What do you need to check when applying for a pension? Photo: nur.kz Any person who works officially for a long period counts on a significant pension, which he will be able to receive upon reaching a certain age. But at the same time, citizens often, when contacting PF employees, are faced with receiving a much smaller payment than is required by law.

Therefore, when assigning a pension, you should ask the fund representative some significant questions. After receiving answers, you can perform certain actions that will allow you to receive a higher payout.

List of important questions for the Pension Fund

Was the pension assigned based on savings?

Some people, when going on vacation, do not think about whether the funded pension was taken into account during the calculation. Now it is calculated only for people who were born after 1967.

But in the period from 2002 to 2004, this pension was calculated for all people, regardless of their age. Therefore, due to these years, you can count on a certain additional payment.

These contributions are transferred in the form of a lump sum benefit if the payment is less than 5% of the entire pension. Typically, this condition is met for all people retiring between 2017 and 2025.

Is it worth recalculating taking into account periods that are non-insurance?

During some periods of time, people do not work. This includes military service or maternity leave. These periods can be equated to insurance time under old laws, but under modern legislation they are replaced by pension points.

Who is entitled to early retirement by law - watch this video:

If periods are replaced with points, then this is more beneficial compared to increasing the length of service. How pension points are calculated for Soviet service – read here.

For example, if a woman was on maternity leave for 1.5 years, then she can count on 2.7 points, and when caring for a second baby, 5.4 points are awarded.

What coefficient is taken into account?

The size of this coefficient depends on the salary received before 2002. At the same time, a maximum limiting coefficient is established at the federal level. For example, for residents of the northern regions it is maximum 1.2.

If a pensioner finds out that a smaller coefficient was used during the calculation, then it is advisable to find documents on the amount of earnings for other time periods or make a calculation without taking into account the coefficient.

Were all periods of work included in the length of service?

Some employers make significant mistakes when filling out a work book. This leads to the fact that some periods are simply not taken into account in the length of service.

Therefore, it is advisable to send a special request to the Pension Fund to obtain information about which periods were not included.

Certain periods in some cases are included in the length of service even if the citizen did not perform labor duties. This includes studying at a university while taking time off work or caring for a disabled relative.

Therefore, for each such period, it is advisable to request information from the PF employee to ensure that the length of service is accrued correctly. If any periods are not taken into account, then it is important to collect official documents confirming the need to complete this process.

How to calculate your pension points - here are detailed instructions.

What questions should you get an answer to in advance from the Pension Fund? Photo: lenta.ru

Can a pensioner count on social supplements?

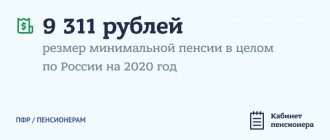

With a low coefficient, a small number of pension points or insignificant length of service, a situation often arises when a citizen can count on too small a pension.

Its size may even be less than the subsistence minimum, the size of which is established at the regional level.

Under such conditions, a pensioner can count on a special social supplement. It is paid from the Pension Fund or the social security department of a particular region.

You can obtain information about the possibility of receiving such an additional payment directly from the PF employee. He must additionally notify the pensioner about how this additional payment is drawn up, what documents are collected for these purposes, and also what its amount will be.

Every pensioner can submit an application to the Pension Fund and ask their questions - see details here:

Questions about applying for a pension

Opens a category of frequently asked questions – formal, related to concepts such as:

- retirement age;

- where to submit documents;

- What are pension points and how to earn them.

Such questions are asked not only by people who are about to retire, but also by those who have just started their working lives. Therefore, such a short educational program will be useful to everyone.

Retirement age

Since the times of the USSR and until 2020, the age when a person could leave work and enjoy rest has not changed and was 60/55 years for men/women, respectively. However, as a result of pension reform, justified partly by demography and partly by increasing life expectancy, the retirement age has been shifted up to 65/60 years for men and women.

