Information about the fund

- Full name of the organization (name of NPF): Joint Stock Company "Non-State Pension Fund "Telecom-Soyuz"

- Status in 2020: Active - Valid license

- License number: 94/2

The date of registration and immediate launch of the non-state pension fund Telecom-Union is considered to be February 15, 1996.

The main part of the fund's client base are employees of Rostelecom (since 2004) and Russian Post (since 2009), who have entered into corporate agreements for the provision of pension services. There are over 450 thousand participants in pension programs in the fund, of which about 140 thousand people are already receiving a pension. The Foundation is the winner of many industry awards, incl. for leadership in NGOs and high reliability indicators. NPF "Telecom-Soyuz" has been working stably and reliably in the market of services for non-state pension provision for workers in the communications industry for more than twenty-three years. The fund is among the TOP 10 NPFs in Russia in terms of the number of participants and the volume of pension reserves under management.

Affiliated funds

No affiliated funds

Requisites

View details

Bank details for the transfer of pension contributions of depositors-legal entities of JSC NPF Telecom-Soyuz INN 7714323994/KPP 770201001 PJSC Sberbank Account No. 40701810238180120052 in PJSC Sberbank Moscow Account number 301018104000000 00225 BIC 044525225

Bank details for the transfer of pension contributions of individual depositors JSC NPF Telecom-Soyuz INN 7714323994/KPP 770201001 PJSC Sberbank Account No. 40701810538180120053 to PJSC Sberbank Moscow Account number 3010181040000000 0225 BIC 044525225

Bank details for carrying out business transactions of JSC NPF Telecom-Soyuz INN 7714323994/KPP 770201001 PJSC Sberbank Account No. 40701810538000000004 in PJSC Sberbank Moscow Account 30101810400000000225 BIC 044525225

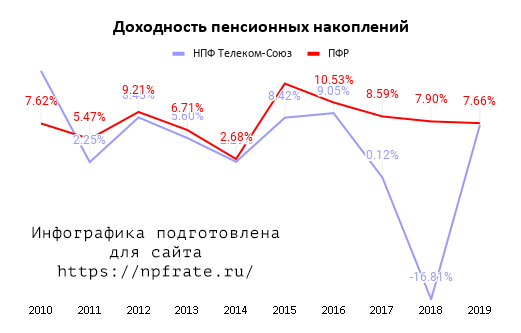

NPF Telecom-Soyuz: login and registration of your personal account

Before using your account, please pre-register. The rules of the Telecom-Soyuz Foundation prohibit remote registration. To create an account, visit the fund's representative office with a Russian passport and SNILS number. Show the required documents to the staff and fill out the application. After successful registration, employees will send an authorization password via email. To log in, visit the organization’s main page, enter your email with a password and click the login button.

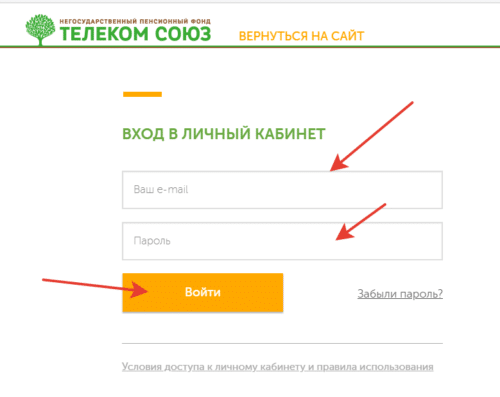

If you can't log in, carefully check your IDs. The user may have made a mistake or selected the wrong keyboard layout. In some cases, the password is forgotten. To restore access, click the “Forgot your password” link and enter your login. The system will soon send a new access key by email.

Contacts

Official website of NPF Telecom-Soyuz

https://www.npfts.ru/ On the website you can find information about the activities of the fund, many official documents with statistics by year, background information about the pension system of the Russian Federation. Unfortunately, there is no personal account or calculators for calculating pensions on the website. If NPF Telecom-Soyuz makes any changes in payments, this will be reported in the news on the website. Also there you can find a statement of termination of the contract.

Email mail

Address

HEAD OFFICE JSC NPF Telecom-Soyuz 127051, Moscow, Tsvetnoy Boulevard, building 2

Hotline number

Unified information and reference service: 8-800-200-08-09

How to terminate the contract?

In order to stop cooperation with a non-state pension fund , a citizen must do the following:

- Choose another NPF or return savings to the Pension Fund.

- Fill out an application at the selected fund. The insured person must have an identification document and insurance certificate number (SNILS).

