How are maternity capital and mortgage related?

Maternity capital is provided within the framework of Federal Law No. 256 of December 29, 2006. The Law defines who the payments are intended for, the procedure for obtaining a certificate at the birth of a child, and for what purposes the funds can be spent.

One of the areas for spending money is the purchase of finished housing, an apartment in a building under construction, or individual housing construction. The funds can be used to pay off existing mortgage debt or to make a down payment on a loan to purchase real estate. (Article 10 of Federal Law No. 256).

Methods of using maternity capital in a mortgage

Today, the amount of maternity capital is 466 thousand 617 rubles (the amount is indexed from January 1, 2020). These funds, as a rule, are enough for 10-40% of the cost of housing, depending on the region of residence. Using maternity capital allows you to significantly save family money and close your mortgage in a shorter time.

Capital can be spent on a mortgage loan in several ways:

- Payment of the down payment . Not all banks operate according to this scheme, so during the initial consultation it is necessary to inform the bank employee that the first installment is paid from capital. In any case, most banks do not allow capital to be used as 100% of the contribution. In this case, the borrower needs to pay at least 5% of the cost of housing from personal funds (it is possible to raise capital in this way only after the child turns three years old).

- Repaying the principal debt ahead of schedule . This method is interesting when the mortgage was issued before the right to maternity capital arose. It is most convenient for both parties. The borrower makes an early repayment, due to which he can reduce the required payment or the loan term. For the bank, such a procedure does not carry any risks.

- Payment of interest on the loan . This scheme is used extremely rarely. It is interesting for the borrower only if he does not plan to make early repayment in the future. The bank receives a guarantee that interest will be paid.

What can the funds be used for?

- Repay a loan. If there is enough money to fully repay the mortgage with maternity capital, the borrower will be able to pay the debt in final payment.

- Pay interest and partially the loan body. This option is suitable for borrowers who have paid their mortgage not long ago and still have an impressive debt balance. In case of partial early return, the amount of overpayment for the transaction is reduced. The debtor will be able to reduce monthly payments or the loan term.

- Making a contribution using your own funds. Having a down payment will allow you to obtain a mortgage on more favorable terms, a favorable interest rate will be offered, and the loan amount will increase.

Banks allow early and partially early repayment of debt, no penalties are collected, and no additional conditions are imposed. The main thing is to fill out the application correctly and comply with the repayment regulations.

Having a certificate does not guarantee getting a mortgage!

Banks allow funds to be invested in a mortgage transaction, but this does not increase the likelihood of issuance. If the applicant is declared insolvent or has a bad credit history, the lender will refuse to issue the loan, regardless of whether the client has maternity capital.

How much does it cost to allocate shares to children from a notary?

Notary services for the allocation of shares after repayment of the mortgage with maternal capital are paid. The amount of the amount that will need to be paid in favor of the specialist is set forth in paragraph 5 of Article 333.24 of the Tax Code of the Russian Federation. The specialist will charge 0.5% of the amount specified in the sales contract. Certification of the gift agreement is paid separately. The cost is influenced by the cadastral price of the property. The citizen must pay 0.2% of the contract amount + 3,000 rubles.

Additionally, you need to provide a state fee for registering property rights in Rosreestr. Its size is 2,000 rubles (333.33 Tax Code of the Russian Federation).

Basic requirements and mortgage repayment procedure

Basic requirements are established in Art. 10 Federal Law No. 256:

- You can purchase real estate located in Russia.

- In residential premises, a share must be allocated for spouses and minor children.

- Funds are provided to one of the parents, most often the mother is the owner of the certificate.

- Funds can only be used to improve housing conditions: for the purchase or reconstruction of housing, for concluding a management agreement, for individual housing construction.

- The loan must be obtained from a bank, credit cooperative or AHML (House of the Russian Federation).

- You can pay off the actual debt and/or interest; the funds cannot be used to pay fines, accrued penalties, commissions, etc.

- The transaction is carried out in a non-cash form, so the real estate seller must have an account to which the funds will be transferred.

