All about funded pension

With this option, not being an investor himself, the pensioner chooses a management company with which he will cooperate, thereby influencing the safety and increase of funds in the account. How to choose the right NPF? A non-state pension fund, as a rule, has several management companies that are engaged in different types of investment, some invest in securities, others work on deposits, making a profit, others invest in securities, others in precious metals, some may work in stock markets, and so on. Further. When choosing a pension fund for cooperation, you need to pay attention to its profitability for previous periods, to the financial instruments that are used in relation to the funds of potential pensioners.

Differences between insurance and funded pensions

Formation and receipt of a funded pension is possible only for citizens of the Russian Federation born in 1967. Persons over this age can rely exclusively on the insurance part of pension payments. To form a funded pension, you can contribute not only a percentage of your salary to the pension fund, but also personal savings or maternity capital.

The main difference between the funded form is that all contributions are managed personally by the future pensioner. Moreover, a citizen can himself calculate the amount of pension payments using several formulas. In the case of an insurance form, this is impossible to do, since the percentage of the tariffed contribution is constantly changing.

Currently, in Russia there is a concept of solidarity between generations. This means that those insurance premiums that are charged by the employer to the employee’s account do not go directly to the account of the insured. The funds are used to pay today's pensioners. In the case of the funded form, this does not happen; on the contrary, finances go into investments and deposits, thanks to which, in addition to the employer’s contributions, a percentage of profit from deposits is also added to the total amount. The potential pensioner himself decides which pension fund to entrust his financial resources to. It could be:

- Management Company;

- Russian Pension Fund;

- non-state PF.

As a rule, private pension funds and companies provide investors with greater income than the state Pension Fund, but provide fewer guarantees, which increases the risk of financial loss.

It should also be taken into account that you can make a choice in favor of a funded pension only once, but it is quite possible to transfer material funds to the insurance form at any time.

Where is it more profitable to keep?

Any issue must be considered from several angles, and if the funded part of a pension is so attractive, then the question quite naturally arises as to why everyone, without exception, does not switch to this type of formation of future pensions. The answer is simple and straightforward - there are certain risks that very few people take .

As you know, free cheese can only be in a mousetrap, and modern society still remembers the collapse of MMM and other formations that were so attractive. Despite this, many are still willing to take risks and increase the amount of their savings over the years. Among other things, citizens are attracted by the very approach of non-state structures to serving their clients.

If we compare the profitability of a state and non-state structure, then in the first option the amount will increase twice a year by the amount of inflation, which depends on the economic situation in the country, and in a non-state structure the income is obtained from investment , that is, investing funds in activities that will generate income .

Moreover, the second option is not unambiguous; the amount of the increase may be higher or lower than that offered by the state.

Attention! The only clear conclusion that can be drawn is that government funds are more reliable.

However, non-state ones carry risks, where a pensioner can get much greater income from investing.

Advantages of transferring to non-governmental organizations

Dividing your pension into components undoubtedly has its advantages. Now there will be no such “equalization” that took place previously, and in connection with this, each employee will receive his pension deservedly.

The amount of payments will now be different, and a potential pensioner will be able to regulate the amount of payments , or rather increase it by a certain amount in some available ways.

Reference. The employer makes contributions in the amount of 22% of wages to the Pension Fund for each employee.

But with the introduction of innovations in this area, a citizen can control the funded part of a future pension. Of the 22% of contributions, 6% in any case goes to the state treasury and is used to pay off current obligations to pensioners.

The remaining 16% is divided into two parts:

- 10% is the insurance part; these payments cannot be influenced;

- 6% is a component that can be directed to a funded pension or, by default, it is stored in the insurance tariff.

If you want to have a funded part of your pension, then for this you need to write a corresponding application to the Pension Fund. The undoubted advantage of this formation is that the funded part can be replenished independently , maternal capital or part of it can be directed to it, as well as through participation in the state financing program.

Since the funds allocated for the accumulative component of payments are used in investment activities, the amount gradually increases, it turns out that money brings money.

Important! Part of the total amount can be inherited, and if an insured event occurs, the payment amount can be received as a one-time payment.

These issues are regulated by law, namely Federal Law No. 360 of October 30, 2011 (Article 4, paragraph 1, paragraph 1).

What years are taken to calculate a pension for work experience before December 31, 2001?

According to the Federal Law of the Russian Federation (hereinafter referred to as the Federal Law of the Russian Federation) dated December 17, 2001 No. 173-FZ, in force until 2020, when going on a well-deserved rest, a worker can choose 1 of two periods when calculating pension points for working time up to 2001 inclusive :

- average monthly salary for calculating the pension of the insured person for 2000–2001. according to individual (personalized) accounting data in the state OPS system;

- any 60 consecutive months of all labor activity, including under the Union of Soviet Socialist Republics (hereinafter referred to as the USSR), up to and including December 31, 2001, on the basis of papers issued by government bodies in accordance with primary accounting documents.

Since 2020, the Federal Law of the Russian Federation of December 28, 2013 No. 400-FZ has come into force and is in force - it replaced the previous legal norm.

Only some provisions regulating the procedure for calculating pension capital (hereinafter referred to as PC) until 2002 have remained relevant and are applied.

- How to stop brain aging

- 5 most important spices for mulled wine

- Table of carbohydrates in foods

Why do you need a transfer to a non-state pension fund?

The main purpose of transferring savings to a private pension company is to invest pension savings. NPFs offer to increase client contributions according to their profitability. However, no fund gives a 100% guarantee that investors will receive investment income.

Transferring the funded portion of a pension allows clients to exercise their right to choose a decent future. Otherwise, the savings will be distributed to the needs of the state. Citizens cannot use funds that have not been transferred to the savings part of the NPF. It is possible to receive investment income only during the validity period of the compulsory pension insurance agreement.

In order to wisely distribute the opportunity to increase the size of your future pension, it is recommended to choose companies with a high reliability rating.

Expert advice: where is the best place to store retirement savings?

