The Australian pension system is one of the most advanced pension systems in the world. It is significantly different from the Russian one. For example, on the Green Continent, older people, whose earnings during their active working years were smaller, receive more state support. Also, pensions in Australia are based on wealth. At the same time, problems associated with the aging of the nation are beginning to appear in the country.

Who is entitled to pension payments?

Anyone for whom emigration to Australia has long been a reality, who has lived and worked in this country for ten years or more, is considered sufficiently Australian to qualify for a pension from a certain age. True, this “certain age” may come as a surprise to yesterday’s Russians - people here retire a little later than here. Women - from 64 years old, men - from 65. It is believed that up to this age a person is quite capable of working. Which, given the quality of life and medicine in the country, is completely justified.

Requirements for receiving a pension

In addition to age requirements, a citizen must also meet residency requirements, namely:

- Be a resident of Australia and be physically present in the country on the day of application

- Live in Australia for at least 10 years

- And have at least 1 period of continuous residence in the country for 5 years.

There are exceptions to this rule if the applicant is a refugee or receiving widow's benefits.

Income Requirements

To receive a state pension, a future pensioner also needs to prove that he receives insufficient income. In other words, if a citizen at retirement age earns sufficient income, he is not entitled to receive an old-age pension. For 2019, this income per person is $2,024.40.

No need to work

You only need to be Australian to receive the State Pension. It doesn't matter if you're a purebred or a migrant. Only resident status for 10 years

, it is he who gives the right to pension payments in old age.

The state pension is a guaranteed income.

But it’s not the only one: besides it, there are private pension funds and various investment programs that make it possible to increase the size of monthly payments.

High pensions and the resort climate of the coast make Australia attractive to expats

Note to emigrants

Canada has concluded agreements on the mutual exchange of pension contributions with 49 countries.

According to the laws of this country, taxpayers planning to immigrate are required to obtain a certificate of the status of their retirement account every 36 months. It is recommended that you order this information every year.

All contributions to the Pension Fund reduce income, which is taxed.

A pension transferred to a person in exile is paid only after submitting the appropriate application.

Find out how to immigrate to Canada and whether you need a visa to enter on our website.

Return to contents

Old age pension

The retirement age in Australia is: - for women: 64 years - for men: 65 years. Not only age is considered a condition for paying a pension, but there are also additional conditions related to the financial difficulties of an Australian resident.

Retirement age in Australia

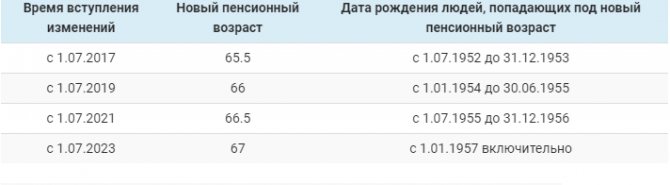

However, this idea was abandoned in 2017. Nevertheless, a law was passed according to which the age limit for retirement will be raised to 67 years by mid-2023. The provisions of this regulation apply only to people born after July 1952.

More detailed information is presented in the table:

But in Australia there are also opponents of such half-measures. They said that the decision to abandon retirement at age 70 would cost the state budget AUD 5 billion.

In the third quarter of 2020, life expectancy on the Green Continent is 84 years. According to forecasts, every fifth resident of the country will be over 65 years of age by 2045, which will lead to a manifold increase in the volume of pension payments.

Features of the Australian pension system

There are a number of certain purely Australian aspects of receiving a pension that you need to know if you are going to receive a pension in this country.

So, there is a rule in the Australian pension system that means that the more income a person has, the less his state pension will be.

It is important to know! In Australia, private pensions are also included in the income list.

Thus, a married couple can expect to receive a full pension if their joint income is less than 230 Australian dollars, and a single pensioner will receive full pension payments with an income of less than 130 Australian dollars.

Attention! A pensioner risks depriving himself of government benefits while having additional income.

That is why in Australia, people of retirement age try to regulate their income and keep it below the threshold set by the state.

If we talk about the most profitable type of accumulation of pension funds, then today private pension funds , which the state responsibly controls, are in demand. Payers will have access to the money upon reaching retirement age.

Pension in Australia - how much do they pay?

The average payment for a single citizen after retirement is $500 monthly. An elderly couple is entitled to an average amount of $900. The pension is subject to changes from year to year due to fluctuations in the economy and changes in the external political environment.

The size of payments is reduced when owning large private property, up to the deprivation of a pension. If, according to the authorities, a citizen owns real estate for a large amount, then he is able to live on personal savings and does not need support from the state.