- In order to prevent fraudulent cash transactions, purchasing residential premises from relatives is not allowed.

- You can use all or part of the funds in the account. Money is allocated not monthly, but in one amount.

Regardless of who the certificate is issued for, the state allocates funds for the whole family. Therefore, if a spouse who is not the owner took out the mortgage, you can use the funds to pay off the debt.

You can spend money on repaying a housing loan without waiting until your child turns 3 years old

In order to repay the mortgage, you will need to agree on a deal with the pension fund and the creditor bank.

Notarial obligation to allocate shares in maternity capital

Within the framework of the Rules approved by the Government, the obligation to allocate shares to the spouse and children in residential premises acquired using maternal capital funds can only be formalized by a notary or a person authorized by law to do so. The original of the obligation remains with the Pension Fund of Russia, and a copy is transferred to the holder of the certificate (the person who gave the obligation).

A simple written form of obligation drawn up without the participation of a notary has no legal force and is not accepted .

The obligation is given by the person who has the right of ownership of the residential premises. It could be:

- certificate owner;

- spouse;

- both spouses, if the two of them are buyers (purchasers) of housing or co-borrowers on a mortgage.

including adults , should be allocated shares under the obligation .

To formalize the obligation, you should contact any notary office and provide the required package of documents. When drawing up this document, the person(s) giving the obligation must be personally present.

Parents must sign the pledge together in cases where they are:

- co-borrowers on a mortgage loan;

- parties to the agreement (buyers, participants under the contract, etc.).

What documents are needed to register an obligation with a notary?

To draw up a document containing a person’s obligation to allocate shares in a residential property purchased using maternal capital funds, the following documents (copies are possible, with the exception of a passport):

- Passport of the certificate holder and/or her husband.

- Birth certificates for all children.

- Documents on the adoption of a child (children).

- Marriage registration certificate.

- Maternity capital certificate.

- Title documents for residential premises (purchase and sale agreement, residential building agreement, land agreement for the construction of individual housing construction, extract from the register for cooperative members, etc.).

- Certificate of state registration of ownership of residential premises and/or land (from January 1, 2020 - extract from the Unified State Register of Real Estate EGRN).

- Loan agreement and mortgage agreement (if any).