In fact, rates are “floating”; profitability varies significantly from year to year. Sometimes the accrued interest is only enough to cover inflation. There are other disadvantages of NPFs:

- in the event of bankruptcy, revocation of a license, or closure of a fund, the investor receives only a nominal amount of savings without indexation or interest;

- when transferring funds to a non-state fund, you will have to regularly monitor the situation on the stock market, maintain control over your savings, and in the event of a sharp drop in profitability, urgently transfer the money to another organization;

- If the fund invests the funds received irrationally, there is a high risk of going into the negative – a complete loss of accrued interest.

However, investing through non-state pension funds is still the best way to increase pension payments.

Where can I store it?

In order to better understand the mechanism of formation and payment of the funded part of the pension, it is necessary to understand the fact that insurance premiums paid by a citizen are stored in an electronic database , or rather not the funds themselves, but information about savings, where you can see the current state of your insurance account. Thus, everything that the employee earns will be returned to him, but in a slightly different form.

After receiving the right to retire, a person submits an application to the Pension Fund and there the amount that will be allocated in the form of monthly payments will be calculated.

In this case, the approximate period is taken until the age of 80 years. Attention! Citizens who are engaged in labor activity now have the right to choose which pension fund to transfer the funded part of their pension to.

Selected organizations store and then pay part of the pension to the potential retiree.

This can be either a state PF or a non-state one. In addition to NPFs, you can invest the funded component of your future pension in a management company. Everyone has their own opinion on this matter; some trust government organizations, while others, on the contrary, do not want to fully cooperate only with the government structure.

While accumulating funds, they also earn money through the deposit mechanism as the funds are invested and due to this, some income is generated. There are several types of management companies in which you can invest your savings. Based on the form of ownership, organizations can be divided into structures:

- The state company is represented by Vnesheconombank.

- Non-state PF.

- Private property management company.

Which option to choose and where to transfer the funded part of the pension in the future, everyone decides for themselves, taking into account risk levels and setting priorities.

Pros and cons of charging a pension to a card

Let me remind you that all citizens who receive funds from the budget (pensions, scholarships, salaries, social benefits, etc.) from July 1, 2017 must do so on a MIR card. State employees were transferred a little earlier, until July 1, 2018. And pensioners will be transferred gradually. When the card expires, you will be given a MIR when you register for a new one.

This does not mean that pensioners are required to receive money only on the card. The Pension Fund clearly spoke on this matter on its official website. Anyone can choose the organization and method of pension delivery:

- Via Russian Post, with delivery to your home or branch. You are given a specific day of receipt.

- Through the bank. You can open an account or get a bank card. As soon as the Pension Fund transfers the money, it immediately goes into your account.

- Through special organizations. For example, these could be social protection authorities.

Thus, the pensioner himself chooses how he will receive his pension. At the beginning I said that pension plastic cards are convenient and profitable. Let's take a closer look at these points:

- You are not tied to a specific day of delivery of your pension to the Russian Post office or to the social security authorities. There is no need to sit at home and wait for the money to come.

- There is no need to stand in lines at the Russian Post to receive your pension.

- You don't keep cash at home. Today, the arrival of all sorts of dubious personalities to the elderly for the purpose of stealing is not uncommon.

- Convenient to pay in stores. There is no need to carry a wallet with you and look for the smaller money the cashier needs.

- If you master Internet banking, you will be able to pay utility bills, cellular communications, etc. without wasting time.

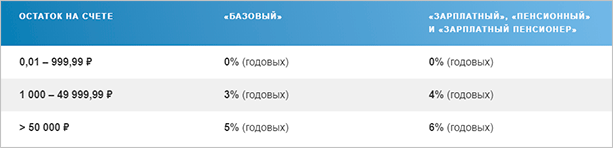

- And finally, banks offer special conditions for pension cards. For example, accrual of income on the account balance up to 6% per annum.

We need to get the basics down

There is nothing to be done, sooner or later we all have problems when, without money, solving these problems becomes impossible. We anticipate these problems in advance and what do we do? Everything is very clear! We are not waiting for the situation to come to a head, but are gradually accumulating the funds needed in the future.

One of the main problems for everyone over time becomes age, or rather, the circumstances associated with it. Yes, the time comes when a person is simply no longer able to perform those functional duties that are required of him in the workplace.

You have to move to another job, an easier one, or give up work altogether and start living on the money that you were able to accumulate during your entire previous life. And if banks helped you with your savings, they kept these funds and put them into circulation, generating interest, then that’s absolutely wonderful.

But here the question arises - do we, as a whole, have that determination, that character, that willpower to simply save money for retirement for decades, all our lives. The state answers unequivocally - NO! And this answer is probably correct. From here, from this excusable mistrust of the state towards its citizens, the country’s Pension Fund is developing.

In other words, pension contributions are essentially voluntary. But the state cannot be at risk of annually “entering the market” of hundreds of thousands of its citizens who do not have the slightest content and are no longer able to provide it. Hence the mandatory nature of pension contributions.

So far everything is white.

The “black” begins when the Pension Fund starts functioning.

Benefits of a funded pension

The main advantage of a funded pension is that your future pension does not lie “dead weight”, but works and can bring income in the future.

In addition, a funded pension can be inherited, and insurance savings in the event of the death of a pensioner will be distributed among other pensioners.

Pension savings will belong exclusively to you exactly to the extent that you were able to generate by the time of retirement. And the size of the insurance pension may depend, among other things, on the number of pensioners in the country.

There is a stereotype in society that pensioners have a hard time switching to using new tools, for example, bank cards or mobile phones. But that's not true. They evaluate each new product from the point of view of economy and convenience, so the question of which card is better to transfer a pension to is relevant for most pensioners.

Our elderly parents and grandparents with small salaries managed to save money for a “rainy day.” And then they helped their careless offspring survive this day when it came. This generation has saving skills in their blood. A bank card is not only convenient, but also profitable.

In this article we will look at popular banking products to which you can transfer your pension and receive interest on your account balance.

Advantages and disadvantages of non-state pension funds

Non-state funds are non-profit organizations whose main task is to profitably invest pension savings of citizens, increasing their income. They can invest money in any type of assets, projects and companies, which allows them to achieve impressive returns. Thus, NPF Sberbank showed a profitability of more than 13% per annum according to the Central Bank. In addition, this commercial structure is one of the oldest operating in the security sector in our country and has a high reliability rating.

