in combat operations implies social payments taking into account the coefficient and the assigned group:

- Group I – 280%.

- Group II – 230%.

- Group III – 170%

On average, a serviceman's pension ranges from 15 to 20 thousand rubles per month. This figure is approximate, since in each case the calculation will be individual depending on the conditions of service.

Right to work

Retirement (due to disability or length of service) in the military occurs much earlier than the civilian retirement age. This allows a retired military personnel to acquire the right to a second pension - insurance. But to receive a second pension, a serviceman must fulfill 3 conditions.

- Serve a minimum number of years in civilian life, and military service will not be counted as it is taken into account when calculating the length of service of a military pension. Therefore, in 2020, a military retiree will need 10 years of service, and in 2025, 15 years of service.

- Earn the minimum amount of IPC (pension points). In 2019, 16.2 points are needed, and by 2025, the IPC must be at least 30.

- Reach retirement age. Since 2020, retirement ages in Russia have been gradually increasing by a year every year. From 2024, the retirement age in the Russian Federation for applying for an old-age insurance pension will be 65 years for men and 60 years for women.

A retired military serviceman who does not have time to earn experience or points by the generally established age will be able to continue working until the required indicators can be achieved. In addition, experience and points can be purchased quite officially by entering into a voluntary legal relationship with the Pension Fund.

Having worked the minimum required number of years, reached retirement age and at the same time accumulated a sufficient number of points on his personal account, a military pensioner will be able to receive 2 pensions at once.

- A military pension, which is paid by the department where the citizen served and earned a military pension.

- Insurance pension, which is paid through the Pension Fund.

Sources

- https://Pravda-Zakona.ru/article/vozrast-vyhoda-voennyh-na-pensiyu.html

- https://pensiology.ru/vidy-pensij/voennye/za-vyslugu-let/naznachenie/

- https://zen.yandex.com/media/vzapase_expert/povyshenie-pensionnogo-vozrasta-voennoslujascim-5c40b3aade561900b0a5d599?from=channel&rid=799772324.210571.1547998494172.17327

- https://zen.yandex.ru/media/id/5992fe889d5cb31f15d855be/5c3715092fe7ad00aa078863

- https://www.audit-it.ru/terms/trud/pensionnyy_vozrast.html

- https://pf-magazine.ru/articles/voennosluzhashhim/kogda-voennye-ukhodyat-na-pensiyu.html

- https://zen.yandex.ru/media/id/5b1135b9256d5c490fc0d476/5c9b22c461fcd2300032b4dc