For this reason, wealthy Australian citizens are trying to reduce their average income to the normal level, as they value special preferential opportunities for pensioners on the continent. In this case, after reaching retirement age, they receive minimum payments and retain benefits.

Be sure to read it! Insurance payment in case of an accident: how to get compensation according to the law in 2020?

How to get extra income

One real opportunity to improve the future financial situation of Australian seniors is to receive additional income through the Super co-contribution scheme. It provides for an increase in the funded part of the pension during the period of active work.

For each voluntary contribution made by an employee to the pension fund, the state adds a certain amount to his account. Its amount depends on the level of income and the size of the additional payment.

To get an idea of how much will be added in 2020, check out the data presented in the table.

| Official income, AUD | Amount of additional contribution, AUD | |||

| 200 | 500 | 800 | 1000 | |

| 50564 | 100 | 100 | 100 | 100 |

| 47564 | 100 | 200 | 200 | 200 |

| 44564 | 100 | 250 | 300 | 300 |

| 41564 | 100 | 250 | 400 | 400 |

| 38,564 and less | 100 | 250 | 400 | 500 |

For income equal to or greater than AUD 53,564, no additional amount is transferred to the employee's account. Residents of Australia under the age of 71 can take part in the Super co-contribution program.

Another option to increase your future retirement benefit is to create your own pension fund. Entrepreneurs can do this. With the right approach to investing, funds of this type can bring significant income.

The state encourages such activities of entrepreneurs by reducing their tax rate on profits received by 2 times.

Find out about income, property and salary taxes in Australia.

Types of contributions to pension funds

Tax deductions in pence. Fund of Canada are made for all officially employed citizens. The tax rate has a fixed rate and has been equal to 4.96% of the monthly salary since 2013. The same percentage is charged monthly to employers if they are not included in the “self-employed” group, since for employers in this category the interest rate is 9.92%.

Tax deductions in pence. The fund is levied only on those financial sources that fall within the range of the state-established minimum ($3,500 per year) and maximum ($53,500 per year), the amount of which can be indexed each year.

There are 2 types of pension payments in Canada:

- OAS is a universal pension that is awarded to people who have reached the age of sixty-five, regardless of their monthly income. The only condition for receiving such a pension is that the citizen has resided in Canada for at least 10 years.

- SPP are pension payments that are accrued from the age of 60, provided that the citizen has made contributions to the pension fund every month throughout his life without delay.

If a person lives in Canadian territory for most of his life, that is, more than 20 years, then pension payments are accrued to him even if he subsequently resides in another state.

If a person who has lived in Canada for less than 20 years retires and leaves the country for a period of more than 6 months, then the pension is temporarily suspended until the citizen returns to his “homeland.”

Retirement age in Canada

The retirement age in Canada for women is 65 years. Taking earned leave may be slightly delayed, but not longer than 4 years 11 months, provided that the person legally has permanent residence within the country.

This privilege makes it possible to earn a substantial pension, the size of which will exceed the old-age pension by 31%. But not everyone benefits from using such a privilege, namely:

- People who have not lived in Canada for more than 20 years;

- Citizens leaving the country for more than 6 months, or living in the territory of another state.

It is important to understand that by voluntarily deferring a pension, a Canadian is deprived of the right to receive additional benefits.

The state retirement age in Canada for men is also 65 years. Men, like women, can leave earlier or later, subject to the established rules.

Structure of the Australian pension system

The structure of the pension system, which is based on a complex of two types of pensions, is attractive for older people:

State

Financed from the state budget, paid to a citizen of the country or a person from another state who has reached 65 years of age. You do not have to work to receive an old-age pension.

The salary doesn't mean anything. But at the same time, the presence of income and real estate is taken into account. The purpose of such a pension is to ensure a normal standard of living for older Australians. To receive a state pension, it is necessary to fulfill the conditions that apply to native residents and emigrants from other countries, including from Russia:

- Be a citizen of the country and have resided on its territory for at least 10 years.

- For expats, be in Australia when you reach retirement age.

- The amount in the bank account should not exceed 50,000 AUD.

- If there is a land plot, its area should not be more than 2 hectares.

- The total value of all property should be assessed at a maximum of 160,000.

Failure to comply may result in the pension being reduced or denied altogether.

It is believed that if a family has the opportunity to purchase expensive real estate, then they can have income from its use.

Private pension (Superannuation)

Australians with a formal job can count on a private or funded pension.

By law, employers are required to contribute 9% of an employee's salary to a private pension fund, provided the employee is over 18 years of age and works more than 30 hours a week. By 2025, the government plans to increase the percentage of contributions to 12%.

