What is maternity capital?

To begin with, it is important to understand that maternity capital, in a broad sense, is state assistance regulated by a certain law.

a second child were born (or adopted) can apply for subsidies .

This subsidy was introduced in 2007. Almost every year, amendments are made to the program affecting the validity period. Today, taking into account all the adjustments, it will be implemented until the end of 2021.

In a material sense, capital is a paper or electronic (at the request of citizens) document that confirms the right to this benefit. Registration is carried out once at the Pension Fund of the Russian Federation.

Legislative framework of the Maternity Capital program

Maternity capital is regulated by Art. 3 Federal Law dated December 29, 2006 (as amended on August 2, 2019), which sets out the conditions for obtaining this right. According to the law, male persons who are one parent when adopting a second and subsequent children can also claim a subsidy. But, like women, this right can only be used once.

In cases of loss of parental rights or after the cancellation of adoption, state financial assistance will not be provided. However, if the mother dies and loses her parental rights, the right passes to the child (or equally between the children).

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

It is important to know that the use of subsidies is allowed only 3 years after the birth of the 2nd or subsequent children.

When did this program start? What has changed today?

The family capital program dates back to 2007 and is valid until this year. Indexation was carried out annually until 2020, however, it was by decree of the President due to the difficult situation in Russia. Therefore, in the current year 2020, the subsidy in monetary equivalent corresponds to 2020 and amounts to 466,617 rubles.

How maternity capital changed from 2007 to 2020

| Year | Maternal capital | Inflation in % | Indexation of MSK in % | Indexation amount |

| 2007 | 250,000 rub. | 11,9 | — | — |

| 2008 | RUB 276,250 | 13,3 | 10,5 | RUB 26,250 |

| 2009 | RUB 312,163 | 8,8 | 13 | RUB 35,913 |

| 2010 | RUB 343,379 | 8,8 | 10 | RUB 31,216 |

| 2011 | RUB 365,698 | 6,1 | 6,1 | RUB 22,319 |

| 2012 | RUB 387,640 | 6,6 | 6 | RUB 21,942 |

| 2013 | RUB 408,961 | 6,5 | 5,5 | RUB 21,321 |

| 2014 | RUB 429,409 | 11,4 | 5 | RUB 20,448 |

| 2015 | 453026 rub. | 12,9 | 5,5 | RUB 23,617 |

| 2016 | 453026 rub. | 5,4 | — | — |

| 2017 | 453026 rub. | 2,5 | — | — |

| 2018 | 453026 rub. | 2,89 | — | — |

Who can receive maternity capital in 2020

According to the above-mentioned law, all grounds for receiving maternity capital are available to the mother, father (in the case of a single representative) or adoptive parent and children.

Mother

A priori, assistance from the state is provided to mothers, but certain conditions must be met:

- birth (including adoption) of the 2nd child from 01/01/2007

- the appearance (or adoption) of future children (starting from the third), but in cases where the certificate was not received earlier.

- Mother and child are required to be citizens of the Russian Federation.

Capital may in some cases (loss of parental rights or death of the mother) be transferred to the father.

Father or adoptive parent

Not everyone knows that male representatives - the father/adoptive parent - can also claim a subsidy, but the stepfather is not entitled to such benefits. Registration and confirmation of these rights is lengthy and labor-intensive and requires the provision of documents such as:

- Medical report on the death of the mother;

- a court decision establishing the fact of the wife’s death (or loss of parental rights);

Also, in cases where the mother commits an act that encroaches on the health of the child, it is necessary to submit the appropriate court document.

Children

Sometimes cases arise when children receive the right due to certain circumstances when both parents are absent. In this case, age restrictions are put forward: children who have not reached 18 years of age or those who have reached 23 years of age, but subject to full-time study at an educational institution, will receive it. If there are several children, the certificate is divided into equal parts.

