NPF Promagrofond is the first of the large non-state funds in the field of pension provision. The main directions of the closed company NPF Promagrofond are: activities within the terms of the non-state pension service agreement and insurance activities within the framework of compulsory pension insurance.

On the official website it is possible to use the Fund’s services through the Promagrofond personal account.

Founded back in 1994, the Fund is one of the most reliable in the country, serves over 2 million Russian citizens and has representative offices in 70 cities of Russia. Over the entire period of its existence, even in crisis conditions, the Fund managed to conduct highly effective investment activities and make payments to its clients on time.

General information about Promagrofund

The NPF Promagrofond under consideration has been operating on the market for about 20 years.

During its activities, this organization was able to achieve high results, for example:

- Currently, the NPF has about two million clients;

- on reserve funds – 714 million;

- accumulation of pension value – 53 billion rubles.

The company has 56 billion worth of property and has 70 offices in the country. All crises by this organization were endured without consequences for citizens who invested in the fund, while the level of the organization’s rating was maintained.

Promagrofond – reliability rating, official website, telephone numbers

To evaluate the activities of a non-state pension fund, there are many criteria that need to be paid attention to. The main one is rating. By analyzing it, we can draw a conclusion about how reliable the background is. Special information databases have been created throughout the country to help track the indicator and how successful the company is.

According to the latest data, Promagrofond is among the TOP 5 best commercial funds. As a rule, it occupies positions 1 to 3 on the lists. This is a high all-Russian rating, allowing us to conclude that the fund can be trusted.

Equally important is the level of trust. It determines how likely citizens are to trust NPFs. It directly correlates with the reliability factor presented above. Since the company occupies a high position in the rating, it means it can be trusted.

In various sources, you can see a mark about the A++ trust rating. This means the highest category of trust. It is important to take into account that a high trust rating can already be considered starting from A+.

If you have any questions or need to consult with specialists from NPF Promagrofond, just call the hotline 88007008585, the call is free. Or visit the official resource of the company https://www.promagrofond.ru.

Reliability and profitability rating

It is worth paying attention to the fact that the rating level is set by different agencies, for example, Expert RA, which set the rating “A++” for the fund in question. This rating indicator is the maximum, which indicates that the company provides high quality services and investments in it are protected.

An increased level of reliability is ensured due to the fact that the organization’s activities are ensured through strict control by government agencies.

The work of the fund is subject to licensing, in addition, there is an indicator of the normative contribution of the founders in the aggregate, in addition, the placement of investment funds and reserves from pension savings. Similar rules apply to the formation of a reserve of insurance value.

Important! The funds accumulated in pension accounts cannot be subject to penalties that relate to the debt that is registered with the fund. If there is a negative return, then it can be covered using the funds of the fund.

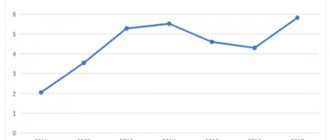

Between 2005 and 2012 there was an increase in funds. Every 1000 in the account became equal to 2002 rubles. Over eight years of operation, the organization’s income was 73% . In this case, the average is 9.1%. In 2020, the profitability of the organization in question exceeded 16%.

It should be pointed out that during the crisis in 2008, the level of profitability of this fund did not fall below 5.2%. If we consider from the same point of view the activities of the official manager of the Pension Fund, then during the specified period of time the indicator had a negative value.

The fund in question has some advantages. Among the main ones, we can highlight the fact that there is transparency and openness in working with clients. For example, this concerns information about the distribution of incoming investments, which is publicly available. This means that every citizen has the right to familiarize himself with this information.

There are several main indicators that characterize the fund’s activities.

Funds are invested in financial instruments:

- government-developed securities;

- bonds issued by companies conducting economic activities;

- deposits in banking organizations;

- shares of enterprises that operate in a strategic direction;

- securities of companies.

In addition, this is documentation of mortgage relations and bonds of the municipality. You can obtain up-to-date information by contacting the fund.

Reliability of NPF "Promagrofond"

The company's reliability has been proven by satisfied customers who have been investing their money for decades. Everyone agrees that receiving a large amount is very nice. Based on the results of 2020, the fund’s funds increased - the amount was 451 billion rubles. Pension reserves amounted to 372 billion rubles.