But reviews from many investors indicate that high interest rates often turn out to be just a publicity stunt, a way to attract new clients. In fact, rates are “floating”; profitability varies significantly from year to year. Sometimes the accrued interest is only enough to cover inflation. There are other disadvantages of NPFs:

- in the event of bankruptcy, revocation of a license, or closure of a fund, the investor receives only a nominal amount of savings without indexation or interest;

- when transferring funds to a non-state fund, you will have to regularly monitor the situation on the stock market, maintain control over your savings, and in the event of a sharp drop in profitability, urgently transfer the money to another organization;

- If the fund invests the funds received irrationally, there is a high risk of going into the negative – a complete loss of accrued interest.

However, investing through non-state pension funds is still the best way to increase pension payments. After all, expanded investment opportunities are the most important advantage of commercial structures in the OPS segment. In addition, all non-state entities provide certain guarantees. For example, if an insured event occurs (for example, the death of the insured person), his successors may receive payments in full.

It is also important to note: NPF is a place where your pension savings can be distributed evenly over many years, and also paid in full at a time upon request. To do this, you just need to write an application in the prescribed form. But what to do if the fund goes bankrupt, loses its license and is declared bankrupt?

Profitability

The growth of savings in non-state pension funds depends on profitability. The higher it is, the faster the funded part of the pension increases. But it should be borne in mind that high interest rates often turn out to be a kind of advertising, one of the ways to attract new clients. In fact, rates vary, and returns can vary significantly from year to year. And it often happens that accrued interest only partially covers inflation. Therefore, if the NPF as a whole receives little income from investing funds, then there may be a risk of losing accrued interest.

“It is more profitable to keep a pension where the person himself considers it more profitable. The fact is that NPFs and Pension Funds are different funds. In the Russian Pension Fund, everything is always conservative and calm - income will always be small, and one cannot count on any hyper-large income from investing pension savings. The Pension Fund of Russia is an extremely conservative investor, which cannot be said about NPFs. Such funds are interested in attracting as much money as possible, they have commission income from the amount of money they have under management, so they always show beautiful tracks, profitability history, etc. But you always need to understand that with increasing profitability, risks also arise. Therefore, answering the question of who is more profitable - of course, NPFs, but there are pitfalls there,” says independent economic expert Anton Shabanov .

Educational program for a pensioner. What to do to avoid spending the rest of your life in poverty Read more

A funded pension can also be entrusted to the state, then the Pension Fund will transfer it to Vnesheconombank, and it, in turn, will invest it at its discretion.

“The funded part of the pension, which was not transferred to the Non-State Pension Fund, automatically came under the management of VEB. According to statistics, the management results of the state corporation turned out to be below the average level of non-state pension funds. The profitability of VEB's expanded portfolio over the past 5 years was 28 out of 38 active managers, over the entire history - 24. This result may be a consequence of VEB's more conservative investment strategy, which involves placing funds primarily in deposits and bonds. We believe that for the purposes of pension accumulation, the investor’s portfolio should be more aggressive, so investing with a non-state pension fund may be more suitable,” says , head of the investment analytical service .

Question answer

How much money is lost when changing NPF?

As follows from statistics published by the Central Bank, the average profitability of non-state pension funds (NPFs) on investments of pension savings for the first quarter of this year was 8.2% per annum, while the state management company, according to VEB reports, was 7.9% per annum.

“NSPFs today show quite good profitability. On average, it is higher than that of the Pension Fund, since the state fund is not as effective in managing the funded part of the pension,” says leading analyst Andrei Kochetkov .

You can find out how successful the financial operations of a particular NPF are on the website of the fund itself and from the reports of the Bank of Russia.

Hunters for pensions. What can scammers do if they know their SNILS number? More details

What pension funds can I invest in?

Investing free funds is the right decision, which will subsequently help increase the amounts needed to pay pensions. In this case, the monthly payment amount will be increased. So, citizens have a choice of ways to invest their funded pension:

- You can invest in the state PF - Vnesheconombank.

- It is possible to invest funds in a non-state PF.

- You can completely abandon the savings part; it will be directed to the insurance component. This option will apply to those who choose the “default” option and where the funds of the silent ones will be stored.

Attention! There are many non-state PFs; there are those that have proven themselves well and are ready to cooperate with the population, bringing them profit.

With this option, not being an investor himself, the pensioner chooses a management company with which he will cooperate , thereby influencing the safety and increase of funds in the account.

How to choose the right NPF?

A non-state pension fund, as a rule, has several management companies that are engaged in different types of investment, some invest in securities, others work on deposits, making a profit, others invest in securities, others in precious metals, some may work in stock markets, and so on. Further.

When choosing a pension fund for cooperation, you need to pay attention to its profitability for previous periods, to the financial instruments that are used in relation to the funds of potential pensioners. It is also important to guarantee the safety of investments ; if this is guaranteed by the state, then the risks are much lower - this is a positive thing.

It would also be a good idea to analyze the effectiveness of the PF in terms of management; if there are positive trends in the development of management companies, there have been no losses or damages, and at the same time there is a gradual increase in profitability, then such a fund is good for cooperation.

Important! When choosing a non-state pension fund, pay attention to customer reviews.

Key selection criteria

Before choosing a non-state pension fund, it is advisable to analyze some points:

- View the list of those funds that are included in the list of those for which state deposit guarantees apply. This way you can protect your savings.

- Pay attention to companies' profitability indicators.

- View the list of management companies.

- Read customer reviews, which may reveal more than meets the eye.

Proven PFs that have proven themselves and maintain positive development trends are the most optimal funds for cooperation.

Rating and reputation

Reputation for most state and non-state funds is one of the key positions that plays a decisive role for potential pensioners who want to cooperate with the Pension Fund. In the Russian Federation, these are the following investors:

- Over the past period, the electric power industry non-state pension fund showed the highest rate of return.

- PPF RGS turned out to be one of the first in the list of the most profitable funds.

- Lukoil-Garant is one of the top five companies in terms of profitability.

- Sberbank NPF is a profitable and popular fund for cooperation.

