Municipal employee status

The defining features of this type of professional activity of citizens are set out in legislation. The differences between municipal service and other types of employment are:

- work on a permanent basis in positions in local government structures;

- financing from the local budget.

Like civil servants, local government employees have the opportunity to receive an additional pension. At the same time, municipal employees do not include persons who ensure the work of local administrations using various technical means (for example, cleaners, security guards, electricians, etc.). Subjects of the Russian Federation independently establish lists of positions that serve as the basis for drawing up staffing schedules. The table shows options for classifying workers in accordance with the following registers:

| Subdivision principle | Examples |

| Scope of powers available | Head of municipal administration, head of a territorial structural unit, head (manager) of a department. |

| Level of education received and skills by profession | Chief specialist, leading specialist, category 2 specialist. |

| Qualification category | Acting municipal councilor 1st class, senior assistant of the municipal service 2nd class. |

Legal regulation

The basic legal framework defining pension provision for municipal employees is set out in federal laws. This includes:

- No. 166-FZ “On state pension provision in the Russian Federation” dated December 15, 2001. This legislative act considers the general principles of calculating pensions for citizens of the Russian Federation and the emergence of the right to this type of social support.

- No. 25-FZ “On municipal service in the Russian Federation” dated 03/02/2007. This law explains relevant concepts and terminology. Here the circle of persons who are municipal employees is designated and their rights are determined.

- No. 400-FZ “On insurance pensions” dated December 28, 2003. Here we consider the general provisions for the appointment of state benefits in old age, for example, at what age the right to these social benefits becomes available.

Regional legislation supplements and specifies basic regulations, for example, determines the specific amount of payments. Federal Law No. 166-FZ sets the minimum pension at 45% of the average monthly wage (AMS). Local laws may increase this figure. Thus, in the Moscow region, the standard amount of such deductions for municipal employees is 55% of the SOT.

Question answer

You should prepare for retirement in advance by finding out, for example, what length of service is required for this and at what age you can apply.

Experience for retirement

Length of service in municipal bodies - the total duration of work in the municipal service, including time spent working in the municipality, in the civil service in the constituent entities of the Russian Federation, as well as in the state civil and military services, but with receipt of remuneration from the municipal authorities.

This is important to know: Formula for calculating military pension in 2020

Other periods of work may also be included in the length of service.

Retirement age for municipal employees

According to the new Federal Law of the Russian Federation, municipal workers retire at 63 and 65 years of age. But this retirement age will be reached gradually. So, in 2019, you can receive payments upon reaching 56.5 and 61.5 years.

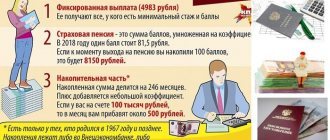

Types of pensions

Rights and benefits for municipal employees are established by federal and local legislation. The state support defined by him contains:

- Long service pension. It is financed from the regional budget. In addition to officials, representatives of professions associated with risk to life - military personnel, rescuers, test pilots, etc. - have a similar benefit for length of service.

- Insurance payment for disability or old age. This subsidy has federal funding and is assigned on a general basis.

- Various surcharges. It is necessary to have the right to receive them, so they are not paid to all pensioners.

The municipal long-service pension supplements the state old-age or disability benefit up to a certain limit. In general, the total amount of the two payments should not exceed 75% of the average monthly salary for the last year worked. In this form, it is fair to consider municipal payments not as an independent state benefit, but as an additional payment to the existing one (insurance or disability).

- Additional payment to pensions for flight crews of civil aviation vessels

- Pickled eggplants for the winter - step-by-step recipes for cooking at home with photos

- How to calculate early repayment of a loan at Sberbank

Minimum and maximum pension amount

Suppose a municipal employee meets the criteria that allow him to count on a long service pension. What size is she? If you want to find out how to solve your particular problem, please contact us through the online consultant form or call :

The legislation of the Russian Federation establishes that the long-service pension is 45% of the average salary of a municipal employee. At the same time, we repeat, for each year worked over 15 years, you are paid in the form of a bonus of 3% of average earnings.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Its maximum size is 75% of the salary level. This means that pension payments are calculated not from the established salary, but from the monetary allowance, which includes official and rank-appropriate salaries, allowances for special conditions of service, monthly incentives and other payments due to a municipal employee. We also talked about the minimum size above. This type of pension cannot be lower than the minimum wage. A long-service pension for those persons who left service due to disability is paid in the amount of:

- for groups 1 and 2 - 75% of the monthly allowance;

- for group 3 - 50% of the allowance.

Long service pension for municipal employees

State support of this type acts as compensation for increased workload when performing work duties. According to current legislation, a municipal employee's pension for long service is due to all officials of local administrations if they have specialized experience, the duration of which is determined by law. The period of work in the municipality is also taken into account when determining the employee’s right to additional payments to his pension.