- Submit an additional application to the Pension Fund if this function is not performed by employees of the selected NPF. When returning funds to the Pension Fund, a citizen writes one application instead of two.

- Signing a new OPS agreement - when transferring savings to another NPF (there is no agreement in the Pension Fund of the Russian Federation). It is necessary to indicate the heirs in the document.

NPF clients should not notify this fund about the decision to transfer savings to another company. This function is performed directly by the Pension Fund.

The best time to transfer the savings portion is the end of the year in order to maintain investment profitability from the Telecom-Soyuz NPF.

Statistics of NPF Telecom-Soyuz: rating of reliability and profitability

According to the Central Bank of the Russian Federation from the reporting “Main performance indicators of non-state pension funds” as of the date: 01/01/2020

Fund assets (thousand rubles): 24389507.92

Statistics on NPO (non-state pension provision) as of 01/01/2020

- Total volume of pension reserves (thousand rubles): 21194733.01

- Total number of participants (people): 304827

- Participants receiving a pension (persons): 99749

- Total amount of pensions paid under NPO (thousand rubles): 1177750.12

Statistics on compulsory pension insurance (compulsory pension insurance) as of 01/01/2020

- Pension savings (thousand rubles, market value): 1442121.11

- Number of insured persons (people): 15697

- Participants receiving a pension under compulsory pension insurance (persons): 249

- Amount of pension payments under compulsory pension insurance (thousand rubles): 8441.42

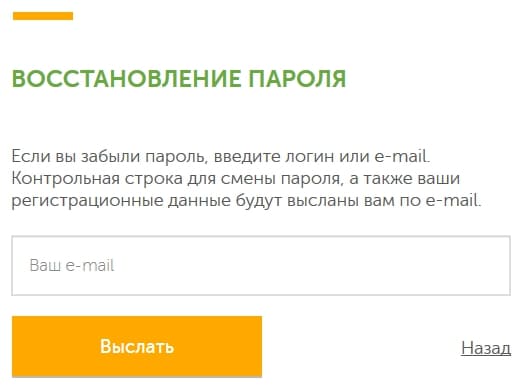

Profitability of pension savings

Current profitability

Minus remuneration for management companies, specialized depository and fund.

- Profitability of placing funds from pension reserves (NPO): -7.58%

- Return on investment of pension savings (OPS): 7.41%

Profitability chart

Data on the profitability of NPF Telecom-Soyuz in 2020 (as of 01/01/2020), including information for the previous 10 years in comparison with the profitability of the Pension Fund (VEB):

Yield comparison table

| Year | NPF Telecom-Soyuz | Pension Fund |

| 2010 | 14.91% | 7.62% |

| 2011 | 2.25% | 5.47% |

| 2012 | 8.45% | 9.21% |

| 2013 | 5.60% | 6.71% |

| 2014 | 2.29% | 2.68% |

| 2015 | 8.42% | 13.15% |

| 2016 | 9.05% | 10.53% |

| 2017 | 0.12% | 8.59% |

| 2018 | -16.81% | 7.90% |

| 2019 | 7.41% | 7.66% |

Profitability and reliability

Profitability shows the effectiveness of the fund's investment portfolio: how profitable the projects in which the company invested were. Using statistics over several years, you can evaluate the results and possible prospects.

The table shows the years and profitability of Telecom-Soyuz as a percentage.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 (March) |

| 10,09 | 0 | 25,74 | 14,91 | 2,25 | 8,45 | 5,6 | 2,29 | 8,42 | 9,05 | 0,12 | 11,57 |

For reference.

Unstable profitability caused an outflow of customers. In 2010, the number of insured persons was 19.7, in 2020 - 17.4. The total number of clients decreased from 458.4 thousand to 309.6 over the same period of time. Reliability of NPF "Telecom-Soyuz" by year (assessments of the rating agency "Expert RA"):

- 2010: A+. The mark confirms a very high level of financial reliability.

- 2011: rating upgraded to A++ “Exceptionally high”.

- 2012: A++ Forecast “stable” - the mark will remain in the near future.

- 2013: A++. The forecast is “developing”. This means that the valuation will remain the same or decrease in the future.

- 2014: withdrawn.

In 2014, the fund refused to provide information to maintain the rating.

For clients

Fonda

- NGOs that have entered into an agreement with the foundation

- Those who have entered into an OPS agreement with the fund

NPF "Telecom-Soyuz" was registered on February 15, 1996 and was one of the first in the Russian Federation to begin operating non-state pension provision.