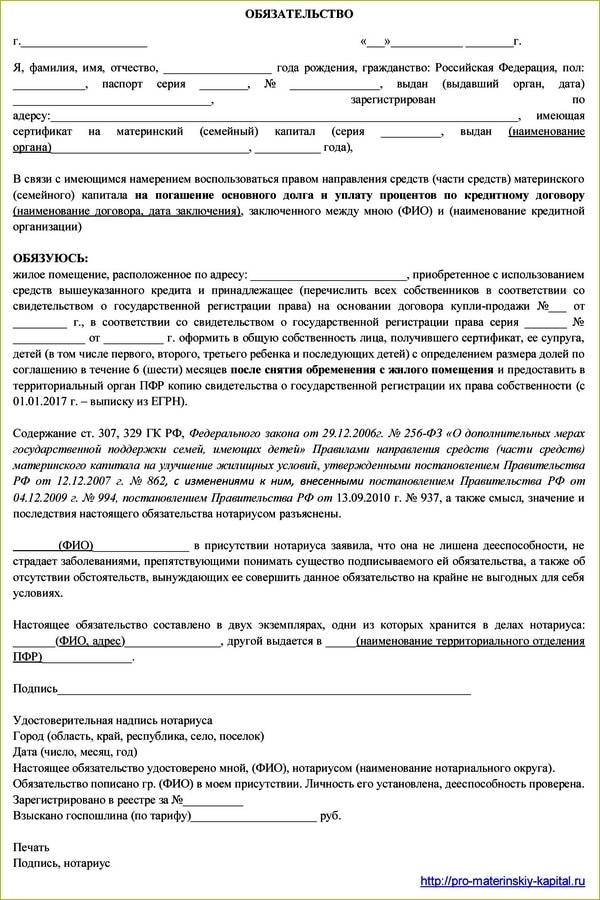

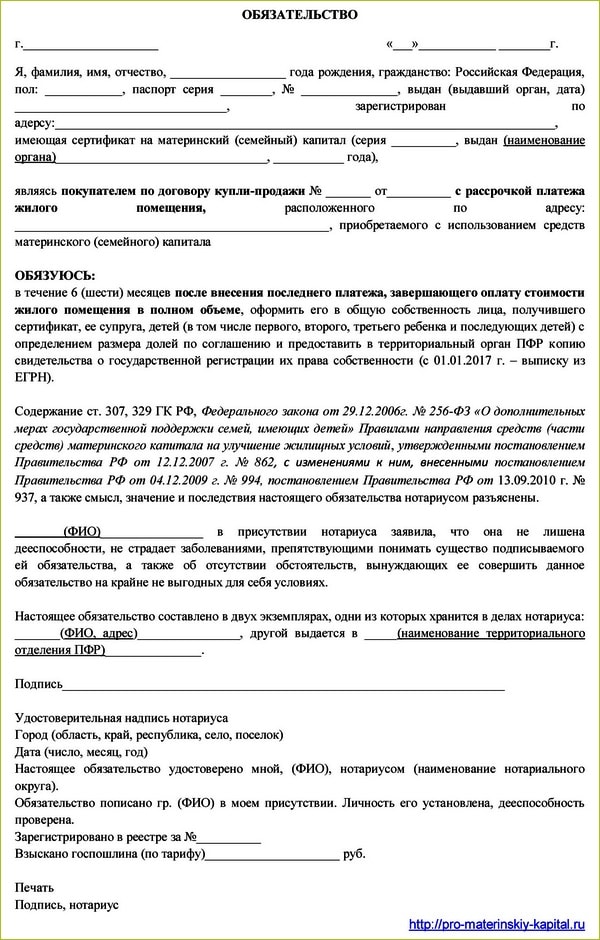

Sample obligation to allocate a share of maternity capital

The text (content) of the maternity capital obligation depends on the method of purchasing housing:

- ownership of the residential premises is registered in the name of the husband and/or wife;

- repayment of a loan or loan (with or without mortgage encumbrance);

- acquisition of ready-made housing, shared construction of an apartment building or construction (reconstruction) of a private residential building (individual housing construction project).

do not contain requirements for formalizing the obligation . In different regions, Pension Fund authorities may have their own requirements for the content of the obligation, so it makes sense to first clarify its form with the Pension Fund.

Most often, the owner of the certificate (her spouse) turns to a notary to draw up this document. The latter, having samples of various obligations, draws up an obligation independently based on a specific situation.

Below are sample examples of obligations to allocate a share of maternity capital:

- When purchasing a home by the owner of the certificate under a sales contract :

- When repaying principal and interest on a mortgage (home loan or loan):

- When purchasing housing in installments provided by an individual or legal entity:

- When receiving maternity capital for the construction of a residential building (or its reconstruction):

Of course, spouses can draw up an obligation form themselves and then go to a notary with it. But this is hardly advisable, since the notary may simply refuse to certify such a document. And even if he does agree to the registration, he will still have to pay the notary fee ( 500 rubles according to Article 333.24 of the Tax Code of the Russian Federation).

Therefore, you should not waste time on drawing up an obligation yourself. You just need to take all the necessary documents and contact a notary office.

Be that as it may, the following information is indicated in all types of obligations :

- Full name of the person (persons) taking on the obligation, indicating passport details;

- Maternity capital certificate data (series, number, date of issue);

- Name of the Pension Fund of Russia body that issued the certificate;

- Purposes of using maternal capital funds (payment of the cost under the contract, loan repayment, construction of individual housing construction, preschool building, contribution to the cooperative);

- Details of the agreement (credit, mortgage, purchase and sale, equity participation, etc.);

- Description of the residential premises indicating the address of its location;

- The obligation to register the residential premises as the common property of all family members by agreement, determining the size of each person’s shares, indicating the transfer period and conditions (removal of encumbrance, putting into operation, obtaining a cadastral passport for a residential building, etc.);

- An obligation to subsequently transfer copies of state registration certificates of common property rights (from 2020 - extracts from the Unified State Register of Real Estate) to the Pension Fund of Russia;

- Notary's note confirming the identity and legal capacity of the person(s) giving the obligation;

- An indication of the number of copies of the document and the location of their storage (transfer);

- Signature indicating full name;

- Information about certification of a document by a notary;

- Date, notary stamp, amount of payment according to the tariff.