Even the Expert RA agency confirmed the A++ rating that was assigned to the fund. In 2013, it was in 9th place in terms of savings among all non-state funds in Russia. The company has an official website, it is updated and filled with up-to-date information.

It contains complete information about the work of the organization, a map with the location of offices. Link to personal account, calculator. Thanks to it, future clients can view the interest rate by year and see the amount accumulated over several years.

Pension accumulation programs

Currently, the organization in question has developed several programs that focus on pension insurance.

These include:

- The classic program is used to subsequently receive pension payments on a lifetime basis. In this case, it is not provided that funds can be transferred on the basis of relations of hereditary significance. In order to calculate the redemption amount, you need to use the minimum period, which is represented by two years. You will need to deposit a minimum of 2000 rubles. Receipts must be monthly;

- free program. It is used to receive an urgent payment. A special feature of the program is that the schedule for depositing funds has an arbitrary value, that is, the citizen decides on his own how often the money should be credited to the account. The balance of funds in the account is transferred to legal successors upon the death of the owner. The accumulation period is 2 years and the minimum contribution is 500 rubles;

- guaranteed. It is also used to receive an urgent type of payment, while funds are deposited randomly. A citizen has the opportunity to independently determine the frequency of payment; this time cannot be less than a year. The minimum contribution is a couple of thousand rubles and a period of 2 years. The remainder is inherited;

- confident "S". In this case, the amount of contributions is agreed upon by the fund. The payment is made over an annual period and the entire account balance can be transferred to the heirs. The person independently decides how often to deposit funds;

- confident "P". A fixed lifetime payment is provided. It will not be possible to inherit funds; the savings period is a couple of years;

- caring. In this situation, the program makes it possible to transfer pension rights to a third party. You can use any periodicity, but not less than 12 months, with a minimum of 2 years. Every month you need to deposit at least a couple of thousand into your account;

- pension annuity. The citizen receives a pension and the period of contributions is not limited. Payment is made within a year, the remainder is inherited. Every month you need to deposit five thousand rubles.

Due to the fact that funds received from citizens are subject to investment, citizens receive profit. It is transferred to the account. You need to open a separate account for the program. Many of these programs provide a social deduction, which entitles you to a refund of 13% of transfers to NPFs.

Profitability from the fund

Many citizens decide to use the services of funds because they guarantee an increase in their income. To transfer your savings into “safe hands”, it is important to pay attention to the profitability indicator. Due to its high impact, Promagrofond attracts a large number of citizens.

According to the administration, citizens should receive returns in the range of 15-18%. As for reality, the result turns out to be much less: 5-7%.

Such a large difference is often explained by the constantly increasing level of inflation. Similar discrepancies can be found in every non-state pension fund, since this situation occurs throughout the country and does not depend on the fund.

Analyzing the profitability rating of other funds, regardless of the discrepancies in promises, we can conclude that in Promagrofond the percentage is still an order of magnitude higher than in other organizations.

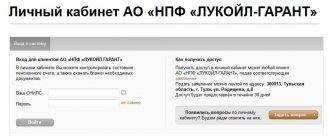

Personal account on the fund website

Each client of the organization in question has the right to register a personal account on the official website of the non-state pension fund "Promagrofond". If, before the merger of Promagrofond CJSC with Gazfond, a person used the capabilities of a personal account, then after that there will be no need to register on the site again.

Algorithm of actions for registration

Using a personal account brings many positive aspects for a citizen. In particular, it is possible to control accumulated funds online.

Registration is done as follows:

- make a scanned passport and SNILS, a statement regarding joining a specific program (it can be drawn up during registration;

- click on the link with the name of the fund’s website;

- reflect SNILS and telephone number, email, residential address;

- attach scanned documents.

Then the citizen receives an identifier on his phone. 10 days are allotted for this. Next, the person will be able to log into his personal account. You will need to change the temporary password and set a permanent one.

What opportunities does LC provide?

The account can be used:

- to check pension savings;

- filling out an application for copies of papers;

- change of personal information.

Also, through your personal account, you will be able to analyze your personal savings and pay the contribution online.