If you are refused

When your situation meets all the requirements for issuing an MSC, there is no need to worry too much. The main thing is to correctly prepare all the necessary documents. But extradition can be refused only in serious cases:

- the mother or second child does not have Russian citizenship;

- mother lost her parental rights;

- the mother committed a crime against the person of the child or children;

- the adoption of a child has been cancelled;

- The documents contained incorrect information about the order of birth of children and the dates of their birth.

When considering applications for the use of MSK funds, there are additional reasons why the Pension Fund may refuse. For example, when buying a home with capital money, it is important to comply with the requirements for the property. If you want to pay for your child’s education, here are the requirements for the educational institution.

If you believe that the Pension Fund refused unlawfully, you should appeal the decision. To do this, contact the higher authority of the Pension Fund - for example, the regional branch of the fund. Another option is to go to court.

Maternity capital for the first child

In order to increase the population in the country, starting from 2020, payments are being made (monthly) to families who have one child (Federal Law No. 418-FZ). However, the amount of the benefit is not fixed and is determined by the minimum wage (for each region individually). Benefits will be provided in the amount of one and a half minimum wages until the child reaches one and a half years of age.

To find out the total amount of payments, simply add up the accruals for 18 months. An important point for many is the absence of requirements indicating the reporting of benefit expenses. Do not forget that the presented changes were made last year, which means that families in which the child was born since 01/01/2018 will be able to receive such state support.

Amount of maternity capital payment for the first child in 2020

It is important to understand that the size of the minimum wage in different regions of the Russian Federation is very variable due to various reasons (for example, the cost of goods and services). In 2020, the average monthly payment amount was approximately ten and a half thousand rubles. In 2020, the subsidy amount increased to 10,800 rubles with an increase in the minimum wage. When calculated for a year and a half, the total amount of subsidies is about 190 thousand rubles.

Monthly child benefits

In 2020, parents received another type of support from the state - monthly payments for children born this year. Those wishing to apply for benefits must prepare an application. If the child is the first, then the application is sent to social protection institutions. The federal budget allocates money for such payments.

For second, third and subsequent children, you can also apply for benefits. Documents and application should be submitted to the Pension Fund office. In this case, maternity capital will be involved, and payments will be made from its fund. Therefore, its size will gradually decrease.

How much is this benefit? It is equal to the cost of living for a child, which was established in each region for the 2nd quarter of last year. For example, if parents applied in 2020, then you need to look at the cost of living for the 2nd quarter of 2020, if they apply in 2020 - the amount for the 2nd quarter of 2020.

The benefit is not provided to everyone, but only to those citizens who meet certain criteria:

- the child and the applicant for benefits are Russian citizens;

- year of birth of the second child – 2020 and subsequent years;

- The average per capita income per family member is less than 1.5 times the subsistence level in a given region.

The benefit is assigned until the child is one and a half years old. The application can be submitted at any time, but remember that if you contact the Pension Fund immediately after birth or within six months after that, the payment will be assigned from the day the child is born. If the applicant does not meet this deadline and writes an application after 6 months, then the payment will be assigned to him, but from the date of application.

The application must be submitted twice: the first time to apply for benefits for 1 year, once to apply for six months.

To assign benefits, submit the following documents:

- child's birth certificate;

- applicant's passport;

- certificates of income of family members: from the place of work, study, from institutions that issue benefits and pensions;

- a certificate from the military registration and enlistment office confirming the parent’s service;

- a certificate from the bank with account details;

- SNILS;

- documents containing information about family composition. These include a certificate of marriage or divorce, certificates of family composition.

Documents can be submitted in person, through the MFC or electronically. The payment is transferred to the applicant's bank account.

How to calculate average per capita family income

When calculating family income, not only salaries and bonuses are taken into account, but also pensions, student scholarships, various types of benefits, as well as military allowances and compensation.