Contacting the Pension Fund

The owner of the Certificate applies to the Pension Fund of the Russian Federation with an application for the disposal of maternity capital, indicating the type of expenses and the amount of funds.

In accordance with GD No. 862 dated December 12, 2007, the following documents will be required:

- For spouses: ID cards of husband and wife; marriage certificate or divorce certificate if the applicant is divorced;

- For real estate: documents confirming the purchase of real estate and its ownership by the borrower;

- From the lender: a loan agreement with a repayment schedule, a collateral agreement, a certificate of the balance of the loan debt and interest on the date of application, confirmation that the loan was issued by transferring funds to the account;

- A written obligation of the borrower to register a share for each family member, certified by a notary;

- Certificate with account details of the certificate owner;

- If maternity capital is used to improve housing conditions, a permit for construction or reconstruction is additionally provided, as a result of which the area of housing will be increased in accordance with the accounting norm;

- With individual housing construction, documents for the land plot are submitted.

The rules for submitting documents are established by Order of the Ministry of Labor of Russia No. 606n dated 08/02/2017. They determine that the certificate holder must submit a request personally or through an authorized representative. The application can be submitted at any time, regardless of the child's date of birth.

Application methods:

- Visit to the Pension Fund;

- Visit to the MFC;

- Sending by mail;

- Online through the websites of State Services and the Pension Fund.

Why do you need to register?

As has already become clear from what was described above, the paper in question is necessary in order to ensure the acquisition of ownership of a new residential property for each family member who was provided with family capital at the birth of a second or subsequent child. And this rule, first of all, is enshrined in Part 4 of Art. 10 of Law 256-FZ.

But what is the ultimate goal of the legislator who provided such a norm? The answer lies on the surface and lies in ensuring equal rights of both spouses and all their minor children. Another theory is discussed at a less official level.

It consists in the fact that a citizen who, as a minor, received the right to a share in an apartment or house , in adulthood will no longer be able to apply for residential premises from the municipality in which he lives. And this entails significant savings for the consolidated budget, reducing the load on it.

Reference! In any case, such paper is necessary for managing maternity capital money in the event of improvement of living conditions through the acquisition or construction of residential real estate by the recipient of the certificate.

Documents to the bank

To agree on a transaction with the lender, you must inform the financial company of your intention to repay the loan and/or interest within the established period before the payment date.

To pay the debt, the creditor will need to provide a Certificate, a certificate from the Pension Fund about the balance in the account. It is better to draw up the application in two copies, so that on the second the authorized employee signs the visa to take note of the document.

The settlement date of the transaction will be determined, and the lending company will make a preliminary calculation of the loan amount and interest to be repaid.

Documents for maternity capital (mortgage)

Every family with 2 or more children has the right to receive a certificate confirming their right to receive a state subsidy at their place of residence at the local branch of the Pension Fund.

You should submit your papers as soon as possible to avoid missing deadlines. The family will be able to manage the money after the second child turns 3 years old, but from the moment of his birth you can receive a certificate within 3 years.

This is a general list, but other papers may be required.

So, if at the moment the first child is already 18 years old and is studying somewhere full-time, then you will need to attach a certificate from the educational institution . If it is not the applicant himself who applies to the Pension Fund, but his authorized representative, then it is necessary to confirm the authority with a power of attorney.

Advice! To find out exactly how much money is left from the maternity capital in the account, you need to issue a certificate of maternity capital for a mortgage. You can obtain it by submitting an application to the Pension Fund of Russia, the response to which will be sent to the applicant’s address within 3 days.