Benefits of transferring savings

The main advantages of transferring to a non-state pension fund include the following aspects:

- Security of pension contributions

- Growth of the savings part

- Promagrofund has some of the highest rates

- Ability to track all savings and account status in your personal account

- High level of trust and reliability.

Thanks to high rates, many citizens decide to transfer their pension savings in order not only to preserve them, but also to increase them. To make a final decision about transferring your funds, it is recommended that you read reviews on the Internet.

Read more about how to make money on Avito

The disadvantages of working as a merchandiser are here

5 profitable deposits from B&N Bank:

1.2.1. The size of the authorized capital of the NPF Promagrofond CJSC being created is 230,000,000 (Two hundred and thirty million) rubles and consists of the par value of the shares to be placed upon the creation of the Promagrofond NPF CJSC.

The authorized capital of the newly created NPF Promagrofond CJSC is divided into 230,000,000 (Two hundred and thirty million) ordinary registered uncertificated shares with a par value of 1 (one) ruble each.

1.2.2. On the date of entry into the unified state register of legal entities of the state registration record of CJSC NPF Promagrofond, ordinary shares of CJSC NPF Promagrofond are subject to placement in the amount of 172,500,001 (One hundred seventy-two million five hundred thousand one) pieces, which is 75 percent and 1 (one) ordinary share of the total number of ordinary shares of NPF Promagrofond CJSC subject to placement. The specified ordinary shares of NPF Promagrofond CJSC are distributed to Pension Technologies LLC.

1.2.3. Ordinary shares of CJSC NPF Promagrofond that remained unplaced on the date of entry into the unified state register of legal entities of the state registration of CJSC NPF Promagrofond are subject to placement on the date determined by the decision of the board of directors of CJSC NPF Promagrofond on the procedure and on the terms of placement of such shares. This decision is made no earlier than 12 months and no later than 14 months after the state registration of NPF Promagrofond CJSC.

1.2.4. Ordinary shares of NPF Promagrofond CJSC that remained unplaced on the date of entry into the unified state register of legal entities of the state registration of NPF Promagrofond CJSC are distributed in the following order:

1) to persons whose stated demands for the distribution of the remaining unplaced ordinary shares of CJSC NPF Promagrofond have been satisfied. At the same time, the number of ordinary shares to be distributed to such persons is determined in proportion to the share of their contribution in the total contribution of the founders of the reorganized NPF Promagrofond;

2) the remaining undistributed ordinary shares are distributed between the shareholders of CJSC NPF Promagrofond and persons whose stated demands for the distribution of the remaining unallocated ordinary shares of CJSC NPF Promagrofond have been satisfied, in proportion to the number of ordinary shares owned or distributed by them, respectively.

The list of persons to whom ordinary shares of NPF Promagrofond CJSC are subject to distribution, remaining unplaced on the date of entry into the unified state register of legal entities of the entry on the state registration of NPF Promagrofond CJSC, and the number of ordinary shares subject to distribution to each of such persons, is determined decision of the board of directors of NPF Promagrofond CJSC on the procedure and conditions for the distribution of such shares.

The Board of Directors of CJSC NPF Promagrofond is considering the requirements for the distribution of ordinary shares of CJSC NPF Promagrofond, received after the Board of the Fund of NPF Promagrofond made a decision on its reorganization in the form of transformation into CJSC NPF Promagrofond and before inclusion in a single state the register of legal entities records the state registration of CJSC NPF Promagrofond, and makes a decision on satisfying such requirements or refusing to satisfy them no later than one month from the date of state registration of CJSC NPF Promagrofond, and claims submitted after the state registration of NPF Promagrofond CJSC - no later than one month from the date of their receipt.

Reorganization process, merger

In 2020, another significant event occurred that determines the work of the fund for the near future. We are talking about the merger of Promagrofond with NPF Gazfond. Let us recall that a similar procedure was carried out by the Heritage funds (Norilsk Nickel), as well as Kit-Finance.

Since then, all clients of Promagrofond have come under the management of Gazfond, which has become the legal successor in terms of fulfilling all obligations of the listed structures to clients.

Good to know! A non-state pension fund is required to send written notice to clients about the procedure for merging with another structure.

In case of early transfer to another fund or Pension Fund, investment income for a certain period of time may be lost. We are talking about changing the fund more than once every five years.