JSC NPF Telecom-Soyuz is a basic industry fund that operates in non-state pension provision for workers in the communications industry.

In 2013, the Expert RA rating agency awarded NPF Telecom-Soyuz with diplomas “For High Reliability” and “Leader in the NPO System.”

Information for clients

The website contains information for non-state pension fund clients who have entered into personal and corporate programs, for persons insured under compulsory health insurance, as well as for companies that have entered into non-state pension agreements in favor of their employees.

Registration of the contract

To begin cooperation with the fund, you must fill out an application and conclude an official agreement.

The applicant's passport and SNILS are required. You can write an application for an NGO agreement at the fund’s office.

It is possible to conclude an OPS agreement:

- at the NPF branch;

- through the State Services portal;

- at the MFC.

Important! The duty of the fund employee is to explain to the applicant the details, advantages and specifics of cooperation with the NPF, and to select an individual pension program.

Non-State Pension Fund programs

Fund employees individually develop and select pension programs for NPF clients, taking into account personal goals and requirements. The Foundation has prepared various options for corporate and individual programs for individuals and organizations.

Healthy! Potential clients have the opportunity to choose the frequency and size of contributions, and the conditions for paying out savings.

Termination of contract with NPF

The fund’s website contains a form, sample, instructions and requirements for filling out an application for termination of an individual pension agreement (IPA).

Recommendation! Before terminating the mandatory pension agreement with the fund, you need to decide where the funded pension funds will be placed in the future. There are two options:

- Return of funds to the Russian Pension Fund. It is necessary to write an application for the transfer of funds at the Pension Fund branch. There is no need to visit Telecom-Soyuz; all necessary actions will be performed by Pension Fund employees;

- Transfer of money to another NPF. You should:

- at the Telecom-Soyuz branch, write an application for termination of the contract, transfer of funds to another NPF;

- choose a fund, conclude an agreement with it, take account details.

Advice! Please note that when transferring funds, income received from investment is subject to tax.

Statistics of the non-state Pension Fund Telecom-Soyuz (JSC)

According to statistics as of January 1, 2013, we can note:

| Pension reserve volume | RUB 18,280 million |

| Volume of payments | 606 610 t.r. |

| Number of clients in the database | 452,930 people |

| Payments are received | 137,257 people |

Statistics on compulsory pension insurance as of July 1, 2013 are as follows:

| Accumulation volume | RUB 1,553,540 |

| Client insurance | 20,968 people |

| Profitability | 7, 30% |

Pension fund savings will increase from 1 thousand to 1540 rubles for 2007–2010.

Profitability and reliability

The accumulated return for 2007-2012 is 56.6%. The highest level was recorded in 2009 – 25.7% per annum. Profitability was equal to zero during the crisis in 2008.

As for 2012, the percentage component was average - 7.3%, which is 3% below the norm. Overall, the profitability picture is stable over a long period of time.

Information on profitability as of January 1, 2017 together with the past decade when compared with the Russian Pension Fund.

The investment indicators in the fund reserve are as follows:

| 54% | Bank deposits |

| 26,7% | Household bond Russian society |

| 14% | Household shares Russian society |

| 2,2% | Accounts receivable |

| 1% | Funds in mutual funds |

| 1,02% | Government papers of high value |

| 0,4% | State and subjective valuable documents |

| 0,03% | Amounts in bank accounts |

The above information is original, since the information from 2012 was recorded on the official website of the non-state pension fund Telecom-Soyuz.

There were rumors on the Internet that the company’s license was revoked in 2020. In 2020, the company operates as before with a perpetual license, and information that the fund has gone bankrupt is considered unfounded.

Conditions

The requirements for joining Telecom-Soyuz are not clearly different from other NPFs. The first step is to contact a branch of the organization.

In this regard, the company has a disadvantage, since its branches are geographically located in large cities.

From time to time, the company carries out promotions where employees are sent to different organizations and with a presentation they offer to join the project. In this case, you can draw up an agreement without visiting a branch.

At the time of consultation, it is important to establish an individual pension plan, which will result in contributions, and subsequently accumulated payments and co-financing options.

When concluding an agreement, you will need a passport and SNILS. And you also need to register on the official website and control your personal account and replenishment of contributions.

A password for your personal account is provided at the time of registration of the contract. If the password is lost, you will need to visit the fund in person with your passport to restore your login.

Important! Once a contract is concluded, it is valid. You are allowed to switch to another fund after 5 years, but not earlier.

In the case where the client wishes to immediately leave the organization, this can be done, but then the citizen will suffer financial losses.