- Gazfond also has positive trends in developing cooperation with pensioners.

Reference. These NPFs have an excellent reputation and at the moment they are successfully cooperating with the population of the country.

Watch a video on how to choose the right non-state pension fund:

Where can you invest your money more profitably?

If a citizen decides to entrust his savings to a private financial company, he ceases to be a “silent man” and becomes a client of a non-state pension fund.

In addition to the compulsory pension insurance agreement, NPF clients can enter into a pension co-financing program and enter into an individual or corporate pension plan.

An IPP (individual pension plan) is an option for co-financing a future pension, in which contributions are paid not by the employer, but by the investor himself. Clients choose the size, frequency and frequency of contributions based on the conditions offered by the NPF and their own financial capabilities. An IPP, unlike an OPS, can be concluded for a limited period, unless otherwise provided in the contract.

EXAMPLE: IPP with a yield of 9% per annum with an unlimited period, a minimum contribution of 10 thousand rubles and arbitrary replenishment. With this IPP option, the client pays a mandatory contribution of 10 thousand rubles when concluding a co-financing agreement, and contributes the remaining amount of funds at his own discretion. The higher the amount of funds deposited, the more income the investor will receive after retirement.

The difference between OPS and IPP also lies in the features of termination. The OPS is terminated when the investor reaches retirement age, chooses another fund, or returns to the Russian Pension Fund. The IPP is terminated at the client’s initiative, and as a result of early termination, clients lose part of the invested funds (unless otherwise provided by the IPP agreement).

Which pension fund is better to transfer to?

The choice of a non-state pension fund depends only on the participant in the compulsory pension agreement, since the transition to a private pension company is voluntary.

Where is it better to contribute your pension savings? It is not recommended to pay attention to new companies that do not have experience in the insurance market. Their conditions may be more attractive than those of well-known competitors, however, such funds cannot guarantee profitability.

At the same time, well-known non-state pension funds with a low level of profitability are also not able to compete with other funds: when choosing them as an investor, investors risk receiving only the volume of invested savings.

The optimal option is a stable non-state company with an average level of profitability and maximum reliability indicators. When choosing such a fund, clients do not risk losing investment income and are guaranteed to receive payment of all funds after termination of the OPS agreement.

You can draw up an OPS agreement with 9/10 leading companies online by providing copies of documents by e-mail. But during a personal visit, clients have the opportunity to receive more detailed advice about the work of the fund, learn about additional ways to increase their pension and the specifics of concluding an agreement.

Key selection criteria

When choosing a non-state pension fund, it is recommended to be guided by the following factors:

- A non-state pension fund has a license giving the right to engage in compulsory pension insurance. Without a license, the fund cannot guarantee payment of funds to investors and calls into question its reliability.

- Availability of a branch or official representative at the client’s place of work or registration. Sometimes financial issues cannot be resolved remotely, using the Help Desk or Contact Center. Official representation allows you to reduce the time for considering a claim or concluding an agreement, as well as accepting documents for receiving payments upon reaching retirement age.

- Positive customer reviews about the work of the fund and its employees. The absence of complaints about delays in payments, the presence of an online account for mobile access to an individual account, the competence of employees and the clear interface of the website simplify maintenance and obtaining information about the activities of the fund.

- Current co-financing programs and favorable conditions under OPS agreements. Having a regular income is one of the main priorities when choosing a fund. It is important that the income exceeds the inflation rate in the country and does not go beyond the average. If the income of a non-state pension fund is several times higher than the average annual income of leading companies, this may be an alarming signal - in this way, non-state pension funds with a low level of reliability “lure” new clients, acting without availability licenses and not fulfilling obligations to retired investors.

- High level of reliability for at least 3 years. It is recommended to evaluate the reliability of the fund over a three-year period, since an assessment of one year does not guarantee an accurate picture of the company's activities. If the fund’s performance is consistently high for three years in a row, this confirms its reliability. When assessing the criteria, it is recommended to pay attention only to trusted sources, for example, the Expert RA and National Rating agencies, which have a high reputation among other competitors.

Review of conditions for pension programs in banks

Let's review pension programs in the most popular banks. And let's start, of course, with Sberbank of Russia, which does not change its traditions and offers the most unfavorable conditions, but at the same time has the largest number of pensioner clients.

Please note that all MIR cards issued for receiving pensions are debit cards.

Sberbank

Allows you to issue a card online without leaving your home. To do this, you need to fill out a form and after 3 days (as the bank claims) pick up the completed one. To receive it you will need a passport and SNILS.

Tariffs and conditions:

- free service,

- 3.5% on account balance,

- SMS notifications are free for the first 2 months.

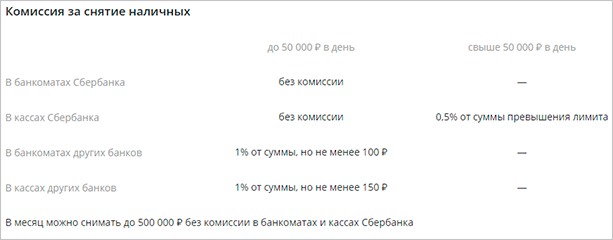

Important information on cash withdrawal fees.

The bonus program offers an accrual of 0.5% of the purchase amount in the form of Thanks from Sberbank. These are virtual bonuses that can be spent on paying for goods and services in stores and partner organizations of the bank.

Mobile banking is easy to use. To pay for utilities and taxes, just hold the bill with a barcode to your phone. Payment will take 1 – 2 minutes.

Sberbank's traditional advantage is its developed network of branches and ATMs throughout Russia.

Post Bank

Offers to leave an application on the website without visiting the Pension Fund. Post Bank has developed a special program for pensioners:

- Up to 6% per annum on the balance, the interest rate depends on the minimum amount in the account during the month. Interest is compounded monthly and capitalized, increasing income.

- Free service.

- Attractive bonus program. You will receive a 3% return to your account if you pay with a card in pharmacies, gas stations, in city and suburban transport, and taxis.

- Free and 24-hour service for pensioners to provide legal, psychological and medical advice.

- Free registration of a Pyaterochka card for online purchases and return up to 25% of the amount to your account.