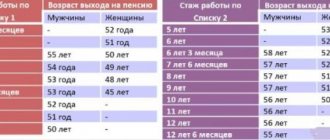

The transition period to the new age is 5 years and will end only in 2024. Up to this point, from 2020, 1 year is added to the previous values, but a number of benefits apply:

- after completing 42/37 years of service, men/women can retire 2 years earlier than the “standard” retirement age, but the pensioner cannot be younger than 60/55 years, respectively;

- for the first 2 years, there is a preferential retirement 0.5 year earlier (if a person was planning to retire in the first half of 2019, then he will be able to apply for state support in the second half of 2020).

However, when applying to the Pension Fund, you should keep in mind that a person must have a minimum amount of experience and accumulate a minimum number of points. Since 2020, the requirements have increased annually. In 2019, at least 10 years of experience 16.2 pension points are required. And from 2025, you will need 15 years of experience and at least 30 pension points.

Muscovite Nina S. turned to a lawyer for help. The woman was wondering what she should do - she has the required 10 years of experience, but due to her small salary, she earned only 14.5 points. During the conversation, the lawyer found out that the woman has a child, the period of care for which is not included in the length of service. Since this period is not an insurance period, but pension points are awarded for it, the woman can claim an additional 2.7 points for child care, and therefore, the Pension Fund of the Russian Federation is obliged to grant Nina an old-age pension.

Where to submit documents

To assign a pension, a citizen must contact the territorial office of the Pension Fund at his place of residence. You can send documents in any of 4 ways:

- in person at the Pension Fund branch or through the MFC;

- with the help of an authorized person who represents the interests of the applicant on the basis of a power of attorney;

- via Russian Post;

- via the Internet on the State Services portal or on the Pension Fund website.

The package of documents consists of papers confirming the applicant’s experience and salary. If necessary, the Fund's specialists may request additional documents. The pension is assigned from the day the application is accepted.

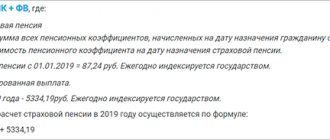

How is the pension calculated?

The calculation of pensions in 2020 does not change compared to the provisions in force from 2020. The amount is still determined by length of service and salary, which are converted into pension points. Moreover, the pension itself consists of 2 parts.

- Fixed payment, which is determined by the state (RUB 5,334.19 in 2020).

- The amount of pension points multiplied by the cost of 1 point (RUB 87.24 in 2020).

The third part is the amount of savings in the funded pension system. The monthly amount paid depends on which form of receipt the pensioner chooses. There are 3 options possible.

- One-time payment of savings (no more than once every 5 years);

- Urgent pension payment.

- Indefinite payment.

1. What will change with the adoption of new pension legislation?

1. Raising the retirement age to 65 years for men and 60 years for women; 2. Early retirement for mothers with many children: at 57 years old - with 3 children, at 56 years old - 4 children, at 50 years old - 5 or more; 3. The total length of service providing the opportunity for early retirement has been reduced by 3 years relative to the generally established periods. Now women with 37 years of age and men with 42 years of work experience will be able to use this right; 4. The maximum unemployment benefit has been increased to 11,280 rubles; 5. Administrative and criminal liability has been introduced for the dismissal of citizens of pre-retirement age or refusal to hire due to age; 6. Approval of a special program for advanced training for people of pre-retirement age; 7. People who were supposed to retire in the next two years received the right to apply for a pension 6 months earlier; 8. During the transition period (until 2028), tax breaks on real estate and land have been retained within the old pension limits (55 years for women, 60 years for men); 9. Introduction of a 25% supplement to the fixed part of the pension for non-working pensioners with at least 30 years of experience in agriculture; 10. Providing employees of retirement age with 2 days for free medical examination while maintaining their wages.

2. How will the retirement age increase?

In order for people and businesses to adapt to new conditions, the “age bar” will be raised gradually. Every year the generally established retirement age will increase by one year. And this transitional period of “incomplete” increase will continue from 2019 to 2028. In addition, in the first two years of the changes - in 2020 and 2020 - a pension can be issued six months earlier than the new age limit.