The following may participate in individual pension programs without legal entities:

| Individuals who have entered into an Agreement with JSC Telecom-Soyuz and make deposits in their favor | Or an individual in whose favor another investor has drawn up a security document and the funds are being invested |

| An individual who receives payments from the fund | The prisoner is an investor for his own benefit or a third party |

When receiving lifelong non-state pension benefits, you must bring to the company from October 1 to December 25 of this year an agreement that fixes the right to receive funds.

How to draw up an agreement with the fund (application form)

A sample agreement on compulsory pension insurance between a non-state pension fund and the insured person is available.

Required documents for the application:

- photocopy of passport, full name, place and date of birth, registration certificate;

- information that is selected by the bank associated with the details for transferring the amount to the recipient’s number.

Additional information that may be required during registration:

- certificate from the Federal Tax Service of the Russian Federation, which establishes receipt/non-receipt of social benefits. tax deduction;

- NPF data;

- photocopy of the passbook.

Advantages and disadvantages

The main advantages of a non-state pension fund:

| The company is engaged in investments | Thus, the size of the funded pension increases. If the operation is unsuccessful, the company is liable to the client with property |

| Inheritance system | When a client dies, a close blood relative has a right to the property. And also the will may indicate to whom the deceased transfers his savings |

| Transfer of savings from a non-state pension fund to another similar company | — |

| High degree of protection of funds (inflation is not taken into account) | Upon liquidation of the company, investments are insured and will be provided by the state without fail. |

| Organizational transparency | Everything a pensioner needs to know is provided upon request. |

| Exemption from payment | When withdrawing funds and receiving savings, based on the agreement between the client and the NPF |

The main disadvantages include:

| Possibility of investment fraud | Money depreciates every year, but savings do not improve |

| Be sure to pay taxes when paying out money | This is stated in Article 213.1 of the Tax Code, where the pension provided by a non-state pension fund on the basis of an individual agreement |

| The likelihood of many such organizations closing by the end of 2020 | Due to changes made and stricter requirements for such companies, many will come to a complete cessation of functionality |

Allocation of mandatory shares

This process is regulated by law. The allocation of obligatory shares occurs with the participation of a notary. This is the part of the property that is calculated first. Certain categories of citizens may enter into inheritance rights, regardless of other conditions of the will.

The obligatory share is allocated:

- Minors or disabled children of the testator who cannot work.

- Dependents who lived off the income of the deceased person, regardless of their relationship with him.

- Disabled mothers, fathers or spouses.

More on the topic Pension Fund personal account - login to the site

Duration of the procedure

To avoid problems, open an inheritance and enter into rights, it is necessary to submit all documentation to the notary no later than 6 months after the death of the citizen. According to the law, this is the time necessary to verify the degree of relationship and other information. After this, a certificate of right to inheritance is issued.

Sometimes a citizen is deprived of property automatically if the statute of limitations for the procedure has expired. In order for the right to be restored, you need to write an application. It must indicate a valid reason why the document was not completed on time.

More on the topic: How to choose a non-state pension fund in 2020, which rating is better?

Official site

Information about the fund can be found on the website, address https://www.npfts.ru.

Information on performance results, development statistics, documents, background information, news and changes in work are available.

On a note! There is no pension calculator on the website and clients have no way to calculate savings.

Personal Area

NPF provides convenient services for clients with a personal account located at https://lk.npfts.ru/auth/

Login to your Personal Account

Important! The downside is that the office cannot be opened remotely.

To gain access to your personal account, you must:

- visit the NPF branch with your passport and SNILS;

- fill out an application;

- receive a password to log into your account by email;

- log in to the site.

On a note! In the Personal Account on the website, information is available on the amount of savings, the movement of funds in the account, the amount of profit, the creation and printing of an account statement.

What documents are needed

In order to register an inheritance case and assume his rights, the applicant must prepare and submit a package of papers:

- Death certificate of the testator.

- Passport of the heir.

- Certificate from the last place of residence of the testator. If a person lived outside the country, you need to make a request for official registration.

- House book.

- Technical or cadastral passport for property from the State Register.

- Documents containing information about the estimated value of an entire estate or a specific share.

- Certificate of right to inheritance.

- A document confirming the absence of debt on property.

More on the topic Preferential certificate for a pension fund sample

If you are registering the right to accept an inheritance in the form of bank deposits, you need to prepare an account opening agreement or a savings book. When all issues are handled by a trusted person, a power of attorney and an identity card are attached to the package of documents.