You won’t have to pay for cash withdrawals only at Post Bank and VTB ATMs.

Bank opening

Otkritie Bank offers:

- up to 4% per annum on the account balance, income accrued monthly;

- 3% money back when paying in pharmacies;

- free service;

- free SMS information.

The bank does not have a well-developed ATM network in Russia, but it has found a way out of the situation and makes it possible to withdraw cash from an ATM of any bank without commission.

The opening itself will inform the Pension Fund about the transfer of your pension to the bank card. All you need to do is fill out an application at the branch.

Binbank

B&N Bank accrues 4% on the account balance on a pension card. You don't have to pay anything for the service. Cash can be withdrawn from any ATM in Russia without commission.

For pensioners, there is a special program “Care” - this is a remote service of round-the-clock consultations on medical, psychological, legal and social issues. But the service is not free. Cost from 2 to 5 thousand rubles per month.

Who is more profitable to save for retirement?

Important! Part of the total amount can be inherited, and if an insured event occurs, the payment amount can be received as a one-time payment. These issues are regulated by law, namely Federal Law No. 360 of October 30, 2011 (Article 4, paragraph 1, paragraph 1). Where is it more profitable to keep? Any issue must be considered from several angles, and if the funded part of a pension is so attractive, then the question quite naturally arises as to why everyone, without exception, does not switch to this type of formation of future pensions. The answer is simple and straightforward - there are certain risks that very few people take.

As you know, free cheese can only be in a mousetrap, and modern society still remembers the collapse of MMM and other formations that were so attractive. Despite this, many are still willing to take risks and increase the amount of their savings over the years.

The low interest rate of the Pension Fund of the Russian Federation is associated with serious restrictions in the field of investment: investing money is only allowed in assets permitted by law (government bonds and shares). The investment of funds is directly carried out by the manager and a number of other management companies with which the fund has concluded trust management agreements.

Advantages and disadvantages of non-state pension funds Non-state funds are non-profit organizations whose main task is to profitably invest pension savings of citizens, increasing their income. They can invest money in any type of assets, projects and companies, which allows them to achieve impressive returns.

Thus, NPF Sberbank showed a profitability of more than 13% per annum according to the Central Bank. In addition, this commercial structure is one of the oldest operating in the security sector in our country and has a high reliability rating.

In the meantime, that's the point

In the meantime, everything is controlled by the forced idea of the Pension Fund, we “hand over” a fifth of our honestly earned labor to the state - 22% (now we don’t even say that they are actually divided into insurance 16% and funded 6%).

What are the advantages of such a “mutual partnership”?

First. The state is responsible for the money received and guarantees its payment throughout the entire pension period.

But here we are counting again.

Initial data:

- the amount of savings by the age of 60 is 6 million rubles;

- I’m going to live at least 30 more years (oh, “Dreams, dreams, without them life would be boring,” as the brilliant American writer Edgar Allan Poe wrote, by the way, one of the founders of science fiction and “fear” in literature, the beginning of the 19th century, still in full heyday Alexander Sergeevich Pushkin).

We count:

- Every month a pensioner will have 20 thousand rubles at his disposal. So, now more than half of pensioners can only dream of such a pension (and in our country it turns out to be minimal, note!).

When we say that the Pension Fund is under state guarantee, we are not exaggerating at all; after all, it is a state structure. Moreover, the state annually carries out indexation (increase, in simple terms) of pensions, if those 400-600 rubles are of interest to anyone at all. Nevertheless, this is also some kind of plus, although for some it is even reduced.

But we must understand that the state will not be able to protect anyone in the event of global financial crises, such as those that occurred during the collapse of the Soviet Union, in 1998 or 2008. All the same, you will have to “get out” (and think!) yourself.

How to fix the situation?

Correcting the situation in this generally noble idea of the Pension Fund is as follows:

- The state must loudly announce to its citizens that their money in the Pension Fund still belongs to them and without any conditions.

- Any citizen can at any time find out the amount that he has personally accumulated (the state has accumulated for him - and there is nothing reprehensible in this, let’s not forget about our lack of organization in life and the state’s assistance to us in this matter).

- Any citizen has the opportunity to refuse to participate in the formation of his pension and take all accumulated funds for himself. The reason, yes, any: from the confidence that this will be enough for him until hour “X”, to the reluctance to leave something behind, and over 60 he no longer sees himself or does not want to see himself.

- The state, respecting the opinion of its citizens (A CORNER MESSAGE TO WHICH NEEDS TO BE CONSTANTLY PAYED ATTENTION) and caring about their future, can only constantly remind them of the need to think, not to let things take their course, they say, we'll see. The state needs to constantly pursue targeted lifestyles. You shouldn’t be afraid that everyone around you is so stupid that they will definitely do everything wrong (and we’ll just add - as the official wants).

As a matter of fact, the situation is very similar to that with the contract army. How is this voluntary! So there will be no army at all, who will join it voluntarily! But as the experience of the United States shows, they really do, and there are advertisements all over the country, and there are recruiting stations all over the country, and the idea is constantly working on how to make serving in the army attractive.

Profitability and reliability

One of the main characteristics of the fund for potential investors is the profitability and reliability of the NPF.

Yield is the interest accrued annually on depositors' funds. The higher the company’s profitability, the greater the percentage of investment the client will receive upon retirement.

Until 2014, every 4th NPF had a negative or zero percent return. At the end of the period, investors of non-state funds with negative income (or equal to zero) received only funds transferred from the Pension Fund. At the same time, the company’s income could increase due to the constant influx of capital - an increase in the number of investors who signed an OPS agreement.

Reliability is characterized by the fulfillment of obligations to investors who have retired. Upon reaching retirement age, the compulsory pension insurance agreement is considered terminated, so clients receive 6% of the funds transferred from the employer and investment income accrued by the non-state pension fund.

If the volume of pension savings is less than the amount of financial obligations to investors, then the NPF is deprived of its license. Clients receive 6% deductions if the fund was part of the deposit insurance system. Otherwise, they may receive only part of the transferred funds or completely lose the funded part of the pension (similar to the position of the “silent people”).