To determine whether a payment is due or not, you need to make the following calculations:

- Calculate the income of each family member for 12 months before taxes. For example, there are 5 people in a family: father, mother, and three children. The youngest was born in 2020. Salary per year: mother 324,000 (27,000*12 rubles), father 648,000 (54,000*12); scholarship for the eldest child 30,000 (2,500*12). There are no other sources of income.

- Add all income. 324,000+648,000+30,000=1002,000 rubles.

- Divide the resulting number by the number of family members: 1002,000/12/5=16,700 – average per capita income.

The family lives in Murmansk and the cost of living for able-bodied citizens in the region is 15,185 rubles, 1.5 the minimum is 15,185 * 1.5 = 22,778 rubles. And since the average per capita income in this case is less than 16,700 < 22,778, then this family is entitled to a payment. In the Murmansk region, the cost of living per child is 15,048 rubles. This amount will be the monthly payment for this family.

If several children appeared in a family at the same time, for example, twins or triplets, then the application must be submitted to 2 departments:

- per child to social protection authorities;

- for the rest - to the Pension Fund department.

Payments will be made for each child, for the first from the federal budget, and for the rest from maternity capital.

Payments are terminated under the following circumstances:

- the child will be 1.5 years old;

- the recipient of the payment moved to another subject of the Russian Federation for permanent residence. He must notify the Pension Fund employees about this;

- the recipient wrote a refusal of the benefit. It stops being transferred on the 1st day of the next month. To restore the payment, you need to write a corresponding application to the Pension Fund branch;

- the child who created the right to payment will die;

- the recipient will be deprived of parental rights or die. In the first case, in order to restore the payment, you will need to submit a corresponding court decision to the Pension Fund.;

Also, the benefits will stop being transferred if the MSC funds are completely spent.

How to fill out an application for monthly payments

There is no special application form, but the law establishes certain requirements for its content. It must indicate:

- name of the Pension Fund department;

- surname (indicate the surname at birth next to it in brackets), first name, patronymic of the applicant;

- date of birth;

- passport series and number;

- citizenship;

- SNILS number;

- full address;

- telephone for communication;

- child’s details, including citizenship; date of birth;

- information about the deprivation of parental rights, about the cancellation of the adoption of a child, about the facts of a crime against the child’s personality. If such events did not occur, briefly indicate this (“I was not deprived of parental rights,” “I did not commit a crime,” etc.);

- Bank account number;

- income information.

At the end, indicate the list of documents attached to the application, date it and sign it.

All documents can be sent electronically, using various media, through the State Services website, as well as by post.

Maternity capital for a second child

The requirements for receiving a subsidy for the 2nd child remain the same. However, in 2019, changes were made to expand the acceptable uses of funds. For example, it is now possible to pay for kindergartens without waiting for the child to turn 3 years old. Another innovation was the payment, which is paid once a month, as with the birth of 1 child, in the amount of the minimum wage.

Amount of maternity capital payment for the second child in 2020

In 2020, the subsidy amount remained the same as in 2020, since no indexation was carried out during this time. For the current year, the amount of the subsidy for the 2nd child is 466,617 rubles.

Who is entitled to monthly payments from maternity capital?

In accordance with Part 4 of Art. 1 of Law No. 418-FZ, holders of a maternity capital certificate can take advantage of the right to receive monthly payments for a second child. But in addition to this, a number of other conditions must be met:

- Russian citizenship for the applicant (must also reside permanently in Russia) and the child;

- second child born in 2020 or later (2019, 2020 onwards);

- the average monthly income per family member does not exceed two regional subsistence levels for the working-age population for the 2nd quarter of last year (the last 12 calendar months are taken for calculation).

A monthly benefit from maternity capital funds will not be assigned if:

- the child is fully supported by the state;

- the applicant is deprived of parental rights;

- Maternity capital funds have been spent.

Payments can be received until the second child reaches three years of age. It is important to take into account that when applying before he is six months old, money will be credited from the date of birth, and after six months - from the date of filing the application.