Step-by-step instructions for investing mat capital in a mortgage

How to pay off a mortgage with maternity capital:

- Carefully study the conditions for early repayment of the mortgage established by the loan agreement. Banks set different requirements for paying debts ahead of schedule; usually you should apply 15–30 days before the date of the next scheduled payment. The debtor must formalize his intention in writing.

- Receive a certificate from the credit company about the balance of debt and interest with account numbers for transfer.

- Notify the regional office of the Pension Fund;

- Receive a list of necessary documents on the website of the State Services or Pension Fund and collect them;

- Prepare an application. The form can be downloaded on the website or obtained from its representative office on site.

- Submit a package of documents for review.

- Wait for a decision.

- Contact the bank with an application for early repayment.

- After approval, the money is transferred to the accounts specified in the bank certificate.

After the transaction is completed, in case of partial early repayment, the lender will create a new debt repayment schedule.

Deadlines for transferring money

According to Art. 8 Federal Law No. 256, the application is considered by the Pension Fund within up to 30 days. Within the next 5 days, the applicant will receive notification of the decision. If a refusal to pay is received, the document must contain the reasons. If a positive decision is made, the money is transferred in accordance with the application within ten days (clause 17 of PP No. 862 of December 12, 2007). This must be taken into account if the funds are included in the final settlement of the mortgage repayment, since during the consideration of the application interest the debt balance is accrued as standard, and the amount payable can be changed.

How to submit an application electronically

In accordance with PP No. 553 dated 07/07/2011, the State Services portal has implemented the ability to electronically fill out an application for preliminary consideration and sign up for a visit to the Pension Fund to provide original documents. When applying through the State Services portal, you must first register on the site and confirm your account.

The procedure is as follows:

- Log in to the site;

- Select the “Services” navigation panel;

- Go to the “Family and Children” category;

- Open “Management of maternity capital”;

- Select the type of receipt;

- Read the package of documents;

- Click “Get service”;

- Complete an application and submit it for consideration;

- After 1–2 days, the user will receive an invitation at what time he can come to the Pension Fund with the original documents.

How to pay off a mortgage with maternal capital at Sberbank

You can repay your mortgage with maternity capital in 2020 at almost all credit institutions that issue loans secured by real estate. The largest volume of issuances falls on Sberbank, VTB, Dom. Russian Federation, Delta Credit mortgage bank.

Sberbank offers families with children to use the “Mortgage plus Maternity Capital” program to purchase finished housing or housing under construction. Certificate funds can be made as a down payment or used to pay off existing debt.

Conditions for repayment:

- The money was spent on the purchase of finished or under construction housing from an accredited seller company.

- The owners of the real estate are the borrowers and their children.

- The debt can be repaid after 6 months from the date the loan was issued.

- It is necessary to submit to the bank a Certificate and a certificate from the Pension Fund about the balance of funds in the account. The certificate can be submitted to the bank within 3 months after approval of the transaction, along with real estate documents.

Loan repayment conditions in other banks are similar

Repayment of mortgage (principal and interest) with maternity capital

Repaying the principal debt and interest on a mortgage with maternity capital is much easier to implement, which is why this practice is much more widespread.

A new addition to the family (and even more so, a second one!) often occurs when the mortgage has already been issued and even partially repaid. And the emerging right to receive maternal family capital (MSC) allows in this case to quickly resolve the issue of mortgage debt.

If the certificate for the right to receive MSC appeared after the loan was issued, or if the certificate was received, but your own savings were made as a down payment, then maternity capital can be used to pay off a previously taken mortgage .

How to do it?

Everything is simpler here - you no longer need to prepare any documents for the bank (after all, the loan has already been issued and the apartment has been purchased). We will only need documents for the Pension Fund to transfer funds from maternity capital to the bank to pay off the mortgage debt.

How to apply for a deposit when buying an apartment - see this article.

Documents to the Pension Fund for repaying a mortgage with maternity capital

The first thing we do in this case is to take a certificate from the bank about the balance of debt on the mortgage loan previously issued to us. This certificate must indicate:

- loan agreement number;

- passport details of borrowers;

- the balance of the unpaid debt and interest thereon;

- Bank account details for transferring maternity capital.