To avoid an unfavorable outcome, before choosing a non-state pension fund, it is recommended to study the lists of rating agencies that assign reliability ratings to non-state companies based on their financial well-being and prospects in the compulsory pension insurance market.

Advantages and disadvantages

The insurance part has a significant advantage over the savings part - it is the safety and security of material assets, since all deposits are subject to state guarantees. According to statistics from the Pension Fund of Russia, a large number of non-state accumulative funds became bankrupt, and citizens’ deposits were reset to zero. However, this does not apply to those owners of funded pensions whose deposits were insured. The Deposit Insurance Agency assumed the obligation to pay them.

Let's take a closer look at all the pros and cons of two types of pensions: insurance and funded.

Among the disadvantages of an insurance pension are the following:

- It is not profitable for private entrepreneurs and informal workers to form an insurance pension, because it represents only a percentage of the official salary.

- The employer is not interested in increasing the amount of contributions, so he registers the majority of his employees at the minimum rate, which significantly affects the percentage of insurance premiums.

- Profitability is decreasing due to the fact that finances are at the disposal of Vnesheconombank.

- A citizen can manage funds in a pension account only after reaching retirement age.

- The size of the state pension, taking into account the low income, is less than the standard subsistence level in Russia.

The disadvantages of a funded pension include:

- High commission for NPF services, which is charged on investment income.

- Strict control over the timeliness of tariffed contributions.

- High probability of loss of funds in the event of company bankruptcy.

- Additional payment of insurance reserves.

- Possibility of losing deposits due to scammers.

As for the benefits of a funded pension, the main thing is a person’s ability to manage his pension account at any time: invest, invest additional funds. Most non-state savings funds offer their clients high income from deposits and guaranteed receipt of funds under the concluded agreement. Relatives of a deceased or missing pensioner can receive payments for him, which guarantees full payment of all funds. The client also has the right to freeze deposits for up to one year or reduce contributions. A noticeable advantage of the funded form is that such a pension almost completely covers wages.

Where can I place funds?

To increase their savings, citizens can transfer them to a non-state pension organization. In a private fund, funds will be invested annually, and clients of the fund will receive information about the state of the individual account.

The Foundation is responsible for the safety of funds. Leading NPFs are included in the deposit insurance program, which guarantees receipt of 100% of payments to clients in the event of liquidation of the fund or deprivation of its license. The absence of an insurance program means that in the process of liquidation of the fund, investors will lose invested funds and investment income for the period of validity of the compulsory pension insurance agreement.

“Silent people” keep their pension savings in an individual account with the Pension Fund, however, they do not have the opportunity to use them. Their investments go into insurance premiums and are spent by the government. In order not to lose investment income, clients must invest in a non-state pension fund. The full funded part of the pension will be transferred to the NPF account one year after submitting the application, the client will receive a notification about this by mail or email.

Since 2014, the transition of non-state pension funds has not brought profit to clients, since Russia has introduced a moratorium on the formation of the funded part of citizens’ pensions. The lifting of the moratorium will return investment income to Russians. Until the freeze is lifted, savings will be automatically transferred to the insurance part of the pension.

Advantages of receiving a pension on a bank card

For older people, receiving pensions through a bank has a number of advantages:

- convenience - no need to stand in line at the post office;

- money is credited on the day it is received from the Pension Fund (PFR);

- the opportunity to participate in bonus programs of a bank or payment system, receive advantageous offers and discounts from partners;

- accrual of interest on the balance (not everywhere), which allows you to use the card as a savings account;

- the ability to withdraw cash any day after it is credited to the account;

- availability of money transfers from card to card;

- the ability to pay for housing and communal services and the purchase of goods via the Internet in your personal account or on the seller’s website;

- Non-cash funds are protected from theft (subject to all security rules).

Where do the silent ones keep their savings?

Russians, who have not yet decided where it is best to keep their pension savings and who have not decided whether to trust them to private funds, remain in the status of “silent people”. Their savings are formed only into the insurance part of the pension, which is distributed for the needs of the state and is not subject to investment.

All contributions to the Pension Fund for a working Russian are 22% of their salary. Of these, 16% automatically goes into the insurance part of the pension (by default), and 6% represents accumulated funds.

The funded part of the pension can be used as funds for investment by a non-state pension fund. To do this, the client must transfer his savings to one of the private companies by drawing up a compulsory pension provision agreement (OPS). The OPS agreement is drawn up for an indefinite period and is terminated upon return of funds to the Russian Pension Fund or transfer from one NPF to another.

NPF invests funds received from clients taking into account its profitability. At the same time, upon retirement, clients receive both the funded portion transferred from the Pension Fund to the Non-State Pension Fund and the interest accrued by the fund for the entire period of validity of the compulsory pension agreement.

“Silent people” do not have additional income when they reach retirement age. 6% of their contributions are used by the state for socially significant needs: payment of pensions to current pensioners, fulfillment of obligations to preferential categories of citizens and municipal institutions, etc.

There are several ways to find out where the funded part of your pension is located. Check out the following materials:

- How to find out the location of savings by SNILS number?

- How to determine the location of savings on the Internet?

Peculiarities of pension calculation before 2001

The assignment and calculation of old-age pensions until 2002 are made after calculation using the formula SPg = PC / PD, where:

- SG – amount of old-age benefit;

- PD - the survival period during which the worker will receive PO is 228 months. for 2020;

- PC – pension capital.

PC is calculated using the clarifying formula PC = (RVSPg – 450) x PD, where:

- RVSPg – estimated payment of insurance pension, relevant for the selected calculation period;

- 450 – the amount (in rubles) of the fixed payment (hereinafter – FV) for old age – the minimum or basic social pension, which was established as of 01/01/2002 by the legislation of the Russian Federation. This amount should be subtracted from RVSPg because to calculate this result, only the SP value without PV is required.

RVPSG = SK x ZK x SZ, where SK is the length of service coefficient, ZK is the salary coefficient, and SZ is the average salary in the country until 2002 - a constant that is calculated by the Pension Fund of Russia (hereinafter referred to as the PFR) and is 1671 rubles.