3. For whom the retirement date will not change?

Raising the retirement age will not affect citizens working in workplaces with dangerous and harmful working conditions: • in underground work; • at work with hazardous working conditions and in hot shops; • in difficult working conditions, as locomotive crew workers and workers directly organizing transportation and ensuring traffic safety on railway transport and the subway, as well as as truck drivers in the technological process in mines, open-pit mines, mines or ore quarries (men and women); • in the textile industry in work with increased intensity and severity (women); • in expeditions, parties, detachments, on sites and in teams directly on field geological exploration, search, topographic and geodetic, geophysical, hydrographic, hydrological, forest management and survey work; • in underground and open-pit mining (including personnel of mine rescue units) for the extraction of coal, shale, ore and other minerals and in the construction of mines and mines. In addition, the increase in the retirement age will not affect drivers of buses, trolleybuses, trams on regular city passenger routes and rescuers in professional emergency rescue services and units. The Pension Fund of the Russian Federation allocates persons to a special category whose pension will be assigned regardless of innovations for social reasons and health status: women who gave birth to five or more children and raised them until they reach the age of 8 years; women who have given birth to two or more children, with the necessary insurance work experience in the Far North or equivalent areas; disabled people due to military trauma; visually impaired people with disability group I; citizens injured as a result of radiation or man-made disasters, including the disaster at the Chernobyl nuclear power plant, etc.

4. How to start receiving pension payments at the same retirement age?

Only if the person falls into the categories specified in the previous section.

But if you conclude a non-state pension agreement before the end of 2020 and accumulate enough funds using an individual pension plan, then, with sufficient insurance coverage, you can stop working at 55 (women) or 60 years (men) and receive a non-state pension, and 60 -65 years of age apply to the Pension Fund for payment of an insurance pension.

An individual pension plan (IPP) is one of the most effective ways to take care of your own pension. This is an investment instrument that will help you achieve your desired pension size through self-contributions and investment income from the Fund.

Unlike other financial instruments, in order to obtain a sufficiently high return on the IPP, it is not necessary to deposit large amounts at once. Contributions can be paid in amounts that are comfortable for your budget and at a convenient frequency, the main thing is to start as early as possible and pay at least little by little from all income, or better yet, set up automatic payment. At the same time, your investments in IPP will increase due to the investment income that the Sberbank Non-State Pension Fund will earn for you annually. In addition, you can apply for a social tax deduction through your employer or at the tax office, which will further increase the profitability of your investment.

You can enter into an IPP agreement with Sberbank Non-State Pension Fund and set up automatic payment for pension contributions in any convenient way:

1. On the website of Sberbank NPF; 2. In the mobile application of Sberbank NPF; 3. In the office of NPF Sberbank at the address: Moscow, metro station. Shabolovskaya, st. Shabolovka, 31G, 4th entrance, 3rd floor.

Find out more by following the link:

Test on the topic of pension provision

1.

The conditions for assigning an old-age insurance pension include :

1) age and length of service;

2) age and insurance period;

3) age and continuous work experience;

4) age and length of service;

5) age, insurance period and individual pension coefficient.

2.

Indicate the category of citizens entitled to an insurance pension in the Russian Federation:

1) only citizens of the Russian Federation;

2) foreigners permanently residing and necessarily working on the territory of the Russian Federation;

3) stateless persons permanently residing and necessarily working in the territory of the Russian Federation;

4) citizens of the Russian Federation, foreigners and stateless persons permanently residing in the territory of the Russian Federation;

3.

Which of the following statements is true?

1. Pension provision for career military personnel is regulated by the Federal Law “On Insurance Pensions”

2. All insurance pensions consist of three parts - basic, insurance and funded

3. The Federal Law “On Insurance Pensions” provides for three types of insurance pensions: old age, disability and survivors

4. The current pension legislation does not provide for the possibility of receiving two pensions at the same time:

4. Survivor pensions are:

1) This is a state-guaranteed minimum social assistance provided to persons specified in the law, regardless of their work experience, payment of insurance contributions, paid upon reaching a specified age

2) Monthly payments from the Pension Fund of the Russian Federation, as well as from the Federal budget for the disabled, assigned in amounts commensurate with the earnings of the deceased (unknown) breadwinner who was dependent on the deceased

3) Monthly cash payments assigned to citizens who have persistent impairment of body functions, both with and without the necessary work (insurance) experience

Based on what document is the length of service acquired after registration as an insured person established:

a) work book; b) extracts from an individual personal account; c) employer's certificates.

