No one will argue that today it is quite easy to find out this or that type of information. To carry out this request, you should use the Internet and special services. They will not only help you obtain information in a short time, but will also help you avoid paperwork with queues and other restrictions. To find out which non-state Pension Fund I am a member of, it is enough to arm yourself with step-by-step instructions and carefully follow the sequence of specified actions and methods of collecting information.

Who is a member of the State Pension Fund?

Citizens who have not signed agreements on transferring pensions to a non-state institution can rest assured that their savings are in the Pension Fund. You can always go to the personal account of the pension fund and find out the status of your pension.

When the pension reform began, there were cases when representatives of the Pension Fund of Russia visited apartments and asked to conclude agreements with them. As it turns out later, Foundation employees do not go around and force anyone to sign papers. People who signed the agreements transferred their savings to non-governmental organizations. In their case, there is no need to fear that the funds will be lost or burned. In the event of bankruptcy of a frequent institution dealing with pensions, the entire base and savings are automatically transferred to the Pension Fund.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

If a non-state fund changes its name, transfers will also not be affected. The only question that remains is, what is the new name of the non-state pension fund? There are several ways to find out this information.

Which method is more reliable?

If all the applicant’s actions are correct, and the search is carried out exclusively through official channels, then we can confidently speak about the reliability of the information received. The website of the State Services and the Pension Fund is not only reliable, but also a quick way to obtain information. More conservative citizens and those who wish to have confirmation on paper should make a personal visit using one of the options described above - this is also a reliable way. But you should not trust third-party resources on the network and intermediary structures that want to make money on the desire to find out which pension fund the applicant is a member of.

Why do you need to check your deductions?

Control over an account in the Pension Fund makes it possible to verify the integrity of the employer. If an employment contract is concluded with the employee, the company owner is required to transfer 22 percent to the employee’s pension account. In the event of a violation being detected, an individual can prove that he is right and that the employer is guilty thanks to a notice of pension.

Non-state Funds may abandon their activities and declare themselves bankrupt. In this case, the individual is not notified about this. The citizen himself checks and controls his future pension.

Organizations holding information on pension savings

For the working population of the country, money is automatically deducted from each salary to the pension fund, which will add up to the total amount after the transition to a well-deserved rest. It should be taken into account that such contributions are divided into two main parts - insurance and funded pension. In the second case, you can independently select the desired non-governmental organization, in whose accounts an accumulation of 6 percent of official earnings will be deposited. Everything else goes to the Pension Fund. This division contributes to an increase in the standard amount of payments to pensioners.

All deductions from official income are controlled by government agencies and, by default, are transferred to the required account of the responsible organization. You can change the non-state fund at your discretion, but situations of confusion may arise. A citizen may forget where his savings are. To prevent a similar situation from recurring, it is recommended to periodically check the information about the holder of your income accruals. Such issues are dealt with by authorized agencies, which can provide up-to-date information and statistics for a specific user free of charge. These include:

- Regional centers of the pension fund of the Russian Federation. Accurate information is contained in the organization’s file for each person. The staff will take your application and provide the necessary information.

- If they are officially established, then the accounting department of the company or enterprise should contain such information, and it is not confidential and every employee can request it.

- Banking organizations. There is a list of financial companies and banks for which data on pension savings is freely available. It is enough to submit a request for a certificate.

- Internet resources, among which the unified portal of public services occupies a special place.

Such departments have the information you need and should provide it upon your first request.

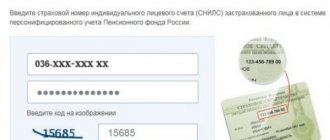

Personal visit to the Pension Fund of Russia using SNILS number and passport

You must show up at the State Fund branch at your place of registration with your passport and SNILS number. In order not to waste time, it is best to make an appointment in advance through government services.

Arriving on the appointed day, the employee uses the SNILS number to request an application for the issuance of the document. After 10 days, the visitor will again have to appear on the threshold of the Pension Fund. The employee provides information about transfers for the entire length of service. The document will also contain the name of the organization in which the savings are stored. The service is provided free of charge. The method is inconvenient because the Pension Fund will have to visit the Pension Fund twice and wait more than a week for a response.

In order not to come to the Pension Fund a second time, you can make a request (again in writing) to provide the document by mail.