Conditions of appointment

In order to qualify for a municipal pension, it is not enough to be an employee of the local administration. You can receive this government payment only if you fully comply with the requirements set out in Law No. 25-FZ. The table shows the conditions, upon fulfillment of which the citizens are assigned state payments:

| Peculiarities | Federal legal requirements |

| Municipal service experience | In 2020 - at least 16 years (with the requirement to work in one position for 1 year or more). This entitles you to payments of 45% of the average monthly salary (unless higher values are established by local legislation). For each year worked above the standard, the amount of state benefit increases by 3%, but the maximum allowable amount is 75%. |

| Specific reasons for dismissal | To receive state benefits based on length of service, dismissal from work must be:

|

| Last place of work | For the last 12 months, the person must be employed in the municipality and from here his dismissal based on length of service must occur. If this condition is violated (for example, taking another job), the citizen loses the right to state pension payments for length of service in municipal work. |

How is it calculated

When calculating the amount of state support for length of service, you need to take into account that according to the law, the amount of labor and municipal pensions should not be higher than 75% of the employee’s average monthly salary for the last year. In this case, in order to find out the amount of payments that a citizen will receive in person, you need to calculate the full amount of the benefit and subtract from it the amount of state old-age benefits. The calculation is carried out using the formulas DSP = PVL – RSP and PVL = SMZ x PS, where:

- DSP is an addition (supplement) to the insurance pension.

- VSP – the amount of the insurance pension (fixed part and bonuses).

- PVL – long service pension. By law, this value (or the value of DSP + RSP) is limited to 75% of the SMZ and should not exceed the official salary by more than 2.3 times.

- SMZ – average monthly salary.

- PS – interest rate set depending on length of service. Its basic size is 45% (unless otherwise established by local legislation), which means that the minimum value of municipal-type state pension provision is equal to SMZ x 45%.

- Cat carrier - how to choose a soft, plastic, backpack or basket based on characteristics and price

- Pickled cauliflower - step-by-step recipes for preparing it for the winter in jars with photos

- Temperament types

For example, you can find out the amount of payments for length of service to an employee with 20 years of specialized experience, in the last year of work he had a salary of 20,000 rubles, an average monthly salary of 60,000 rubles and received state old-age payments in the amount of 32,000 rubles. The calculations look like this:

- This employee has worked 5 years in excess of the required rate, which means that 3% is added to the minimum rate determined by the state for each year worked: PS = 45% + 3% x 5 years = 60%.

- PVL is calculated = 60,000 rubles. x 60% = 36,000 rubles. This value does not exceed the maximum values established by law (60,000 rubles x 75% = 45,000 rubles and 20,000 rubles x 2.3 = 46,000 rubles).

- The result is a supplement to the labor pension: DSP = 36,000 rubles. – 32,000 rub. = 4,000 rubles.

Features of calculating pensions for municipal employees in 2019

First of all, about terminology. Who are municipal employees?

This is important to know: Payment for travel for military pensioners to a place of rest

As follows from Article 10 of Law No. 25-F3, a municipal employee is a person who was hired for a vacant full-time position in an institution that has the status of “municipal” and receives monetary remuneration for the performance of his official duties from budgetary funds.

The positions that these workers can occupy are divided into five categories:

The right to receive pension benefits for municipal employees is regulated by federal laws No. 166-F3 and No. 25-F3. According to these laws, pensions for civil servants are calculated not according to old age, but according to length of service.

Expert opinion

Grigoriev Pavel Kirillovich

Head of the department for conscription of citizens for military service of the Russian Federation

A pension is assigned to a municipal employee in 2020 if the applicant has worked in the municipal service for the minimum calendar period possible for retirement and has reached retirement age.

Insurance pension

Obtaining labor-type pensions for municipal employees does not differ from the generally accepted procedure. By meeting the basic requirements, an official can receive an insurance pension, completing the required municipal experience. The table shows the conditions for the appointment of different types of state support, according to Law No. 400-FZ:

| Types of insurance pension | Terms of service |

| By old age | Simultaneous compliance with the specified requirements (data are indicated for 2020, in the future they will increase to the limit established by law):

|

| By disability | Assigned when an employee receives group I, II or III disability (regardless of the reasons). An indispensable condition for the appointment is the presence of insurance experience (if it is completely absent, a social pension is assigned). |

Pension insurance for local government employees is subject to the requirement of Law No. 400-FZ on mandatory indexation. Every year, the amount of payments is equal to the inflation rate for the second quarter of the previous year, so on January 1, 2018, this type of state benefits increased by 3.7%.

Procedure for appointment and registration

The correct procedure implies that first the citizen applies for an old-age retirement pension. To do this, he needs to contact the territorial branch of the Russian Pension Fund when he becomes eligible for this type of social benefits (after turning 55 for women, and 60 for men). State old-age benefits will be assigned from the date of application. Having applied for a retirement pension and having the necessary length of service, the employee must contact the human resources department at his place of work in order to be assigned a pension.

What documents need to be provided

Applying for a municipal pension involves preparing an application. It is drawn up in free form and in it the citizen, with reference to Law No. 25-FZ, notifies the employer of his right to this type of payment. The application is accompanied by the following package of documentation:

- passport of a citizen of the Russian Federation;

- a copy of the dismissal order;

- work book and other documents confirming specialized work experience and positions held in the municipality;

- certificate of compulsory pension insurance;

- military ID (for those who served);

- a certificate confirming income for the last 12 months;

- document confirming the assignment of an old-age pension.