- Subsidies for housing and communal services for pensioners - terms of appointment and procedure for registration

- Life with diabetes after 50: duration, types of disease

- Hormone analysis in women

What does coefficient 1.2 mean when calculating pensions?

The ratio of a pensioner's salary to the average labor remuneration in the country on the date of calculation of the old-age insurance benefit is called the salary coefficient. According to the Federal Law of the Russian Federation dated December 17, 2001 173-FZ, this indicator should not exceed 1.2.

Questions and answers

Several years ago I transferred the funded part of my pension to a non-state pension fund.

Please explain what is the current legislation regarding this part of the pension? Do I need to withdraw money from the NPF? Is it possible to pick them up? Is there a tax deduction for these savings? Is it possible to get any benefit from these savings?

Links to previously discussed questions on the topic here date back 3 years ago and may no longer be relevant.

Please give a fresh answer.

Expert:

Anna.

Please explain what is the current legislation regarding this part of the pension?

The list of legislation is as follows:

Federal Law of December 28, 2013 N 424-FZ

“About funded pension”

Article 9. Procedure for establishing, paying and delivering funded pensions

https://www.consultant.ru/docum...

Order of the Ministry of Labor of Russia dated November 28, 2014 N 958n

https://www.consultant.ru/docum...

Order of the Ministry of Labor of Russia dated November 17, 2014 N 884n

https://www.consultant.ru/docum...

Federal Law “On Non-State Pension Funds” dated 05/07/1998 N 75-FZ

https://www.consultant.ru/docum...

Do I need to withdraw money from the NPF?

This is the right of a citizen to transfer savings back to the Pension Fund of the Russian Federation, or leave them in a non-state pension fund.

In accordance with Federal Law dated 05/07/1998 N 75-FZ

“On non-state pension funds”:

Article 36.12. The procedure for transferring the pension savings of insured persons by the Pension Fund of the Russian Federation and the fund

2. Pension savings of an insured person who refused to form a funded pension in the fund and exercised the right to transfer to the Pension Fund of the Russian Federation in accordance with Federal Law of July 24, 2002 N 111-FZ “On investing funds to finance a funded pension in the Russian Federation” , are transferred by the fund to the Pension Fund of the Russian Federation in the manner established by this Federal Law.

Also additional information from the Pension Fund at the following links:

https://www.pfrf.ru/press_cente…

https://www.pfrf.ru/branches/hm...

https://www.pfrf.ru/branches/sv…

Is it possible to pick them up? Is it possible to get any benefit from these savings?

It all depends on the form of payment of pension savings, there are only three of them: fixed-term, pension and lump-sum, each has its own procedure and conditions. in the presence of which this is possible.

Relevant clarifications of the Pension Fund of the Russian Federation using official links:

https://www.pfrf.ru/branches/ch...

https://pfrp.ru/faq/kak-poluch…

Is there a tax deduction for these savings?

In accordance with the Tax Code of the Russian Federation, Article 219. Social tax deductions:

1. When determining the size of the tax base in accordance with paragraph 3 of Article 210 of this Code, the taxpayer has the right to receive the following social tax deductions:

5) in the amount of additional insurance contributions for a funded pension paid by the taxpayer during the tax period in accordance with the Federal Law “On additional insurance contributions for a funded pension and state support for the formation of pension savings” - in the amount of expenses actually incurred, taking into account the limitation established by paragraph 2 of this article.

Additional clarifications from the Federal Tax Service of the Russian Federation at the official link: https://www.nalog.ru/rn77/taxa...

Where is it more convenient to store pension savings, in a state or non-state fund?

Is there information about the Sberbank pension fund?

Expert:

Tatiana. Unfortunately, this is not a legal question. Everyone decides the issue of convenience for themselves. You can obtain information about the fund on its official website npfsberbanka.ru/, or by contacting the fund personally.

I’m a student, I’m 19 years old, I want to know: where is the best and safest place to invest my retirement savings? I need your advice and adequate recommendations. If it’s convenient, it’s better to write on WhatsApp

Expert:

Vladimir! If we talk about the safety of investments, then according to the current legislation, citizens’ deposits in the bank do not exceed the amount of 700 tr. are insured by the Deposit Insurance Agency (DIA), so a deposit within this amount in a bank that has a license to attract funds from citizens is completely safe. If we talk about financial safety, this is of course not a legal issue, but economists advise storing it in the currency in which you are going to spend these funds in the future, or putting them into baskets of currencies, that is, part in rubles, dollars and euros. The proportions are up to you to decide.

Good luck to you!

“I, Kristina Yuryevna Sinitsyna (born May 11, 1968, living in Nevinnomyssk, Stavropol Territory) am turning to you for clarification. I am a depositor of VTB Bank (I have a salary and credit card from the bank), and previously transferred my funded part of my pension to JSC NPF VTB Pension Fund.

In March 2020, I contacted a local bank branch with an application to pay me the funded part of my pension (at that time, according to a bank employee, it was just over 120 thousand rubles). After a while on my phone

I received a call and the girl, introducing herself as an employee of VTB Bank in Moscow, told me that I do not have the right to receive the funded part of the pension, and that I would learn about the reason for the refusal from a written notice. At the same time, as an option, I was offered a funded pension in the amount of 464 rubles 38 kopecks monthly. In a telephone conversation, I agreed, expecting to receive clarification.

After some time I received a notification. The notice does not indicate the reason for the refusal and the procedure for appealing it, all the documents I submitted were not returned (clause 7 of Article 10 of the Federal Law of December 28, 2013 N 424-FZ “On Funded Pension” (December 28, 2013)).

As I understand it, during the period of being in the bank, the funded part of the pension was invested, and some interest appeared. But I can’t get it, the explanations are all vague. They talk about some 5% - in relation to what? How to calculate them? Is it possible to divide the savings and get some part? 464 rubles - funny! My colleagues received it, and some of them had more money than mine. Help!

Expert:

From the data you provided, namely that you were born on May 11, 1968, I found that you are now 47 years old. According to Article 6 of the Federal Law dated December 28, 2013 N 424-FZ “On Cumulative Pension”, the Cumulative Pension is assigned to insured persons entitled to an old-age insurance pension, including early, in accordance with the Federal Law “On Insurance Pensions”.