How to find out your NPF online through State Services using SNILS

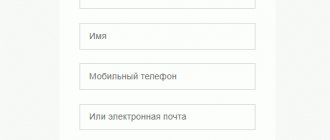

You can also find out about your non-state pension fund using the Internet, but this option is available only to registered users of the public services portal. The registration procedure is based on confirming your identity using the chosen method:

- By notification by mail sent to the specified address. This may take 1-3 weeks;

- Through Rostelecom service points with provision of SNILS, INN, passport;

- Electronic signature. It is obtained from an accredited certification center;

- Via a universal electronic card.

After the registration procedure is completed, the user gains access to his personal account. This makes it possible to receive a variety of services, including an answer to the question: “how can I find out which non-governmental pension fund I am a member of through government services?”

Important! Do not use third-party sites to search for such information that require authorization by sending SMS messages to short numbers. To avoid becoming a victim of criminals, use exclusively the official resource of government services.

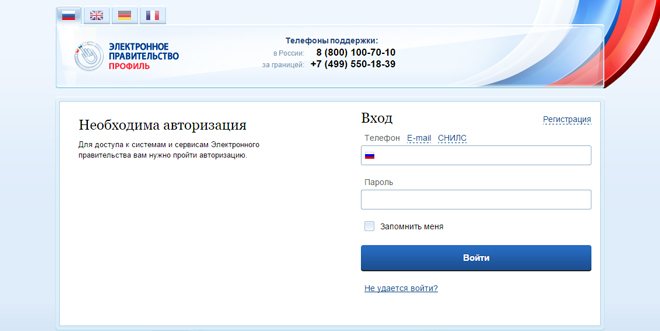

By registering on the portal, you will gain access to data about your NPF in a few minutes. You need to enter your login and password in the appropriate fields, and then select the section intended for checking pension savings.

There is information about the fund in which your funds are located, as well as about pension calculations. You can find out your work experience, IPC coefficient and pension option.

The portal user can control the employer’s contributions to the Pension Fund. The website shows the amounts of deductions broken down by year and place of work. Information can be saved and forwarded if necessary. This may be required when applying for a loan from a bank. The reliability of the data is ensured through a special format.

Another way to find out details about the pension fund is to ask them in the accounting department of your organization. Each institution has an employee responsible for staff pension contributions. It is he who provides information about which NPF you are a member of.

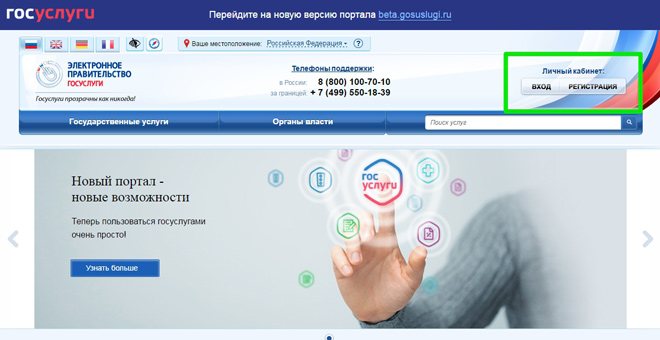

Find out which Pension Fund we are a member of on the State Services website

Having a personal account on this portal, finding out the name of your PF will not be difficult. The user must have a standard or verified account. In the case of a simplified registration option, you will not be able to receive the service.

Those who have SNILS registered on the website will need to complete the following steps:

- log into your personal account in a way convenient for you;

- find the “Service Catalog” at the top and open it;

- find the category “Pension, benefits, benefits” in the general list;

- select the link “Notification of the status of a personal account in the Pension Fund of Russia”;

- Click “Get service”.

After completing the actions, a message with the attached file will appear in the notification feed. You can open it, print it, or send it by email. The pdf format is readable on all devices.

Necessary conditions, requirements and documents

Please note that in order to obtain information you will have to collect a package of documents, which include:

- Passport of a Russian citizen or other identification document.

- SNILS is a must; this is your identifier in the pension financing system. Without it, you won't be able to get the information you need. To receive it, you need to visit the Pension Fund branch according to your place of permanent registration and write an application.

As for submitting an electronic request through the government services portal, you will need to have a verified account. According to the legislation of the Russian Federation, the consumer has the opportunity to change insurance organization no more than once a year.