For example, if the documents were submitted when the child was 4 months old, then for all this time the benefit will be transferred in full. If you submit the papers when the child is 7 months old, then the previously missed months will not be reimbursed in any way.

How to calculate average per capita income

The conditions regarding the year of birth of the second child and citizenship do not require additional explanation. But it makes sense to examine the procedure for calculating the average per capita family income in more detail.

To calculate it, you will need to add up all the income of family members for the past 12 full months six months before the month of application. The resulting amount must be divided first by 12 (this will be the average monthly income for everyone), and then by the number of family members.

The composition of the family for calculation is determined by part 10 of Art. 4 laws on monthly payments. In this case, family members are considered:

- mother and father (adoptive parents) or guardians;

- parents' spouses;

- children under 18 years of age.

The income of any other relatives is not taken into account, even if they live with the child. Moreover, even the family members listed above are ignored according to Part 11 of Art. 4 of Law No. 418-FZ, if they:

- are serving a prison sentence or are in custody;

- deprived of parental rights;

- undergo compulsory treatment;

- are fully supported by the state.

Income accounting

Income for calculation is taken only official and received in cash, and before the deduction of all applicable taxes. According to Part 1 of Art. 4 of the law on payments the following types of income are taken into account:

- “white” wages, as well as compensation, bonuses and other official income for work;

- scholarships, pensions, benefits and other payments established by the legislation of the Russian Federation;

- payment of pension savings to the legal successors of deceased insured persons;

- compensation for performing public or government duties;

- monetary allowance (maintenance) for military and law enforcement officials.

To assign monthly payments, state financial assistance after a fire, flood, natural disaster, terrorism or other emergency circumstances is not taken into account In addition, previously received “presidential” payments are not included in income.

Income from previous places of work of those citizens who are recognized as officially unemployed will not be taken into account throughout 2020 in accordance with paragraph 1 of Art. 2 of Federal Law No. 125-FZ of April 24, 2020.

Example

A family of four lives in Belgorod: mother Irina, father Andrey, daughter Valeria (5 years old) and son Artem (born in April 2020). They applied for benefits from maternity capital immediately, in April, so their income was considered for the period from October 2020 to September 2020 inclusive.

Andrey’s official salary is 35,000 rubles, his total income for the required period is 420,000 rubles.

Irina earns 25,000 rubles per month, and over the same 12 months she received a total of 300,000 rubles.

The family has no other income. From here we find that their total income for the established period was 420,000 + 300,000 = 720,000 rubles. The average for everyone for the month is 720,000 / 12 = 60,000 rubles, the average per capita for the month is 60,000 / 4 = 15,000 rubles .

The size of the monthly minimum wage for the working population is not taken as current at the moment, but for the 2nd quarter of the last year. In Belgorod it amounted to 10,039 rubles, and its double value is equal to 20,078 rubles .

If we compare the selected values, the first does not exceed the size of the second. Accordingly, the family of Andrei and Irina is entitled to a “Putin” allowance for their second child in the amount of 9,084 rubles (PM per child for the 2nd quarter of 2020 in the Belgorod region).

Maternity capital for a third child

The maternity capital for the 3rd child, as well as for the 2nd child, is not indexed and is temporarily frozen at a fixed amount. A distinctive point is the fact that when a third child appears, you can use the subsidy immediately after receiving it, provided that it will be used to pay for a mortgage, kindergarten or home renovation. Other cases are provided for when the child reaches one and a half years old.

Amount of maternity capital payment for the third and subsequent children in 2020

There are a huge number of myths that arise about the amount of maternity capital for the 3rd child. One could often hear that when a third child appears in a family, one and a half million rubles are paid, but this is absolutely not true. But don’t be upset, because this particular project, associated with such an amount, is already in development. In the meantime, for 2020 the amount of the subsidy is 466,617 rubles.