Then we will need to formalize with a notary an obligation to allocate shares in the purchased apartment to the spouse and children no later than 6 months after the mortgage encumbrance is removed from the ownership of the apartment. Why such an obligation to allocate shares is given, how it is formalized, how and exactly which shares are allocated is described in a separate note at the link.

The next step is to contact the territorial body of the Pension Fund of the Russian Federation with an application for the disposal of maternity capital . In the application, we ask you to transfer funds from MSK to the bank to repay the housing loan. It is not necessary to use the entire MSC. If the loan debt is less than this amount, then the application may talk about repaying the mortgage with part of the maternity capital .

In addition to the application itself, we will need to submit the following documents to the Pension Fund:

- Certificate for maternity capital (received by us earlier in the same Pension Fund);

- Documents confirming the identity of the applicant (passport, SNILS);

- Marriage certificate and documents confirming the identity of the spouse, if he is a co-borrower on the mortgage;

- A copy of the loan agreement with the bank;

- An extract from the Unified State Register of Registered Rights to the apartment (if the apartment has already been registered as the property);

- Title document for the apartment – i.e. a copy of the Sales and Purchase Agreement indicating that the apartment was purchased with a mortgage and is pledged to the bank, or an Equity Participation Agreement (or an Assignment Agreement) indicating the pledge of claims, or an Extract from the register of members of the cooperative with a certificate of the amount paid and a copy of the charter of the cooperative (if the share contribution to the housing cooperative was paid with a loan);

- A copy of the registered mortgage agreement (if its conclusion is provided for in the loan agreement);

- A certificate of the current debt balance, which we took from the bank (see above);

- A notarized obligation to allocate shares to the spouse and children (see above about this);

- A document confirming the fact of transfer of credit money by the bank to the seller of real estate (payment).

All these documents can be taken in person to the local Pension Fund branch or transferred through the MFC. It is also possible to submit an application electronically in a citizen’s personal account on the Pension Fund website (here) or on the State Services portal (here). But in this case, a package of documents will need to be submitted to the Pension Fund within the next 5 days.

According to the law, documents are reviewed by the Pension Fund within one month. The transfer of money occurs within 10 days after review and approval. In practice, however, this period may be longer, so banks usually set a deadline for receiving maternity capital funds from the Pension Fund - up to 3 months.

Why banks refuse mortgages and what to do about it - we answer point by point.

What to use maternity capital for - to pay interest or principal

This depends on the terms of the loan agreement. The procedure can be established at the discretion of the bank or in agreement with the borrower. More often, the principal debt is paid with interest on the current date, and a new debt repayment schedule is formed. Reducing the loan term may be more beneficial for the borrower in terms of reducing overpayments.

If the debtor does not plan to pay off the mortgage ahead of schedule, it will be more convenient for him to pay interest and then repay only the debt. The amount of the monthly payment will decrease, this will reduce the financial burden on the family budget.

Methods for realizing capital

The main condition for using MK before the child turns 3 years old is the availability of a formalized mortgage. Options for using funds from the budget involve the allocation of funds:

- As a down payment on a home loan.

- To repay interest and principal on a mortgage debt, in whole or in part.

- Use in military mortgages (for NIS participants).

The mortgage payment is made in a lump sum, in an amount equal to the amount of the total debt, or in the form of partial repayment of the mortgage with a revision of further repayment terms.

To exercise the right, they choose banks known for their successful long-term cooperation with the state on a number of social projects, including MK. While almost any bank will allow you to pay part of the mortgage received, schemes for using maternal capital for a down payment are not implemented by everyone.

Depending on whether the mortgage is repaid in full, or whether the mortgage company reduces the amount of debt, reducing the borrower’s credit burden, the registration procedure will differ. There are also general requirements for the implementation of funds from the budget. For example, the obligation to notify the bank about repayment before the due date.

What are the requirements for the borrower represented by the owner of the certificate for maternal capital?

The moment when you can use the capital is when the child reaches the age of three, but for mortgage borrowers this restriction is lifted.