The employee has the right to choose his own pension fund. There are a huge number of them in Australia, and they differ in the size of the entry fee and the percentage that is charged on service fees.

The fund can be changed at any time. This is very easy to do - you just need to call the newly selected pension fund or fill out a special form (Rellover Form) on its website.

After the employee decides on the fund, he can choose whether to leave the transferred funds for storage at a fixed percentage or invest. There are several options for investment - shares of Australian or foreign companies and real estate. If the investment was successful, the fund returns the interest and the pension grows. In this way, pension funds support the country's stock exchange.

Most funds provide clients with the opportunity to track their pension savings using an online account. There you can transfer money from one type of investment to another.

Money from the fund can be withdrawn upon reaching 60 years of age. The accumulated amount is not subject to tax. The pensioner himself decides what to do with them - buy a villa on the seashore or add to the state pension.

Other types of pensions and benefits

In Australia you can get a pension that is not age related. Parents can count on state help. The government redistributes the amounts collected from taxes, trying to help everyone who is raising a child.

A woman who divorces and is left with small children in her arms will not vegetate in poverty. The state will support her financially, paying about $16,500 per year. Mom is also entitled to the benefits that pensioners have. A small child is considered to be one who has not yet reached the age of 8.

In addition to money and benefits, single parents have the opportunity to obtain public housing. Although you will have to pay rent, it is minimal. This is very often used by divorced women to reduce their expenses.

The pension received for children is also calculated individually depending on the income the mother has. The minimum amount for the year is $5,179, and the maximum is $47,330.

Be sure to read it! Responsibilities of an employee in the field of labor protection: what the law says

Not only single parents can count on state help when raising children. A pension is provided for children and married couples if they have a small income. Getting this help is not so easy: a number of conditions and requirements have been developed that applicants for receiving benefits must fulfill.

Citizens who are unemployed and do not receive pensions can count on unemployment benefits. Even those who have not yet lived in the country for 10 years can count on it. Often those who have just arrived in the country or people who are not yet entitled to an old-age pension apply for it.

It is quite possible to live on unemployment benefits in Australia, as the amount is $250 per week.

There are many different types of assistance in Australia. The government cares about the citizens of its country.

Benefits and allowances

Pensioners, in addition to the actual financial state assistance, receive a discount on a considerable number of services. Of course, for a proper vacation, for example, in the same boarding house, they will have to pay, but to get there by public transport, they will be able to buy a ticket at a reduced rate.

In addition, pensioners who receive some other income pay less taxes.

The purchase of pharmaceutical products deserves a separate discussion. Most pensioners are issued cards for the purchase of medicines: Commonwealth Seniors Health Card or Health Care Card. The bearer of such a document can buy the drug at the minimum price. Moreover, the real cost of the medicine does not play any role: it costs 50 or 15 AUD, the card holder will pay about 4 AUD in any case.

In addition, for elderly people who do not have their own home, the state partially compensates for rental costs. The amount of such assistance for a single pensioner or for a family couple is 3,000 AUD/year.

In Australia, it is possible to receive pensions that are not age-related.

The state will always come to the aid of parents who are raising young children. According to the law, a woman who divorces and is left with a small child in her arms will be paid approximately AUD 16,500 per year until the baby turns 8 years old.

The pension that a mother receives for her children is calculated individually, taking into account her income. The minimum volume is 5,179 AUD/year, and the maximum is 47,330AUD.

Single parents, in addition to money, have the opportunity to receive housing from the state. They still need to pay rent, but it is small.

Married couples with a small income and raising children can also count on a pension. However, receiving funds is not easy: applicants for such benefits must meet a number of requirements and fulfill certain conditions.

Unemployment benefits are paid to people who have lost their permanent job and are not receiving a pension, even if they have lived in Australia for less than 10 years.

Benefits for pensioners

In addition to regular cash payments, pensioners in Australia are entitled to various benefits. The main ones are the issuance of special cards that make it possible to buy medicines and essential goods at significantly reduced prices. Preferential travel on all types of public transport and tax benefits for working and retired citizens.

Seniors in Australia are provided with large discounts throughout the country - in shops, cafes and restaurants, hotels and inns. The pensioner is also entitled to a free intercity ticket within the country once a year.

As for utilities, certain categories of pensioners are also provided with discounts - on electricity, telephone, etc. However, the size of the discount depends on the city. In various states of Australia, retired citizens are additionally provided with various allowances and surcharges.

What is the average payout?

The dependence of an Australian's pension on his previous income still exists - but in the opposite direction. The more a person earned, the lower the amount of pension payments will be (if he lived well - he could save): 500-700 Australian dollars. The maximum payment is received by those whose annual income does not exceed 4,000 - they are entitled to $1,590 per month if a single person, and 1,200 if married.