Pension accruals are made from the salary of an able-bodied citizen, but it should be borne in mind that the rule applies only to white official income. If you receive earnings in an envelope, then in the future you will be left without well-deserved payments.

The article discussed how to find out through government services which pension fund I am a member of. This method is simple and effective; you do not have to wait a long time for a response from the department. The result will be instantly displayed on the screen of your mobile device; if necessary, save or print the report so as not to forget in the future.

Via bank

To provide information about the types and amounts of pensions, you must go to the bank and sign a written permission to exchange information between the bank and the Pension Fund. If you already have such a document, you can view your pension savings and the name of the Fund in your personal bank account. A credit institution will not be able to provide information about pensions if it does not have an agreement with the Pension Fund. The list of banks with which the Pension Fund cooperates can be viewed on their website or follow the link https://www.pfrf.ru/branches/spb/news~2015/12/04/102779.

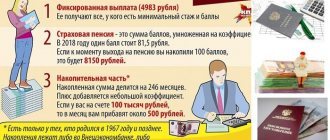

How to calculate your future pension?

This question is most relevant for people who are about to retire. In Russia these are: women over 55 years old and men over 60 years old.

A pension calculator will help you calculate your future pension, which you can use on the Pension Fund website. The calculation is made based on a large number of different factors and indicators.

Let us indicate the key data used in the calculation:

- Salary amount.

- Length of work experience.

- Retirement age (if you have worked or are currently working after reaching retirement age);

- The period of being on parental leave for up to one and a half years (this time is included in the total length of service) and the number of children in the family.

- Duration of military service upon conscription.

The calculation formula contains the following constants; they are indexed annually in accordance with the inflation rate (data for 2020):

- The cost of a pension point (is 74.27 rubles).

- Fixed payment of labor pension (4,558 rubles. 93 kopecks).

- Pension calculation system. It is different for citizens born before and after 1967.

Please note that the amount of the insurance pension received is conditional and may differ from the final calculation to the Pension Fund office.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Since 2103, Russians have independently controlled their pension savings. A year earlier, the Pension Fund sent written notifications to citizens, which contained information about the status of personal personal accounts, as well as the fund in which the funds are located.

How to get information about your NPF

If someone does not have this information saved or is missing for some reason, the person sooner or later asks the question: “how can I check which NPF I am a member of?” By the way, the savings of a future pensioner can be located both in a state structure - the Pension Fund of Russia, and in a non-governmental organization.

Today there are dozens of non-state pension funds in the Russian Federation. In relation to the insurance portion of the pension, indexations are carried out to a level corresponding to or exceeding annual inflation.

This rule does not apply to the cumulative share. Meanwhile, non-state structures accumulate depositors’ finances and invest them in reliable instruments. Payments to pensioners increase by the amount of income received.

If you have a question “how do I find out which NPF I am a member of?”, the answer can be obtained in several ways:

- In the Pension Fund of Russia;

- Through the Internet;

- From your employer;

- In banks interacting with the Pension Fund.

Let's look at each option in more detail. Everyone has the opportunity to check their NPF using SNILS. To do this, just visit the PFR branch and provide the number of your insurance document. In this case, you will have to write an application to provide the necessary information.

What are pension contributions and why are they needed?

Pension Fund contributions are insurance-type contributions that every employer is required to give to state/non-state specific funds. At the moment, such contributions are made at a set rate, which is 22% of the total wage fund of employees.

Six percent of the total 22 percent can be used to create pension savings , and the remaining 16 percent can be used to create an insurance-type pension. By independent choice of a citizen, all 22% can go to organize the latter.

Transfer of such contributions by employers in the period 2012–2013. was carried out in accordance with Federal Law No. 212-FZ, dated July 24, 2009. It is in accordance with it that the object of taxation for such contributions are payments, as well as many other remunerations that were accrued by employers in favor of individuals within the boundaries of labor relations and a civil law contract.

That is, contrary to common misconception, the payer of insurance premiums is not the employee who receives wages, but the employer.

Moreover, payments of this nature will be deducted not from the employee’s salary, but from the policyholder’s own funds.

However, in 2013, this procedure for creating pension savings was legally adjusted . According to the changes made, during 2014 the future pensioner had to decide on the issue of deducting funds either for the insurance and savings parts, or exclusively for the insurance part. How to find out your pension certificate number - read here.