Nuances

Using maternity capital, like any other business, has its own subtleties that must be paid attention to.

- it can only be used by a mother who gave birth to a second, third or subsequent child after 2007;

- after the woman’s death, the children retain the right to use the certificate;

- provided that the funds are registered for the second child and the third is born, it is impossible to receive it again.

Help : if the registration for the second one has not been completed before, then for the third one the charges will be higher, respectively, for the fourth one the percentage will increase even more. All children are included, including adults.

Maternity capital can be issued twice, provided that the second or subsequent child is born in an area with a low demographic level.

Since 2009, maternity capital has been used to repay housing loans. It has become one of the most common investments today.

When investing MK in housing, you should take into account some nuances:

- in this way you can repay part of the mortgage or loan without waiting 3 years;

- Both parents can act as borrowers, provided that they are legally married;

- the new living space must be registered in the name of all family members, including children, within 6 months after repayment of the loan.

Important : to use funds to repay the mortgage, the apartment must be owned.

The following points need to be taken into account:

- The agreement between the bank and the borrower must include permission for early repayment.

- With the help of maternity capital, you can shorten the mortgage term or reduce payments. When choosing the latter, you must take into account that the duration of payments will remain the same and the decrease will be insignificant.

- When deciding to build a house, money is not issued in full, but in parts after providing certain documents.

How and where to apply for a maternity capital certificate

To be on the list of families who will receive government assistance. support in the form of maternity capital, first of all, you will need to send an application to the Pension Fund, or to the MFC, or using the State Services Internet portal. When submitting an application in person, the required documents will be checked directly on site. If the application was sent through State Services, then after some time the citizen will receive a letter asking him to confirm the authenticity of the documents submitted by sending it to the Pension Fund.

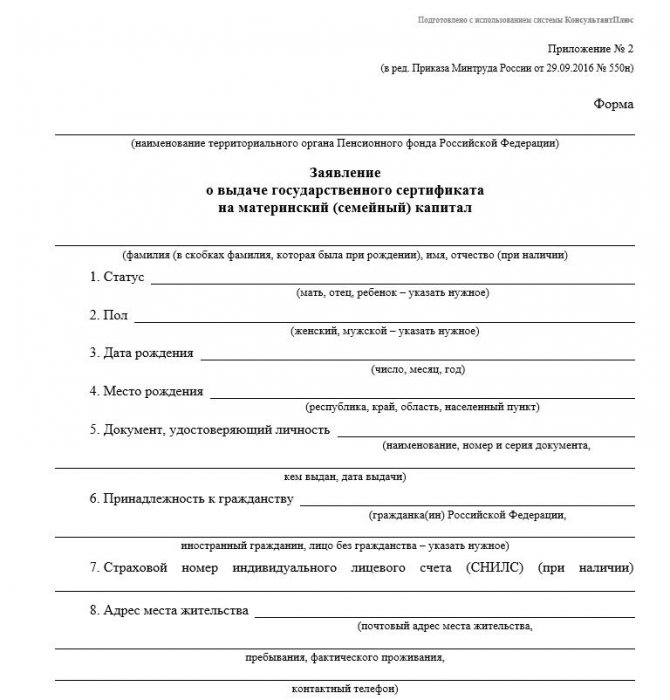

The application form for receiving maternity capital can be viewed or downloaded here:

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The application is considered within 15 calendar days, but cases are not excluded when the consideration time can be extended to 1 month due to additional checks or a lengthy response from other departments.

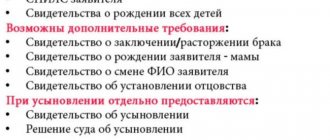

Required documents to obtain a certificate

To provide government assistance, a citizen must go to the Pension Fund or MFC. Below is a list of documents that should be presented to the authority:

- a statement that a person can write independently at home or directly to the authorities presented above;

- passport details and compulsory insurance card of the applicant;

- birth (adoption) certificate of children;

- a document indicating the child’s citizenship;

In cases of death of the mother, a certificate is required.