If a citizen owns expensive real estate, the state does not award him compensation, since the property can be rented out. And if he has dependent children, he receives additional payments. That is, support is distributed according to the principle of “who needs it most.”

In addition, there are other benefits:

- subsidy for rent if you don’t have your own home;

- discounts on medicines using a special card and utility bills;

- tax benefits for working pensioners;

- discounted travel on public transport, etc.

Funded pension

The country has a non-state funded pension system, i.e. All working citizens are entitled to a private pension financed by individual contributions. The size of such contributions can reach 9%. The funded pension can be used by residents of the country who work at least 30 hours a week.

There are many superannuation funds in Australia, and the number continues to grow. The employee must independently choose the fund, and, if necessary, can change it. With the introduction of electronic systems, these procedures have been greatly simplified, and today any citizen can choose the fund that suits him via the Internet by filling out the required form on the pension fund website.

Having reached the age of 60, a working citizen has the right to withdraw the accumulated amount from the fund and use the funds received at his own discretion. The funded part of the pension can also be increased at the expense of the state if the citizen takes advantage of a number of special programs.

How is a pension issued to a foreigner?

Residents of the country, as well as immigrants, can receive a pension in Australia. The latter are subject to the following requirements:

- availability of a permanent visa;

- Duration of residence in the country is at least 10 years. The total time is taken into account, but the duration of one of the periods must be at least 5 years.

Issues related to the assignment of pensions, including for immigrants, are dealt with by the Centrelink agency, an analogue of the Russian Department of Social Protection.

To apply for a pension to this organization you must provide:

- A document capable of proving identity.

- Tax number. Those foreigners who do not have one need to take a special form from Centrelink, fill it out and send it to the tax office at their place of residence. In a few days the TFN tax number will be ready.

- A document confirming 10 years of residence in Australia. This can be done by a certificate from a local employer.

The pension will be issued if there are no comments on the submitted documents.

Retirement benefits for Canadians

The size of the increase depends on the amount of salary paid to the pensioner; the fact of whether the person is in a marital relationship also has an impact. To confirm your income, you will need to file tax returns, which must be done annually. However, the deadline for submission is limited to the end of April.

If a citizen requires additional assistance, he needs to perform a certain sequence of actions.

Including:

- if a person plans to enter into a marriage relationship, then he needs to fill out a special form. Similar rules apply to the situation when a citizen divorces;

- to download the form you will need to go to the official Service Canada portal;

- when married citizens do not live together apply for an additional payment, they can receive additional payments intended for a single pensioner.

These actions assume that the person contacts the authorized body and submits a completed application. If a person receives basic payments and uses additional payments, then the amount of his security is on average 1.5 thousand dollars per month.

At the minimum, married couples receive $1,090 each. The amount is indicated per month. The amount of the allowance for a person with additional income is reduced depending on the profit for the month.

Important! When a citizen’s income is 17.4 thousand dollars, he will not be able to count on an increase. For family individuals, this limit is set at $23 thousand.

How is pension calculated?

For Canadian pension contributions, the value is set at $1,066 per month. The indexation process is of annual importance , and it is constantly implemented in early January. A prerequisite is to take into account the level of inflation.

It is stipulated that it is permissible to register a pension status only after a citizen reaches seventy years of age. Pension payments, which are calculated for each month overworked or underworked by a person until he reaches 60 years of age, can be increased or decreased. The approximate amount of change is half a percent.

Over the entire period of time, pension contributions can be increased or decreased by approximately 31 percent.

Minimum, average and maximum pension

The amount of pension payment depends on how many years citizens have lived in the territory of the state in question. This means that a person can expect to receive benefits in full or in part. At its maximum, monthly payments equate to approximately $573.

This amount is paid to those who have lived in Canada for more than 40 years.

The amount of a partial pension depends on how many years a person has lived in the country:

- 10 years before retirement age;

- 14 years old.

In the first case, the amount is set at $143, in the second – $200.

Allowances

Almost all citizens who live in Canada are entitled to allowances. They are referred to as GIS. This amount is due to those who have a monthly income level that is less than the subsistence level.

The amount of the increase is affected by marital status and income . The higher this indicator, the less the increase will be. When a citizen receives 17.4 thousand rubles in a month, this deprives him of the right to receive an additional payment. For a family of pensioners, this value is 23 thousand.

Reference! The amounts paid to pensioners are correlated with the cost of living. If a citizen is single and has applied for an allowance, then the amount will be about 1.5 thousand rubles.