To successfully receive a tranche from the state, you must ensure that the following conditions are met:

- The loan used to purchase housing is targeted, i.e. aimed solely at improving the living conditions of the family.

- Housing must meet certain requirements set by the lender (private property, in a non-emergency, relatively new building, equipped with modern communications.

- A property for a Russian family to live in must be purchased within the Russian Federation.

- When mortgage lending, the vast majority of loans are issued to both spouses at once (if there is a legal marriage).

- After the last payment on the mortgage debt, it is important to have time to convert the housing into common shared ownership within six months, giving each family member a share. This requirement is ensured through a notarized obligation to allocate a share to everyone.

In a normal home purchase without credit, parents are required to immediately register the property for everyone, but in the case of a mortgage, it is necessary to wait until the encumbrance is lifted after the entire debt has been repaid, and only then introduce family members as owners.

Failure to comply with this condition entails a judicial challenge and cancellation of the payment with the forced recovery of the amount of public funds from the borrower.

Why they may refuse and what to do in this case

The possibility of using allocated funds to repay a mortgage is provided for at the legislative level, so they can only refuse if the requirements for the transaction are not met.

In accordance with Article 8 of Federal Law No. 256, the reasons for refusal may be:

- If the borrower has lost the right to government support: deprivation of parental rights, cancellation of adoption;

- Not a complete package of documents has been presented;

- Errors and inaccurate information were found in the certificates, the application was not drawn up in the correct form;

- Failure of the lender to meet the requirements.

According to the requirements of Federal Law No. 37 of March 18, 2019, the application will be refused if the purchased housing does not actually improve the family’s living conditions, for example, it is recognized as unsafe and subject to reconstruction.

Having received a negative decision, the debtor will be able to correct the errors and resubmit it or go to court.

How to use maternity capital for a mortgage

The legislation of the Russian Federation allows the use of maternity capital to improve the comfort of living conditions. But since the amount allocated by the state in the amount of 466,617 rubles cannot buy an apartment, most families who have received the certificate use it to purchase real estate with the help of a mortgage.

At the moment, the law allows the money allocated under the above program to be directed in the following areas:

- Contribute money from maternity capital in the form of a down payment. This method of implementing government support is convenient when a family does not have money for a down payment on a housing loan. But be prepared for the fact that not all banking organizations accept maternity capital as a down payment on a mortgage. In addition, if you do not have your own savings, then you will also be limited in the cost of purchased real estate. Most credit institutions require at least 20% of the price of the purchased apartment as a first payment.

- With maternity capital you will also be able to pay off interest and some of the mortgage debt. To do this, you initially notify the bank of your desire to repay part of the mortgage early, and then go to the Pension Fund and write a corresponding application. The money will arrive in the bank within 1 to 2 months.

- Full repayment of the mortgage with maternal capital. If you decide to completely repay the balance of your mortgage with money from maternity capital, then, first of all, you need to contact the bank with a question about the availability of fees for full early repayment. If there are none, you can safely go to the Pension Fund and write an application for the transfer of capital funds to the bank.

Particular attention should be paid to the fact that banks, within the framework of the law, can establish a number of restrictions on the sale of maternity capital in order to repay the mortgage. Be careful.

Where can I send

Lawyers and banking experts are often asked the same question: is it possible to use maternity capital to obtain a mortgage to buy a dacha or house in a rural area? The answer to this question is ambiguous. The procedure for registration and implementation of this type of state assistance is strictly controlled by the Pension Fund of the Russian Federation.

Strict requirements are imposed on housing purchased with allocated funds:

- The property must be located in our country and must have an address.

- Housing must be suitable for living all year round.

- If this is a private house, then it must have all the benefits of civilization (heat, electricity, etc.).

- Housing should not be old, dilapidated or in disrepair.

- Possibility of registration in the house. Is it possible to register in a mortgaged apartment? We have already written here.

As we can see, it is possible to buy a house or cottage with a certificate, but only if all the above requirements are met. Please note that it will not be possible to deceive the Pension Fund, since each property purchased under such a family support program is carefully checked not only by the bank, but also by the Pension Fund.