Information online

If you have already received a certificate for maternal capital, you can check information about its amount on the Pension Fund website. To do this, create a personal account. Through it, it is easy to find out whether the transfer you need has been made and how much money is left.

For example, you want to spend 420 thousand of your family capital to pay off your mortgage. You submitted an application to the Pension Fund and after a while you see that the balance of your capital has decreased by these 420 thousand. That is, the fund transferred money to the bank, and your loan became smaller.

To gain access to such a service, you must first register on the State Services website. After this, create a personal account on the Pension Fund website.

Through the Pension Fund website, you can also request a written certificate about the amount of the balance of your maternity capital. The certificate will be ready in three working days. You need to come to the fund branch to get the paper.

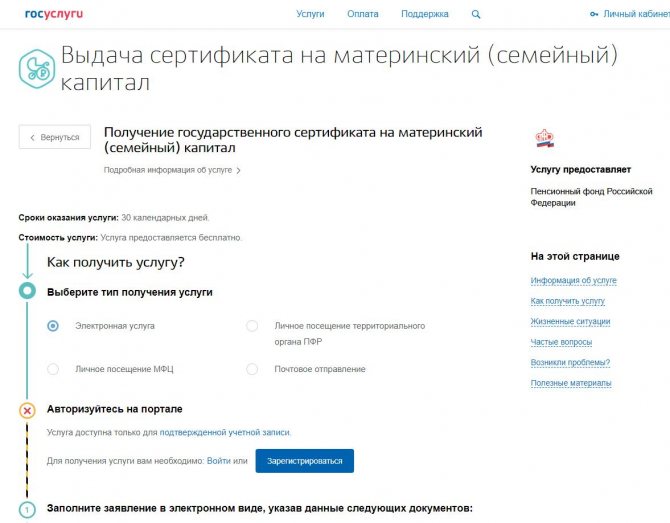

How to issue a certificate for maternity (family) capital through State Services?

The method of submitting an application using the Internet is very popular in modern society, regardless of the type of services provided.

To obtain a certificate through the State Services portal, you must complete the following steps:

- Select the service category section on the start page.

- From the list presented, select “Obtaining a state certificate for maternity capital.”

- Please indicate how you would like to receive the service (by email, by post or in person through the Pension Fund, MFC).

- Fill in the required data , using documents such as: passport data;

- birth (adoption) certificate of children;

- documents indicating the citizenship of the child;

- a document that confirms the right of the father or child to receive a certificate.

After completing the steps, submit your application for consideration.

Information about the readiness of the document will be sent to the State Services personal account or by email, depending on which notification method the person has chosen.

How to arrange monthly payments from maternity capital

To receive monthly payments from maternity capital, you need to submit an application and documents to the Russian Pension Fund - directly or through the MFC. This can be done at any time from the birth of the second child (if he was born no earlier than January 1, 2020) until he reaches the age of three.

There is no need to confirm income and renew payments every month, but you will have to do this once a year. The fact is that payments are assigned until the child turns one year old. Then they need to be re-registered up to 2 years, and then up to 3 years. In this case, each time you will need to re-confirm your income level.

Monthly benefits will begin to be transferred to the recipient’s bank account no later than the 26th day of the month following the month of application. As for the possibilities of using the money received, the law does not establish any restrictions on the intended purpose, so it can be spent on any family needs.

If the maternity capital certificate has not yet been issued, then it is not necessary to wait to receive it. An application for payments can be submitted simultaneously with an application for maternity capital.

What can you spend mat capital on?

The areas of use of funds for the subsidy have been preserved since 2007 and include 4 main areas: housing, education and upbringing, rehabilitation for children with disabilities and a pension for the mother. The choice of goal remains up to the citizen himself, and as statistics show, a large number of people use subsidies for major repairs or the purchase of a home.