It is also useful to read: Pension and retirement age in Italy

The state of pensions in Australia today

Today the average pension in Australia is $2,610. Like other countries around the world, Australia's population is noticeably aging.

It is expected that by 2030, 25% of the population will approach the retirement age limit and cross it.

That is why the state is trying to make the pension system as thoughtful as possible . This gives a positive result.

From 2020, the government plans to gradually increase the retirement age. To begin with, the retirement age will move from 65 years to 67 years, and then rise to 70 years.

Today, compared to 2020, there is a sharp decrease in the size of the state pension. The fact is that according to this item, income growth is not desirable. Experts predict that a gradual reduction in pension benefits from the state is inevitable in the future.

Today, Australia is one of the top 12 countries with policies that allow retirees to live comfortably . This is not surprising, because the government of this country strives to teach citizens to provide for themselves in old age, first by paying taxes responsibly.

Future retirees are offered several profitable ways to receive a pension . This allows each Australian citizen to determine for himself what type and amount of pension is acceptable to him.

Pension Plan in Canada: 4 Most Frequently Asked Questions

What will my pension benefits be?

Less than you think. The maximum eligible monthly benefit for 2010 is $934, starting at age 65. In addition, most do not receive the maximum possible benefits, so to be sure of what you are expecting, you must contact Service Canada and request a statement containing information about your contributions and contributions.

In general, it is not easy to meet the requirements set for receiving the maximum possible monthly payments. To do this, you will need to have 40 years of full-time work experience, which occurred between the ages of 18 and 65. Add to this the trend of more and more people retiring before age 65, and you're getting less and less of your maximum.

Can I take early retirement?

The Canada Pension Plan provides for retirement at age 65. Despite this, you can retire either earlier (no earlier than 60 years old) or later (no later than 70 years old). For a better understanding, let's look at twins Janet and Beth. Let's assume they both qualify for the Canada Pension Plan at $900/month at age 65. Next, Beth decides to take early retirement at age 60 at a reduced rate, while Janet plans to wait until age 65, since the amount of her monthly benefit will increase by delaying her retirement date by 5 years.

Under the Canada Pension Plan rules, Beth can retire at age 60, subject to a 0.5% attenuation rate for each month before her 65th birthday. Therefore, Beth's pension benefits would be reduced by 30% (0.5% x 60 months = 30%) and the monthly benefits that would begin when she turns 60 would be $630.

Let's fast forward 5 years. Beth and Janet are both 65. Over the past 5 years, Beth has saved $37,800 at $630 a month. In other words, before Janet received her first pension check, Beth already had $37,800. So Janet starts earning $900 a month, which is $270 more than Beth. Now the question is, for how many months does Janet need to receive higher benefits than Beth to “catch up” to the amount of $37,800 (the amount Beth had accumulated by the time Janet’s pension payments began)? It will take Janet 140 months (11 years, 8 months) to reach Beth's level of savings. In other words, Beth will be ahead (having more money) before her 77th birthday, and Janet will be ahead after her 77th birthday.

From a lifestyle perspective, it is controversial that Beth will be happier with the amount of income she receives from ages 60 to 77, and it is also controversial that Janet will receive more money than Beth after age 77.

This example is very simplified. Taxes, investment income, etc. are not taken into account here. No matter what, the bottom line is this: by retiring earlier, you will receive a larger amount faster, but in the long term the savings will be less.

Can pension payments be divided?

The Canada Pension Plan allows spouses to share benefits with each other. The premise here is that the separation must be mutual.

Let's return to our characters. Beth married Larry. As in the previous example, she retired early and receives $630 per month. Her total income is quite low and she pays taxes at a marginal tax rate of 25%. Larry is 5 years older and earns a salary of $850 per month, in addition to being retired, which makes his total income much higher than Beth's. Its marginal tax rate is 32%.

The way the Canada Pension Plan works is that each party contributes its share of the pension plan. In other words, to get the idea, you just need to add the two values (in this case, $850 and $630) and divide by 2. As a result of the division, Larry's pension payments will drop from $850 per month to $740 per month. Janet's income, in turn, will increase from $630 to $740 per month. As a result, $110 of monthly income will be taxed at a rate of 25% instead of 32%.

Please note that Canada Pension Plan requires both parties to be 60 years of age or older to share benefits. To effect such a division, spouses must submit an application.

In the event of the death of one of the spouses, the remaining spouse will begin to receive pension contributions in their previous amount. For example, if Beth had passed away, Larry's payments would have increased from the $740 per month to the $850 per month he originally received.

Does the size of my pension depend on my income?

In short, no. There are no strict provisions in this regard in the pension plan. Similar interactions are possible, but within the framework of other pension programs.