Allocation of shares to children after repayment of the mortgage with maternal capital

According to Art. 10 Federal Law No. 256, the mortgage can be repaid only if the debtor agrees to allocate shares in the purchased housing to both spouses and children.

The allocation of shares is made within 6 months after repayment of the loan and removal of the encumbrance from the collateral. Therefore, at the time of execution of documents for redemption, the owner of the certificate provides an order for the distribution of shares. It must be certified by a notary.

The procedure is as follows:

- Collect a package of documents for the notary: Marriage certificates, birth certificates, certificates, real estate documents, USRN extract, mortgage agreement.

- Visit a notary office with your passport. If the housing is registered in the name of both spouses, it is necessary that both owners be present or a power of attorney for the transaction must be issued.

- Pay the fee.

- The document is prepared in a notary's office, checked by the client, and certified by a notary.

- Next, the documents must be registered with Rosreestr.

You can also distribute shares by drawing up a deed of gift.

What share each family member should receive is not established by law. In practice, this value is determined based on what percentage of the total mortgage debt is repaid with the allocated money.

If a third or subsequent child is subsequently born into the family, he will also have to be allocated a share in the acquired property. In this case, the shares are redistributed.

What share should be allocated to children in maternity capital after paying off the mortgage?

IMPORTANT

The property owner decides this issue independently. However, experts advise following a number of rules when allocating a share of maternity capital to children after paying off the mortgage. It is advisable for a minor to be allocated a so-called ideal share. Its size is at least 6 sq.m. Additionally, it is worth considering the ratio of the amount of maternity capital to the total amount of funds spent on the purchase of housing with a mortgage.

Let's say a family bought a property worth 1.5 million rubles. In this case, the share of maternity capital funds will be 1/3 of the housing price. In the current situation, experts recommend allocating 1/3 of the property to children. If the above rules are not followed, the notary may refuse to certify the obligation.

Borrower's right

At the legislative level, citizens have the right to use maternity capital when purchasing housing.

The money does not have to be invested specifically in the purchase under the purchase and sale agreement; it is allowed to use it for:

- construction;

- buying a home with a mortgage.

This right is granted to a young family with more than two children in order to protect their rights. Therefore, the law establishes such an obligation to accept mortgage debt with maternity capital.

Here's how you can pay off your mortgage:

- Pay a down payment: this option is not available at all credit institutions. Many banks believe that payment by maternity capital indicates the insolvency of the borrower. However, it is worth remembering that this is not particularly beneficial for the borrower himself, because the interest rate turns out to be high, even if the loan term is short.

- Pay off the principal portion of debt obligations. This option is quite often used, and in principle is beneficial for borrowers, because in this case the amount of the principal debt becomes smaller, and therefore the bank’s interest will be charged on the remaining amount of the debt. This means that the overpayment amount will be significantly less.

- Paying interest is not the most common option, because... it is more profitable for the bank, because it is this organization that will receive the required interest. However, there are also advantages for the borrower, this applies to cases when the mortgage will not be repaid ahead of schedule. When paying interest, the borrower will only pay the principal amount, which means that due to interest payments, the monthly payment will be less. However, it is allowed to deposit a larger amount in order to pay off the debt faster.

Conditions

The mortgage repayment conditions are quite acceptable and achievable.

The main ones:

- By purchasing home ownership, the borrower thereby strives to improve living conditions;

- housing must be purchased on the territory of the Russian Federation;

- payment of the principal debt under an earlier open mortgage agreement;

- payment of the down payment;

- payment of interest under a mortgage agreement.

Not all banks use maternity capital to pay off a mortgage, but such banks as Sberbank of Russia, VTB 24 and Gazprombank create all the necessary conditions for paying off a mortgage loan using the above method.

This is important to know: Power of attorney to receive maternity capital: sample

Providing this opportunity does not require additional investments and does not depend on the amount of purchase of the home.

Moreover, the certificate for receiving maternity capital does not have a specific validity period, and therefore can be used at any time.

However, if the borrower wishes to make a down payment using these funds, this is possible only when the child reaches three years of age.