Apartment, house

Continuing the topic of living space, it is important to mention that the program, in addition to the acquisition and improvement of housing, also provides for the repayment of mortgage interest on existing housing.

To implement a subsidy in the form of purchasing an apartment, there are certain conditions:

- the living space must be located on the territory of the Russian Federation;

- the transaction can take place in any form that does not contradict the law;

- fill out the application correctly, indicating the purpose and amount of costs;

- privatization of apartment ownership should take place taking into account the interests of children, in addition, shares should be allocated.

The last requirement is mandatory and requires a written commitment drawn up by a notary. Moreover, this must be done within a certain period, namely within six months after the transfer of funds from the family capital fund to the seller’s account.

In cases of building a house, the program also provides subsidies. When rebuilding a house on your own without the participation of any contractors, the Pension Fund transfers funds to the certificate holder, but in parts. The first payment will be 50% and only after the construction of the main frame the remaining 50% . If the house is built by contractors, then the money will be sent to the account of the organization providing these services.

To use state support subsidies, you must submit an application to the territorial Pension Fund, indicating the purpose of using these funds. Verification of documents and consideration of the application is carried out within one month. After the document is approved by the employees, the funds will be credited to the bank or developer.

Earth

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

According to the law, you cannot purchase an empty plot of land, since this is not included in the list of improving housing conditions.

In this regard, land acquisition is carried out at our own expense. But, the Pension Fund will be obliged to transfer funds after registering a house built on this site.

Mother's pension

The method of use is becoming popular in connection with pension reform and consists of compensating the mother for an unpaid period of childcare between the ages of 1.5 and 3 years. In addition, upon reaching retirement age, the payment amount will be increased. The positive aspect is the possibility of changing the decision towards other methods. To do this, you only need to send funds to one of the selected areas. In cases where a woman does not live to retirement age, the right to use subsidies passes to the children and father.

Education

The certificate can be used for the education of all children in the family, the only restriction will be age - up to 23 years. This opportunity involves studying on the territory of Russia and the institution must have state accreditation.

Education in the broad sense of the word in this program also involves paying for private tutors registered with the tax service.

Rehabilitation for a disabled child

Rehabilitation involves reimbursement of funds spent on necessary goods and services. In this case, you must contact social security to obtain an act confirming the expenses.

Other uses of mat capital

Certificate holders, in accordance with Art. 7 of Law No. 256 have the right to use the certificate to pay utility bills, purchase furniture, items necessary for children with disabilities to adapt to the conditions of society, and also receive monthly payments from the maternity capital fund.

Why is a consultation needed?

In addition to a pleasant bonus, young parents who have become mothers and fathers for the second or third time, in addition to caring for a newborn, have new concerns and questions.

Doubts about some points and nuances of using the state bonus lead many to a stupor.

Maternity capital can be sold after 3 years and only for specific purposes:

- expansion or improvement of living conditions;

- children's education;

- funded part of the pension.

Each goal has its own nuances, which can be explained by competent specialists.

You can get legal advice on video:

What is regional maternity capital?

Regional family capital assumes the size established at the regional level. The purpose of this subsidy is to support and stimulate large families in which a third or subsequent children were born. Funding comes from the regional budget. There is one more difference from the state program: indexing is carried out taking into account inflation. Indexation is carried out even if there is an incomplete subsidy amount.

Where it works

The regional maternity capital program operates in most regions of the Russian Federation and is regulated by the annually updated regional law. Examples include the Moscow, Ulyanovsk, Kirov regions, Krasnoyarsk and Kamchatka territories and many others.

How and for what to apply

The conditions for receiving regional capital are the same, but the place of residence of the parents must be the region of residence. To receive a subsidy, you must receive a personal certificate issued from the moment of birth/adoption of the 3rd child. Together with the application and certificate, you should send it to the authorized body. Regional subsidies are issued one-time.