A pension for long service may be assigned to military personnel undergoing military service:

a) by conscription;

b) under a contract; c) both by conscription and by contract; d) military personnel cannot be granted a long service pension.

7.

Does the degree of disability affect the size of the labor disability pension:

A) Yes, it affects the size of the basic and insurance parts

B) Yes, it affects the size of the insurance part

B) Yes, it affects the size of the base part

D) No, it does not affect

8. Compulsory health insurance is:

A) An integral part of state social insurance and provides all citizens of the Russian Federation with equal opportunities to receive medical and pharmaceutical care provided at the expense of compulsory health insurance funds

B) There is no correct answer

C) Part of state social insurance, providing all citizens of the Russian Federation with the opportunity to receive medical and pharmaceutical care provided at the expense of compulsory health insurance funds

D) An integral part of medical insurance for citizens of the Russian Federation to receive medical and medicinal care provided at the expense of compulsory medical insurance funds

9.

Who is the subject of legal relations in the field of social security? a) citizen; b) local government body; c) charitable foundations; d) insurance agents.

10.

What is state social support for low-income families and citizens? a) in organizing various events to unite such categories of citizens throughout the country and abroad; b) in organizing holidays abroad; c) in cash; d) in carrying out business activities.

1.

Which of the specified conditions, as a general rule, is necessary to include the specified periods in the insurance period?

1. The only sufficient condition is the fact that the employment contract is valid during the period of operation

2. Any activity of a citizen, subject to its social usefulness

3.The work must be carried out on the territory of Russia, and for this period insurance contributions must be accrued and paid to the Russian Pension Fund

4. The only sufficient condition is the fact that the employment contract is valid during the work period, but the work must be carried out on the territory of Russia

2.

Insured in the compulsory social insurance system are:

1. only persons working under civil contracts

2.only persons who provide themselves with work

3.only persons working under employment contracts

4.all of the above options are incorrect, since they are all insured.

3.

Indicate the category of citizens entitled to an insurance pension in the Russian Federation:

1) only citizens of the Russian Federation;

2) foreigners permanently residing and necessarily working on the territory of the Russian Federation;

3) stateless persons permanently residing and necessarily working in the territory of the Russian Federation;

4) citizens of the Russian Federation, foreigners and stateless persons permanently residing in the territory of the Russian Federation;

5) all listed categories of persons.

4. Recipients of funeral benefits are:

1) the spouse of the deceased, his close and other relatives, legal representative or other person who has assumed the responsibilities and expenses of the funeral

2) the spouse of the deceased, his close and other relatives

3) only the spouse of the deceased, father or mother

6. Federal civil servants have the right to a pension for long service if they have length of public service:

1) at least 25 years;

2) at least 20 years;

3) at least 15 years.

7.

The following cannot be recognized as unemployed:

1) All of the above are true

2) Able-bodied citizens who do not have work or income

3) Convicted by a court decision to punishment in the form of imprisonment

8.

Pensions for long service are:

1) Monthly cash payments assigned to citizens who have a persistent impairment of body functions, both with and without the necessary work (insurance) experience

2) A monthly cash payment established for citizens in connection with long-term work or professional activity defined by law, and assigned, as a rule, regardless of the age of the recipient upon leaving this work or completing this activity

3) This is a state-guaranteed minimum social assistance provided to persons specified in the law, regardless of their work experience, payment of insurance contributions, paid upon reaching a specified age

4) Monthly payments from the Pension Fund of the Russian Federation, as well as from the Federal budget for the disabled, assigned in amounts commensurate with the earnings of the deceased (unknown) breadwinner who was dependent on the deceased

9.

Which of the following periods is not included in the length of service:

1) The period of care provided by an able-bodied person for a disabled person with a 3rd degree limitation in the ability to work, a disabled child or a person who has reached the age of 80 years

2) The period of military service, as well as other service equivalent to it

3) Period of receiving unemployment benefits

4) The period of care of one of the parents for each child until he reaches the age of one and a half years without limitation

10.

Types of social services include: 1) social services for people of average income; 2) social services at home; 3) social rehabilitation of citizens who were laid off at enterprises or laid off at their own request. 4) provision of places for long-term residence of any category of citizens.