And according to the Federal Law “On Insurance Pensions,” women who have reached the age of 55 years and men who have reached the age of 60 have the right to an old-age insurance pension.

So if you do not have conditions that give you the right to receive an early old-age pension, the bank’s refusal is legal. And as soon as the Pension Fund assigns you an old-age insurance pension, you will immediately receive the right to a funded one.

When you retire, you can take your savings portion as a lump sum payment, but only if your pension savings do not exceed 5% of your pension.

And the documents you provided must be returned to you on the basis of Article 10, Clause 7 of the Federal Law of December 28, 2013 N 424-FZ “On Funded Pension”. Contact your NPF with a request to return the documents.

The most profitable pension cards

Plastic for crediting pension and social benefits has a number of distinctive features. The cards are debit, but some of them can be overdrafted. Banks issue cards for pensioners: Visa, MasterCard, Maestro and MIR. From July 1, 2020, all pension cards will be serviced exclusively by the MIR payment system.

Pension card MIR from Sberbank

The country's largest bank has an advantageous offer for older people - free issuance and maintenance of the MIR pension card. The plastic is equipped with a magnetic stripe and a chip. In addition, there is the possibility of contactless payments. The account balance is charged 3.5% per annum every 3 months. Additionally, a pensioner can become a participant in the THANK YOU program and receive up to 20% of the money spent back (cashback) to the account.

Sberbank sets a number of card limits:

- maximum withdrawal without commission is 5 thousand rubles/day at an ATM or 50 thousand rubles through a cash register;

- You can withdraw no more than 500 thousand rubles per month without commission;

- for cashing out at other ATMs you will have to pay 1%, but not less than 100 rubles.

- Re-issuing a card is free; if you lose or change your personal data, you will have to pay 30 rubles for a new card;

- the cost of checking your balance using ATMs of other banks is 15 rubles;

- extended SMS notification – 30 rubles per month, and the first 2 months of use of the service are provided free of charge.

Debit from Binbank for pensioners

On January 1, 2020, Otkritie Bank and B&N Bank merged and now operate under the single Otkritie brand. Those pensioners who already have a card from B&N Bank will continue to be served at current rates until the expiration date of the plastic card. Otkritie Bank offers the following favorable conditions to new clients:

- issue and maintenance free of charge;

- free cash withdrawals from any ATMs (up to 250 thousand rubles/month);

- SMS notification – 0 rubles;

- registration of a card and writing an application for crediting a pension - at any bank branch without the need to visit the Pension Fund;

- The cashback amount is 3%, but you can only receive it for purchases in pharmacies;

- Interest accrual on the balance is up to 4% per annum, based on the amount.

MIR card of Rosselkhozbank

To apply for a card, a pensioner needs to contact an authorized specialist of any branch of the Russian Agricultural Bank. Having received the plastic, you should write an application to the Pension Fund for crediting payments. Issue and maintenance are carried out free of charge, and up to 6% per annum is charged on the balance of funds. SMS notifications on transactions are provided at no additional cost.

Cash withdrawals are charged 1% of the amount (minimum RUB 100). Free cash withdrawal is possible only at RSHB ATMs and partner banks:

- Alfa Bank;

- Prosvyazbank;

- Rosbank;

- Raiffeisenbank.

- Good and bad cholesterol after 50 years

- What fines can you avoid paying?

- Spotlights for suspended ceilings - how to choose by power, size, shape and cost

Plastic for crediting pensions from Post Bank

The bank offers pensioners a favorable condition - free issue and maintenance of a MIR debit card for crediting pensions. Delivery of the card is possible to any post office, but you will have to pay 100 rubles for the service. To register a pension transfer, you do not need to visit the Pension Fund. The application is filled out at the bank itself. Additional favorable conditions for the card:

- free withdrawal of money from ATMs of Post Bank and VTB;

- balance bonus – up to 6% per annum;

- cashback amount is up to 3%, but you can only receive it by paying in pharmacies, gas stations, public transport, commuter trains and taxis;

- favorable offers on deposits and loans;

- the possibility of issuing a special Pyaterochka card for payments in the chain of stores of the same name (in Moscow and the regions) for increased accrual of bonus points.

Promsvyazbank debit card

Promsvyazbank offers free issue and maintenance of MIR payment system cards to pensioners. You can pick up the plastic on the same day of application. Having issued a card, a pensioner receives a number of advantageous offers:

- reward on account balance – up to 5%;

- refund - up to 3% for payments at gas stations and pharmacies, up to 20% - from partners of the MIR payment system;

- contactless payment;

- free internet banking.

For combat veterans and pensioners of law enforcement agencies, Promsvyazbank offers additional conditions:

- free withdrawal of up to 50 thousand rubles from ATMs of third-party banks;

- free payments and transfers up to 100 thousand rubles per month.

Multicard for pensioners from VTB

To obtain a bank card, a pensioner needs to come to any VTB branch with a passport and fill out the appropriate application. The bank's most profitable pension card is issued free of charge under the brand of the MIR payment system. Up to 8.5% per annum is charged on the cash balance.

Cash withdrawals from ATMs of other banks are free, but only if the pensioner pays at least 5 thousand rubles with a card every month. Cashback – up to 10%. It is possible to connect profitable options in order to receive additional bonuses.

Free pension Tinkoff Black

The card is issued free of charge in conjunction with the MasterCard payment system. It is necessary to take into account that from July 2020 the Pension Fund will not transfer payments to it: pensions will only be received on MIR cards. Since Tinkoff Bank is a virtual financial institution, to issue a card you only need to fill out an application on the organization’s website, after which the courier will deliver the plastic to the specified address.

You can use the card's free service only for the first month. Subsequent fees will be 1,990 rubles. 0 rubles – if spending on the card exceeds 200 thousand rubles. A pensioner can independently set a suitable PIN code, limit payment limits and receive notifications about completed transactions.

Main advantages:

- cashback for purchases – up to 30%, but not more than 30 thousand rubles per month;

- free withdrawals from ATMs around the world;

- favorable exchange rates;

- income on the balance – 6% per annum;

- free transfers between bank cards in the amount of up to 50 thousand rubles/month.